Short in oversold region and share price just above critical support is very risky.

I rather long now and Genting result is coming out. Generally will rally before result based on past movement.

I will change my view if 1.78 breached.

alexchia01 ( Date: 25-Jul-2011 12:21) Posted:

|

Even veteran stock players can lose money.

This is why it is so important to treat the stock

market with respect. If we don't respect the market,

the market will smack us. People who are very confident

of winning do not respect the market, they respect themselves

and their opinions more than they respect the market...

master ipunter is the legend kungfu master

rarely trade.. but once trade, must win :P

iPunter ( Date: 25-Jul-2011 14:09) Posted:

|

I only short at the juicy juicy peaks...

and never after it has fallen much.

for obvious reasons, namely

profit potential and also risk

of rebound on shirt-covering...

Joshua_0718 ( Date: 25-Jul-2011 14:01) Posted:

|

alexchia01 ( Date: 25-Jul-2011 12:21) Posted:

|

I just short Genting SP.

If you want to follow, short as long as Genting SP is $1.80 or below.

Set a Stop-Loss at $1.830.

T.P. is $1.50. A bit aggressive, but I think it's possible.

frOm the letters in the newspapers and online

sEEms lIke

sIngapOre hIred ALL the wrOng tAlent

at the tOp ? ? ? ?

What about non-fuel cost?

Letter from David Boey

IT IS not surprising that the recent application by the two public transport operators to increase bus and train fares has raised the ire of some commuters.

Consumers do not welcome price increases for goods or services for which an alternative is out of their reach.

It is surprising, therefore, that households have generally accepted the electricity tariff without much fuss.

This may be due to most of them believing, somewhat mistakenly, that the tariff is closely correlated to the price of fuel and, as price-takers, there is nothing much they can do about the latter. And because the tariff has risen less rapidly than the price of fuel this year, perhaps it cannot be all that bad.

However, the cost of fuel accounts for about only half the tariff.

One component of the tariff that has received scant scrutiny is the non-fuel generating cost — the amount paid to the electricity generating companies to cover their non-fuel expenses (such as depreciation, staff costs, taxes) and profit.

For the first nine months of this year, the average non-fuel generating cost (excluding Goods and Services Tax) stands at 6.63 Singapore cents/kWh, an increase of almost 18 per cent from the 5.62 cents/kWh for the corresponding period last year.

These cents translate into about S$480 million annually for domestic consumers in total, compared to about S$410 million last year (annualised and based on last year’s demand).

Domestic demand is less than one-fifth of total demand, however.

Including non-domestic consumers, the total non-fuel generating cost paid to the electricity generating companies may be as much as, if not more than, the S$1.4 billion in combined annual passenger revenues of SMRT and SBS Transit.

The percentage increase, at least for domestic consumers, is much more than the proposed 2.8-per-cent increase in bus and rail fares.

How much of it goes towards the generating companies’ profits?

OVERHEARD:

Singapore is only gOOd in

MONOPOLYING

and paying

TOP SALARIES

tO CORPORATE RUNNERS

Singapore is nOt flUId like MACAU

nOt STRATEGIC

and is CONCERNED with

HOUSEFOLD ISSUES like:

- NO FREE FOODS ? ? ? ?

- NO FREE COACHES ? ? ? ?

because

FREE FOODS would affect RETAIL FOOD SALE ? ? ? ?

FREE COACHES would affect SMRT & SBS TURNOVER ? ? ? ?

PURE PROTECTIONISM ? ? ? ?

focusy ( Date: 24-Jul-2011 11:31) Posted:

|

GENTING SP

has nO JUNCKET LICENCE

Y E T ? ? ? ?

after one and a half years in operations ? ? ??

focusy ( Date: 24-Jul-2011 11:31) Posted:

|

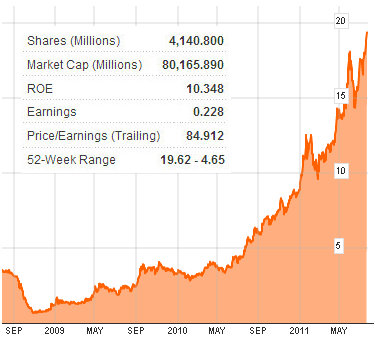

| GALAXY ENTERTAINMENT: Bingo! Up 1,700% in 2.5 years |

|

Excerpts from analyst reports...

Galaxy started 2009 at HK$1.06 and recently closed at HK$19.36 for a 1,700% return.

INVESTORS OF Genting Singapore, whose stock has been weak in recent months, might take heart from the amazing performance of Galaxy Entertainment (HK:27) which is listed on the Hong Kong Exchange. Get this: Galaxy has chalked up a 1,700% return since the start of 2009! And research house Capital Securities says that leading gaming and leisure firm would continue to enjoy a “supernormal growth era”, and is raising the target price to 28.08 hkd from 18.01, with a potential 51.5% upside. The “STRONG BUY” rating is maintained on Galaxy. “Via its subsidiary, Galaxy Casino, S.A., the Group holds one of six Macau gaming oncessions authorized to carry out casino games of chance in Macau. Based on our Discounted 3-Stage FCFE H Model with CAPM 11.2%, gs 15.0%, gl 3.0% and H factor of 4.0, we would like to upgrade our 12-month target price,” Capital said. The target price will result in EV of HK$121,271.0mn, with regard to FY11E Adjusted EBITDA of HK$5,018.9mn, EV/Adjusted EBITDA 24.2x.

Capital: Galaxy enjoying 'supernormal growth era'. Photo: Galaxy

The application of Discounted 3-Stage FCFE H model is due to the start of another “supernormal growth era” of the company, Capital added. “There is no point in arguing that Galaxy Macau will be the next growth driver, though the existing organic growth of StarWorld Hotel, Waldo casino, Rio casino, Grand Waldo should not be ignored. " Yes, competition is intensifying. Though, the cake is getting bigger and bigger.” Capital said that the winner will be those who completed their expansion plans as soon as possible. “As such, the beginning of operations for Galaxy Macau will be of paramount importance. Key risks include political and policy risks, interest rate risks, intensifying competition and uncertainties from the black market.” |

focusy ( Date: 24-Jul-2011 11:31) Posted:

|

HSBC Global Research upgrades Genting Singapore (GENS) to Overweight from Neutral.

HSBC analyst, Sean Monaghan, noted that the stock has been weak since the company reported 1Q11 results, which showed a slowing in earnings growth (excluding VIP win rate volatility).

" While we acknowledge the slow relative growth of the Singapore casino market vs. the regional peers such as Macau, we suggest the Singapore market offers an excellent platform for casino operators to generate reliable earnings and cash flow."

HSBC maintained its target price of SGD2.22/share, calculated based on a 10% premium to its sum of the parts valuation. For the upcoming 2Q results, HSBC sees an erosion in market share in the mass gaming segment but a retention of its dominant position in the international VIP segment.

HSBC believes GENS is in a position to generate substantial free cash flow from 2012 and will be in a sound position to fund future expansion initiatives or commence paying dividends.

1.79 now...traders are taking some money away from the table at the moment...

still in watch list.....

GALAXY ENTERTAINMENT: Bingo! Up 1,700% in 2.5 years

But some bets are more worthwhile than others. :)

You are talking the world inside out..........lol!!

iPunter ( Date: 22-Jul-2011 15:46) Posted:

|

niuyear ( Date: 22-Jul-2011 15:45) Posted:

|

iPunter ( Date: 22-Jul-2011 08:26) Posted:

|