GLD USD

Last:447.4

-3.29

-3.29

Gold & metals

Post Reply

3481-3500 of 4402

Post Reply

3481-3500 of 4402

live

![Live New York Gold Chart [Kitco Inc.]](http://www.kitco.com/images/live/nygold.gif)

Last Updated : August 15, 2011 21:31

Gold prices could see $2,000 an ounce in the coming months, but in the short-term, gold prices could see further weakness, says TD Securities.

“Reminiscent of Silver after its parabolic rise, gold, which has jumped about 12% in August alone, is set to continue its correction over the short-term. Moderating momentum, higher spec margins, a sharp jump in implied volatilities and a small improvement in investor risk appetite are the key catalysts to drive gold lower,” says Bart Melek, head of commodity strategy at TDS.

Yet he says because the Gold market is more liquid than silver, with favorable fundamentals, the correction shouldn’t be “overly brutal.” In the long-term, he says gold prices should go higher as gold will act as both a safe haven asset and a store of value to offset the inflationary aspects of further easing,” he says, raising the banks forecast for average gold prices. In the third quarter, gold prices should average $1,680 and average $1,750 in the fourth quarter. In 2012, he estimates gold prices will average $1,850.

By Debbie Carlson of Kitco News

By Peter LaTonaAugust 15, 2011

40th Anniversary of Coming off the Gold Standard!Forty years ago today, President Richard Nixon signed into a law a bill that would take the United States off the gold standard and signal to the rest of the world the end of the Bretton Woods agreement.The Bretton Woods agreement had fixed the price of the U.S. dollar to gold and the price of gold at $35 an ounce. The gold-fixed U.S. dollar had been the foundation of the global economy. Prior to 1971, there was an unspoken agreement amongst foreign treasuries not to ask for gold, which could produce a gold run. However in 1971, with the U.S. facing accelerating inflation and the expense of the Vietnam War, other countries began to lose faith in the U.S. dollar and began asking for payments in gold. Fearing a run on gold would deplete their gold reserves, along with growing concerns of a deficit trade imbalance with Japan the Nixon administration went off the gold standard in order to devalue the U.S. dollar. Lowering the value of the U.S. dollar was able to marginally offset the trade imbalance and there was no run on the U.S. gold supply. In the time since this agreement was signed, gold prices have climbed 5000%, while the purchasing power of the U.S. dollar has continually declined.

U.S. stock futures were up in early morning hours, but have retreated on the report that New York manufacturing contracted for a third month in a row. The “Empire State” general business conditions index fell to negative 7.72 from a negative 3.76 the previous month. Economists had expected a rise to zero, so this represents a ten point swing off expectations.

The big event this week is tomorrow’s meeting between the leaders Germany and France. They are expected to come up with new plans to solve the euro zone debt crisis. One idea that has been floated is the creation of a euro bond. Many analysts see this as a positive development, but Germany has indicated that in their view, this is not an option.

At 8AM (CT) the APMEX precious metal prices were:

- Gold price - $1,741.70 – down $2.90

- Silver price - $39.31 – up 9 cents

.................................................................................................................

It is time to diversify your portfolio or recover your losses in stocks.

To reach financially freedom, you need to invest in not just stocks.

Invest in land and get a double return in 4 to 5 years.

It is just about 0,70 lots of GLD for 1 unit of land.

http://www.niagarafallstourism.com/

How? Just leave me a private message (PM) here for details.

LONDON | Mon Aug 15, 2011 10:09am EDT

(Reuters) - Gold prices eased for a third session on Monday as stock markets and cyclical assets such as industrial commodities continued to recover from a rout they suffered early last week, diverting investment away from the precious metal.

Gold hit a record $1,813.79 an ounce on Thursday and posted its biggest weekly gain since April 2009 as European stock markets fell to two-year lows, hit by concerns over euro zone debt levels. Investors flocked to gold as a haven from risk.

A reversal in appetite for assets seen as higher risk has led the precious metal to retreat, however. Spot gold was down 0.6 percent at $1,736.29 an ounce at 9:47 a.m. EDT.

" The (Federal Reserve) decision to keep the Fed funds target rate between 0 and 0.5 percent for the next two years... has stabilized the stock markets," said Peter Fertig, a consultant with Quantitative Commodity Research. " We have seen a recovery from the lows in still very volatile trading."

" This has been a reason for taking profits in gold, while other precious metals which have a more industrial use, like silver but in particular the platinum group metals, have recovered from the lows."

European equities extended Friday's gains on Monday, benefiting from economic data and technical buying after key stock indexes became oversold. Their rise helped depress the cost of insuring Italian and Spanish debt against default. .EU

Oil and base metals also firmed, supported by positive data from Japanand the United States, which posted strong retail sales numbers on Friday, helping allay fears an economic slowdown would hurt demand for raw materials.

Nonetheless, concerns remain that the U.S. recovery is flagging after weak consumer confidence numbers on Friday, while worries persist over sovereign debt in the euro zone and the prospect of rising inflation in Asia.

" Related uncertainty in financial markets, whether from the growth outlook or the ongoing sovereign debt crisis, is expected to remain a benefit to perceived safe-haven commodityassets, of which we believe gold is the stand-out exposure," said Morgan Stanley in a note.

U.S. gold futures for August delivery were down $3.50 an ounce at $1,739.10.

Monday marks the fortieth anniversary of the end of the Gold Standard, in place since the Bretton Woods agreement of 1944.

UNCERTAINTY BENEFITS GOLD

World Bank Chief Robert Zoellick said on Sunday the loss of market confidence in economic leadership in the United States and Europe, coupled with a fragile economic recovery, have pushed markets into a new danger zone.

He said uncertainty about the role of currencies was driving financial markets toward the Australian dollar, the Swiss franc and gold.

Reuters calculations based on data from the U.S. Commodity Futures Trading Commission showed big speculators slashed bullish bets in U.S. commodity markets by a massive $21 billion in the week to August 9, selling heavily into a major gold rally and cutting net long positions to the lowest in a year.

Meanwhile, holdings of the world's largest gold-backed exchange-traded fund, the SPDR Gold Trust, declined by nearly 50 tonnes between Monday and Friday last week.

The gold market is awaiting U.S. data on Monday that will show changes in investment holdings by hedge funds and institutional investors in the second quarter. All eyes will be on John Paulson, the biggest holder of the SPDR Gold Trust.

Among other precious metals, silver was up 1 percent at $39.40 an ounce. Data showed holdings of the world's largest silver-backed ETF, the iShares Silver Trust (SLV.P) dropped 0.7 percent to 9705.90 tonnes on Friday.

Meanwhile spot platinum was flat at $1,793.74 an ounce, while spot palladium was up 1.5 percent at $753.97 an ounce.

Platinum prices have risen back above those of gold, having traded at a discount last week for the first time in 2-1/2 years last week. However, any fresh rally in gold prices could put the yellow metal at a premium once again.

(Additional reporting by Rujun Shen editing by Anthony Barker)

Markets heading to new danger zone: Zoellick

(Reuters) - The loss of market confidence in economic leadership in key countries like the United States and Europe coupled with a fragile economic recovery have pushed markets into a new danger zone, something that policymakers have to take seriously, the head of the World Bank said on Sunday.

Speaking at the Asia Society dinner in Sydney, Robert Zoellick also said the global economy was going through a multi-speed recovery, with developing countries now the source of growth and opportunity.

" What's happened in the past couple of weeks is there is a convergence of some events in Europe and the United States that has led many market participants to lose confidence in economic leadership of some of the key countries," he said.

" I think those events combined with some of the other fragilities in the nature of recovery have pushed us into a new danger zone. I don't say those words lightly ... so that policymakers recognize and take it seriously for what it is."

Zoellick said the process of dealing with the sovereign debt problem and some of the competitive issues in the euro zone have tended to be done " a day late," leaving markets worried that authorities may not be ahead of the problem or moving in the right direction.

" That (worry) has accumulated and so we're moving from drama to trauma for a lot of the euro zone countries," he said.

On the United States, Zoellick said it wasn't fears the world's biggest economy faced an imminent problem, but " frankly that markets are used to the United States playing a key role in the economic system and leadership."

He said efforts to cut U.S. government spending have so far been focused on discretionary spending as opposed to the entitlement program such as social security. " Until they make an effort on those programs, there is going to be continued skepticism about dealing with long-term spending."

Zoellick said while market confidence has been hit, the real issue was whether this will spread to business and consumer confidence, something that was still unclear.

" What is different from the world of the past is now emerging markets are sources of growth and opportunity. About half of global growth is represented by the developing world ... so this is a very rapid change in a relatively short span of time in historical terms," he added.

On China, Zoellick said the appreciation of the yuan would be constructive, especially in helping tackle the country's inflationary pressure.

On Australia, he said the country was in a much better position than other developed countries because it undertook structural reforms. On the fiscal side, he noted Australia's debt was only 7 percent of gross domestic product and taking advantage of its position in the Asia Pacific..

(Reporting by Ian Chua Editing by Cecile Lefort)

BlackRock to use gold, bond profits to buy beaten-down stocks.

Gold extends losses to second day, but silver rises

NEW YORK (Aug 12) Gold futures traded lower Friday, extending the previous session’s fall to a second day as investors took profits after a record-studded run earlier in the week.

Gold for December delivery lost $10.30, or 0.6%, to $1,740.70 an ounce on the Comex division of the New York Mercantile Exchange.

Gold has gained 5.3% so far this week, and on Wednesday set an intraday record of $1,801 an ounce.

“We’ve come a long way with gold, we are seeing some profit-taking in the market,” said Frank Lesh, a broker and futures analyst with FuturePath Trading in Chicago. “We braced for a demise in a European bank, and we didn’t have that ... we are unwinding that fear trade.”

Earlier this week, markets were abuzz with concerns a big French bank might be in trouble and France could be the next developed nation to lose its triple-A bond rating, which would come on the heels of a downgrade for U.S. credit by Standard & Poor’s last week.

Gold pared some of its losses after consumer-sentiment data showed consumers at their most pessimistic in three decades, but the respite proved to be short-lived.

The University of Michigan-Reuters index tumbled to 54.9 in August, the lowest since May 1980, from 63.7 in July.

During the regular U.S. session Thursday, the contract settled down $32.80, or 1.8%, at $1,751.50 per ounce. The lower settlement snapped a three-day winning streak that took gold to an intraday record of $1,801 an ounce.

The “downside move was bound to happen after three straight sessions of consecutive gains ... the (CME Group Inc.) decision to hike margins on gold futures certainly played a vital part here as smaller market participants rushed to square their books,” analysts at VTB Capital in London wrote in a note to clients.

“Bullion remains well underpinned in the short term, with very limited downside. Uncertainties over the global economic recovery are still rife, as are fears of peripheral debt troubles in the Eurozone,” they added.

Other metals, more closely linked with industrial uses, took some strength from rising U.S. equities, often a barometer of economic conditions.

Silver futures traded higher, undoing some of their overnight drop, with the September contract /quotes/zigman/704345 SI1U +1.37% up 31 cents, or 0.8%, to $39 an ounce. The contract retreated 1.7% the previous session.

September copper added 1 cent, or 0.2%, to $4.02 a pound.

Initial margin requirements to trade gold rose 22% to $7,425 per 100-ounce contract, from $6,075. Maintenance margins increased 18% to $5,500 from $4,500, CME said. See report on CME margin hike.

The CME has increased gold margins twice in 2011, and has decreased them once earlier this year.

Sell when everyone is greedy.

Weekend reading...

Dow Theory Update

Tim Wood

Ever since the rally out of the March 2009 low began, I've been saying that we have been in a bear market rally that should ultimately prove to separate Phase I from Phase II of a longer-term secular bear market. This view has not changed. Based on the overall evidence at hand, I continue to believe that we are operating in an environment much like that of the 1966 to 1974 secular bear market, with the advance out of the 1966 Phase I low being similar in nature to the rally out of the 2009 low. Please see the charts at the end of this article for comparison. It is because of the fact that the preceding bull market, that peaked at the 2007 top, ran some 33 years, as opposed to the 24 year bull market that preceded the 1966 top, that this bear market is expected to also be proportionally longer in duration. We know, based upon our bull and bear market relationship studies, which have been discussed here many times in the past, that this secular bear market is expected to run some 10 to 12 years, which means that we shouldn't expect THE bear market bottom until the 2017 to 2019 timeframe. So, in the big picture, the bear market was not over at the 2009 low and it will not be over with the Phase II low either.

In accordance with orthodox Dow theory, the previously established trend is considered to be intact until it is authoritatively reversed. I have been telling my subscribers since June that the June low was not a secondary low point and that the June low should be violated. This has obviously now happened. I explained in my last post here that many would mistake a violation of the June low as being a so-called " Dow theory sell signal," which also happened. In reality is was the March low that marked the last secondary low point and as a result of the August 4th close below the March lows, the previously established bullish trend has been authoritatively reversed in accordance with orthodox Dow theory.

The question now is, " Is this the return of the bear market?" I don't think so, at least not yet. While I do respect the fact that we saw a trend change in accordance with Dow theory on August 4th, this is not the whole story. During the great bull market that ran between 1942 and 1966 there were several Dow theory trend changes that occurred. During that time, the leading Dow theorist, E. George Schaeffer, used other tools besides Dow theory to aid him as these trend changes occurred. In doing so, Mr. Schaeffer was able to remain invested in accordance with the longer-term secular bull market and used these periods of weakness as buying opportunities. Also, during the great secular bull market that ran between 1974 and 2007 there was also Dow theory trend changes that occurred throughout that period. But, once again, there was more to the story than just a Dow theory trend change and by understanding that and by having the ability to weigh the totality of the technical evidence, one could have better identified the more serious hazards, such as the 2000 and 2007 top, verses say the 1990 top or the 1998 top.

With this all said, there is also more to the story in regard to our current setup. Therefore, while I do respect this trend change, based on the additional tools that I have available to me through my trend quantification work and the statistical based research, I'm not convinced that the bear is back. In spite of my views that the rally out of the 2009 low is a bear market rally that should ultimately prove to separate Phase I from Phase II of the longer-term secular bear market, I do not believe that this Dow theory trend change in and of itself is ample evidence to suggest that the bear market is back. Explaining those details is not within the scope of this article, but are covered in the research letters and short-term updates. It is my belief that the markets are now making a secondary low point. By default, this means that a rally will follow. It will then be the technical details surrounding that rally that are more important to me that this decline. In fact, there is evidence that suggests this may be a very good buying opportunity and that we could still see a much more surprising rally than most anyone can imagine at this point. So, once again, the developments that follow in the wake of this secondary low point will be extremely important. If the trend quantification work and/or if the statistical data begins to fade, then at that time the technical picture will begin to change and this trend change will begin to carry more weight. If not, then it will begin to carry less weight as the bear market rally resumes.

10 August 2011

I have begun doing free market commentary that is available at

www.cyclesman.info/Articles.htm The specifics on Dow Theory, my statistics, model expectations, and timing are available through a subscription to Cycles News & Views and the short-term updates. I have gone back to the inception of the Dow Jones Industrial Average in 1896 and identified the common traits associated with all major market tops. Thus, I know with a high degree of probability what this bear market rally top will look like and how to identify it. These details are covered in the monthly research letters as it unfolds. I also provide important turn point analysis using the unique Cycle Turn Indicator on the stock market, the dollar, bonds, gold, silver, oil, gasoline, the XAU and more. A subscription includes access to the monthly issues of Cycles News & Views covering the Dow Theory, and very detailed statistical based analysis plus updates 3 times a week.

For your weekend reading....

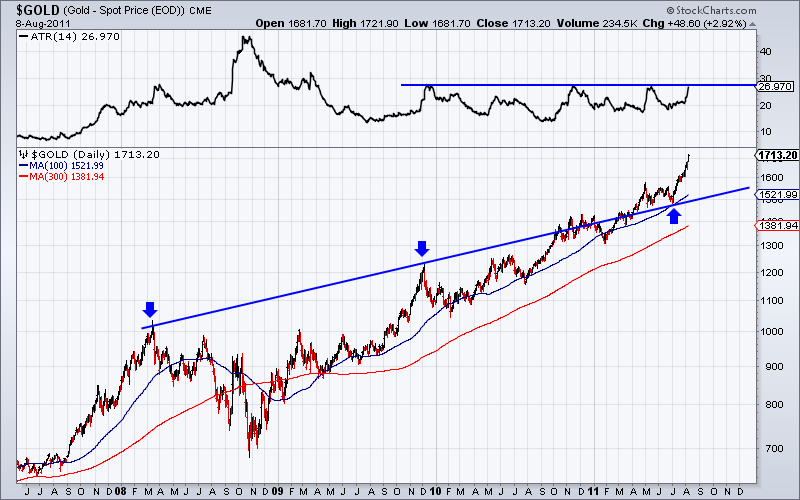

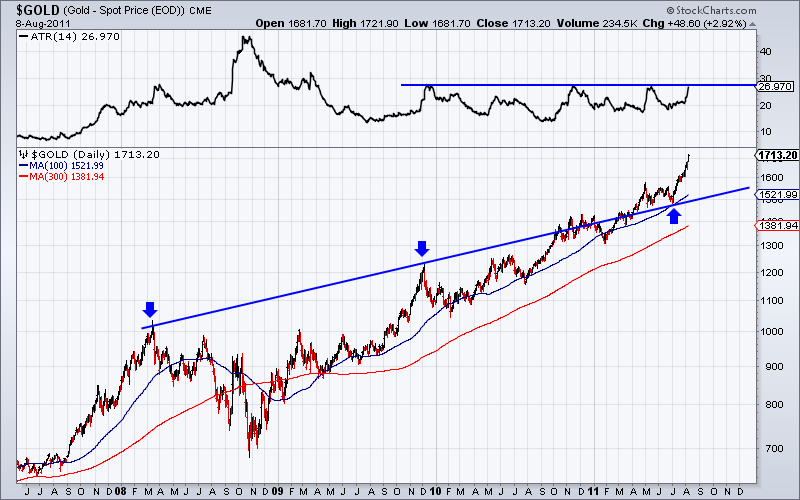

An Acceleration In Gold Has Begun

Jordan Roy-Byrne, CMT

9 August 2011

In recent months we've been talking and writing about a potential acceleration in Gold. The chart said we were close and in all honesty Gold has actually been in a state of gradual acceleration since the 2008 low. Furthermore, we'd noted that in most secular bull markets, accelerations usually begin in the 11th or 12th year and are totally obvious by the end of the 13th year. Given the move of the past five weeks, there is no reason to think otherwise. An acceleration in the bull market has begun and will take Gold to $2000/oz and quite a bit higher in the next 18 months.

In the chart below we show four different but parallel trendlines. Trendlines one and two contained the bull market from 2001 to 2005 while trendlines two and three contained the bull market from 2006 to early 2010. Since then the market has tried to break and hold above trendline four. It happened in April of this year and the recent low was a successful retest of the breakout. Secondly, we'd like to point out the strong Fibonacci targets at $1820 and $2300.  The next chart is a zoomed in look of the fourth trendline which connects the 2008 and 2009 highs and the June 2011 low. The top indicator is a volatility indicator. If it breaks higher then it could signal the start of parabolic move. Gold now has strong support at $1580 to $1600. A $100 or even $150 pullback wouldn't change the current state of acceleration

The next chart is a zoomed in look of the fourth trendline which connects the 2008 and 2009 highs and the June 2011 low. The top indicator is a volatility indicator. If it breaks higher then it could signal the start of parabolic move. Gold now has strong support at $1580 to $1600. A $100 or even $150 pullback wouldn't change the current state of acceleration  Sentiment has become more bullish. But that is only a reflection of an acceleration in a raging bull market. More and more will pile in as the trend accelerates… but so too does volatility. Readers are advised to increase positions on pullbacks, and to consider the gold and silver shares which are setting up for a fantastic 2012 and 2013.

Sentiment has become more bullish. But that is only a reflection of an acceleration in a raging bull market. More and more will pile in as the trend accelerates… but so too does volatility. Readers are advised to increase positions on pullbacks, and to consider the gold and silver shares which are setting up for a fantastic 2012 and 2013.

NEW YORK (Commodity Online) : Gold and oil finished lower Friday after five days of hectic trade, which saw the yellow metal hit a new record earlier in the week.

Analysts attributed the dips to mounting concern that the euro zone debt crisis and weak US economy could help push the world back into recession.

WTI crude closed at $85.38 a barrel on the New York Mercantile Exchange while London’s Brent crude ended slightly up at $108.03 a barrel on the ICE Futures Exchange.

For the week the WTI contract was off $1.50 from its close last Friday, but in between it swung as low a $75.71, as global stock markets plunged, revived and plunged again.

Analysts said the black gold is highly influenced by fears of more instability in the euro zone, Standard & Poor’s historic downgrade of the US sovereign credit rating, and the slow-growth picture behind the US Federal Reserve’s vowing to keep interest rates ultralow for two more years.

Meanwhile, Gold eased Friday as gold futures contract for December delivery declined 0.5 percent or $8.90 to $1,742.60 per ounce on Comex trading session of the New York Mercantile Exchange.

However, for the week, the precious yellow metal recorded gains up to 5.5 percent for the whole week and hit a record high of $1,801 per ounce on Wednesday.

On Thursday, CME said it would raise collateral requirements for benchmark 100-troy-ounce contracts by 22 percent, which likely contributed to a tighter Gold market Friday.

Silver too ended the last day of the week on a higher note as Silver futures contract for September delivery surged 1.2 percent or $0.44 to $39.11 per ounce. The respective contract gained 2.4 percent for the whole week.

Gold extends dip from record as risk appetite firms

* Gold extends retreat from record high near $1,815/oz

* Risk appetite picks up dollar, stocks, euro recover

* Largest gold ETF sees largest outflow since late January

By Jan Harvey

LONDON, Aug 12 (Reuters) - Gold prices fell on Friday,

extending the previous session's retreat from record highs as

fresh strength in equity markets and gains in the euro versus

the safe-haven Swiss franc pointed to sharper appetite for risk.

Spot gold was down 1.7 percent at $1,735.64 an ounce

at 1340 GMT. It is still on track for its best weekly

performance since November 2009, however, and has risen 22

percent so far this year on a potent mix of concerns over U.S.

and euro zone debt levels and economic growth.

The precious metal hit a record $1,813.79 an ounce early on

Thursday. Investors remain jittery over the outlook for the U.S.

economy, which could eventually spark a fresh rally in gold,

analysts said.

" Near term, a correction makes sense in relation to other

safe havens," said Macquarie analyst Hayden Atkins. " Gold has

traded in lockstep with U.S. government debt in particular. As

Treasuries have risen, gold has basically gone the same way."

" The question is, if people are more concerned about the

sovereign risks around the United States, added into the

problems elsewhere, will that relationship break down?

" That is what you would need for the gold price to go higher

-- for people to be reflecting their concerns more in gold than

in safe havens in general."

Gold hit a session low of $1,734.90 an ounce after Wall

Street stocks rose at the open after data showed U.S. retail

sales posted their biggest gain since March last month.

A rebound in stock markets in recent days has diverted some

investment from gold.

The world's largest gold-backed exchange-traded fund, New

York's SPDR Gold Trust , reported its biggest one-day

outflow since Jan. 25 on Thursday, with its holdings declining

by 23.6 tonnes, worth some $1.3 billion at current prices.

" Some ETF investors clearly view the recent gold's sharp

price rally as exaggerated and have taken profits as financial

markets calm," said Commerzbank in a note.

OUT IN FORCE

But overall risk-averse buyers have been out in force this

week, putting gold on track for its biggest one-week rise in

nearly two years, up 4.4 percent.

In the week ended Aug. 10, two of the largest gold ETFs,

SPDR and the iShares Gold Trust , had their fourth-biggest

week of net inflows, data from Lipper showed on Thursday.

On the physical market, robust investment demand in Asia

helped gold premiums in Hong Kong and Singapore remain steady.

" The gold market remains underpinned by the movement to

physical gold, which has persisted all week," said UBS in a

note. " European demand for small bars particularly, but also

coins, remains very strong. As the week has progressed Asian

physical demand, outside India, has been noticeably higher.

" We have also observed among existing and indeed new clients

this week a growing preference towards allocated gold instead of

metal account/unallocated gold. This is quite obvious among our

wealth management and private clients, but even among the fund

industry, interest in allocated gold is growing again.

" The move to real assets such as gold in physical form

signifies the heightened state of risk aversion at present."

While investment remains high, relatively little gold scrap

is being returned to the market, with much readily available

metal already having been sold.

Among other precious metals, silver was down 0.5

percent at $38.51 an ounce.

The gold:silver ratio, or the number of ounces of silver

needed to buy an ounce of gold, held near 46 on Friday, close to

its highest since early February, as silver underperformed gold.

Meanwhile, spot platinum was up 0.7 percent at

$1,795.20 an ounce, while spot palladium was up 0.7

percent at $743 an ounce.

Platinum prices edged back above those of gold after the two

metals reached parity for the first time since late 2008 early

this week, but gold may still regain its premium over platinum

if risk aversion rises once more, lifting gold as a safe-haven

and weighing on platinum as an industrial metal.

By Peter LaTonaAugust 12, 2011

Wild Week of Ups & Downs Ends on a High NoteThis was one of the most volatile weeks for the stock market in recent memory, but with today’s 125 point gain, stocks are only down 1% for the week. Gold prices were down sharply for most of the day, but have rallied back up towards even as we come to the close. Silver, platinum and palladium were up throughout the day. Is the worst of the selling over? Will aggressive buying come back in? Are we still on the verge of a double dip depression? There is a multitude of opinions, but does anyone really know? Stay tuned. It all begins again next week. The only true protection may lie in a well balanced and diversified portfolio, utilizing the four asset classes of stocks, bonds, cash and gold.

One thing we can be sure of is that all eyes will still be on Europe next week. Today,

the Italian government approved new austerity cuts aimed at avoiding another Greek situation for the European Central Bank (ECB). The ECB had insisted on these measures as they know the Italian economy is too large for them to bail-out. Italy’s Cabinet pushed through these cuts despite strong opposition from local government officials, who denounce these as unjust and damaging to the economy. Next Tuesday, we will be watching the Merkel (Germany)-Sarkozy (France) meeting with great interest. German Chancellor Merkel is coming under more and more political pressure regarding their financial support for the European Union.

At 4:15 PM(CT) the APMEX precious metal prices were:

- Gold price - $1,751.10 – down $2.40

- Silver price - $39.18 -up 41 cents

.................................................................................................................

It is time to diversify your portfolio or recover your losses in stocks.

To reach financially freedom, you need to invest in not just stocks.

Invest in land and get a double return in 4 to 5 years.

It is just about 0,70 lots of GLD for 1 unit of land.

http://www.niagarafallstourism.com/

How? Just leave me a private message (PM) here for details.

By Ryan SchwimmerAugust 12, 2011

GOOD NEWS IN U.S., EUROPE NOT TEMPERING DEMAND FOR SAFE HAVENRetail sales for July increased by 0.5%, allowing stock futures to add to gains this morning. Another closely-watched report to be released this morning is the University of Michigan’s August index of consumer sentiment. Expectations are that sentiment will have fallen to 62.0 from 63.7, but most are looking forward to next month’s report, which will take into account the U.S. credit rating downgrade and this week’s volatility in the market.

In Europe,

a ban on short-selling has supported a market rally after banks have taken major hits over the past week. This situation was also softened by data released by the European Central Bank that showed that the banks do not have liquidity issues, as previously speculated.

The Italian cabinet called a meeting today to approve a deal regarding balancing the budget in the next two years, easing fears of contagion of the European debt crisis. Many reports have surfaced recently that Italy was too big to bailout, so this is an important move.

Gold and silver are relatively flat this morning, as investors continue to seek the safe haven appeal of precious metals.

In fact, many “cash-for-gold” companies are having a hard time finding people willing to give up even their old jewelry for cash.

At 8:00 am (CT) the APMEX precious metals spot prices were:

- Gold – $1,749.20 – Down $4.40.

- Silver – $38.56 – Down $0.22.

gold price claw back, not good

Will you sell your gold when it reaches 2000 mark?

By Peter LaTonaAugust 11, 2011

JOBLESS CLAIMS DIP BUT U.S. TRADE DEFICIT WIDENSNew U.S. claims for unemployment benefits dropped by 7,000, thus reaching a four month low.

This was a better than expected result as expectations were for a slight upswing in benefits claims. The current seasonally adjusted total is 395,000. The four-week moving average for claims, which is considered to be the most important measure, dropped 3,250 to 405,000.

The positive jobless claims is somewhat offset by an unexpected widening in the U.S. trade gap. In June, the trade gap widened to its largest gap since October 2008, which is an indicator of a slowing global economy. Both U.S. imports and exports registered a decline.

Dow futures were up in early morning activity, but they along with global stocks are now retreating on continued concerns with the European banking system. The equities markets continue to be nervous, fast acting and volatile. The euro has fallen to a five-month low against a low-yielding yen, oil is going lower, and Italian and Spanish government bonds are higher due to the purchasing activities of the European Central Bank. The French banks continue to be under scrutiny despite assurances from credit rating agencies that their credit rating is not in jeopardy. There is a general distrust of the voices that come out and attempt to dissuade concerns that French banks are overexposed.

The Chicago Mercantile Exchange’s (CME) decision to raise gold trading margins is not expected to damper the world’s enthusiasm for gold. Gold prices were near record highs while trading in Asian markets on Thursday. " There's no way gold is going to come off anytime soon, regardless of how much the margins actually go up," said Kelvin Tay, Chief Investment Strategist at UBS Wealth Management Singapore. " You also have to consider the fact that (there is a) real lack of alternatives right now."

India, who is the world’s largest buyer of gold, is certainly not slowing down. In India, gold is most often purchased in the form of jewelry, and Indians are buying jewelry at a record pace despite record high prices. This is an important reminder the gold has a global market, and unlike stocks and bonds, you can buy and sell anywhere in the world, no matter how remote. Gold prices form from world demand and not any individual country.

At 8:15 AM (CT) the APMEX precious metal prices were:

- Gold price - $1,773.80 – down $12.30

- Silver price - $38.74 – down 70 cents

Gold eases from record high after CME margin hike

* Spot gold record at $1,813.79 U.S. gold at all-time high $1,817.6

* CME Group raises margin on U.S. gold futures

* Spot gold to retrace $1,775/oz -technicals

* Coming up: U.S. weekly initial jobless claims 1230 GMT

By James Regan and Rujun Shen

SYDNEY/SINGAPORE, Aug 11 (Reuters) - Gold eased on Thursday

from record highs struck earlier in the session after the CME

Group raised margins on COMEX gold futures, but turmoil in the

global financial markets and fears of slower growth will buoy

sentiment.

Spot gold hit an all-time high of $1,813.79, and U.S.

gold GCcv1 rose to a record high of $1,817.6 early in the day.

Both eased after the CME Group raised margins on

U.S. gold futures by 22.2 percent, driving spot gold down to

$1,790.29 an ounce by 0337 GMT, off 0.2 percent from the

previous close.

U.S. gold traded up 0.5 percent at $1,793.

" Historically when margins are raised significantly it tends

to cause a bit of sell-off," said Darren Heathcote, head of

trading at Investec Australia.

" We've seen some of it now, but it's difficult to see a

great deal of selling, because we are in very, very volatile and

uncertain times when markets are moving very violently. Gold has

proven too much of an attraction as an alternative investment

and the margins may not have as much influence."

On the relative strength index, spot gold fell to 82,

suggesting a heavily overbought market, although it was off its

earlier level near 86, the highest since October 2010.

But the rapid rise in prices has prompted concern of a price

retracement.

" Gold is overbought and things are looking a little risky,"

said a physical dealer in Hong Kong, who felt gold could fall

towards $1,750.

" But as the debt worries linger and the stock market is

still on the downslide, gold remains a safe haven."

Technical analysis suggested gold could fall to $1,775 an

ounce, said Reuters market analyst Wang Tao.

Gold's safe-haven allure has attracted investors fleeing the

risk of debt crisis contagion in Europe and slowing global

growth. Prices of cash gold have risen as much as 21 percent

since the end of June.

Stockmarket woes have helped push gold's ratio to the

S& P-500 stock index to its highest since 1988. But that

ratio remains far below its peaks of 1980 and the 1930s, and

gold is still below its inflation-adjusted record near $2,500.

Extreme market turmoil is forcing central banks to shift

policy. Central banks in Japan and Switzerland said they would

rein in the appreciation of their currencies, while the U.S.

Federal Reserve promised to keep rates near zero for at least

two more years.

" With the authorities in both Japan and Switzerland

announcing intentions to intervene to weaken their currencies,

gold remains the last protection against the potential for

widescale money printing as governments seek to recapitalise

their banks and restimulate their economies," UBS said in a

research note.

/

Gold prices to rise under loose monetary policy, public debt worries

11.8.11

(Kitco News) - Gold prices have set a series of record nominal price highs in recent days and market watchers expect the yellow metal to continue to press higher. The continued economic uncertainties – whether it is public debt in the Western countries or inflation in emerging markets – combined with the Federal Reserve’s declaration to keep U.S. interest rates floating between zero and 25 basis points until mid-2013 make gold an attractive asset.

This week several investment banks raised their forecast for gold prices. On Monday HSBC lifted its average price for 2011 to $1,590 an ounce and for 2012 to $1,625. Goldman Sachs raised their three, six and 12-month average price forecasts to $1,645, $1,730 and $1,860, respectively. On Tuesday, Commerzbank increased their third quarter average price outlook to $1,700 and the fourth quarter 2011 and first quarter 2012 to $1,800.

Kitco News interviewed several veteran market watchers for their outlook for gold prices this year and into the first quarter of 2012.

David Wilson, director, metals research, Societe Generale:“Everything points to more support for gold. We’re at $1,769 (an ounce) right now. With low interest rates (in the U.S.) that’s supportive because there are inflation concerns that can happen further out.” “Political prevarication” in both the European Union and the U.S. in dealing with their respective debt issues is another reason to give gold a boost. Prior to Standard & Poor’s downgrade of the U.S. debt rating he forecast gold rising to $1,800 by year’s end, but “I have to work on a new forecast for further upside.”

Afshin Nabavi, head of trading, MKS Finance:“As long as there are no solutions to the financial problems of the U.S. and the European Union, the market will continue to go higher…Any kind of short-term correction would be a good dip to buy into.” How high can gold go yet this year? “As they say, the sky is the limit,” he says with a laugh. “We saw $1,782 yesterday. $1,800 is probably the next psychological level. If that goes, we could head for the $2,000 area. It all depends on if they find any kind of solutions. “Technically, we haven’t had a correction since $1,580. We will see it (a correction) eventually once things calm down. But until then, we could continue to go higher and higher.”

George Gero, vice president and precious-metals strategist, RBC Capital Markets Global Futures:“I think probably some profit-taking (will occur) at some point, but nothing major until we see some clearance in the other markets.” He notes safe-haven demand continued as equities opened weaker. “The need for a haven hasn’t extended too much to other assets because none of them are acting as well as gold. Money managers look for performing assets.” It’s hard saying where gold will go, he says. “This actually could turn on a dime, just the way the stock market turned on a dime yesterday a few times. Gold yesterday at one point dropped $50 in a very short period of time…Also, there are more worried people in gold who tend to make headline(-based) decisions instead of investment decisions.”

Mark Leibovit, editor, VRTrader Newsletter:“Though there is theoretical risk back to $1,683 or so, I am still targeting gold to $2,000+…. The big question is whether short-term negative seasonality will even kick in here which calls for a pullback in August and sometimes September before the market launches again to the upside. It may all come down to the fact that so many investors had their fingers on the buy trigger anticipating a summer pullback, someone flinched and jumped the gun an off we went into the stratosphere.”

Mike Daly, gold and Silver specialist, PFGBEST:Gold is underpinned by U.S. concerns such as a still-soft economy and S& P’s downgrade of U.S. long-term debt. “Until we get our house in order here and can stop worrying about what is going on in Europe, people will want to stay in the gold market.” He looks for further support from the Indian “wedding season” that starts next month. “It doesn’t really matter what the price of gold is. It’s very hard to tell a bride she can’t have this on her wedding day. The quality of gold might be less. Instead of 24-karat, maybe it will be 18-karat or 14-karat or maybe it will be a combination of gold and silver.” He says $2,000 gold is possible by year end. “If things stay the same, $2,000 is not out of the realm at all. I keep trying to think of what will bring the market down. One of the things I thought would bring the market down would be if the FOMC started to raise rates. Well, they’ve basically said they’re not going to do that for two years…I think people have wised up since 2008 and become savvier and said that during times of economic chaos or uncertainty or whatever word you choose,

Gold and

Silver retain their value better.”

Michael Lewis, managing director, global head of commodities research, Deutsche Bank:“For the time being, we are leaving our $2,000 price target for 2012 unchanged. However, as we outlined a few years ago the likelihood of a bubble developing in the gold market is a high probability event given the appetite to buy gold when the US dollar is rising and falling, and to buy gold to hedge against inflation and deflation. On the indicators we measured and published in June last year, the gold price would need to hit USD2,960/oz to bring the gold price relative to the S& P500 back to the levels of the 1930s. For the time being this is not the economic scenario that we are forecasting, but, events in recent days have certainly moved us closer to this outcome. According to the gold options market, the probability of the gold price trading at the $1,800 level for the foreseeable future is a high probability. However, a move lower to $1,600 is considered a more likely scenario than a rise to $2,000. A view we do not share.”

Sterling Smith, commodity trading adviser and market analyst with Country Hedging:“Gold is getting overheated from a technical point of view. That said, the current environment is rather difficult and unique. Demand remains retail and institutional investors remains well-supported. Given the condition of the current global financial mess, despite its overheated nature I remain bullish on gold. In the near-term (Comex December gold) could go to $1,829 and beyond that $1,863. If something extreme happens, given the U.S. downgrade, gold is the safe haven given the ridiculous appreciation of the Swiss Franc, we could see $2,000 gold by Labor Day, but I doubt it. By the end of the year we could see $2,200-$2,250 which would about equal the inflation-adjust high set during the Carter administration.” Is gold going parabolic like silver did? “It’s acting a little like it, but gold’s characteristics are different. You have a little better holder in gold, less Michelle Bachman like in their behavior. If we put together a gold rally of up $400 two days in a row, then there would be serious parabolic concerns.”

Kevin Grady, gold trader on Comex floor, MF Global:“I do think the psychological number of $2,000 is attainable. The exchange may come out and raise margins and that will drop the price down, or something like that. But the bottom line is there really are no other reasons for gold to sell off right now. The one knock on gold is that it’s a non-interest-bearing asset. Why keep my money there? But if you look at what happened with bonds…you’re not getting any money there." U.S. 10-year Treasury note yields have fallen to the low 2% area. So there goes that argument (of gold not providing interest payments). So that’s why people are starting to drive into gold. I still say there is central-bank buying under the market and that’s why you’re not getting $100 to $200 corrections. You could get a push down of maybe $80. But I think down around those levels, it’s a very strong buy.”

Frank Lesh, broker and futures analyst with FuturePath Trading:“It depends on the markets at the moment and that will determine how long the fear trade goes on. There’s no reason to be short on gold at the moment. Even if there is a correction in gold, I expect people to buy on dips….The Fed keeping interest rates low until 2013 could also play a part in the rise. Higher interest rates could bring gold back down. At the moment, fear is driving gold.”

Spencer Patton, chief investment officer, Steel Vine Investments:

" In the short term, my thesis is that stocks will find some stability (after the recent sell-off). I think gold is ready for a pullback shortly, visiting the high $1,600s again over the next couple of weeks…However, I think that these pullbacks are buying opportunities in gold. I really don’t think that we have a massive decline ahead of us. I think the long-term trend is higher…You could see it moving toward $1,900 by year-end.”

Alexander Letourneau contributed to this story.

by Craig C. Calvin August 10, 2011

U.S. STOCKS FALL AMID EURPEAN DEBT WORRIES GOLD PRICES CONTINUE TO BREAK RECORDS

Stocks in the U.S. fell to their lowest level in nearly a year as a result of general concerns about the overall global economy and specific concerns that the European sovereign-debt crisis won’t be adequately contained.

The Dow closed with a 4.6% (520-point) drop, and the S& P 500 dropped 4.4%. A market strategist with Stifel Nicolaus & Co. explained the drop by saying, “The message is that the market is concerned about the financial industry.” He added, “…the banks are exposed to a deteriorating economy. The European debt crisis has a whole set of issues. The concern is about a spillover effect of that.”

Gold prices once again hit a record in trading today, at one point rising above $1,800 as investors continued to look to the precious metal as a safe haven from increasing economic uncertainties. James Dailey, a manager with TEAM Financial Management LLC, said in a phone interview today, “The race to debase currencies is on. Gold will continue to appreciate until there is a fundamental shift in government policies.” In the wake of Standard & Poor’s downgrade of the U.S.’s credit rating this past Friday, gold prices have increased $132.50 so far this week.

At 4:15 pm (CT), the APMEX precious metals spot prices were:

· Gold - $1,799.80 - Up $54.80

· Silver - $39.41 - Up $1.42

.................................................................................................................

It is time to diversify your portfolio or recover your losses in stocks.

To reach financially freedom, you need to invest in not just stocks.

Invest in land and get a double return in 4 to 5 years.

It is just about 0,70 lots of GLD for 1 unit of land.

http://www.niagarafallstourism.com/

How? Just leave me a private message (PM) here for details.

![Live New York Gold Chart [Kitco Inc.]](http://www.kitco.com/images/live/nygold.gif)