so power! 81c

gd luck dyodd

Super cheong ahhhhhhhhhh!!

Fake buy (a few hundred lots) queue at $0.775 just disappeared.

Think too high may sell down.

Wow Bill, indeed hit 77.5 and react down to 755. Now up again to 77.5..

Hope it reach the prices you predict..

hello123 ( Date: 04-Jun-2013 04:31) Posted:

|

drop 1.5c today..

may want to take some profit 1st..

gd luck dyodd

Swiber should hit 77.5 , react down a little then 81.5 react down

then finally 83-84 before reacting down strong

for more details, see my swiber chart .tq

come in the ARABS.... good!

ozone2002 ( Date: 03-Jun-2013 10:18) Posted:

|

Remember to TP if you feel enough already.

Shiok!

NAISE!

Time: 9:25AM

Exchange: SGX

Stock: Swiber(AK3)

Signal: Resistance - Breakout with High Volume

Last Done: $0.78

Swiber Holdings announced that the Group is exploring

options to establish Islamic Trust Certificates Programme

to broaden and deepen its investors’ pool.

Once you find a company with gd fundamentals.. the price will take care of itself

gd luck dyodd

Super cheong ah!!

Any updates for Swiber for now? Thanks.

marubozu1688 ( Date: 20-Apr-2013 20:58) Posted:

|

i posted @1:30pm in SJ forum ... 3pm SWIBER breakout as alerted by chart genie..

super fast reaction time :)

gd luck dyodd

Time: 3:01PM

Exchange: SGX

Stock: Swiber(AK3)

Signal: Resistance - Breakout with High Volume

Last Done: $0.75

ozone2002 ( Date: 31-May-2013 13:27) Posted:

|

Nice move.

breakout............... !

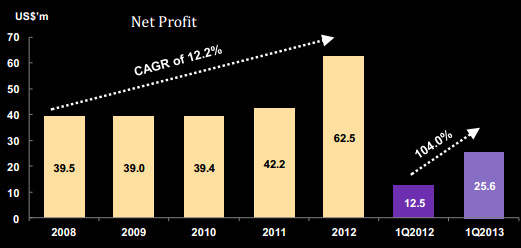

swiber's profit very steady from 2008-2011, then 2012 surged higher..

1Q13 earnings already dble that of 1Q12 earnings..wow..

gd luck dyodd

CIMB says Swiber is 'cheap' at 72 cents target is 91 cents

Net profit doubled to US$25.6 million in 1Q on a 59.3% increase in revenue to US$309.7 million

Net profit doubled to US$25.6 million in 1Q on a 59.3% increase in revenue to US$309.7 millionAnalyst: Lim Siew Khee

What Happened

Upstream reported that Swiber is preparing to invest as much as US$500m to build a deep-water offshore construction vessel. The company has floated a newbuild tender for a 4,000-tonne crane vessel with S-lay, reel lay and flex-lay systems. According to Upstream, at least eight yards have been shortlisted for the tender with a contract value of US$400m-500m.

What We Think

Management is non-committal on the news but stated that deep-water is an eventuality. The company is only at the preliminary stage of evaluating the newbuild project. If it goes ahead, we believe that Swiber is likely to choose Chinese yards that provide favourable financing with low upfront payment. Assuming tail-heavy payment terms, a cash call is likely in 2015/2016, nearer to delivery, in our view.

Swiber has a fleet of about 62 vessels currently (12 units under sale and leaseback, 27 units via JVs and 23 units 100% owned). The new deepwater addition will be similar to Ezra’s iced-class subsea construction vessel, Lewek Constellation (about US$420m). We make no changes to our EPS forecasts as the news is not confirmed and the project, if it goes ahead, can only start contributing in FY16/17.

Swiber has a fleet of about 62 vessels currently (12 units under sale and leaseback, 27 units via JVs and 23 units 100% owned). The new deepwater addition will be similar to Ezra’s iced-class subsea construction vessel, Lewek Constellation (about US$420m). We make no changes to our EPS forecasts as the news is not confirmed and the project, if it goes ahead, can only start contributing in FY16/17.

What You Should Do

The stock is cheap at 7.4x CY14 P/E and 0.7x P/BV vs. Singapore OSV’s average of about 1.1x P/BV and 9x CY14 P/E.

Wahahahahahaha..... :) so polite.....

tea444u ( Date: 23-May-2013 16:56) Posted:

|