Stocks set to slip at the open

By CNNMoney staffJanuary 25, 2011: 8:17 AM ET

By CNNMoney staffJanuary 25, 2011: 8:17 AM ET

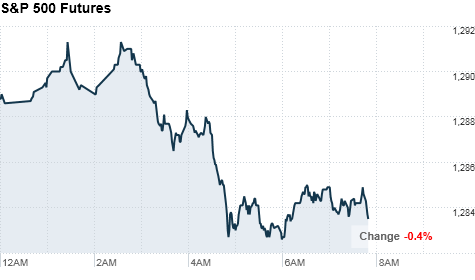

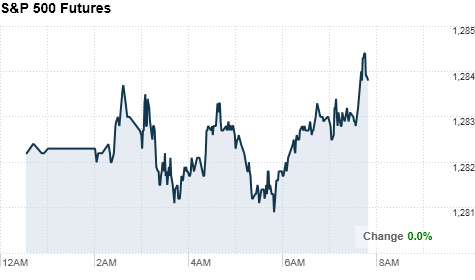

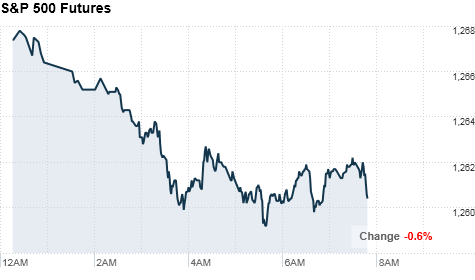

NEW YORK (CNNMoney) -- U.S. stocks were set for a slightly lower open Tuesday, as investors weighed a fresh batch of earnings results and awaited reports on home prices and consumer confidence.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were down ahead of the opening bell. Futures measure current index values against perceived future performance.

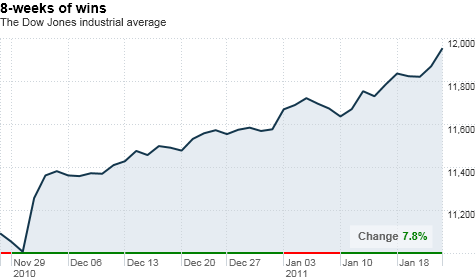

Stocks began the week with a solid start, with the Dow inching toward the 12,000 mark on Monday. The blue-chip index has been on an upward trend since Thanksgiving, and is now within a stone's throw of 12,000 -- a level last seen on June 18, 2008.

While economic reports may continue to be lackluster in the coming month, stocks are likely to remain in an upward march as investors focus on strong earnings.

But there will be pauses along the way as investors take stock of their portfolios, said Tom Winmill, portfolio manager at Midas Funds.

"It's going to be choppy, but still a continuing an upward trend," said Winmill. "There's an expectation that earnings will keep improving and we're looking for more surprises on the upside."

Companies: Before the opening bell, DuPont (DD, Fortune 500) logged quarterly results that widely beat expectations. The company also hiked its forecast for the current quarter. The results boosted shares slightly in pre-market trading.

Verizon (VZ, Fortune 500)'s earnings missed by a penny, while revenue fell 2.6% from a year earlier. Shares of the phone service provider slumped 1%.

3M (MMM, Fortune 500) posted earnings that were down slightly from a year ago, beating expectations by a penny. Shares of the company fell 1% in early trading.

Johnson & Johnson (JNJ, Fortune 500)'s earnings met expectations, while revenue slipped 5.5%. Shares of the company fell 1.5% ahead of the market open.

After the bell on Monday, American Express (AXP, Fortune 500) reported earnings of 94 cents per share on revenue of $7.32 billion. The numbers fell a hair short of analyst estimates. Shares fell about 1% in pre-market trading.

Yahoo (YHOO, Fortune 500) is slated to report the market closes Tuesday, and is expected to report earnings per share of 22 cents on $1.19 billion in revenue.

Economy: The Case-Shiller November index of home prices in 20 major U.S. markets will be released before the market opens. The index is forecast to fall 1.5% in November, after ticking down 0.8% in the previous month.

The Conference Board, a business research group, will report its January report on consumer confidence shortly after the opening bell. The index is expected to increase to 53.5 from last month's reading of 52.5.

President Obama is scheduled to deliver his State of the Union address Tuesday night, during which he is expected to talk about the health of the U.S. economy -- especially the labor market.

World markets: European stocks were mixed in morning trading. Britain's FTSE 100 slipped 0.4%, following disappointing fourth-quarter GDP data from the United Kingdom. The DAX in Germany edged up 0.3% and France's CAC 40 was up 0.1%.

Asian markets ended the session mixed. The Shanghai Composite fell 0.7%, and the Hang Seng in Hong Kong ended barely below breakeven. Japan's Nikkei rose 1.2%, after the Bank of Japan kept interest rates steady but boosted its 2010 GDP forecast and said deflation is continuing to ease.

Currencies and commodities: The dollar rose against the euro and the British pound, but fell against the Japanese yen.

Cocoa futures retreated in early trading, after soaring more than 4% in the previous session as the Ivory Coast called for a one-month export ban.

Oil for March delivery slipped $1.36 to $86.51 a barrel.

Gold futures for February delivery tumbled $18.50 to $1,326 an ounce.

"It's been a mixed market for commodities lately, but it's generally been favoring oil and not gold," said Winmill. "There's going to be a rough patch for gold now, because with rising equity prices there will be more optimism for U.S. markets and less worry about finding a safe haven."

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.38% from 3.41% late Monday.

Dow marches toward 12,000

By Annalyn Censky, staff reporterJanuary 24, 2011: 4:47 PM ET

By Annalyn Censky, staff reporterJanuary 24, 2011: 4:47 PM ET

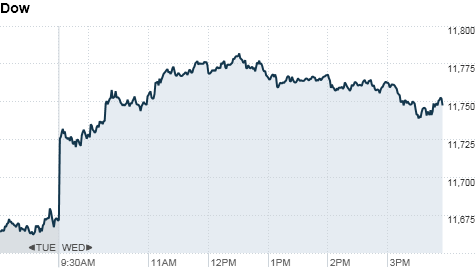

The Dow Jones industrial average (INDU) closed at 11,980, up 109 points, or 0.9% from the prior trading session.

The blue-chip index has been on an upward trend since Thanksgiving, and is now within a stone's throw of 12,000 -- a level last seen on June 18, 2008.

Meanwhile, the S&P 500 (SPX) gained 7 points, or 0.6%; and the Nasdaq (COMP) rose 28 points, or 1%.

While analysts say a slight pullback could be in the cards soon, companies are reporting strong earnings, which should drive continued positive momentum over the long term.

"American companies are doing quite well, and I think that's going to eventually show up in the employment numbers," said Chad Cunningham, chief investment officer at Iron Horse Capital Management. "If we get any sort of a short-term technical pullback, I think it's a good time to allocate money to U.S. equities."

The rest of the week brings an onslaught of earnings results from blue chip companies, as well as the latest readings on consumer confidence, new home sales and the overall economy. Cunningham said he expects to see slight improvement in all the economic indicators.

Companies: After the bell, American Express (AXP, Fortune 500) reported earnings of 94 cents per share on revenue of $7.32 billion, falling just a hair short of analyst estimates. Its stock fell 1.1% in after-hours trading.

Shares of Amgen (AMGN, Fortune 500) also fell 0.5% in late trading, after the biotech giant announced earnings that barely beat the Street. Earnings from Texas Instruments (TXN, Fortune 500) came in slightly better than expected too, but its stock fell 2.2%.

Earlier during the trading session, RadioShack (RSH, Fortune 500) shares tumbled 11.4% after the electronics retailer forecast a weak fourth-quarter profit and announced its CEO Julian Day plans to retire in May.

The end of the year was tough on electronics retailers, with sales falling below expectations. Last month, Best Buy (BBY, Fortune 500) lowered its outlook for the full year.

JC Penney (JCP, Fortune 500) shares surged 7.2% after the retailer announced it has named prominent hedge fund manager William Ackman and Steven Roth, chairman of Vornado Realty Trust, to its board of directors. JC Penney also said it plans to close six unprofitable stores and continue phasing out its catalog business.

Before the opening bell, Halliburton (HAL, Fortune 500) logged better-than-expected earnings. Shares of the company rose 0.6%.

McDonald's (MCD, Fortune 500) reported earnings in line with expectations. Shares of the fast food chain rose 0.5%.

World markets: European stocks ended their session higher. Britain's FTSE 100 edged up 1.1%, France's CAC 40 rose 0.5% and the DAX in Germany was little changed.

Asian markets ended the session mixed. The Shanghai Composite slid 0.7% and the Hang Seng in Hong Kong fell 0.3%, as Japan's Nikkei ticked up 0.7%.

Economy: There are no major economic reports on tap for Monday.

Currencies and commodities: The dollar rose against the British pound, but fell against the euro and the Japanese yen.

Oil for March delivery slipped $1.24 to settle at $87.87 a barrel.

Gold futures for February delivery rose $2.90 to settle at $1,345.50 an ounce on the Chicago Mercantile Exchange.

Cocoa futures for March delivery jumped 4%, after the Ivory Coast put a one-month ban on cocoa exports.

Bonds: The price on the benchmark 10-year U.S. Treasury rose slightly, sending the yield down to 3.41%.

Stocks trim losses, close modestly lower

By Ben Rooney, staff writerJanuary 20, 2011: 4:42 PM ET

By Ben Rooney, staff writerJanuary 20, 2011: 4:42 PM ET

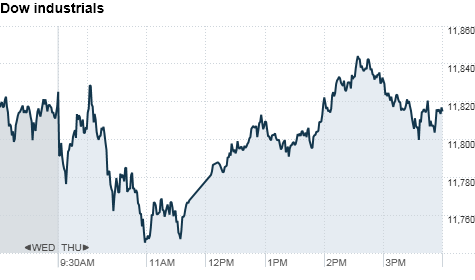

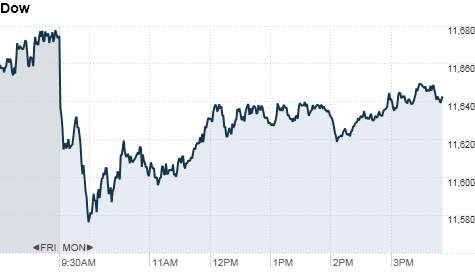

NEW YORK (CNNMoney) -- U.S. stocks recovered from early weakness Thursday to close modestly lower as technology shares remained weak and worries about the downside of China's robust economy hung over the market.

The Dow Jones industrial average (INDU) lost nearly 3 points, or less than 0.1%, to close at 1,1822.8. The S&P 500 (SPX) slid over 1 point to end at 1,280. The tech-heavy Nasdaq (COMP) fell 21 points, or 0.7%, to close at 2,704.

After the market closed, Google (GOOG, Fortune 500) reported quarterly earnings and sales that topped analysts' expectations and reshuffled its management. The search giant said Eric Schmidt is stepping down as chief executive, with cofounder Larry Page taking over in April.

Google shares edged up 1% in after hours trading.

Also after the bell, Hewlett-Packard (HPQ, Fortune 500) announced that four directors are stepping down. Five new directors will join the company's board, including ex-eBay CEO Meg Whitman.

Stocks opened lower Thursday after a stronger-than-expected report on China's gross domestic product "spooked people that China has more tightening to do than we originally thought," said Paul Zemksy, head of asset allocation at ING Investment Management.

"China is a very important part of the recovery and expansion of global GDP," he said. "Until we see signs of moderation in their growth and a slowdown in inflation, I think the market is going to be a bit jittery about that."

Companies with exposure to China were among the worst performers on the Dow, including Caterpillar (CAT, Fortune 500), Du Pont (DD, Fortune 500) and Boeing (BA, Fortune 500). But consumer-linked stocks such as Wal-Mart (WMT, Fortune 500), Procter & Gamble (PNG) and Home Depot (HD, Fortune 500) were the top gainers on the blue-chip index.

Bank stocks, which have been battered by mixed earnings results, regained some ground. Bank of America (BAC, Fortune 500) and JPMorgan (JPM, Fortune 500) were both up over 1%. Morgan Stanely (MS, Fortune 500) was up 4.5% after it posted better than expected quarterly earnings, but missed on sales

In the technology sector, shares of F5 Networks (FFIV) plunged 20% after the maker of Internet networking devices issued a dour outlook for the second quarter.

Commodity prices were also under pressure. Oil prices sank after the government reported a surprise jump in U.S. crude supplies. Gold and silver prices fell as the dollar strengthened.

The retreat came despite better-than-expected reports on U.S. home sales and weekly claims for unemployment benefits. Some traders said the market appears to be entering a "correction" phase, although any retreat is expected to be modest.

"With so much bullishness in the market, it's not surprising to see a bit of a pullback," said Brian Gendreau, market strategist at advisory firm Financial Network.

On Wednesday, stocks ended lower, with tech stocks getting hammered and the Nasdaq suffering its biggest one-day loss in nearly two months.

Economy: The number of Americans filing for first-time unemployment insurance eased by 37,000 to 404,000 last week. The number was lower than forecast.

The National Association of Realtors said sales of existing homes rose 12% in December to a seasonally adjusted annual rate of 5.28 million. The total was much larger than expected.

The Philadelphia Fed index, a regional reading on manufacturing, edged down in December. And the index of Leading Economic Indicators increased more than expected in December.

World markets: Asian markets ended sharply lower following China's GDP report. The Shanghai Composite tumbled 2.9%, the Hang Seng in Hong Kong lost 1.7% and Japan's Nikkei fell 1.1%.

China's gross domestic product, the broadest measure of economic output, expanded at an annual rate of 9.8% in the fourth quarter of 2010. The rate was faster than the 9.6% rate reported in the prior quarter, according to the National Bureau of Statistics.

Meanwhile, inflation cooled -- with the nation's consumer price index rising 4.6% last month, compared to 5.1% in November.

China's rapid growth has sparked fears that its economy may overheat, and many economists are expecting China to further tighten its monetary policy and hike interest rates.

European stocks also slumped. Britain's FTSE 100 slid 1.8%, the DAX in Germany fell 0.8% and France's CAC 40 edged down 0.3%.

Companies: Google said its net income in the fourth quarter rose to $2.5 billion, up 29% from a year earlier.

The results included one-time charges of 94 per share. Without the charges, Google said it earned $8.76 per share. Analysts polled by Thomson Reuters, who typically exclude one-time items from their estimates, forecasted earnings of $8.10 per share.

Sales for the company rose 26% to $8.4 billion. Excluding advertising sales that Google shares with partners, the company reported revenue of $6.3 billion, which topped analysts' forecasts of $6.1 billion.

Morgan Stanley (MS, Fortune 500) posted fourth-quarter earnings of $1.1 billion, or 43 cents a share. Revenue rose 14% from a year earlier to $7.8 billion. Analysts expected the investment bank to report earnings per share of 35 cents on revenue of $7.35 billion. Shares of Morgan Stanley rose 4%.

Wendy's/Arby's Group shares spiked 9% after the fast food giant announced it may sell its struggling Arby's roast beef sandwich chain to focus resources exclusively on the Wendy's brand.

F5 Networks said it expects to report second-quarter sales in the range of $275 million to $280 million. Wall Street analysts surveyed by Thomson Financial were expecting revenues between $272 million and $308 million.

Currencies and commodities: The dollar gained against the euro, the Japanese yen and the British pound.

Oil for March delivery fell $2.22 to close at $89.59 a barrel.

Gold futures for February delivery fell $23.70 to settle at $1,346.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.45% from 3.34% late Wednesday.

Stocks stumble after Goldman Sachs earnings

By Hibah Yousuf, staff reporterJanuary 19, 2011: 4:57 PM ET

By Hibah Yousuf, staff reporterJanuary 19, 2011: 4:57 PM ET

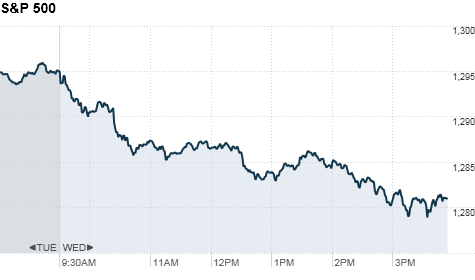

NEW YORK (CNNMoney) -- U.S. stocks took a hit Wednesday, as weak results from Goldman Sachs pressured financial shares and weighed on the overall market.

"So far, earnings have gotten off to a mixed start," said Michael Sheldon, chief market strategist at RDM Financial Group. "We've seen very positive results from tech giants like Apple (AAPL, Fortune 500) and IBM, but financial companies are still dealing with new financial regulation, weakness in the housing market and slow loan growth."

Shares of Goldman Sachs and Bank of America declined more than 4% Wednesday, while shares of Morgan Stanley and Barclays fell more than 3%.

The Dow Jones industrial average (INDU) shed 13 points, or 0.1%, with Bank of America (BAC, Fortune 500) and American Express (AXP, Fortune 500) posting the biggest drops. But losses were capped by a 3% jump in IBM's (IBM, Fortune 500) stock. Earlier in the session, the blue-chip index rose 23 points to its highest level since August 2008.

The S&P 500 (SPX) lost 13 points, or 1%, and the Nasdaq (COMP) dropped 40 points, or 1.5%. It was the biggest one-day loss for the tech-heavy index in almost two months.

Sheldon said that going forward he would not be surprised to see a modest pullback. "Historically, stocks run up into earnings season but experience some profit taking once companies start reporting," he said. Next week, more than 100 S&P 500 companies open their financial books.

But Sheldon added that any weakness in stocks will be short-term.

"As long as the direction of the economy remains on track, the outlook for markets remains positive, at least for the first half of the year," he said.

Investors will also be paying close attention to Chinese President Hu Jintao's visit to the United States as the White House plays host Wednesday to both Hu and a group of American and Chinese business leaders.

"I don't believe the visit will produce any real changes that the U.S. is looking for in terms of a re-evaluation of the yuan, so people will be looking carefully at what agreements can be made in terms of American companies exploring bigger opportunities in China," said Peter Cardillo, chief market economist at Avalon Partners.

On Tuesday, stocks closed higher as shares of Boeing (BA, Fortune 500) and other industrial names rose -- offsetting weakness from Citigroup (C, Fortune 500) and Apple (AAPL, Fortune 500).

Companies: Goldman Sachs (GS, Fortune 500)'s stock tumbled almost 5% after the bank posted better-than-expected fourth-quarter earnings, but missed on revenue estimates.

Meanwhile, shares of Wells Fargo (WFC, Fortune 500) fell 2.1% following results that were in line with forecasts.

Apple reported its best quarter ever late Tuesday, driven by holiday iPad and iPhone sales that were much better than forecast. Shares of Apple (AAPL, Fortune 500) slipped 0.5% Wednesday, after closing down 2% Tuesday amid concerns about Steve Jobs' medical leave of absence.

Shares IBM (IBM, Fortune 500) rose more than 3% Wednesday after the tech giant reported fourth-quarter earnings that topped forecasts Tuesday night.

Starbucks (SBUX, Fortune 500) announced early Wednesday that it will begin accepting mobile payment in all of its U.S. stores, allowing customers to use select smartphones to make purchases. Shares of the company ended slightly higher.

Shares of American Express (AXP, Fortune 500) slid 2.4% after the credit card company said it will shut down a facility in Greensboro, N.C., resulting in 550 job cuts.

Economy: Government figures for December showed a steep decline in housing starts but a surprisingly dramatic increase in building permits.

The U.S. Census Bureau reported that new home construction slumped 4.3% last month, while building permits jumped 16.7%.

World markets: European stocks closed lower. Britain's FTSE 100 dropped 1.3%, while the DAX in Germany and France's CAC 40 fell 0.9%.

Asian markets ended the session higher. The Shanghai Composite rallied 1.8%, the Hang Seng in Hong Kong gained 1.1% and Japan's Nikkei rose 0.4%.

Currencies and commodities: The dollar fell against the euro, the Japanese yen and the British pound.

Oil for March delivery fell 50 cents to settle at $91.81 a barrel.

Gold futures for February delivery rose $2.00 to settle at $1,370.20 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose slightly, pushing the yield down to 3.34% from 3.36% late Tuesday.

Stocks gain despite weakness in banking sector

By Ben Rooney, staff reporterJanuary 18, 2011: 5:09 PM ET

By Ben Rooney, staff reporterJanuary 18, 2011: 5:09 PM ET

NEW YORK (CNNMoney) -- U.S. stocks showed surprising resilience Tuesday, closing higher as shares of Boeing and other industrial names rose, offsetting weakness from Citigroup and Apple.

The Dow Jones industrial average (INDU) added 50 points, or 0.4%. The broad S&P 500 (SPX) index edged up nearly 2 points, or 0.1%. The Nasdaq (COMP), a proxy for the technology sector, added 10 points, or 0.4%.

After the market closed, Apple reported a record jump in quarterly earnings and sales, driven by strong demand for Macs, iPhones and iPads during the holiday season.

Apple shares, which were halted briefly before the announcement, rallied over 4% in after hours trading. Shares fell over 2% in during market hours Tuesday amid worries about CEO Steve Jobs' medical leave.

IBM gained 2.4% in extended trading after the company reported fourth-quarter earnings that beat analysts' estimates.

Boeing led gainers during active trading, adding 3.4% after the defense and aeronautics company said it expects to deliver its 787 Dreamliner in the third quarter of 2011. The 787, which has been plagued by delays, was previously slated for delivery in the first quarter.

"It may be that the stock was oversold enough for it to rally back, despite the disappointing news," said Bruce McCain, chief investment strategist at Key Private Bank.

In addition to Boeing, industrial stocks Alcoa (AA, Fortune 500) and Caterpillar (CAT, Fortune 500) were both up about 2%, reflecting the bullish outlook many investors have for economic growth in 2011.

"Investor sentiment is extremely positive right now," said McCain. "And that's a risky time for the market."

He said any improvement in corporate earnings or economic data will likely have a "muted effect" on stocks, while negative surprises "can torpedo the market."

Looking ahead, quarterly reports are due early Wednesday from Goldman Sachs and Wells Fargo. Investors will also take in the latest readings on housing starts and building permits before the market opens.

Markets were closed Monday due to Martin Luther King Jr. Day. On Friday, stocks ended moderately higher, with the Dow and the S&P posting their seventh straight week of gains. That's the longest weekly win streak for the Dow since the two months of consecutive gains that ended last April.

Companies: Apple reported results late Tuesday for its best-ever quarter, with revenue of $26.7 billion driven by holiday iPad and iPhone sales that were much better than forecast. Apple's profit of $6 billion also set a new record.

Apple sold 7.3 million iPads in the quarter, easily surpassing the expectations of nearly every Wall Street analyst. It also sold 16.2 million iPhones, 4.1 million Macintosh computers and 19.5 million iPods during the quarter.

Shares of Apple had been under pressure for most of the session Tuesday, after the company announced Monday that CEO and co-founder Jobs will take another leave of absence because of health problems.

Jobs' leave of absence comes two years after the Apple CEO took a six-month sabbatical, during which he received a liver transplant. While the news may weigh on Apple shares in the coming days, the slump isn't likely to last long, said Tom Winmill, portfolio manager at Midas Funds.

"This is a very short-term phenomenon," Winmill said. "Jobs is the face of Apple, so there's no question that a lot of people think Apple is a one-man band, but Apple's really anything but -- and the prior time he went on leave, it proved to be a great buying opportunity."

Also after the bell, IBM (IBM, Fortune 500) reported net income of $5.3 billion, or $4.18 per share, for the fourth quarter. That's up from $4.8 billion, or $3.59 per share, a year ago. Analysts had predicted earnings of $4.08 per share.

Citigroup (C, Fortune 500) posted quarterly results before the opening bell that missed expectations. The bank reported a profit of $1.3 billion, or 4 cents per share, on revenue of $18.4 billion.

While Citi's quarterly earnings disappointed, many other companies are on deck to report results this week -- and Winmill said he is bullish about the quarter.

"I think overall we'll see earnings come in this quarter as they did in the prior quarter, with companies continuing to surprise on the upside," he said.

Rival JPMorgan Chase (JPM, Fortune 500) laid the foundation for overall strength on Friday when it reported a 47% jump in fourth-quarter earnings to $4.8 billion, or $1.12 per share. Goldman Sachs (GS, Fortune 500) is due to report Wednesday morning.

Delta (DAL, Fortune 500) reported quarterly earnings that missed forecasts, posting earnings of 19 cents per share -- compared to the 24 cents expected by analysts. Shares of the airline company dropped 5.6%.

Outside the earnings arena, shares of commercial banking firm Comerica (CMA) tumbled nearly 8% Tuesday, after the company agreed to acquire Sterling Bancshares (SBIB) in a $1 billion all-stock deal.

The Federal Communications Commission approved the merger of Comcast, of the country's largest cable operator, and broadcasting company NBC Universal.

Economy: The New York Fed released its Empire Manufacturing Survey before the market open. The reading ticked up to 11.92 in January, which was in line with expectations.

Separately, the National Association of Homebuilder's Housing Market Index for January came in unchanged at 16, as expected.

World markets: European stocks closed higher. Britain's FTSE 100 rose 1.2%, the DAX in Germany and France's CAC 40 both gained 0.9%.

Asian markets ended mostly higher. The Shanghai Composite edged up 0.1%, the Hang Seng in Hong Kong was barely above breakeven and Japan's Nikkei rose 0.2%.

Currencies and commodities: The dollar lost ground against the euro, the Japanese yen and the British pound.

A stronger-than-expected report on GDP from Germany gave the euro a boost in early trading and helped lift European markets, Winmill said.

Oil for February delivery fell 22 cents to $91.32 a barrel.

Gold futures for February delivery added $7.70 to settle at $1,368.20 an ounce.

Bonds: Foreign investors bought $93.9 billion in long-term Treasuries in November, increasing their net holdings after purchasing $56 billion the month before, according to the Treasury's latest reading.

The largest lender to the U.S. remains China, which slightly decreased its holdings to $895.6 billion.

Meanwhile, the price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.39% from 3.33% late Friday.

Stocks: Tech and bank earnings in spotlight

NEW YORK (CNNMoney) -- Stocks have shrugged off economic reports lately, looking instead to this week's results from big names in the technology and financial industries.

"All eyes on are on the earnings -- they drive stock prices," said Keith Springer, head of Springer Financial Advisors. "The real key is corporate America remaining strong. Little else seems to matter much right now."

Analysts say the market is due for a correction, but is "resting" by moving sideways -- instead of lower -- as it awaits the avalanche of earnings this week.

On Friday, the Dow and the S&P posted their seventh straight week of gains. That's the highest streak for the Dow since the two months of consecutive gains that ended in April 2010.

Traders will be looking to the earnings reports to see if companies talk about an improving economic picture, said Mark Luschini, chief investment strategist at Janney Montgomery Scott.

"They also want to see what company management says about hiring prospects -- because in order to sustain an economic recovery, we need to see jobs growth," he added.

Luschini said Wall Street is looking for big numbers this earnings season: "news that doesn't continue to really surprise on the upside looks like it's going to be treated as indifferent."

S&P 500 earnings are expected to have climbed 31.8% in the fourth quarter of 2010, according to earnings tracker Thomson Reuters. S&P companies' revenues are expected to have risen 6%.

The recession brought nine straight quarters of losses until the final quarter of 2009, which snapped the downward trend. Then the first three quarters of 2010 logged growth -- so this reporting period could bring the fifth-straight upward quarter.

Springer said he's expecting fourth-quarter 2010 earnings were "stellar," especially in the banks and techs that are reporting this week.

JPMorgan Chase (JPM, Fortune 500) laid the foundation for strong bank earnings on Friday, when it reported a 47% jump in fourth-quarter earnings to $4.8 billion, or $1.12 per share. That beat the 99 cents per share forecast by analysts.

"Banks are going to make a fortune," Springer said.

Several technology companies, including Apple, Google and IBM will also report this week. Springer notes these reports could give some insight into business spending.

Despite a holiday on Monday, the week is still chock-full of economic reports. Many are in the housing sector, with data due about housing affordability, new home construction, building permits and existing home sales.

Monday: The U.S. stock market, bond market and federal offices are closed in observance of Martin Luther King, Jr. Day.

Tuesday: A reading on New York regional manufacturing in January is due before the bell. Also, Citigroup (C, Fortune 500) will report its earnings before trade starts.

After the start of trade, the National Association of Home Builders and Wells Fargo will release a report with their housing affordability index. Economists polled by Briefing.com expect the reading stayed flat at 16 in January.

After the bell, both Apple (AAPL, Fortune 500) and IBM (IBM, Fortune 500) will release earnings results.

Wednesday: Chinese President Hu Jintao will visit the White House to talk with President Obama.

Before the start of trade, Goldman Sachs (GS, Fortune 500) and Wells Fargo (WFC, Fortune 500) will report quarterly earnings.

Also before the opening bell, government figures for December are expected to show that initial construction of single family homes fell and requests for building permits rose.

Thursday: Morgan Stanley (MS, Fortune 500) will report results ahead of the bell, while Google (GOOG, Fortune 500) and Advanced Micro Devices (AMD, Fortune 500) come out after the close of trade.

The weekly jobless claims report is due in the morning. Also out early is the Philadelphia Fed index, a regional reading on manufacturing.

The weekly crude oil inventories report is due later in the morning, one day later than usual because of Monday's holiday.

The National Association of Realtors will release its monthly report on existing home sales, which analysts polled by Briefing.com expect rose to an annual rate of 4.8 million in December from 4.68 million the previous month.

The Leading Economic Indicators (LEI), from the Conference Board, is expected to have fallen to 0.6% in December from 1.1% the previous month.

Friday: Both Bank of America (BAC, Fortune 500) and General Electric (GE, Fortune 500) will report earnings before the start of trade.

Jan 17, 2011

STI lower at midday

SINGAPORE shares were lower at midday on Monday, with the benchmark Straits Times Index at 3,241.67, down 0.13 per cent, or 4.29 points.

About 845.6 million shares exchanged hands.

Losers beat gainers 216 to 150.

Stocks set for lackluster open

By CNNMoney staffJanuary 13, 2011: 8:16 AM ET

By CNNMoney staffJanuary 13, 2011: 8:16 AM ET

NEW YORK (CNNMoney) -- U.S. stocks were poised for a lackluster open Thursday, as investors braced for readings on jobless claims and inflation.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were flat ahead of the opening bell. Futures measure current index values against perceived future performance.

On Wednesday, financial shares sparked a broad rally, sending stocks to multi-year highs and marking the second straight winning day for the Dow.

Credit rating agencies Standard & Poor's and Moodys issued a warning on U.S. credit, citing mounting debt, according to The Wall Street Journal. Meanwhile, Spain held a successful auction of government debt.

Eurozone jitters have led to choppy trading this week, but markets are still trending higher.

"Stocks are slightly overbought right now so we might have a nominal pullback in the short-term," said said Chip Brian, chief executive of MySmartrend.com, which analyzes over 6,000 stocks in real time.

"But the uptrend will continue once the European debt crisis du jour simmers out and people realize that, while there's been issues with Spain, Greece, Portugal and Italy, no one's toppled," he added.

Economy: After a light start to the week, investors face a full day of economic reports Thursday.

The Department of Labor releases its weekly jobless claims report before the opening bell. The number of Americans filing new claims for unemployment is expected to have climbed to 415,000 last week, from 409,000 the previous week.

Continuing claims -- a measure of Americans who have been receiving benefits for a week or more -- are expected to have fallen to 4.08 million, from 4.10 million in the previous week.

The Producer Price Index, a measure of wholesale inflation, is due out from the Commerce Department at the same time. The index is expected to have edged up 0.8% in December, after climbing the same amount in November. The so-called core PPI -- which excludes volatile food and energy prices -- is expected to have risen 0.2%, after increasing by 0.3% in the previous month.

The trade balance, also due in the morning from the Commerce Department, is expected to have widened to $41.0 billion in November, from $38.7 billion in October.

In the afternoon, Federal Reserve Chairman Ben Bernanke will speak at the Federal Deposit Insurance Corporation's forum on small business lending.

World markets: European stocks were mixed in morning trading, despite a Spanish auction of government bonds that was met with solid demand. The nation rose the $3.9 billion (3 billion euros) as hoped. But the results had little impact on markets because the results were widely expected, said Brian.

"The bond auctions in Spain went pretty well, but there still seems to be concern about other countries," he said. "I think it's a good thing that each of the countries in the eurozone are trying to seek their own footing instead of waving their hands in the air and saying 'save us'!"

Britain's FTSE 100 lost 0.2% and the DAX in Germany edged up 0.1%, while France's CAC 40 rose 0.6%.

Asian markets ended the session higher. The Shanghai Composite ticked up 0.2%, the Hang Seng in Hong Kong rose 0.5% and Japan's Nikkei gained 0.7%.

Companies: Shares of Williams Sonoma (WSM) gained 1% in pre-market trading after the company boosted its fourth-quarter earnings and sales guidance following strong holiday sales.

After the closing bell, Intel (INTC, Fortune 500) is expected to report a quarterly profit of 53 cents per share -- versus 40 cents a year ago.

Currencies and commodities: The dollar slipped against the euro and the Japanese yen, but rose versus the British pound.

Oil for February delivery fell 10 cents to $91.76 a barrel.

Gold futures for February delivery dropped $5.10 to $1,380.70 an ounce.

In other commodities, corn continued its recent tear, surging 1% to $6.37 per bushel.

Bonds: The yield on the benchmark 10-year U.S. Treasury was little changed at 3.35%.

Stocks climb to 2-year highs

By Laurie Segall, staff writerJanuary 12, 2011: 4:35 PM ET

By Laurie Segall, staff writerJanuary 12, 2011: 4:35 PM ET

NEW YORK (CNNMoney) -- Financial shares sparked a broad rally Wednesday that sent all three major indexes to fresh multi-year highs.

The Dow Jones industrial average (INDU) added 83 points, or 0.7% to close at 11,755.44 -- its highest level since September 2008.

JPMorgan Chase (JPM, Fortune 500) was the Dow's biggest gainer, jumping more than 2%, followed by Bank of America (BAC, Fortune 500), American Express (AXP, Fortune 500) and Boeing (BA, Fortune 500).

Bank shares also got a lift Wednesday from Wells Fargo's upgraded outlook for the sector. "It's a group that lagged pretty badly in the fall, and they're still playing catch-up," said Timothy Ghriskey, CIO at Solaris Asset Management.

The S&P 500 (SPX) rose 11 points, or 0.9%, closing at 1,285.96 -- its highest level since August 2008.

The Nasdaq (COMP) gained 20 points, or 0.8%, ending the day at 2,737.33 -- a three-year high.

Europe continues to be a wild card as 2011 gets underway, so investors are looking for any signs that those issues are under control.

A rally in overseas markets spilled over to U.S. stocks early in the session as a solid auction of Portuguese bonds helped ease eurozone jitters.

"The bond offering went relatively decently for Portugal [and] that relieved the fears about a bailout." said John Wilson, Chief technical strategist at Morgan Keegan.

World markets: European stocks rose after Portugal's successful auction of government debt. The auction came amid recent speculation that Portugal might be the next eurozone country to need a bailout.

"They sold $1.249 billion at the auction, so basically money is costly but they are selling it, so that's a relief for the market," said Peter Cardillo, chief market economist at Avalon Partners.. "Tomorrow is Spain's turn, and that auction shouldn't be a problem either, so the market is going to be moving higher on that as well."

Optimism about Thursday's upcoming bond auction in Spain lifted U.S.-listed shares of Spanish banking giant Banco Santander (STD), whose stock gained nearly 11%. Shares of rival bank Banco Bilbao Vizcaya Argentaria (BBVA) also rose about 11%.

The DAX in Germany ended the day up 1.8%, France's CAC 40 closed 2.2% higher, and Britain's FTSE 100 added 0.6%.

Asian markets also ended higher. The Shanghai Composite rose 0.6%, the Hang Seng in Hong Kong climbed 1.5% and Japan's Nikkei was barely above breakeven.

Meanwhile, Bank of China is allowing customers in the United States to trade its currency, the yuan, for the first time.

Economy: Treasury Secretary Timothy Geithner said China's policies are a growing source of concern in the United States and other countries. In a speech at Johns Hopkins, Geithner also said that China's undervalued currency and dependence on exports must be addressed. His remarks come ahead of next week's U.S. visit by Chinese President Hu Jintao.

The Federal Reserve released its snapshot of economic activity for January Wednesday afternoon.

Known as the Beige Book, the report showed that the economy continued to grow moderately across the nation. Despite the lagging housing market, the Fed reported bright spots in manufacturing, retail, and non financial services sectors.

The December Treasury budget was also released Wednesday afternoon. The budget shortfall eased to $80 billion in December from $91.4 billion in the previous month.

Companies: AIG (AIG, Fortune 500) announced Wednesday that it has agreed to sell its Taiwan unit, Nan Shan Life Insurance Company, for $2.16 billion in cash. Shares of the insurer closed down 1.1%.

Shares of ITT (ITT, Fortune 500) ended the day up 16% after the manufacturing company announced plans to split into three publicly traded companies by spinning off its water-related businesses and defense division.

A number of big names are hovering around 52-week highs Wednesday, including Exxon Mobil Corp. (XOM, Fortune 500), Chevron Corp. (CVX, Fortune 500), United Technologies Corp. (UTX, Fortune 500), and CNNMoney parent company Time Warner Inc. (TWX, Fortune 500)

Currencies and commodities: The dollar lost ground against the euro and the British pound, but gained slightly against the Japanese yen.

Oil for February delivery settled up 75 cents to $91.86 a barrel.

Gold for February ended the day up $1.50 to $1,385.80 an ounce.

Corn futures rose 3% Wednesday after the U.S. Department of Agriculture predicted corn supplies would fall to their lowest level since 1996.

The report is the latest sign of stretched food supplies at a time when growth in developing countries is fueling seemingly insatiable demand for agricultural goods.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.35% from 3.34% late Tuesday.

Wednesday's $21 billion auction of 10-year notes was met with strong demand.

The bid-to-cover ratio of 3.3 means that there was more than $69 billion worth of demand for the $21 billion worth of debt.

Stocks finish higher

By Hibah Yousuf, staff reporterJanuary 11, 2011: 4:13 PM ET

By Hibah Yousuf, staff reporterJanuary 11, 2011: 4:13 PM ET

NEW YORK (CNNMoney) -- U.S. stocks closed higher Tuesday as investors turned their attention toward corporate earnings and Japan's pledge to buy eurozone bonds helped ease debt jitters.

The Dow Jones industrial average (INDU) finished up 34 points, or 0.3%, with Bank of America (BAC, Fortune 500), Intel (INTC, Fortune 500) and Chevron (CVX, Fortune 500) leading the advance. Earlier, the blue-chip index had climbed as much as 67 points.

The S&P 500 (SPX) rose 5 points, or 0.4%, and the tech-heavy Nasdaq (COMP) gained 9 points, or 0.3%.

Dow component Alcoa (AA, Fortune 500) kicked off the reporting period late Thursday with better-than expected results. Financial Network market strategist Brian Gendreau said he wouldn't be shocked to see quarterly earnings continue to surprise on the upside, which would push stocks upward.

"We're looking ahead into what seems like it'll be a pretty good earnings season," he said.

Sears Holdings (SHLD, Fortune 500) and Apollo Group (APOL) were the big gainers on the S&P 500 and the Nasdaq. Sears' fourth-quarter and full-year outlook topped analysts' forecasts, while Apollo's quarterly results beat expectations.

While stocks were holding gains, there was some pull back from earlier in the session, which analysts say is to be expected. "There's still a lot of enthusiasm in the market, but we've been rallying for four months now so we may see a bout of weakness," said Steven Goldman, market strategist at Weeden & Co.

Eurozone jitters ease: On Monday, stocks ended just below breakeven as investors worried about a possible bailout for Portugal.

Those concerns faded Tuesday amid reports that Japan will buy eurozone bonds to help prevent the spread of the region's debt crisis, but Gendreau said problems will resurface throughout the year.

"Concerns about Europe's debt problems crop up every couple of weeks, but they tend to get outweighed by U.S. economic or company news," he said. "But I think eurozone issues will weigh on the market for some time to come."

World markets: European stocks ended higher on the talk about a Japanese purchase of eurozone bonds.

"Certainly there's a lot of buying power in Japan, so if they are seriously willing to help Europe by buying up some of those bonds, that will limit -- to a degree -- the downside the sovereign debt crisis poses, said Bruce McCain, chief investment strategist at Key Private Bank.

Britain's FTSE 100 jumped 1%, the DAX in Germany gained 1.3%, and France's CAC 40 climbed 1.6%.

Asian markets ended mixed. The Shanghai Composite rose 0.4%, and the Hang Seng in Hong Kong gained 1%, while Japan's Nikkei edged down 0.3%.

Companies: Verizon (VZ, Fortune 500) said it will begin selling Apple's iPhone on Feb. 10, ending AT&T's four-year run as the smartphone's exclusive carrier. Shares of Verizon fell almost 1.6%, while shares of Apple (AAPL, Fortune 500) edged down slightly.

Sears (SHLD, Fortune 500) stock jumped 6.3% after the retailer's fourth-quarter outlook topped forecasts. Sears said it expects to earn between $3.39 and $4.12 per share for the quarter ending Jan. 29. Analysts have been looking for earnings of $3.09 per share.

For the year, Sears expects to earn between $130 million and $210 million, or between $1.16 and $1.88 per share.

Apollo Group's (APOL) stock rose 13.4% after the for-profit educator posted fiscal first-quarter earnings that trounced Wall Street expectations despite a 42% drop in new student enrollment during the quarter.

Shares of Tiffany & Co. (TIF) declined 0.6% after the jeweler and luxury goods retailer raised its outlook and posted an 11% rise in sales over the two-month holiday period.

Shares of Talbots (TLB) sank 17.4% Tuesday after the women's retailer posted a 6% drop in same-store sales so far this quarter and lowered its outlook due to weak customer demand.

Lennar (LEN), one of the nation's largest homebuilders, posted quarterly earnings per share of 17 cents before the opening bell. Analysts had forecast 3 cents. Its stock rose nearly 7%.

AMD's (AMD, Fortune 500) stock dropped 9% after the chip maker announced the immediate resignation of CEO Dirk Meyer on Monday. The company named CFO Thomas Seifert as interim chief executive.

Shares of Supervalu (SVU, Fortune 500) tumbled 11.6% after the grocery store chain posted disappointing quarterly results and lowered its guidance for the year, which ends in February.

Shares of Alcoa (AA, Fortune 500) slipped 1%, despite its positive earnings news the night before, amid worries about the aluminum producer's rising raw material supply costs.

Economy: Wholesale inventories fell 0.2% in November, the Commerce Department said. Economists were expecting inventories to have risen 1% during the month, after jumping 1.7% in October.

Currencies and commodities: The dollar lost ground against the euro and the British pound, but rose versus the Japanese yen.

Oil for February delivery gained $1.86 to settle at $91.11 a barrel.

Gold futures for February delivery climbed $10.20 to settle at $1,384.30 an ounce.

Bonds: The price of the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.34% from 3.30%.

Earlier, the yield had climbed as high as 3.7%.

Treasury prices trimmed losses after the sale of $32 billion in 3-year notes was met with strong demand. The bid-to-cover ratio, a measure of demand, was 3.06, up from 2.9 in December's auction.

Jan 11, 2011

STI higher at midday

SINGAPORE shares were higher at midday on Tuesday, with the benchmark Straits Times Index at 3,237.76, up 0.26 per cent, or 8.49 points.

About 916.7 million shares exchanged hands.

Gainers beat losers 210 to 170.

Stocks end lower amid eurozone jitters

By Hibah Yousuf, staff reporterJanuary 10, 2011: 4:29 PM ET

By Hibah Yousuf, staff reporterJanuary 10, 2011: 4:29 PM ET

NEW YORK (CNNMoney) -- U.S. stocks came off morning lows but still ended mostly lower Monday following a sell-off in European markets, as investors worried about a possible bailout for Portugal.

The Dow Jones industrial average (INDU) closed down 37 points, or 0.3%. Earlier in the session, the blue-chip index dropped 100 points. The S&P 500 (SPX) shed 2 points, or 0.1%. After spending most of the session in the red, the Nasdaq (COMP) managed to turn higher in the afternoon. The tech heavy index added 5 points, or 0.2%.

"There's a lot of anxiety in the marketplace, with the focus on what's happening overseas," said Bruce McCain, chief investment strategist at Key Private Bank.

Concerns over European debt problems resurfaced as Germany, France and other eurozone countries pressured Portugal to take a bailout to ease its massive debt crisis.

McCain added that the slump could also be part of a small pullback investors have been anticipating following six consecutive weeks of gains.

"We've had a series of very good weeks and now that we're into January, the market is vulnerable to a pullback for the short-term," McCain said.

Meanwhile, investors digested of a slew of corporate merger deals and geared up for the start of fourth-quarter corporate results.

On Friday, stocks dropped after a court ruled against Wells Fargo (WFC, Fortune 500) and U.S. Bancorp (USB, Fortune 500) in a foreclosure case. The ruling sparked a selloff in bank stocks that rippled through the broader market.

The government's latest reading on the labor market also dragged markets lower. The U.S. economy added slightly fewer jobs in December than expected, but the unemployment rate edged lower than economists had anticipated.

That disappointment over the jobs number may continue to trickle into trading this week, said David Jones, chief market strategist at IG Markets.

"There's still an air of caution after the payroll data on Friday," Jones said. "The market had factored in a good number, so anything less than expected is always going to be a disappointment, and shows what a problem U.S. employment really still is going forward."

World markets: European markets fell Monday amid talk that Portugal is being pressured to take a bailout package to stop the spread of eurozone debt. Investors are also preparing for government bond auctions in Portugal, Spain and Italy this week.

"Markets are worrying that the European debt crisis is coming back again," Jones said. "[Portugal] is denying that they need [a bailout], but we saw that with Greece and Ireland as well before they got bailouts."

Britain's FTSE 100 closed down 0.5%, the DAX in Germany lost 1.2% and France's CAC 40 dropped 1.5%.

Asian markets ended lower. The Shanghai Composite fell 1.7% and the Hang Seng in Hong Kong slipped 0.7%. Japan's market was closed for a holiday.

Companies: Shares of Sara Lee (SLE, Fortune 500) jumped 4.5% on reports that Apollo Global Management and other private equity firms are looking into acquiring the food company.

Chemical maker DuPont (DD, Fortune 500) said Sunday it will buy Danisco, a Danish enzyme and food ingredients company, for $5.8 billion in cash. Shares of DuPont slipped 1.5%.

Shares of Progress Energy (PGN, Fortune 500) fell 1.6% after Duke Energy (DUK, Fortune 500) said it will buy the fellow power company for $13.7 billion in stock. Shares of Duke Energy fell 1.2%.

Shares of Standard Microsystems (SMSC) dropped almost 10% after the chip maker announced it is buying rival Conexant (CNXT) for $284 million. Conexant's stock jumped 14.3%.

Playboy's (PLA) stock surged more than 17% after founder Hugh Hefner signed an agreement to take his publicly traded company private. Hefner, who already owns a substantial amount of the adult magazine publisher's shares, has entered an agreement with Icon Acquisition Holdings to pay $6.15 per share for the portion of Playboy Enterprises that he does not own.

Shares of Strayer Education (STRA) sank 23% after the for-profit college said winter new student enrollment dropped 20% from a year ago. For-profit education stocks including Devry (DV), Washington Post (WPO, Fortune 500) and Apollo Group (APOL) were among the biggest losers in the S&P 500.

Shares of General Motors (GM) fell 1% after the plug-in Chevrolet Volt was named North American Car of the Year at the Detroit Auto Show.

Meanwhile, shares of Ford (F, Fortune 500) were up 0.2% after Ford Explorer was voted Truck of the Year, and the automaker announced it will add more than 7,000 new hourly and salaried jobs in the United States over the next two years.

Alcoa (AA, Fortune 500), the first Dow component to report fourth-quarter results, posted its highest quarterly earnings in more than two years and topped forecasts. The aluminum maker earned 21 cents per share during the quarter, on revenue of $5.7 billion. Analysts were expecting 19 cents per share, according to analysts surveyed by Thomson Reuters.

Economy: No major economic reports were scheduled Monday.

Currencies and commodities: The dollar lost ground against the euro, the British pound, and the Japanese yen.

Oil for February delivery edged up $1.22 to settle at $89.25 a barrel.

Gold futures for February delivery rose $5.20 to settle at $1,374.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.30% from 3.33% late Friday.

Jan 10, 2011

STI closes 0.98% down

SINGAPORE shares closed lower on Monday, with the benchmark Straits Times Index at 3,229.27, down 0.98 per cent, or 32.08 points.

About 2.1 billion shares exchanged hands.

Losers beat gainers 335 to 188.

Stocks set to slip on eurozone jitters

By CNNMoney staffJanuary 10, 2011: 8:14 AM ET

By CNNMoney staffJanuary 10, 2011: 8:14 AM ET

NEW YORK (CNNMoney) -- U.S. stocks were poised for a lower open Monday, taking cues from European markets as investors worry about a possible bailout for Portugal.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were down ahead of the opening bell. Futures measure current index values against perceived future performance.

On Friday, stocks dropped after a court ruled against Wells Fargo and U.S. Bancorp in a foreclosure case. The ruling sparked a selloff in bank stocks that rippled through the broader market.

The government's latest reading on the labor market also dragged markets lower. The U.S. economy added slightly fewer-than-expected jobs in December, but the unemployment rate edged lower than economists had anticipated.

That disappointment may continue to trickle into trading this week, said David Jones, chief market strategist at IG Markets.

"There's still an air of caution after the payroll data on Friday," Jones said. "The market had factored in a good number, so anything less than expected is always going to be a disappointment, and shows what a problem U.S. employment really still is going forward."

World markets: European markets fell in morning trading, amid talk that Portugal is being pressured to take a bailout package to stop the spread of eurozone debt. Investors are also preparing for government bond auctions in Portugal, Spain and Italy this week.

"Markets are worrying that the European debt crisis is coming back again," Jones said. "[Portugal] is denying that they need [a bailout], but we saw that with Greece and Ireland as well before they got bailouts."

Britain's FTSE 100 edged down 0.5%, the DAX in Germany lost 1% and France's CAC 40 dropped 1.6%.

Asian markets ended the session lower. The Shanghai Composite fell 1.7% and the Hang Seng in Hong Kong slipped 0.7%. Japan's Nikkei was closed for holiday.

Companies: Shares of Sara Lee (SLE, Fortune 500) jumped nearly 7% in pre-market trading on reports that Apollo Global Management and other private equity firms are looking into acquiring the food company.

Chemical maker DuPont (DD, Fortune 500) said Sunday it will buy Danisco, a Danish enzyme and food ingredients company, for $5.8 billion in cash. Shares of DuPont edged slightly lower in early trading.

Shares of Progress Energy (PGN, Fortune 500) rose more than 2% before the opening bell, after Duke Energy (DUK, Fortune 500) said it will buy the fellow power company for $13.7 billion in stock.

After markets close, Alcoa (AA, Fortune 500) will release its quarterly results, the first of the Dow components to report its fourth-quarter figures. The aluminum maker is expected to announced earnings per share of 19 cents, according to analysts surveyed by Thomson Reuters.

Economy: No major economic reports are scheduled for Monday.

Currencies and commodities: The dollar gained ground against the euro and the British pound, but slipped versus the Japanese yen.

Oil for February delivery edged up 29 cents to $88.32 a barrel.

Gold futures for February delivery fell $2.20 to $1,366.70 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.31% from 3.33% late Friday.

james87 ( Date: 03-Jan-2011 22:42) Posted:

|

The Dow is very 'guai' (good boy)...

it closed green...

After rocky day, stocks end mixed

By Annalyn Censky, staff reporterJanuary 4, 2011: 4:46 PM ET

By Annalyn Censky, staff reporterJanuary 4, 2011: 4:46 PM ET

NEW YORK (CNNMoney) -- After a tumultuous day, U.S. stocks ended mixed Tuesday, as investors mulled over reports on auto sales, factory orders and the Federal Reserve's December meeting.

Stocks struggled for direction all day. After losing as much as 0.3% mid-day, the Dow Jones industrial average (INDU) ended the session up 20 points, closing at a fresh two-year high of 11,691.

Meanwhile, the S&P 500 (SPX) was down 2 points, or 0.1%; and the Nasdaq (COMP) fell 10 points, or 0.4%.

Throughout the day, investors weighed a better-than-expected factory orders report with concerns that stocks may be overextended, after posting double-digit percentage gains in 2010.

"We've had such a run here in the last four weeks, without any downside relief," said Rich Ilczyszyn, a market strategist with futures-broker Lind Waldock. "It's a normal market reaction, as we go up for a month or so and then we pull back."

Stocks ended 2010 with their best December since 1991, and some traders think they may have gotten a bit ahead of themselves. As a result, stocks were held back Tuesday as some investors tried to reap the rewards of their 2010 bets now -- in case the market falls back in January.

Traders also mulled over the minutes from the Federal Reserve's latest meeting in December, which showed that the central bank's policymakers remain committed to the purchase of $600 billion in U.S. Treasurys as a means of stimulating the economy.

Anticipation of that stimulus policy, referred to as "quantitative easing" or "QE2," had fueled bullish stock market gains in the second half of 2010. Investors had grown concerned about whether the Fed will follow through with the full $600 billion program in 2011.

The minutes alleviated some of those fears.

"Takeaway number one is they're not going to stop QE2 right now," said Doug Roberts, chief investment strategist at Channel Capital Research. "And it looks like from this, they're not as hesitant about QE3 as one might think."

Stocks are coming off a rally on Monday, when the Dow closed at a fresh two-year high.

Economy: After the opening bell, the Commerce Department reported that November factory orders rose 0.7% in November, following a 0.7% decrease in October. Analysts surveyed by Briefing.com had expected total orders to fall by 0.3% during the month.

Investors also watched as major auto companies release their December sales figures throughout the day. General Motors was the first to report Tuesday morning, saying it ended a challenging 2010 with a bang.

GM's U.S. sales rose 8% in December from a year earlier -- the company's best sales month of the year. GM (GM) shares rose 2.3% after the news.

Ford Motor (F, Fortune 500) shares rose 0.8% after the company reported December sales were up 4% from a year ago.

Analysts surveyed by Briefing.com had expected overall auto sales for December to drop to 3.7 million, from 3.8 million the previous month. The fact that most automakers reported a strong sales month raised hopes for the industry heading into the new year.

Reports on jobless claims, job cuts and manufacturing are on tap later in the week, and the government's closely-watched jobs report is due Friday.

Economists expect the monthly report to show employers boosted payrolls by 135,000 last month, after adding 39,000 jobs in November.

Also on Friday, Federal Reserve Chairman Ben Bernanke is scheduled to testify before the Senate budget panel.

Companies: Motorola's long-awaited split into two separate companies went into effect at the start of trading Tuesday. The company's cell phone business now operates as Motorola Mobility Holdings Inc., under the stock symbol MMI (MMI). Motorola Solutions Inc., a company that makes other telecommunications gear, trades under MSI (MSI).

Motorola Mobility shares debuted at $31.17, and Motorola Solutions shares started at $37.30.

Shares of BP (BP) rose 2.5% after London newspaper the Daily Mail reported Royal Dutch Shell (RDSA) previously considered making a bid for the oil giant during the Gulf oil spill. Royal Dutch Shell shares rose 0.6% in .

Borders Group (BGP) stock fell 12.5%, after the company announced late Monday that its general counsel Thomas Carney and Chief Information Officer D. Scott Laverty both resigned.

World markets: European stocks were mixed, with Britain's FTSE 100 starting 2011 with a bang. The FTSE soared 1.7% in its first trading day of the new year, while the DAX in Germany fell 0.3% and France's CAC 40 rose 0.3%.

Asian markets ended the session higher. The Shanghai Composite jumped 1.6%, the Hang Seng in Hong Kong ticked up 1% and Japan's Nikkei gained 1.7%.

Currencies and commodities: The dollar lost ground against the the British pound, but gained versus the Japanese yen and the euro.

Oil for February delivery fell $2.17 to settle at $89.38 a barrel.

Gold futures for February delivery pulled back from the previous session's highs, slipping $44.10 to settle at $1,378.80 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.34%.

The Dow skyrocketted +100 pts on the opening bell

on the first trading day...

Stocks poised to start year higher

By CNNMoney staffJanuary 3, 2011: 8:52 AM ET

By CNNMoney staffJanuary 3, 2011: 8:52 AM ET

NEW YORK (CNNMoney) -- U.S. stocks were poised to kick off the new year with gains Monday, as investors returned from the holidays and awaited a key report on manufacturing.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were higher ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks ended a roller coaster year with a lackluster showing Friday, but all three major indexes logged double-digit percentage gains for the year. The Dow Jones industrial average finished 2010 up 11%, the S&P 500 climbed 13%, and the Nasdaq rose 17%.

While the economy has a long road to recovery, investors are bullish about the upcoming year.

"There's an overall optimism in the market and traders are going to be looking for more good economic data," said Len Blum, managing director at Westwood Capital LLC.

"Stocks are at two-year highs -- and momentum has been helped by the stimulus -- so the real question now is whether this momentum will turn into significant economic growth, which means making a meaningful change in unemployment and dealing with real estate weakness," he added.

Economy: On the first trading day of 2011, traders will be eyeing a report on manufacturing data for signs of economic strength

The Institute for Supply Management's manufacturing index for December is due after the start of trading, and is expected to have edged up to 57.3 from 56.6 in November. Any number above 50 indicates growth in the sector.

A report on construction spending will also be released after the opening bell. Economists are looking for an increase of 0.2% in November, following a 0.7% rise in October.

The most closely watched report of the week will be the government's reading on the labor market, due Friday. Economists expect employers boosted payrolls by 132,000 last month, following a 39,000 gain in November.

Companies: Bank of America (BAC, Fortune 500) announced Monday that it is taking a charge for faulty mortgages sold to Freddie Mac and Fannie Mae. Bank of America expects to take a provision of about $3 billion related to the loans and an impairment charge of $2 billion to fourth-quarter results. The bank has made cash payments of about $1.3 billion to both Freddie Mac and Fannie Mae.

Shares of Bank of America rose more than 5% before the opening bell.

Late Sunday, the New York Times reported Goldman Sachs (GS, Fortune 500) and an anonymous Russian investor have invested $500 million in Facebook. The deal values the social networking giant at $50 billion -- a valuation higher than CNNMoney parent Time Warner (TWX, Fortune 500), as well as other major media companies. Shares of Goldman Sachs jumped 1.5% in pre-market trading.

World markets: European stocks were higher in midday trading. France's CAC 40 rose 1.8% and Germany's DAX gained 1.4%. Britain's market was closed.

Most Asian markets were closed Monday. Tokyo and Shanghai were dark, while the Hang Seng in Hong Kong finished 1.7% higher.

Currencies and commodities: The dollar gained against the euro, the Japanese yen and the British pound.

Oil for February delivery rose 80 cents to $92.18 a barrel.

Gold futures for February delivery rose $1.60 to $1,424.40 -- topping its previous intra-day record of $1,421.20.

Bonds: The price on the benchmark 10-year U.S. Treasury fell Monday, pushing the yield up to 3.34% from 3.30% Friday.