Others

Market News that affect STI

Post Reply

361-380 of 1458

Post Reply

361-380 of 1458

Stocks rally chilled by economic jitters

By Ben Rooney, staff reporterAugust 3, 2010: 5:30 PM ET

By Ben Rooney, staff reporterAugust 3, 2010: 5:30 PM ET

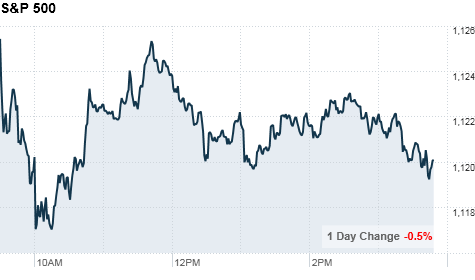

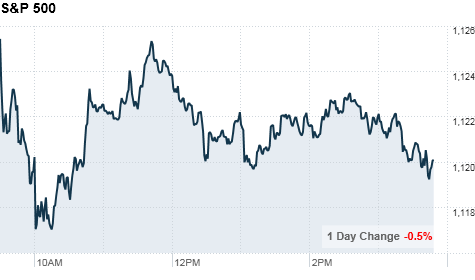

NEW YORK (CNNMoney.com) -- Stocks closed lower Tuesday, trimming some of the previous session's big gains, as optimism over corporate earnings gave way to concerns about the strength of the economic recovery.

The Dow Jones industrial average (INDU) fell 38 points, or 0.3%. The S&P 500 (SPX) index slid 6 points, or 0.5%, and the Nasdaq (COMP) composite dropped 12 points, or 0.5%.

The retreat came after stocks surged Monday, lifted by upbeat manufacturing data and strong earnings from Europe. But the investors were more cautious Tuesday following disappointing results from Procter & Gamble, and mixed reports on housing, factory orders and personal spending.

"It's the same battle between positive earnings and negative underlying fundamentals in the real economy," said Dan Cook, senior market analyst at IG Markets. "The big question is still where do we go after earnings season."

Better-than-expected corporate earnings helped boost the market 7% in July, which was the best month for stocks in a year. At the same time, however, a spate of disappointing economic reports has raised concerns about the pace of the recovery.

"The outlook is pretty dark," said Cook. "It's not dire, but growth will be slow and investors are starting to wonder where these companies will draw profits from next year."

Investors are particularly worried about consumer spending, which drives the bulk of U.S. economic activity, as household budgets remain strained by the weak job market. As a result, trading could be choppy this week as investors brace for the government's monthly payrolls report Friday.

Economists expect Friday's report to show that employers cut payrolls in July and that the unemployment rate ticked up slightly. Treasury Secretary Tim Geithner said Tuesday on ABC's "Good Morning America" that the nation's jobless rate could rise for a few months before it falls.

Investors will look for clues on the job market Wednesday, when payrolls processing firm ADP releases July data on private sector employment. In addition, outplacement firm Challenger, Gray & Christmas is due to report on last month's planned job cuts before the market opens.

"Jobs are probably the dominant economic variable with respect to the health of the economy right now," Lawrence Creatura, a portfolio manager with Federated Clover Investment Advisors, adding that consumers who are employed continue to spend.

Despite the broad decline on Tuesday, energy stocks rose as oil prices closed above $82 a barrel and BP (BP) appeared poised to permanently seal the ruptured well in the Gulf of Mexico. Chevron (CVX, Fortune 500) and ExxonMobil (XOM, Fortune 500) both gained about 1.5%.

Shares of companies with exposure to the health care industry gained on strong earnings from drugmaker Pfizer. But a dour report from Dow Chemical weighed on the basic materials sector.

Economy: Government figures showed that both personal income and spending were unchanged in June, adding to concerns about the slowing pace of the economic recovery.

Economists polled by Briefing.com had expected spending to remain flat but were forecasting personal income to edge up 0.1% in June, following a revised 0.3% gain in May.

Separately, factory orders fell for the second month in a row, declining 1.2% in June, the government said. Economists expected a 0.5% dip in total orders, after a 1.8% drop in May.

Pending home sales fell 2.6% in June, according to the National Association of Realtors. Economists had expected pending home sales to fall 5% in the month, after a 30% plunge in May.

Earnings: Procter & Gamble (PG, Fortune 500) reported that its fiscal fourth-quarter net income fell 12% from a year earlier, missing expectations. Sales rose modestly, but also fell short of forecasts.

Shares in the company, a Dow component, slid nearly 4%.

Dow Chemical (DOW, Fortune 500) reported second-quarter earnings that missed analysts' expectations, even as sales rose 20%. Excluding certain items, the largest U.S. chemical company said it earned 54 cents in the quarter. Analysts surveyed by Thomson Financial were expecting 56 cents.

Archer Daniels Midland's (ADM, Fortune 500) profit rose to $446 million and trounced forecasts, but the agricultural product company's revenue fell, surprising analysts.

Drugmaker Pfizer (PFE, Fortune 500) posted second-quarter profit and revenue that beat estimates.

Other company news: Most major automakers reported improved U.S. sales in July, making it one of the best months for industrywide sales over the past two years. General Motors, Ford (F, Fortune 500) and Chrysler all said sales rose 5% in the month, versus July 2009.

Toyota (TM) said sales slipped 3% in July, but were slightly better than analysts' forecasts. Sales slipped 2% at Honda Motor. (HMC)

French drugmaker Sanofi-Aventis (SNY) has reportedly entered into friendly takeover talks with U.S. biotech firm Genzyme (GENZ, Fortune 500). A potential deal would value Genzyme at more than $18 billion, according to the Wall Street Journal.

Research in Motion (RIMM) unveiled the much-hyped BlackBerry Torch 9800 on Tuesday, a new touch-screen BlackBerry smartphone with a pull-out keyboard and an updated operating system designed to compete with the likes of the iPhone and Android smartphones.

World markets: European markets ended mixed. Germany's DAX gained 0.2%, while Britain's FTSE 100 was little changed. France's CAC 40 fell 0.1%.

In Asia, Japan's Nikkei jumped 1.3% and the Hang Seng in Hong Kong gained 0.2%. The Shanghai Composite tumbled 1.7%.

Currencies and commodities: The dollar was lower versus the euro, the British pound and the Japanese yen.

U.S. light crude oil for September delivery rose $1.16 to settle at $82.49 a barrel.

COMEX gold's December contract edged up $2.10 to close at $1,187.50 per ounce.

Bonds: Treasury prices rose, pushing the yield on the 10-year note down to 2.91% from 2.97% late Monday. Bond prices and yields move in opposite directions.

Stocks roar into August, Dow gains 200 points

By Ben Rooney, staff reporterAugust 2, 2010: 4:51 PM ET

By Ben Rooney, staff reporterAugust 2, 2010: 4:51 PM ET

NEW YORK (CNNMoney.com) -- Stocks rallied Monday, extending last month's gains, as investors welcomed upbeat economic reports and strong earnings from European banks.

The Dow Jones industrial average (

INDU) rose 208 points, 2%, according to early tallies. The S&P 500 (

SPX) index jumped 24 points, or 2.2%, and the Nasdaq (

COMP) composite gained 41 points, or 1.8%.

The rally came after stocks

rose 7% in July, marking the best monthly gain in a year, on solid second-quarter results from a range of major U.S. companies. The bullish tone carried over Monday as investors cheered quarterly results from European banks HSBC and BNP Paribas.

"I think the market is looking at earnings reports and saying things are not as bad as we thought," said Dave Hinnenkamp, chief executive at KDV Wealth Management. "Yes, the economic recovery won't be at a brisk pace, but companies are still earning money and their balance sheets are in good shape."

Given the strength of corporate earnings, Hinnenkamp said the S&P 500 could be headed back towards its late-April highs near 1,200. The broad stock index ended Monday at 1,125.81 after breaking through a key technical level.

Energy giants Chevron (

CVX,

Fortune 500) and ExxonMobil (

XOM,

Fortune 500) both jumped as

oil prices surged past $80 a barrel on renewed optimism about global economic growth. But the rally was broad-based too. All 30 Dow stocks were positive, with the biggest gains in the materials and technology sectors.

In addition to encouraging corporate results, stocks were helped by a smaller-than-expected decline in a gauge of U.S. manufacturing activity and a surprise increase in construction spending.

While questions remain about growth in the second half of the year, Monday's reports helped ease worries that the economy could relapse into recession.

"Manufacturing is still holding steady," said Steven Goldman, market strategist at Weeden & Co. "That gives investors a convincing argument that the economy is not going to double dip."

Stocks closed mixed Friday as economic concerns tempered upbeat earnings sentiment. Despite the rally in July, the market is up modestly for the year. Stocks had slumped in April and May amid concerns about the European debt crisis and mixed economic indicators in the United States.

Looking ahead, investors said the focus may shift later this week from earnings to the economy, particularly the outlook for the U.S. job market.

"Earnings are going to start to wane," said Stephen Carl, head equity trader at Williams Capital Group. "So the market is going to be reacting to the economic numbers."

On Tuesday, investors will take in government data on personal income and spending before the market opens, while a report on factory orders comes out later in the morning. Automakers are slated to report July sales throughout the day.

The government's monthly payrolls report is due from the Labor Department on Friday. Economists expect the report to show that the economy lost jobs for the second month in a row in July and the unemployment rate is forecast to increase slightly.

Economy: A key index of U.S. manufacturing activity came in better than expected in July, while construction spending rose unexpectedly in June.

The Institute for Supply Management's (ISM) index

eased slightly last month to a reading of 55.5 from 56.2 in June. But the measure has been above 50, the level indicating growth, for a full year.

Economists surveyed by Briefing.com had expected the index to fall to 54.2, according to consensus estimates.

Separately, the Commerce Department said construction spending rose 1% in June to a seasonally adjusted annual rate of $836 billion. Economists expected construction spending to fall 0.8% in June, following a 0.2% dip in May.

Companies: HSBC (

HBC), Europe's biggest bank, said Monday that its earnings more than doubled in the first half of the year. The bank's profit climbed to $6.76 billion during the first six months of the year, up from $3.35 billion in the same period a year earlier.

French bank BNP Paribas (

BNP) said net income jumped 32% in the second quarter on strength across all business units.

Shares of BlackBerry maker Research in Motion (

RIMM) fell 1.7% after the United Arab Emirates said it will

ban the Web operations of more than a half-million BlackBerry users due to security issues.

Bernanke: Federal Reserve chairman

Ben Bernanke said Monday that financial markets have improved from the depths of the crisis, but he acknowledged that conditions have become "somewhat less supportive of economic growth in recent months."

He said concerns about the fiscal health of many European economies had weighed on the market this year, although a recent round of bank "stress tests" have eased those worries.

In a speech about the financial challenges facing state governments, Bernanke said the economy should continue to grow at a "moderate pace" as businesses restock depleted inventories and consumer spending gradually resumes. However, the recovery faces "notable restraints," he said, such as high unemployment and weakness in the housing market.

Financial reform: Treasury Secretary Tim Geithner is due to speak on Wall Street reform at New York University after the market closes.

Geithner

will promise to press federal bureaucrats to swiftly translate a sprawling 2,300-page regulatory reform bill into clear new financial rules, according to excerpts of the speech released by the Treasury.

"We will move as quickly as possible to bring clarity to the new rules of finance," Geithner will say in the speech. "The rule writing process traditionally has moved at a frustrating, glacial pace. We must change that."

World markets: European stocks rallied Monday. The CAC 40 in France closed 3% higher. The FTSE 100 in Britain rose 2.6% and Germany's DAX added 2.3%.

Asian markets also rose. The Hang Seng in Hong Kong jumped 1.8%, the Shanghai Composite rose 1.3% and Japan's Nikkei gained 0.4%.

China's manufacturing sector is still growing, but the pace is starting to slow, according to

data released over the weekend from the government-run China Federation of Logistics and Purchasing.

Currencies and commodities: The dollar was lower versus the euro and the British pound, but up against the Japanese yen.

U.S. light crude oil for September delivery rose $2.51 to settle at $81.46 a barrel.

COMEX gold's December contract edged up $1.50 to close at $1,185.40 per ounce.

Bonds: Treasury prices fell, pushing the yield on the 10-year note up to 2.96% from 2.90% late Friday. Bond prices and yields move in opposite directions.

DOW future up more than 70 points....

No wonder, textile is less and less in DEMAND.pharoah88 ( Date: 02-Aug-2010 08:36) Posted:

With the prOmOtIOn of Cycling in SINGAPORE,

what;s NEXT ?

MANKINIS ?

|

|

HEARD:

DiScussIOn on thIs QuestIOn ?

hOw faIthfUl are MPs tO theIr vOters ? ? ? ?

How loyal are S’poreans?

Loyalty and pride remained stable, but two in three

said national unity would be affected by foreign immigrants

Leong Wee Keat

weekeat@mediacorp.com.sg

SINGAPORE

This result is an improvement from the 85 and 84 per cent of Singaporeans who said so in 1999 and 2005, respectively.

An Institute of Policy Studies (IPS) survey also found two in three respondents felt the world would be a better place if people from other countries were more like them.

IPS interviewed 2,016 citizens last year, a representative sample, to probe their feelings.

— About nine in 10 Singaporeans (93 per cent) polled think the Republic is a better country than most other countries, according to a new report card on national pride.

hahah! those green clothes should strech all the way across the nipples and the underarm, covering up the nipples and arm pit hairs lar.

Dont ever expose nipples to the sun too much, might get nipple cancer....LOL!

pharoah88 ( Date: 02-Aug-2010 08:36) Posted:

With the prOmOtIOn of Cycling in SINGAPORE,

what;s NEXT ?

MANKINIS ?

|

|

sOme iDEAS prObably were UNnOtIced Or nOt Learned ? ? ? ?

- Britian had UNEPLOYMENT BENEFITS ? ? ? ?

- USA now have FREE MEDiCAL fOr ALL CiTiZENS ? ? ? ?

- AUSTRALIA has monthly allowances for KiDS and homemaking mothers ? ? ? ?

- AUSTRALIA NEW ZEALAND INDONESIA MALAYSIA have nOrmalised Bank Deposit Interest Rates for the CITIZENS ? ? ? ?

- CHINA has UNEMPLOYMENT INSURANCE for the EMPLOYEES ? ? ? ?

“I think the young have taken a different approach. They know it adds to their CV for the next promotion, or in a different company, to have experience abroad,” he said. Mr Lee himself gained new ideas from spending time in Britain as a young man in his 20s, and later in the United States.

For instance, he had noticed in Boston that planes took off and landed over water, and hence created “no footprint of sound of the aircraft over the city”. So he opted to reclaim land in Changi for a new airport, where planes would take off over water, instead of building a second runway at Paya Lebar. Mr Lee also compared Singapore to Japan, which he said is ahead in productivity levels due to the latter’s greater employee- company cooperation and bottom-up rise through the ranks.

Behind Every SUCCESSFUL Man

is a WOMAN

and Several Silent Mistresses ?

SUCCESS is like hIttIng a bAll into many hOles with crOOked stIcks ?

Elin Nordegren Gets $750M, Custody of Kids in Exchange for Silence in Tiger Woods Divorce

Published June 30, 2010

Tiger Woods, estranged wife Elin and their children in happier times.

Tiger Woods is banned from letting girlfriends near his kids in a divorce deal netting his ex a record $750 million settlement, The Sun reported Wednesday.

The golfer agreed to keep single women away from daughter Sam, three, and son Charlie, one.

He can bring a new flame into their lives only if he marries her. In return, former wife Elin Nordegren ,30, gets the biggest payout ever seen in a celebrity divorce.

But she can never publicly speak out over his alleged flings with socialite Rachel Uchitel, reality star Jaimee Grubbs, porn queen Joslyn James and up to 17 others.

A pal said: "Elin is desperate to protect the children from the womanizing side of their father.

SLIDESHOW: The Women Linked to Tiger Woods

"Tiger's main fear is her telling her story after he's rebuilt his reputation, sending him back to the gutter."

Swedish ex model Nordegren ended up with double the sum she originally sought, after her lawyers proved Woods, 34, was worth much more than the $1billion she thought.

Her friend explained: "Elin's legal team have done a great job digging up all sorts of assets.

"The price of the huge sum is her silence: no interviews, tell-all books, or TV appearances about this for the rest of her life -- even if Tiger dies first -- or she'll lose the lot."

With the prOmOtIOn of Cycling in SINGAPORE,

what;s NEXT ?

MANKINIS ?

Bulls brace for earnings hangover

By Ben Rooney, staff reporterAugust 1, 2010: 8:48 AM ET

NEW YORK (CNNMoney.com) -- After a big rally in July, investors could be in for another bout of economic jitters this week as the focus shifts from earnings to the weak job market.

Stocks booked the

best monthly gain in a year during July as investors cheered strong second-quarter results from an array of major U.S. companies. About 75% of the roughly 300 companies in the S&P 500 that have reported earnings so far have beat analysts' estimates.

But with relatively few top tier companies left to report earnings, the economic outlook is likely to set the tone for the market this week.

"As we get past earnings season it will be harder for the market to sustain the positive tone it has had over the last few weeks," said Bruce McCain, chief investment strategist at Key Private Bank.

As such, trading could be choppy in the early part of the week as investors gear up for the all-important monthly jobs report from the Labor Department on Friday. In addition, investors will take in government data on personal income and spending, as well as a key index of manufacturing activity.

"Without jobs it's difficult to have a robust economic recovery, and that will make it harder for the market to move significantly higher," said David Levy, a portfolio manager at Kenjol Capital.

Most economists expect the report to show that payrolls fell in July as the impact of temporary Census hiring continues to fade. But the market could rally if the number comes in better than expected or shows any improvement in private sector hiring, according to Alec Young, an equity analyst at Standard & Poor's.

"There's room for the market to move higher if jobs pick up," he said. "But earnings alone are not enough anymore."

Meanwhile, Treasury Secretary Tim Geithner will be in New York to discuss financial reform on Monday.

Concerns about tax policy may also weigh on the market as the

debate heats up in Washington over the 2001 and 2003 Bush tax cuts, which are set to expire at the end of the year.

On the docket

Monday: Reports on manufacturing activity and construction spending are due out after the market opens.

The Institute for Supply Management's (ISM) index of U.S. manufacturing in July is expected to have dropped to 53.5 from 56.2 in June, according to economists surveyed by Briefing.com. A number above 50 indicates growth in the sector.

Separately, the government is expected to report that construction spending fell 1% in June after a 0.2% drop the month before.

Treasury Secretary Tim Geithner will discuss financial reform in a speech at New York University.

Tuesday: The government is due to report on June personal income and spending. Economists believe incomes rose 0.2% in the month, while spending is forecast to be up 0.1%.

A report on June factory orders comes out after the opening bell.

In addition, top auto makers will report July car and truck sales throughout the day.

Wednesday: Before the market opens, payroll processing firm ADP is expected to report that private sector employers added 30,000 jobs in July.

The Institute for Supply Management's index of activity in the service sector for July is expected to show little change when it is released after the opening bell.

The government's weekly oil inventory report is also due Wednesday.

Thursday: The Department of Labor releases weekly jobless claims figures in the morning. The number of Americans filing new claims for unemployment last week is expected to drop slightly to 455,000. Continuing claims, a measure of Americans who have been receiving benefits for a week or more, is expected to fall to 4.53 million.

Friday: The government's closely-watched jobs report is expected to show the U.S. economy lost 116,000 jobs in July after a decline of 125,000 jobs the month before. The unemployment rate is forecast to rise to 9.6% in the month from 9.5%.

Insurance giant AIG (

AIG,

Fortune 500) is also expected to post quarterly results at some point Friday.

Stocks edge lower

By Alexandra Twin, senior writerJuly 29, 2010: 4:29 PM ET

NEW YORK (CNNMoney.com) -- Stocks slid Thursday, although they finished off their session lows, as investors weighed cautious comments from a regional Federal Reserve president about the health of the economy and a mix of quarterly profit reports.

The Dow Jones industrial average (

INDU) lost 30 points, or 0.3%, the

S&P 500 (

SPX) index dipped 4 points or 0.2% and the Nasdaq (

COMP) composite dropped 13 points, or 0.6%.

After an early boost from Exxon Mobil's and a drop in weekly jobless claims, the market's tone turned negative.

"A lot of the earnings have been good, but the Fed speak and the economic reports over the last two days have not been helping," said Joseph Saluzzi, co-head of equity trading at Themis Trading.

Plaguing the market were worries about Friday's initial GDP report for the second quarter and Federal Reserve Bank of St. Louis President James Bullard's warning about the threat of deflation to the economy.

The GDP report is expected to show second-quarter growth at a 2.5% annualized rate, down from the 2.7% rate reported for the quarter.

Bullard warned that the Fed's current policies were putting the United States at risk of falling into an extended period of falling wages and prices.

The warning was noteworthy because Bullard, a voting member of the Fed's policy committee, has previously been an inflation hawk, more focused on the threat of higher prices and costs.

Low summer trading volume exacerbated the market moves. "There's such slight volume that you're seeing these quick reactions," Saluzzi said.

Stocks were also vulnerable near the end of a strong month in which all three major indexes have risen between 7.5% and 8%, as of Thursday's close.

On Wednesday, the markets finished lower on a worse-than-expected durable goods orders report and weaker quarterly results from Boeing.

Quarterly results: Dow component Exxon Mobil (

XOM,

Fortune 500)

reported higher quarterly earnings and revenue thanks to an increase in oil prices versus a year ago. Earnings results topped estimates, but analysts surveyed by Thomson Reuters expected higher year--over-year revenue growth. Shares fell 1%.

Colgate-Palmolive (

CL,

Fortune 500) tumbled 7% after the maker of toothpaste and pet food products reported second-quarter sales that were shy of forecasts. The company said weaker consumer spending accounted for slower sales, as well as the impact of devaluation of the

Venezuelan currency. Colgate cut its full-year profit outlook.

A number of consumer stocks tumbled as well, including Dow components Procter & Gamble (

PG,

Fortune 500) and Kraft Foods (

KFT,

Fortune 500).

On the upside, consumer products maker Avon Products (

AVP,

Fortune 500) reported higher quarterly revenue and earnings that topped expectations. The company said increased sales of beauty products and strength in its Latin American market helped to offset weakness on home products and the impact of currency fluctuations. Shares gained 1%

Company news: Trading in Cisco Systems (

CSCO,

Fortune 500) was briefly halted in the late morning after it triggered a circuit breaker by jumping at least 10% in a five-minute period. NYSE Amex, where the trade occurred has said it

will stand, following examination.

Circuit breakers were instituted in the wake of the May 6 "flash crash" in which the Dow lost nearly 1000 points in a matter of minutes before recovering due to faulty trades.

Amazon (

AMZN,

Fortune 500)

released the Kindle 3 on Wednesday, the newest version of its e-reader. Due to the ongoing e-reader price war, the company also released a cheaper model that sells for $139. Shares fell modestly Thursday.

Jobs: The number of Americans filing for first-time unemployment benefits fell by 11,000 to 457,000 last week, the Department of Labor reported in the morning. Claims were expected to dip to 464,000, according to a consensus of economists surveyed by Briefing.com.

Continuing claims, a measure of Americans who have been receiving benefits for a week or more, rose to 4,565,000 from 4,484,000 in the previous week. Economists expected 4,550,000 claims on average.

World markets: European markets fell. The CAC 40 in France fell 0.5%, Germany's DAX fell 0.7% and the FTSE 100 lost 0.1%.

Asian markets were mixed. Japan's Nikkei fell 0.6%. The Hong Kong Hang Seng index ended just above unchanged. The Shanghai Composite gained 0.6%.

Currencies and commodities: The euro gained against the dollar, while the U.S. currency fell versus the Japanese yen.

U.S. light crude

oil for September delivery rose $1.40 to $78.39 a barrel on the New York Mercantile Exchange.

COMEX

gold for August delivery climbed $7.10 to $1,167.50 per ounce.

Bonds: Treasury

prices rose, lowering the yield on the 10-year note to 2.99% from 3% late Wednesday. Bond prices and yields move in opposite directions.

Market breadth: Breadth was mixed. On the New York Stock Exchange, losers beat winners by four to three on volume of 760 million shares. On the Nasdaq, advancers narrowly beat decliners on volume of 1.79 billion shares.

NEA’s sending out the wrong message

Letter from Yee Ming Fai

I AM disappointed with the move to give free portable ashtrays to stop litterbugs.

Doesn’t this send out the wrong message that smoking is acceptable, as long as the butts are dealt with appropriately?

I hope the National Environment Agency can focus on the health issues of smoking and second-hand smoke instead.

Mr Lee also compared Singapore to JAPAN, which he said is Ahead in Productivity Levels due to the latter’s greater employee- company cooperation and bottom-up rise through the ranks.

QUESTiONS:

1. In 1970s, Singapore COPIED the JAPAN Quality Control Circles [QCC] System.

Where is it now?

Who are the Singapore Productivity GURUS ?

What happened to ALL the PRODUCTIVITY ?

How can there be Productivity Improvement when there is nO Productivity System nOw in SingapOre ? ? ? ?

When is a Singaporean productivity in Singapore ?

Which company has a Productivity System in Singapore ?

Why there are nO Chief Productivity Officer [CPO] in the Boardroom and Ministry of Productivity ?

2. Consequences of JAPAN's Lead in Productivity:

2.1 In Tokyo City TODAY, there are more and more homeless beggars.

2.2 Since 1997 Asian Financial Crisis, Japanese are nO lOnger known as FiVE STARS CLASS. In fact, in Japan TODAY, Japanese are no longer Brand Conscious due to the High Cost of Living which they now find it HARD TO COPE . . . .

2.3 JAPAN is nOt a rOle mOdel for PRODUCTIVITY anymOre . . . .

2.4 JAPAN's QUALITY is also deteriorating . . . .

2.4.1 SONY notebook Quality issues . . . .

2.4.2 JAPANESE cars Quality issues . . . .

COV reflects instant price changes (silmilar to daily share prices) while valuation acts like moving average, behind the actual price movement. COV must be reflected in the sale price otherwise it is considered underdeclared. In down market (post 1997), valuation dropped slower than actual price.

Live, learn and venture overseas

Minister Mentor Lee on not retiring, and how

Singaporeans gain new ideas from going abroad

Neo Chai Chin

chaichin@mediacorp.com.sg

SINGAPORE

However, in 15 years or so, the Minister Mentor expects that the Republic will have an intellectual class “maybe three times as big as what we have now”.

The war for talent is turning on two counts here, it seems.

Speaking at a dialogue on the leadership challenge in productivity and sustainable growth, Mr Lee said firstly that Singapore was getting “a lot of talented people” from China, India and Malaysia.

“I’m quite sure that in 15, 20 years, when all these bright kids we’ve attracted from overseas grow up and mature — educated here and maybe educated also overseas — we’re going to have an intellectual class maybe three times as big as what we have now,” he said. These talents will accelerate Singapore’s development.

But a change is also happening among young Singaporeans, he assessed when asked by consultant Philip Merry the same question he asked Mr Lee 15 years ago.

Young Singaporeans now know the value of overseas experience in moving up the corporate ladder and for learning new ways to do things, said Mr Lee, the special guest at the Singapore National Employers Federation’s 30th anniversary CEO and Employers Summit, which ends today.

“I think the young have taken a different approach. They know it adds to their CV for the next promotion, or in a different company, to have experience abroad,” he said. Mr Lee himself gained new ideas from spending time in Britain as a young man in his 20s, and later in the United States.

For instance, he had noticed in Boston that planes took off and landed over water, and hence created “no footprint of sound of the aircraft over the city”. So he opted to reclaim land in Changi for a new airport, where planes would take off over water, instead of building a second runway at Paya Lebar. Mr Lee also compared Singapore to Japan, which he said is ahead in productivity levels due to the latter’s greater employee- company cooperation and bottom-up rise through the ranks.

But the Republic makes up for it “the Singapore way”: Being a safe, clean and liveable city, well-connected to the rest of the world, with an English-speaking environment, and by embracing foreigners.

‘I don’t think there should be a retirement age’: MM

Asked for his views on the ageing workforce’s impact on productivity and growth, Minister Mentor Lee Kuan Yew said Singaporeans would be healthier and happier if they worked for as long as they could.

“I don’t think there should be a retirement age,” he said.

Mr Lee said he is still functioning at the rate he was 20 years ago — save for some “aches and pains”, for which he sees a physiotherapist.

He said Singaporeans have to accept the “painful” prospect of being paid less as they work into old age. “You are superior, and suddenly your junior overtakes your position and you have less pay and he’s the boss. So you find the psychological switch unpleasant, but that’s life,” he said.

Neo Chai Chin

— Fifteen years ago, when he was asked why Singaporeans were reluctant to venture overseas to learn new skills, Mr Lee Kuan Yew said it was because Singapore was too comfortable.

The higher the COV, the more the Property Agent will get paid the commission!!

How to curb this escalating COV price - the only way is :

COV price SHOULD NOT be included into the sales and purchase of housing agreement. In this way, Properpty agenty will only be paid commission based on the Actual sale price of the house.

COV will then be negotiated between the buyer and seller and be paid directly into the seller's pocket.

This method itself serves as moderator of COV prices and have it under control in a fair mannar.

pharoah88 ( Date: 28-Jul-2010 13:14) Posted:

Cash Over Valuation [COV]

Is COV a LEGAL Practice under Real Estate Laws ? ? ? ?

Is COV like Money Laundering ? ? ? ?

Is COV like an UNderdeclaration of Valuation ? ? ? ?

Is COV like BRIBERY in Business Transaction ? ? ? ?

Is COV like an UDNERTABLE SCHEME to withdraw MONEY from CPF ? ? ? ?

WHAT is the Objective to have COV ? ? ? ?

Should GST be payable on COV ? ? ? ?

|

|

CONFLiCT OF iNTERESTS [COI]

1. MANAGEMENT is RESPONSIBLE to SECURE HiGHEST RETURNS for SHAREHOLDERS

2. MANAGEMENT increases own compensations is to SECURE PERSONAL iNTEREST and nOt SHAREHOLDERS' iNTEREST.

iT iS a dIrect CONFLiCT Of iNTEREST [COi]

pharoah88 ( Date: 28-Jul-2010 17:50) Posted:

|

Wednesday: 28 JULY 2010 TV CHANNEL 8 - GOOD MORNING SINGAPORE !

CONFLICT OF INTERESTS [COI]

MULTIPLE RELATIONSHIPS between Housing Agent and House Owner/Seller

1. HOUSE SALE RELATIONSHIP

Housing Agent has the SOLE RESPONSIBILITY to PROTECT House Owner/Seller Interest

Secure HiGHEST SALE PRiCE for House Owner/Seller

2. HOUSE BRIDGING LOAN RELATIONSHIP

Bridgeing Loan is required by House Owner/Seller who is buying a house which cost more than the SALE PRiCE of existing home, because RESALE MARKET PRiCES are in RiSiNG TREND

Housing Agent as Loan Lender has PERSONAL INTEREST to secure the Loan Repayment by House Owner/Seller in the Shortest Time.

This PERSONAL INTEREST is in DIRECT CONFLiCT with the House Owner/Seller's Interest to secure the HiGHEST SALE PRiCE.

In this Conflict Of Interest [COI] situation, Housing Agent would cOmprOmIse the securing of HiGHEST SALE PRiCE with the securing of the SALE at lower price but in SHORTEST TiME.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

EMPHASiS:

Due to the High Cost of Living in Singapore, Bridging Loan is only extended when the House Seller's Salary is above S$1,800 per month.

pharoah88 ( Date: 28-Jul-2010 13:01) Posted:

|

Thousands of housing agents get the axe

Real estate firms take action ahead of implementation of new rules

JOANNE CHAN

joannechan@mediacorp.com.sg

SINGAPORE

Under a new regulatory framework to be implemented by the Ministry of National Development (MND), a statutory board known as the Council for Estate Agencies will be set up. MediaCorp understands that a Bill could be introduced in Parliament as early as October.

When contacted, MND would only say that a Bill will be introduced later this year, with the council operational by the end of the year. Under the new framework, all agents must register with the council before they are allowed to practice. In the meantime, MND had asked estate agencies to submit their agents’ particulars and qualifications. Some firms have taken the opportunity to do some housekeeping.

Dennis Wee Group (DWG) updated the particulars of all its 5,000 agents earlier this month. They were also briefed on the new requirements.

DWG director Chris Koh said as a result of the exercise, some 1,500 agents were axed. They were mostly inactive or part-time agents.

“With the new central registry, where a member of public can turn to the registry and see if you are an agent, it’s going to be difficult for those with a full-time job to moonlight as an agent.”

Under the new guidelines, agents will also be required to pass a mandatory industry exam.

Only those with an industry certification will be exempted.

Rather than wait, DWG has asked all its agents to equip themselves — either with the Certified Estate Agent Course or the Common Examination for Salespersons.

Another real estate agency, PropNex, has also taken action.

Its CEO, Mohamed Ismail, said some 1,200 agents were terminated, either because they’re inactive or unwilling to take up personal indemnity insurance. The insurance covers any financial liabilities arising from housing transactions.

Agents who are associated with moneylending have also been let go. “We have made it a policy that any PropNex agent, who has a moneylending licence, will not be allowed to practice because we do see a conflict of interest.”

ERA, which has about 3,000 active agents, says it removes about 100 inactive agents from its database every month. Associate director of ERA Asia-Pacific, Mr Eugene Lim, said the company has also been training its agents for the Common Examination for Salespersons.

To date, more than 2,500 ERA agents have taken the exam.

HSR, which represents about 7,000 agents, says it regularly checks its database for inactive agents, who are then put on a passive list and sent reminders to go for retraining.

There are an estimated 30,000 housing agents in Singapore. — Real estate firms have axed thousands of housing agents ahead of enhanced regulations aimed at improving the professionalism of the industry.

We have made it a policy that any PropNex agent, who has a moneylending licence, will not be allowed to practice.

PropNex CEO Mohamed Ismail |

|

|

|

By Channel NewsAsia, Updated: 28/07/2010

There should be no retirement age: MM Lee

There should be no retirement age: MM Lee

SINGAPORE: Minister Mentor Lee Kuan Yew has said that there should be no retirement age for workers.

He made the point at a dialogue session with over 900 senior managers, government officials and unionists on Wednesday.

The session was held in conjunction with the 30th anniversary of the Singapore National Employers Federation (SNEF).

Minister Mentor Lee got the audience in stitches when he made the bold suggestion — no retirement age for Singapore.

He said: "You work as long as you can work and you will be healthier and happier for it. If you ask me to stop working all of a sudden, I think I’ll just shrivel up, face the wall and just that."

The 86—year—old said old people should be more productive.

Mr Lee was responding to a question on challenges Singapore may face with an aging population.

He said that at his age, he may have aches and pains but he can keep going.

He said: "Many of our workers have a preferred retirement, and then they die early! It won’t be long before the message sinks home that if you keep doing what you’re doing for almost the whole of your life, the chances are you will stay interested and engaged in life, there’s something to do tomorrow and you keep going. If you start saying,’oh! I’m old!’ And you start reading novels and playing golf or playing chess, well, you’re on the way down."

From 2012, employers in Singapore will have to offer workers re—employment when they hit the retirement age of 62.

Mr Lee said older workers will need to come to terms with the psychological switch — that is, working for less pay and very likely for a younger boss.

He said: "That’s life! You know American Generals — they don’t do well, they get fired and they give them a medal, they send a new general! I think we have to develop that approach to life. (When) you have reached the maximum you can do at your age in that position, you move sideways and you take less pay and you move gradually, (getting) less and less pay because you are moving slower and slower, especially when you’re doing physical work."

Mr Lee stressed the need to continue learning even as one gets older, adding "I’m still learning."

Attracting talents was another hot topic at the dialogue session. Mr Lee said foreign talents come to Singapore because of the opportunities it offers.

Their numbers will add to what Mr Lee called a growing "intellectual class".

Mr Lee said: "We are going to have an intellectual class, about maybe three times as big as what you have now and that will give us the dynamism, the powerful engine to carry us forward faster."

Mr Lee added that Singapore’s attraction as a liveable, safe city with good infrastructure will support its push to enhance productivity.

The 45—minute dialogue was engaging and peppered with personal anecdotes. For example, Mr Lee shared how many of his ideas were gleaned from his travels.

He noted how a lot of policies in Singapore were the result of his experiences overseas. For example, deciding on having an underground train system over a network of tunnels for buses.

— CNA/ir