Others

Market News that affect STI

Post Reply

541-560 of 1458

Post Reply

541-560 of 1458

Stocks rise after Fed holds rates

By Ben Rooney, staff reporterMarch 16, 2010: 5:02 PM ET

NEW YORK (CNNMoney.com) -- Stocks closed higher Tuesday after the Federal Reserve voted to keep interest rates at historic lows and Standard & Poor's did not downgrade Greece's credit rating.

The Dow Jones industrial average (INDU) rose 44 points, or 0.4%. The S&P 500 index (SPX) added 9 points, or 0.8%, to close at a fresh 18-month high. The Nasdaq composite (COMP) gained 16 points, or 0.7%.

Stocks have been grinding higher in recent weeks as traders remain bullish about the economic recovery. But the number of shares trading hands has been relatively low, suggesting that many investors are on the sidelines awaiting more concrete evidence of improvement.

"The market has been in an optimistic mania," said Bruce McCain, chief investment strategist at Key Private Bank. "For whatever reason, investors have cast aside worries and money is flowing into both stocks and bonds."

However, it remains to be seen if the optimism can be sustained.

"We think this is a transition phase for the economy," McCain said. "There are plenty of opportunities for investors to become discouraged."

Looking ahead, investors will take in a report on inflation at the wholesale level Wednesday. Reports on consumer prices and weekly jobless claims will be in focus later this week.

On Monday, stocks closed mixed after Moody's issued a warning about the United States' AAA rating and lawmakers put forward a bank regulation bill.

Fed holds rates: In a widely expected move, the Federal Reserve announced plans to hold its benchmark interest rate at historic lows near zero percent, the level at which the rate has been since December 2008. Echoing past statements, the Fed added that rates will remain "exceptionally low" for an "extended period" of time.

The Fed said economic conditions continue to improve and that the job market is stabilizing. While the Fed expects economic growth to be "moderate" in the short run, the bankers said activity could pick up in the future as inflation remains tame.

As previously announced, the Fed said its plan to buy $1.25 trillion in mortgage-backed securities will end later this month.

"Not a big surprise," Key Private Bank's McCain said of the Fed's announcement. "They have gone out of their way to indicate improvement, while continuing the fight to establish economic growth."

Thomas Hoenig, president of the Federal Reserve Bank of Kansas City, was the one dissenting vote. Hoenig, who was also the sole dissenter at the Fed meeting in January, is concerned that keeping rates low indefinitely could be creating new bubbles in financial markets.

"Even the description of Hoenig's position seems to be a bit more strident," McCain said.

Greece gets a reprieve: Stocks were also supported by news that ratings agency Standard & Poor's did not cut Greece's credit rating after warning last month that a downgrade was possible.

"That's allaying some fears about the potential for the sovereign debt crisis to spread," said Abigail Doolittle, a portfolio manager at Johnson Illington Advisors. However, she added that many large European nations and U.S. states are still facing dire fiscal scenarios.

S&P said its decision was based on deficit reduction measures Greek policy makers introduced in March, which aim to reduce the nation's budget deficit to 8.7% of gross domestic product this year.

"We view the government's fiscal consolidation program as supportive of the ratings at their current level," said Standard & Poor's credit analyst Marko Mrsnik.

Still, the agency said the outlook for the debt-stricken nation remains negative.

Economy: New home construction fell 5.9% to an annual rate of 575,000 in February, according to a government report, from an upwardly revised 622,000 during the previous month.

Economists surveyed by Briefing.com expected housing starts to have fallen to an annual rate of 570,000 during the month.

The report said building permits slipped 1.6% to an annual rate of 612,000 in February. They were expected to have fallen to an annual rate of 601,000 during the month.

A separate reading showed import prices slipped 0.3% in February, posting the first decline since July 2009. Excluding fuel, import prices gained 0.2%. Import prices in January were revised to a 1.3% increase.

Export prices slipped 0.5% last month, following a revised 0.7% rise in January.

Companies: Intel (INTC, Fortune 500) jumped 4% after the chip maker unveiled new processors it says can deliver up to 60% greater performance than the previous generation processor.

Shares of General Electric (GE, Fortune 500) rose 4.5% after the conglomerate said during a conference with analysts that it expects higher profits and dividend payments in 2011.

Boston Scientific (BSX, Fortune 500) recovered from a drubbing in the previous session to trade 4.3% higher. Shares of the medical device maker fell 16% Monday after the company halted delivery on some implantable defibrillators because it neglected to notify federal regulators of a manufacturing change.

Sony (SNE) and the estate of Michael Jackson have signed a landmark music deal for 10 albums over seven years. The deal is said to be worth as much as $250 million.

Lehman Brothers Holdings submitted a proposal to the U.S. Bankruptcy Court in New York to resolve the biggest Chapter 11 filing in Wall Street history.

The defunct brokerage, which collapsed in September 2008, would form a subsidiary called LAMCO to oversee its remaining assets, which include commercial real estate, residential mortgages and derivatives.

The dollar and commodities: The dollar slipped versus the euro, the pound, and the yen.

U.S. light crude for April delivery rose $1.90 to settle at $81.70 a barrel.

The price of gold rose $17.10 per ounce to settle at $1122.50.

Bonds: The price of the 10-year note fell, boosting the yield to 3.65%. Treasury prices and yields move in opposite directions.

World markets: European markets rose. The CAC 40 in France and Germany's DAX both gained about 1.4%, while Britain's FTSE 100 advanced 0.6%.

European finance ministers said late Monday that euro area countries have developed a mechanism to help Greece if it determines that the debt-stricken country needs to be rescued.

In Asia, the Hang Seng in Hong Kong and Japan's benchmark Nikkei index both lost about 0.3%.

Simple. A dollar's worth in the future for Dow is at least $2.00 whereas a dollar's worth today for the STI is probably 1 cent or at least never worth a dollar but mostly discounted by half for the future. The balance's worth is to be eaten by something not nice to mention. Heehee.

pharoah88 ( Date: 16-Mar-2010 10:26) Posted:

dOw has been pOsitive ALL the WAY.

WHY STI iS sUch a cOward? |

|

dOw has been pOsitive ALL the WAY.

WHY STI iS sUch a cOward?

Mixed finish for stocks

By Alexandra Twin, senior writerMarch 15, 2010: 5:41 PM ET

By Alexandra Twin, senior writerMarch 15, 2010: 5:41 PM ET

NEW YORK (CNNMoney.com) -- Stocks ended mixed Monday, fighting back from big losses, as investors weighed Moody's warning about the United States' AAA rating and a proposed bank regulation bill ahead of Tuesday's Federal Reserve meeting.

The Dow Jones industrial average (INDU) added 17 points, or 0.1%. The S&P 500 index (SPX) ended just above unchanged, eking out a fresh 18-month high. The Nasdaq composite (COMP) slid 5 points, or 0.2% after ending Friday's session at an 18-month high.

Stocks had tumbled through the early afternoon, but managed to trim losses by the close.

Comments by Moody's that the United States and Britain are more likely to see a downgrade than rivals Germany and France initially soured investor sentiment.

However, the ratings agency was quick to note that there is no imminent rating pressure for the United States or the other countries, even amid extensive spending in the aftermath of the global recession.

Moody's raising the warning on U.S. debt was unsurprising and not a cause for alarm, said Matt King, chief investment officer at Bell Investment Advisors.

"The risk of the U.S. defaulting on its debt is nil and there's no cause for immediate concern," he said. "Longer term, it means that we'll see rising rates."

He said that stocks are in a quiet period right now in terms of news flow, making continued market choppiness likely, until the next unemployment report is released and the first-quarter reporting period gets underway.

Stocks may see volatility this week in the aftermath of an advance that propelled the Dow, S&P 500 and Nasdaq higher in four of the last five weeks. The rally left the Nasdaq and S&P 500 at the highest point since September 2008 and the Dow just below those levels.

Since bottoming at a 12-year low on March 9 of last year, the Dow has gained 62% and the S&P 500 has gained 70% as of Monday's close. Since bottoming at a 6-year low on the same day, the Nasdaq has gained 87%.

Company news: Google (GOOG, Fortune 500) is reportedly close to shutting down its Chinese search engine, amid strict government monitoring and a recent targeted cyber attack. Shares fell 4% and the weakness dragged on other tech stocks.

Philips-Van Heusen (PFH), the owner of Calvin Klein, will buy fashion brand Tommy Hilfiger from Apax Partners in a cash-and-stock deal worth $3 billion. Shares of Philips-Van Heusen rose 9.8% in Monday trading.

Chordiant Software (CHRD) shares rallied 30% in unusually active trading after the maker of customer service management software agreed to be bought by Pegasystems (PEGA) for $161.5 million in cash. Chordiant shares rallied 31%. Pegasystems shares gained 6.7%.

Boston Scientific (BSX, Fortune 500) said it is halting sales of its heart-shocking defibrillator implants after it neglected to tell regulators about two production changes in the manufacturing of the product. Shares fell 13% in active New York Stock Exchange trading.

Wal-Mart Stores (WMT, Fortune 500) rose 2.8% after Citigroup upgraded it to "buy" from "hold" and raised its price target to $65 from $54, saying the company is getting more competitive in the "modern day price war in food retail in 2010."

AIG: Troubled financial firm AIG (AIG, Fortune 500) said it will withhold $21 million in bonuses that are due to former and current staff of its Financial Products unit, the unit most directly responsible for its almost-collapse 18 months ago. AIG will pay out $46 million to other employees of that unit.

Financial reform: Roughly 18 months after the collapse of Lehman Brothers, Senate Banking chief Christopher Dodd, D-Conn., released a draft bill of broad regulatory changes aimed at preventing another financial crisis.

The bill calls for a new consumer protection bureau within the Federal Reserve that would regulate all lending transactions. It would also set up a new process to put struggling firms under government control and break up large companies if they pose a major threat to the stability of the system.

The bill does not go as far as what President Obama has proposed, nor does it go as far as similar legislation already passed in the House. Still, getting it passed will be an uphill battle in the Senate.

Economy: Industrial production and capacity utilization, which measure factory output, both rose more than expected last month, according to a Federal Reserve report released Monday.

Industrial production rose 0.1% in February, after rising 0.9% in January. Economists surveyed by Briefing.com thought industrial production would be unchanged, according to a consensus of economists surveyed by Briefing.com.

Capacity utilization rose to 72.7% from 72.5% in January, versus forecasts for an unchanged reading.

The Empire manufacturing survey, a regional reading on manufacturing, fell to 22.86 in March from 24.91 in February, a little stronger than the 22 level expected by economists.

Fed meeting looms: On Tuesday, the focus turns to the Federal Reserve, meeting to discuss interest rates. The central bank is widely expected to hold the fed funds rate, a key overnight banking rate, steady at historic lows near zero. However, what the bankers say in the statement about the economic outlook and the future of Fed policy will be critical.

The dollar and commodities: The dollar gained versus the euro and fell versus the yen.

U.S. light crude oil for April delivery fell $1.44 to settle at $79.80 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery rose $3.70 to settle at $1,1105.40 per ounce.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.7% from 3.71% late Friday. Treasury prices and yields move in opposite directions.

World markets: In overseas trading, European markets fell. The London FTSE lost 0.6%, the French CAC 40 fell 0.9% and the German DAX lost 0.7%. Asian markets were mixed, with Japan's Nikkei little changed and the Hong Kong Hang Seng lower.

Market breadth was negative. On the New York Stock Exchange, losers beat winners four to three on volume of 930 million shares. On the Nasdaq, decliners beat advancers by five to four on volume of 1.91 billion shares.

STI 0.13% lower at midday

SINGAPORE shares were lower at midday on Thursday, with the benchmark Straits Times Index at 2,858.53, down 0.13 per cent, or 3.76 points.

About 918 million shares exchanged hands.

Losers beat gainers 194 to 178.

Stocks post modest gains

By Ben Rooney, staff reporterMarch 10, 2010: 4:53 PM ET

NEW YORK (CNNMoney.com) -- Stocks rose Wednesday, with the Nasdaq ending at its highest level in more than 18 months, on strength in the financial services sector and an upbeat report on wholesale inventories.

The Dow Jones industrial average (INDU) rose 3 points, or less than 0.1%, at 10,567, according to early tallies. The S&P 500 index (SPX) added 5 points, or 0.5%, to 1,145.

The Nasdaq composite (COMP) rose 18 points, or 0.8%, to 2,358. The tech-heavy index closed at its highest level since August 2008. Wednesday marked the 10th anniversary of the Nasdaq's all-time closing high of 5,048.62 at the peak of the dot-com bubble.

Bank stocks advanced on upbeat analyst comments and bullish statements from some executives. Citibank (C, Fortune 500) rose 3.6% after the company priced a $2 billion offering of trust-preferred securities. Bank of America (BAC, Fortune 500) gained nearly 2%.

American International Group (AIG, Fortune 500) soared over 10% as investors cheered the insurance giant's recent asset sales. Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500) also gained significant ground.

Technology stocks also posted strong gains. The Sox (SOX), an index of semiconductor shares, gained about 2%.

However, traders said volumes have been declining this week as many market participants move to the sidelines amid a lack of market-moving economic reports.

"There are no buyers to get us over the next hump," said Dave Rovelli, managing director of U.S. equity trading at Canaccord Adams. He said the market has stalled, with the S&P 500 struggling to push past its Jan. 19 high of 1,150. "Until that happens, the market is just going to drift."

Shares of energy producers weakened as oil prices pared earlier gains. Oil briefly traded above $83 a barrel after the government reported a smaller-than-expected increase in oil supplies and a dip in gasoline inventory but ended 60 cents higher to settle at $82.09 a barrel. Gold prices fell.

Stocks managed slight gains Tuesday, which was the one-year anniversary of what many consider to be the bottom of the bear market.

Looking ahead, investors will turn Thursday to the government's weekly report on initial claims for unemployment benefits. Economists surveyed by Briefing.com expect claims to have risen last week by 9,000 to 460,000.

The Census Bureau's report on the January trade gap is also due out Thursday.

Economy: The U.S. Commerce Department said wholesale inventories fell 0.2% in January, after a 1% drop the month before, raising expectations that consumer demand is strengthening.

"It's not that inventories are rebuilding, but the declines are waning," said Bruce McCain, chief investment strategist at Key Private Bank. "Sooner or later, businesses will have to begin producing more."

Separately, the Labor Department said fewer states reported increases in unemployment in January.

The Treasury Department said the government suffered a record $220.9 billion budget deficit in February, after a shortfall of $42.6 billion in January. It was the 17th consecutive monthly deficit and was slightly smaller than the $221 billion shortfall economists had forecast.

Company news: Shares of Facet Biotech (FACT) surged 66% after Abbott Labs (ABT, Fortune 500) announced plans to acquire the company for $27 a share. Abbott gained about 0.7%.

Airline stocks rallied on growing expectations that 2010 is shaping into a profitable year for the industry. Shares of UAL (UAUA, Fortune 500), holding company for United Airlines, and Continental Airlines (CAL, Fortune 500) surged about 5%.

World markets: European markets posted solid gains, while Asian shares ended the session flat.

China reported a 46% increase in exports during February. The rise was due in part to stronger demand from consumers in the United States and Europe, analysts said.

The dollar and commodities: The dollar slipped versus the euro but rose against the yen and the pound.

The price of oil rose 60 cents to settle at $82.09 after hitting a high of $83.03 earlier in the session.

Meanwhile, the price of gold fell $14.20 to close at $1,108.10 an ounce.

Bonds: The price of the 10-year note fell, pushing up the yield to 3.71%. The government sold $21 billion worth of reopened 10-year notes Wednesday as part of a $74 billion offering of U.S. debt this week.

Market breadth was positive. On the New York Stock Exchange, winners beat losers by two to one on volume of 961 million shares. On the Nasdaq, advancers topped decliners by just under two to one on volume of 2.2 billion shares.

Stocks muster gains; Nasdaq at 18-month high

By Alexandra Twin, senior writerMarch 9, 2010: 6:29 PM ET

NEW YORK (CNNMoney.com) -- Stocks managed gains Tuesday at the end of a choppy session as investors mulled the latest corporate deal and profit news on the anniversary of the bear-market bottom.

The Dow Jones industrial average (INDU) added nearly 12 points, or 0.1%. The S&P 500 index (SPX) added less than two points. Both closed at 6-week highs.

The Nasdaq composite (COMP) gained 8 points, or 0.4%, ending at a fresh 18-month high.

A stock advance fizzled out Tuesday, one year after what many consider to be the bottom of the bear market.

On March 9, 2009, the Dow ended at a 12-year low of 6,547.05, as months of stock weakness in response to the financial market crisis pushed the blue-chip average to its nadir. Since then, the Dow has gained 61.2% through Monday's close, ending at 10,552.52.

In the same time period, the S&P 500 gained 68%, bouncing off of 12-1/2 year lows. The Nasdaq's gain of 84% was off of six-year lows. The gains were fueled by bets on an economic recovery and the impact of trillions of dollars of government stimulus injected into the system.

But the pace of the advance has slowed this year, as investors have gone from pricing in an economic recovery to waiting for evidence that the recovery has legs. A still-abysmal job market and ongoing weakness in housing and consumer spending have dragged on sentiment.

Worries about a European debt crisis and the impact of China slowing its growth have also been in play.

But the ongoing skepticism of the so-called average investor, or retail investor, continues to give the market some support.

"You've seen this massive rally over the last year, but it hasn't coincided with the retail investor really participating," said Larry Glazer, managing director at Mayflower Advisors.

He pointed to mutual fund flow information that shows investors are still pouring substantially more money into lower-yielding bond funds than stock funds, a trend that was evident throughout the rally last year. Also, nervous investors who dump stocks for cash or cash equivalents are getting minimal or non-existent returns, he said.

"The retail investor skepticism could prolong the market advance because there is so much potential that they haven't tapped into yet," he said.

Stocks ended little changed Monday after AIG (AIG, Fortune 500) sold its American Life Insurance unit to MetLife (MET, Fortune 500) in a $15.5 billion cash-and-stock deal. Typically, such deals would spark a bigger stock market advance, but investors were wary after pushing stocks higher for three of the last four weeks.

Corporate news: AIG (AIG, Fortune 500) shares rallied for a second day in a row. Other financial gainers included Citigroup (C, Fortune 500), Fannie Mae (FNM, Fortune 500) and Freddie Mac (FNM, Fortune 500).

Cisco Systems (CSCO, Fortune 500) said it is introducing a new Internet router that will power the most heavily-trafficked parts of the web at twelve times the speed of its competitors. Cisco shares were little changed on the news, but the stock was heavily traded, with over $150 million shares changing hands.

Texas Instruments (TXN, Fortune 500) updated its first-quarter profit estimates late Monday, saying it expects to earn between 48 cents and 52 cents per share on revenue of $3.07 billion to $3.19 billion.

The new forecast was an improvement over the chipmaker's earlier forecast, but investors took a "sell the news" approach, sending shares 2% lower.

Northrop Grumman (NOC, Fortune 500) dropped out of the competition late Monday to build tanker planes for the U.S. Air Force, leaving Boeing (BA, Fortune 500) the only bidder in a contract that could be worth as much as $50 billion.

Merck (MRK, Fortune 500) and Sanofi-Aventis (SNY) said they are combining their animal health care businesses to create one of the biggest in the world. The combined business will have about a 29% market share in a global market worth around $19 billion. Merck shares fell and Sanofi-Aventis shares were little changed.

World Markets: In overseas trading, European markets ended mixed, with London's FTSE 100 down 0.1%, Germany's DAX up 0.2% and France's CAC 40 up 0.2%. Most Asian markets ended higher, with the exception of Japan's Nikkei, which finished lower.

The dollar and commodities: The dollar gained versus the euro and fell versus the yen.

U.S. light crude oil for April delivery dipped 38 cents to settle at $81.49 a barrel on the New York Mercantile Exchange.

COMEX gold for May delivery fell $1.70 to settle at $1,122.90 per ounce.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.69% from 3.71% late Monday. Treasury prices and yields move in opposite directions.

Market breadth was positive. On the New York Stock Exchange, winners beat losers by nine to seven on volume of 1.12 billion shares. On the Nasdaq, advancers topped decliners by seven to six on volume of 2.57 billion shares.

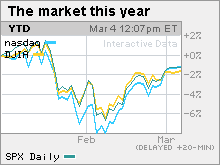

Dow positive for 2010

by Alexandra Twin, senior writerMarch 4, 2010: 4:18 PM ET

NEW YORK (CNNMoney.com) -- Stocks ended a volatile session higher Thursday as investors welcomed improved retail sales and a report showing the pace of job losses is slowing, ahead of Friday's big government employment report.

The Dow Jones industrial average (INDU) gained 47 points, or 0.5%, according to early tallies. The S&P 500 index (SPX) added 4 points or 0.4% and the Nasdaq composite (COMP) gained 11 points or 0.5%.

The strong dollar dragged on dollar-traded commodities as well as on shares of companies that do a lot of business overseas, and therefore benefit from a weaker dollar.

Wall Street ended little changed Wednesday as investors remained cautious over the jobs outlook and the strength of the recovery. That caution remained in place Thursday.

"We had some good news this morning with the jobs numbers and the retail sales, but I think the market is really waiting for tomorrow," said Ron Kiddoo, chief investment officer at Cozad Asset Management.

The government releases the February jobs report before the start of trading Friday. The payrolls number is expected to show that employers cut 65,000 jobs in February, after cutting 20,000 in the previous month. The unemployment rate, generated by a separate survey, is expected to have risen to 9.8% from 9.7% in the previous month.

"Unless the actual payrolls number is way off base, you're not going to see a big stock market reaction beyond the early morning," said Kiddoo.

But the report overall is key for the direction of the stock market beyond just Friday's session, he said, as investors look for signs that an economic recovery has legs.

Jobs: Ahead of Friday's big non-farm payrolls report, investors digested the government's weekly tallies.

The number of Americans filing new claims for unemployment fell to 469,000 last week from a revised 498,000 the previous week. Economists surveyed by Briefing.com thought claims would fall to 470,000.

Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 4.5 million from a revised 4.634 million in the previous week. Economists thought claims would only drop to 4.6 million.

On Wednesday, reports from payroll services firm ADP and outplacement firm Challenger, Gray & Christmas showed the pace of job cuts is slowing as the labor market begins to stabilize.

Home sales slump: The January pending home sales index plunged 7.6% -- far worse than expected -- as brutal storms on the east coast kept potential buyers on the sidelines.

The report from the National Association of Realtors was a surprise to economists, who were expecting sales to rise 1%, on average, after rising a revised 0.8% in December.

Retail sales rise: Despite massive snow storms, shoppers picked up the pace in February, boosting total retail sales by 4%, according to sales tracker Thomson Reuters.

It was the sixth month in a row that same-store sales rose and the best monthly gains since November 2007, a month before the official start of the recession. Same-store sales is a retail industry metric that refers to sales that have been open for a year or more.

Among the standouts, clothing chain Abercrombie & Fitch (ANF) reported that same-store sales rose 5% versus forecasts for a decline of 6.1%. Shares rallied 14%.

Factory orders: Factory orders climbed 1.7% in January, just shy of forecasts for a rise of 1.8%, the Commerce Department reported. Orders rose a revised 1.5% in the previous month.

Citigroup: Company CEO Vikram Pandit thanked taxpayers for the $45 billion in aid his company received during the height of the financial crisis, as part of his testimony before a Congressional panel. Citi (C, Fortune 500) shares gained 2%.

World Markets: In overseas trading, European markets were little changed after the European Central Bank held its benchmark interest rate steady at 1% and the Bank of England held its rate steady at 0.5%. Both decisions were in line with expectations.

The London FTSE and the German DAX were barely changed and the French CAC 40 gained 0.1%.

Asian markets ended lower, although the Japanese Nikkei rose 0.3%.

The dollar and commodities: The dollar gained versus the euro and the yen, pressuring dollar-traded commodities.

U.S. light crude oil for April delivery fell 66 cents to settle at $80.21 a barrel on the New York Mercantile Exchange.

COMEX gold for May delivery lost $11.30 to settle at $1,132.60 per ounce.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.60% from 3.61% late Wednesday. Treasury prices and yields move in opposite directions.

Asian shares lower at midday

KUALA LUMPUR

At 12.30pm on Thursday, there were 219 gainers, 329 losers and 264 counters traded unchanged on the Bursa Malaysia.

The FBM-KLCI was at 1,285.66 down 0.44 of a point, the FBMACE was at 4,224.01 down 15.40 points, and the FBMEmas was at 8,648.61 down 2.13 points.

Turnover was at 353.588 million shares valued at RM532.490 million (S$221 million).

HONG KONG

Hong Kong fell 0.53 per cent by the break on Thursday, off earlier lows due to caution ahead of a key parliamentary session in China.

The benchmark Hang Seng Index fell 110.54 points to 20,766.25. Turnover was HK$34.35 billion (S$6.19 billion).

TOKYO

Japanese shares were flat on Thursday morning as investors awaited US jobs data this week for a fresh trading peg.

The Nikkei-225 index fell by just 2.96 points or 0.03 per cent to 10,250.18 by the lunch break. The broader Topix index of all the first section shares added 0.08 points or 0.01 per cent to 905.73.

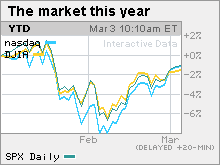

Stocks struggle ahead of jobs reports

By Alexandra Twin, senior writerMarch 3, 2010: 4:14 PM ET

NEW YORK (CNNMoney.com) -- Stocks ended mixed Wednesday, giving up the day's gains by the close as reports showing a stronger economy and a slower pace of job cuts failed to reassure investors after the recent run.

Also in play: An announcement from Greece about the steps it will take to cut its deficit.

Stocks had posted slim gains through the early afternoon following reports showing some stability in the job market and a pick up in the services sector. But the gains petered out in the afternoon.

Investors had a mild reaction to the Fed's periodic "Beige Book" reading on the economy, released around 2:00 p.m. ET. The Beige Book showed that economic activity picked up somewhat in 9 of the Fed's 12 districts. Consumer spending also improved modestly.

But the report failed to sway investors, leaving stocks near unchanged.

Stocks have drifted higher over the past three sessions, pushing the S&P 500 and the Nasdaq into positive territory for 2010. The Dow briefly moved into positive territory during Wednesday's session, before retreating.

After a strong rally in 2009, stocks have been volatile this year as investors look for evidence that an economic recovery is taking hold, above and beyond the considerable government stimulus that has been put into play.

Market participants have been reluctant to move much in the aftermath of a big rally. Between the lows of last March and the highs of January, the S&P 500 jumped 70%.

Jobs: A pair of economic reports showed that the pace of job cuts is slowing as the labor market slowly begins to stabilize.

Payroll services firm ADP said employers in the private sector cut 20,000 jobs from their payrolls in February, meeting the expectations of economists surveyed by Briefing.com. The drop was the smallest decline in two years. In January, employers cut a revised 60,000 jobs.

Outplacement firm Challenger, Gray & Christmas said that 42,090 job cuts were announced in February, down from 71,482 in January. It was the smallest number of announced job cuts since July 2006, when 37,178 cuts were announced.

Separately, the Senate voted late Tuesday to extend the deadline for unemployed Americans to apply for benefits, after previous attempts to do so failed. President Obama signed the measure shortly thereafter.

Over 200,000 people would have stopped receiving unemployment checks this week.

Services sector grows: In other economic news, the Institute for Supply Management's services sector index rose to 53 in February from 50.5 in January, hitting the highest point since December 2007, at the start of the recession. Economists surveyed by Briefing.com thought it would rise to 51.

Greece: The debt-strapped nation announced a $6.5 billion plan Wednesday to help it cut its ballooning deficit. The plan includes $3.3 billion in new revenues such as taxes and another almost $3.3 billion in spending cuts, including pension freezes and cuts in civil servants' salaries.

Worries that Greece might default on its debt have pummeled the euro and unnerved world markets over the last two months, as investors have wondered if the problems are indicative of a bigger euro zone crisis.

The European Union said Wednesday that it will more closely regulate the economies of its 27 members so as to avoid a repeat of the Greece crisis. The new system will issue warnings if a country is heading for trouble, something that might have alerted officials to Greece's problems at an earlier date.

On the move: Hedge fund Elliott Associates made an unsolicited all-cash offer for Novell (NOVL) that values the business software maker at around $2 billion.

Elliott Associates offered to buy the remaining 91.5% of the company it doesn't already own for around $5.75 per share, or $1.83 billion. The price is a 21% premium over Novell's closing stock price from Tuesday.

Novell jumped 28% and was the Nasdaq's most-actively traded issue.

On the downside, biotech Medivation (MDVN) lost two-thirds of its value after the company said that its experimental Alzheimer drug Dimebon failed to produce desired results in a late-stage clinical study. Dow component Pfizer (PFE, Fortune 500), which co-develops the drug, lost 1%.

Among other Dow movers, Caterpillar (CAT, Fortune 500), Home Depot (HD, Fortune 500), General Electric (GE, Fortune 500), Coca-Cola (KO, Fortune 500) and Boeing (BA, Fortune 500) all gained.

Market breadth was positive. On the New York Stock Exchange, winners topped losers four to three on volume of 580 million shares. On the Nasdaq, advancers topped decliners seven to six on volume of 1.86 billion shares.

World Markets: In overseas trading, European markets rallied, with the London FTSE rising 0.9%, the French CAC 40 gaining 0.8% and the German DAX advancing 0.7%. Most Asian markets ended lower, although the Japanese Nikkei rose 0.3%.

The dollar and commodities: The dollar gained versus the euro and fell versus the yen.

U.S. light crude oil for April delivery rose $1.19 to settle at $80.87 a barrel on the New York Mercantile Exchange.

COMEX gold for May delivery gained $5.90 to settle at $1,143.30 per ounce.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.62% from 3.60% late Tuesday. Treasury prices and yields move in opposite directions.

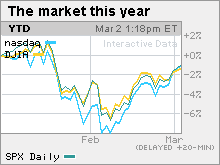

Stocks eke out gains

By Alexandra Twin and Blake Ellis, staff writersMarch 2, 2010: 6:02 PM ET

NEW YORK (CNNMoney.com) -- Stocks ended with modest gains Tuesday, giving up a bigger advance, as investors weighed February auto sales, some upbeat company news and signs that Greece won't default on its debt.

The Dow Jones industrial average (INDU) ended just above unchanged. The S&P 500 index (SPX) added 2 points, or 0.2%, and the Nasdaq composite (COMP) rose 7 points, or 0.3%.

Stocks gained in the previous two sessions and in two of the last three weeks. The Nasdaq and S&P 500 ended in positive territory for the year Monday for the first time in six weeks.

"I think stocks are benefiting from a little bit of buying in the month-end, new-month period," said Ben Halliburton, chief investment officer at Tradition Capital Management.

He said that the gains were surprising considering the recent batch of weaker-than-expected economic news, especially in housing, consumer confidence and consumer spending.

Worries about Greece and a broader euro-zone debt crisis caused the more than nine-month-old U.S. stock rally to halt and do an about-face in mid-January. Mixed readings on the U.S. economy have added to the stock market weakness as investors have worried that the recovery won't be as robust as had been hoped.

"I think the challenges to the economic recovery are well known, but the question is whether they have been fully discounted by the market," Halliburton said.

Investors are gearing up for a busy three days of economic news. The highlight is Friday's government jobs report, expected to show continued weakness in the labor market.

Stocks still vulnerable: The mid-January to early February selloff sent the S&P 500 down over 9% and the Dow and Nasdaq down more than 7%. But that selloff is unlikely to be the last big retreat this year, or even in the first half of the year, Halliburton said, considering the size and pace of last year's rally.

Between bottoming at a 12-year low in March of last year and hitting a 2010 high on Jan. 19, the Dow gained 64% and the S&P 500 gained 70%. After bottoming out at a six-year low last March, the Nasdaq gained 83% through Jan. 19.

Greece: Investors took some comfort Tuesday from signs that Greece's debt situation seems to be under control. Greek Prime Minister George Papandreou said more aggressive action needs to be taken to get the company's ballooning deficit under control. His government is expected to announce further initiatives Wednesday after already announcing plans to raise the retirement age and freeze salaries for civil workers.

Autos: Automakers released February vehicle sales numbers on Tuesday in the aftermath of Toyota's massive recall last month.

Toyota Motor (TM) said sales fell 9% in February versus a year ago, better than the 10% drop tracker Edmunds.com was forecasting.

Ford Motor said February sales jumped 43% from an abysmal month a year ago, the worst month for the industry in 19 years. Sales also outpaced those of General Motors for the first time in 10 years.

GM said February sales rose about 12% from a year ago, far short of estimates. GM was expected, along with the other automakers, to benefit more substantially from Toyota's ongoing problems.

Earlier GM said it had recalled 1.3 million Chevrolet and Pontiac models in North America due to power steering failures

Company news: CF Industries Holdings (CF) relaunched its bid for fellow fertilizer firm Terra Industries (TRA), offering $4.75 billion in cash and stock, after giving up its aggressive takeover attempt in January. CF jumped back into the fray after Terra agreed last month to a $4.1 billion buyout from Norway's Yara.

CF shares fell 1%, while Terra shares gained 11%.

Qualcomm (QCOM, Fortune 500) said late Monday that it was hiking its dividend by 12% and that it was initiating a new $3 billion stock buyback program. Investors welcomed the news, propelling the stock of the wireless chipmaker up 6.7% Tuesday in active Nasdaq trading.

Market breadth was positive. On the New York Stock Exchange, winners beat losers by more than two to one on volume of 835 million shares. On the Nasdaq, advancers topped decliners by less than two to one on volume of 2.52 billion shares.

Federal Reserve: Kansas City Fed President Thomas Hoenig said the central bank should raise short-term interest rates sooner rather than later, even with high levels of unemployment. Hoenig said that the extended period of historically low rates raises the risk of speculative behavior.

Hoenig, a voting member of the Fed's policy committee, was the only Fed official to vote against the group at the last Fed meeting in January, when the bankers opted to hold interest rates steady at levels near zero.

However, rates are not expected to rise for some time, as has been indicated by recent comments from Chairman Ben Bernanke and other voting members of the Fed's policy-setting committee.

World Markets: In overseas trading, European markets rallied, with the London FTSE rising 1.5%, the French CAC 40 gaining 1.1% and the German DAX advancing 1.1%.

Asian markets ended mostly lower, although the Japanese Nikkei rose 0.5% after the government said the unemployment rate dropped for the second month in a row. Japan also said consumer spending grew.

The dollar and commodities: The dollar gained versus the euro and fell versus the yen.

U.S. light crude oil for April delivery rose 98 cents to settle at $79.68 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery gained $19.10 to settle at $1,137.40 per ounce.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.60% from 3.61% late Monday. Treasury prices and yields move in opposite directions.

Nasdaq, S&P turn positive for 2010

By Alexandra Twin and Blake Ellis, staff writersMarch 1, 2010: 6:28 PM ET

NEW YORK (CNNMoney.com) -- Stocks jumped Monday, with the Nasdaq and S&P 500 pushing back into positive territory for the year, as investors welcomed AIG's $35 billion asset sale and a pair of mergers in the pharmaceutical sector.

Signs that a Greek bailout package is in the works also came into play.

Both the S&P 500 and the Nasdaq ended in positive territory for the year for the first time in over a month.

Stocks rallied Monday, the first day of March, as investors dug back in after last week's retreat. Stocks have been choppy and volatile this year in the aftermath of 2009's big rally.

Stocks jumped last year after trillions of dollars in fiscal and monetary stimulus were injected into the financial system. But optimism about a 2010 economic recovery also fueled the advance.

However, mixed signals about the economy this year have given investors pause as they look for clearer indications that a recovery is not only in place, but can take on a life of its own once the government stimulus fades out.

Concerns that Greece's debt crisis could spread to the rest of Europe and that China is seeking to pull back its expansion all dragged on stocks earlier in the year. But stocks have risen in two of the last three weeks.

"There are a few positives today, with some of the deal news, but there's still uncertainty about the economy," said Gary Webb, CEO at Webb Financial Group.

"It's going to be a lot more volatile this year," he said. "We saw a correction through early February and now we're seeing a rebound. I think we're going to continue to see that seesaw effect throughout this year."

February auto and truck sales are due throughout the day Tuesday. Toyota Motor (TM) is expected to take a hit in the aftermath of its recall of millions of vehicles plagued with safety programs.

AIG: AIG said Monday that it was selling its Asian life insurance business to Britain's Prudential PLC in a deal worth $35.5 billion. The deal includes $25 billion in cash, $16 billion of which the company has earmarked to pay back the government and taxpayers.

Troubled AIG (AIG, Fortune 500) has avoided collapse by borrowing about $132 billion from the government since 2008.

On Friday, the company reported a fourth-quarter loss of $8.9 billion, due mostly to costs connected to selling off large stakes in its insurance businesses.

Shares gained 4% Monday.

Deal news: Japanese drugmaker Astellas Pharma made an unsolicited $3.5 billion bid for OSI Pharmaceuticals (OSIP), maker of the blockbuster Tarceva cancer drug. The deal represents a 40% premium over OSI's Friday closing price.

OSI said it would review the offer and that shareholders should make no move as of yet. OSI shares rallied 52% Monday.

Over the weekend, German pharmaceutical company Merck KGaA said it would buy U.S.-based Millipore (MIL) for $7.2 billion. Millipore is a life sciences tools maker. Millipore shares gained 11.1% Monday.

MSCI (MXB) said it would buy risk advisory firm RiskMetrics Group (RISK) in a $1.55 billion cash-and-stock deal. MSCI shares fell 4% while Risk shares gained 13%.

SanDisk (SNDK) jumping 12%, after the flash memory card maker raised its first-quarter sales outlook to between $925 million and $1 billion.

Market breadth was positive. On the New York Stock Exchange, winners topped losers three to one on volume of 967 million shares. On the Nasdaq, advancers beat decliners by more than three to one on volume of 2.46 billion shares.

Economy: A busy day for economic news included readings on manufacturing, construction and income and spending.

The Institute for Supply Management's manufacturing index fell to 56.5 in February from 58.4 in January, surprising economists who thought it would only fall to 57.9. Any reading over 50 signifies expansion in the sector.

Construction spending declined 0.6% in January after falling 1.2% in the previous month, the government reported. The drop was in line with estimates.

Personal income rose 0.1% in January after gaining 0.3% in December. Economists expected income to climb 0.4%. Personal spending jumped 0.5% after rising 0.3% in the previous month. Economists thought spending would increase 0.4%.

Greece: Amid ongoing worries about Greece's ballooning deficit, Olli Rehn, the European Union's financial affairs commissioner, urged the nation to make more budget cuts. Greece has already announced plans to raise the retirement age and freeze wages, but Rehn said such moves are not enough.

Greece's finance minister, Giorgos Papaconstantinou, said the government would do "whatever it takes" to cut the deficit.

World Markets: In overseas trading, European markets rallied, with the London FTSE rising 1%, the French CAC 40 gaining 1.6% and the German DAX advancing 2%. Asian markets ended higher.

The dollar and commodities: The dollar gained versus the euro, the yen and the U.K. pound.

U.S. light crude oil for April delivery fell 96 cents to $79.66 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery eased 60 cents to settle at $1,118.30 per ounce.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.61% from 3.59%. Treasury prices and yields move in opposite directions.

By Agence France-Presse, Updated: 3/1/2010

Prudential buys AIG Asia arm for 35bln dlrs: source

US insurance giant AIG has agreed to sell its Asian arm, AIA, to British insurer Prudential for around 35 billion dollars (26 billion euros, 23 billion pounds), a source close to the deal said.

Prudential buys AIG Asia arm for 35bln dlrs: source

American International Group (AIG), which received a huge taxpayer bailout to stave off collapse during the financial crisis, had been persuaded to let Prudential take over its Asian businesses, said the source late Sunday.

The deal will transform Prudential into the world's top non-Chinese insurer by market capitalisation, ahead of major competitors Allianz and AXA.

It is understood the sale will be unveiled in the coming days, perhaps as early as Monday.

The purchase will be financed in cash, through a rights issue by Prudential, and through AIG taking a minority part of the British insurer, said the source.

Tidjane Thiam, who took up the job of Prudential chief executive in October, had never hidden his desire to expand the business in Asia.

The business chief, who has French nationality but was born in Ivory Coast, went to New York at the end of last week to persuade AIG's board to sell American International Assurance (AIA) to his company.

Prudential stepped in as AIG was planning an initial public offering for its Asian arm in Hong Kong in April.

Estimates had valued the market flotation at around 10 billion dollars -- which would have been the biggest of 2010 on global markets.

Prudential's shareholders, for their part, had welcomed the company's projects, said the source.

AIG was forced into giving up some of its assets after the company's near collapse in the depths of the financial crisis led the US government to hand it a bailout which totalled around 180 billion dollars.

In 2008, the firm tried to sell up to 49 percent of AIA through an auction process but had to drop the idea after failing to receive suitable offers. The company then turned to the idea of an initial public offering.

The US giant reported Friday a worse-than-expected fourth quarter net loss of 8.9 billion dollars -- still nearly 10 times less than in 2008, when AIG recorded 99.2 billion dollars in losses.

Prudential will be transformed by the deal to buy AIA, which will double its size. The company, founded in 1848, currently has a market capitalisation of about 23 billion dollars.

Sales in Asia already make up half of new contracts for Prudential across a number of countries including China, India, Indonesia, Malaysia and Thailand.

The takeover also marks a success for Thiam -- who was the first black chief executive of a company listed on London's benchmark FTSE 100 index -- after leaving rival Aviva to join Prudential in 2008.

AIG almost went under in September 2008, unable to meet its obligations for contracts written to insure mortgage securities and related assets without sufficient capital.

The Federal Reserve, fearing a shock to the global financial system in the event of an AIG default, provided a loan of 85 billion dollars to AIG in September 2008 in what would be the first portion of the gigantic bailout.

AIG generated fresh controversy at the start of February when it revealed plans to pay 100 million dollars in bonuses -- a year after similar payments ignited a political firestorm.

"(President Barack Obama) is frustrated and angry that Wall Street continues to have the sense that excessive compensation should reward some of the excessive risk taking we've seen over... the last couple years on Wall Street," said White House deputy press secretary Bill Burton.

Stocks lose big early, then cut losses

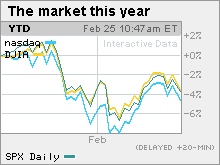

By Alexandra Twin, senior writerFebruary 25, 2010: 4:20 PM ET

NEW YORK (CNNMoney.com) -- Stocks ended with modest losses Thursday, fighting off a bigger decline that surrounded the latest worries about Greece's debt crisis and weaker-than-expected reports on the economy.

The Dow Jones industrial average (INDU) lost 53 points or 0.5%, according to early tallies. The S&P 500 index (SPX) fell 2 points, or 0.2%. The Nasdaq composite (COMP) lost 2 points or 0.1%.

Stocks tumbled out of the gate after both Standard & Poor's and Moody's said they may have to cut Greece's debt rating if the country doesn't implement its so-called austerity measures, meant to rein in its deficit.

But after a bigger selloff through the early afternoon, stocks cut losses heading into the final hour of the session.

Greece has said it will raise the retirement age and have civil servants take bonus cuts, among other measures. A workers' strike Wednesday added to questions about the nation's ability to cut its debt. Investors are concerned about the broader implications for other euro zone countries, and the euro, should Greece default.

"It seems like the market doesn't know how worried it should be about Greece, which is why we're rallying off the lows of the day," said Ryan Atkinson, market analyst at Balestra Capital.

While the Greek debt situation is a serious one for the market, it's probably going to come in waves over the next six to nine months, Atkinson said. "Maybe they'll cut a deal initially [with officials], but longer term there are going to be more issues."

He said that investors were likely just as concerned about the day's economic news, including worse-than-expected reports on jobless claims and factory orders.

Market breadth was negative. On the New York Stock Exchange, losers beat winners eight to seven on volume of 950 million shares. On the Nasdaq, decliners topped advancers eight to five on volume of 2.1 billion shares.

Greece: The threat of a Greek default rattled global markets earlier in the month, pushing U.S. stocks to three-month lows and causing the S&P 500 to lose over 9%, just shy of the technical definition of a correction.

Investors worried that Greece's problems could reflect a broader euro zone debt crisis that could impact Portugal, Spain, Ireland, Italy and other debt-challenged European nations.

But European officials said earlier this month that they were ready to step in and help Greece if need be, and that seemed to calm investors for a few weeks. S&P and Moody's downgrade talk revived the worries.

In addition, stocks have been rising for the last two weeks, setting the market up for a little pullback, particularly in the aftermath of last year's big rally.

Bernanke: Federal Reserve Chairman Ben Bernanke told Senators Thursday that the central bank is looking into whether Goldman Sachs and other big banks worsened Greece's debt crisis.

News reports have said that Goldman and other banks helped arrange deals that may have disguised the extent of Greece's debt problems. In addition, the banks have made bets that Greece will default on loans it took from U.S. financial institutions, according to a New York Times article.

Bernanke spoke before the Senate Banking Committee Thursday in his second day of Congressional testimony on the economy.

On Wednesday he told a House committee that while the economic recovery is chugging along, the job market remains weak. Against that backdrop, interest rates will stay low for the foreseeable future. That seemed to reassure investors worried about the outlook for the economy and stocks rallied Wednesday.

Jobs: The number of Americans filing new claims for unemployment jumped last week to 496,000 from a revised 474,000 the previous week. Economists surveyed by Briefing.com expected 460,000 new claims.

Claims have jumped 12% over the past two weeks, due in part to the impact from the severe winter storms on the east coast.

Durable goods orders: Orders for big-ticket items meant to last three years or more jumped in January, with aircraft demand fueling the rise.

Durable goods orders rose 3% in January, the biggest increase since last summer and better than the 1.5% jump forecast by economists. Orders rose 1.9% in the previous month.

Orders excluding transportation fell 0.6% after rising 2% in December. Economists expected a rise of 1%.

Coke: Coca-Cola (KO, Fortune 500) said it will buy the North American operations of its biggest bottler, Coca-Cola Enterprises (CCE, Fortune 500) (CCE) in a deal that would cut costs and give it more control of its distribution.

The multi-layered deal has Coca-Cola giving up its 34 percent stake in CCE, worth about $3.4 billion, and taking on $8.88 billion in debt.

Additionally, the companies agreed that CCE will buy Coke's bottling operations in Norway and Sweden for $822 million and that it has the right to buy Coke's 83% stake in its German bottling operations.

The deal comes as rival PepsiCo (PEP, Fortune 500) is about to close a $7.8 billion deal to buy Pepsi Bottling Group and PepsiAmericas, its largest bottlers.

Coke shares plunged 4% and CCE shares rallied 32%.

Palm: Palm (PALM) said it expects revenue to fall far below current forecasts due to worse-than-expected sales of its new smartphones. Shares plunged 16% on the forecast.

Health care: The Obama administration's health care summit was underway Thursday, with Republican and Democratic leaders from both houses of Congress debating ways to reform the system.

The president said that both sides agree that costs need to be contained, but they remain bitterly divided over whether to press through with the current bill or start over.

World Markets: In overseas trading, major European and Asian markets ended lower.

The dollar and commodities: The dollar fell versus the euro, reversing earlier gains. The greenback also fell against the yen.

U.S. light crude oil for April delivery fell $1.83 to settle at $78.17 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery rose $11.30 to settle at $1,108.50 per ounce.

Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.64% from 3.69% late Wednesday. Treasury prices and yields move in opposite directions.

One day good, another day bad, another day good, other day bad.

Nikkei closes lower

KUALA LUMPUR

AT 12.30PM today, there were 281 gainers, 271 losers and 279 counters traded unchanged on the Bursa Malaysia.

The FBM-KLCI was at 1,274.61 up 3.83 points, the FBMACE was at 4,345.59 down 5.05 points, and the FBMEmas was at 8,581.59 up 22.43 points.

Turnover was at 435.571 million shares valued at RM697.776 million (S$289 million).

HONG KONG

Hong Kong shares were 0.76 per cent lower by the break on Thursday, reversing earlier gains.

The benchmark Hang Seng Index was off 155.91 points at 20,311.83. Turnover was HK$36.69 billion (S$6.67 billion).

SHANGHAI

China's key stock index ended up 1.27 per cent at a one-month closing high on Thursday, continuing a technical bounce and buoyed by bargain-hunting in banks and other financial stocks amid optimism that an annual parliamentary session in March may reaffirm China's relatively loose monetary policy.

But several analysts and traders said the index may bump into stiff resistance at the psychologically important 3,100 point mark in coming days as the government pursues quantitative tightening steps, including two hikes in bank reserve requirement ratios so far this year.

The Shanghai Composite Index finished at 3,060.618 points, its highest close since Jan 25, extending Wednesday's 1.33 per cent rise that was propelled by widespread speculation in small-cap shares including loss-making companies.

In the broader market, gaining Shanghai stocks prevailed over losers by 845 to 50, with turnover rising to a one-month high of 139 billion yuan from Wednesday's 105 billion yuan.

TOKYO

Japanese shares fell 0.95 per cent on Thursday, weighed down by the yen's rise and concern over the US economic recovery, brokers said.

The Tokyo Stock Exchange's benchmark Nikkei-225 index lost 96.87 points to 10,101.96. The Topix index of all first-section issues slid 4.28 points or 0.48 per cent to 891.41.

Stocks surge on renewed optimism

By Alexandra Twin, senior writerFebruary 24, 2010: 4:18 PM ET

NEW YORK (CNNMoney.com) -- Stocks rallied Wednesday after Federal Reserve Chairman Ben Bernanke again pledged to keep interest rates low for the foreseeable future, reassuring investors worried about the outlook for the economy.

The Dow Jones industrial average (INDU) gained 91 points, or 0.9%, according to early tallies, while the S&P 500 index (SPX) rose 11 points, or 1%. The Nasdaq composite (COMP) added 22 points, or 1%.

Stocks posted slim gains in the early going, lost some steam after a worse-than-expected new home sales report and then turned higher again after the Fed chief began speaking. The gains continued throughout the session.

"Bernanke said they are going to keep the fed funds rate low, the dollar got hit and people started buying stocks," said Dave Rovelli, managing director of U.S. equity trading at Canaccord Adams.

The weaker dollar lifted dollar-traded commodities and big corporations that do a lot of business overseas and therefore benefit from a weaker greenback. Financial and technology shares were also on the rise.

Investors were digging back in after a two-session decline. That retreat occurred as a lackluster forecast on consumer spending and a plunge in a key measure of consumer confidence amplified concerns about the strength of the recovery.

Stocks managed to advance in the previous two weeks as investors focused on the positives in the company and economic news, after a four-week rout.

Bernanke: In his first day on Capitol Hill, Bernanke told the House Financial Services Committee that while the economic recovery is moving along, the jobs market remains weak. Against this backdrop, the Fed is unlikely to lift the fed funds rate, the key overnight bank lending rate, anytime soon.

Bernanke was testifying before the House Wednesday and was scheduled to appear before the Senate Thursday.

"I don't think Bernanke is breaking a lot of new ground here," said Scott Anderson, senior economist at Wells Fargo. "A lot of his testimony is defending the Fed's actions during the crisis, while the economic outlook is similar to the minutes from the last Fed meeting."

Investors are looking for more on how and when the central bank plans to unwind emergency programs that were put in place at the height of the financial crisis, particularly after the Fed boosted the discount rate last week.

The Fed boosted the discount rate -- the emergency bank lending rate -- by a quarter-percentage point to 0.75%. It was a largely symbolic move in a rate that is rarely used by banks, but it was also the first rise in rates in over a year and the first move in any direction for rates in over two years.

The move was another step toward returning monetary policy to a so-called normalized state after the extraordinary measures of the last two years.

In his early statements, Bernanke implied that the Fed will at some point need to raise the fed funds rate, the key bank lending rate, but that such a move is not likely to happen soon, considering the still moderate pace of recovery.

On the move: Big financial firms JPMorgan Chase (JPM, Fortune 500), Morgan Stanley (MS, Fortune 500) and Bank of America (BAC, Fortune 500) all rallied, along with regional banks such as Keycorp (KEY, Fortune 500), Fifth Third Bancorp (FITB, Fortune 500) and Regions Financial (RF, Fortune 500).

In deal news, printing services firm R.R. Donnelley (RRD, Fortune 500) said it is buying Bowne & Co. (BNE), a printer of corporate regulatory filings, in a deal worth $481 million. The $11.50 per share all-cash deal values the stock at more than 60% over Friday's closing prices.

Shares of Bowne & Co. rallied 60% in unusually active New York Stock Exchange trading, while RR Donnelley shares gained 3%.

Shares of STEC (STEC) plunged 24% in unusually active Nasdaq trading after the company issued a 2010 profit forecast late Tuesday that disappointed investors. The computer data storage firm forecast revenue in a range that is more than 50% below analysts' forecasts and said it would report a quarterly loss, versus current forecasts for a profit.

JPMorgan Chase led the list of analysts downgrading or cutting forecasts on the company on Wednesday.

Market breadth was positive. On the New York Stock Exchange, winners beat losers by more than five to two on volume of 1 billion shares. On the Nasdaq, advancers beat decliners eight to five on volume of 1.3 million shares.

Toyota: The carmaker faced Congressional scrutiny for the second straight day, with company president Akio Toyoda speaking before the House Oversight Committee regarding the recall of millions of vehicles over safety issues.

Toyoda, speaking through a translator, apologized for the safety problems that led to deaths, injuries and the eventual recall of more than 8 million vehicles with brake problems.

The company said it is creating a system that will make it easier for customer complaints to be addressed and that it is forming a "quality advisory group" to seek input on safety and quality measures.

On Tuesday, witnesses argued that the problems with the brakes could be tied to the vehicles' electronic throttle system, but Toyoda disputed that.

New home sales: Sales of new homes tumbled to the lowest level on record in January, the government reported Wednesday, surprising economists who expected a rise in sales.

Sales fell 11% to a 309,000 annual unit rate from 348,000 in the previous month. Economists expected sales to rise to a 354,000 annual unit rate.

"It's a quite disappointing number," said Anderson. "We saw incredible weakness in new home sales following the improvements we saw in the fall."

He said the improvements in the fall were largely as a result of the tax rebates for buyers and that, with the impact of those rebates fading, the sales have dropped off. But the existing home sales market is improving, he said, and the overall outlook for housing is getting better.

Jobs: The Senate approved a $15 billion jobs creation bill that gives businesses tax breaks for hiring the unemployed and extends tax breaks that encourage companies to buy equipment.

World Markets: In overseas trading, major European markets ended with moderate gains. Asian markets ended lower.

The dollar and commodities: The dollar tumbled versus the euro and the yen.

The dollar's weakness gave a boost to dollar-traded commodities.

U.S. light crude oil for April delivery rose 92 cents to $79.78 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery fell $6 to $1,097.20 per ounce.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.67% from 3.68% late Tuesday. Treasury prices and yields move in opposite directions.

Stocks hit as confidence slips

By Alexandra Twin, senior writerFebruary 23, 2010: 4:23 PM ET

NEW YORK (CNNMoney.com) -- Stocks tumbled Tuesday after a key measure of consumer confidence plunged, reflecting investors' growing pessimism about the strength of the economic recovery.

The Dow Jones industrial average (INDU) lost 100 points, or 1%, according to early tallies. The 30-share Dow had lost as much as 115 points earlier.

A mixed market turned negative after the late morning release of a weaker-than-expected reading on consumer confidence. The report reflected investor wariness this year amid some conflicting readings on the economy, debt issues at home and abroad, and lawmaker squabbling in Washington.

Stocks have been choppy lately, with the major indexes declining for four weeks, advancing for two weeks and then slipping again Monday -- despite some upbeat earnings and an $11 billion merger in the oil services sector.

The Volatility (VIX) index, Wall Street's so-called fear factor, rose 9% Tuesday as nervousness grew about the strength of the recovery.

"The bears and the bulls are in a tug of war, and today, the bears have the upper hand," said Bill Stone, chief investment strategist at PNC Financial Services Group.

He said that the consumer confidence number is one of the more forward-looking readings and is raising worries that the consumer -- already struggling in a battered labor market -- might pull back even more.

"Today it's a combo of a weak number and maybe needing to take a breather after the rally," Stone said.

Struggling after the rally: After a huge runup in 2009 based on expectations for a strong recovery in 2010, investors are now looking for proof that such a recovery will take hold.

A mixed batch of economic readings has put some doubt in the market this year, while better-than-expected fourth-quarter earnings and revenues have had little impact on investor sentiment.

China's decision to temper growth by limiting bank loans and fears of Greece's debt crisis spreading to other European nations have also played a role in the market's seesawing.

"In a broad sense, we're in the fourth quarter of a bull rally and a lot of the steam is out of it now," said Tom Hepner, financial adviser at Ruggie Wealth Management.

He said investors are looking past the fiscal and monetary stimulus that has propped up the economy over the last year and are looking at the earnings and economic reports. "We're looking at the so-called fundamentals of the market and we're not quite sure it's all there yet," he said.

Federal Reserve: Last week, the Federal Reserve surprised investors by boosting the discount rate, the emergency bank lending rate, by a quarter-percentage point, to 0.75%.

It was the first change in interest rates in over a year and signaled the very early stages of the Fed returning to a more normal phase of monetary policy. However, the move was largely symbolic, as the discount rate is rarely used.

Fed Chairman Ben Bernanke testifies on Capitol Hill Wednesday and Thursday. He is expected to discuss the economy and monetary policy, but investors will be listening to see if he says anything more about the central bank's plans to close out some of the emergency programs put in place during the height of the financial crisis.

Housing: The S&P/Case-Shiller Home Price index of the 20 largest metropolitan areas fell 3.1% in December versus a year ago, in line with estimates and an improvement after a drop of 5.3% in the previous month. However, the index rose 0.3% from November's levels, suggesting the housing market is continuing to recover.

On a quarterly basis, the index fell 2.5% versus a year earlier, an improvement over the last three years.

Jobs: The Senate on Monday agreed to move forward on a $15 billion jobs creation bill that gives businesses a tax break for new hires. The bill would also extend an existing break for spending money on investments like equipment and funds highway and transit programs through the rest of the year.

Toyota: Executives from the troubled auto manufacturer are in Washington this week to discuss the company's massive recall and future plans.

At the first of three congressional hearings, witnesses argued that the problems with the brakes could be tied to the vehicles' electronic throttle system.

James Lentz, the company's U.S. sales chief was testifying Tuesday and Akio Toyoda, the company's president, was due to testify Wednesday. Toyoda is expected to tell U.S. lawmakers that the rush to expand Toyota Motor's business led to the safety issues that resulted in the recall.

Quarterly results: A number of retailers reported results Tuesday morning, including Dow component Home Depot (HD, Fortune 500).

Home Depot said it returned to a profit in its fiscal fourth quarter after posting a loss a year earlier, with earnings of 18 cents per share, two cents better than expected. Home Depot also boosted its dividend. But the company gave a cautious 2010 outlook amid the still-fragile economic recovery.

Target (TGT, Fortune 500) and Sears Holdings (SHLD, Fortune 500) also reported better-than-expected quarterly profit. Sears is the operator of Sears and Kmart.

Banks: Over 700 banks are at risk of failing, according to a report from the Federal Deposit Insurance Corp. published Tuesday. The FDIC said that the number of banks on its so-called problem list has climbed to 702, the highest number in 6-1/2 years.

The number has increased steadily since the start of the recession in December 2007. However, only a small percentage of banks identified as being in danger end up failing.

World Markets: In overseas trading, European markets fell and Asian markets ended mixed.

The dollar and commodities: The dollar gained versus the euro and fell against the yen.

U.S. light crude oil for April delivery fell $1.45 to settle at $78.85 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery fell $9.90 to settle at $1,103.20 per ounce.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.70% from 3.79% late Monday. Treasury prices and yields move in opposite directions.

Market breadth was negative. On the New York Stock Exchange, losers beat winners seven to three on volume of 1.08 billion shares. On the Nasdaq, decliners beat advancers by over two to one on volume of 1.7 billion shares.

Nikkei opens lower

TOKYP

Jaqpanese share prices opened lower on Tuesday, with the benchmark Nikkei-225 index losing 72.83 points, or 0.70 per cent, to 10,327.64 in the first minute of trading.

Stocks end volatile session lower

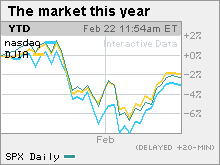

By Alexandra Twin, senior writerFebruary 22, 2010: 4:11 PM ET

NEW YORK (CNNMoney.com) -- Stocks ended a choppy session lower Monday as investors weighed earnings news, President Obama's health care proposal and Schlumberger's $11 billion buyout deal for oil services rival Smith International.

The Dow Jones industrial average (

INDU) lost 19 points or 0.2%, according to early tallies. Last week, the Dow surged 300 points for its biggest one-week gain since November.

"The markets are fairly quiet after a strong week," said Alan Gayle, senior investment strategist at RidgeWorth Investments. "But after a 65% run (on the S&P 500) off the lows and some concerns about the economy in the near term, I'm expecting more choppiness in the weeks ahead."

Gayle said investors were eying the deal and earnings news, the direction of the dollar and commodity prices. Investors may have also taken comfort from signs that regulatory changes being proposed in Washington will be milder than feared, he said, including the provisions in President Obama's health care plan, announced Monday.

Stocks ended higher last week as investors digested the Federal Reserve's decision to lift the emergency bank lending rate. Stocks also posted gains for the second week in a row after four weeks of declines.

But after that advance, stocks are bound to be volatile this week amid ongoing concerns about the outlook for the U.S. economy. Reports are due on housing, jobs and GDP growth. Federal Reserve Chairman Ben Bernanke testifies before Congress Wednesday and Thursday. Lawmakers meet in Washington later this week to discuss the Toyota recall, bank health and fiscal stimulus.

Corporate news: Schlumberger (

SLB) said it was

buying fellow oil driller Smith International (

SII,

Fortune 500) in an all-stock deal worth $11 billion. The two companies' boards of directors have already approved the deal and shareholders are expected to follow suit. Schlumberger shares fell 3% and Smith shares gained 9%.

In other company news, Lowe's (

LOW,

Fortune 500)

reported higher-than-expected quarterly earnings and revenue and said sales would keep rising in the current year. However, shares of the home improvement retailer were little changed.

Shares of Dow component Bank of America (

BAC,

Fortune 500) rose 2% after a judge approved the proposed $150 million settlement between the financial firm and the Securities and Exchange Commission.

Credit cards: New credit card

rules aimed at protecting consumers went into effect Monday. However, the regulations could result in consumers facing new charges and additional fees as the industry looks to offset the lost revenue.

Health care: President Obama presented his

outline for

health care reform Monday, ahead of the bipartisan health care summit later this week. The 10-year, nearly $1 trillion plan would purportedly cover more than 31 million Americans currently not insured without adding to the budget deficit.

The plan also allows the government to shoot down or roll back insurance premium hikes.

Economy: A survey from the National Association for Business Economics showed that most leading economists think the recovery will remain

on track.

World Markets: In

overseas trading, most European markets ended lower and Asian markets ended higher.

The dollar and commodities: The

dollar gained versus the euro, recovering from a morning slide. The greenback was weaker versus the yen.

U.S. light crude

oil for March delivery rose 35 cents to settle at $80.16 a barrel on the New York Mercantile Exchange.

COMEX

gold for April delivery fell $8.70 to settle at $1,112.60 per ounce.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.79% from 3.77% late Friday. Treasury prices and yields move in opposite directions.