Stocks at a standstill ahead of Fed

By Blake Ellis, staff reporterNovember 1, 2010: 4:54 PM ET

By Blake Ellis, staff reporterNovember 1, 2010: 4:54 PM ET

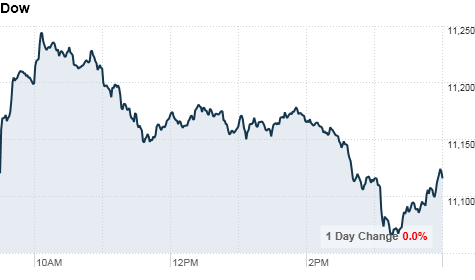

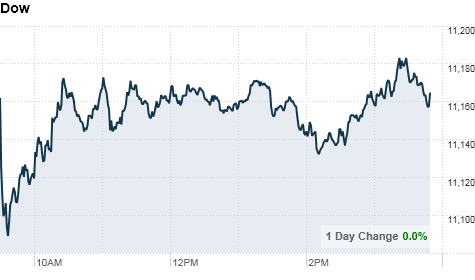

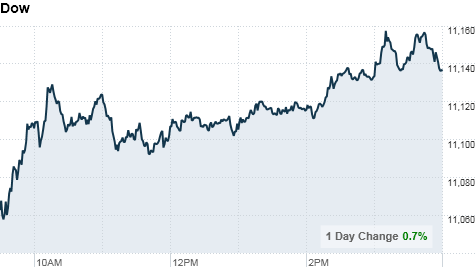

NEW YORK (CNNMoney.com) -- Stocks ended a choppy session little changed Monday as investors remained jittery ahead of the week's three big events -- the midterm elections, the Federal Reserve meeting and the October jobs report.

After soaring more than 100 points earlier in the session, the Dow Jones industrial average (INDU) ended just 6 points higher. The S&P 500 (SPX) edged up 1 point, and the Nasdaq (COMP) fell 3 points.

Stronger-than-expected readings on U.S. and Chinese manufacturing growth sparked an early buying spree.

But gains were muffled as investors turned their focus back to the upcoming election and the Fed's policy statement on Wednesday.

Expectations of additional stimulus from the Federal Reserve and bets that Tuesday's congressional elections will favor the Republicans have buoyed markets since late August. But this is a pivotal week.

"All that really matters now is the Fed coming in with a boat-load of money," said Joseph Saluzzi, co-head of equity trading at Themis Trading. "The only reason the market has been going higher for the past two months is because of these expectations of Fed money-pumping."

The Dow is coming off its best October since 2006, but stocks have moved sideways over the last week.

Economy: The Institute for Supply Management's manufacturing index jumped to 56.9 in October from 54.4 in September. That easily beat the reading of 54 expected by economists. Any reading above 50 indicates growth in the sector.

"Regional manufacturing surveys leading up to this report had indicated a slowdown, so the fact that this hasn't occurred is encouraging," said Mark Luschini, chief investment strategist at Janney Montgomery Scott.

Strong manufacturing numbers out of China, the world's second-biggest economy, also provided a lift to the market and sent Chinese stocks higher overnight.

"China is seen as the growth engine for the world, so this data coming in positively adds support to the fact that their economy is continuing to grow," said Luschini.

A report on personal income and spending before the bell showed that personal income declined 0.1% while personal spending increased 0.2% in September.

Economists had expected the Commerce Department to report that spending by individuals rose 0.4% in September, according to a consensus estimate from Briefing.com. Personal income was expected to have risen 0.2% in the month.

Separately, government data showed that construction spending unexpectedly rose 0.5% in September, while economists had expected a 0.7% drop.

Companies: JPMorgan Chase (JPM, Fortune 500) shares slipped nearly 1% amid reports that the Securities and Exchange Commission is investigating the bank's $1.1 billion deal with hedge fund Magnetar.

Shares of Exco Resources Inc. surged 30% after the company's chairman offered to buy the company in a $4.4 billion deal.

Cablevision Systems Corp. announced over the weekend that it has reached an agreement with News Corp. to return Fox programming to Cablevision. That sent shares of Cablevision (CVC, Fortune 500) up 1.7%, and shares of News Corp. (NWSA) edged slightly higher.

AIG (AIG, Fortune 500) said early Monday that it has raised nearly $37 billion by selling off one insurance subsidiary, and the initial public offering of a second, AIA Group Ltd. AIG's stock edged down slightly.

Before the bell, Loews (L, Fortune 500) reported that its net income dropped in the third quarter to $36 million, compared to $468 million in 2009. That included a one-time charge of $328 million stemming from CNA Financial Corporation, a subsidiary. Excluding that charge, Loews reported earnings of 13 cents per share, topping analyst expectations. Shares were little changed.

Shares of Wilmington Trust (WL) sank 41% on news of a bigger-than-expected third quarter loss. The bank also agreed to be bought by M&T (MTB).

Companies scheduled to post results this week include BP (BP), MasterCard (MA, Fortune 500), Pfizer (PFE, Fortune 500), CVS Caremark (CVS, Fortune 500) and WellPoint (WLP, Fortune 500).

World markets: European shares finished slightly higher. The CAC 40 in France closed 0.2% higher, the DAX in Germany rose less than a percent and Britain's FTSE 100 was up 0.3%.

Asian markets ended mixed. Japan's benchmark Nikkei index dropped 0.5%, while the Hang Seng in Hong Kong rose 2.4%. The Shanghai Composite ticked up 2.5%.

Currencies and commodities: The dollar rose against the euro, the British pound and the Japanese yen.

Oil futures for December delivery rallied, gaining $1.52, or nearly 2%, to settle at $82.95 a barrel.

Gold for December delivery tumbled $7 to settle at $1350.60 an ounce.

Bonds: Prices on U.S. Treasuries fell Monday, pushing the yield on the benchmark 10-year note up to 2.63% from 2.61% late Friday.

Stocks: Betting on a triple play

By Blake Ellis, staff reporterOctober 31, 2010: 10:43 AM ET

By Blake Ellis, staff reporterOctober 31, 2010: 10:43 AM ET

NEW YORK (CNNMoney.com) -- October was another strong month for markets, but uncertainty kept stocks in a tight range over the past week.

Now, some of that uncertainty is about to fade.

The first week of November brings three events that have the potential to shake up markets: the Federal Reserve's meeting, the midterm elections and the release of the government's October jobs report.

"We have a triple play coming up," said Doug Roberts, a chief investment strategist at Channel Capital Research. "These three events are going to overshadow everything else."

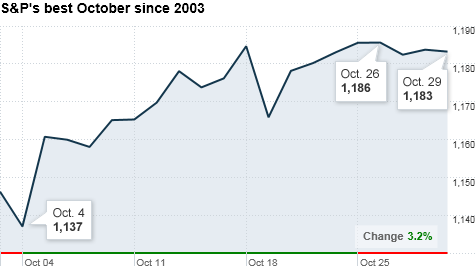

While the S&P 500 and Dow logged their best October in several years, major indexes simmered in the last week of the month as investors stayed on the sidelines amid a raft of economic reports.

"We've seen all that we need to see of the economic data, there are no surprises now -- it's still the weakest recovery we've seen in generations," said David Sandell, portfolio manager at Leeb Capital. "It's clear that we need more help, and whether it comes out of the Fed or out of Washington remains to be seen, but likely we'll see it from both."

Elections: Wall Street is banking on a win for Republicans in Tuesday's midterm elections, a change that many investors believe to be pro-business and therefore a boost to the market.

"There's pretty decent certainty that Republicans will take over the House, but the question is whether they will take over the Senate," said Roberts. "Either way, the results will lift a little bit of uncertainty."

Fed decision: Investors will be pouring over the Federal Open Market Committee's meeting announcement, released Wednesday.

The Fed is widely expected to launch another round of monetary stimulus in an effort to boost the economy.

Just the anticipation of the move -- referred to as quantitative easing -- has pushed the S&P 500 up 11% since the Fed's intentions were announced in August. Now the question is how big the injection will actually be.

"People are wondering, 'is it going to be $500 billion? $1 trillion? $2 trillion?'," said Roberts. "If the size of the stimulus is less than expected then you might have a little bit of a sell-off, but the market would accept a smaller amount positively if [the Fed] indicates continuity with it and says it won't stop until they achieve their goals."

Jobs report: The third piece of the triple play is the government's closely watched jobs report.

Since the extent of quantitative easing is expected to be known by the time the jobs report is released Friday, investors will be eyeing it for signs of whether the Fed's action was warranted.

Employers are expected to have added 45,000 jobs in October after cutting payrolls by 95,000 the month before. The unemployment rate is expected to hold steady at 9.6%.

Home run?: If the midterm elections result in a power change, the Fed provides an appropriate boost to the economy and the jobs report shows signs of life, stocks will likely get a significant lift -- at least for the short-term.

"Everything has to fall into place correctly next week to continue going higher," said Alan Lancz, president of Alan B. Lancz & Associates.

Monday: A report on personal income and spending is due before the market open. Economists surveyed by Briefing.com expect income to have risen 0.3% in September after jumping 0.5% in August.

The Institute for Supply Management's manufacturing index for October is on tap in the morning and is expected to have edged down to 54 from 54.4 in September. Any number above 50 indicates growth in the sector.

Construction spending is forecast to have ticked down 0.5% in September, following a rise of 0.4% in August.

Tuesday: On top of midterm elections, the FOMC meeting begins and BP is slated to report results.

Wednesday: The FOMC's rate decision is due at 2:15 p.m. ET. Economists expect the Fed to leave key interest rates unchanged at a range of between 0% and 0.25%.

Payroll services firm ADP is forecast to report that employers in the private sector added 25,000 workers to their payrolls in October after cutting 39,000 in the previous month. Outplacement firm Challenger, Gray & Christmas issues its report on planned job cuts in October.

Factory orders are due from the Commerce Department. Orders are expected to have edged up 0.6% in September after slipping 0.5% in August.

The ISM services sector index for October is expected to have ticked up slightly to 53.6 from 53.2 in September.

Auto and truck sales are due throughout the day, and the government's weekly oil inventory report is also released Wednesday.

Time Warner (TWC, Fortune 500), AOL (AOL), CVS Caremark (CVS, Fortune 500) and News Corp. (NWSA) are all on tap to release earnings.

Thursday: The government's weekly jobless claims report comes out Thursday, with 450,000 Americans expected to file new claims for unemployment, after 434,000 were filed in the previous week.

October same-store sales figures from major retailers are due in the morning, along with a report on third-quarter business productivity from the Commerce.

Results from Cablevision (CVC, Fortune 500), DirecTV (DTV, Fortune 500) and Sirius XM (SIRI) are on deck.

Friday: In addition to the government's big jobs report, the National Association of Realtors releases its pending home sales index, a measure of sales contracts for existing homes.

The index is due before the start of trading and is expected to have risen 0.5% in September after rising 4.3% in August.

A report on consumer credit is forecast to show a decline of $3.8 billion in September, following a drop of $3.3 billion in the previous month.

Dow has best October since 2006

By Blake Ellis, staff reporterOctober 29, 2010: 5:25 PM ET

By Blake Ellis, staff reporterOctober 29, 2010: 5:25 PM ET

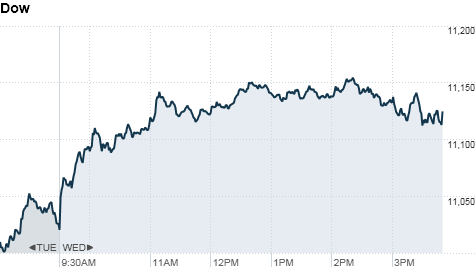

NEW YORK (CNNMoney.com) -- Stocks ended October with gains, but uncertainty sent investors to the sidelines Friday following a lackluster reading on economic growth and ahead of next week's Federal Reserve meeting.

For the month, the Dow logged its best October since 2006, rising 3%. The S&P gained 4%, its best October since 2003; the Nasdaq jumped 6%.

But the month ended on a quiet note Friday. TheDow Jones industrial average (INDU) inched up 5 points, the S&P 500 (SPX) ticked down less than a point, and the Nasdaq (COMP) rose less than a point.

A report on third-quarter GDP early Friday showed the economy grew at a sluggish pace in the third quarter, signaling that quantitative easing from the Fed is still on its way.

But speculation about how far the Fed will go to boost the economy, along with the highly-anticipated Nov. 2 elections, has kept stocks in a tight range this week.

"We are waiting in the wings here for two major events that could really shake the economy going forward," said David Sandell, a portfolio manager at Leeb Capital.

Markets ended flat Thursday after a strong start gave way to trepidation.

"There are earnings reports that might move the markets a little each way, but until next week we're not going to get much direction, so markets are going to be choppy," said Sandell.

Economy: A mixed bag of economic data Friday contributed to the skittishness.

Ahead of the opening bell, the government issued its first look at third-quarter gross domestic product -- the broadest measure of the nation's economic activity.

The government reported that GDP rose at an annual rate of 2% in the third quarter, slightly higher than the 1.7% rate in the prior three months. The result was slightly above the 1.9% rate forecast in a CNNMoney.com consensus of economists.

Also before the bell, the Bureau of Labor Statistics reported compensation costs for civilian workers increased 0.4% in the third quarter.

After the start of trading, a report on manufacturing activity came in better than expected. The Chicago PMI rose to 60.6 in October from 60.4 in September, beating the reading of 58 expected by economists.

Meanwhile, a revised reading on consumer sentiment fell short of expectations. The Michigan consumer sentiment index slipped to 67.7 in October from 67.9 in September, missing the rise to 68 economists had forecast.

Companies: Shares of Monster Worldwide (MWW) soared 26% Friday, making it the biggest winner in the S&P 500. The job recruitment site raised its fiscal outlook and posted third-quarter results that topped forecasts.

Merck (MRK, Fortune 500) and Sony (SNE) were among the big companies reporting results ahead of the opening bell.

Merck topped analyst forecasts by 3 cents a share, reporting a profit of 85 cents a share. Merck's third quarter net income was $342 million, spurred by progress in emerging markets. Despite the better-than-expected results, shares of Merck slipped 2%.

Sony (SNE) reported a third-quarter net income of $375 million, driven by higher sales and cost cutting. The electronics maker also raised its income forecast for the rest of the year, despite the expectation of a continued difficult business environment.

Meanwhile, shares of Microsoft (MSFT, Fortune 500) rose more than 1.5%, after the software giant said late Thursday that sales and profits in the most recent quarter rose more than analysts expected.

Also, Coinstar (CSTR)'s stock soared 24% after it reported earnings that blew past analyst forecasts and raised its full-year guidance. The company's Redbox DVD vending business has been a big boost, and Coinstar recently recently said it planned on expanding into streaming, putting the heat on Netflix (NFLX).

World markets: European shares finished little changed. The CAC 40 in France and Britain's FTSE 100 fell by less than a percent, while Germany's DAX rose 0.1%.

Asian markets ended their session lower. Japan's benchmark Nikkei fell 1.8%, while the Hang Seng in Hong Kong and Shanghai Composite dipped 0.5%.

Currencies and commodities: The dollar strengthened against the euro, but fell against the British pound and Japanese yen.

Oil futures for December delivery fell 75 cents to settle at $81.10 a barrel.

Gold for December delivery jumped $15.10 to close at $1,357.60 an ounce.

Bonds: Prices on U.S. Treasuries rose Friday, pushing the yield on the benchmark 10-year note down to 2.6%, from 2.7% late Thursday.

Stocks waver amid investor caution

By Hibah Yousuf, staff reporter October 28, 2010: 4:34 PM ET

By Hibah Yousuf, staff reporter October 28, 2010: 4:34 PM ET

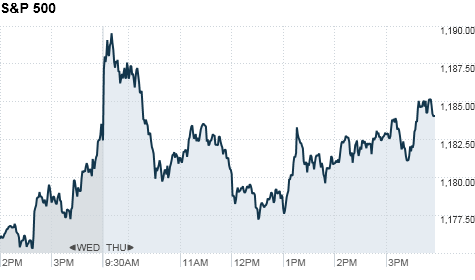

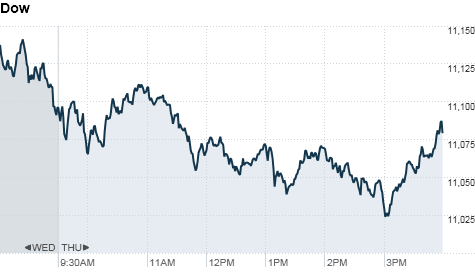

NEW YORK (CNNMoney.com) -- Stocks pared earlier losses and ended virtually unchanged Thursday, as investors remained cautious ahead of next week's Federal Reserve meeting.

Starting the session with strong gains, stocks were fueled by optimism from corporate earnings and a report showing fewer people filing for first-time unemployment. However, skittishness prevailed and stocks seesawed throughout the session.

The Dow Jones industrial average (INDU) closed 12 points lower, or 0.1%, with 3M (MMM, Fortune 500) and Caterpillar (CAT, Fortune 500) leading the decline. Earlier, the blue chip index had added as many as 53 points and had lost 74 points.

The S&P 500 (SPX) finished 1 point higher, or 0.1%, while tech-heavy Nasdaq (COMP) gained 4 points, or 0.2%.

"We're going to have a lot of choppiness in the market until we get some clarity from the Fed's plan next week," said Peter Tuz, president at Chase Investment Counsel.

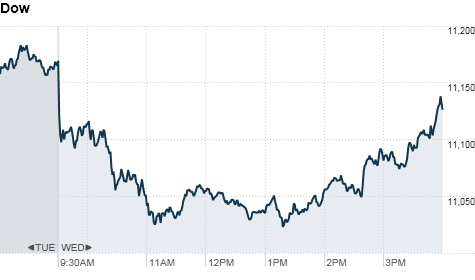

Stocks also ended the session mixed Wednesday as investors lowered their expectations for an aggressive move by the Federal Reserve to stimulate the economy.

Speculation over just how big of a move the Fed is going to make will continue to drive market activity through next week's Fed meeting, according to analysts.

"It's really all about the Fed next week -- and to a lesser extent elections," said Frank Longman, a market technician with Brean Murray, Carret & Co.

Stocks will likely remain on a roller coaster leading up to and possibly after the Fed announcement on Nov. 3.

Economy: The Department of Labor released its weekly jobless claims figures before the start of trade. The number was much lower than expected.

The number of Americans filing new claims for unemployment fell to a 3-month low of 434,000 -- a decline of 21,000 from the prior week. Economists expected claims to have risen to 458,000, according to Briefing.com.

Companies: 3M (MMM, Fortune 500) reported a third-quarter profit of $1.53 per share on revenue of $6.9 billion. The company beat on earnings but fell short on sales, sending its stock down 6.5% and making it the Dow's biggest loser.

Exxon Mobil (XOM, Fortune 500) also beat expectations on profit but not revenue. The oil giant earned $1.44 per share on revenue of $95.3 billion for the third quarter. Shares rose 0.8%.

Eastman Kodak (EK, Fortune 500) shares surged 15.3% after the company reported a narrower loss, citing growth in its digital businesses. While total sales edged down 1%, digital sales surged 10% during the latest quarter.

Shares of Avon Products (AVO) lost 5.6%, after the company's profit and sales came in weaker than expected. Avon's sales in North America and Latin America fell short of the company's forecast.

Halliburton (HAL, Fortune 500) stock sank 8% after a report from federal investigators suggested the oil services company knew the cement it used on the BP oil well was unstable.

Motorola (MOT, Fortune 500) reported better-than-expected third-quarter earnings of 16 cents per share, on total sales of $5.8 billion. The company attributed its strong earnings to growth in smartphone sales, particularly in China. Shares rose 0.5%.

Shares of Microsoft (MSFT, Fortune 500) spiked 1% after-hours after the company beat expectations with a quarterly profit of $5.41 billion, or 62 cents per share. Sales soared 25% to $16.2 billion, and also topped estimates.

Microsoft (MSFT, Fortune 500) will release its quarterly earnings after the market closes. Analysts predict a profit of 55 cents per share on $15.8 billion in revenue. Microsoft's stock edged up 0.9%.

General Motors is taking a big step toward repaying taxpayers for last year's $50 billion bailout, announcing it will repurchase $2.1 billion in preferred stock held by the Treasury Department.

Verizon Wireless (VZ, Fortune 500) has agreed to pay $25 million to the government to settle an investigation of the "mystery fees" it improperly charged millions of customers for data sessions they never intended to launch, the Federal Communications Commission said Thursday. The stock closed down 0.3%.

World markets: European stocks ended higher, with Britain's FTSE 100 and France's CAC 40 adding 0.6%. The DAX in Germany advanced about 0.5%.

Asian markets ended the session mixed. The Shanghai Composite slid 0.2%, while the Hang Seng in Hong Kong rose by 0.2%. Japan's Nikkei fell 0.2%.

Currencies and commodities: The dollar fell against the euro, Japanese yen and the British pound.

Oil for December delivery gained 24 cents to settle at $82.18 a barrel.

Gold futures for December delivery gained $19.90 to finish at $1,342.50 an ounce.

Bonds: Prices on U.S. Treasuries rose, pushing the yield on the benchmark 10-year bond down to 2.7%.

Stocks falter on questions about Fed stimulus

By Ben Rooney, staff reporterOctober 27, 2010: 5:19 PM ET

By Ben Rooney, staff reporterOctober 27, 2010: 5:19 PM ET

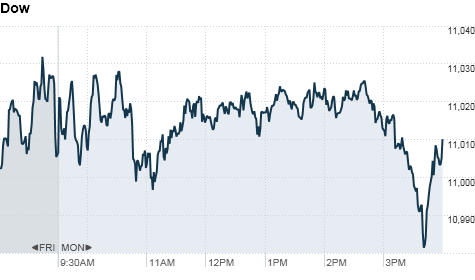

NEW YORK (CNNMoney.com) -- Stocks closed mixed Wednesday, with technology shares posting small gains, as investors lowered their expectations for an aggressive move by the Federal Reserve to stimulate the economy.

After falling over 130 points earlier in the day, the Dow Jones industrial average (INDU) closed down 43 points, or 0.4%. The S&P 500 (SPX) slid 3 points, or 0.3%. But the Nasdaq (COMP) gained 6 points, or 0.2%, to close above 2,500 points.

Stocks had been climbing for weeks on speculation that the U.S. central bank will announce another round of asset purchases at the end of its next policy meeting on November 3. But investors said the market may have over estimated the size and timing of the expected policy, known as quantitative easing.

"The headlines today are that the Fed's effort to rescue the economy may not be the shock-and-awe campaign many had expected," said Mark Luschini, chief investment strategist at Janney Montgomery Scott. "That's taking some of the fun out of the market."

Luschini said investors are now expecting the Fed to take a more "measured approach" to quantitative easing. "We're likely to see the Fed doing it in a stair step fashion to see if it's getting traction," he said.

The change in sentiment came after a report in the Wall Street Journal said the Fed is likely to buy "a few hundred billion" worth of Treasuries over a period of "several months." Market participants had been expecting the Fed to announce plans to buy an additional $500 billion to $1 trillion worth of Treasuries.

In addition, Bill Gross of PIMCO, the largest U.S. bond fund, wrote in his most recent outlook that he thinks the Fed is setting the stage for a future bout of inflation.

But the toned down expectations helped support the U.S. dollar, which gained ground against the euro, pound and yen. The stronger buck weighed on commodities priced in the U.S. currency. Oil futures fell 0.7%, while gold futures lost over 1%.

Shares of energy companies led decliners on the Dow, with Chevron (CVX, Fortune 500) and Exxon (XOM, Fortune 500) both down about 2%. Industrial names Caterpillar (CAT, Fortune 500) and Boeing (BA, Fortune 500) were also down sharply.

But the technology sector was generally stronger, driven by gains in shares of semiconductor companies such as Broadcom.

Shares of some big banks, which had been beaten down recently, were also higher. Bank of America (BAC, Fortune 500) gained 2% and JPMorgan (JPM, Fortune 500) edged up nearly 1%.

After the market closed, Visa (V, Fortune 500) said fiscal fourth-quarter profits rose 51% over last year on strong sales performance across all business lines. But shares of the credit card provider fell 1.5% in after hours trading.

Meanwhile, investors largely shrugged off economic reports on durable goods orders and new home sales in September. But traders said there was some trepidation ahead of next week's midterm elections to determine which political party will control of Congress.

Companies: Shares of Sprint (S, Fortune 500) fell nearly 10% after the company reported a loss of 30 cents per share, which the company said was caused by a massive tax-related charge.

German software maker SAP (SAP) said third-quarter earnings rose 11% versus last year, though results were below analysts' forecast. Shares fell 5%.

Chipmaker Broadcom (BRCM, Fortune 500) reported strong third-quarter results and said it expects growing demand for wireless services to support profits in the future. The company's stock gained over 11%.

Results from Procter & Gamble beat expectations by 2 cents, posting earnings per share of $1.02. The company reported growth in all geographic regions, with their shippment volumes rising 8%. Shares rose 0.2%.

Comcast (CMCSA, Fortune 500) also beat analyst expectations, reporting earnings per share of 30 cents -- a decrease from the 33 cents posted last year. The company said a large chunk of revenue loss is due to NBC Universal integration-related costs. Shares gained nearly 3%.

Tech infrastructure firm CommScope (CTV) announced that it has reached an agreement to be purchased by asset manager The Carlyle Group, in a transaction valued at about $3.9 billion.

The New York Post reported that Google (GOOG, Fortune 500) is close to striking a $2 billion deal for a building in Manhattan that occupies an entire city block. Google currently rents office space in the building.

Economy: The Commerce Department said new orders for manufactured durable goods in September increased $6.3 billion or 3.3%, after falling 1.3% in August.

Economists surveyed by Briefing.com had expected an increase of 1.8%. However, orders excluding transportation were down 0.8%, which was worse than expected.

A separate report showed that sales of newly built single-family homes rose 6.6% in September to an annual rate of 307,000 units. Economists had expected an annual rate of 299,000 units in the month, compared with 288,000 units the month before.

World markets: European stocks also tumbled. Britain's FTSE 100 dropped 1%, the DAX in Germany lost 0.7% and France's CAC 40 declined 0.9%.

Asian markets ended their session mixed. Japan's benchmark Nikkei index rose 0.1%, and the Hang Seng in Hong Kong lost 1.9%. The Shanghai Composite ended down 1.5%.

Currencies and commodities: The dollar continued to strengthen against the euro, the British pound and the Japanese yen.

Oil futures for December delivery dropped 59 cents to $81.96 a barrel. The government's weekly oil inventory report showed Wednesday that oil and gas supplies rose more than expected last week.

The drop in oil prices followed a U.S. Geological Survey report that showed revised estimate for the amount of conventional, undiscovered oil in the National Petroleum Reserve in Alaska. The agency said untapped oil reserves are about 90% less than previously estimated.

Gold for December delivery fell $15.30 to $1,3227 an ounce.

Bonds: Prices on U.S. Treasuries fell, pushing yields higher. The benchmark 10-year note yield rose to 2.7% from 2.64% late Tuesday. The government is expected to auction off $35 billion of 5-year notes on Wednesday.

Stocks claw out small gains

By Blake Ellis, staff reporterOctober 26, 2010: 4:40 PM ET

By Blake Ellis, staff reporterOctober 26, 2010: 4:40 PM ET

NEW YORK (CNNMoney.com) -- Stocks ended in slightly positive territory Tuesday after seesawing throughout the session, as investors weighed readings on consumer confidence and housing against a slew of earnings reports.

The Dow Jones industrial average (INDU) ticked up 5 points, the S&P 500 (SPX) rose less than a point, and the Nasdaq (COMP) gained 6 points.

Stocks climbed to six-month highs Monday, propelled higher by a stronger-than-expected report on existing home sales. But with so much uncertainty underlying the daily economic and corporate reports, volatility will continue to dominate.

"We've had a big run-up, so I don't see how they can go much higher," said Karl Mills, president and CIO at Jurika Mills & Keifer.

With the Nov. 2 elections approaching and the Federal Reserve's next policy meeting on tap early next month, the possibility of quantitative easing is also in the back of investors' minds.

"The belief is that quantitative easing is a done deal, and to a great extent that's why the market has been as buoyant as it has despite the fact that many leading indicators have stalled or gone down," said Ryan Atkinson, vice president of Balestra Capital. "But it's now late October, so a lot of players are sitting on the sidelines until the elections and FOMC meeting."

Economy: The Case-Shiller 20-City index of home prices in major metropolitan areas indicated that the housing market remained sluggish in August, with prices falling 0.2% from July. From a year earlier, prices edged up a modest 1.7%, missing the 2% rise economists had been expecting.

"[The report] is consistent with what we've been seeing," said Mills. "Housing isn't going to be coming back robustly any time soon here. We're going to have a long recovery period."

After the start of trading, the Conference Board released a report showing that consumer confidence inched up in October, but remained at historically low levels. The index rose to 50.2 from 48.6 in September, coming in slightly higher than the reading of 49 economists had forecast.

"Confidence may be improving, but with the housing market still real early in what may be a turnaround and unemployment running so high, there are still a whole lot of people out there not feeling so confident," said John Wilson, chief technical strategist at Morgan Keegan.

Companies: After the market close Tuesday, Barnes & Noble (BKS, Fortune 500) unveiled a new full-color, touchscreen version of its Nook e-reader. The company did not immediately announce the price of the new Nook Color.

Shares of Coach Inc. (COH) jumped 12% after the company posted a 34% rise in first-quarter profit and earnings of 63 cents a share -- topping analysts' estimates.

Ford (F, Fortune 500) reported third-quarter earnings that beat analysts' expectations. The automaker reported a profit of $1.7 billion, or 43 cents per share. Ford also announced plans to further pay down its debt. Shares rose 1.5%.

DuPont (DD, Fortune 500) exceeded forecasts by reporting quarterly earnings of 40 cents per share early Monday, despite a decline in pharmaceutical income related to patent expirations. Shares of the company slipped 1%.

Shares of Sony (SNE) rose 1% Tuesday, on media speculation that the electronics maker might be a takeover target for Apple (AAPL, Fortune 500).

Shares of Lexmark (LXK) tumbled 21% after the printer-maker's CEO Paul Curlander announced that he will retire in the spring of 2011.

Late Monday, insurance giant AIG (AIG, Fortune 500) disclosed that its chief executive, Robert Benmosche, has been diagnosed with cancer and is undergoing "aggressive" treatment. AIG shares jumped 2.3%.

World markets: European stocks finished with losses. Britain's FTSE 100 dropped 0.8%, and the DAX in Germany was down 0.4%. France's CAC 40 slipped 0.5%.

Asian markets ended the session lower. The Shanghai Composite was off 0.3%, while the Hang Seng in Hong Kong was 0.1% lower. Japan's Nikkei fell by 0.2%.

Currencies and commodities: The dollar strengthened against the euro and the Japanese yen, but fell against the British pound.

Oil for December delivery added 3 cents to settle at $82.55 a barrel.

Gold futures for December delivery fell 30 cents to $1,338.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 2.65% from 2.57% late Monday.

Stocks rally to 6-month highs

By Julianne Pepitone, staff reporterOctober 25, 2010: 4:48 PM ET

By Julianne Pepitone, staff reporterOctober 25, 2010: 4:48 PM ET

NEW YORK (CNNMoney.com) -- Stocks climbed to 6-month highs Monday after a report on housing sales came in much better than expected.

The Dow Jones industrial average (INDU) added 31 points, or 0.3%, to close at 11,164, its highest level since April. The S&P 500 (SPX) increased 3 points, or 0.2%, to 1,185 and the Nasdaq (COMP) was up 11 points, or 0.5%, to 2,491.

All three indexes had been up nearly 1% earlier in the morning, after the release of a strong report on existing home sales. Gains receded slightly as the day continued, but most sectors were still strong -- 23 of the 30 blue-chip Dow components were higher at the closing bell.

It marked the second time in the past week that the Dow has eclipsed its highest closing level this year, only to quickly pull back. It rose as high as 11,247.60 earlier Monday; the year's highest close was 11,205.03 on April 26. The intraday peak for the year was 11,258, also on April 26.

In addition to the strong housing data, stocks have recently gotten a boost from strong corporate earnings and bets that Republicans will win control of the House next week -- a shift that market participants believe will further lift stocks.

"President Obama has come out and said, 'I'm pro-business,'" said Kenny Landgraf, principal and founder at Kenjol Capital Management. "But if you have to keep insisting something over and over, it starts to sound like it isn't true."

Experts thought the election bets were already baked into the market, Landgraf said, but stocks have continued a somewhat steady climb throughout October.

Stocks ended mixed Friday, as investors balanced strong U.S. corporate earnings against currency tensions at the G-20 summit in South Korea.

Economy: Before Monday's open, Federal Reserve Chairman Ben Bernanke said that a federal agency review of foreclosure procedures at the nation's largest mortgage servicers should be completed next month.

Bank stocks have been under pressure in recent weeks, though, as mortgage servicers reviewed documents after allegations of sloppy paperwork surfaced. Bank stocks felt the blow, with JPMorgan (JPM, Fortune 500) down 1.7% and Bank of America (BAC, Fortune 500) off 2.5% Monday.

In its October industry survey, the National Association for Business Economics (NABE) said Monday that employment conditions improved in the third quarter to the highest level since the start of the 2008-2009 recession. The survey also showed expectations for hiring over the next 6 months rose to the highest level since 2006.

The National Association of Realtors released a report that said existing home sales shot up 10% over the month, to an annual rate of 4.53 million in September. Analysts surveyed by Briefing.com expected an increase to a rate of just 4.25 million.

Companies: After the bell, Texas Instruments (TXN, Fortune 500) reported third-quarter earnings per share of 71 cents, stronger than the 69 cents per share expected by analysts. Shares of the company rose 0.2% in evening trading.

Office Depot (ODP, Fortune 500) announced that CEO Steve Odland, who has led the company since 2005, is resigning his post effective Nov. 1.

The office supplies retailer also said it expected earnings per share of 18 cents for the third quarter. Shares of Office Depot rose 3.5%.

World markets: European stocks closed higher Monday. Britain's FTSE 100 added 0.2%, Germany's DAX rose 0.5% and France's CAC 40 gained less than 0.1%.

Asian markets ended the session mixed. The Shanghai Composite rose 2.6%, while the Hang Seng in Hong Kong was up 0.5%. Japan's Nikkei dropped 0.3%.

Currencies and commodities: The dollar edged lower against the euro and British pound, and it fell against the yen to as much as ¥80.41 -- a 15-year low.

Oil for December delivery gained 83 cents to settle at $82.52 a barrel.

Gold futures for December delivery rose $13.80 to settle at $1,338.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell slightly late in the afternoon, pushing the yield up to 2.57% from 2.56% on Friday.

Stocks eke out gains

By Blake Ellis, staff reporterOctober 21, 2010: 5:04 PM ET

By Blake Ellis, staff reporterOctober 21, 2010: 5:04 PM ET

NEW YORK (CNNMoney.com) -- U.S. stocks ended a shade higher Thursday after seesawing throughout the session, as investors balanced strong earnings with building speculation that the Fed's next round of asset-buying won't be as dramatic as anticipated.

The Dow Jones industrial average (INDU) rose 39 points, or 0.35%, the S&P 500 ticked (SPX) up 2 points, or 0.2%, and the Nasdaq (COMP) edged up 2 points, or 0.1%.

Stocks have been on a roller coaster this week -- starting with gains on Monday, diving to 2-month lows on Tuesday, and ending sharply higher Wednesday. Investors have been taking in mixed earnings results, and waiting for clues about the next round of asset purchases from the Federal Reserve.

There has been growing speculation over the past month that the Fed will launch more quantitative easing. The move -- known as QE2 -- would mark the second round of large-scale asset purchases of U.S. Treasuries by the Fed, as part of its effort to get the economy moving.

But comments from U.S. Treasury Secretary Timothy Geithner on Thursday suggested that the Fed's action won't be as large as expected, sending the dollar higher and taking steam out of the stock market's early rally.

"Geithner hinting that the dollar isn't as weak as we thought is making people start to think quantitative easing is going to be smaller than expected," said Dave Rovelli, managing director of U.S. equity trading at Canaccord Adams. "Markets have been banking on a huge printing of money, so if it's smaller, that's good for the dollar but bad for stocks."

China's growth cools: Helping to spur the market's early run-up, government figures released Thursday showed China's economic growth slowed for the second quarter in a row, easing fears that its economy is growing at an unsustainable pace.

"The report on China's growth was kind of like the story of the three little bears -- [the porridge] wasn't too hot, it wasn't too cold, it was just right," said Tom Schrader, managing director at Stifel Nicolaus.

China's gross domestic product, the broadest measure of economic output, grew at an annual rate of 9.6% during the third quarter of 2010.

While that number was still higher than many analysts expected, investors welcomed the report as a sign that China's economy will continue to lead the world recovery.

"If it was too weak it would have scared everyone that their economy is weakening," Schrader said.

Economy: The government's weekly jobless claims report showed that the number of Americans filing for first-time unemployment insurance was lower than expected, with 452,000 claims filed in the week ended Oct. 16.

A consensus of economists surveyed by Briefing.com had expected 455,000 jobless claims.

The Conference Board's Leading Economic Indicators rose 0.3% in September -- in line with expectations, and up from a downwardly revised 0.1% increase in August.

The Philadelphia Fed index, a regional reading on manufacturing, rose to 1 in October, from a negative 0.7 in September. While a step in the right direction, economists were expecting a slightly higher reading of 1.4.

"The economic data is not so strong that it will eliminate the possibility of QE2, but it lessens the chances," Schrader said. "And markets would definitely prefer not to see the necessity of QE2."

Companies: Traders also welcomed a slew of upbeat earnings reports Thursday.

After the market close, Amazon (AMZN, Fortune 500) posted a 39% jump in sales and third-quarter earnings per share of 51 cents, topping the 48 cents expected by analysts.

Before the opening bell,McDonald's Corp (MCD, Fortune 500). logged a 10% jump in third-quarter profit -- beating expectations and sending the fast-food chain's stock up 2.6% to a record high of $79.48 per share in early trading.

Nokia (NOK) beat estimates when it announced a third-quarter profit of $737.9 million, compared with a $783 million loss a year earlier. But the mobile phone maker also said it will cut as many as 1,800 jobs as it streamlines its operations. Shares of Nokia rose 4%.

UPS (UPS, Fortune 500) and Caterpillar (CAT, Fortune 500) also both beat forecasts on income and revenue. AT&T (T, Fortune 500) beat estimates on revenue, but its profit was skewed by a $8.3 billion gain related to its acquisition of Cingular Wireless in 2006.

Netflix (NFLX) shares surged 13%, after it posted stronger-than-expected earnings after the closing bell Wednesday.

EBay (EBAY, Fortune 500) reported better-than-expected earnings results after the market close Wednesday, sending shares of the company up 6% Thursday.

World markets: Asian markets finished mixed. Japan's benchmark Nikkei was a few points lower, while the Hang Seng in Hong Kong rose 0.4%. Shares in Shanghai eased 0.7%.

European markets posted strong gains. The DAX in Germany and the CAC 40 in France both surged 1.3%, while Britain's FTSE 100 jumped 0.5%.

Commodities and Currencies: The dollar climbed against the euro, the Japanese yen, and the British pound.

Oil prices for December delivery slipped $1.98 to settle at $80.56 a barrel.

Gold futures for December delivery dropped $18.60 to $1,325.60 an ounce.

Meanwhile, coffee futures settled more than 2% higher after soaring to the highest level in 13 years amid supply crunch concerns.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, boosting the yield to 2.55%.

Dow holds triple-digit gains

By Julianne Pepitone, staff reporterOctober 20, 2010: 6:36 PM ET

By Julianne Pepitone, staff reporterOctober 20, 2010: 6:36 PM ET

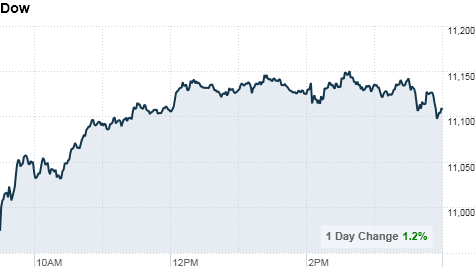

NEW YORK (CNNMoney.com) -- Stocks have fallen into a pattern: Rise, rise, rise for several sessions, then sell off after a spot of bad news. Recover the next day, and repeat.

This week has been no exception. Stocks rebounded to end sharply higher Wednesday, following the worst session in more than two months. Investors digested a mixed batch of financial results and shrugged off a tepid report on regional economic conditions.

The Dow Jones industrial average (INDU) added 129 points, or 1.2%, to end at 11,107.97. The S&P 500 (SPX) gained 12 points, or 1.1%, to close at 11,178.17, and the Nasdaq (COMP) rose 20 points, or 0.8%, to settle at 2,457.39.

Gains were broad-based in the recovery from Tuesday's rout, with 27 of the 30 blue-chip Dow components ending higher. Airline stocks received a boost following Boeing's upbeat earnings, but financial shares lagged on mixed reports from big banks.

Stocks have been rising on speculation that the Federal Reserve will announce plans to resume large-scale purchases of U.S. Treasuries, a policy called quantitative easing, when it meets next month.

"Everyone's thinking, the Fed's got my back, and when they run out of money they'll just find some more," said Joseph Saluzzi, co-head of equity trading at Themis Trading.

But investors fled stocks Tuesday after China unexpectedly raised interest rates, heightening concerns that cooling growth in China would drag on global growth. Major U.S. stock indexes posted the biggest one-day declines since early August.

Saluzzi said the market is in a cycle of rising for weeks on an expectation of Fed moves -- then selling off for a day on disappointing news, followed by a rebound session.

"It's more of the same, with no end in sight," Saluzzi said of Wednesday's session.

Companies: Shares of Wells Fargo (WFC, Fortune 500) ended 4.3% higher after the bank posted a profit of $3.15 billion, or 60 cents per share -- up 19% from a year earlier and above what analysts estimated. The San Francisco-based bank's sales were in line with expectations at $20.9 billion.

Morgan Stanley (MS, Fortune 500) reported a profit of $313 million, or 5 cents per share, for the third quarter -- down $67% from a year ago, due to a weak trading environment. Revenue also tumbled 20% compared to a year ago. Shares closed flat.

Dow component Boeing (BA, Fortune 500) said it earned $837 million, or $1.12 per share, on revenue of $17 billion -- topping expectations for earnings of $1.06 per share on revenue of $16.8 billion.

The aircraft maker also raised its guidance for the remainder of the year to between $3.80 and $4 per share, thanks to an improved outlook for commercial airplanes. Shares spiked to end 3.4% higher.

Yahoo (YHOO, Fortune 500) reported higher net income from the year-earlier period after U.S. markets closed Tuesday. But the company posted sales that fell short of expectations. Shares rose 2% Wednesday.

After the bell Wednesday, Netflix (NFLX) said its third-quarter net income grew as its subscriber base increased 52% over the year. Shares rose almost 8% in after-hours trade.

Economy: The Federal Reserve released its Beige Book at 2 p.m. ET, which showed that economic growth in various regions continued at a modest pace last month. Despite the lagging housing market, the Fed reported bright spots in the manufacturing, travel, tourism and auto industries.

The Fed's monetary policy has been in focus as investors anticipate the central bank's launch of a new round of quantitative easing at the conclusion of its meeting on Nov. 3.

World markets: European markets ended higher. The CAC 40 in France gained 0.4%, DAX in Germany rose 0.5%, and Britain's FTSE 100 posted a 0.4% increase.

Asian markets mostly finished lower on Wednesday, as investors got their first chance to react to China's rate hike. Japan's benchmark Nikkei tumbled 1.7% and the Hang Seng in Hong Kong dropped 0.9%. Shares in Shanghai closed a shade higher.

Commodities and currencies: The dollar fell against the British pound, euro and Japanese yen.

Oil prices for November delivery gained $2.28 to settle at $81.77 a barrel.

Gold futures for December delivery rose $8.20 to close at $1,344.20 an ounce.

Bonds: The price on the benchmark 10-year Treasury bond was unchanged, and the yield held steady at 2.48%.

Stocks: Worst day in two months

By Hibah Yousuf, staff reporter October 19, 2010: 4:39 PM ET

By Hibah Yousuf, staff reporter October 19, 2010: 4:39 PM ET

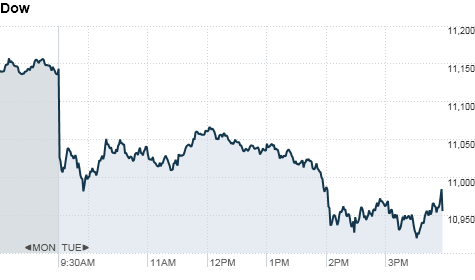

NEW YORK (CNNMoney.com) -- Stocks fell sharply Tuesday, amid reports that a group of bondholders are trying to force Bank of America to repurchase bad mortgages. Investors also weighed a surprise rate hike by the Chinese government, and mixed data on the housing market and corporate results.

The Dow Jones industrial average (INDU) lost 165 points, or 1.5%. All but two of the blue chip index's components were laggards, with Bank of America (BAC, Fortune 500) leading the decline.

The S&P 500 (SPX) slipped 19 points, or 1.6%, and the tech-heavy Nasdaq (COMP) shed 44 points, or 1.8%.

All three indexes logged their biggest daily drops since Aug. 11.

Stocks were under pressure throughout the session, but the the sell-off picked up steam in the afternoon following a Bloomberg news report that said PIMCO, BlackRock and the Federal Reserve Bank of New York are seeking to force Bank of America to buy back about $47 billion in bad mortgages that were packaged by its Countrywide Financial unit. Shares of Bank of America tumbled 4.4% on the news.

Earlier in the day, stocks drifted in the red after the People's Bank of China raised its benchmark deposit and lending rates for the first time in 3 years.

"The Chinese are basically telling the rest of the world that they're going to slow down their economy," said Mark McCormick, currency strategist for Brown Brothers Harriman. "It's kind of nerve wracking for the global economy, because China has been the key driver of world growth. This was clearly a major surprise."

But other experts said China's move isn't a cause for concern, and markets just needed a reason to take a breather.

"China's real estate values are hot, so they're putting a barrier in front of them. But I see it as a normal part of the economic recovery," said Rob Lutts, chief investment officer at Cabot Money Management. "The markets have been rallying for about 8 weeks, so it's not unusual to see them retreat between 2% and 5% -- and China's rate hike is a good excuse to reap profits."

China boosted its key lending rate to 2.50% from 2.25%, in an effort to help slow the country's rapid growth. With the rate increase, the Chinese central bank's one-year lending rate now sits at a lofty 5.56%.

Stocks ended sharply higher Monday after Citigroup (C, Fortune 500) reported upbeat financial results and a report showed improvements in the housing sector.

Companies: Ahead of the opening bell, Bank of America reported a third-quarter net loss of $7.3 billion. The bank said the loss was due to the recently passed financial reform law, for a one-time charge of $10.4 billion in its credit and debit card unit.

Goldman Sachs (GS, Fortune 500) reported a 40% plunge in profit to $1.9 billion for the third quarter, citing "challenging" market conditions. But it still managed to beat Wall Street's lowered estimates. The financial firm reported revenue of $8.9 billion, a mild increase from the year-earlier quarter. Shares rose 2%.

Johnson and Johnson (JNJ, Fortune 500) reported earnings per share of $1.23 on revenue of $14.98 billion. The stock sank 0.9% after company beat on profit but missed on sales.

J&J reported a dip in sales citing the drug recall's effect, saying it has made "considerable progress" to resolve the problem. On Monday, J&J subsidiary McNeil Consumer Healthcare recalled 127,728 bottles of Tylenol 8-hour caplets sold in the United States and Puerto Rico, due to complaints of a musty or moldy odor.

After Monday's close, Apple and IBM also posted results that topped analysts' expectations. But investors weren't satisfied, and shares of both companies fell. Shares of Apple (AAPL, Fortune 500) fell by 2.7% and IBM's (IBM, Fortune 500) stock was down 3.4%.

Shares of Yahoo (YHOO, Fortune 500) extended declines in after-hours trading Tuesday after the company reported that its quarterly net income more than doubled to $396 million from a year ago but sales missed analysts' forecast. The stock dropped 2.8% Tuesday.

Intel (INTC, Fortune 500) announced Tuesday that is investing up to $8 billion in microchip manufacturing plants, creating up to 1,000 permanent high-tech jobs in Arizona and Oregon. Shares were up 0.1%.

Shares of SuperValu (SVU, Fortune 500), which operates grocery store chains Albertsons and Shop n' Save, sank 14.9% after the company posted a steep loss in the second quarter.

Economy: A reading on September housing starts blew away expectations, but building permits lagged behind.

The U.S. Census Bureau reported that housing starts edged up in September to an annual rate of 610,000 from the revised August rate of 608,000.

Economists were expecting the report to show new home construction fell in September, with housing starts -- or the number of new homes being built -- falling to a seasonally adjusted annual rate of 579,000. This expectation was based on the previously reported rate of 598,000 in August.

Building permits rose more than 5% to the adjusted annual rate of 539,000 in September. They still fell short of the 565,000 expected.

World markets: European shares ended lower, with the FTSE 100 in Britain sliding 0.6%. The CAC 40 in France fell 0.7% and Germany's DAX slipped 0.4%.

In Asia, markets were more upbeat, but they closed ahead of China's rate hike. The Shanghai Composite rallied 1.6%, the Hang Seng in Hong Kong jumped 1.3% and the Nikkei in Japan added 0.4%.

Commodities and Currencies: The dollar rallied against the British pound, the Japanese yen, and the Euro.

The stronger buck added pressure on commodities like gold and oil, which are priced in dollars.

Gold futures for December delivery settled down $36.10 to $1,336.00 an ounce.

Crude oil for November delivery tumbled $3.59 to settle at $79.49 a barrel.

Bonds: The price fell on the benchmark 10-year U.S. Treasury, pushing the yield up to 2.48% from 2.51% late Monday.

Stocks get pumped up for earnings

By Julianne Pepitone, staff reporterOctober 18, 2010: 4:51 PM ET

By Julianne Pepitone, staff reporterOctober 18, 2010: 4:51 PM ET

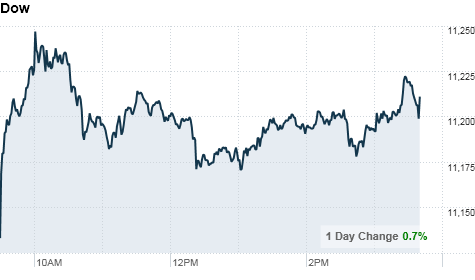

NEW YORK (CNNMoney.com) -- Stocks gained steam to close the session sharply higher Monday, extending last week's rally, on upbeat earnings from Citigroup and improvement in the housing sector.

The Dow Jones industrial average (INDU) added 81 points, or 0.7%, to end at 11,143.69. The S&P 500 (SPX) rose up 9 points, or 0.7%, to settle at 1,184.71, and the Nasdaq composite index (COMP) gained 12 points, or 0.5%, to close at 2,480.66.

The blue-chip Dow index ended strong, with 24 of its 30 components closing higher. Financial stocks helped the advance following Citi's strong earnings, with JPMorgan (JPM, Fortune 500) ending 2.8% higher. The energy sector lagged, with Halliburton and Fluor Energy losing about 5%.

It was a strong start to a week that will bring an avalanche of corporate results. Seven of the 30 companies that make up the Dow will release their third-quarter results, in addition to several big banks and tech companies.

So far, third-quarter results have generally come in above expectations. Of the S&P 500 companies that have posted results, 83% have topped analyst estimates, according to Thomson Reuters. But it's still early in the reporting period.

Spotlight on Q3 earnings: Jeff Saut, chief investment strategist with Raymond James, noted that "last year's third quarter was pretty lousy, so comparisons on a year-over-year basis are going to look pretty good."

But many companies are improving their bottom line through cost-cutting rather than material increases in performance, said Allan Boomer, investment manager at Fiduciary Management Group.

"I'm really not expecting a lot of top-line growth, but investors are positive on stocks anyway," Boomer said. "Bond yields are so low right now, and stocks are the next place investors look."

Stocks have been rising recently on speculation that the Federal Reserve will announce plans to resume large-scale purchases of U.S. Treasurys, a policy called quantitative easing, when it meets next month.

Companies: Citigroup (C, Fortune 500) posted a third-quarter profit of $2.2 billion, beating analyst forecasts as the bank reduced its credit losses to their lowest level since 2007. Shares of Citigroup ended 5.6% higher.

Goldman Sachs, Morgan Stanley and Wells Fargo will also report earnings this week. The financial sector led the market lower late last week as investors worried about the fallout from investigations into the foreclosure practices of many banks and mortgage servicers.

After the closing bell, IBM (IBM, Fortune 500) posted earnings that beat analyst estimates -- but shares still fell 3% in after-hours trading after closing Monday at a new all-time high.

Net income for the quarter was $3.6 billion, up 12% from last year. The tech giant said earnings per share rose 18% from last year to $2.82 per share. Analysts polled by Thomson Reuters expected earnings to be $2.75 per share.

Apple (AAPL, Fortune 500) also reported its fiscal fourth-quarter earnings after the bell, easily beating Wall Street estimates. The company said it earned $4.64 per share on $20.3 billion in revenue.

In other company news, BP (BP) said it is selling its businesses in Venezuela and Vietnam to Russian oil producer TNK-BP for $1.8 billion. The stock closed up 2.1%.

New England utility companies Northeast Utilities (NU, Fortune 500) and NStar (NST) announced that they have agreed to merge, creating one of the nation's largest utility companies. The company will continue to be called Northeast Utilities after Northeast buys NStar for $4.3 billion in stock.

Shares of Northeast Utilities fell 0.9%, and shares of NStar fell 0.6%.

Medical device company St. Jude Medical (STJ, Fortune 500) agreed to buy AGA Medical Holdings (AGAM) for $20.80 per share in a cash-and-stock transaction valued at a total of $1.3 billion.

Shares of St. Jude Medical ended 1.8% higher, while shares of AGA Medical Holdings skyrocketed 40.7%.

Economy: Just before the bell, the government released a report on production and activity in the nation's factories. Industrial production fell 0.2% in September, countering consensus estimates from Briefing.com that predicted a 0.2% jump. Capacity utilization stayed almost flat over the month, at 74.7%.

Later in the morning, the National Association of Home Builders released a report that showed builder confidence has increased in October. That report marked the index's first improvement in five months.

World markets: European stocks ended slightly higher. Britain's FTSE 100 added 0.7%, Germany's DAX gained 0.5% and the CAC 40 in France increased 0.2%.

Asian markets finished in negative territory. The Hang Seng in Hong Kong tumbled 1.2%. The Shanghai Composite fell 0.5%, and the Nikkei in Japan ended a shade lower.

Commodities and currencies: The dollar was flat against the British pound and euro, but it fell versus the Japanese yen.

Gold futures for December delivery gained 10 cents to settle at $1,372.10 an ounce.

Crude oil for November delivery added $1.59 to settle at $82.84 a barrel, after slipping below $81 a barrel earlier.

Bonds: The price rose on the benchmark 10-year U.S. Treasury, pushing the yield down to 2.49%.

Non-oil domestic exports see double digit growth in Sep

By Mustafa Shafawi | Posted: 18 October 2010 1330 hrs ![]()

|

||||||

A shop selling consumer electronic products |

||||||

SINGAPORE: Singapore's non-oil domestic exports (NODX) continued to enjoy double digit growth, due to an expansion of both electronic and non-electronic products.

Trade promotion agency IE Singapore said they rose by 23 per cent in September, compared to a year ago, following the 31 per cent rise in the previous month

It added electronic NODX increased by 21 per cent, after the 35 per cent rise in August.

IE Singapore said the expansion in electronic domestic exports was largely due to higher domestic exports of integrated circuits (ICs), parts of ICs and diodes & transistors.

Non-electronic products rose 24 per cent in September, after the 28 per cent rise in the previous month.

The increase in non-electronic NODX was led by higher domestic exports of specialised machinery, ships & boats and pharmaceuticals.

IE Singapore said exports to all of the top 10 NODX markets increased.

The largest contributors to the increase were the EU 27, the US and Hong Kong.

Domestic exports to emerging markets increased by 36 per cent in September compared to the 23 per cent decline in the previous month.

IE Singapore said the rise in NODX to the emerging markets was because of higher shipments to the Middle East and South Asia.

Wall Street stages late day comeback

By Ben Rooney, staff reporterOctober 14, 2010: 5:33 PM ET

By Ben Rooney, staff reporterOctober 14, 2010: 5:33 PM ET

NEW YORK (CNNMoney.com) -- In an abrupt about-face, stocks closed with minor losses Thursday as investors shook off concerns about the banking sector to do some bargain hunting late in the day.

The Dow Jones industrial average (INDU) closed down 1 point, after tumbling more than 40 points earlier in the session. The S&P 500 (SPX) lost 4 points, or 0.3%. The Nasdaq (COMP) slid 6 points, or 0.2%.

Bank stocks led the market lower in the morning as concerns about investigations into foreclosure proceedings by state regulators weighed on the sector.

JPMorgan (JPM, Fortune 500) lost 2.8% one day after it reported a surge in third-quarter profit. Bank of America (BAC, Fortune 500) fell 5%, and Citigroup (C, Fortune 500) lost 4.4%.

But stocks regained most of the lost ground in the afternoon as buyers came back into the market to scoop up shares that had been beaten down earlier in the session, said Ryan Larson, a senior equity trader at RBC Global Asset Management.

"As the financials weighed on the market, things became cheap," he said.

After the closing bell, Google (GOOG, Fortune 500) reported quarterly profit and sales that rose from year-ago levels and beat Wall Street's forecasts. Shares of the web giant were up 9% after hours.

Chipmaker AMD (AMD, Fortune 500) reported a quarterly loss that narrowed from last year, although its adjusted earnings beat analysts' expectations. Shares rose 7% in extended trading.

The reports were the latest in a slew of quarterly financial statements released this week from major U.S. companies. On Friday, the deluge will continue with General Electric (GE, Fortune 500) and Mattel (MAT, Fortune 500) due to report results before the market opens.

Larson said investors are looking for solid revenue growth and will pay close attention to what executives have to say about the outlook for next year.

"It has to be about sales, not cost cutting," he said. "And the revenue picture has been mixed so far."

Meanwhile, the dollar continued to deteriorate on Thursday. That helped to drive gold prices higher as investors moved to more tangible assets. Oil prices also rose.

The greenback has been under pressure this week, as investors anticipate another round of asset purchases from the Federal Reserve. That policy -- known as quantitative easing -- could push interest rates down and keep the dollar weak.

Fed policy will probably be in focus again Friday morning when Ben Bernanke, the central bank's chairman, makes a speech in Boston.

Also on Friday, investors will take in reports on consumer prices and retail sales, as well as consumer sentiment, business inventories and regional manufacturing activity.

Stocks rallied Wednesday, amid speculation that the central bank will announce plans to do more quantitative easing at its next meeting in November.

Economy: Initial jobless claims rose to 462,000 in the latest week, from a revised 449,000 the week before, the Labor Department said.

Economists had expected initial claims to have risen to 450,000, according to consensus estimates from Briefing.com.

The government's latest reading on inflation at the manufacturing level rose 0.4% in September, matching the pace in August. Excluding volatile food and energy prices, core PPI rose 0.1%, also the same rate as the month before.

The U.S. trade balance widened to $46.3 billion in August from a revised $42.6 billion in July, the Commerce Department said.

Companies: Verizon Wireless said it will begin selling Apple's iPad at its 2,000 retail stores nationwide beginning next month.

The move ends AT&T's (T, Fortune 500) exclusive grip as the wireless carrier for Apple's wildly popular tablet, and potentially sets the stage for a broader partnership between Apple and Verizon.

Verizon (VZ, Fortune 500) shares were up 0.5%. Apple's stock, which crossed $300 for the first time Wednesday, dipped 0.4%.

Shares of Yahoo (YHOO, Fortune 500) gained 4.5%, after The Wall Street Journal reported AOL is considering teaming up with private-equity firms to make a bid for the search engine.

Apollo Group (APOL), which operates the University of Phoenix, withdrew its 2011 earnings guidance late Wednesday. Apollo said the company faces an "uncertain regulatory environment." The stock plunged 23%, dragging down other education companies such as DeVry (DV) and ITT Educational Services (ESI).

World markets: European markets ended mixed. Germany's DAX rose 0.4%, while the CAC 40 in Paris fell 0.2% and the FTSE 100 lost 0.3%.

In Asia, stocks closed in positive territory. The Hang Seng in Hong Kong rose 1.7% and the Shanghai Composite gained 0.6%. Japan's Nikkei edged higher 1.9%.

Commodities and Currencies: The dollar fell against major international currencies including the British pound, the Japanese yen and the euro.

Gold futures for December delivery rose $7.10 to close at $1,377.60 an ounce. In earlier trading, gold reached $1,388.10 an ounce -- a new intra-day trading high.

The price of oil gained 48 cents to settle at $82.53 per barrel.

Bonds: The price fell on the benchmark 10-year U.S. Treasury, pushing up the yield to 2.46% from 2.42% late Wednesday.

Singapore's GDP expands by 10.3% on-year, contracts by 19.8% on-quarter in Q3

Posted: 14 October 2010 0819 hrs ![]()

|

||||||

|

||||||

SINGAPORE: Singapore's GDP expanded by 10.3 percent on a year-on-year basis in the third quarter of 2010.

On a quarter-on-quarter basis the economy contracted by 19.8 percent, a reversal from the growth of 27.3 percent in the previous quarter.

The advance estimates released by the Ministry of Trade and Industry (MTI) on Thursday said that the Singapore economy remains on track to achieve the overall growth forecast of 13 to 15 percent for the whole of 2010.

Commenting on the sectoral decline on a quarter-on-quarter basis, MTI said the manufacturing sector contracted by 57 percent in the third quarter, after expanding by 67 percent in the preceding quarter.

It attributed the decline largely to the biomedical manufacturing cluster, where some pharmaceutical companies switched to producing a different value-mix of active pharmaceutical ingredients. MTI also cited some plant maintenance shutdowns during the quarter.

The construction sector also contracted by 12 percent, compared to an expansion of 29 percent in the preceding quarter. MTI said this was mainly due to the completion of key commercial and industrial building projects earlier in the year.

The services-producing industries registered a modest sequential growth of 1.6 percent, following a 13 percent expansion in the previous quarter.

MTI said growth for the rest of the year will be underpinned by a number of industry-specific factors.

It said continued growth in global demand for electronic products will lend some support to the electronics and precision engineering clusters.

It added that increasing visitor arrivals, drawn by the Integrated Resorts, will continue to bolster tourism in Singapore.

MTI will release the preliminary GDP estimates for the third quarter of 2010, including performance by sectors, sources of growth, inflation, employment and productivity, in November 2010.

Stocks rally, but close off session highs

By Ben Rooney, staff reporterOctober 13, 2010: 4:48 PM ET

By Ben Rooney, staff reporterOctober 13, 2010: 4:48 PM ET

NEW YORK (CNNMoney.com) -- Stocks rallied Wednesday as investors bet that the Federal Reserve is moving toward a more accommodative policy.

The Dow Jones industrial average (INDU) closed up 76 points, or 0.7%, after climbing 130 points earlier in the session. The S&P 500 (SPX) gained 8 points, or 0.7%, and the Nasdaq (COMP) rose 23 points, or 0.9%.

The advance began after blue chips JPMorgan Chase and Intel reported quarterly earnings that beat Wall Street estimates. But traders said the rally was driven by speculation the Fed will announce plans next month to resume large-scale purchases of Treasurys, a strategy called quantitative easing.

"Earnings so far have been strong, and that's definitely a positive," said Abigail Doolittle, a portfolio manager at Johnson Illington Advisors. "But everything is taking a backseat to this incredible focus on QE2," she added, using Wall Street shorthand for the Fed policy.

Minutes from the Fed's September policy meeting showed Tuesday that the central bank is willing to make good on its pledge to support the economy if conditions continue to deteriorate. Investors took that as a sign the Fed will announce plans to buy more Treasurys at its next policy meeting in November.

The dollar, which would suffer if more Treasurys were purchased, continued to weaken Wednesday. Treasury prices fell, pushing yields higher, as investors transferred money into stocks.

The anemic dollar boosted commodities that are priced in the U.S. currency, such as gold and oil. Gold rose to another record high, and oil prices surged 1.6%.

Strength in commodities helped support shares of companies in the industrial and materials sector. Caterpillar (CAT, Fortune 500) and Boeing (BA, Fortune 500) both rose more than 1%.

The weak dollar also lifted shares of companies that do business overseas, since a softer greenback boosts profits for U.S. multinationals. IBM (IBM, Fortune 500), 3M (MMM, Fortune 500) and United Technology (UTX, Fortune 500) all gained significant ground.

"It's a risk on trade," said David Levy, portfolio manager at Kenjol Capital Management. "Investors are putting money into assets that will benefit from a weaker dollar."

Stocks recovered from early loses on Tuesday to close higher after the Fed minutes were released.

On Thursday, the nation's troubled job market could come to the fore when the Labor Department's weekly report on initial claims for unemployment benefits comes out. A report on inflation at the wholesale level is also due before the market opens.

After the closing bell Thursday, search giant Google (GOOG, Fortune 500) is expected to report another jump in quarterly profit.

Companies: Apple's (AAPL, Fortune 500) stock rose to $300.11 per share, climbing above $300 for the first time ever. That's an increase of about 40% year-to-date, driven by the success of its iPad and iPhone.

JPMorgan Chase (JPM, Fortune 500) reported earnings of $4.4 billion as its loan losses continued to decline.

After rising about 2% earlier in the session, shares of JPMorgan fell 1.4% on concerns about the legal implications of potentially inaccurate foreclosure filings.

The bank acknowledged that it has found cases in which the signers of foreclosure affidavits didn't personally review underlying loan files, as they are required to. It also said affidavits weren't properly notarized in some cases.

But the strong report could bode well for Citigroup (C, Fortune 500), Wells Fargo (WFC, Fortune 500), Bank of America (BAC, Fortune 500), Morgan Stanley (MS, Fortune 500) and Goldman Sachs (GS, Fortune 500). All are slated to report their results next week.

On Tuesday, Intel (INTC, Fortune 500), reported a rise in quarterly sales and profit. Despite the upbeat results, shares of the chipmaker fell 2.7% Wednesday.

Shares of CSX (CSX, Fortune 500) rose 4.2% after the railroad operator posted results that beat expectations after the closing bell Tuesday. Other railroad companies also gained, including Union Pacific (UNP, Fortune 500) and Norfolk Southern (NSC, Fortune 500).

Shares of MGM Resorts International (MGM, Fortune 500) fell over 11% after the casino operator warned Tuesday that it expects to suffer a loss of 70 cents per share in the third-quarter.

Chevron (CVX, Fortune 500) said Tuesday that it expects to report a drop in earnings when it releases its third-quarter results later this month. Shares of the oil giant dipped 0.2%.

Economy: The Bureau of Labor Statistics reported that U.S. import prices fell 0.3% in September, following an increase of 0.6% the prior month. The price of fuel imports led the decline, falling 3.1%.

Export prices rose in September by 0.6%, following a rise of 0.8% the prior month. This was driven by agricultural import prices, which rose 2.4%.

World markets: European markets ended sharply higher. The FTSE 100 in London, CAC 40 in Paris and Germany's DAX all gained more than 2%.

In Asia, stocks closed in positive territory. The Hang Seng in Hong Kong shot up 1.5% and the Shanghai Composite gained 0.7%. Japan's Nikkei edged higher 0.2%.

China posted a trade surplus of $16.9 billion for September, as exports climbed 25% and imports rose 24%. That's down from a $20 billion surplus in August.

But the drop was not enough to ease tensions between the China and the United States, which has been pressuring China to allow its currency to appreciate against the dollar because an undervalued yuan hurts U.S. manufacturers by undercutting their export prices.

"China's overall trade surplus may have declined slightly last month, but tensions are unlikely to do the same," said Mark Williams, senior China economist at Capital Economic.

Commodities and Currencies: The dollar slipped against the major international currencies, including the British pound, the Japanese yen and the euro.

Gold futures for December delivery surged $23.80 to settle at another record high of $1,370.50 an ounce.

The price of oil rose $1.29 to close at $82.96 per barrel.

Treasurys: The price fell on the benchmark 10-year U.S. Treasury, pushing up the yield to 2.43% from 2.42% late Tuesday.

Stocks end higher as Fed signals more aid

By Ben Rooney, staff reporterOctober 12, 2010: 4:53 PM ET

By Ben Rooney, staff reporterOctober 12, 2010: 4:53 PM ET

NEW YORK (CNNMoney.com) -- Stocks recovered from earlier losses to close higher Tuesday after meeting minutes suggested the Federal Reserve will act soon to provide additional support for the economy.

The Dow Jones industrial average (INDU) rose 10 points, or 0.1%, after falling more than 70 points earlier in the session. The S&P 500 (SPX) gained 4 points, or 0.4%. The Nasdaq (COMP) added 15 points, or 0.6%.

Fed policymakers continue to believe that the pace of the economic recovery is slowing, according to minutes from the central bank's September meeting.

The minutes also suggest that the Fed is ready to make good on its previous pledge to provide additional "unconventional measures" to boost the economy.

While there is still debate over how to proceed, the minutes revealed that talks in September centered around more large-scale purchases of assets such as U.S. Treasurys, a policy known as quantitative easing.

The minutes did not specify how big the program could be, when it could start or how long it could last. But investors took the notes as further evidence that the Fed will announce plans to buy more assets when it meets next month.

"This communiqué leaves the door open for actions in November," said Lawrence Creatura, a portfolio manager with Federated Clover Investment Advisors.

The dollar fell versus the euro, reversing an earlier advance. Prices for Treasurys remained under pressure, pushing the yield on the 10-year note up to 2.42%.

Meanwhile, investors are also focused on the outlook for the third-quarter corporate reporting period, which gets into full swing this week.

After the market closed Tuesday, Intel Corp (INTC, Fortune 500). reported quarterly profit and sales figures that rose sharply from a year ago and beat Wall Street's forecasts.

Intel is one of several major U.S. companies due to report results this week. JPMorgan Chase (JPM, Fortune 500) reports before the opening bell Wednesday, while General Electric (GE, Fortune 500) and Google (GOOG, Fortune 500) are slated to post results this week.

Corporate earnings have largely exceeded expectations in recent quarters, but investors are eager to hear what companies are doing to boost profits beyond cutting costs.

"Forward-looking comments will be far more important than in past quarters," said Creatura.

Stocks ended with single-digit gains Monday, with the Dow closing above the key 11,000 level for a second straight session.

Companies: Drugmaker Pfizer (PFE, Fortune 500) announced it is buying King Pharmaceuticals (KG) for $3.6 billion, or $14.25 per share. King Pharmaceutical's stock spiked 39.3%.

Shares of Avon (AVP, Fortune 500) gained more than 8% on speculation that France's L'Oreal was considering a takeover bid for the cosmetics and beauty products manufacturer. The rally cooled off as the session wore on with Avon's stock gaining 4% near midday.

Google said it has agreed to invest in a proposed$5 billion transmission system that will connect offshore wind farms built along a 350-mile stretch between New Jersey and Virginia.

Gap (GPS, Fortune 500) said it is reverting to its classic logo, after a new logo it debuted on its website ignited a customer backlash.

Wal-Mart (WMT, Fortune 500) finance chief Charles Holley will speak at a two-day investor conference Tuesday evening. The company just unveiled plans to start selling the iPad come February. The retailer's performance is considered a key measure of consumer spending and the overall health of the economy.

Shares of Transocean (RIG) rose nearly 5% after the Obama administration said it would allow deepwater drilling to resume in the Gulf of Mexico for companies that meet all U.S. safety requirements. The ban on deepwater drilling was put in place earlier this year in response to the BP oil spill.

Diamond Offshore Drilling (DOS), Seahawk Drilling (HAWK) and Noble Corp (NE) were also higher.

Starbucks (SBUX, Fortune 500) and Green Mountain (GMCR) both rallied as investors warmed to the coffee companies. Starbucks got a lift from an analyst upgrade, while Green Mountain was boosted by takeover talk.

World markets: European stocks closed lower. Britain's FTSE 100 lost 0.2%, and France's CAC 40 tumbled 0.5%. The DAX in Germany fell less than 0.1%.

Asian markets ended the session mixed. The Shanghai Composite rose about 1.2%, while the Hang Seng in Hong Kong slipped 0.4%. Japan's Nikkei sank 2.1%.

Large Chinese banks dropped in Shanghai and Hong Kong after Reuters reported that China has temporarily raised reserve requirements on six banks as it tries to temper inflation and sustain the recovery.

Currencies and commodities: The dollar fell against the euro, but remained weak versus the British pound and the Japanese yen.

Oil for November delivery slipped 47 cents to $81.74 a barrel.

Gold futures for December delivery dropped $3.40 to $1,351.20 an ounce.

Bonds: Treasury yields rose as prices fell. Yields on 10-year notes rose to 2.42% on Tuesday, down from a close of 2.39% on Friday. The bond market was closed Monday for Columbus Day.

Dow holds above 11,000

By Ben Rooney, staff reporterOctober 11, 2010: 5:13 PM ET

By Ben Rooney, staff reporterOctober 11, 2010: 5:13 PM ET

NEW YORK (CNNMoney.com) -- Stocks ended with slight gains Monday as investors shifted their focus towards corporate financial results.

The Dow Jones industrial average (INDU) gained nearly 3 points, or less than 0.1%, to close at 11,010 points. The S&P 500 (SPX) edged up 2 points, while the Nasdaq (COMP) gained about half a point.

The U.S. government and Treasury market were closed for Columbus Day, but all other financial markets were open. Trading volumes were light because of the holiday, and stocks traded in a narrow range for most of the session.