Post Reply

261-280 of 416

Post Reply

261-280 of 416

SHIM = SHE + HIM = more powerful......

SGG_SGG ( Date: 13-Feb-2011 22:53) Posted:

Profile :

Male.. disgruntled and possibly offended by something that probably wasn't meant to offend.

Using psuedo ID just to post the comments. Probably still lurking here, maybe even friendly with the victim of the post! (just to keep the disguise)

Women are more straightforward :D heheheheh...

Andrew ( Date: 13-Feb-2011 22:44) Posted:

| Come to think about.......From the way it is written......read like the words of a woma |

|

|

|

Ya.....if only the ID can come forward.......but...

Women are more straightforward .......you must be kidding.......

SGG_SGG ( Date: 13-Feb-2011 22:53) Posted:

Profile :

Male.. disgruntled and possibly offended by something that probably wasn't meant to offend.

Using psuedo ID just to post the comments. Probably still lurking here, maybe even friendly with the victim of the post! (just to keep the disguise)

Women are more straightforward :D heheheheh...

Andrew ( Date: 13-Feb-2011 22:44) Posted:

| Come to think about.......From the way it is written......read like the words of a woma |

|

|

|

Forgot to include :

Probably suffering from D I S C! Highly frustrated you see.. hahahahaha....

SGG_SGG ( Date: 13-Feb-2011 22:53) Posted:

Profile :

Male.. disgruntled and possibly offended by something that probably wasn't meant to offend.

Using psuedo ID just to post the comments. Probably still lurking here, maybe even friendly with the victim of the post! (just to keep the disguise)

Women are more straightforward :D heheheheh...

Andrew ( Date: 13-Feb-2011 22:44) Posted:

| Come to think about.......From the way it is written......read like the words of a woma |

|

|

|

Profile :

Male.. disgruntled and possibly offended by something that probably wasn't meant to offend.

Using psuedo ID just to post the comments. Probably still lurking here, maybe even friendly with the victim of the post! (just to keep the disguise)

Women are more straightforward :D heheheheh...

Andrew ( Date: 13-Feb-2011 22:44) Posted:

Come to think about.......From the way it is written......read like the words of a woman

des_khor ( Date: 13-Feb-2011 22:27) Posted:

| hi ! are you still out there ? |

|

|

|

Gender Inclusive detected.

Putting a lot of tone in visual.

Strong ending per sentence.

Multitasking detected.

Man generally are indifferent as we are single task. Anyway, we have some other gift.

Just guessing..........so free......no mahjong.......heeeeeee

des_khor ( Date: 13-Feb-2011 22:45) Posted:

How to make you so sure ?? Maybe is shim ?

Andrew ( Date: 13-Feb-2011 22:44) Posted:

| Come to think about.......From the way it is written......read like the words of a woma |

|

|

|

Hahaha... so interesting...

Don't know when

Ris Low will be coming here to play shares one day...

Then maybe can 'disturb' her a bit (poke fun at, '

kai wan xiao') ...

Andrew ( Date: 13-Feb-2011 22:44) Posted:

Come to think about.......From the way it is written......read like the words of a woman

des_khor ( Date: 13-Feb-2011 22:27) Posted:

| hi ! are you still out there ? |

|

|

|

How to make you so sure ?? Maybe is shim ?

Andrew ( Date: 13-Feb-2011 22:44) Posted:

Come to think about.......From the way it is written......read like the words of a woman

des_khor ( Date: 13-Feb-2011 22:27) Posted:

| hi ! are you still out there ? |

|

|

|

Come to think about.......From the way it is written......read like the words of a woman

des_khor ( Date: 13-Feb-2011 22:27) Posted:

hi ! are you still out there ??

des_khor ( Date: 11-Feb-2011 00:18) Posted:

Wow !!

you must be lost a lot of your hard earn money since Monday.....

you must be one of the failure BB ......

you must be the most need seeking attention from SJ.......

you must be either either GOD or MFT ....

TRUE or FALSE ? |

|

|

|

hi ! are you still out there ??

des_khor ( Date: 11-Feb-2011 00:18) Posted:

Wow !!

you must be lost a lot of your hard earn money since Monday.....

you must be one of the failure BB ......

you must be the most need seeking attention from SJ.......

you must be either either GOD or MFT ....

TRUE or FALSE ??

ofcauseme ( Date: 10-Feb-2011 17:44) Posted:

I have been observing all your posts.U r a truely no nosense guy/girl.In another word,u r LOUD,IMPATIENT n VERY VERY ATTENTION SEEKING.

U play very BIG is it? Judging from your posts,I cant help but noticed that u r only a small fry who always scream WHO IS GOD OR MFT........... etc etc.Always kapo and give advices to others where they did not even ask for any.Trust me,even if they wanted any advice,u r sure sure to be the last one.

KNN buy a few lot of penny share like Longcheer etc,lost a few bucks then make so much noise.Let me tell u,to live,u need to be humble.Obviously,u r not or maybe u know but afraid that ''eating'' too much humble pie u will grow FAT.

To be able to post this message,I took the trouble to be registered as a member of sharejunction,this shows how much i wanted to send this msg to u.PLEASE WAKE UP and dont be so ATTENTION SEEKING ANYMORE.

By the way,if you cant have sex,then dont have sex(dont think viagra can help u),if you got no mood to eat,try eating ''humble pie''.Please dont be angry,I merely trying to help you live again |

|

|

|

* The table above displays the monthly average.

The "

Hulumas" super printer, of course...

hehehe...

DelphinusSnow ( Date: 13-Feb-2011 02:44) Posted:

yea..good idea....i have to start my own QE1 soon....which printer the bestest?

Hulumas ( Date: 12-Feb-2011 20:19) Posted:

| Just keep buying that will do best |

|

|

|

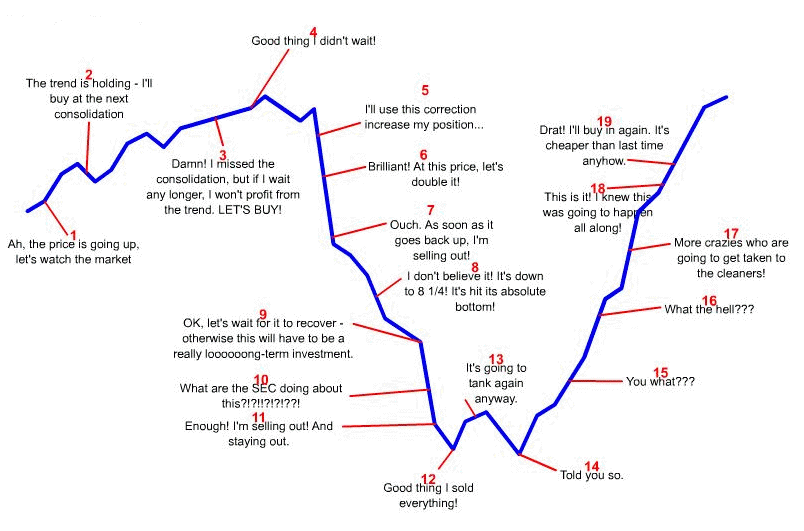

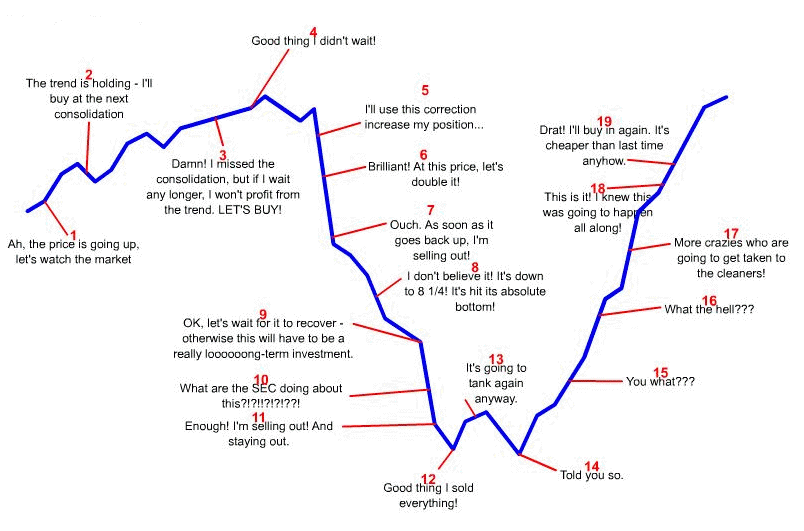

Where are we now in this investor psychology???

yea..good idea....i have to start my own QE1 soon....which printer the bestest?

Hulumas ( Date: 12-Feb-2011 20:19) Posted:

Just keep buying that will do best!

tiancai007 ( Date: 11-Feb-2011 19:54) Posted:

|

The lao sai has to stop. If not, then really need to go hospital diao shui for food poisoning... 残 !

|

|

|

|

Everything You Ever Wanted To Know About The Worls's Battle With Inflation But Were Afraid To Ask

It is the du jour worry in the back of the minds of every investor and regular person on the street. But do people actually know what it means or how it works?

Prices are rising, that's a fact. The U.S. Consumer Price Index and the CPI of any countries around the world indicate that prices are increasing on a variety of goods.

But that's not necessarily a bad thing. Price increases suggest growth. And right now, the U.S. economy is growing, as are economies like China, India, and Germany. But that's only one of the reasons prices are increasing across the U.S. and the world.

Another reason is the weather. The weather has slammed the global economy, reduced crop output, and increased prices for food around the world. All at a time where supplies were already low, and demand was rebounding.

But there's another lingering concern that all of the money the Federal Reserve and other central banks have added to the international finance system to combat the economic downturn is now moving from bank balance sheets to the market.

That stimulus is fueling the economic growth that driving the global recovery. It has been particularly effective in Asia, where now policy markers are pulling back those measures as inflation rises.

Where do we stand in the current conflict with inflation? And how did we get here in the first place?

The rebound in Asia was driven by aggressive fiscal and monetary policy

Asia's biggest economies, all concerned about the extent of the international downturn, put in place stimulus packages in 2009 and 2010 to pull their economies from the brink. This stimulus was both fiscal and monetary in nature, meaning it included the easing of interest rates and spending on infrastructure projects.

China's program included extensive loans, which eventually increased the country's loan to GDP ratio to 117.4% in 2009. China's fiscal program was worth $586 billion.

Source: Morgan Stanley, Wikipedia

The stimulus injection in Asia turned around the region's economies way faster than expected

What happened is, while Asia had been busy stimulating domestic demand through loans and other stimulus, the west turned it around too, with the U.S. and Europe both engaging in massive stimulus programs.

This coordinated world stimulus made the recession rebound take just as much time as those from the two previous Asian downturns, while it was much deeper.

That means the turnaround was way bigger, and inflation rose with it.

Source: Morgan Stanley

The inflation rebound hit the entire region, with China and India feeling it the most

But putting this in perspective: This spike is now weakening, and recent inflation, at its peak, is only back to 2008 levels.

This is not just an Asian phenomenon: Inflation is rising in Latin America too

In fact, it's pretty much up in every emerging market

One of the items impacted by price increases is food

You can see the rebound in food price inflation occurred just as Asia's economies turned around. That suggests the price spike was associated with the return of rampant Asian growth, as well as a push through impact of regional monetary stimulus.

The price spikes are a lot like those in 2008, but as of yet are not as high.

Source: Citi

Beyond the rebound in demand, Asia has been hit by the effects of the weather event La Nina

This reduces the supply side of the food equation. So while the region is rebounding, more people are employed, and spending is up, the supply of food is down.

Citi say that even before the weather effects were in place, there was a low supply of food stocks in Asia.

Source: Citi

Food prices have a large impact on headline inflation because they're weighted heavily in indices.

In some countries, the weight is as high as 50%. Notably, in China, the weight is over 30%. And while in India, food makes up a smaller portion of the country's CPI basket, it's also

at record highs.

Energy prices, fueled by the global rebound, are also contributing to the spike in food prices

The increase in energy prices is adding to the increase in food prices, through and rise in the cost of transporting goods. But the rise is oil prices is also increasing demand for biofuels, made from soya and corn.

Demand for oil has rebounded with the global recovery.

But it's important to note: WTI crude prices are actually down 40% from 2008.

Source: Citi

But how does the Asian inflation story get passed on to the U.S.?

The rising costs in China will eventually be passed on to U.S. consumers. As wages and commodity prices increase the cost of producing goods in China, so to will they increase the costs U.S. consumers pay when they shop.

Source: Societe Generale

But the recovery in the U.S. is also a chief cause for the rise in inflation

Inflation expectations in the United States have increased as the recovery has taken hold. That's only natural: the economy does better, people expect prices to rise.

Source: Societe Generale

But there's reason to believe this inflation spike will soon be tamed

The emerging world is in line for a significant round of monetary tightening. China, India, and Brazil have already started. Latin America is expected to tighten big this year. It's only Russia that is not.

Tightening outlook for the rest of 2011, according to Citi:

- Brazil will raise rates by 1.5%

- China will raise rates by 0.75%

- India will raise rates by 0.5%

Source: Citi

Simultaneously, the weather is getting better

Farmers are going to plant more as result of this past year's high prices. And weather should, theoretically, improve over the course of 2011, and the La Nina effect dims.

Source: Citi

China Spends $1 Billion To Fight Massive Drought Wrecking Country's Wheat Crop

China has announced $1 billion in funding to help farmers fight the country's devastating droughts, according to The Guardian.

The country is facing its worst drought in 60 years right where it hurts the most, the wheat producing province of Shangdong.

Beyond the impact on the country's wheat crop, the drought has left 2.81 million people without drinking water, according to Xinhuanet.

China is not alone in its wheat crop problems. Russia, after a summer of wildfires, has canceled exports and recent floods in Australia have damaged crops.

Things to note this week--Was due to this that start fund pulling out, following by Egypt polictical crises.

yummygd ( Date: 12-Feb-2011 20:13) Posted:

market corrected from 3300 (around) till now around 300 points liao.But by percentage its only around 10 percent(from top) so lets say now great singapore sale is only 10 percent. so if it falls another 10 percent for a 20 percent discount.....we might have to wait for another month?

iwonder ( Date: 11-Feb-2011 22:02) Posted:

Not to worry...after one week of bashing, things will look up again

The selling is overdone.....time to accumulate...must bu |

|

|

|

Dearest Hulumas, I like u a lot, u guy or gal or? Cause wait i W@# dream wrong target. Rose Hulumas, to prove my love to u, u buy i buy, u sell i sell.

PS: Your Love Begger

Hulumas ( Date: 12-Feb-2011 20:19) Posted:

Just keep buying that will do best!

tiancai007 ( Date: 11-Feb-2011 19:54) Posted:

|

The lao sai has to stop. If not, then really need to go hospital diao shui for food poisoning... 残 !

|

|

|

|

Just keep buying that will do best!

tiancai007 ( Date: 11-Feb-2011 19:54) Posted:

The lao sai has to stop. If not, then really need to go hospital diao shui for food poisoning... 残 !

DelphinusSnow ( Date: 11-Feb-2011 19:41) Posted:

| yalor...strange leh...are the unrest in Egypt and i/r hike in China so powderful??? economists say investors pouring back into US market...really meh...they not scared US bubble will burst soon with all those fiat money (and more coming) floating around meh? Waliao....I SEE RED everyday in my portfolio...cham man.. |

|

|

|

Sifu is right...

Making money in the stock market is hard... because the game is

always never over.

This is why many who are accountants, professional market analysts, etc lose money too.

Many who have lost before always want to 'take revenge' and make back their previous losses.

But unfortunately, the stock market does not work that way.

This is because the greater the desire to win it back, the more will be lost...

warrenbegger ( Date: 11-Feb-2011 21:13) Posted:

I think those scare here and there better go catch fish, catch butterfly or go fly kite better. No one can win or lose forever, but those who learn to be wiser will win more and those who never learn or learn the wrong thing will lose more. Even u do all the right thing and sometime unlucky luck just kill u, u will never know. That life, very very unfair.

sinetic8 ( Date: 11-Feb-2011 20:46) Posted:

Today my close friend cum broker told me.

" stocks surging u scared to go in, scared correction. stocks plunging, u also scared to go in, scared plunge further. Like that u might just stay sideline and watch show better" .

|

|

|

|

market corrected from 3300 (around) till now around 300 points liao.But by percentage its only around 10 percent(from top) so lets say now great singapore sale is only 10 percent. so if it falls another 10 percent for a 20 percent discount.....we might have to wait for another month?

iwonder ( Date: 11-Feb-2011 22:02) Posted:

Not to worry...after one week of bashing, things will look up again

The selling is overdone.....time to accumulate...must buy

elton81 ( Date: 11-Feb-2011 21:52) Posted:

| i kena left right left right up down up down select start. ultimate combo |

|

|

|