Post Reply

4521-4540 of 4996

Post Reply

4521-4540 of 4996

October 2006 OSIM share price hit $2.10 and all the way gone down to 3 cents.

That's because the company finance has confronted problem. Finally Osim turned into black and share price follow his finance result.

The PE traded with 20 times for the time being.

Osim is a retail marketing business the profit can be generated from expanding his business to oversea easily with low cost.

China Gaoxian product with his own brand which is not so attractive. We can see this product mainly for China domestic market.

China Gaoxian recently has announce land acquisition to expand his product line. The return on this expanding may generate 2 times revenue at most and realistic only after few years. In between of this expanding the SOA will incur in expenses and result definitely will be affected.

Assume Gaoxian PE is 6.5 times after new ordinary shares issued and double his share price from $0.27 to $0.54 (PE become 13 times) and the return after few years from new plant has double up profit. If this realized the share price may jump to $1.00 at least.

Suppose you buy at $0.25 which is only 4 times. 10 times jump is over optimism and hard to achieve unless another bullish on China Stocks repeat is just like 2008 when Shang Hai index hit 8000.

masterlim ( Date: 17-Nov-2010 12:55) Posted:

who would believe osim can rise from 3 cents to 130 cents now? how many times thats for a bagger? the optimism is from the high playing field for china growth as the company is planning to aggressively expanding more outlets.

i strongly believe gaoxian can do it within a few years if it were able to substain the growth. the mid to high tiers kind of materials may not be easily replicated. if you were to talk to the suppliers in china, china gaoxian's types of final products is considered branded in china. the brand name is not something that can be substituted. factories work through golden week and they turn away some customers as demand is overwhelming. the increasing machinery can further fulfill the demands and growth will be steadily upwards.

i will only say shareholders have picked a winner if they are vested. lets keep an eye on this gem and hopefully what i said today will be crystallized in times to come. 10x bagger !

load up before you are left out ! |

|

Still holding on to my 1000 lots..

deeply undervalued stock now in the limelight of investors...TP is 35-40c

will dispose off once TP is reached

gd luck

ozone2002 ( Date: 22-Oct-2010 09:15) Posted:

|

really wait long long..but i don't mind..patience is the key to good stocks

every 1 c rise is 10K how to earn that kinda money..

SHIOK! =)

ozone2002 ( Date: 23-Sep-2010 15:04) Posted:

|

Finally reaping the benefits..

every 1c rise $10k into my pocket.. |

|

|

|

who would believe osim can rise from 3 cents to 130 cents now? how many times thats for a bagger? the optimism is from the high playing field for china growth as the company is planning to aggressively expanding more outlets.

i strongly believe gaoxian can do it within a few years if it were able to substain the growth. the mid to high tiers kind of materials may not be easily replicated. if you were to talk to the suppliers in china, china gaoxian's types of final products is considered branded in china. the brand name is not something that can be substituted. factories work through golden week and they turn away some customers as demand is overwhelming. the increasing machinery can further fulfill the demands and growth will be steadily upwards.

i will only say shareholders have picked a winner if they are vested. lets keep an eye on this gem and hopefully what i said today will be crystallized in times to come. 10x bagger !

load up before you are left out !

yes.. 2 to 3 times or maybe 4 times are still acceptable.

freeme ( Date: 17-Nov-2010 12:18) Posted:

2011 theme play will be textile and fabrics.. haha they have been staying so low for the past 2 yrs.. It might not goes back to pre crisis level bec things changes.. such as higher wages.. etc.. but if the just recover 50%, im sure its already 3-4x bagger liao..

masterlim ( Date: 17-Nov-2010 12:14) Posted:

target price of 32 cents is overly conservative. it should be at least 40 cents. it hits high of 0.295 before the markets pull back starting last week. it should continue for rest of the week for market maybe trading sideways. news of europe debts and china tightening policies should subside and investors will focus back onto the basic economic data.

trading in whatever financial instruments from bonds to equities to derivatives to options carries risk. all rewards thrive on risks, key is to manage the risks in these instruments. keep things simple here, buying equities we need some guides i.e. research reports, basic fundamental accounting ratios like current ratios, return on equity, contigent liabilities in the long and short term, sales and cost management by companies. if these figures are solid rock, we should invest this counter for considerably decent period of years to maximize returns. some of s chips encountered a no. of problems, thus people are scared of s chips, therefore quite a number of very good s chips are substantially undervalued. there are a lot of s chips, if you take a look at their biz models, is very very good. an example i would give here is this counter hu an cable, eratat, sinomem, just a handful. these are very good stocks. some of the energy stocks are underperforming also, sunpower and renewable energy. look them fast forward 2 years, i gurantee you it will be a multi bagger as well.

china gaoxian is one of the few stocks that has solid earnings, growth story coincides with the Asian story in the next few years and a potential to be a 10x bagger. enough said, stretch your holding time frame a little longer and watch this gem shine

load up before you are left out |

|

|

|

I agree to what you mentioned below.

However, 10X multi bagger is over optimism.

The manufacturer especially OEM company want to have 10 times profit is very very hard to achieve.

Unless the selling price can be at least few times up or expand very huge plant with a lot of new potential customers.

Besides that, this is red ocean type of manufacturer (fabric chemical) easy to setup and the competitor can come in easily.

25% of net earning margin is very good for fabric chemical manufacturer. I don't expect to reach 40% or more unless they can find to use water to replace crude oil(one of the mixed for chemical) .

I vested to this company is because of its undervalued share price, sustainable earning, dual listing news of KRX but I don't love it much.

We may divorce anytime because I'm not blindly follower.

masterlim ( Date: 17-Nov-2010 12:14) Posted:

target price of 32 cents is overly conservative. it should be at least 40 cents. it hits high of 0.295 before the markets pull back starting last week. it should continue for rest of the week for market maybe trading sideways. news of europe debts and china tightening policies should subside and investors will focus back onto the basic economic data.

trading in whatever financial instruments from bonds to equities to derivatives to options carries risk. all rewards thrive on risks, key is to manage the risks in these instruments. keep things simple here, buying equities we need some guides i.e. research reports, basic fundamental accounting ratios like current ratios, return on equity, contigent liabilities in the long and short term, sales and cost management by companies. if these figures are solid rock, we should invest this counter for considerably decent period of years to maximize returns. some of s chips encountered a no. of problems, thus people are scared of s chips, therefore quite a number of very good s chips are substantially undervalued. there are a lot of s chips, if you take a look at their biz models, is very very good. an example i would give here is this counter hu an cable, eratat, sinomem, just a handful. these are very good stocks. some of the energy stocks are underperforming also, sunpower and renewable energy. look them fast forward 2 years, i gurantee you it will be a multi bagger as well.

china gaoxian is one of the few stocks that has solid earnings, growth story coincides with the Asian story in the next few years and a potential to be a 10x bagger. enough said, stretch your holding time frame a little longer and watch this gem shine

load up before you are left out |

|

2011 theme play will be textile and fabrics.. haha they have been staying so low for the past 2 yrs.. It might not goes back to pre crisis level bec things changes.. such as higher wages.. etc.. but if the just recover 50%, im sure its already 3-4x bagger liao..

masterlim ( Date: 17-Nov-2010 12:14) Posted:

target price of 32 cents is overly conservative. it should be at least 40 cents. it hits high of 0.295 before the markets pull back starting last week. it should continue for rest of the week for market maybe trading sideways. news of europe debts and china tightening policies should subside and investors will focus back onto the basic economic data.

trading in whatever financial instruments from bonds to equities to derivatives to options carries risk. all rewards thrive on risks, key is to manage the risks in these instruments. keep things simple here, buying equities we need some guides i.e. research reports, basic fundamental accounting ratios like current ratios, return on equity, contigent liabilities in the long and short term, sales and cost management by companies. if these figures are solid rock, we should invest this counter for considerably decent period of years to maximize returns. some of s chips encountered a no. of problems, thus people are scared of s chips, therefore quite a number of very good s chips are substantially undervalued. there are a lot of s chips, if you take a look at their biz models, is very very good. an example i would give here is this counter hu an cable, eratat, sinomem, just a handful. these are very good stocks. some of the energy stocks are underperforming also, sunpower and renewable energy. look them fast forward 2 years, i gurantee you it will be a multi bagger as well.

china gaoxian is one of the few stocks that has solid earnings, growth story coincides with the Asian story in the next few years and a potential to be a 10x bagger. enough said, stretch your holding time frame a little longer and watch this gem shine

load up before you are left out |

|

target price of 32 cents is overly conservative. it should be at least 40 cents. it hits high of 0.295 before the markets pull back starting last week. it should continue for rest of the week for market maybe trading sideways. news of europe debts and china tightening policies should subside and investors will focus back onto the basic economic data.

trading in whatever financial instruments from bonds to equities to derivatives to options carries risk. all rewards thrive on risks, key is to manage the risks in these instruments. keep things simple here, buying equities we need some guides i.e. research reports, basic fundamental accounting ratios like current ratios, return on equity, contigent liabilities in the long and short term, sales and cost management by companies. if these figures are solid rock, we should invest this counter for considerably decent period of years to maximize returns. some of s chips encountered a no. of problems, thus people are scared of s chips, therefore quite a number of very good s chips are substantially undervalued. there are a lot of s chips, if you take a look at their biz models, is very very good. an example i would give here is this counter hu an cable, eratat, sinomem, just a handful. these are very good stocks. some of the energy stocks are underperforming also, sunpower and renewable energy. look them fast forward 2 years, i gurantee you it will be a multi bagger as well.

china gaoxian is one of the few stocks that has solid earnings, growth story coincides with the Asian story in the next few years and a potential to be a 10x bagger. enough said, stretch your holding time frame a little longer and watch this gem shine

load up before you are left out

Trading in e Mkt has risks. But trading in China's Stocks, e risks r more comparing others.

Des-khor, am I rite???

('',)

vest4fun ( Date: 17-Nov-2010 00:37) Posted:

first time post here...

its good to see from both sides of the coin. agreed with bon3260, being cautious and follow the market trend is always wise. For me, i invest the company behind the shares. Gaoxian fundamentally is worth vesting for long term, especially with its expanding business in the coming 4Q10, i would see a sustainable revenue and profit gain, which matches UOB's forecast valuation. market's getting side line and bear is waking, cant expect px to go high even with dual listing news updated, it would be premature to bring up the price now to further alienate the local investors, so buy on dips if you want invest long, or short if you want to make some cash. ppl are selling in short terms and wait for the market to adjust. Expected to see price drops further in the week to 240 and maybe the following as well, then bounce back a bit before month end, unless the market is turning up for a month end run ,which is unlikely ..=(. there is a support at 0.23-0.235 which i certainly dun wan it to fall under :D. Maybe the biggest concern for big investors to hestitate is the EPS after dual listing, due to its high volumn...

if you are really looking into s-chip with low P/E and steady growth for long term vest, might put fuxing, eratat and qingmei in ur watchlist =).

happy vesting...

|

|

i wonder who trade those huge married deals. so far, no announcement in sgx.

medivh ( Date: 10-Nov-2010 17:09) Posted:

| 16:49:36 |

0.270 |

200,000 |

Sell Down |

| 16:49:14 |

0.255 |

10,000,000 |

X |

| 16:47:54 |

0.270 |

50,000 |

Sell Down |

Here it is .. married.

masterlim ( Date: 10-Nov-2010 14:47) Posted:

load now !

it will continue to run up till 30 cents ! look out for huge married deals and huge buy ups for indications |

|

|

|

first time post here...

its good to see from both sides of the coin. agreed with bon3260, being cautious and follow the market trend is always wise. For me, i invest the company behind the shares. Gaoxian fundamentally is worth vesting for long term, especially with its expanding business in the coming 4Q10, i would see a sustainable revenue and profit gain, which matches UOB's forecast valuation. market's getting side line and bear is waking, cant expect px to go high even with dual listing news updated, it would be premature to bring up the price now to further alienate the local investors, so buy on dips if you want invest long, or short if you want to make some cash. ppl are selling in short terms and wait for the market to adjust. Expected to see price drops further in the week to 240 and maybe the following as well, then bounce back a bit before month end, unless the market is turning up for a month end run ,which is unlikely ..=(. there is a support at 0.23-0.235 which i certainly dun wan it to fall under :D. Maybe the biggest concern for big investors to hestitate is the EPS after dual listing, due to its high volumn...

if you are really looking into s-chip with low P/E and steady growth for long term vest, might put fuxing, eratat and qingmei in ur watchlist =).

happy vesting...

The ups & downs are common. No cause of alarm.

Bought Olam @ $2.49, went up to $2.84 and came crashing down to $2.19. Just offloaded.

Bought PEC @ 70cts, traded between 70cts to 84cts band a few times before the current price now. Offloaded at $1.22 ( inclusive of 4cts dividend).

Bought Sunvic @ 15cts. Sleep for many months.....Just let go at 68cts.

Bought CGX at 15cts - 16.5cts range.

Will transfer fund to CGX. Will buy more. Every year earning S$80 - $85 mil. With the upstream factory expansion, it will net another S$30 - S$50 mil or more on COG as 95% of the expenditure is on COG.

Buy for long term.

ZhiXuen,

Yes, u might rite...

Mayb 大鱼s 1 2 make u all scare throw & run...

('',)

zhixuen ( Date: 16-Nov-2010 21:22) Posted:

If a counter soar with some good news I will think this counter still have upside channel.

If a counter jump without reason I will think this counter is crazy and not sustainable.

China Gaoxian goes up with dual listing news, good fundamental, low PE and I monitor this counter everyday the consolidation at 0.240 - 0.245 on past few days will be the critical support for this white horse.

Maybe I'm wrong but I see Ziwo and run with so nice why Gaoxian cannot?

|

|

UOB KayHian has just upgraded the TP from 29cts to 32cts and can be more.....

UOBkayhian rise TP to 32cents after reviewing gaoxian Q3 results. They advise buy on dips and express confidence over its long term prospect.

See below

Updates on Potential KDR Listing

∑ The company held an extraordinary general meeting on 12 Nov 10 and successfully passed a resolution amongst its shareholders to issue new shares for its KDR listing.

∑ We believe the fungibility of a KDR dual listing will be a potential catalyst for the share price.

∑ Higher valuation multiples on the Korean bourse could bolster its valuations on the Singapore Exchange.

∑ Peers on the KRX are trading at an average 2009 PE of 32.7x, at a premium to China GaoXianís 2009 PE of 3.85x.

Valuation/Recommendation

∑ We increase the target price of the stock to S$0.32 from S$0.29 previously, based on a discounted cash flow model. This is on the back of higher expected demand and ASPs for its products.

∑ Our valuation of S$0.32 will implicitly yield a 2011F forward PE of 4.27x and forward P/B of 1.0x. This is relatively undemanding and we see possible further upside for the stock.

∑ Although the stock has seen a 34.2% upside since our report on 14 Oct 10, we believe it is still highly undervalued given its strong growth prospects and track record of producing solid results. We advise investors to adopt a buy-on-dips strategy to ride on the long-term prospects of the company.

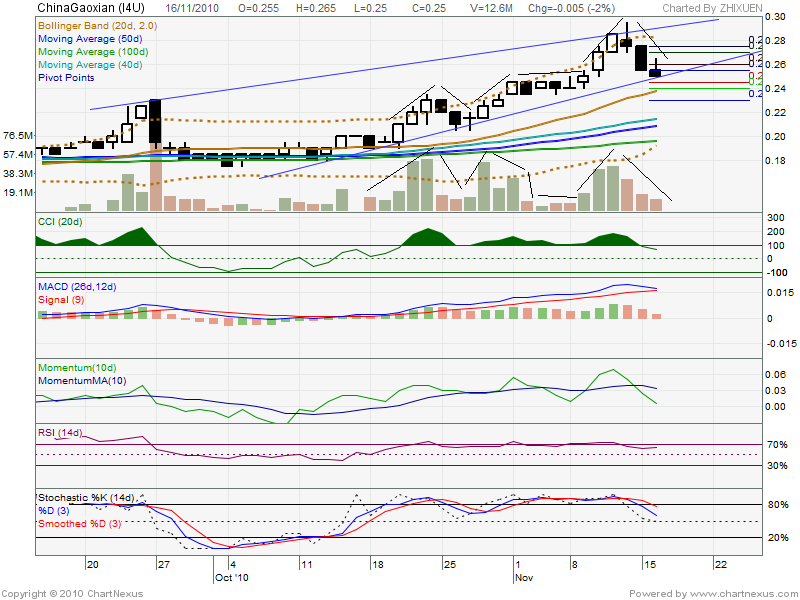

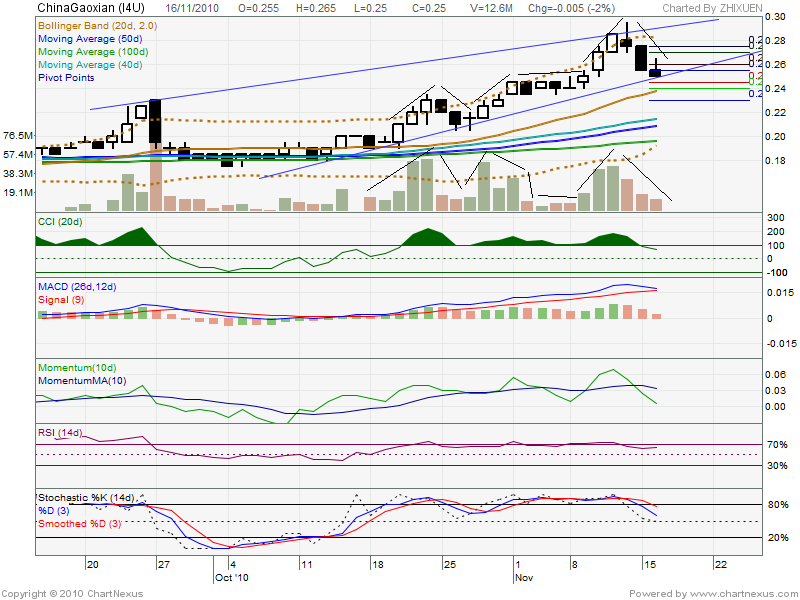

If You see from the chart when gaoxian share price goes up the volume increase as well and if the share price plunge down the volume decline also. You can see the past one month the volume and share price is correspondence by almost same wave.

This is a health and solid I guess unless the marriage deal is just to confuse investors.

I hope I'm right.

If a counter soar with some good news I will think this counter still have upside channel.

If a counter jump without reason I will think this counter is crazy and not sustainable.

China Gaoxian goes up with dual listing news, good fundamental, low PE and I monitor this counter everyday the consolidation at 0.240 - 0.245 on past few days will be the critical support for this white horse.

Maybe I'm wrong but I see Ziwo and run with so nice why Gaoxian cannot?

Sori, I dun hv ChinaGaoxian. I only hv Meiban Gp now.

On e 11-Nov-2010 (Thu) aftnoon, I asked my student 2 sell his 600 lots ChinaGaoxian @ 0.285. But he only can manage 2 sell @ 0.280.

On e 12-Nov-2010 (Fri) morning, I asked my student 2 sell shorts Chinagaoxian @ 0.290 & buy back @ e same day @ 0.275. But he refused.

Ydae, 15-Nov-2010 (Mon) morning, I again asked my student 2 sell shorts ChinaGaoxian @ 0.270 & buy back @ e same day @ 0.260. But he again refused.

Today morning, I again asked my student 2 sell shorts ChinaGaoxian @ 0.260 & buy back @ e same day @ 0.250. But he again refused.

Of cos, u'll say me "马后炮". But I'm not. I even can read ChinaGaoxian's nxt move if I 1 2 (see my below posting today b4 Mkt opens)...

('',)

Actually, I hv many students. But I'm glad 2 hv tis gd student cos he's alittle like my character. Both of us hv a kind hearted.

zhixuen ( Date: 16-Nov-2010 20:59) Posted:

I'm sure you sold at 0.195 :-)

Bon3260 ( Date: 16-Nov-2010 20:55) Posted:

|

Jfierce,

Sm pple here dun like 2 listen bad commends. But wat if I tell u dat ChinaGaoxian'll drop till 0.195 few days later...

Wat do u think? Do u listen? But I might wrong...

@ least, u r lucky cos I saw 大鱼still draw chart in ChinaGaoxian. Sm counters w/o 大鱼 2 draw chart @ all... Cos they oredi run rd liao.

('',)

Sounds looks like Masterlim has alot of ChinaGaoxian on hand ley... : ( |

|

|

|

I bot due to recent dual listing news and low PE.

Anyway I buy at $0.18

des_khor ( Date: 16-Nov-2010 21:04) Posted:

Too bull later become panda....

zhixuen ( Date: 16-Nov-2010 20:52) Posted:

|

|

|

Too bull later become panda....

zhixuen ( Date: 16-Nov-2010 20:52) Posted:

mind to share your bull?

des_khor ( Date: 16-Nov-2010 20:44) Posted:

| I saw few bulls as well ! |

|

|

|

I'm sure you sold at 0.195 :-)

Bon3260 ( Date: 16-Nov-2010 20:55) Posted:

|

Jfierce,

Sm pple here dun like 2 listen bad commends. But wat if I tell u dat ChinaGaoxian'll drop till 0.195 few days later...

Wat do u think? Do u listen? But I might wrong...

@ least, u r lucky cos I saw 大鱼still draw chart in ChinaGaoxian. Sm counters w/o 大鱼 2 draw chart @ all... Cos they oredi run rd liao.

('',)

Sounds looks like Masterlim has alot of ChinaGaoxian on hand ley... : (

Jfierce ( Date: 16-Nov-2010 17:19) Posted:

Could i just ask.. if you say the big fish are drawing chart.. do u think they are going to let the share price plummet all the way? For someone like me who bought at 0.26, do you think it will eventually go past that amount or its going to go down down down? Your opinion would be very much appreciated. Thanks!

|

|

|

|

Jfierce,

Sm pple here dun like 2 listen bad commends. But wat if I tell u dat ChinaGaoxian'll drop till 0.195 few days later...

Wat do u think? Do u listen? But I might wrong...

@ least, u r lucky cos I saw 大鱼still draw chart in ChinaGaoxian. Sm counters w/o 大鱼 2 draw chart @ all... Cos they oredi run rd liao.

('',)

Sounds looks like Masterlim has alot of ChinaGaoxian on hand ley... : (

Jfierce ( Date: 16-Nov-2010 17:19) Posted:

Could i just ask.. if you say the big fish are drawing chart.. do u think they are going to let the share price plummet all the way? For someone like me who bought at 0.26, do you think it will eventually go past that amount or its going to go down down down? Your opinion would be very much appreciated. Thanks!

Bon3260 ( Date: 16-Nov-2010 17:07) Posted:

|

Close 0.250! Expected...

大鱼s r drawaing chart now!

| WEIGHTED AVG PRICE : 0.2553 |

LAST DONE PRICE : 0.250 |

| SPREAD/PRICE RATIO : 0.0000 |

AVG TRADE SIZE : 140.056 |

|

|

|

| |

|

('',) |

|

|

|