Stocks fall on economic fears

NEW YORK (CNNMoney.com) -- Stocks fell Wednesday as a worse-than-expected report on durable goods orders and weaker quarterly results from Boeing and others added to concerns about the pace of the economic recovery.

The Dow Jones industrial average (INDU) lost 40 points, or 0.4%. The S&P 500 (SPX) lost 8 points, or 0.7%. The Nasdaq (COMP) composite lost 24 points, or 1%.

The surprise drop in durable goods orders and a slide in European markets kept concerns about the U.S. economy front and center.

David Levy 512 506 9395

"I think the selling today was a result of us getting overbought in the short term, as a result of the S&P rising 8% this month," said David Levy, portfolio manager at Kenjol Capital Management.

"The bigger picture is that we're still in a tug-of-war between better earnings news and mixed economic news," he said. "Today some of the earnings news wasn't as good as it has been and the economic news was also disappointing, so people backed out."

Bets on a strong profit reporting period fueled stock gains through most of July. Month-to-date, the Nasdaq, S&P 500 and Dow industrials are all up between 8% and 8.5% through Thursday's close.

Thanks to that strength, stocks have erased second-quarter losses, leaving the major stock gauges all near breakeven for 2010. But in order for stocks to make gains through year-end, investors need more reassurance that the economic recovery will be sustainable, even if it is weaker than had been hoped during last year's rally.

"There's still a lot of uncertainty about employment, real estate and the deficit," said Gary Webb, CEO at Webb Financial Group. "I think we'll end the year higher but probably not by much."

Economy: Durable goods orders fell 1% in June after dropping 0.8% in May, surprising economists who thought orders would rise 1%. Durable goods orders are orders on products meant to last at least three years, such as cars and computers.

The economy continues to improve at a modest pace, according to the latest "beige book" report released by the Fed in the afternoon. Economic activity held steady or improved in 10 of the 12 districts, the central bank said.

Quarterly results: Dow component Boeing (BA, Fortune 500) said its second-quarter profit fell from a year earlier, due to less airplane deliveries and defense revenue. The company's weaker quarterly revenue and earnings topped the average forecast of analysts surveyed by Briefing.com. Shares dropped just short of 2%.

Comcast (CMCSA, Fortune 500) reported weaker quarterly earnings and higher revenue, as costs associated with its takeover of NBC Universal were countered by higher advertising revenue. Results on both an earnings and revenue basis were above consensus. Shares of the cable operator gained 1.2%.

Sprint Nextel (S, Fortune 500) posted its first rise in subscribers in three years, but also posted a wider second-quarter loss as it lost more lucrative customers who hold longer-term deals. Shares gained modestly.

ConocoPhilips (COP, Fortune 500) was one of several oil companies to report a big jump in quarterly earnings and revenue that topped estimates, thanks to a turnaround in refining. Shares were little changed. Exxon Mobil (XOM, Fortune 500) reports results Thursday.

Aetna (AET, Fortune 500) and WellPoint (WLP, Fortune 500) both posted better-than-expected profits and boosted their full-year forecasts, but shares fell anyway.

World markets: European shares were mixed. The CAC 40 in France gained 0.1%, Germany's DAX fell 0.5% and the FTSE 100 lost 0.9%.

Asian markets rallied. Japan's Nikkei gained 2.7%. The Hong Kong Hang Seng gained 2.6%. The Shanghai Composite gained 2.3%.

Currencies and commodities: The euro fell against the dollar after seesawing through the day, while the U.S. currency fell versus the Japanese yen.

U.S. light crude oil for September delivery fell 19 cents to $76.80 a barrel on the New York Mercantile Exchange.

COMEX gold for August delivery rose $2.80 to $1,163.90 per ounce.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.00% from 3.05% late Tuesday. Bond prices and yields move in opposite directions.

Market breadth: Breadth was negative. On the New York Stock Exchange, losers beat winners by two to one on volume of 1 billion shares. On the Nasdaq, decliners beat advancers by over two to one on volume of 1.88 billion shares.

Wednesday: 28 JULY 2010 TV CHANNEL 8 - GOOD MORNING SINGAPORE !

CONFLICT OF INTERESTS [COI]

MULTIPLE RELATIONSHIPS between Housing Agent and House Owner/Seller

1. HOUSE SALE RELATIONSHIP

Housing Agent has the SOLE RESPONSIBILITY to PROTECT House Owner/Seller Interest

Secure HiGHEST SALE PRiCE for House Owner/Seller

2. HOUSE BRIDGING LOAN RELATIONSHIP

Bridgeing Loan is required by House Owner/Seller who is buying a house which cost more than the SALE PRiCE of existing home, because RESALE MARKET PRiCES are in RiSiNG TREND

Housing Agent as Loan Lender has PERSONAL INTEREST to secure the Loan Repayment by House Owner/Seller in the Shortest Time.

This PERSONAL INTEREST is in DIRECT CONFLiCT with the House Owner/Seller's Interest to secure the HiGHEST SALE PRiCE.

In this Conflict Of Interest [COI] situation, Housing Agent would cOmprOmIse the securing of HiGHEST SALE PRiCE with the securing of the SALE at lower price but in SHORTEST TiME.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

EMPHASiS:

Due to the High Cost of Living in Singapore, Bridging Loan is only extended when the House Seller's Salary is above S$1,800 per month.

pharoah88 ( Date: 28-Jul-2010 13:01) Posted:

|

iS COV a HinT or an EVIDENCE ? ? ? ?

OWNER, SELLER, BUYER are BETTER in VALUATION

than the PAID VALUER ? ? ? ?

Tax COV as income?

Letter from Johnnie Chia

The current feeling is that the Housing Board will not interfere in the cash-over-valuation (COV) for HDB flats between buyers and sellers.

In the past, when the process of reselling HDB flats was tightly regulated, and property agents were not allowed to deal in such transactions, there was no such thing as a COV.

When the resale market rules were relaxed, some enterprising flat owners began asking for “under the table” money, above the official valuation; this was illegal then, and a number of such people were caught. I believe that COV evolved from such early beginnings.

Today, COV is accepted as part of a property transaction. The primary trigger for the rise in COV lies in the valuation process:

“Valuation” in Singapore is a table top exercise, with the valuer considering only broad factors and past trends.

With such an approach, there will definitely be Variances in Valuation between individual flats, even in the same block.

On the other hand, if the valuation process is refined, I guess other problems may crop up.

If there is a status quo in the valuation process, then, perhaps, the COV should be taxed as income. After all, when property is sold at valuation, any gains the seller reaps are capital gains, and not taxable here.

Therefore, any surplus above the valuation cannot be capital gains and must be deemed as income.

The seller still keeps a portion of the surplus, but the Government now shares in the surplus.

If this money is then channelled back to the town council where the transaction took place, that would really be an incentive for the respective town councils to make the estate even more valuable.

This would be a neat way to solve a knotty problem, and the market forces will still be left to find their own equilibrium.

pharoah88 ( Date: 28-Jul-2010 13:14) Posted:

|

Jeyaretnam to head Law Firm

SINGAPORE

The firm said yesterday that Mrs Helen Yeo, who had served in the role for eight years since she merged HelenYeo & Partners with Rodyk in 2002, will step down at the end of December. She would have reached the contractual retirement age of 60 for equity partners in the firm.

Mrs Yeo will move into a new role as senior consultant. She will continue to look after key client relationships that she has built for the firm and assist in developing new business, the law firm said.

Mrs Yeo described Mr Jeyaretnam, 46, as having one of the finest minds in the profession and is confident that he has the leadership and vision to take Rodyk to new heights.

Mr Jeyaretnam said Rodyk will continue to strengthen and deepen its talent pool to serve clients effectively. The leadership succession comes at a significant time in its history: Rodyk celebrates its 150th year next year.

— Senior Counsel Philip Jeyaretnam will take over as managing partner of Rodyk & Davidson, the nation’s OLDEST law practice, from January.Can COV Scheme be applied to the

SELLING of CPF shares

? ? ? ?

Cash Over Valuation [COV]

Is COV a LEGAL Practice under Real Estate Laws ? ? ? ?

Is COV like Money Laundering ? ? ? ?

Is COV like an UNderdeclaration of Valuation ? ? ? ?

Is COV like BRIBERY in Business Transaction ? ? ? ?

Is COV like an UDNERTABLE SCHEME to withdraw MONEY from CPF ? ? ? ?

WHAT is the Objective to have COV ? ? ? ?

Should GST be payable on COV ? ? ? ?

Thousands of housing agents get the axe

Real estate firms take action ahead of implementation of new rules

JOANNE CHAN

joannechan@mediacorp.com.sg

SINGAPORE

Under a new regulatory framework to be implemented by the Ministry of National Development (MND), a statutory board known as the Council for Estate Agencies will be set up. MediaCorp understands that a Bill could be introduced in Parliament as early as October.

When contacted, MND would only say that a Bill will be introduced later this year, with the council operational by the end of the year. Under the new framework, all agents must register with the council before they are allowed to practice. In the meantime, MND had asked estate agencies to submit their agents’ particulars and qualifications. Some firms have taken the opportunity to do some housekeeping.

Dennis Wee Group (DWG) updated the particulars of all its 5,000 agents earlier this month. They were also briefed on the new requirements.

DWG director Chris Koh said as a result of the exercise, some 1,500 agents were axed. They were mostly inactive or part-time agents.

“With the new central registry, where a member of public can turn to the registry and see if you are an agent, it’s going to be difficult for those with a full-time job to moonlight as an agent.”

Under the new guidelines, agents will also be required to pass a mandatory industry exam.

Only those with an industry certification will be exempted.

Rather than wait, DWG has asked all its agents to equip themselves — either with the Certified Estate Agent Course or the Common Examination for Salespersons.

Another real estate agency, PropNex, has also taken action.

Its CEO, Mohamed Ismail, said some 1,200 agents were terminated, either because they’re inactive or unwilling to take up personal indemnity insurance. The insurance covers any financial liabilities arising from housing transactions.

Agents who are associated with moneylending have also been let go. “We have made it a policy that any PropNex agent, who has a moneylending licence, will not be allowed to practice because we do see a conflict of interest.”

ERA, which has about 3,000 active agents, says it removes about 100 inactive agents from its database every month. Associate director of ERA Asia-Pacific, Mr Eugene Lim, said the company has also been training its agents for the Common Examination for Salespersons.

To date, more than 2,500 ERA agents have taken the exam.

HSR, which represents about 7,000 agents, says it regularly checks its database for inactive agents, who are then put on a passive list and sent reminders to go for retraining.

There are an estimated 30,000 housing agents in Singapore.

— Real estate firms have axed thousands of housing agents ahead of enhanced regulations aimed at improving the professionalism of the industry.We have made it a policy that any PropNex agent, who has a moneylending licence, will not be allowed to practice.

PropNex CEO Mohamed Ismail

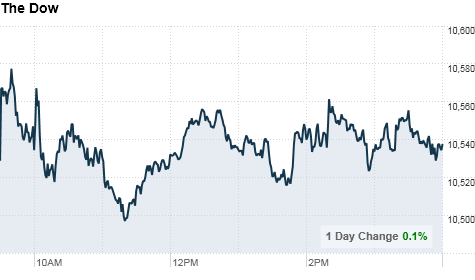

Stocks: Earnings help, economy hurts

NEW YORK (CNNMoney.com) -- Stocks churned Tuesday, losing steam after a three-session run, after a big drop in consumer confidence offset better-than-expected profit growth from DuPont, UBS and others.

The Dow Jones industrial average (INDU) added 12 points, or 0.1%. The S&P 500 (SPX) lost just over 1 point. The Nasdaq (COMP) composite lost 8 points, or 0.4%.

Consumer confidence declined in July, according to the Conference Board's closely watched index, which fell to 50.4 from an upwardly revised 54.3 in June. Economists surveyed by Briefing.com thought the index would decline, but only to 51. The report served to underscore the weak outlook for consumer spending heading into the fall, and caused stocks to erase early gains.

"The consumer confidence index was below expectations but not surprising," said David Chalupnik head of equities at First American Funds. "We had a down market in May, June and early July, and that weighs on consumer spending and confidence."

Better-than-expected results from a number of companies had propelled markets in the morning, extending the recent rally. But that advance lost steam, with technology and consumer stocks hit the most.

Stocks gained Monday after FedEx (FDX, Fortune 500) lifted its profit forecast and new home sales grew more than expected in June. The advance built on last week's rally, pushing the Dow into positive territory for the year, along with the Nasdaq. The S&P 500 moved into positive territory for the year on Tuesday morning, before retreating.

Company results: Dow component DuPont (DD, Fortune 500) reported higher quarterly sales and earnings that topped estimates, thanks to higher prices and increased demand. The chemical maker also boost its earnings forecast for the year. Shares gained 3.6%.

Swiss bank UBS (UBS) reported higher quarterly profit that topped estimates, thanks to the stock market rally and currency trading gains. U.S.-traded shares gained 9%.

Swiss rival Credit Suisse (CS) also reported a better-than-expected profit as tax and accounting gains tempered the impact of investment banking losses. Shares gained 4.4%.

German competitor Deutsche Bank (DB) reported higher quarterly earnings. But revenue was weaker due to a decline in its investment banking profit. Shares gained 2.8%.

Tellabs (TLAB) reported higher quarterly sales and earnings that beat estimates and lifted its fiscal second-quarter outlook. But shares of the communications gear maker dropped on concerns that it will lose some of its business building wireless networks for AT&T to a rival vendor. Shares fell 5.9%.

With just over one-third of the S&P 500 having reported, Earnings are currently on track to have risen 34% from a year ago, according to earnings tracker Thomson Reuters.

Chalupnik said the gap between economic and earnings news reflects that U.S. companies benefit from exposure to strong emerging markets and a not-yet slowing European economy, offsetting the weakness in the U.S. economy.

BP: BP posted a huge quarterly loss of $17.2 billion due to costs connected to the Gulf of Mexico oil spill. The company also said that British CEO Tony Hayward will be replaced by American Robert Dudley Oct. 1. BP (BP) shares fell 1.7%.

Housing: The Case-Shiller 20-city home price index rose 1.3% in May versus April and up 4.6% from a year earlier, suggesting pricing has stabilized.

World markets: European shares rose. The CAC 40 in France gained 0.8%, Germany's DAX rose 0.2% and the FTSE 100 added 0.3%.

Asian markets finished mixed. Japan's benchmark Nikkei index edged down 0.1% and the Hang Seng in Hong Kong ended 0.6% higher.

Currencies and commodities: The euro fell against the dollar, while the U.S. currency gained versus the Japanese yen.

U.S. light crude oil for September delivery settled down $1.48 to $77.50 a barrel on the New York Mercantile Exchange.

COMEX gold's August contract fell $25.10 to $1,158 per ounce.

Bonds: Treasury prices fell, and the yield on the 10-year note climbed to 3.05% from 2.99% late Monday. Bond prices and yields move in opposite directions.

Market breadth: Breadth was negative. On the New York Stock Exchange, losers beat winners by eight to seven on volume of 1.11 billion shares. On the Nasdaq, decliners edged advancers by seven to six on volume of 2.07 billion shares.

Judge rejects ‘romance’ claim

SINGAPORE

In a 25-page judgment released yesterday, Justice Tay felt Dr Chee had succeeded in her claim and awarded her $292,255.

Dr Tan, however, succeeded in his counterclaim against Dr Chee over the share of the profits in respect of the sale of an apartment at Maplewoods condominium.

Justice Tay found that Dr Tan had contributed $279,917 towards the purchase of the apartment and is also entitled to half of the $377,061 profit from its sale.

In the end, after setting off the respective amounts, Dr Tan was entitled to a net payment of $176,193.

In his written judgment, Justice Tay said evidence showed Dr Chee did not initiate any of the payments made to Dr Tan.

Instead, the Judge felt Dr Tan “was always the one who expressly requested” that Dr Chee help him financially.

Justice Tay also found that every request made by Dr Tan was couched in the form of a request for a loan.

The pair met in late 1999 when Dr Chee, the general manager of Parkway Healthcare Foundation and charity arm of the healthcare group, was introduced to Dr Tan, then a third-year medical student and wheelchair athlete, as a possible fund-raiser.

A month later, she began transferring $500 to his bank account every month.

While he hesitated to find the pair actually had a romantic relationship, Justice Tay felt the existence of such a romantic relationship would not be sufficient to prove the money was meant as love gifts, or that Dr Chee had waived her right to repayment.

— Prominent paraplegic athlete William Tan Kian Meng, who was sued for $400,000, had claimed the amount was the result of “love gifts” given by Dr Stephanie Chee Jok Heng because they were in an intimate relationship. But High Court Judge Tay Yong Kwang did not accept this contention.Leong Wee Keat

ROMANCE has NO CLAIMS on MONEY

Those who stay infront of computer (young and old) all day long and llive in the virtual world, very prone to sucidal thoughts. No social life, dare not face up to the world, keep problems to themselves, poor hygiene, slacking all the time , short tempered

They are in the environment of single parenthood, divorces, or parents' seperation, and family violent

pharoah88 ( Date: 27-Jul-2010 10:14) Posted:

|

NO LONELINESS

@ AZZURA BEACH CLUB

The Azzura concept is the first of its kind in Asia.

A multi-level entertainment, dining & hydrosports complex, Azzura is innovatively designed to maximize experiences; thus creating, and offering, a unique lifestyle experience to its guests.

401 suicides last year: SOS

Young men aged 20 to 29 identified as high-risk group here

Leong Wee Keat

weekeat@mediacorp.com.sg

Younger men who call the hotline spoke of depression and loneliness.

Ms Christine Wong, executive director of SOS

If you need help, call:

Samaritans of Singapore: 1800-221-4444 (24 hours)

Comcare helpline: 1800-222-0000

Care Corner counselling (Mandarin): 1800-353-5800

Singapore Association For Mental Health: 1800-283-7019

Stocks rally on housing, FedEx

NEW YORK (CNNMoney.com) -- Stocks rallied Monday after FedEx's improved forecast and a better-than-expected housing market report tempered worries about the economic outlook.

The Dow Jones industrial average (INDU) added 100 points, or 1%. The S&P 500 (SPX) index rose 12 points, or 1.1%. The Nasdaq (COMP) composite gained 27 points, or 1.2%.

Both the Dow and Nasdaq are now positive for the year, while the S&P 500 stands roughly where it stood at the end of 2009. All three major gauges had rallied soundly through late April, sold off through the end of June and have recovered in July.

Stocks gained in the morning and built on those gains as the session wore on, with investors scooping up a variety of shares. 29 of 30 Dow shares gained, led by oil stocks Exxon Mobil (XOM, Fortune 500) and Chevron (CVX, Fortune 500).

"The new home sales was a bright point but it was really FedEx's earnings and outlook that gave the market some buoyancy," said Matthew Kaufler, equity market strategist at Federated Clover Investment Advisors.

"The company represents a broad take on the economy and that's given investors some optimism today," he said.

But the gains also reflect the recent more positive tone to the market, said Stephen Goldman, market strategist at Weeden & Co.

Stocks slid in the second quarter as investors factored in a slower pace of recovery for the economy. But July has been a strong month as market pros anticipated improved quarterly results, a development that has played out so far.

Goldman said that the market is currently in a "reflex rally" following the selling in the second quarter, in which the major gauges lost more than 15% off the highs and flirted with a bear market -- a plunge of at least 20% off the highs.

"We're still going to see choppy trading after this rally fades out," Goldman said. "The economy is fragile and while it's not going to be a double-dip recession, growth is still going to be slow."

FedEx: Package shipper FedEx (FDX, Fortune 500) lifted its fiscal first-quarter earnings-per-share guidance to a range of $1.05 to $1.25, from 58 cents per share a year ago. Analysts are currently expecting earnings of $1.10 per share, according to Thomson Reuters. The company also boosted its forecast for fiscal year 2011, citing improved demand particularly for international shipments.

Like UPS (UPS, Fortune 500), FedEx is seen as a proxy for the economy, due to the nature of its business. Last week, UPS reported better-than-expected quarterly sales and earnings and also boosted its full-year forecast.

FedEx gained over 5.6% and UPS gained 1.2%.

Housing: New home sales rose to a seasonally adjusted annual unit rate of 330,000 in June, bouncing from a revised 267,000 unit rate in May, the lowest reading on record, dating to 1963. Sales were expected to rise to 310,000, according to a consensus of economists surveyed by Briefing.com.

While the pace was an improvement from the previous month, it was still the second-lowest on record, reflecting the end of the homebuyer tax credit. The slow pace also reflects the slow speed of the economic recovery.

Quarterly results: Roughly 157 major companies, or 31% of the S&P 500, reports results this week. Standouts include Dow companies Boeing (BA, Fortune 500), DuPont (DD, Fortune 500), Exxon Mobil (XOM, Fortune 500), Chevron (CVX, Fortune 500) and Merck (MRK, Fortune 500).

Also, BP (BP) reports on Tuesday, providing the first snapshot of the company's performance during the quarter in which the oil spill began. Separately, BP CEO Tony Hayward will step down in October and be offered a job with the company's joint venture in Russia, according to published reports Monday.

World markets: European markets rose as investors mulled the results of the bank stress tests released after European markets closed Friday. Britain's FTSE 100 rose 0.7%, Germany's DAX rose 0.5% and France's CAC 40 added 0.8%.

Asian markets ended the session higher, with Japan's Nikkei index up 0.8%, the Hong Kong Hang Seng up 0.2% and the Shanghai Composite up 0.7%.

Currencies: The euro fell versus the dollar, giving up earlier gains, while the dollar gained versus the Japanese yen.

Commodities: U.S. light crude oil for September delivery fell 6 cents to $78.92 a barrel on the New York Mercantile Exchange.

COMEX gold for August delivery fell $2.70 to $1,185.10 an ounce.

Bonds: Treasury prices fell, boosting the yield on the 10-year note to 3.00% from 2.99% late Friday. Debt prices and yields move in opposite directions.

Market breadth: Breadth was positive. On the New York Stock Exchange, winners beat losers by almost three to one on volume of 470 million shares. On the Nasdaq, advancers beat decliners by over two to one on volume of 1.22 billion shares.

CORPORATE POLYGAMY

CIVIL POLYGAMY

BEWARE

AWARE

SCARE

CARE

Affected wives, children

reject polygamy: Survey

KUALA LUMPUR

Sisters in Islam (SIS), a Malaysian women’s advocacy group, worked with researchers from Malaysian universities to conduct face-to-face interviews with some 1,600 members of polygamous households.

Their findings appear to bolster claims by women’s rights activists who say polygamy undermines the well-being of wives and children.

“We do not oppose polygamy but we believe that monogamy is preferable,” said SIS representative Adibah Jodi.

There are no official Malaysian statistics on the number of polygamous marriages but activists estimate they account for about 5 per cent of all new marriages every year, including ones not legally registered.

According to the survey, at least 90 per cent of 523 children interviewed insisted they would not start polygamous households when they grow up. Nearly 70 per cent of 259 women whose husbands took a second wife would not recommend polygamy and said their husbands were now unable to meet their needs fairly.

# MERITOCRACY IS BAD #

Islam allows a man to take up to four wives but also warns men not to neglect any of them [MUST BE FAIR to everyone].

# NO MERITOCRACY #

# WINNER CANNOT TAKE ALL #

Those who back POLYGAMY say it helps deter adultery and improve the marriage prospects of single mothers and reformed prostitutes.

The SIS plans to submit the complete results of the survey to the government and urge the authorities to formulate better family policies for Muslims.

— Malaysian children and first wives in polygamous families overwhelmingly oppose the practice as the men seem too stretched to devote enough time and money to them, according to the country’s largest study on the effects of polygamy.AP

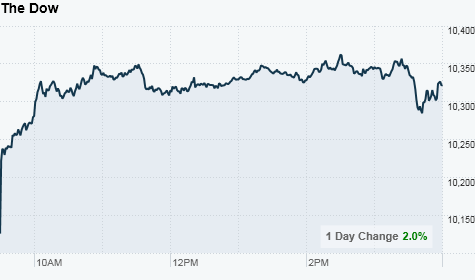

Dow's 200-point rebound

Better-than-expected earnings from 3M, Caterpillar and UPS helped lift stocks Thursday.

Better-than-expected earnings from 3M, Caterpillar and UPS helped lift stocks Thursday.NEW YORK (CNNMoney.com) -- Stocks rallied Thursday after better-than-expected earnings and forecasts from 3M, Caterpillar, AT&T and UPS helped reassure investors about the pace of the economic recovery.

The Dow Jones industrial average (INDU) rose 202 points, or 2%. The S&P 500 (SPX) index jumped 24 points, or 2.3%. The Nasdaq (COMP) composite gained 58 points, or 2.7%.

Stocks slumped Wednesday after Federal Reserve Chairman Ben Bernanke told Congress the outlook for the economy was "unusually uncertain," adding to worries about the pace of the recovery.

But the tone was positive Thursday, on the back of improved earnings, better-than-expected housing market news and a surge in European markets.

After the close, Dow component Microsoft (MSFT, Fortune 500) reported higher quarterly sales and earnings that topped estimates, thanks to strong sales of its Windows 7 and a better personal computer market than in recent months. Shares were barely changed after the close.

Also after the close, Dow component American Express (AXP, Fortune 500) reported higher quarterly sales and earnings that topped expectations. But AmEx's CEO said the company remains cautious about the economic outlook and shares dipped 1% in after-hours trading.

Quarterly results: Dow component Caterpillar (CAT, Fortune 500) reported higher quarterly sales and earnings that topped estimates due to better sales of gear for the mining, infrastructure and energy industries. Caterpillar also boosted its 2010 profit forecast. Shares gained 1.7%.

Fellow Dow component 3M (MMM, Fortune 500) reported higher quarterly sales and earnings and said that full-year 2010 profit will exceed its earlier targets, thanks to strong demand in both the United States and abroad. The company is seen as a good proxy for the economy due to the breadth of its business, which includes everything from Scotch tape to films for flat-screen TVs. Shares gained 3%.

UPS (UPS, Fortune 500) reported higher quarterly sales and earnings that topped estimates and said that 2010 earnings will surpass its earlier forecasts. The delivery company cited an increase in package revenue in both the United States and abroad. Shares gained 6%. UPS is often seen as an economic bellwether due to the nature of its business.

Dow component AT&T (T, Fortune 500) reported higher quarterly earnings that topped estimates and higher revenue that was shy of estimates. The company also lifted its 2010 forecast, citing cost cutting and a surge in wireless business, thanks to its exclusive iPhone deal with Apple. Shares gained 2.4%.

Late Wednesday, eBay (EBAY, Fortune 500) reported higher quarterly sales and earnings that topped estimates, thanks to strength at its PayPal only payments unit. The online auctioneer also lowered the high end of its full-year 2010 profit forecast, citing the impact of the weaker euro. Shares gained 3.8% Thursday.

Housing: Sales of existing home sales fell 5.1% in June from May levels, according to a report from the National Association of Realtors released Thursday. But the drop was smaller than expected. Sales rose nearly 10% from a year earlier.

Jobs: The House voted to extend jobless claims benefits until November, ending a seven-week old debate between lawmakers that saw federal benefits for the long-term unemployed run out. President Obama is expected to sign the extension shortly.

Earlier, the Department of Labor reported that the number of Americans filing new claims for unemployment rose to 464,000 last week from a two-year low of 427,000 in the prior week. Economists surveyed by Briefing.com thought claims would rise to 445,000.

Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 4,487,000 from 4,710,000 in the previous week. Economists surveyed by Briefing.com expected 4,600,000.

Deals: General Motors said it will buy auto financing firm AmeriCredit (ACP) in a $3.5 billion all-cash deal. The deal gives GM a lending unit after selling its majority stake in GMAC in 2006. The deal was also seen as a key step as GM prepares its initial public offering for later this year, after the government restructured it in bankruptcy. AmeriCredit shares jumped 23%.

Dell: Computer maker Dell (DELL, Fortune 500) agreed to pay $100 million to settle fraud charges with the Securities and Exchange Commission. Chairman Michael Dell and former CEO Kevin Rollins will pay $4 million each. Dell shares finished 2.5% higher.

Leading indicators: The index of leading economic indicators fell 0.2% in June, the Conference Board reported, after rising 0.5% in May. Economists expected the index to have fallen 0.4%.

World markets: European markets rose, with Britain's FTSE 100 up 1.9%, Germany's DAX up 2.5% and France's CAC 40 up 3%.

Asian markets ended mixed. Japan's Nikkei fell 0.6%, while Hong Kong's Hang Seng gained 1.1% and the Shanghai Composite gained 0.3%.

Currencies: The euro gained versus the dollar. The dollar rose versus the Japanese yen.

Commodities: U.S. light crude oil for September delivery rose $2.46 to $79.02 a barrel on the New York Mercantile Exchange.

COMEX gold for August delivery rose $2.80 to $1,194.60 an ounce.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 2.93% from 2.89% late Wednesday. Debt prices and yields move in opposite directions.

Market breadth: Breadth was positive. On the New York Stock Exchange, winners beat losers by over six to one on volume of 1.18 billion shares. On the Nasdaq, advancers beat decliners by five to one on volume of 2.28 billion shares.

Blastoff ( Date: 22-Jul-2010 07:22) Posted:

|

Just a comment and the market falls by more than 100 points....

Blastoff ( Date: 22-Jul-2010 07:20) Posted:

|

Stocks slump on Bernanke comments

NEW YORK (CNNMoney.com) -- Stocks tumbled Wednesday after Federal Reserve Chairman Ben Bernanke told Congress that the outlook for the economy is "unusually uncertain," adding to worries about the pace of the recovery.

The Dow Jones industrial average (INDU) lost 109 points, or 1.1%, the S&P 500 (SPX) index dropped 14 points, or 1.3%, and the Nasdaq (COMP) composite tumbled 35 points, or 1.6%.

Stocks were slightly lower through the early afternoon as better-than-expected quarterly profit reports from Apple, Morgan Stanley and Wells Fargo were countered by disappointment about results from Yahoo and others.

But the selling picked up steam in the afternoon following the 2 p.m. ET release of Bernanke's prepared testimony for a Senate committee. The Fed chief told lawmakers that, despite ongoing signs of weakness in the economy, central bankers expect gradual recovery over the next few years, although the labor market healing will be slower than previously thought.

"He's basically saying the economy is getting worse, and that while it's still going to grow, it's not recovering at the pace they had hoped," said Dave Rovelli, managing director of U.S. equity trading at Canaccord Adams.

Bernanke also provided more details on how the Fed plans to withdraw the trillions in stimulus it has pumped into the economy since the start of the financial crisis in 2008. But he also said that the Federal Reserve will be ready to provide additional help if the economy deteriorates.

Stocks found a little momentum Tuesday amid speculation that the Federal Reserve may take more steps to encourage bank lending. But that failed to transfer to Wednesday's trading despite a number of improved earnings.

"Right now the macro-economic environment is trumping the good earnings," Rovelli said. "The earnings have been good but people are worrying about what the next few quarters are going to look like if the recovery is losing steam."

After the close, eBay (EBAY, Fortune 500) reported higher quarterly sales and earnings that topped estimates, thanks to strength at its PayPal only payments unit. The online auctioneer also lowered the high end of its full-year 2010 profit forecast, citing the impact of the weaker euro. Shares gained 3% in after-hours trading.

Results: After the close Tuesday, Apple (AAPL, Fortune 500) posted its best quarter ever, thanks to sales of its Mac computers, iPads and iPhones. Shares gained 1% Wednesday.

But search engine operator Yahoo (YHOO, Fortune 500) reported results that disappointed investors. The Internet company reported higher earnings that beat estimates on revenue that was barely higher from a year earlier and was shy of analysts' expectations.

Citigroup downgraded the stock Wednesday, while a variety of other firms downgraded it or cut earnings estimates on the company. Shares fell 8.5%.

Dow component Coca-Cola (KO, Fortune 500) reported higher quarterly sales and earnings that topped estimates, helped by increased sales in most of its markets, with particularly strong demand overseas. Shares gained 1.6%.

Morgan Stanley (MS, Fortune 500), Wells Fargo (WFC, Fortune 500) and US Bancorp (USB, Fortune 500) all reported strong profits, but bank shares were mixed. The KBW Bank (BKX) index lost 2.4%.

Morgan Stanley reported a profit of $1.4 billion, better than expected and reversing a loss from the same quarter a year ago. The company also reported higher earnings that topped estimates.

Wells Fargo reported a higher second-quarter profit that topped expectations, thanks to smaller loan losses. Shares gained 4.7%.

US Bancorp reported higher quarterly sales and earnings that topped expectations, thanks partly to lower credit costs.

Wall Street reform: President Obama signed the Wall Street reform bill into law Wednesday, enacting the most far-reaching financial overhaul since the Great Depression.

World markets: European markets rose, with Britain's FTSE 100 up 1.5%, Germany's DAX up 0.4% and France's CAC 40 up 0.8%.

Asian markets ended mixed. Japan's Nikkei fell 0.2%, while Hong Kong's Hang Seng gained 1.1% and the Shanghai Composite gained 0.3%.

Currencies: The euro fell versus the dollar. The dollar fell versus the Japanese yen.

Commodities: U.S. light crude oil for September delivery fell $1.16 to $76.56 a barrel on the New York Mercantile Exchange.

COMEX gold for August delivery fell $5.90 to $1,191.80 an ounce.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 2.89% from 2.93% late Wednesday. The two-year note hit a record low. Debt prices and yields move in opposite directions.

Market breadth: Breadth was negative. On the New York Stock Exchange, losers beat winners by two to one on volume of 1.2 billion shares. On the Nasdaq, decliners beat advancers by almost three to one on volume of 2.25 billion shares.