First day trading of GM deemed a success

Though it rose just over a dollar, Wall Streeters say GM's return to the market was a success

Nov 19, 2010

4% to 6% growth next year

2010 growth expected to be record 15%; no technical recession

SINGAPORE'S economy is officially expected to grow by 4 per cent to 6 per cent next year, a marked slowdown from this year's sizzling effort, but still above the expected long-term trend.

The Ministry of Trade and Industry (MTI) said this year's growth is set to come in at a blistering 15 per cent - which, some economists say, could make Singapore the world's fastest growing economy for this year.

The figures, released yesterday, show that growth in the June to September quarter was 10.6 per cent compared with the third quarter last year.

The figures also indicate Singapore is all but certain to avoid a technical recession, defined as two straight quarters of quarter-on-quarter contraction.

That is because the full-year 15 per cent forecast implies a quarter-on-quarter expansion in the year's final quarter, brought on by strong growth in financial services, tourism and pharmaceuticals, explained MTI permanent secretary Ravi Menon.

Though Singapore is on track to hit a record high growth rate, the pace of economic growth has slowed significantly.

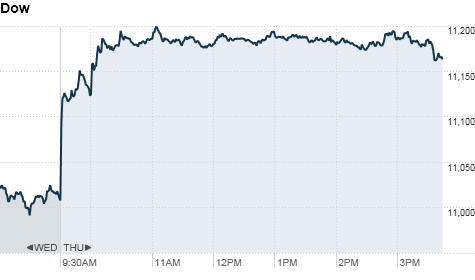

Stocks finish higher after GM debut

NEW YORK (CNNMoney.com) -- U.S. stocks surged more than 1% Thursday as an early rally gained steam, following a strong debut by General Motors' stock.

Overnight talk that the Irish government was close to accepting a bailout loan eased eurozone worries and sent global stocks soaring. That momentum spilled over to U.S. markets.

The Dow Jones industrial average (INDU) jumped 173 points, or 1.6%. The S&P 500 (SPX) rose 18 points, or 1.5%, and the Nasdaq (COMP) ticked up 38 points, or 1.6%, according to early tallies.

Shares of General Motors (GM) opened at $35 apiece, $2 above the offering price. Trading was very active, with volume topping 452 million shares at the close. That's equivalent to about 10% of the total volume trading on the New York Stock Exchange's Thursday.

The automaker's highly-anticipated initial public offering raised more than $20 billion, making it the largest in U.S. history.

"The GM deal looks like it went well, which shows there's finally some stability and a growing company," said Joseph Saluzzi, co-head of equity trading at Themis Trading. "There was really no question of it not going well, because they had the government behind them, so it's a no brainer for investors -- they're thinking they can get a quick flip here, buying at $33 and selling at $35."

All but one of the Dow's 30 components rose, with Alcoa (AA, Fortune 500), Caterpillar (CAT, Fortune 500) and Boeing (BA, Fortune 500) leading the gains.

"The market is bipolar right now -- one day death is upon us, the next day everybody's jumping in," said Saluzzi. "There's not a lot of conviction overall, but today's one of those 'risk on' days."

After rallying in September and October, stocks have had a rocky November as eurozone worries and uncertainty about the U.S. economy's future have bubbled to the surface.

U.S. stocks ended Wednesday's session mixed, failing to break out of a narrow range as investors digested reports on inflation and the housing market.

A possible solution to the Irish debt crisis pushed European and Asian stocks higher, and those gains carried over into the U.S. market. Britain's FTSE 100 closed 1.3% higher, while Germany's DAX and France's CAC 40 surged 2%.

While Irish government officials had been denying that a loan to contain its growing debt was necessary, the International Monetary Fund and European Central Bank met in Ireland Thursday, and Central Bank of Ireland governor Patrick Honohan said he expects an IMF loan.

Asian markets ended with gains across the board. The Shanghai Composite rose 0.9%, and the Hang Seng in Hong Kong ticked up 1.8%. Japan's Nikkei gained 2.1%, which pushed the index above the 10,000-point threshold for the first time since June.

"The Irish debt situation has been the hot topic, so the news [that Ireland may accept a loan] took off some of the scare and this is a relief rally based on that initial headline," Saluzzi said. "But the issue is far from solved. It's like a bucket with many holes in it -- you plug one hole and water gushes somewhere else.

Economy: Strong U.S. economic data also helped boost markets Thursday.

Before the opening bell, the Labor Department reported the number of people filing for first-time unemployment benefits edged up 2,000 to 439,000 in the latest week.

While the number of claims moved higher, analysts had expected a larger increase of 442,000.

Continuing claims, a measure of Americans who have been receiving benefits for a week or more, slipped to 4,295,000 in the most recent week -- the lowest level in nearly 2 years.

The Philadelphia Federal Reserve index, a regional reading on manufacturing, surged to 22.5 -- up from 1 in October, and much higher than the reading of 5 economists had been expecting.

The Conference Board's index of leading economic indicators jumped 0.5%, after rising 0.5% the previous month. The reading slightly missed the 0.6% rise economists had forecast.

Companies: Staples (SPLS, Fortune 500) reported earnings ahead of the opening bell that were in line with analyst expectations. The office supply chain reported earnings per share of 40 cents, on total company sales of $6.5 billion for the third quarter. Shares of Staples jumped 2%.

Sears Holdings (SHLD, Fortune 500) posted results before the market open that were far worse than analysts expected. The company reported a loss of $1.98 per share, wider than the predicted loss of $1.07 a share. Sears shares slipped 4%.

Dell (DELL, Fortune 500) will release its quarterly results after the close. The PC maker is expected to report earnings of 33 cents per share, up from 23 cents per share a year earlier.

Meanwhile shares of NetApp (NTAP) led a broad tech advance, rising more than 8%. Shares of the data storage company had dropped about 6% Wednesday, after parts of its quarterly report were leaked.

Other big tech gainers included Yahoo (YHOO, Fortune 500), Amazon (AMZN, Fortune 500), Broadcom (BRCM, Fortune 500).

In other corporate news, coal producer Walter Energy (WLT) offered $3.24 billion to buy Western Coal Corp. Shares of Walter Energy edged slightly higher.

Currencies and commodities: The dollar fell against the euro and the British pound, but strengthened against the Japanese yen.

Oil for December delivery gained $1.41, or 1.8%, to $81.85 a barrel.

Gold futures for December delivery rose $16.10 to settle at $1,353 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 2.92%.

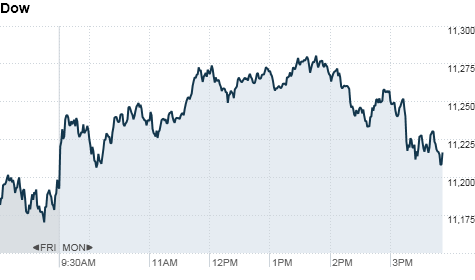

Stock rally bites the dust

By Annalyn Censky, staff reporterNovember 15, 2010: 5:54 PM ET

By Annalyn Censky, staff reporterNovember 15, 2010: 5:54 PM ET

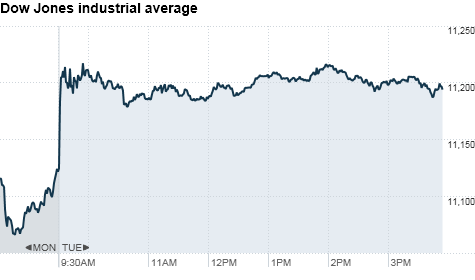

NEW YORK (CNNMoney.com) -- After posting gains nearly all day, U.S. stocks tumbled at the session's close Monday, as investors remain jittery during a week with a full economic calendar.

At the closing bell, the Dow Jones industrial average (INDU) only gained 9 points, or 0.1%, after climbing as much as 88 points earlier in the session. The S&P 500 (SPX) fell 1 point, or 0.1% and the tech heavy Nasdaq (COMP) fell 4 points, or 0.2%.

Early in the session, investors welcomed news from Caterpillar (CAT, Fortune 500) that it planned to acquire mining equipment company Bucyrus International (BUCY). A strong retail sales report also gave stocks a boost at the get-go.

But stocks struggled to hold on to those gains toward the closing bell, as investors gear up for more economic data due out later this week. Tuesday brings reports on industrial production and the latest Producer Price Index, an important reading on the price of goods at the wholesale level.

"This market never really had a lot of conviction going in, even though we had some pretty good economic data to chew on. Investors just didn't have the passion for buying stocks today," said Jack Ablin, chief investment officer for Harris Private Bank in Chicago.

Meanwhile, worries about a sovereign debt crisis in Europe are once again bubbling to the surface, after the Group of 20 meeting of world leaders last week revived jitters about the global economy. And Irish debt continues to be a sore point, even as the country's government insists that it will not need a bailout.

"We've got some problems in the euro zone that are continuing to escalate," said Phil Streible, senior market strategist with Lind-Waldock. "The economic data hasn't been all that great, and I'm not so comfortable remaining upbeat about the stock market at these levels," he added.

Stocks ended on a sour note last week, as concerns about the global economy took center stage. All three major indexes closed with their worst weekly declines in three months.

Economy: A government report released before the market's open revealed good news for retailers heading into the holiday shopping season. Retail sales increased 1.2% in October -- a far better number than the 0.6% gain expected by analysts.

The report comes at the perfect time for retailers hoping for strong holiday sales. "There is a lot of demand out there and people feel better. Those who have money are spending it," said Harry Clark, founder and CEO of Clark Capital Management Group.

But two other economic reports were less upbeat, and could be holding stocks back from climbing more.

Investors cautiously looked to a bigger-than-expected rise in inventories at U.S. businesses in September as a sign that demand is not keeping up with supply. Inventories increased 0.9% from the prior month, higher than the 0.6% increase economists had been expecting.

A separate report on manufacturing in the New York area indicated that activity declined in early November from the month before.

For the first time since mid-2009, the general business conditions index fell below zero -- declining 27 points to -11.1. New orders also registered a sharp decline, the New York Fed said.

Tax policy is also likely to be on investors' minds as Congress reconvenes for a lame-duck session. Lawmakers have yet to decide the fate of key tax breaks that are due to expire at the end of 2010

Companies: After the bell, Nordstrom (JWN, Fortune 500) reported third-quarter earnings of 53 cents per share, slightly better than the 52 cents per share analysts were expecting. Nordstrom shares rose 1% in after-hours trading.

Earlier in the day, Caterpillar (CAT, Fortune 500) announced its plans to buy mining equipment giant Bucyrus International (BUCY) in a deal valued at $7.6 billion. The price per share is valued at a 32% premium to Bucyrus' share price as of Friday. Shares of Caterpillar edged up 1%, while Bucyrus's stock rose 29%.

The deal lifted stocks of other mining equipment manufacturers, driving shares of Joy Global Inc. (JOYG) up 7.5%, while shares of Terex Corp. (TEX, Fortune 500) rose 2.9%

Shares of Ford Motor Co (F, Fortune 500). rose 4.3% as rival automaker General Motors Co. prepares to price its initial public offering on Nov. 17.

BHP Billiton (BHP) withdrew its hostile takeover bid for Canadian mining company PotashCorp (POT) following intervention by Canadian regulators. Shares of BHP rose 0.8% afternoon trading, while PotashCorp shares fell about 1.9%.

Data-storage company EMC Corp. (EMC, Fortune 500) announced it will purchase Isilon Systems Inc. (ISLN) for $2.25 billion, increasing its competitiveness in the cloud computing sphere. Shares of EMC fell 1.2% and Isilon stock rose 28.5%.

Lowe's (LOW, Fortune 500) reported quarterly results early Monday morning. The home improvement retailer said it earned 29 cents per share, falling short of analysts' expectations by one cent per share. Sales rose to $11.6 billion.

The company said its earnings were hamstrung by overall sluggishness in the economy, and that uncertainty in employment and housing continue to pressure the industry. Lowe's shares fell 1.1%.

World markets: European stocks opened the week mixed. Britain's FTSE 100 rose 0.4%, the DAX in Germany gained 0.8% and France's CAC 40 fell 0.1%.

Asian markets also ended the session mixed. The Shanghai Composite gained 1.0% and Japan's Nikkei rose 1.1%, while the Hang Seng in Hong Kong lost 0.8%.

Currencies and commodities: The dollar strengthened against the euro, the Japanese yen and the British pound.

Oil for December delivery fell 2 cents, settling at $84.86 a barrel.

Gold futures for December delivery rose $3 to settle at $1,365.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury dropped, pushing the yield up to 2.95% from 2.76% late Friday.

extra...extra....extra...

Stocks fall, dollar rises on Irish debt worries .... ....

On Monday 15 November 2010, 16:28

By Ian Chua

SYDNEY (Reuters) - Stocks in Asia and Europe fell on Monday on fears that Ireland may be forced to seek a financial rescue package, while a jump in U.S. Treasury yields helped drive the dollar higher.

Nov 15, 2010

STI lower at midday

SINGAPORE shares were lower at midday on Monday, with the benchmark Straits Times Index at 3,233.30, down 0.58 per cent, or 18.70 points.

About 972.5 million shares exchanged hands.

Losers beat gainers 303 to 114.

Nov. 12, 2010, 4:47 p.m. EST

U.S. stocks slide on China inflation fears

NEW YORK (MarketWatch) — U.S. stocks sank Friday, ending a lackluster week as investors already on edge about global growth prospects became concerned that China could take steps to brake its economy’s expansion.

The Dow Jones Industrial Average(DJIA 11,193, -90.52, -0.80%) fell 90.52 points, or 0.8%, to 11,102.58, its lowest level since Nov. 2, the day of the U.S. congressional midterm elections.

The Dow fell 2.2% this week on worries about the consequences of the Federal Reserve’s bond-buying initiative and renewed concentration on Europe’s sovereign-debt issues. On Friday, stocks slid as concerns were reignited that China could be moving toward further tightening of its monetary policy.

“The recent resurgence of the sovereign debt situation in Europe coming back into play — that’s certainly been back on the front burner, and the situation in China, those are the two biggest drivers,” said Mark Turner, head of sales trading at Instinet.The Nasdaq Composite Index(COMP 2,518, -37.31, -1.46%) fell 37.31 points, or 1.5%, to 2,518.21. The Nasdaq shed 2.4% this week, snapping a string of five consecutive up weeks. The S&P 500 Index (SPX 1,199, -14.33, -1.18%) shed 14.33, or 1.2%, to 1,199.21 on Friday, also breaking a five-week streak of gains.

Materials led the S&P 500’s decline as investors worried demand could slide if China, a big user of natural resources, cools its economy. Fertilizer producer CF Industries (CF 119.62, -0.03, -0.02%) slid 6.3%, while copper producer Freeport-McMoRan Copper & Gold (FCX 102.58, -1.34, -1.29%) sank 3.8% and metal processor Allegheny Technologies lost 2.7%. Aluminum maker Alcoa (AA 13.58, +0.09, +0.67%) dropped 2.3%.Crude-oil prices slid 3.3%, their largest one-day decline in nearly a month. Gold futures fell 2.7% on Friday, the biggest one-day drop since July 1.

Blastoff ( Date: 04-Nov-2010 07:24) Posted:

|

Blastoff ( Date: 04-Nov-2010 07:24) Posted:

|

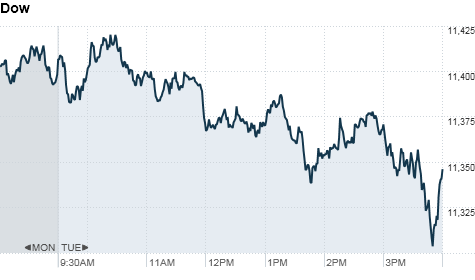

Stocks: No comeback after Cisco

By Annalyn Censky, staff reporterNovember 11, 2010: 4:47 PM ET

By Annalyn Censky, staff reporterNovember 11, 2010: 4:47 PM ET

NEW YORK (CNNMoney.com) -- Stocks sold off at the open and never looked back Thursday after a disappointing outlook from Cisco Systems dragged on the technology sector all day.

The Dow Jones industrial average (INDU) fell 0.7% to close at 11,283, after falling as much as 1% earlier in the trading session.

The S&P 500 (SPX) lost 0.5% to close at 1,214, and the biggest loser was the tech-heavy Nasdaq (COMP), which fell 0.9% to close at 2,556, after plunging 2% in the morning.

Cisco's (CSCO, Fortune 500) lower outlook for the year initially got the tech sector off to a rocky start, and stocks grappled to make up some lost ground throughout the day.

"There was a realization that the world didn't end because of Cisco," said David Kotok, chairman and chief investment officer at Cumberland Advisors. "What's really driving stock prices today, yesterday and tomorrow more than anything else, is the central bank policies of very low interest rates for a very long time."

Kotok is referring to the Federal Reserve's policy of quantitative easing -- a $600 billion bond-buying spree the central bank announced last week. The news has sent stocks trending generally upward, as investors welcome the stimulus effect of the policy.

Meanwhile, investors are feeling jittery amid a gathering of the world's largest nations in Seoul, South Korea. The stakes are high at the Group of 20 meeting, especially as the European sovereign debt crisis and currency tensions once again move to center stage.

Market participants are hoping the meeting will conclude with a clear, detailed direction about where the world economy is headed. But if the end result is of little substance, markets could interpret that as a sign of more uncertainty and weakness in the economy.

"Investors want confidence," said Jim King, president and chief investment officer of National Penn Investors Trust Company. "They want to be confident in the direction of the economy, and that we're closer to creating solutions rather than creating more problems."

Stocks posted slight gains Wednesday after spending most of the session in the red.

Economy: World leaders including President Obama convened at the G-20 summit in Seoul that began Thursday. Heads of the world's major economies were expected to discuss recent currency tensions, as well as other global economic challenges and regulations.

Treasury Secretary Tim Geithner pushed back against an op-ed piece in the Financial Times written by former Fed Chairman Alan Greenspan that suggested the United States was pursuing a policy of currency weakening.

"The United States of America will never do that," Geithner told CNBC. "We will never seek to weaken our currency as a tool to gain competitive advantage or grow the economy."

World markets: European stocks closed little changed. Britain's FTSE 100 and the DAX in Germany were flat, and France's CAC 40 dipped 0.5%.

Asian markets ended higher. The Shanghai Composite gained 1%, the Hang Seng in Hong Kong ticked up 0.8% and Japan's Nikkei was up 0.3%.

Currencies and commodities: The dollar strengthened against the euro and the Japanese yen, but fell against the British pound.

Oil for December delivery settled flat at $87.81 a barrel.

Gold futures for December delivery rose $7.60 to settle at $1,406.90 an ounce.

Companies: Before the opening bell, media conglomerate Viacom (VIAB, Fortune 500) beat Wall Street expectations with strong earnings -- excluding writedowns from its Harmonix video game division, which Viacom plans to sell. Shares of Viacom moved 3% higher during the trading session.

In a surprise early release of its fourth-quarter earnings report just before the closing bell, rival Walt Disney (DIS, Fortune 500) announced earnings of 45 cents per share, falling short of analyst estimates. The Street was looking for 46 cents per share, according to analysts polled by Thomson Reuters. Its stock fell 2.8% before the closing bell.

Treasury markets, government offices and some banks were closed Thursday in observance of Veterans Day.

Singapore Stocks-SingTel up on dividend plan; 3,320 STI cap eyed

Singapore shares end lower on profit taking

Posted: 10 November 2010 1857 hrs

|

||||||

Traders in Singapore |

||||||

SINGAPORE - Singapore share prices ended 0.7% lower on Tuesday as investors booked profits from an eight-session winning streak.

The blue-chip Straits Times Index ended 24.37 points lower at 3,289.24.

In the broader market, losers outnumbered gainers 293 to 201.

Overall volume traded was 2.41 billion shares worth S$2.52 billion.

Commodity stocks led the losers, with Wilmar International losing 5.4% to S$6.51 as its third-quarter earnings fell 60% on-year to US$259.5m.

Golden Agri Resources meanwhile lost 2.6% to S$0.750 and Olam International lost 1.8% to S$3.32.

Noble Group, however, gained 1.9% to S$2.17 after it said its third-quarter net profit rose 19%, helped by contributions from new businesses.

Singapore Airlines, which said it swung to a net profit for the second quarter, saw its shares slide 1.2% to S$16.12, in line with broad market weakness.

The company posted a net profit of S$380 million for the quarter ended September 30, compared with a net loss of S$158.8 million a year earlier.

Casino operator Genting Singapore shed 3% to S$2.28, ahead of its third-quarter earnings results on Wednesday.

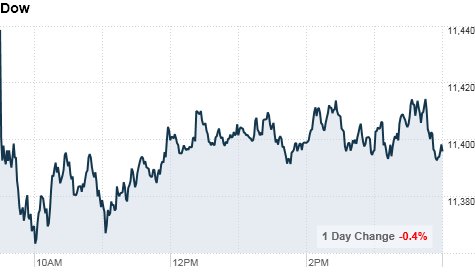

Stocks bounce back

By Hibah Yousuf, staff reporterNovember 10, 2010: 4:46 PM ET

By Hibah Yousuf, staff reporterNovember 10, 2010: 4:46 PM ET

NEW YORK (CNNMoney.com) -- U.S. stocks made a comeback Wednesday afternoon to finish higher, as the dollar turned lower after an earlier rally. But the gains were tepid as investors remained jittery ahead of the G-20 meeting.

The Dow Jones industrial average (INDU) added 10 points, or 0.1%, and the S&P 500 (SPX) rose 5 points, or 0.4%. The tech-heavy Nasdaq (COMP) added 16 points, or 0.6%.

All three major indexes had fallen sharply earlier in the session, with the Dow shedding 92 points, as the dollar soared to a one-month high against the euro and the yen. But stocks clawed higher as the dollar eased.

"We're seeing some abatement in the dollar's rally, which has contributed to the slight lift in the stock market," said Mark Luschini, chief investment strategist at Janney Montgomery Scott.

Investors remain cautious ahead of the G-20 meeting, which starts Thursday. Worries about sovereign debt continue to underpin sentiment and that could keep stocks trading in a tight range this week.

"I suspect stocks will stay in a range, largely directionless, leading into the weekend," Luschini said. He expects that investors will be sitting on their hands as the world's major economies meet in Seoul and discuss currency exchange rates, among other global economic issues.

Stocks ended lower Tuesday, as investors also continued to grapple with the Federal Reserve's latest effort to stimulate the economy.

The Fed unveiled details about its first round of debt buying as part of its $600 billion Treasury buying plan.

Economy: The number of people filing for initial jobless benefits plunged to 435,000 last week, according to the Department of Labor -- the lowest number in four months and much better than expected.

The number of Americans filing new claims for unemployment last week was forecast to fall to 450,000, from 459,000 in the previous week, according to a consensus of economists surveyed by Briefing.com.

U.S. trade balance contracted by 5.3% in September, narrowing to $44 billion, according to the Commerce Department. It was expected to have narrowed to $44.8 billion in September, from $46.3 billion in August.

The October Treasury budget is on tap for Wednesday afternoon.

Companies: Macy's (M, Fortune 500) reported a quarterly profit of 2 cents per share, an improvement from its loss of 8 cents per share a year ago. Macy's increased its earnings guidance for the second half of the year. The stock fell 1.3%.

General Motors, which is readying a $13 billion initial public offering, reported third-quarter net income of $2 billion on revenue of $34.1 billion. The results marked the automaker's best quarter in at least six years. GM also said it expects to "post a solid and profitable first year post-bankruptcy."

Boeing announced that it canceled test flights of its 787 Dreamliner, after one of the new airplanes made an emergency landing in Texas. Boeing's (BA, Fortune 500) stock fell more than 3%.

Campbell Soup Co. (CPB, Fortune 500) lowered its full-year guidance because of weaker-than-expected results for its upcoming quarter. The company said it expects a decline of 1% in net sales for the quarter, along with a 6% drop in earnings per share. For the full year, the company now forecasts net sales growth of 1% to 3%, as well as growth of 2% to 4% in earnings per share. The stock slipped 3.3%.

Shares of Assurant Inc. (AIZ, Fortune 500) plunged more than 11%, making the specialty insurer the biggest loser on the S&P 500. The stock dropped after an article in the American Banker suggested the company is tied to evidence of "abuse" and "conflicts of interest."

After the closing bell, network equipment maker Cisco (CSCO, Fortune 500) reported a quarterly profit Wednesday that rose 8% from year-ago to $1.9 billion, or 34 cents per share. Excluding a one-time charge, the company earned 42 cents per share. That topped Wall Street's forecast for 40 cents per share. Cisco's stock rose 4.2% after-hours.

World markets: European stocks closed lower. Britain's FTSE 100 and the DAX in Germany declined by 1%. France's CAC 40 fell 1.5%.

Asian markets ended the session mixed. The Shanghai Composite dropped 0.6% and the Hang Seng in Hong Kong lost 0.9%, while Japan's Nikkei rose 1.4%.

Currencies and commodities: The dollar lost ground against the British pound and the euro, easing from highs hit earlier in the session. It remained firm against the yen.

Commodity prices, which have been on a tear as investors bet that the Fed's $600 billion boost will weaken the greenback, took a breather thanks to the dollar's surge. A weaker dollar typically supports commodities priced in the U.S. currency, such as oil and gold, while a stronger dollar adds pressure.

Gold futures for December delivery fell $10.80 to settle at $1,399.30 an ounce, backing off from its record high achieved on Tuesday. Silver for December delivery slipped $2.04 to $26.87 an ounce.

Meanwhile, oil for December delivery gained $1.09 to finish at $87.81 a barrel, the highest settlement since Oct. 2008, after a government report showed a surprise decrease in inventories.

Bonds: The price on the benchmark 10-year U.S. Treasury fell slightly, pushing the yield up to 2.67% from 2.66% late Tuesday. Earlier the yield had climbed to 2.74%.

Blastoff ( Date: 10-Nov-2010 07:00) Posted:

|

Stocks flounder as commodities shine

By Ben Rooney, staff reporterNovember 9, 2010: 4:52 PM ET

By Ben Rooney, staff reporterNovember 9, 2010: 4:52 PM ET

NEW YORK (CNNMoney.com) -- Stocks slumped while gold rallied to a record high Tuesday as investors continued to grapple with the Federal Reserve's latest effort to stimulate the economy.

The Dow Jones industrial average (INDU) was down 60 points, or 0.5%, to end at 11,421. The S&P 500 (SPX) shed 10 points, or 0.8%, to 1,227. The Nasdaq (COMP) slipped 17 points, or 0.6%, to 2,593.

Bank of America (BAC, Fortune 500) lead decliners on the Dow, while energy giant Exxon Mobil (XOM, Fortune 500) was the best performer on the index. Shares of other big banks also fell, with Citigroup (C, Fortune 500) and Morgan Stanley (MS, Fortune 500) down over 3%.

Meanwhile, gold prices surged to a record high for the second day in a row, while silver prices also jumped to fresh 30-year highs. Oil prices erased earlier gains to end slightly lower after the dollar regained ground in the currency market.

"Everything is really dictated by the dollar," said Ryan Larson, a senior equity trader at RBC Global Asset Management, noting that low trading volumes were adding to the market's lack of conviction. "The dollar is catching a bid and conversely we've seen the equity markets selloff modestly," he said.

Traders said the market is still adjusting to last week's announcement from the U.S. central bank, which officially unveiled plans to pump $600 billion into the economy via a bond-buying policy known as quantitative easing.

Some investors are betting the Fed policy will hurt the dollar and cause inflation to spike at some point in the future. As a result, they have been buying up gold as a hedge against rising prices. Others believe the extra liquidity will continue to boost stocks and commodities.

After climbing to fresh two-year highs last week on anticipation of the move, stocks have been drifting sideways since the Fed announced its plan.

"The lack of catalyst that is leaving traders without direction," said Larson.

The job market will be in focus Wednesday morning when the Labor Department releases its weekly report on initial claims for unemployment benefits. Investors will also take in reports on the U.S. trade balance and treasury budget.

In addition, investors are looking ahead to this week's meeting of leaders from the Group of 20 major economies, which starts Thursday in Seoul.

The meeting comes against a backdrop of tensions over global trade and currency policies. While expectations are high for the G-20 meeting, analysts said a definitive accord is unlikely to be achieved.

Stocks ended lower Monday amid a lack of economic data and strong demand for commodities.

Currencies and commodities: Gold and silver soared to new highs, while cotton prices rose 6% to another all-time high following a USDA crop report that cut the production outlook for 2011.

Oil prices slipped, erasing earlier gains, as the dollar recovered some ground. The dollar rose 0.7% on the euro, and gained the 0.8% versus the British pound. Against the Japanese yen, the dollar was up 0.4%.

Oil for December delivery fell 34 cents to close at $86.72 a barrel.

Gold futures for December delivery rose $6.90 to settle at an all-time high of $1,410.10 an ounce. Earlier, gold reached a record trading high of $1,422.10 an ounce.

Silver prices rose $1.47 an ounce to end at a 30-year high of $28.91.

Prices for commodities of all sorts have been rising recently as investors bet the Fed's accommodative policies will undermine the greenback. A weaker dollar typically supports commodities priced in the U.S. currency, such as oil and gold.

At the same time, some commodities are benefiting from concerns that Fed policy will lead to a bout of inflation at some point in the future.

"Investors are searching for potential alternatives in a world where paper currency, specifically dollars, may be less trustworthy than they once were," said Lawrence Creatura, a portfolio manager with Federated Clover Investment Advisors.

Economy: A government report showed that wholesale inventory levels rose more than expected in September, while a survey of small business owners showed optimism rose in October.

The Commerce Department said wholesale inventories rose 1.5% in the month from an upwardly revised 1.2% gain in August. Economists had expected a 0.6% increase, according to consensus estimates from Briefing.com.

The National Federation of Independent Business said its Index of Small Business Optimism gained 2.7 points in October, rising to 91.7. While the index remains below pre-recession levels, the NFIB said last month's increase reflects an expected improvement in economic activity.

Companies: Shares of Yahoo (YHOO, Fortune 500) rose 3% following reports that a group of private equity investors had approached Alibaba Group chairman Jack Ma about joining a takeover bid. The report is the latest in a series of takeover and merger rumors involving Yahoo in recent weeks.

Online travel booking service Priceline.com (PCLN) reported better-than-expected gains in third-quarter sales and profits. Shares of the company were up nearly 8%.

GE (GE, Fortune 500) announced a $2 billion investment in China through 2012. $500 million of the funds will be used to increase research and development, while $1.5 billion will be invested with joint ventures with Chinese state-owned enterprises. GE shares eased 0.6%.

Natural gas producer Atlas Energy (ATLS) said early Monday that it has agreed to be purchased by Chevron (CVX, Fortune 500) in a deal worth $4.3 billion. Atlas shareholders will receive $43.34 per share, in what is the latest deal in a string of large oil companies snapping up natural gas producers. Chevron shares fell 1.6%, but shares of other natural gas producers such as Cabot Oil & Gas (COG), Range Resouces (RRC), Chesapeake Energy (CHK, Fortune 500) and Southwestern Energy (SWN) all moved higher.

World markets: European stocks closed higher. Britain's FTSE 100 rose 0.4%, the DAX in Germany ticked up 0.5% and France's CAC 40 added 0.8%.

Asian markets ended the session lower. The Shanghai Composite fell 0.8%, the Hang Seng in Hong Kong dropped 1% and Japan's Nikkei declined 0.4%.

Bonds: The price on the benchmark 10-year U.S. Treasury edged lower, pushing the yield up to 2.64% from 2.56% late Monday.

Stocks step down as gold steps up

By Julianne Pepitone, staff reporterNovember 8, 2010: 4:24 PM ET

By Julianne Pepitone, staff reporterNovember 8, 2010: 4:24 PM ET

NEW YORK (CNNMoney.com) -- Stocks ended lower Monday, as investors took a step back from last week's run-up and shifted their focus to the global economic picture.

The Dow Jones industrial average (INDU) lost 38 points, or 0.3%, to end at 11,406.84. The S&P 500 (SPX) dropped 3 points, or 0.2%, to close at 1,223.25, and the Nasdaq (COMP) added 1 point to end at 2,580.05.

Instead, investors turned to commodities. Gold surged to a new record high, settling at a record $1,403.20 an ounce, as jittery investors continue to see it as a hedge against inflation.

"After last week's historic events, today is all new territory," said Adam Harter, chief strategist at Financial Enhancement Group. "We have nothing in history to compare last week to, so it's a lot for investors to digest."

Stocks rallied last week on two major pieces of news. Tuesday's midterm elections saw the Republican party win control of the House. On Wednesday, the Federal Reserve said it will buy $600 billion in U.S. Treasuries by the middle of next year to stimulate the economy.

"There's an old saying on Wall Street: 'Don't fight the Fed,'" Harter said. "They want assets to go up, and stocks are going to benefit from that in the short- to medium-term period."

After a busy week of domestic news, this week will turn investors' attention overseas. On Thursday, leaders of the world's major economies -- including President Obama -- will start a two-day summit in South Korea. The Group of 20 is expected to discuss recent currency tensions and other global economic challenges.

Stocks ended slightly higher Friday, but it was enough for all three major indexes to close at fresh two-year highs. Both the Dow and S&P also logged their biggest weekly gains in more than two months.

Economy: After the opening bell, a report from Federal Reserve Bank of New York said total consumer debt was $11.6 trillion at the end of September. That's down 7.4%, or $922 billion, from the peak reached in the third quarter of 2008.

Companies: Before the bell, Sysco (SYY, Fortune 500) reported earnings per share of 51 cents -- meeting the expectations of analysts surveyed by Thomson Reuters. But net earnings for the quarter dropped 8.3% over the year, and shares ended down 2.7% Monday.

AOL (AOL) has hired financial advisers to explore the possibility of a merger with rival Yahoo (YHOO, Fortune 500), the Wall Street Journal reported Monday.

Meanwhile, the Wall Street Journal also reported that the Securities and Exchange Commission has subpoenaed a number of former Citigroup (C, Fortune 500) brokers, who contend the bank misled investors on risky bond funds.

Shares of JDS Uniphase (JDSU) ended 4.8% higher after the company reported results for its fiscal first quarter after the close of trade Thursday. The telecom's revenue was was $405.2 million, which came in below estimates but was still a 36.3% growth over the year.

Warner Chilcott (WCRX) shares closed almost 14% lower after the drugmaker reported third-quarter earnings that missed estimates and lowered its revenue forecast for the full fiscal year.

World markets: European stocks lost their earlier gains and ended lower. Britain's FTSE 100 dropped 0.4%, while the DAX in Germany and France's CAC 40 ended down less than 0.1%.

Asian markets ended higher. The Shanghai Composite gained 1%, the Hang Seng in Hong Kong rose 0.4% and Japan's Nikkei ticked up 0.7%.

Currencies and commodities: The dollar strengthened against the euro and British pound, but it fell against the Japanese yen.

Oil for December delivery rose 36 cents to settle at $86.85 a barrel.

Gold broke through the $1,400 ceiling, settling at a record high of $1403.20 an ounce. Earlier in the session, it hit an intraday record at $1,408.70 an ounce.

Cotton futures hit an all-time high Monday morning, after news reports said China's cotton harvest may fall 5% this year due to natural disasters in major production areas.

Bonds: The price on the benchmark 10-year U.S. Treasury ticked down slightly, pushing the yield up to 2.56% from 2.54% late Friday.

Nov 8, 2010

STI higher at midday

SINGAPORE shares were higher at midday on Monday, with the benchmark Straits Times Index at 3,268.40, up 0.87 per cent, or 28.09 points.

About 1.8 billion shares exchanged hands.

Gainers beat losers 324 to 129.

Dow, Nasdaq at 2-year highs

By Hibah Yousuf, staff reporterNovember 3, 2010: 4:44 PM ET

By Hibah Yousuf, staff reporterNovember 3, 2010: 4:44 PM ET

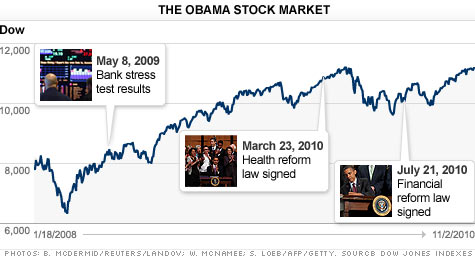

NEW YORK (CNNMoney.com) -- U.S. stocks seesawed Wednesday amid a widely-anticipated Republican victory and the Federal Reserve's announcement of a second round of economy-boosting asset purchases, but managed to end the session with modest gains, pushing the Dow and Nasdaq to their highest levels in over two years.

The Dow Jones industrial average (INDU) rose 27 points, or 0.2%, to finish at 11,215, the highest since September 2008. The tech-heavy Nasdaq (COMP) increased 7 points, or 0.2%, to close at 2,540, highest since June 2008.

|

The Fed said it will buy$600 billion in long-term Treasuries by the middle of next year, at the pace of $75 billion a month.

The three major indexes drifted between negative and positive territory immediately following the announcement, but posted slight gains toward the end of the session.

The Fed policy, known as quantitative easing, is designed to put downward pressure on interest rates and pump money into the economy. It is also seen as a way for the Fed to combat deflation, a debilitating cycle of falling prices and demand.

Market participants and economists expected the Fed would buy a total between $500 billion and $1 trillion.

While the central bank cleared the low end of estimates, that may not be enough for Wall Street.

"The market was hoping for something a little more dramatic from the Fed to ensure a more robust economic growth outlook," said Jeff Kleintop, chief market strategist for LPL Financial. "I don't think the Fed exceeded expectations enough to prompt investors who have been waiting on the sidelines to step back into the market today."

The S&P has climbed more than 12% since late August on expectations of another round of stimulus from the Federal Reserve. Most of the advance was logged in September, and stocks have been rangebound for the past few weeks.

Though the market reaction to the Fed's measures was muted, Kleintop said the October jobs report, the last of three major events this week, could provide investors with more clarity to drive the market's next big move. The Labor Department reports the figures Friday ahead of the market's open.

At the conclusion of its two-day meeting Wednesday, the Fed also announced it will reinvest an additional $250 billion to $300 billion in Treasuries with the proceeds of its earlier investments. The central bank kept the federal funds rate, a benchmark for interest rates on a variety of consumer and business loans, at historic lows near zero.

Elections: Stocks started the day with slight gains following a widely expected Republican victory in the House and upbeat economic data.

But the political upside was already priced into the market, and stocks drifted into the red as investors displayed caution ahead of the Fed's announcement.

As expected, the midterm elections resulted in big gains for the Republican party, which won control of the House by capturing at least 60 seats.

The shifting balance of power on Capitol Hill is largely seen as a positive for Wall Street, since Republican lawmakers are viewed as more business friendly and fiscally conservative than their Democratic rivals.

Traders also paid close attention to President Obama's remarks Wednesday afternoon, for hints as to how he will navigate the new political landscape. Kenny Landgraf, principal and founder at Kenjol Capital Management, said investors needed the president to suggest that he is ready to change course.

During his address, Obama said he looks forward to working with presumptive House Speaker John Boehner and Senate Republican leader Mitch McConnell.

Obama added that he takes responsibility for the fact that Americans across the country are frustrated with the pace of the economic recovery, and hope lawmakers will be able to find common ground in order to make progress.

Stocks closed higher Tuesday, after interest rate hikes from the central banks of Australia and India sparked an early rally.

World markets: European stocks ended their session lower on news of the election results, and in anticipation of the Fed's next move. Britain's FTSE 100 lost 0.15%, and the DAX in Germany and France's CAC 40 fell 0.6%.

Asian markets ended mostly higher. The Hang Seng in Hong Kong gained 2%, after Hong Kong launched a gold exchange-traded fund backed by physical gold held in vaults within Hong Kong. Tokyo's Nikkei was up about 0.1% and the Shanghai Composite Index lost 0.5%.

Currencies and commodities: The dollar fell against the euro and the British pound following the Fed announcement -- which could weaken the greenback further. The greenback gained against the Japanese yen.

Oil for December delivery gained 79 cents, or 0.9%, to settle at $84.69 a barrel.

Gold futures for December delivery slipped $19.30 to end at $1,337.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell after the Fed announcement, pushing the yield up to 2.60% from 2.59% late Tuesday.

Economy: In addition to the Fed announcement, investors also took in economic reports on the job market, activity in the services sector and factory orders.

A report from Automatic Data Processing, which manages payrolls for 500,000 companies, showed that private-sector employers added 43,000 jobs in October -- rebounding from a modest decline in the prior month.

In a separate report, employers announced 37,986 job cuts last month -- up 2.2% from September -- according to outplacement firm Challenger, Gray & Christmas. But the October number was still well below the year-ago level.

The Institute for Supply Management's services index jumped to 54.3 in October, from 53.2 the previous month. Analysts were expecting the service sector to expand at a more modest pace, with the index rising to 53.4.

A government report showed that factory orders improved 2.1% in September. Analysts were expecting orders to tick up 1.7%.

Companies: CNNMoney's parent company, Time Warner (TWX, Fortune 500) reported earnings of $1.4 billion and raised its outlook for 2010. Shares of Time Warner slipped 1.1%.

AOL (AOL) reported a decline in revenue for the third quarter that exceeded analysts' expectations. The stock gained 3.2%.

CVS Caremark (CVS, Fortune 500) said third-quarter earnings and revenue fell, but the results were in line with expectations. CVS shares rose 1.1%.

Qwest Communications (Q, Fortune 500) posted a loss, but beat expectations sending shares up 1.2%.

Garmin (GRMN) missed estimates thanks to slow sales and cut its forecast for the year. Shares sank 5.3%, and was the biggest loser on the Nasdaq.

Health insurer WellPoint (WLP, Fortune 500) posted a third-quarter profit that beat expectations and raised its outlook for the year. Shares of WellPoint were up 0.5%.

Hartford Financial Services (HIG, Fortune 500) returned to profit during the third quarter from a year-ago loss, and raised its outlook for the remainder of the year. The stock jumped 9.2% and was the biggest gainer on the S&P 500.

Toyota (TM), Ford (F, Fortune 500) and General Motors reported October sales figures throughout the day. Shares of Toyota rose 0.7%, while Ford's stock gained 5.2%.

Meanwhile, GM said it plans to sell up about $13 billion in common and preferred shares as part of its initial public offering, one of the largest in U.S. history.

After the close, News Corp. (NWSA) posted a profit of $775 million, or 30 cents per share. Revenue rose 3.2% to $7.43 billion. The stock slipped 0.3% after hours.

Stocks hold gains on election day

NEW YORK (CNNMoney.com) -- After an initial boost at the market's open, stocks held steady throughout the day as investors sat on their hands to wait for the outcome of two major events: the mid-term elections and a two-day Fed meeting.

The Dow Jones industrial average (INDU) closed ahead 64 points, or 0.6%, with 23 of its 30 components rising. The S&P 500 (SPX) rose 9 points, or 0.8%, and the Nasdaq (COMPX) climbed 29 points, or 1.1%.

Early in the morning, stocks got an upward jolt from optimism about rapid growth overseas, after both Australia and India raised their key interest rates in an effort to fight off inflation. The rate hikes weakened the U.S. dollar increasing demand for riskier assets like stocks.

As investors refocused on the mid-term elections later in the day, stocks held on to those gains rather steadily on light trading volume.

"People are just holding on to their positions, waiting to see what happens overnight and tomorrow, said Brian Lazorishak, portfolio manager at Chase Investment Counsel of Charlottesville, Va.

Stocks are coming off a lackluster trading day Monday, which was dominated by jitters about the elections and Fed.

Elections and the Fed: Many on Wall Street expect Republicans to win the 39 seats needed to take control of the House. In the Senate, the GOP would need to win 10 of the 37 seats up for grabs to get the majority.

A Republican majority could be perceived as pro-business and therefore give a boost to the market.

"Most of the people I'm dealing with are hoping Republicans get a firm grip on things, and the thinking is that that ultimately helps out the economy," said Phil Streible, a senior market strategist with futures broker Lind-Waldock. "Spending won't be as loose, budgets will be more in line and fiscal responsibility will kick in."

Meanwhile, the Fed ends its two-day meeting, with a highly anticipated policy statement due Wednesday afternoon. The central bank is expected to unveil a new round of asset purchases, as part of a wider quantitative easing plan.

Investors are also looking ahead to Friday's jobs report from the Labor Department. Economists expect the report to show that employers added 60,000 jobs last month.

Companies: BP (BP), recovering from the Gulf oil spill, reported a third-quarter profit of $1.8 billion that included a $7.7 billion pretax charge related to the disaster. While the income was down from $5 billion a year earlier, it was a turnaround from the $17 billion loss posted in the prior quarter due to spill-related charges.

BP's stock rose 1.6%.

Pfizer (PFE, Fortune 500) posted a third-quarter profit that fell from a year earlier, but beat analysts' expectations excluding one-time charges. The drug maker said sales of its blockbusters Lipitor and Celebrex fell. Shares of Pfizer fell about 1% in the trading session.

Audio products-maker Harman International Industries (HAR) was the biggest gainer in the S&P 500 Tuesday. Its shares rose 12% on strong earnings.

Agriculture processor Archer Daniels Midland (ADM, Fortune 500) reported fiscal first-quarter profit below expectations. Shares fell 6.6%.

E-commerce software-maker Art Technology Group (ARTG) announced Tuesday that it has agreed to be acquired by Oracle Corp. (ORCL, Fortune 500) for $6.00 per share in cash, or approximately $1 billion. The deal represents a 46% premium over Monday's closing price. Shares of ATG were up 45% and Oracle rose 1.4%.

World markets: European stocks closed the session higher. The CAC 40 in France rose 0.6%, Germany's DAX climbed 0.8%, and Britain's FTSE 100 gained 1.1%.

Asian markets ended little changed. Japan's benchmark Nikkei index and the Hang Seng in Hong Kong each gained less than 0.1%. The Shanghai Composite ended 0.3% lower.

Currencies and commodities: The dollar eased against the euro, but gained against the British pound and the Japanese yen.

The U.S. dollar index, which measures the dollar against a basket of key currencies, fell 0.7%.

Earlier in the morning, the Australian dollar surged to a 27-year high against the American greenback, after Australia's central bank hiked its key interest rate a quarter percentage point.

Oil futures for December delivery rose 95 cents to settle at $83.90 a barrel.

Gold for December delivery gained $6.30 to settle at $1,356.90 an ounce.

Bonds: The yield on the 10-year Treasury note fell to 2.59%, from 2.63% late Monday.