Stocks wilt in muted trading day

By Annalyn Censky, staff reporterDecember 30, 2010: 4:11 PM ET

By Annalyn Censky, staff reporterDecember 30, 2010: 4:11 PM ET

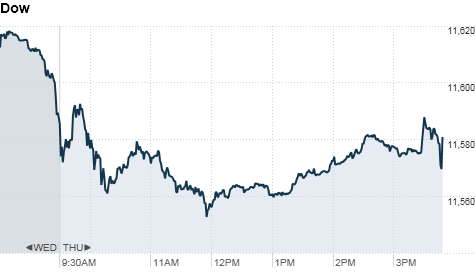

NEW YORK (CNNMoney) -- U.S. stocks ended Thursday's trading session slightly in the red, as trading volume remains light during the last week of the year.

At the closing bell, all three major indexes had lost about 0.1%. The Dow Jones industrial average (INDU) trimmed 16 points, to close at 11,570; the S&P 500 (SPX) fell 2 points to close at 1,258; and the Nasdaq (COMP) shed 4 points, to close at 2,663.

Trading was thin, as the Northeast continues to cope with the lingering effects of a massive snowstorm and many traders left for the holidays. On both the New York Stock Exchange and the tech-heavy Nasdaq, winning stocks beat losers, but by slim margins.

"Most of what we're seeing is really some minor shuffling," said Dan Cook, chief executive officer of IG Markets. "We have some really low volume, so it's really hard to read into general market sentiment."

Better-than-expected reports on jobs, housing and manufacturing data offered traders hope for better economic growth in 2011 -- but the good news wasn't enough to lift stocks during the quiet trading session.

Eager to end the year on a high note, many traders had already closed out their books on Wednesday, after the Dow industrials closed at their highest level since Aug. 28, 2008.

"Why not close out on a really positive note when your books look the best, rather than take a chance today and tomorrow?" Cook said.

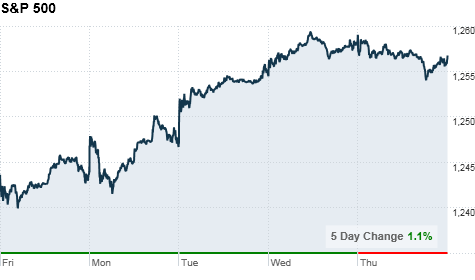

Stocks have climbed 6% in December, and are on track to post double-digit percentage gains for the year. For 2010 overall, the Dow is up about 11%, the S&P 500 is up nearly 13%, and the Nasdaq is up almost 18%.

Economy: Thursday's reports mark the last bit of economic data for the year, and all three brought good news.

Before the bell, the Labor Department said initial unemployment claims fell to 388,000 in the week ended Dec. 25. That marked the lowest level since July 2008, and was much better than the 416,000 claims economists had expected.

Meanwhile, the number of Americans filing for their second week of unemployment insurance or more jumped by 57,000 to 4,128,000; in the week ending Dec. 18, based on the latest data available.

The National Association of Realtors reported that pending home sales rose 3.5% in November, far better than the 3% decrease economists were expecting. Pending home sales are a forward-looking indicator for the housing market, reflecting contracts and not closings.

Also, the Chicago PMI rose to 68.6, showing manufacturing activity picked up more than expected in December in the Midwest region. Economists had forecast the index would edge down to 61.5 in November, from 62.5 the previous month. Any number above 50 indicates growth.

Companies: Shares of Anadarko Petroleum Corp. (APC, Fortune 500) spiked 6.2% after the Daily Mail, citing unnamed sources, suggested that mining giant BHP Billiton (BHP) is gearing up to make a cash bid valued at $90 per share for the oil and natural gas producer. Shares of BHP rose 0.2%.

World markets: European stocks closed lower. Britain's FTSE 100 slipped 0.4%, the DAX in Germany fell 1.2% and France's CAC 40 decreased 1.3%.

Asian markets ended mixed. In the final trading day of 2010, Japan's Nikkei dropped 1.1% as the yen advanced to a fresh seven-week high against the dollar.

The yen has climbed more than 12% this year, and its strength has pressured the Nikkei -- which dropped 3% in 2010. Japan has been taking steps to lower the value of the yen, because doing so will improve profits for its powerful export sector.

The Shanghai Composite rose 0.3% and the Hang Seng in Hong Kong added 0.1%.

Currencies and commodities: The dollar lost ground against the euro and the Japanese yen, but gained against the British pound.

Oil for February delivery slipped $1.28 to settle at $89.84 a barrel.

Gold futures for February delivery fell $7.60 to settle at $1,405.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.37%, from 3.36% late Wednesday.

Dow posts 2-year high in quiet trading

By Annalyn Censky, staff reporterDecember 29, 2010: 4:53 PM ET

By Annalyn Censky, staff reporterDecember 29, 2010: 4:53 PM ET

NEW YORK (CNNMoney.com) -- Stocks crept to yet another two-year record in quiet trading Wednesday, as traders look to end the year on a high note.

At the closing bell, the Dow Jones industrial average (INDU) was up 10 points, or 0.1%, at 11,585 -- it's highest point in two years. The S&P 500 (SPX) rose 1 point, or 0.1%; and the Nasdaq (COMP) ticked up 4 points, or 0.2%.

With no economic reports on the calendar, stocks eked out the slight gains as investors are eager to end the year on the upside.

"The market's going to drift higher for the remainder of the year, as we come into the beginning of January," said Rich Ilczyszyn, market strategist with futures broker Lind-Waldock.

Meanwhile, Ilczyszyn expects trading volume to remain muted for the rest of the week as the Northeast continues to recover from a severe snowstorm and many traders are off for the holidays.

Stocks have climbed 6% in December, and are on track to post double-digit percentage gains for the year. For 2010 overall, the Dow is up about 11%, the S&P 500 is up nearly 13% and the Nasdaq is up nearly 18%.

Companies: Energy giants including Chevron (CVX, Fortune 500), ConocoPhillips (COP, Fortune 500) and Exxon Mobil (XOM, Fortune 500), all posted fresh 52-week highs in mid-session trading Wednesday, but pared back those gains in late afternoon trading.

Shares of Sears Holdings (SHLD, Fortune 500) rose 6.3% Wednesday -- a day after the company announced it has launched its own online movie download service, Alphaline Entertainment. Sears plans to sell the service embedded in portable media players, Blu-ray DVD players, mobile phones and high-definition televisions.

BJ's Wholesale Club (BJ, Fortune 500) stock rose 7.1%, after the New York Post reported that Los Angeles-based firm Leonard Green & Partners LP may make a hostile bid for the company.

A district judge ruled that the German-based business software maker SAP (SAP) will have to pay rival Oracle millions of dollars in interest on the $1.3 billion copyright infringement verdict. SAP shares rose 0.6% and Oracle (ORCL, Fortune 500) shares fell 0.2%.

Bank of America's (BAC, Fortune 500) stock fell 0.2% in afternoon trading, paring back losses from earlier in the morning. Allstate (ALL, Fortune 500) filed a lawsuit against the bank and its Countrywide Financial unit for more than $700 million in mortgage-backed securities that the insurance giant had purchased. The suit also named former Countrywide CEO Angelo Mozilo, who agreed to pay $67.5 million to settle fraud charges in October.

Economy: There were no major economic reports on Wednesday's agenda.

World markets: European stocks closed mixed. Britain's FTSE 100 fell 0.2%, while the DAX in Germany ticked up 0.2% and France's CAC 40 gained 0.8%.

Asian markets ended higher. The Shanghai Composite rose 0.7%, the Hang Seng in Hong Kong rallied 1.5% and Japan's Nikkei ticked up 0.5%.

Currencies and commodities: The dollar fell against the euro, the British pound and the Japanese yen.

Oil for February delivery slipped 37 cents to settle at $91.12 a barrel, but was still near two-year highs as investors anticipate a boost in energy demand in 2011.

Gold futures for February delivery rose $7.90 to settle at $1,413.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.36% from 3.48% late Tuesday.

S'pore stocks end higher SINGAPORE : Singapore stocks closed higher on Wednesday in line with most regional markets.

Posted: 29 December 2010 1859 hrs

The Straits Times Index gained 24.21 points, or 0.8 per cent, to end at 3,207.91. Volume totalled 1.37 billion shares valued at S$1.2 billion.

In the broader market, advancing issues led decliners 386 to 106.

Dealers said though the market trend is rebounding, shares may see some profit-taking in the coming sessions due to recent gains.

Singapore Airlines climbed 22 cents to S$15.58, while OCBC gained 2 cents to S$9.96.

Property stocks continued to advance on hopes that Singapore's strong economic growth will push up demand for residential and office space.

CapitaLand rose 7 cents to S$3.76, while City Development moved up 10 cents to S$12.78.

Rising crude oil prices continued to have a positive impact on rig builders. Keppel Corp gained 6 cents to S$11.04, while Sembcorp Marine added 6 cents to S$5.21.

Dec 29, 2010

STI closes 0.76% higher

SINGAPORE shares closed 0.76 per cent higher on Wednesday, with the benchmark Straits Times Index at 3,207.91, up 0.76 per cent, or 24.21 points.

About 1.4 billion shares exchanged hands.

Gainers beat losers 386 to 106.

Stocks poised for slightly higher open

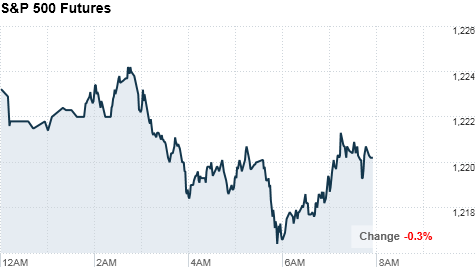

NEW YORK (CNNMoney.com) -- U.S. stocks were poised to advance Wednesday, though trading is likely to remain quiet amid the holiday week, and as investors close their books for the year.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were up about 0.2% ahead of the opening bell. Futures measure current index values against perceived future performance.

Trading volume has been light and markets have barely moved during the final week of the year, as the Northeast continues to recover from severe winter weather and as investors hold off making their next big bets till the new year.

Overall stocks have climbed 6% in December, and are on track to post double-digit gains for the year.

On Tuesday, stocks ended the day mixed -- on either side of the breakeven line -- as investors as investors mulled a disappointing report on consumer confidence, and ongoing weakness in the housing market.

Economy: The U.S. government's weekly crude oil inventories report is due in the morning, though it is typically not a market mover.

World markets: European stocks were mixed in morning trading. Britain's FTSE 100 was down 0.2%, while the DAX in Germany ticked up 0.4% and France's CAC 40 gained 1%.

Asian markets ended the session higher. The Shanghai Composite rose 0.7%, the Hang Seng in Hong Kong rallied 1.5% and Japan's Nikkei ticked up 0.5%.

Currencies and commodities: The dollar was flat against the euro and the British pound, and fell versus the Japanese yen.

Oil for February delivery slipped 43 cents to $91.06 a barrel.

Gold futures for February delivery shed $1.10 to $1,404.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to to 3.45% from 3.48% late Tuesday.

Stocks end the day mixed

By HIbah Yousuf, staff reporterDecember 28, 2010: 4:43 PM ET

By HIbah Yousuf, staff reporterDecember 28, 2010: 4:43 PM ET

NEW YORK (CNNMoney.com) -- U.S. stocks ended the day mixed Tuesday as investors mulled a disappointing report on consumer confidence and ongoing weakness in the housing market.

The Dow Jones industrial average (INDU) ended the day up 20 points, or 0.18%, with about two-thirds of the blue chip index's 30 components advancing. Chevron (CVX, Fortune 500) and Hewlett Packard (HPQ, Fortune 500) posted the biggest gains, while American Express (AXP, Fortune 500), Home Depot (HD, Fortune 500) and Caterpillar (CAT, Fortune 500) led the declines.

The S&P 500 (SPX) rose nearly one point, while the tech-heavy Nasdaq (COMP) drifted down 4 points, or 0.16%.

Investors largely shrugged off the housing report and a report showing that consumers lost confidence in December.

"The housing market is still stuck in the basement, and the drop in consumer sentiment is a disaster as well," said Joseph Saluzzi, co-head of equity trading at Themis Trading. "But the stock market doesn't care."

Such negative economic news typically drives stocks lower, and a flat market is considered positive in light of the news, he added.

"It was another day of very light volume in the market ...stocks eked out a small gain for the day overall with strength in the energy and basic materials sectors," said Timothy Ghriskey, CIO Solaris Asset Management

Historically, stocks advance during the final week of the year, a phenomenon known as a Santa Claus rally. But stocks have been rallying since late August, when Fed chairman Ben Bernanke said the central bank stood ready to take 'unconventional measures' to prop up the economy.

"Santa Claus showed up early this year as Ben Bernanke in Jackson Hole, so we've had a four-month long Santa Claus rally already," he said. "Markets will likely trend flat for the rest of the week."

Economy: The Case-Shiller 20-City index of home prices in major metropolitan areas showed a continuing housing slump. Home prices dropped 1.3% in October from the prior month, and fell 0.8% year over year. Economists were expecting prices to edge up 0.1% from a year earlier.

Consumer confidence took an unexpected step backward in December, with Americans more concerned about the overall economy and the jobs forecast.

The Conference Board said its reading on consumer confidence slipped to 52.5 in December from 54.3 the month before. Economists were expecting the index to have risen to 56.1.

Late Monday, a report from MasterCard Advisors' SpendingPulse data service showed a 5.5% increase in retail sales in the period from Nov. 5 to Dec. 24, as consumer spending continued to make a comeback. The report is based on charges rung up on MasterCard credit cards as well as a survey of sales made by cash or check.

The weekend's blizzard could cut into holiday sales, with analysts at NPD Group saying retailers could lose about 0.5% of holiday sales due solely to the storm.

Companies: Electric car maker Tesla Motors (TSLA) rose 3% Tuesday, a day after its stock tumbled 15%. Monday was the first day that large investors in the company's June IPO could sell shares, and they took advantage of a 70% run-up from the initial pricing.

Shares of Apple (AAPL, Fortune 500), which have climbed more than 50% this year to new all-time highs above $325 per share, inched up slightly. A new lawsuit seeking class-action status accuses the iPhone and iPad maker of enabling advertisers to track how users interact with applications.

The suit, which also names Pandora, The Weather Channel, Dictionary.com and Backflip as defendants, was filed last week in a district court in California.

World markets: European stocks ended on either side of the breakeven line. The DAX in Germany edged up, and France's CAC 40 slipped 0.1%. London remained closed for a holiday, reopening Wednesday.

Asian markets ended lower. The Shanghai Composite lost 1.7%, the Hang Seng in Hong Kong fell 0.9% and Japan's Nikkei slipped 0.6%.

Currencies and commodities: The dollar turned higher against the euro and the British pound, but lost ground versus the Japanese yen.

Oil for February delivery rose 49 cents to settle at $91.49 per barrel.

Gold futures for February delivery rose $22.70 to close at $1,405.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.48% from 3.35% late Tuesday.

Stocks take early vacation, end flat

NEW YORK (CNNMoney.com) -- U.S. stocks ended a strong week on a quiet note Thursday, as mixed economic data kept investors from jumping in ahead of a long holiday weekend.

The Dow Jones industrial average (INDU) edged up 14 points, or 0.1%; the S&P 500 (SPX) fell 2 points, or 0.2%; and the Nasdaq (COMP) slipped 6 points, or 0.2%. The three major indexes were about 1% higher for the week.

On Wednesday, stocks ended at fresh two-year highs as oil prices topped $90 a barrel.

Reports Thursday showed jobless claims barely budging, new home sales rising slightly and personal income and spending ticking higher.

But Wall Street was relatively unfazed by the data, with stocks hovering near the break-even point for most of the session. Many investors have already left their desks for the holidays, and U.S. markets will be closed Friday for the holiday weekend.

"Everyone is on vacation or just taking a break from the stock market," said Tony Zabiegala, managing partner at Strategic Wealth Partners.

While gains have been modest in recent sessions, stocks are still on track to post double-digit increases for the year.

"Economic news continues to show moderate growth," said Keith Springer, president of Springer Financial Advisors. "The market is in a period -- and will be for a while -- where not terrible news is good news, so at this point there's no reason for stocks to sell off unless we get terrible news."

Economy: Before the opening bell, the Commerce Department reported that personal income rose 0.3% and personal spending rose 0.4% in November. The results were mixed, compared to expectations.

A consensus of economists surveyed by Briefing.com expected the report to show that income rose by 0.2% in November, and spending to have risen 0.5% during the month.

Meanwhile, the Department of Labor announced that initial jobless claims fell 3,000 to 420,000 in the week ended Dec. 18. Claims were expected to have edged up to 424,000.

The Commerce Department's report on November durable goods orders declined 1.3% in November, a bit more than the expected decline of 1.1%.

The new home sales index for November from the Census Bureau rose 5.5% to a seasonally adjusted annual rate of 290,000, from a 275,000 in the previous month. The index was expected to have risen to a rate of 300,000 units. But sales are still off 21.2% from a year ago, indicating the recovery is still sluggish.

The University of Michigan's final reading on consumer sentiment in December ticked up to 74.5 from 74.2 in the previous month, slightly missing the 74.8 reading economists had expected.

World markets: European stocks finished mixed. Britain's FTSE 100 closed 0.2% higher, after topping the 6,000 mark for the first time since June 2008 earlier in the session. Germany's DAX edged down 0.1%, while France's CAC 40 ticked 0.2% lower.

Thursday morning, China said it will support the eurozone through its debt crisis. Asian markets ended their session lower. The Shanghai Composite shaved 0.8%, the Hang Seng in Hong Kong lost 0.6% and Japan's Nikkei edged down by 0.2%.

Companies: Jo-Ann Stores (JAS) said Thursday it was being acquired by private-equity firm Leonard Green & Partners for $1.6 billion, or $61 per share in cash. The stock surged 32%.

Currencies and commodities: Oil for February delivery jumped $1.03, or 1%, to settle at a fresh two-year high of $91.51 a barrel, a day after crude topped $90 a barrel for the first time since 2008.

Gas prices surpassed the milestone $3 mark Thursday for the first time since Oct. 17, 2008, as the national average compiled by motorist group AAA reached $3.013 a gallon. Gas prices have risen more than 4% from a month ago, and are nearly 16% higher than the a year ago.

The dollar lost ground against the euro, Japanese yen and British pound.

Gold futures for February delivery fell $8.40 to settle at $1,380.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury was slightly lower, pushing the yield up to 3.39%.

Both bonds and commodity markets had a half-day Thursday, and are closed Friday.

Dec 23, 2010

US weekly jobless claims mostly steady

WASHINGTON - FIRST-TIME claims for US jobless benefits barely budged last week, government data showed on Thursday, suggesting the labour market is healing too slowly to drag down the unemployment rate.

Initial claims dipped slightly to 420,000 in the week ended Dec 18, matching the median forecast in a Reuters poll of economists, from an upwardly revised 423,000 in the prior week.

The Labour Department reported identical figures a week earlier. A spokesman said the weekly jobless claims series was 'settling down a bit' after a volatile period in November and there were no unusual factors affecting the data.

Continuing claims, which exclude the millions of Americans relying on extended benefits, dipped to 4.06 million in the week ending Dec 11, down from 4.17 million a week earlier. The four-week average, which smoothes out week-to-week volatility, fell to 4.16 million from 4.19 million.

The total number of Americans claiming benefits - including those relying on a federal emergency program of extended benefits that was the subject of heated political debate in Washington - was 8.9 million in the week ending Dec 4, down from 9.2 million a week earlier.

Markets open lower

NEW YORK (CNNMoney.com) -- U.S. stocks edged lower at the start of trading Thursday, following a slew of economic reports and as gas topped $3 a gallon for the first time in more than two years.

The Dow Jones industrial average (INDU) slipped 6 points, or 0.1%; the S&P 500 (SPX) fell 2 points, or 0.2%; and Nasdaq (COMP) edged down 6 points, or 0.2%.

On Wednesday, stocks climbed to fresh two-year highs. Pre-holiday trading sessions are usually pretty quiet, but investors are focusing on -- and feeling bullish about -- 2011.

"The equity markets may not be that interesting -- unless there is big news that pops, and we don't see any on the horizon," said Bob Enck, President and CEO of Equinox Fund Management. As investors focus on the next year, 2011 is "clearly starting to improve."

In particular, having the clarity on the tax rates here in the U.S. is encouraging to investors, according to Enck.

U.S. markets will be closed Friday for the holiday weekend.

Economy: The majority of the economic reports due out Thursday won't be market movers, unless they show significant surprises.

"The one that everyone will be zeroing in for some time to come is the jobs report," Enck said. The government's next reading on the unemployment rate is due out in early January -- after the holidays.

Before the opening bell, the Commerce Department reported that personal income rose 0.3% and personal spending rose 0.4% in November. The results were mixed, compared to expectations.

A consensus of economists surveyed by Briefing.com expected the report to show income rose by 0.2% in November, and spending to have risen 0.5% during the month.

Meanwhile, the Department of Labor announced that initial jobless claims fell 3,000 to 420,000 in the week ended Dec. 18. Claims were expected to have edged up to 424,000.

The Commerce Department's report on November durable goods orders declined 1.3% in November, a bit more than the expected decline of 1.1%.

The University of Michigan's final reading on consumer sentiment in December is due after the start of trading. It's expected to tick up to 74.8, from 74.2 in the previous month.

Finally, the new home sales index for November from the Census Bureau is due at 10 a.m. ET. The index is expected to have risen to a seasonally adjusted annual rate of 300,000 units, from a 283,000 unit rate in the previous month.

World markets: European stocks were mixed in afternoon trading. Britain's FTSE 100 was up 0.1% and Germany's DAX was flat, while France's CAC 40 slipped 0.4%.

Thursday morning, China said it will support the eurozone through its debt crisis.

"China supports the financial stabilization package launched by the EU and IMF to deal with the sovereign debt crisis in Europe," said Jiang Yu, a Chinese Foreign Ministry spokeswoman during a weekly briefing. "Whether in the past, the present or the future -- Europe was, is and will be one of the main markets for China's foreign exchange reserve investments."

Asian markets ended their session lower. The Shanghai Composite shaved 0.8%, the Hang Seng in Hong Kong lost 0.6% and Japan's Nikkei edged down by 0.2%.

Companies: Jo-Ann Stores (JAS) said Thursday it was being acquired by private-equity firm Leonard Green & Partners for $1.6 billion, or $61 per share in cash. The stock surged by 33% in early trading.

Currencies and commodities: Oil for February delivery edged up 6 cents to $90.54 a barrel, a day after crude settled at the highest level since 2008.

Enck said that oil being more than $90 a barrel is a pretty big deal for markets. "That will be more of a market mover than most other items," he said. "Rising demand for commodities is a big deal."

On the one hand, rising demand for commodities shows strength in the global economy. However, if prices rise too far -- it could begin to impact corporate profits too, Enck said.

Gas prices surpassed the milestone $3 mark Thursday for the first time since Oct. 17, 2008, as the national average compiled by motorist group AAA reached $3.013 a gallon. Gas prices have risen more than 4% from a month ago, and are nearly 16% higher than the a year ago.

The dollar rose against the euro, but lost ground to the Japanese yen and the British pound.

Gold futures for February delivery fell $10.40 to $1,377 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury was slightly lower, pushing the yield up to 3.37%.

Both bonds and commodity markets have a half-day Thursday, and are closed Friday.

China's Inflation Tops 5%, Adding Pressure for Wen to Raise Interest Rates

By Bloomberg News - Dec 11, 2010 10:00 AM GMT+0800

China’s inflation accelerated to the fastest pace in 28 months in November, underscoring the case for Premier Wen Jiabao to raise interest rates again.

Consumer prices rose 5.1 percent from a year earlier, driven by food costs, a statistics bureau report showed in Beijing today. That was more than the 4.7 percent median forecast in a Bloomberg News survey of 29 economists. In October, inflation was 4.4 percent.

The strength of consumer-price gains and capital flows into the world’s fastest-growing major economy may require the central bank to add to October’s increase in benchmark rates, the first since 2007. Officials yesterday raised reserve requirements for banks for the third time in five weeks to drain money from the financial system.

“The case for a rate hike now to help manage inflation expectations is indisputable,”Wang Tao, a Beijing-based economist at UBS AG, said before today’s release.

China, which overtook Japan as the world’s second-largest economy in the second and third quarters, lags behind Asian countries including Malaysia and South Korea in boosting borrowing costs.

The nation’s industrial-output growth accelerated to 13.3 percent last month from a year earlier, today’s report showed. That exceeded economists’ median estimate of 13 percent.

S&P 500 at two-year high

U.S. stocks end up; S&P 500 at two-year high

Dec 10, 2010

STI lower at midday

SINGAPORE shares were lower at midday on Wednesday, with the benchmark Straits Times Index at 3,186.82, down 0.73 per cent, or 23.38 points.

About 696.5 million shares exchanged hands.

Losers beat gainers 240 to 110.

Blastoff ( Date: 10-Dec-2010 08:31) Posted:

|

Stocks end listless session mixed

By Ben Rooney, staff reporterDecember 9, 2010: 4:51 PM ET

By Ben Rooney, staff reporterDecember 9, 2010: 4:51 PM ET

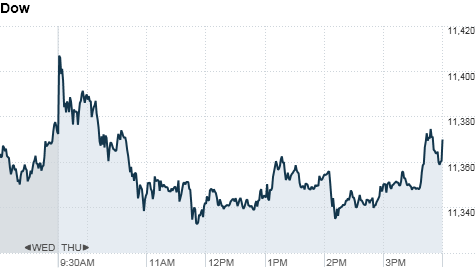

NEW YORK (CNNMoney.com) -- Stocks ended mixed Thursday as a stronger dollar dragged on commodity-related companies, while financials and tech shares firmed.

The Dow Jones industrial average (INDU) fell 2 points, or less than 0.1%, to end at 11,370. The S&P 500 (SPX) gained 5 points, or 0.4%; to 1,233. The tech-heavy Nasdaq (COMP) rose 7 points, or 0.3%, to 2,617.

Bank of America (BAC, Fortune 500) and JPMorgan (JPM, Fortune 500) were among the best performers on the Dow, adding to the previous session's gains. Bank stocks had lagged the broader market earlier this year, but investors are regaining some appetite for financials as economic conditions improve.

DuPont (DD, Fortune 500) was the Dow's weakest component, falling 1.3%. The chemical company issued a 2011 outlook that disappointed investors. Consumer stocks McDonald's (MCD, Fortune 500) and Johnson & Johnson (JNJ, Fortune 500) also tumbled.

Stocks opened modestly higher after government data showed an improvement in the number of jobless claims being filed. But the momentum faded as a stronger dollar pressured commodities prices, and weighed down shares of companies like Boeing (BA, Fortune 500) and 3M (MMM, Fortune 500).

"In the absence of any major economic news -- we're listing a little bit," said Mark Luschini, chief investment strategist at Janney Montgomery Scott. Investors are also awaiting the final word from Washington on the extension of Bush-era tax cuts for those making more than $250,000 a year, he added.

House Democrats voted Thursday against considering the tax package, which would also extend unemployment benefits and create a payroll tax holiday.

The choppy trading Thursday follows a big advance last week, which pushed the Dow and S&P 500 near their highest levels in two years.

"Considering the rally last week, we're seeing some consolidation, which isn't surprising," said Abigail Doolittle, founder of Peak Theories Research. But she added that the market "is very much driven by the dollar."

The dollar index, a gauge against a basket of currencies, edged up to 80 from 79.9. The stronger dollar weighed on oil prices, but gold defended modest gains.

Investors were also keeping an eye on the Treasury market, where yields have spiked this week amid an improved economic outlook, as well as concerns about inflation and the U.S. budget deficit.

On Wednesday, stocks managed to eke out gains as a rebound in bank shares offset concerns about rising interest rates in the Treasury market.

Economy: The number of people filing for initial jobless claims fell 17,000 to 421,000 in the latest week, from 436,000 the previous week, the Labor Department said in its most weekly jobless claims report. Economists had expected the number to decrease to 429,000.

Initial unemployment claims help give a read on the labor market. "But this time of year it tends to be pretty choppy, and that is due to difficulties in the seasonal adjustments," said Scott Brown, chief economist at Raymond James. "The numbers can really jump around week to week." He said the focus should remain on the four-week moving average, rather than the weekly gains or losses.

The four-week moving average, which is calculated to smooth out volatility in the data, fell by 4,000 to 427,500.

Separately, the Commerce Department said wholesale inventories rose 1.9% in October, following a revised 0.6% increase for September. The October gain was much larger than the 0.7% gain economists had expected.

Companies: Shares of AIG (AIG, Fortune 500) jumped 13% after the insurance giant finalized the terms of the latest restructuring of the giant insurer's federal bailout.

Howard Stern announced that he has re-signed with SiriusXM (SIRI) Radio for five years, sending Sirius' stock rising 6.5% in early trade.

Tech giant Dell (DELL, Fortune 500) made a bid for Compellent Technologies Inc. (CML) for $27.50 a share -- well below the $33.65 per share the data storage company closed at on Wednesday. Shares of Compellent fell 14%, while shares of Dell were little changed.

Freeport- McMoRan (FCX, Fortune 500) announced plans to pay a special dividend of $1 per share this year. The copper and gold producer also declared a two-for-one split of its common stock.

Shares of Lululemon Athletica (LULU) jumped 14%, after the Canadian maker of yoga apparel said net income in the third quarter doubled to $42.4 million.

After the market closed, Green Mountain Coffee (GMCR) reported fourth-quarter net income of $27 million, or 20 cents per share, up from $14.1 million, or 11 cents per share, in the same period last year. Analysts had expected earnings per share of 20 cents, according to estimates from Thomson Financial.

But shares of Green Mountain fell nearly 10% in after-hours trading as investors reacted to the company's outlook for next year. Green Mountain lowered the bottom end of its forecast range by 3 cents, citing "expected volatility in coffee prices and flexibility to support anticipated new product launches."

Currencies and commodities: The dollar rose against the euro and the British pound, but fell slightly against the Japanese yen.

Oil for January delivery rose 9 cents to settle at $88.37 a barrel.

Gold futures for February delivery edged up $9.60 to close at $1,392.80 an ounce.

Bonds: The yield on the 10-year Treasury note eased to 3.22% from 3.25% late Wednesday as prices rose. The 10-year yield hit a high of 3.33% on Wednesday, up 36 basis points from Monday, marking the biggest two-day gain since September 2008.

But prices rebounded after the U.S. sold $13 billion in re-opened 30-year bonds. It was the last of three auctions this week totaling $66 billion in 3-, 10- and 30-year Treasuries.

World markets: European stocks were mixed. Britain's FTSE 100 rose 0.2% and France's CAC 40 gained 0.7%, while the DAX in Germany fell 0.2%.

Asian markets also ended the session mixed. The Shanghai Composite shaved 1.3%, the Hang Seng in Hong Kong added 0.3% and Japan's Nikkei gained 0.5%.

US stocks ended little changed on Monday, held in check by worries about Europe 's debt crisis, which frustrated investors looking for a reason to take shares to new highs for the year. Germany rejected a call for euro zone finance ministers to increase the size of a 750 billion euro safety net for debt-stricken members. A decline in the euro limited US stocks' advance as the two have have moved in a tight correlation recently, with the euro acting as a proxy for debt concerns overseas. Further adding to conflicting sentiment were downbeat comments from US Federal Reserve Chairman Ben Bernanke about the economy, which offset his attempts to reassure markets the Fed could step up its economic stimulus efforts if necessary. 'The tone of his voice made me nervous. As a trader and a manager, it made me nervous,' said Paul Mendelsohn, chief investment strategist at Windham Financial Services in Charlotte , Vermont . 'I think he was trying to sell the American people because he has been under pressure.' The Dow Jones industrial average dropped 19.90 points, or 0.17 per cent, to 11,362.19. The Standard & Poor's 500 Index shed 1.59 points, or 0.13 per cent, to 1,223.12. The Nasdaq Composite Index gained 3.46 points, or 0.13 per cent, to 2,594.92. |

| ||||

Source: Reuters | |||||

Stocks set to dip on Bernanke comments

By CNNMoney.com staffDecember 6, 2010: 8:15 AM ET

By CNNMoney.com staffDecember 6, 2010: 8:15 AM ET

NEW YORK (CNNMoney.com) -- U.S. stocks were poised to fall at the opening bell Monday after Fed chairman Ben Bernanke gave a pessimistic outlook about the nation's economy.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all down slightly. Futures measure current index values against perceived future performance.

Stocks ended higher late Friday as investors moved beyond a report that showed U.S. job growth in November was much slower than expected. Despite the lousy jobs data, stocks rallied for the week. All three major indexes ended more than 2% higher.

Federal Reserve Chairman Ben Bernanke, in an interview on CBS' 60 Minutes that aired Sunday, said it could be four or five years before the economy is back to a normal unemployment rate.

Bernanke also said that fears of inflation are overstated, and that the central bank could resort to another round of stimulus by buying up Treasuries.

But Tom Winmill, portfolio manager at Midas Funds, said that it it unsettling to hear that it could be four or five years before the unemployment rate is back to a healthy level. Winmill said it will keep a weight on markets in the short term.

Investors are also looking at talk about a deal involving the Bush-era tax cuts. The reported agreement would extend the cuts for all incomes for two years and would permit the unemployed to file for extended jobless benefits -- a program that expired last week.

Companies: Drug maker Pfizer (PFE, Fortune 500) announced a management shake-up, replacing CEO Jeffrey Kindler with Ian Read, who had been heading the company's global biopharmaceutical operations. Pfizer shares eased in premarket trading.

AOL (AOL) is exploring a break-up of the online services company that could lead to a merger with Yahoo (YHOO, Fortune 500), according to a Reuters report citing sources close to the plans. Shares of Yahoo were up slightly in premarket trade;AOL's stock also dipped in premarket trade.

World markets: European stocks were mixed in early trading. Britain's FTSE 100 edged up 0.4%, the DAX in Germany added 0.1% and France's CAC 40 was down 0.2%.

Asian markets ended the session mixed. The Shanghai Composite added 0.5%, the Hang Seng in Hong Kong shaved 0.4%and Japan's Nikkei lost 0.1%.

Currencies and commodities: The dollar was stronger against the euro, the Japanese yen and the British pound.

Oil for January delivery added 10 cents to $89.29 a barrel after reaching as high as $89.76. Oil prices have been hovering at 2-year highs. The last time they were this high was October 2008.

Gold futures for December delivery was $9.10 higher at $1,415.30 an ounce, after reaching a fresh intraday high of $1,420. On Friday, gold futures settled at a record high as the U.S. dollar slid following a surprisingly weak report on the nation's job market.

Winmill said he was expecting gold prices to pass $1400 by the end of this year and that gold could hit $1600 by the end of 2011.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 2.95%.

Pls use this version for reference:

With two major factors : massive QE2 (US$ 600 billion pumping into the world economy/property/stocks over the next 8 mths, approx US $75 billion /mth till June 2011) and the strong Asian market, driven by China, India, Indonesia etc, the DOW and STI are poised for matured bull run to mid 2011 at least. Reasons for the optimisms:

1. In past 30 years, based on factual statistics, the stock market has risen in approx 47 out of 50 times to reach its previous peak and surpass it. (refer to Coppock curve)

2. Strong correlation between DOW and STI in past 30 years.

3. Previous peak of DOW and STI are 13900 and 3900 respectively. Assuming that DOW and STI break 14000 and 4000 respectively in 8 mths' time, the following will suffice:

based on Thursday closing of approx 11,200 pts (DOW) and 3,200 (STI)

- DOW and STI slated to grow by 25% over next 8 mths

- DOW should grow (2800 pts in next 8 mths or 350 pts/mth or 87.5 pts/wk or 17.5 pts/day), very realistic projection

- STI should grow (800 pts in next 8 mths or 100 pts/mth or 25 pts/wk or 5 pts/day), very realistic projection

With two major factors : massive QE2 (US$ 600 billion pumping into the world economy/property/stocks over the next 8 mths, approx US $75/mth till June 2011) and the strong Asian market, driven by China, India, Indonesia etc, the DOW and STI are poised for matured bull run to mid 2011 at least. Reasons for the optimisms:

1. In past 30 years, based on factual statistics, the stock market has risen 95% to reach its previous peak and surpass it.

2. Strong correlation between DOW and STI in past 30 years.

3. Previous peak of DOW and STI are 13900 and 3900 respectively. Assuming that DOW and STI break 14000 and 4000 respectively in 8 mths' time, the following will suffice:

based on Thursday closing of approx 11,200 pts (DOW) and 3,200 (STI)

- DOW and STI slated to grow by 25% over next 8 mths

- DOW should grow (2800 pts in next 8 mths or 350 pts/mth or 87.5 pts/wk or 17.5 pts/day), very realistic projection

- STI should grow (800 pts in next 8 mths or 100 pts/mth or 25 pts/wk or 5 pts/day), very realistic projection