Stocks make a late-stage comeback

By Hibah Yousuf, staff reporter December 3, 2010: 4:42 PM ET

By Hibah Yousuf, staff reporter December 3, 2010: 4:42 PM ET

NEW YORK (CNNMoney.com) -- Stocks turned higher during the last hour of trade Friday, as investors moved beyond the report that showed U.S. job growth in November was much slower than expected. Instead, they focused on what favorable policy decisions might be triggered by the disappointing numbers.

The Dow Jones industrial average (INDU) rose 20 points, or 0.2%, led by gains in Bank of America (BAC, Fortune 500), as well as the materials sector, including DuPont (DD, Fortune 500), Alcoa (AA, Fortune 500) and Caterpillar (CAT, Fortune 500).

The S&P 500 (SPX) added 3 points, or 0.3%. The tech-heavy Nasdaq (COMP) drifted into positive territory earlier in the day, and finished up 12 points, or 0.5%.

Earlier in they day, stocks were lower as market's responded to the "surprisingly lousy jobs report," but even the negative reaction was "muted," said Timothy Ghriskey, chief investment officer at Solaris Asset Management.

"The market is looking beyond the current employment conditions and is looking forward to prospects of improvement," Ghriskey said. "The weakness in the labor market does justify the Fed's decision to keep buying more securities and keep interest rates low, and it gives Congress ammunitions to extend the Bush tax cuts."

Ghriskey also noted that the market's reaction confirms underlying strength in the stock market.

"At today's valuations, dividend yields and corporate cash levels -- stocks are a bargain, and that continues to draw investors into the market," he said.

Investors have been buying up stocks and other risky assets this week, following a batch of mostly positive economic indicators.

All three major indexes ending more than 2% higher, with the S&P 500 gaining almost 3%. The broad index is just a point shy of the 2-year high it hit early November.

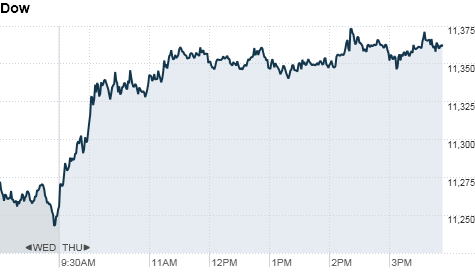

Stocks staged a big rally Thursday, as investors cheered strong retail sales figures and a pledge of support from the European Central Bank. Thursday's gains came on top of Wednesday's powerful rebound, which pushed the Dow near its highs for the year and lifted the S&P 500 above the key technical level of 1,200 points.

Economy: The U.S. economy added 39,000 jobs in November -- the lowest number since September, the Labor Department said.

The total fell far short of expectations. An exclusive CNNMoney.com panel of economists had forecast a gain in payrolls of 150,000 jobs, with some even going as high as 200,000.

The unemployment rate rose to 9.8% after holding at 9.6% for several months.

President Obama's fiscal commission convened to cast a final vote on the controversial plan to slash $4 trillion in federal debt. While the plan drew bipartisan support -- with 11 of 18 members voting yes -- the result still fell short of the 14 votes needed, in order for the commission to present its recommendations to Congress for a legislative vote.

A separate government report showed that factory orders fell in October, dropping 0.9%, for the first time in 4 months. The numbers followed a 3% gain in September. Economists were expecting orders to fall 1.3%.

The Institute for Supply Management's November index on manufacturing activity rose to 55.0, beating expectations. It was 54.3 the month prior.

Companies: Walter Energy (WLT) will buy Western Coal for $3.3 billion, the companies announced Friday. Walter Energy will pay $11.50 per share for the Canadian coal company, creating one of the world's largest publicly-traded producers of steel-making coal. Shares were up 4.7%.

Shares of Ford (F, Fortune 500) edged up 0.1%, after the automaker reported a 20% increase in November sales on Thursday.

World markets: As part of its battle with inflation, China will move to a more "prudent" monetary policy stance next year, the nation's Political Bureau said. The announcement was made Thursday morning in a report by Xinhua -- the government's official news agency.

The report stated that the move away from a "relatively loose" policy, put in place during the global recession in 2009, is aimed at curbing rising prices in China. The People's Bank of China hiked its benchmark interest rate in October, and raised the reserve requirement ratio for banks twice within one month, according to the report.

Asian markets ended the session mixed. The Shanghai Composite was flat, the Hang Seng in Hong Kong slipped 0.5% and Japan's Nikkei rose 0.1%.

European stocks also finished mixed. Britain's FTSE 100 fell 0.4% and the DAX in Germany slipped 0.1%. France's CAC 40 rose 0.1%.

Currencies and commodities: The dollar fell against the euro, the Japanese yen and the British pound.

Oil for January delivery rose $1.19 to settle at $88.19 a barrel, the highest since October 2008.

Gold futures for February delivery rose $16.90, or 1.2%, to finish at a record $1,406.20 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury was unchanged and the yield held steady at 3%.

Dec 3, 2010

STI higher at midday

SINGAPORE shares were higher at midday on Friday, with the benchmark Straits Times Index at 3,201.97, up 0.13 per cent, or 4.01 points.

About 635.7 million shares exchanged hands.

Gainers beat losers 170 to 166.

Stocks extend rally on retail cheer

By Blake Ellis, staff reporterDecember 2, 2010: 5:26 PM ET

By Blake Ellis, staff reporterDecember 2, 2010: 5:26 PM ET

NEW YORK (CNNMoney.com) -- U.S. stocks rallied 1% Thursday, building on the previous session's big gains, as investors cheered strong retail sales and welcomed the European Central Bank's plan to extend liquidity measures.

The Dow Jones industrial average (INDU) jumped 107 points, or 1%; the S&P 500 (SPX) climbed 15 points, or 1.3%; and the Nasdaq (COMP) rose 30 points, or 1.2%.

Gains were broad-based, with all but three of the Dow 30 rising. Home Depot (HD, Fortune 500), Alcoa (AA, Fortune 500) and Bank of America (BAC, Fortune 500) led the advances.

Retailers helped prop up stocks as strong chain-store sales rolled in, signaling consumers are loosening their purse strings. Shares of Abercrombie (ANF), Dillards (DDS, Fortune 500) and JCPenney (JCP, Fortune 500) all jumped.

"This continues the trend we've been seeing in the past couple months of retail sales being better than expected," said Ryan Detrick, senior technical strategist Schaeffer's Investment Research. "It's a very positive signal that consumers are coming back and confidence is coming back with them."

Signs of economic strength sent stocks soaring Wednesday, with all three major indexes surging more than 2%. The blue-chip Dow index added 249 points, its biggest one-day gain since early September.

That momentum continued Thursday after the ECB announced it will continue its stimulus measures and will keep buying government bonds.

"The [announcement] was largely expected, but there's a bit of relief in the market that they aren't withdrawing liquidity," said Ryan Atkinson, vice president at Balestra Capital. "There's a feeling that the monetary authorities can support the [debt] issue, and for the time being that's all investors need."

Recently, investors have worried that Spain will be the next domino to fall in Europe. But Spain does not intend to tap the European Union fund, Spanish Prime Minister Jose Luis Rodriguez Zapatero said in a CNBC interview Thursday morning.

Economy: An encouraging report on the housing market helped stocks extend an early rally.

After the start of trading, the National Association of Realtors said its pending home sales index surged 10.4% in October after slipping 1.8% in September. The index, which measures sales contracts for existing homes, was expected to be unchanged.

"Economic data is looking better all around," said Atkinson. "Data has continued to beat expectations over the past few weeks, so investors are staying hopeful that the economy will continue to grow."

The upbeat housing report overshadowed a slightly worse than expected report on jobless claims. The government reported that the number of Americans filing for first-time unemployment rose to 436,000 last week, while economists polled by Briefing.com had expected 422,000 new claims.

A big week for jobs data culminates with the government's key monthly jobs report due before the opening bell on Friday: Employers are expected to have added 130,000 jobs in November after adding 151,000 jobs in October. The unemployment rate is expected to remain unchanged at 9.6%.

Investors were also looking at reports from top retailers on their November same-store sales, which will give a taste of the holiday shopping season ahead. Discount food shopping giant Costco (COST, Fortune 500) announced that its sales were up 9% year over year. Clothing brand Abercrombie & Fitch (ANF) reported sales were up 22%, and Macy's (M, Fortune 500) showed an increase of 6.1%. Same-store sales measure sales at stores open at least a year.

World markets: European stocks climbed. Britain's FTSE 100 finished 2.2% higher, the DAX in Germany climbed 1.3% and France's CAC 40 gained 2.1%.

Asian markets also had a solid day. The Shanghai Composite Index added 0.7%, the Hang Seng in Hong Kong added 0.9% and Japan's Nikkei jumped 1.8%.

Companies: Food and beverage giant PepsiCo (PEP, Fortune 500) said it would buy Russian food and beverage company Wimm-Bill-Dann Foods (WBD) for nearly $5.8 billion. The purchase will establish PepsiCo as the largest food and beverage business in Russia. Shares of PepsiCo dipped slightly.

Johnson & Johnson (JNJ, Fortune 500) announced that it is recalling 12 million bottles of over-the-counter Mylanta and almost 85,000 bottles of its AlternaGel liquid antacid. Shares of Johnson & Johnson edged up modestly.

Currencies and commodities: The dollar rose against the euro and the British pound, but slipped versus the Japanese yen.

Oil for January delivery rose $1.25 to settle at $88 a barrel.

Gold futures for February delivery gained $1 to settle at $1,389.30 an ounce.

Bonds: The yield on the benchmark 10-year U.S. Treasury rose to 3% from 2.96% on Wednesday. The 10-year yield hasn't been at 3% since late July.

Dec 2, 2010

STI higher at midday

SINGAPORE shares were higher at midday on Thursday, with the benchmark Straits Times Index at 3,199.76, up 0.56 per cent, or 17.82 points.

About 955.3 million shares exchanged hands.

Gainers beat losers 288 to 116.

Stocks rally: Dow soars 249 points

NEW YORK (CNNMoney.com) -- Stocks surged over 2% Wednesday as signs of economic strength in the United States and China tempered worries about the European debt crisis.

The Dow Jones industrial average (INDU) soared 249 points, or 2.3%, to close at 11,256. The S&P 500 (SPX) jumped 25 points, or 2.2%, to 1,206. The Nasdaq (COMP) added 51 points, or 2%, to 2,549.

It was the biggest one-day gain for the Dow since early September, and came after stocks ended November on a sour note, with all three major gauges marking declines for the month.

Stocks opened sharply higher Wednesday as investors cheered a batch of upbeat economic reports, including a strong gain in private-sector payrolls and better-than-expected auto sales.

The rally gained momentum after economists at Goldman Sachs (GS, Fortune 500) raised their forecast for U.S. growth next year to 2.7% from 1.9%. The Federal Reserve's latest snapshot of economic conditions showed the nation's gradual recovery continued in October and November.

"There's a growing sense the economy isn't doing as badly as was priced in three months ago," said Brian Gendreau, market strategist at Financial Network. "All it took was mixed news to price out the double-dip recession, now we're getting genuinely good news."

The improved outlook for U.S. growth temporarily overshadowed concerns about the debt problems facing some European economies. Those jitters were further eased by comments from the head of the European Central Bank, which raised speculation that the ECB is prepared to take additional steps to aid the European economy.

Meanwhile, investors also welcomed a robust reading on manufacturing activity in China, which helped lift shares of major U.S. multinationals, as well as companies in the industrial and materials sectors.

All 30 Dow issues were higher. Home Depot (HD, Fortune 500) was biggest gainer on the blue-chip average, rising nearly 5%. United Technologies (UTX, Fortune 500), Microsoft (MSFT, Fortune 500) and Alcoa (AA, Fortune 500) all gained over 3%.

"There is some chance that this is an effort to get the rally back on track," said Bruce McCain, chief investment strategist at Key Private Bank, in reference to Wednesday's advance.

Stocks powered higher in September and October, before worries about eurozone debt damped enthusiasm in late November.

While it remains to be seen if the market can hold Wednesday's gains in the coming days, "there is evidence that the risk trade is coming back into the market," said McCain.

Looking ahead, the ECB is scheduled to release a policy statement early Thursday at the end its regularly scheduled meeting, and investors are expecting some form of stimulus to be unveiled.

The ECB statement is "the next big hurdle" for stocks, said Paul Zemksy, head of asset allocation at ING Investment Management.

"All expectations are for something positive to come out of the ECB meeting," he said. "If not, it could be a rough day."

Stocks fell Tuesday, as weak housing data and worries about the debt crisis in Europe overshadowed a better-than-expected report on consumer confidence.

Economy: Monthly data from payroll processing firm ADP showed an unexpectedly high gain of 93,000 private sector jobs in November.

It marked the biggest increase in three years and overshadowed an earlier report on planned job cuts in November from outplacement firm Challenger, Gray & Christmas.

Separately, the Institute of Supply Management's index of manufacturing activity edged down slightly in November to 56.6 from 56.9 the month before. Any reading above 50 signals expansion in the sector.

A government report showed that construction spending rose 0.7% in October, beating analysts' expectations of a 0.5% decrease.

The Federal Reserve's Beige Book, a snapshot of economic conditions across the central bank's 12 districts, showed that growth continued to improve in most U.S. regions from early October to mid-November.

World markets: Asian markets all ended higher after a couple of reports showed strength in China's economy. The Shanghai Composite added 0.1%, the Hang Seng in Hong Kong gained 1% and Japan's Nikkei rose 0.5%.

European stocks followed Asian market's rally. Britain's FTSE 100 rose 2%, the DAX in Germany added 2.6% and France's CAC 40 ticked up 1.6%.

The advance in Europe came after comments from ECB chairman Jean-Claude Trichet raised bets that the central bank could announce plans to buying more assets, a strategy known as quantitative easing, after a policy meeting Thursday.

"Trichet referred to bond purchases as 'ongoing,' which raises questions over whether the ECB will unleash its own version of quantitative easing," Ashraf Laidi, chief market strategist at CMC Markets, said in a note to clients.

If it does decide to buy assets, the ECB would be following in the footsteps of the Fed, which pledged last month to buy another $600 billion worth of Treasury bonds.

Companies: General Motors, fresh off its initial public offering, reported an 11% year-over-year increase in November new vehicle sales.

Rival automaker Ford (F, Fortune 500) reported a 20% rise in monthly sales, while Toyota (TM) sales fell 3.2% in November.

In the tech sector, Verizon (VZ, Fortune 500) detailed the company's 4G network launch.

Shares of Bank of America (BAC, Fortune 500) were up 1.3% after the bank dismissed speculation that whistle-blower WikiLeaks had information that could be damaging to the company. BofA shares fell 3% on Tuesday.

Currencies and commodities: The dollar fell against the euro and the British pound, but gained against the Japanese yen.

Oil for January delivery jumped $2.63 to $86.73 a barrel.

Gold futures for February delivery rose $2.20 to $1,387.20 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 2.92% from 2.81% late Tuesday.

Dec 1, 2010

STI lower at midday

SINGAPORE shares were lower at midday on Wednesday, with the benchmark Straits Times Index at 3,143.93, down 0.02 per cent, or 0.77 points.

About 527.3 million shares exchanged hands.

Losers beat gainers 177 to 134.

soloman ( Date: 30-Nov-2010 21:10) Posted:

|

Stocks end November with a whimper

By Julianne Pepitone, staff reporterNovember 30, 2010: 4:31 PM ET

By Julianne Pepitone, staff reporterNovember 30, 2010: 4:31 PM ET

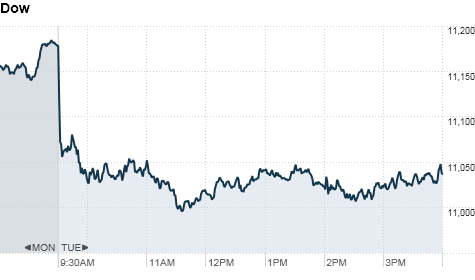

NEW YORK (CNNMoney.com) -- Stocks started November with a bang but ended it with a whimper, as all three major indexes closed the day and month lower on Tuesday.

A stronger-than-expected report on consumer confidence muffled some losses, but the market couldn't fully recover from a weak housing report and concerns about Europe's economy.

The Dow Jones industrial average (INDU) lost 46 points, or 0.4%, but remained barely above the 11,000 mark at 11,006.02. The S&P 500 (SPX) fell 7 points, or 0.6%, to close at 1,180.55, and the Nasdaq (COMP) dropped 27 points, or 1.1%, to end at 2,498.83.

It was a downbeat end to a month that started out strong. The Dow and Nasdaq shot to two-year highs in early November after the Republican success in the Congressional election and the Federal Reserve's announcement of a second round of economy-boosting asset purchases.

But U.S. markets have been whipsawed by overseas worries about debt-ridden European economies, including Ireland, Portugal and Spain. Late Tuesday, S&P said it put Portugal's long- and short-term credit ratings on watch.

The Dow fell by triple digits at Tuesday's open. But the market got a boost when the Conference Board's index of consumer confidence came in above forecasts.

"Clearly we're not seeing a complete breakdown, but cautiousness is definitely in the air," said Kenny Landgraf, principal and founder at Kenjol Capital Management.

"On the upside, the domestic market is much stronger than international markets," Landgraf added. "Europe concerns have really been prolonged, and it seems like new countries keep tacking on more worries."

Stocks ended lower Monday, although a late-session surge eased early losses.

Economy: The Conference Board's index of consumer confidence rose more than expected to 54.1 in November from a downwardly revised 49.9 in October. Economists expected the index to come in at 52.

The Case-Shiller index of home prices in 20 major U.S. markets brought bad news: Home prices fell 2% in the third quarter after mostly steady gains since early 2009. Economists expected prices to rise 1% in September, according to a consensus of economists by Briefing.com.

A measure of manufacturing in the Chicago area showed an unexpected uptick in the pace of activity this month. The Chicago PMI index ticked up to 62.5 in November from 60.6 in October. Economists expected a slight drop. Any index reading over 50 indicates expansion.

Late Tuesday, the co-chairmen of President Obama's debt panel said they will delay a vote on final recommendations until Friday. The panel will release a report Wednesday as originally scheduled.

World markets: Asian markets closed lower. The Shanghai Composite lost 1.6%, the Hang Seng in Hong Kong fell 0.7% and Japan's Nikkei dropped 1.9%.

European stocks ended mostly flat. Britain's FTSE 100 and the DAX in Germany were unchanged, but France's CAC 40 closed off by 0.8%.

Companies: Google's (GOOG, Fortune 500) stock ended down more than 4.5% after the European Commission said it will investigate whether the Internet search company violated antitrust rules. Search service providers allege that Google gives its own services preferential placement on searches.

News reports also said Google is looking to acquire the discount coupon retailer Groupon. The New York Times' DealBook blog reported Google may be bidding as much as $6 billion for Groupon.

Currencies and commodities: The dollar was up against the pound and the euro, but it fell against the yen. Investors tend to move toward the dollar as a safe haven during times of economic uncertainty.

Oil for January delivery fell $1.62 to settle at $84.11 a barrel.

Gold futures for January delivery rose $18 to settle at $1,384 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 2.80% from 2.82% late Monday.

Euro slide gathers pace on debt crisis fears

The euro has dropped below the $1.30 mark for the first time since the middle of September, as fears over the eurozoneís debt crisis continue.

Euro periphery hammered, Portugal warns on banks

LISBON/DUBLIN (Reuters) - The euro zone's debt crisis deepened on Tuesday as investors pushed the risk premiums on Spanish and Italian bonds to euro lifetime highs and Portugal warned of the risks facing its banks

beruangface ( Date: 30-Nov-2010 13:55) Posted:

|

Italy join in leow.

Contagion strikes Italy as Ireland bail-out fails to calm markets

The EU-IMF rescue for Ireland has failed to restore to confidence in the eurozone debt markets, leading instead to a dramatic surge in bond yields across half the currency bloc

Spreads on Italian and Belgian bonds jumped to a post-EMU high as the sell-off moved beyond the battered trio of Ireland, Portugal, and Spain, raising concerns that the crisis could start to turn systemic. It was the worst single day in Mediterranean markets since the launch of monetary union.

STI- Technical Analysis

The STI has shown extended downside correction since topping out at 3,314. The sharp sell-off pushed price down towards the recent trough at 3,119. The ensuing recovery bounce lifted the index up towards the broken 50-day moving average, currently running at 3,171. The market needs to recapture this resistance decisively to allow for a move towards 3,212 (20-day ma) and possibly 3,221. Mid-term risk remains to the downside unless the latter level is taken out. Failure near this zone would shift the focus to a bearish head and shoulders reversal pattern. A break below 3,119 would confirm the bearish bias. Potential initial downside objective is seen at 3,025. The longer-term important rising 200-day moving average is coming in near 2,963.

DB Warrants

/fyi/

Stocks stage an afternoon comeback

By Annalyn Censky, staff reporterNovember 29, 2010: 4:30 PM ET

By Annalyn Censky, staff reporterNovember 29, 2010: 4:30 PM ET

NEW YORK (CNNMoney.com) -- After tumbling early Monday morning, stocks bounced back to end the session still down, but much closer to breakeven.

The Dow Jones industrial average (INDU) fell 40 points, or 0.4%, closing the session at 11,052, according to early tallies. The S&P 500 (SPX) fell 2 points, or 0.1%, and the Nasdaq (COMP) lost 9 points, or 0.4%.

Stocks had fallen nearly 1.5% earlier in the session, sending the Dow temporarily below 11,000, but they bounced back from those lows late in the afternoon.

"I think this is a trader's market. It was a little bit sleepy this morning, but now stocks are going to come back the other way," said Rich Ilczyszyn, a market strategist with futures-broker Lind Waldock.

Ilczyszyn expects stocks to be stuck in a tight range for the last few days of the month, as traders look to close out their bets, with as much profit as possible.

A wave of downbeat news gave investors little to be thankful coming back from the Thanksgiving holiday weekend, as renewed fears about Europe's debt crisis, feuding South and North Korea, and a WikiLeaks release of controversial diplomatic files all weighed on markets.

"The situation in Korea is hot and fluid," economist Robert Brusca of FAO Economics said in a research note. "The WikiLeaks data is very damaging to the U.S. and to many of its important allies."

Meanwhile, Europe was also on investors' minds: On Sunday, European officials announced an Ä85 billion bailout for Ireland and its banks. They also detailed a new protocol for similar rescues of European nations in the future.

The announcement didn't come as much of a surprise, after various media outlets speculated about the size and timing of the bailout over the last few weeks. But it still managed to rattle investors as it thrust Europe's debt crisis back into the spotlight, said Michael Crowley, senior economist with the Bank of Ireland.

"The market is focusing on Portugal and Spain, and wondering whether problems could spread to those countries," Crowley said. "There's an indication that the markets are kind of jittery and concerned about what and who will be next."

Black Friday: Investors were looking at the sales results from the first days of the holiday shopping season, including Black Friday and Cyber Monday.

Early reports already show shoppers spent more on Friday, although sales may have been stronger online.

According to the National Retail Federation, 212 million shoppers visited stores and websites over Black Friday weekend, up from 195 million last year. Spending rose 6.4% over last year, to an average of $365.34 per shopper.

World markets: European stocks tumbled. Britain's FTSE 100 slipped 1.8%, the DAX in Germany dropped 1.9% and France's CAC 40 lost 1.8%.

Asian markets ended mixed. The Shanghai Composite lost 0.2%, while the Hang Seng in Hong Kong gained 1.3% and Japan's Nikkei rose 0.9%.

Economy: President Obama on Monday proposed a 2-year freeze of federal workers' wages. The freeze is a way to save $2 billion for the remainder of the fiscal year 2011, and $28 billion over the next 5 years.

"Getting this deficit under control is going to require some broad sacrifices, and that sacrifice must be shared by employees of the federal government," Obama said.

While no major economic reports were scheduled Monday, investors will take in data on housing, manufacturing and consumer confidence on Tuesday. On Friday, the government will issue its closely watched monthly jobs report.

Companies: FedEx (FDX, Fortune 500) bucked the S&P 500's downward trend, rising 4.7%, after analysts from Credit Suisse raised their rating and price target for the company.

Amazon (AMZN, Fortune 500) stock rose to an all-time high, boosted by indications of solid Cyber Monday sales. Its shares rose 1.3% in afternoon trading, after trading up more than 2% to $181.84 earlier in the session.

Meanwhile, 18 of the 30 Dow components posted losses Monday.

Kraft Foods (KFT, Fortune 500) said Monday it is seeking arbitration in its battle with Starbucks (SBUX, Fortune 500), as the coffee chain tries to end a deal under which Kraft distributes packaged Starbucks coffee to grocery stores. Kraft shares fell 0.4% and Starbucks lost 0.9%.

BP (BP) announced Sunday it would sell its interests in Pan American Energy to Bridas Corporation for $7.06 billion in cash. The move is part of BP's plan to sell $30 billion in assets by the end of 2011, in order to raise funds in the wake of the Gulf oil spill. BP shares fell 0.8%.

A Dutch court ordered U.S.-based Johnson & Johnson (JNJ, Fortune 500) to pay a $130 million fine to pharmaceutical maker Basilea for a licensing agreement breach, Basilea said in a release.

Meanwhile, the Food and Drug Administration posted a report on its website that cites a variety of problems with a McNeil manufacturing facility in Puerto Rico. McNeil is a subsidiary of Johnson & Johnson, and was the source of this year's Tylenol recalls. Shares of Johnson & Johnson fell 0.6%.

Currencies and commodities: The dollar strengthened against the euro, the British pound and the Japanese yen.

Oil for January delivery rose $1.97 to settle at $85.73 a barrel.

Gold futures for December delivery rose $3.60 to settle at $1,366 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 2.84% from 2.87% on Friday.

Nov 29, 2010

STI opens higher

SINGAPORE shares opened higher on Monday, with the benchmark Straits Times Index at 3,161.22 in early trade, up 0.12 per cent, or 3.67 points.

Around 122.2 million shares exchanged hands.

Losers beat gainers 88 to 64.

Stocks skid on Korean hostilities

By Ben Rooney, staff reporterNovember 23, 2010: 4:42 PM ET

By Ben Rooney, staff reporterNovember 23, 2010: 4:42 PM ET

NEW YORK (CNNMoney.com) -- Stocks ran into a wall of worry Tuesday as violence erupted on the Korean peninsula, concerns about Europe's debt crisis expanded and the Federal Reserve issued a dour economic outlook.

The Dow Jones industrial average (INDU) fell 142 points, or 1.3%, to close at 11,036. The S&P 500 (SPX) fell 17 points, or 1.4%, to 1,181. The Nasdaq (COMP) slid 37 points, or 1.4%, to 2495.

The retreat was sparked by an exchange of artillery fire along the disputed sea border between North and South Korea Tuesday morning. The skirmish, which killed two South Korean soldiers and wounded several civilians, was one of the worst since the Korean War of the 1950s ended in armistice.

Dan Cook, chief executive at IG Markets, said thin trading volumes could be amplifying the market's reaction to the Korean hostilities, "but this is still major," he added.

"The uncertainty is so great and the implications could be huge," he said. "People are getting out of risk assets and in some cases going to cash," he added

In the currency market, the U.S. dollar and the Japanese yen both rose sharply. Gold prices and U.S. Treasuries also moved higher as investors flocked to safe haven assets.

The stock declines were broad based. Hewlett Packard (HPQ, Fortune 500) was the only Dow stock in the black. Shares of the computer maker rose 0.9%, after it reported better-than-expected quarterly results.

Chevron (CVX, Fortune 500) and Exxon (XOM, Fortune 500) both fell about 2% as the stronger dollar pressured oil prices. The dollar also weighed on shares of big multinational firms such as IBM (IBM, Fortune 500), Caterpillar (CAT, Fortune 500) and 3M (MMM, Fortune 500).

Concerns about long-term debt problems facing some major European economies had already been hanging over the market this week.

Investors are growing nervous about Spain and Portugal after officials in Ireland officially requested loans from the European Union and the International Monetary Fund over the weekend.

"Portugal is almost assuredly going to take a bailout," said Dan Greenhaus, chief market strategist with Miller Taback & Co. "The question then becomes how much Spain will need," he said, adding that estimates range between $300 billion and $400 billion.

Meanwhile, the Federal Reserve lowered its outlook for U.S. economic growth this year and next. The central bank also projected that unemployment would remain elevated into next year, according to meeting minutes.

But the bleak forecast was expected, and investors are more concerned about geopolitical risks, according to Greenhaus.

Traders said the market could be choppy this week, with many money managers taking time off ahead of the Thanksgiving holiday. All U.S. markets will be closed Thursday.

Wednesday brings reports on personal income and spending, as well as durable goods orders, data on weekly unemployment claims and new home sales for October.

Stocks ended mixed Monday, as shares of big banks fell after federal law enforcement officials searched the offices of three prominent hedge funds, in what is said to be a large-scale insider trading probe.

Economy: The Federal Reserve lowered its estimates for U.S. economic growth this year and next, and raised its outlook for unemployment.

The Fed now expects 2010 gross domestic product to increase between 2.4% and 2.5% this year, compared with an earlier projection of growth between 3% and 3.5%. In 2010, the Fed predicts GDP in the range of 3% to 3.6%, down from the last forecast in June.

Earlier, government data showed the U.S. economy grew at a better than expected 2.5% annual rate in the third quarter, faster than 2% rate previously reported.

The Fed also said the unemployment rate will be between 9.5% and 9.7% for all of 2010. Next year, the bankers believe joblessness could be as high as 9.1%, compared with a previous estimate of between 8.3% and 8.7%.

Minutes from the Fed's most recent policy meeting showed that officials were divided over the central bank's recent plan to boost the economy by purchasing $600 billion in U.S. Treasuries.

On the housing front, existing home sales declined 2.2% to a seasonally adjusted annual rate of 4.43 million in October from 4.53 million in September, according to the National Association of Realtors. Economists had expected a sales rate of 4.42 million in the month.

Companies: Clothing retailer J. Crew (JCG) agreed to be acquired by buyout firms TPG Capital and Leonard Green & Partners for $2.8 billion. Shares of J. Crew rose about 16% shares had been halted most of the morning after rallying as much as 22% in premarket trading.

Blackstone Group's pursuit of electric power provider Dynegy (DYN) has come to an end after activist shareholders objected to the takeover, Dynegy said in a statement.

World markets: The tensions in Korea dragged stock prices lower around the world.

Britain's FTSE 100 and the DAX in Germany both slipped 1.5%, while France's CAC 40 lost 2.3%.

In Asia, South Korea's Kospi index ended 0.7% lower. The Shanghai Composite lost 1.9% and the Hang Seng in Hong Kong dropped 2.7%. Japan's market was closed for a holiday.

Currencies and commodities: The dollar strengthened against the euro and the British pound, but remained weak versus the Japanese yen.

Oil for January delivery slipped 49 cents to $81.25 a barrel.

Gold futures for January delivery rose $19.80 to close at $1,377.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 2.76% from 2.81% late Friday.

Dow Jones is currently resisted by its 20day ma. hopefully it can cheong past it and go higher. if that happens, STI has higher probability to go higher.

http://sgsharemarket.com/home/2010/11/dow-jones-ma-resistence/

LATIN AMERICAN MARKETS

Nov. 18, 2010, 7:24 p.m. EST

LatAm stocks rise as Ireland addresses debt worries

Regional stocks have been hurt in recent sessions by worries that problems overseas, including Irelandís banking problems and a possible rate hike in China, will curb global growth.

Benchmarks in Brazil and Mexico each rose by more than 1% and Argentinaís Merval climbed more than 2%. Investors also drove stocks in the U.S. and Europe higher after Irelandís finance minister for the first time on Thursday said the country may welcome a plan aimed solely at shoring up the banking sector.