Indeed, I always like his analysis. Thank you for sharing.

hello123 ( Date: 23-Aug-2012 12:03) Posted:

|

nice article on kepcorp , genting , ezion , tigerair etc see http://sgxswinger.blogspot.sg/

http://www.global-rates.com/

The above website has got quite a bit of updated data on central bank rates, inflation rates and LIBOR...

If you want to get more materials that related to this

topic, you can visit:

| INTL FCStone interview questions |

Best regards.

krisluke ( Date: 25-Jul-2012 09:29) Posted:

|

SG Market: S’pore shares are likely to drift down in the absence of overseas leads and market-moving corporate news following the end of the earnings results season. The STI appears overextended with Stochastics and MACD indicators losing momentum. Support for the index is tipped at 3040, as represented by the 20-day moving average, while resistance is capped at 3100.

Among stocks in focus, F& N and APB may rise on resuming trade at the market open after Heineken raised its bid for F& N's entire APB holding to $53/share, countering Kindest Place's $55/share bid for part of APB.

Tiong Seng secures a $137m contract to build a building extension at SIM, while Chip Eng Seng won a $138m HDB contract to build 7 blocks of flats in Bukit Panjang.

KEY IDEA

Singapore REITs – Switch to the right REITs

As our house advocated an OVERWEIGHT rating on the S-REIT sector throughout FY12, we saw the FTSE ST REIT index appreciate 22.7% YTD, versus the STI’s 15.7% gain, driven mostly by a flight to safety amidst macro uncertainties and a liquidity driven search for yield. At this juncture when we are seeing prices taking new heights and gaining updated visibility for subsector outlooks, we ask investors: Are you switching to the right REITs today? We present three key ideas for investors with REITs portfolios: 1) Move to office REITs from local retail REITs - prefer CCT [BUY, FV: S$1.53] over CMT [HOLD, FV: S$2.04], 2) Stay in industrial REITs for yield – top pick is CACHE [BUY, FV: S$1.18], 3) Hospitality outlook is intact but rotate to ART [BUY, FV: S$1.34] from CDLHT [HOLD, FV: S$2.06]. Other BUY rated REITs include FCT [FV: S$1.89], SGREIT [FV: S$0.79], MLT [FV: S$1.19], FCOT [FV: S$1.23] and CRCT [BUY, FV: S$1.70]. (Kevin Tan & team)

MORE REPORTS

CapitaCommercial Trust: Showing solid value here

CapitaCommercial Trust’s (CCT) 2Q12 distributable income of S$58.5m was 7.5% higher YoY and translated to a DPU of 2.06 S-cents per share. Judging from consensus estimates, we believe this to be above market expectations which had anticipated weaker rental reversion performances in the year to date. Going forward, we believe the dynamic of limited office completion and stabilizing office vacancy rates, seen over 2Q12, could continue till 2H13 as no major office completions are expected in the meantime. Moreover, with limited office leases in CCT’s portfolio up for renewal (4.1%) in 2H12, we judge its operating fundamentals to be reasonably sound ahead. All considered, we believe there is solid value at current valuations (0.87x PB with a forward yield of 5.6%) for CCT’s portfolio of prime office assets and operating track record. Upgrade to BUY with a higher fair value of S$1.53, versus S$1.31 previously, as we incorporate stronger cap values for CCT’s assets. (Eli Lee)

Ascendas REIT: Strong run-up likely to cap further upside

Ascendas REIT (A-REIT) is Singapore’s first listed business space and industrial REIT. It has a diversified portfolio of 101 properties in Singapore, and a business park property in China. For 1QFY13, we note that A-REIT turned in a commendable set of results, with DPU rising 10.3% YoY to 3.53 S cents despite an enlarged unit base post private placement. For FY13, A-REIT looks set to deliver another year of robust growth, supported by full-year contribution from its recent investments. However, we believe most of the positives have been reflected in its unit price, which has risen by 22.4% YTD. A-REIT is currently trading at 1.2x P/B and is just 1.3% shy of our fair value of S$2.27. Its FY13F DPU yield of 6.2% is also lower than the industrial REIT subsector average of 7.6%. As upside is likely limited, we downgrade A-REIT from Buy to HOLDon valuation grounds. (Kevin Tan)

For more information on the above, visit www.ocbcresearch.comfor the detailed report.

NEWS HEADLINES

- Most U.S. stocks fell given renewed concern over Europe’s debt crisis, although the S& P 500 Index closed relatively flat at 1418.13 points.

- Singapore’s July NODX rose 5.8% YoY, exceeding market expectations for a 5.0% growth.

- F& N announced that it has accepted Heineken’s revised S$53/share offer for its entire interest in APB for a total aggregate consideration of S$5.59b.

- LionGold Corp said that it has entered into a memorandum of agreement to possibly invest up to A$8.5m in Australia-listed miner Gold Anomaly and its PNG subsidiary.

Singapore REITs – Switch to the right REITs

As our house advocated an OVERWEIGHT rating on the S-REIT sector throughout FY12, we saw the FTSE ST REIT index appreciate 22.7% YTD, versus the STI’s 15.7% gain, driven mostly by a flight to safety amidst macro uncertainties and a liquidity driven search for yield. At this juncture when we are seeing prices taking new heights and gaining updated visibility for subsector outlooks, we ask investors: Are you switching to the right REITs today? We present three key ideas for investors with REITs portfolios: 1) Move to office REITs from local retail REITs - prefer CCT [BUY, FV: S$1.53] over CMT [HOLD, FV: S$2.04], 2) Stay in industrial REITs for yield – top pick is CACHE [BUY, FV: S$1.18], 3) Hospitality outlook is intact but rotate to ART [BUY, FV: S$1.34] from CDLHT [HOLD, FV: S$2.06]. Other BUY rated REITs include FCT [FV: S$1.89], SGREIT [FV: S$0.79], MLT [FV: S$1.19], FCOT [FV: S$1.23] and CRCT [BUY, FV: S$1.70]. (Kevin Tan & team)

MORE REPORTS

CapitaCommercial Trust: Showing solid value here

CapitaCommercial Trust’s (CCT) 2Q12 distributable income of S$58.5m was 7.5% higher YoY and translated to a DPU of 2.06 S-cents per share. Judging from consensus estimates, we believe this to be above market expectations which had anticipated weaker rental reversion performances in the year to date. Going forward, we believe the dynamic of limited office completion and stabilizing office vacancy rates, seen over 2Q12, could continue till 2H13 as no major office completions are expected in the meantime. Moreover, with limited office leases in CCT’s portfolio up for renewal (4.1%) in 2H12, we judge its operating fundamentals to be reasonably sound ahead. All considered, we believe there is solid value at current valuations (0.87x PB with a forward yield of 5.6%) for CCT’s portfolio of prime office assets and operating track record. Upgrade to BUY with a higher fair value of S$1.53, versus S$1.31 previously, as we incorporate stronger cap values for CCT’s assets. (Eli Lee)

Ascendas REIT: Strong run-up likely to cap further upside

Ascendas REIT (A-REIT) is Singapore’s first listed business space and industrial REIT. It has a diversified portfolio of 101 properties in Singapore, and a business park property in China. For 1QFY13, we note that A-REIT turned in a commendable set of results, with DPU rising 10.3% YoY to 3.53 S cents despite an enlarged unit base post private placement. For FY13, A-REIT looks set to deliver another year of robust growth, supported by full-year contribution from its recent investments. However, we believe most of the positives have been reflected in its unit price, which has risen by 22.4% YTD. A-REIT is currently trading at 1.2x P/B and is just 1.3% shy of our fair value of S$2.27. Its FY13F DPU yield of 6.2% is also lower than the industrial REIT subsector average of 7.6%. As upside is likely limited, we downgrade A-REIT from Buy to HOLDon valuation grounds. (Kevin Tan)

For more information on the above, visit www.ocbcresearch.comfor the detailed report.

NEWS HEADLINES

- Most U.S. stocks fell given renewed concern over Europe’s debt crisis, although the S& P 500 Index closed relatively flat at 1418.13 points.

- Singapore’s July NODX rose 5.8% YoY, exceeding market expectations for a 5.0% growth.

- F& N announced that it has accepted Heineken’s revised S$53/share offer for its entire interest in APB for a total aggregate consideration of S$5.59b.

- LionGold Corp said that it has entered into a memorandum of agreement to possibly invest up to A$8.5m in Australia-listed miner Gold Anomaly and its PNG subsidiary.

GLOBAL MARKETS-Stocks slip, euro wavers on ECB comment

SE ASIA STOCKS-Thai stocks rise on energy Banks lift Vietnam

STOCKS TO WATCH -- ASIA PACIFIC BREWERIES LTD

CAPITAMALLS ASIA

CHIP ENG SENG CORP LTD

MARKET NEWS > Wall St flat after rally Apple biggest company ever

> Bonds flat as central bank action stays focus

> Euro rises but uncertainty keeps investors cautious

> Platinum hits 2-month high on S.Africa supply fears

> Oil lower in choppy trading Euro zone issues weigh

> Key political risks to watch in Singapore

ASIA-PACIFIC STOCK MARKETS S.Korea [.KS] China [.SS] Hong Kong [.HK] Taiwan [.TW] India [.BO] Australia/NZ [.AX] OTHER MARKETS Currency [FRX/] Eurostocks [.EU] JP bonds [JP/] ADR Report [ADR/] LME metals [MET/L] STOCKS NEWS US [STXNEWS/US] Europe [STXNEWS/EU] Asia [.SI] [.BK] [.KL] DIARIES & DATA: Singapore diary [SG/DIARY] U.S. earnings diary [RESF/US] European diary [WEU/EQTY] Asia Macro

Hi

I read some opinions in this topic. I do not agree above ideal. We can find out some articles at about.com by using Google search.

With this latest ruling from the German Finance Minister, I think if there is any rise in the morning it will evaporate by the afternoon when Europe markets open.

tglim74 ( Date: 30-Jul-2012 00:52) Posted:

|

Thanks for the sharing. Thought of entering a few counters today. Looks like better be more careful and defensive when the markets open.

wanglausern ( Date: 30-Jul-2012 00:25) Posted:

|

Snow White Dumps Prince Charming:

Thursday and Friday of last week, I should imagine, will prove to be those once again days where the flight of fantasy took off and hoped for the best only to find that the fuel in the tanks was dangerously low. Treasuries moved some, not much, the bonds of Spain and Italy gained a bit of ground while the stock markets soared on the basis that all of Europe’s problems had been solved by Draghi & Company. Interestingly enough, after the close of course which is the way these schemes are pre-arranged, the German Central bank came out and said there were no changes in their stance and so the cold water was poured upon the fire after all of the party-goers had gone home. Just this morning in Berlin the German Finance Minister declared that the Stabilization Fund that is currently in existence, the EFSF, will not be buying Spanish debt in the market which topples the dreams and fantasies of last week.

Magic Mirror: Prepare to be amazed beyond all expectations. After all it is what I do.

Draghi represents the Southern contingency, the periphery nations, the troubled cousins who cannot live on what they make. This is all fine and dandy but do not kid yourself if the Germans say “Nein” then it is “Nein” and any other conclusion is foolhardy. We will soon get the German opinion on Greece, the money for the Spanish banks is going to the nation of Spain and will be controlled by the German auditors, Italy is staring at mounting difficulties, Portugal is going to face an Act II and there is only $65 billion left in the EFSF fund while the ESM fund is hung up in the German courts until September 12 and today is July 28.

Whoosh and sorry for the dose of reality.

Research and Markets: Singapore Infrastructure Report Q3 2012: The Tuas West Extension of the East-West Metro Railway Line is Scheduled to Be Operational by 2016

DUBLIN--()--Research and Markets (http://www.researchandmarkets.com/research/k23jlf/singapore_infrastr) has announced the addition of the " Singapore Infrastructure Report Q3 2012" report to their offering.

BMI View: It appears that construction activity in 2011 has surprised on the upside due to an unexpected surge in public residential building activities. We believe that public, rather than private, housing could continue to drive construction activity. This, along with the implementation of other projects in the commercial construction and urban railways sub-sectors, should lead to a recovery in Singapore's construction sector. Accordingly, we have revised up our forecasts for the construction sector, from 3.1% to 3.8% for 2012.

Key drivers affecting construction growth include:

- In February 2012, Thomas Reuters revealed that a property development loan worth SGD5bn (US$4bn) is set to be signed by eight banks to support two projects in Singapore. A joint venture between Singapore's Temasek Holdings and Malaysia-based Khazanah Nasional is to develop the projects. Of the total loan, SGD850mn (US$680mn) is to be contributed by each of the following: DBS Group, Oversea-Chinese Banking, United Overseas Bank and Maybank. Meanwhile, ANZ, Bank of Tokyo-Mitsubishi and Sumitomo Mitsui Banking are also lending SGD500mn (US$400mn) each. CIMB Group is also to provide assistance of SGD100mn (US$80mn).

- In March 2012, Alstom announced that it has been awarded a EUR40mn (US$52.7mn) contract to install the Tuas West extension of the East-West metro railway line. Alstom will be responsible for the design and construction of a 7.5km double-track line, four elevated stations and an 18.5km single-track line in the Tuas depot. The extension, which is scheduled to be operational by 2016, will accommodate approximately 100,000 passengers daily and reduce travel times by 35 minutes.

- In March 2012, Changi Airport Group (CAG), the operator of Singapore's only international airport, announced that it is demolishing its budget terminal to make way for the construction of a larger terminal. The new terminal, to be known as Terminal 4, would have a handling capacity of 16mn passengers per annum, more than double the budget terminal's capacity of 7mn passengers. Terminal 4 would not have aerobridges, but would include more retail stores, restaurants and passenger amenities. The budget terminal is expected to be demolished in September 2012, with the airlines operating from the terminal diverted to Terminal 2. Terminal 4 is expected to start construction in 2013 and be completed by 2017.

Companies Mentioned

- Dragages Singapore

- Hock Lian Seng Infrastructure Limited (HLS)

- Sembcorp Industries

- Hyflux

For more information visit http://www.researchandmarkets.com/research/k23jlf/singapore_infrastr

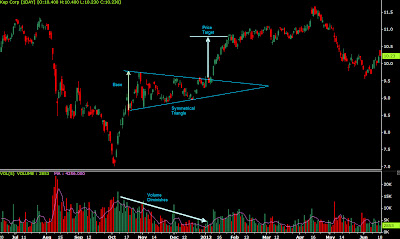

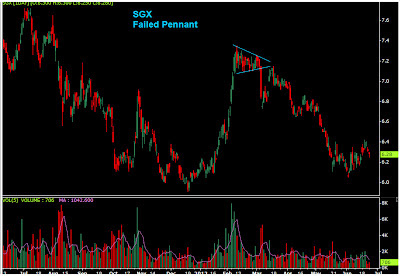

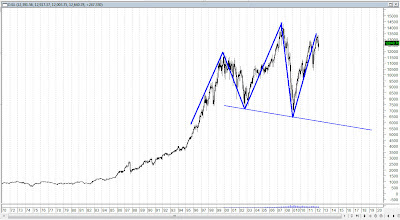

Chart Patterns - Examples

The following charts are pretty random ( I know ). They are here only because they are linked to the PowerPoint presentation materials of an intended Technical Analysis Workshop I am planning to conduct called " Chart Patterns"

Symmetrical Triangle - KepCorp

Head and Shoulders Pattern

Head and Shoulders Pattern Example - City Development

Flags and Pennants

Rectangles

Failed Symmetrical Triangle

Failed Pennant

UOB - Failed Symmetrical Triangle

STI - Failed Ascending Triangle

Yoma - Bull Flag

DJIA - Head and Shoulders Pattern

DJIA - Head and Shoulders Monthly Chart

July 26: Ascendas Hospitality Trust, Aussino, SIA, Biosensors, SATS

| Written by The Edge |

| Thursday, 26 July 2012 08:38 |

|

Singapore stocks may rise on ECB talk and as earnings buoy Dow. Singapore shares closed 0.25% lower on Wednesday. The STI fell 7.52 points to 2,990.92. About 1.2 billion shares were traded. Losers beat gainers 218 to 140. Here are some stocks and factors to watch: Ascendas Hospitality Trust (A-HTRUST), said the public tranche of its IPO was 5.9 times oversubscribed. This was based on valid applications for 484,929,000 stapled securities received for the 70,148,000 stapled securities available to the public at the close of subscription. Frasers Commercial Trust announced a distributable income of $11 million to unitholders for the quarter ended 30 June 2012 (3Q FY12), a 25.8% increase compared to $8.7 million achieved a year ago. Aussino Group, which has been on the watch list of the SGX since September 2011, said it plans to buy Max Strategic Investments for $70 million, payable in shares. Max Strategic has agreed to acquire from Max Myanmar its energy business unit which operates 21 petrol kiosks across key cities in Myanmar. Singapore Airlines reported a 73% increase in earnings to $78 million for the first quarter ended June 30, 2012 from $44.7 million a year ago. SIA warned that profits at its cargo and passenger units remain under pressure. Biosensors International Group said earning for the first quarter ended June 30, 2012 rose 45% to US$32.63 million from a year ago. SATS reported a 2.8% decrease in earnings to $41.3 million for the first quarter ended June 30, 2012 from a restated $42.5 million a year ago. PEC said it has secured a $65 million worth of contracts from new and existing clients. Roxy-Pacific Holdings said its wholly owned subsidiary, RH West Coast, has agreed to acquire a freehold residential site at 223A Pasir Panjang Road, also known as Harbour View Gardens, at $33 million. Mapletree Commercial Trust Management has recorded a DPU of 1.537 cents for 1Q FY 2012/13 (the period from 1 April 2012 to 30 June 2012). This is an increase of 20.6% over the Forecast DPU of 1.274 cents. |

|

It’s been a tough 2012. Yet, the 10 stocks The Edge Singapore recommended during the Lunar New Year period are mostly beating the market six months down the road. When The Edge Singapore put together its 10-stock portfolio for 2012, we were conscious that the equity markets weren’t in a particularly robust state. Europe’s sovereign debt crisis was worsening, a US economic recovery looked doubtful and the possibility of a hard landing in China loomed. Despite the uncertainty, however, we decided against loading up our portfolio with defensive dividendyielding plays. If things improved, we thought, those stocks would fail to keep up in a broad market rally. And, if the economic outlook worsened, defensive stocks might end up being the last shoe to drop. Instead, we pulled together a portfolio of stocks with a cyclical flavour but that also offered some downside protection through conservative balance sheets and low stock valuations. Six months on, global equity markets are still being dogged by the same issues. Europe’s politicians do not seem to be much closer to figuring out a solution to their problems. US economic data has not been conclusively positive. And China has just announced GDP growth of 7.6% y-oy for 2Q — below market expectations. That has been especially hard on commodity prices and growth-oriented stocks. Yet, our portfolio is outpacing the benchmark Straits Times Index. On a total return basis, with dividends reinvested, our portfolio has returned 9.5% since its inception on Jan 25. That compares to a 6.1% return for the STI. Excluding dividends, our return is 7.5% compared with the STI’s 4.3%. Even more gratifying is that six out of our 10 picks have outperformed the index. The best performers were Pan-United Corp, which has returned 31.4% in the period under review, and CapitaMalls Asia (CMA), with a 26% return. The worst performer to-date is Noble Group, with a negative return of 18.1%.

Image: Pan-United has been the top performer in The Edge Singapore’s 10-stock portfolio so far. Credit: The Edge Singapore Will our portfolio keep beating the market in the second half of the year? Much could depend on macroeconomic factors. Clearly, a broad global recovery would be positive. Yet, further weakness might also work out well for us, if it prompts more monetary stimulus by central banks around the globe. “Bad economic data is actually good for the market,” says Jimmy Koh, chief economist at UOB. What could trip us up is a situation where growth is neither strong enough to lift the markets nor weak enough to draw more monetary easing. Simon Grose-Hodge, head of investment advisory for South Asia at private bank LGT, thinks equity markets are unlikely to move upwards this year for exactly that reason. “We don’t believe that we will get QE3 but that’s what a lot of the markets are looking for,” he says. “There are more [Federal Open Market Committee] members against QE3 than there are supporting it. QE3 is probably the last step that they can take [and they need] to keep it for next year.” On the other hand, Fan Cheuk Wan, head of research for Asia Pacific at Credit Suisse’s private banking arm, expects central banks and governments to work towards spurring growth. “Asian central banks have turned more dovish and more decisive easing action is expected in the pipeline. Asia also has the policy flexibility to introduce fiscal stimulus.” In fact, Fan thinks that most of the concerns about weak growth are already priced into stocks and she sees the market moving higher on loosening policy. Over the next 12 months, her target is for the STI to hit 3,300 points. BETTING ON THE BULL If the market rebounds on policy easing, some of the worst performers on our list could well turn sharply. Shares of commodity supplier Noble, for instance, typically enjoy a strong correlation with commodity prices, which would get a lift from policy easing as well as stronger growth expectations. In a July 5 market strategy report, DMG & Partners Research suggests clients look at selective cyclical stocks that have seen their share prices fall significantly. Noble is among them. The brokerage also sees 3Q2012 as being better for commodity plays. There may still be room for shares of Sembcorp Marine to rise further if the market takes off. In a recent note, OCBC Investment Research says the company is “likely to catch up in the orders front in the months ahead” with more orders possibly coming from Brazil’s Petrobras. The brokerage also sees earnings picking up in 2H2012. Petrobras recently approved the construction of six new build semi submersibles and DBS Vickers says this latest development implies the approaching tail end of Petrobras’ protracted 28-rig contracting process. “Sembcorp Marine could also announce firm orders for the remaining five Petrobras drillships. We believe this could be worth circa US$4 billion ($5.02 billion),” says DBS in a report.

Credit: Bloomberg Meanwhile, it could be tough for some of our other cyclical picks to make much more headway because of their increasingly stretched valuations. For instance, United Overseas Bank, has returned 15.1% so far. We picked UOB because, even though it was the most expensive bank, it also has the most conservative balance sheet and loan book. That selection has served us well over the last six months. However, analysts now think the industry is due for a softer 2Q, making further gains unlikely. Yet, it also seems unlikely that the counter will give up much of its gains because of its conservative balance sheet. As for ST Engineering, we placed it in our portfolio as a play on the cyclical aerospace industry, which we hoped would take off this year. To its credit, the company has been able to win quite a number of orders. Moreover, its relatively steady cash flow and generous dividends have helped attract investors this year. Yet, after the good run its stock has enjoyed this year, it could be hard for it to keep going in the months ahead unless it delivers strong earnings growth. SPECIAL SITUATIONS Some of our stocks were picked for micro turnaround or growth stories. Some of those stories have panned out and others haven’t. One idea that is working is Bukit Sembawang Estates, which is up 18.8% to-date. That doesn’t take into account a final dividend of four cents a share and a special dividend of 14 cents, declared for FY2012 ended March — although the share price would have factored in the payout to some extent. CIMB Research believes investors can look forward to higher dividend payouts in the quarters ahead on the back of a strong balance sheet. Genting Hong Kong, on the other hand, is the second-worst performer on our list — down 10%. Besides earnings growth from its operations in the Philippines, we had figured that the company might see some corporate activity either in a spin-off of its cruise unit Norwegian Cruise Line or an injection of some businesses from its parent. No luck so far, though. Nevertheless, UOB Kay Hian still sees catalysts ahead for the stock. The brokerage is expecting an earnings recovery in 2Q2012 and the distribution of maiden dividends. “We believe these catalysts will for now override concerns of maiden competition in the integrated resort and casino space in Manila that would likely impact its bottom line only from mid- 2013 onwards.” We had also expected infrastructure and civil engineering company OKP Holdings to benefit from higher infrastructure spending this year as well as from its partnership with China Sonangol. Unfortunately, the stock has seen little action this year and returned a negative 3%. At the end of last month, OKP announced an investment of $111,111 for a 10% stake in CS Land Properties Pte Ltd, a wholly owned subsidiary of China Sonangol. CS Land Properties is seeking to develop a condominium project and this marks OKP’s first foray into property development. However, OCBC doesn’t see the investment having a material impact on financials for FY2012 and is therefore maintaining its “hold” rating. On the other hand, Pan-United Corp has indeed been benefiting from the infrastructure spending we envisioned. For 1Q2012, the company posted results that came in ahead of expectations. Earnings were up 54% y-oy on ready-mixed concrete sales and analysts expect demand to remain strong this year. In a report, DBS analyst Ho Pei Hwa highlights that public projects will account for 50% of construction output compared to 30% in 2011. Ho has raised her target price on the stock to 70 cents from 68 cents before. CONSUMER STRENGTH A couple of our picks for 2012 were bets on Asian consumption, which we figured would be an abiding theme for the year. Recent data hasn’t been inspiring though. Local retail sales volume and value experienced a pullback in the month of May. And, the Nielsen Global Consumer Confidence Index for 2Q showed a drop of two points in Singapore to 94, following a short-lived uptick in 1Q. A figure below 100 indicates pessimism. Even so, the two consumer driven names in our list have done well. CMA has returned 26% while FJ Benjamin Holdings is up 10%. Can that outperformance continue? DBS analyst Lock Mun Yee recently raised her target price on CMA to $2.06 from $2.02 to factor in the higher share prices of the counter’s listed subsidiaries and associates as well as the recent establishment of a new private equity fund. Lock sees the fund strengthening CMA’s fee income model, increasing assets under management, allowing CMA to realise divestment gains and lowering the company’s gearing. For its part, FJ Benjamin managed to record a 7.5% y-o-y growth in revenue and 7.7% growth in earnings for the quarter to March despite the slower economy. DMG is encouraged by that performance and points out that its gross margins improved to 45.6% from 43.3% a year ago. The research house figures that the company’s performance could also be helped by foreign visitor arrivals, which were up 15% in 1Q while tourism receipts grew 8%. “FJ Benjamin’s portfolio of popular brands and its good relationship with the retailers would help it ride out the near-term uncertainties,” DMG says. Heartened as we are by the performance of our portfolio so far, we aren’t expecting it to be smooth sailing from here on. As Grose-Hodge of LGT notes, “things that are cheap can get cheaper.” Meanwhile, Koh of UOB says: “Investors are already coming back but we have to be prepared for periodic shocks.” Here’s hoping our stock picks will prove themselves to be shockproof. To create link towards this article on your website, copy and paste the text below in your page. Preview : |

| Last Updated on Monday, 23 July 2012 11:02 |

Iran accuses Israel of plotting Bulgaria bus attack

UNITED NATIONS (Reuters) - Iran's U.N. envoy accused Israel on Wednesday of plotting and carrying out a suicide bomb attack on a bus in Bulgaria a week ago in which five Israeli tourists were killed.

A suicide bomber blew up the bus in a car park at Burgas airport, a popular gateway for tourists visiting Bulgaria's Black Sea coast, killing himself, the Israeli tourists and the Bulgarian bus driver and wounding more than 30 people.

Israel has accused Iran and the Lebanese Islamist group Hezbollah of the bombing. Iran has denied the accusations.

" It's amazing that just a few minutes after the terrorist attack, Israeli officials announced that Iran was behind it," Iran's U.N. Ambassador Mohammad Khazaee told a U.N. Security Council debate on the Middle East. " We have never and will not engage in such a despicable attempt on ... innocent people."

" Such terrorist operation could only be planned and carried out by the same regime whose short history is full of state terrorism operations and assassinations aimed implicating others for narrow political gains," Khazaee said. " I could provide ... many examples showing that this regime killed its own citizens and innocent Jewish people during the last couple of decades.

Israel's U.N. Ambassador Haim Waxman said Iran's fingerprints were all over the bomb attack in Bulgaria, as well as dozens of other plots in recent months around the world.

" These comments are appalling, but not surprising from the same government that says the 9/11 attack was a conspiracy theory and denies the Holocaust," Waxman said in a statement.

Some analysts believe Iran is trying to avenge the assassinations of several scientists involved in its controversial nuclear programme that it blames on Israel and the United States. Israeli diplomats have been targeted in several countries in recent months by bombers who the Jewish state maintained had struck on behalf of Tehran.

" The time has come for the world to put an end to this campaign of terror, once and for all," Waxman said.

(Reporting by Michelle Nichols Editing by Jackie Frank)

A suicide bomber blew up the bus in a car park at Burgas airport, a popular gateway for tourists visiting Bulgaria's Black Sea coast, killing himself, the Israeli tourists and the Bulgarian bus driver and wounding more than 30 people.

Israel has accused Iran and the Lebanese Islamist group Hezbollah of the bombing. Iran has denied the accusations.

" It's amazing that just a few minutes after the terrorist attack, Israeli officials announced that Iran was behind it," Iran's U.N. Ambassador Mohammad Khazaee told a U.N. Security Council debate on the Middle East. " We have never and will not engage in such a despicable attempt on ... innocent people."

" Such terrorist operation could only be planned and carried out by the same regime whose short history is full of state terrorism operations and assassinations aimed implicating others for narrow political gains," Khazaee said. " I could provide ... many examples showing that this regime killed its own citizens and innocent Jewish people during the last couple of decades.

Israel's U.N. Ambassador Haim Waxman said Iran's fingerprints were all over the bomb attack in Bulgaria, as well as dozens of other plots in recent months around the world.

" These comments are appalling, but not surprising from the same government that says the 9/11 attack was a conspiracy theory and denies the Holocaust," Waxman said in a statement.

Some analysts believe Iran is trying to avenge the assassinations of several scientists involved in its controversial nuclear programme that it blames on Israel and the United States. Israeli diplomats have been targeted in several countries in recent months by bombers who the Jewish state maintained had struck on behalf of Tehran.

" The time has come for the world to put an end to this campaign of terror, once and for all," Waxman said.

(Reporting by Michelle Nichols Editing by Jackie Frank)

European shares fall for fourth day on U.S. gloom

European flag floating in front of the European Commission building in Brussels

* Weak U.S. home sales, Apple sales wipe off early rebound

* Spanish Italian shares boosted by speculation of ESM boost

By Francesco Canepa

LONDON, July 25 (Reuters) - European stocks extended their fall into a fourth session in thin trade on Wednesday and braced for further losses as weak U.S. home sales data and revenue from consumer bellwether Apple wiped out a tentative rebound.

Pan-European indexes turned negative in the afternoon, when data showed U.S. single-family home sales fell by the most in more than a year in June and Apple's quarterly revenue came in lower than expected, hit by a sagging European economy.

The weak numbers from the United States came hard on the heels of a disappointing reading for Germany's Ifo sentiment index and much worse-than-expected U.K. preliminary GDP data for the second quarter.

" U.S. new home sales printed as the lowest on record, UK and German data (earlier on Wednesday) were weak and the euro zone debt drama remains," Ishaq Siddiqi, a market strategist at ETX Capital said.

" The push up earlier on ... could never be sustainable"

European shares had traded higher for most of the day, helped by speculation the euro zone's bailout fund could be given access to central bank money to help it defuse the region's sovereign debt crisis, as suggested by European Central Bank policy maker Ewald Nowotny on Wednesday.

Nowotny's comments helped Italy's FTSE MIB and Spain's Ibex 35 rise 1.2 percent and 0.8 percent respectively, after shedding around 10 percent in the previous three sessions, while yields on the countries' bonds fell and the euro gained ground against the greenback .

" The market is driven by political announcements, which is a reason to be nervous because politicians themselves are in uncharted territory," Lorne Baring, managing director of B Capital Wealth Management, said.

" Many investors and managers were whipsawed last summer and there is a good possibility that it will be that kind of market behaviour again this year, with accentuated moves to the up and downside."

Baring said he was " steering clear" of European equities after closing his only positions -- in Germany's Dax and Britain's -- earlier this month, when the yield on Spain's 10-year bond climbed above the psychological 7 percent threshold.

He was monitoring the Spanish bond yield, the euro and indicators of the state of the funding market for any sign that sentiment was improving, providing a new entry point for European equities, while he kept his " overweight" positions on U.S. shares and the dollar.

The FTSEurofirst 300 index provisionally closed 0.72 points lower, or 0.1 percent, at 1,017.89 points, adding to the 45.86 points shed in the previous three sessions on mounting concerns about the sustainability of Spain's finances.

Trading volume on the index was very thin at 73 percent of its 90-day average, Thomson Reuters data showed, exacerbating swings in share prices.

MIXED EARNINGS

Britain's ARM Holdings was the top riser, up 8.6 percent in twice its volume average, as its results showed demand for the firm's low-power chips, used in smartphones, outstripped the industry.

German car maker Daimler led a rally among auto stocks after posting a smaller-than-expected decline in results and sticking to its forecast for roughly flat underlying profits this year.

Shares in the group were up 4.1 percent, the best performers in a 1.9 percent stronger European auto sector.

About a fifth of major European companies have reported results so far this earnings season, with half missing analysts' forecasts, Thomson Reuters Starmine data shows.

Earnings growth estimates have been cut by around 6 percent since the start of the year for European companies, compared with 1.7 percent for S& P 500 companies.

Confirming a mixed picture for European earnings, Deutsche Bank sank 4.1 percent after issuing a profit warning, which fuelled worries the German lender may have to raise capital.

It was the biggest faller on the Euro STOXX 50 index, which closed up 0.4 percent at 2,159.09 points.

CHARTS POINT DOWN

Technical charts suggested the euro zone blue-chip index was likely to resume its downtrend after creating a 'bearish gap' between Friday's bottom and Monday's top, which now acted as a resistance on the index between 2,220 and 2,235 points.

On Tuesday, the index had also closed a 'bullish gap' - created at the start of the late June rally - which had been supporting the gauge at 2,167-2,184 points.

" All these negative signals incite us to be bearish for the coming sessions, with a short term target corresponding to June lows at 2,050...within the next one or two weeks," Ouri Mimran, technical strategist at Natixis in Paris, said.

" We still play the break out of this level and a return to the September 2011 level low of 1,936 points (in the next couple of months)."

Mimran said this scenario would be invalidated in the short term if the Euro STOXX 50 managed to close the bearish gap at 2,235, triggering a rebound towards 2,400.

Digg

Digg Del.icio.us

Del.icio.us StumbleUpon

StumbleUpon Netscape

Netscape Yahoo

Yahoo Technorati

Technorati Googlize this

Googlize this Facebook

Facebook