Post Reply

161-180 of 2099

Post Reply

161-180 of 2099

today, st index will be good

Forget red (bad) Feb, a new month for March, for Marching into new affirmative PROPOSITION

NEW YORK (

CNNMoney) -- Stocks opened higher Monday morning, as investors welcomed a report showing a larger-than-expected increase in personal income and saving.

However, the gains were somewhat muted as the ongoing tension in Libya continues to underpin sentiment.

Libya, forsee conclusion...factoring in liao, like ostrich, hope he can find a quick solution, or other wise

.

How come STI still in red while the rest of the markets are in green?????

Feb 28, 2011

STI lower at midday

SINGAPORE shares were lower at midday on Monday, with the benchmark Straits Times Index at 3,015.74, down 0.31 per cent, or 9.42 points.

About 878 million shares exchanged hands.

Losers beat gainers 332 to 110.

Thanks be to GOD, I am right.iPunter ( Date: 20-Feb-2011 13:56) Posted:

If it is on the uptrend, selling against the main trend is pure folly...

But then, since no one can tell the trend, it is also a fair bet...

Hulumas ( Date: 20-Feb-2011 13:14) Posted:

| On Monday onward, I start selling all my US stock, it is due for correction! |

|

|

|

Before the oil hit $85, or $90 or $100, big players already buying / speculaaing oil huge, and would start selling their stocks at hand.

So, a cycle it is only waiting to be happened, Its not a WORLD CRISIs.

Middle east problems is a perpectual problems which is just not happened recently.

Am waiting for US to go back to its gloria stage. It seems it is attractive enough now for investors to enter their market.

What has oil got to do with stocks?? Its all because some hedge funds in order to hedge against its potential losses, one hand buying oil but the other hand, selling stocks at hand, or vice versa.

Blastoff ( Date: 24-Feb-2011 08:14) Posted:

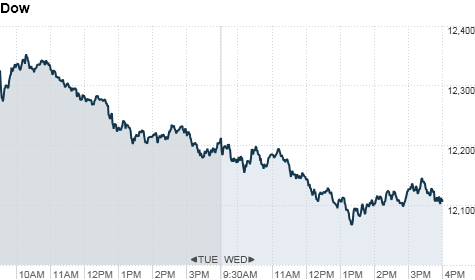

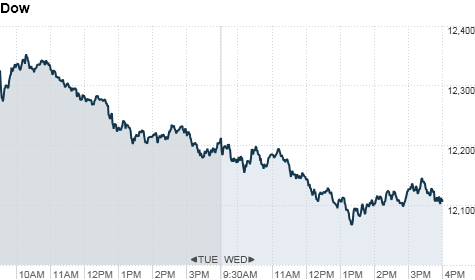

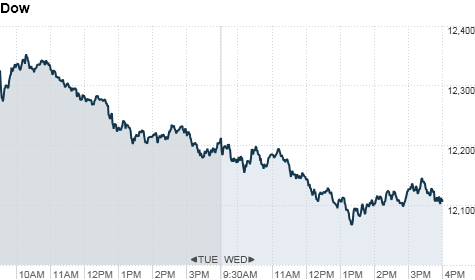

Stocks sink for second day as oil hits $100 By Hibah Yousuf, staff writerFebruary 23, 2011: 4:46 PM ET By Hibah Yousuf, staff writerFebruary 23, 2011: 4:46 PM ET

NEW YORK (CNNMoney) -- Stocks declined for a second straight session Wednesday as oil prices surged to briefly cross the $100 per barrel mark amid mounting turmoil in Libya.

The Dow Jones industrial average (INDU) fell 107 points, or 0.9%, a day after the blue-chip index plunged nearly 180 points. That was the first back-to-back triple-digit drop for the blue-chip index since June.

Meanwhile, the S& P 500 (SPX) slipped 8 points, or 0.6%.

Both indexes were also dragged lower by a 10% tumble in shares of Hewlett-Packard (HPQ, Fortune 500). Late Tuesday, the computer company issued a disappointing outlook and quarterly sales figures.

The Nasdaq (COMP) fell 33 points, or 1.2%, with a 7% decline in shares of Dollar Tree (DLTR, Fortune 500) leading the index lower. HP is not included in the tech-heavy index.

Oil prices continued to climb, jumping more than 4% to $100 a barrel for the first time since October 2008 amid talk of production disruptions. The North African country is the first oil exporting nation to be affected by the unrest sweeping across the Arab world.

While Libya only contributes about 2% of global output, analysts are worried about the violence and chaos spreading to bigger exporting neighbors.

" Investors are watching what's happening across the Middle East, and waiting to see if more dominoes will fall," said Ron Kiddoo, chief investment officer at Cozad Asset Management.

Traders are keeping a particularly close eye on oil-rich Saudi Arabia, where King Abdullah announced a series of measures worth billions of dollars Wednesday in an effort to ward off the kind of revolts that have roiled the region.

World markets: European stocks closed lower. Britain's FTSE 100 fell 1%, the DAX in Germany slid 1.6% and France's CAC 40 edged lower by 0.8%.

Asian markets ended the session mixed. The Hang Seng in Hong Kong declined 0.4% and Japan's Nikkei fell 0.8%, while the Shanghai Composite ticked up 0.2%.

Companies: Shares of CBOE Holdings (CBOE), the parent company of the Chicago Board Options Exchange, jumped almost 2% after Reuters reported that the company is " open to 'strategic transactions" such as a sale or merger with another exchange operator." CBOE declined comment.

Shares of home improvement chain Lowe's (LOW, Fortune 500) declined 1% after the company reported quarterly earnings that beat analysts' expectations.

Economy: A report from the National Association of Realtors showed that existing home sales rose 2.7% to an annual rate of 5.36 million units.

Currencies and bonds: The dollar dropped versus the euro, the British pound and the Japanese yen.

The price on the benchmark 10-year U.S. Treasury fell slightly, with the yield pushing up to 3.49% from Tuesday yield of 3.46%. |

|

Stocks sink for second day as oil hits $100

By Hibah Yousuf, staff writerFebruary 23, 2011: 4:46 PM ET

By Hibah Yousuf, staff writerFebruary 23, 2011: 4:46 PM ET

NEW YORK (CNNMoney) -- Stocks declined for a second straight session Wednesday as oil prices surged to briefly cross the $100 per barrel mark amid mounting turmoil in Libya.

The Dow Jones industrial average (INDU) fell 107 points, or 0.9%, a day after the blue-chip index plunged nearly 180 points. That was the first back-to-back triple-digit drop for the blue-chip index since June.

Meanwhile, the S& P 500 (SPX) slipped 8 points, or 0.6%.

Both indexes were also dragged lower by a 10% tumble in shares of Hewlett-Packard (HPQ, Fortune 500). Late Tuesday, the computer company issued a disappointing outlook and quarterly sales figures.

The Nasdaq (COMP) fell 33 points, or 1.2%, with a 7% decline in shares of Dollar Tree (DLTR, Fortune 500) leading the index lower. HP is not included in the tech-heavy index.

Oil prices continued to climb, jumping more than 4% to $100 a barrel for the first time since October 2008 amid talk of production disruptions. The North African country is the first oil exporting nation to be affected by the unrest sweeping across the Arab world.

While Libya only contributes about 2% of global output, analysts are worried about the violence and chaos spreading to bigger exporting neighbors.

" Investors are watching what's happening across the Middle East, and waiting to see if more dominoes will fall," said Ron Kiddoo, chief investment officer at Cozad Asset Management.

Traders are keeping a particularly close eye on oil-rich Saudi Arabia, where King Abdullah announced a series of measures worth billions of dollars Wednesday in an effort to ward off the kind of revolts that have roiled the region.

World markets: European stocks closed lower. Britain's FTSE 100 fell 1%, the DAX in Germany slid 1.6% and France's CAC 40 edged lower by 0.8%.

Asian markets ended the session mixed. The Hang Seng in Hong Kong declined 0.4% and Japan's Nikkei fell 0.8%, while the Shanghai Composite ticked up 0.2%.

Companies: Shares of CBOE Holdings (CBOE), the parent company of the Chicago Board Options Exchange, jumped almost 2% after Reuters reported that the company is " open to 'strategic transactions" such as a sale or merger with another exchange operator." CBOE declined comment.

Shares of home improvement chain Lowe's (LOW, Fortune 500) declined 1% after the company reported quarterly earnings that beat analysts' expectations.

Economy: A report from the National Association of Realtors showed that existing home sales rose 2.7% to an annual rate of 5.36 million units.

Currencies and bonds: The dollar dropped versus the euro, the British pound and the Japanese yen.

The price on the benchmark 10-year U.S. Treasury fell slightly, with the yield pushing up to 3.49% from Tuesday yield of 3.46%.

Two Dozen Bullish Charts

Scott Grannis

Back in late August I had a post called 20 bullish charts. It was meant to counteract all the concerns at the time that the U.S. economy was headed for a double-dip recession, caused in no small part by the sovereign debt crisis in Europe.

In retrospect, my timing couldn't have been better, since equity markets have rallied strongly since their lows at the end of August.

As we now face another source of concern with the political turmoil in the Middle East and rising oil prices, I thought it might be helpful to review those same charts plus a few others.

As should be evident, the fundamentals of the U.S. economy remain strong, and this is good reason to expect that the economy will continue to push ahead in spite of the headwinds it faces.

This post originally appeared at Calafia Beach Pundit.

Business investment rose 16% last year. Strong capex spending points to growing confidence on the part of business, and that is a leading indicator of future growth in the economy.

Industrial production is rising all over the world. Adverse weather resulted in a modest slowdown in U.S. production in recent months, but production was up 8% in the Eurozone last year, and 5% in Japan.

There is still plenty of idle capacity in world manufacturing that can be put to work quickly and cheaply as demand rebounds.

Commodity prices continue to rise across the board, though agricultural commodities appear to have hit a speed bump the past few days. Rising prices reflect strong growth in global demand and/or accommodative monetary policies worldwide.

Whatever the case, rising commodity prices all but preclude a bout of debilitating deflation, and rule out the existence of a double-dip recession.

Global trade continues to expand. U.S. exports surged at a 17.6% annualized pace in the second half of last year.

Credit spreads have been reliable leading indicators of recessions in the past, and tighter spreads usually signal improving economic conditions. U.S. credit spreads are now at their tightest levels since the end of the recent recession, confirming that economic fundamentals continue to improve.

Swap spreads are good indicators of systemic risk and leading indicators of future economic and financial conditions.

U.S. swap spreads have been quite low and stable for the past six months, an indication that U.S. financial fundamentals are about as healthy as they can get.

Europe remains troubled, however, but Euro swap spreads are not high enough to signal anything more than the likelihood that there will be some form of sovereign debt default in Europe before this is all over, and even should that happen, it is not likely to bring down the Eurozone economy.

The slope of the Treasury yield curve has been an excellent leading indicator of recessions and recoveries for many decades. The curve typically flattens or inverts in advance of recessions, but today it is still very far from being flat or inverted—indeed, by some measures the yield curve today is almost as steep as it has ever been.

The curve is strongly upward-sloping, which reflects easy money and expectations that monetary policy will eventually need to tighten significantly as the economy improves.

We've never seen a recession develop when the curve was this steep and monetary policy was this easy. On the contrary, current curve conditions strongly suggest a continuation of economic growth.

According to the ASA Staffing Index, demand for temporary and part-time workers is steadily increasing compared to this time last year, temp hiring is up almost 14%. Gains of that magnitude are fully consistent with an improving economy.

Auto sales have surged at a 16.6% annualized pace since hitting bottom in Feb. '09. This strongly suggests further growth in the economy, and it reflects very favorably on consumers' confidence and financial health.

Car sales have consistently exceeded expectations for at least the past year, and that means that manufacturers are continuing to ramp up production targets, and that in turn leads to ripple effects throughout the economy. What's good for Detroit is good for the country.

Large-scale corporate layoffs ended almost a year ago. That means corporations have done most or all the belt-tightening they are likely to do.

Businesses are lean and mean, and profits are very strong. Further improvement in the economy is thus very likely to result in more hiring.

China and almost all emerging market economies are growing like gangbusters, and global trade is recovering nicely. What's good for emerging market economies is good for everyone, since the more they produce the more they can buy from us.

It's rare for the economy to stumble when corporate profits are rising. Profits are now at record levels, both nominally and relative to GDP, so it's very likely the economy will continue to grow.

As a result of very strong profit performance, corporations are sitting on over $1 trillion in accumulated profits. That could provide a tremendous amount of fuel for future investment, economic growth, job gains, and income gains.

Although the Vix index (a proxy for the degree of fear and uncertainty that the market is pricing in) has jumped to 21 today, as of yesterday financial conditions were essentially " normal" according to the Bloomberg Financial Conditions Index. Normal financial market conditions are fully consistent with a healthy and growing economy.

A significant increase in new cargo ships has depressed shipping costs for bulk commodities (as reflected in the Baltic Dry Index), but the Harpex Index of shipping costs for N. Atlantic containerships continues to rise.

The equities of major home builders have been relative stable for the past year, suggesting that the housing market bust has run its course.

With new construction far below what is needed to keep pace with a growing population, residential construction activity will sooner or later start picking up significantly as housing inventories are depleted and consumers return to the market.

Meanwhile, prices for commercial and residential real estate have been roughly flat for almost two years. This is the sort of action you would expect to see as a market that has been severely overbuilt and distressed slowly consolidates.

This chart of commercial mortgage-backed security prices lends strong support to the notion that the real estate crisis has passed and underlying conditions are actually improving quite a bit. Distressed sales and fears of a deflation/depression pushed these AAA CMBS prices down as low as 55 at the peak of the crisis, but they have since rebounded to just over 97.

Why? Because defaults have been far less than was once feared. This chart also points to significant unrealized gains on the books of banks and institutional investors who were forced to write off significant amounts as the prices of securities collapsed, but have yet to declare the subsequent gains in the securities they held on to (i.e., profits at many firms are likely understated).

The leading indicators continue to point to growth. Nothing here to suggest even a whiff of impending weakness.

Federal revenues have been rising at a 10% annual rate for the past year. This is an excellent sign of economic health, since it reflects rising incomes, rising capital gains, and rising corporate profits.

The M2 measure of money supply has been growing about 6% per year on average for a long time. That it continues to do so means that a) there is no shortage of money in the economy and b) the Fed's Quantitative Easing program has yet to result in any unusual increase in the amount of money circulating through the economy.

In turn, the latter suggests that there is no reason yet to fear a burst of inflation or an unexpected tightening of monetary policy that could threaten the economy's ability to grow. Although I and many others continue to worry that QE2 will prove inflationary, the jury is still out. Meanwhile, the Fed has managed to expand the supply of money by enough to satisfy the increased, fear-related demands for it, thus avoiding any risk of deflation.

Last but not least, manufacturing conditions according to the Institute for Supply Management are very healthy, suggesting that GDP growth in the current quarter could easily be 4-5%.

Moreover, since last August we see that conditions in the much larger Service Sector have improved significantly. To top things off, both the manufacturing and service sector surveys reflect substantial improvement in new hiring activity.

Here's one more bullish indicator

Stocks: Worst drop of the year amid Libya turmoil

By Hibah Yousuf, staff reporterFebruary 22, 2011: 4:42 PM ET

By Hibah Yousuf, staff reporterFebruary 22, 2011: 4:42 PM ET

NEW YORK (CNNMoney) -- Libya's escalating political crisis sparked a sharp sell-off in U.S. stocks Tuesday, with the three major indexes posting their biggest one-day drops of the year, as oil prices continued to skyrocket.

Ongoing weakness in the housing market also added pressure after a report showed that national home prices fell 4.1% during the fourth quarter of 2010.

The Dow Jones industrial average (INDU) sank 178 points, or 1.4%. That was its worst decline since November. Wal-Mart (WMT, Fortune 500) was one of the biggest losers on the Dow, with shares down 3% after the retailer reported disappointing U.S. sales figures.

The S& P 500 (SPX) dropped 28 points, or 2.1%, and the tech-heavy Nasdaq (COMP) shed 78 points, or 2.7%. Those were the biggest drops since August for both indexes.

The CBOE volatility index (VIX), which is known as the VIX and is used to gauge fear in the market,jumped almost 30% Tuesday.

Market strategists seem to agree that the market is due for a short-term pullback given its steady rise since late August, and the spike in oil prices may be the catalyst to trigger that retreat.

Libya and oil: Oil prices spiked 6% Tuesday to settle at $95.42 a barrel as the trouble in Libya entered an eighth day. Earlier, oil prices came within $2 of $100 a barrel.

The turmoil in North Africa and the Middle East has roiled world financial markets, with stocks sinking across Asia and markets in Europe under pressure.

" We're facing a fear of the unknown," said Michael Sheldon, chief market strategist at RDM Financial Group. " Investors don't know how serious the political upheaval will become, or how high oil prices may end up going over the next several weeks."

The political strife in Libya is part of a chain of uprisings that started this year in Tunisia and spread to Egypt, where protesters deposed Hosni Mubarak earlier this month.

Until Libya, the movement in the Middle East had not impacted a major exporter of crude. Now, investors are concerned that the unrest could disrupt the flow of oil from other key producing countries.

World markets: European stocks fell on the ongoing concerns about Libya. Britain's FTSE 100 fell 0.3%, France's CAC 40 dropped 1.2% and the DAX in Germany lost 0.1%.

Asian markets ended sharply lower. The Shanghai Composite plunged 2.6%, the Hang Seng in Hong Kong tumbled 2.1% and Japan's Nikkei sank 1.8%.

Late Monday, Moody's changed its outlook on Japan's bond rating to negative. The credit ratings agency cited difficulties facing the government and dimming prospects to stem the country's rising debt burden, according to reports.

Economy: Consumer confidence, as measured by the Conference Board's monthly index, rose to a 3-year high in February.

Companies: Shares of Hewlett-Packard Co. (HPQ, Fortune 500) tumbled more than 6% in after-hours trading. The company reported a quarterly profit that rose from year-ago results and soundly beat Wall Street's forecasts. But the company's overall sales and outlook still disappointed.

Shares of Mentor Graphics (MENT) jumped 6.5% after billionaire investor Carl Icahn offered to buy the company for $17 per share, according to a letter obtained by the Wall Street Journal. The stock closed Friday at $14.52 per share.

Chesapeake Energy (CHK, Fortune 500) was up 5.2% after Australian resources company BHP Billiton (BHP) announced plans to buy Chesapeake's shale assets in Arkansas for $4.75 billion.

Shares of Barnes & Noble (BKS, Fortune 500) fell 14.4% after the bookstore suspended its quarterly dividend of 25 cents per share. Barnes & Noble also said it has decided not to issue sales or earnings guidance for the remainder of the year due to the unknown impact of Borders Group's bankruptcy filing.

Currencies and Bonds: The dollar rose against the euro and the British pound, but was weaker versus the Japanese yen.

The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.46% from 3.62% late Friday.

-- The CNN Wire contributed to this report.

If it is on the uptrend, selling against the

main trend is pure folly...

But then, since no one can tell the trend, it is also a fair bet...

Hulumas ( Date: 20-Feb-2011 13:14) Posted:

On Monday onward, I start selling all my US stock, it is due for correction!

vonntan ( Date: 20-Feb-2011 08:15) Posted:

|

|

|

On Monday onward, I start selling all my US stock, it is due for correction!vonntan ( Date: 20-Feb-2011 08:15) Posted:

|

the dow jones is on a clear uptrend mode. it is currently trading above all it's moving averages and does not have any clear resistence seen.

Dow Jones http://sgsharemarket.com/home/2011/02/dow-jones-continued-uptrend/ STIhopefully the STI would follow suit.STI too form a bullish reversal pattern.

http://sgsharemarket.com/home/2011/02/sti-potential-bullish-reversal-with-bearish-pennant/

Feb 18, 2011

STI higher at midday

SINGAPORE shares were higher at midday on Friday, with the benchmark Straits Times Index at 3,107.32, up 0.79 per cent, or 24.49 points.

About 714.1 million shares exchanged hands.

Gainers beat losers 245 to 116.

Stocks end at fresh multi-year highs

By Blake Ellis, staff reporterFebruary 17, 2011: 5:29 PM ET

By Blake Ellis, staff reporterFebruary 17, 2011: 5:29 PM ET

NEW YORK (CNNMoney) -- U.S. stocks ended at fresh multi-year highs Thursday, as investors focused on an upbeat manufacturing report and looked past indications that inflation is heating up.

Dow Jones industrial average (INDU) edged up 30 points, or 0.2%, with 21 of the Dow's 30 components heading higher. Shares of Intel (INTC, Fortune 500) led the advance, while American Express (AXP, Fortune 500) lagged.

The S& P 500 (SPX) rose 4 points, or 0.3%, with Sears Holding (SHLD, Fortune 500) leading the way. Meanwhile, the Nasdaq (COMP) ticked up 6 points, or 0.2%, with Research in Motion (RIMM) among the biggest gainers.

All three of the major indexes finished the session at their highest levels in more than two years for a second day on Thursday.

Investors have been in a bullish mood so far this year, as the outlook for the U.S. economy improves. While inflationary concerns are now creeping into the picture -- with key readings on inflation this week showing that prices are rising more than expected -- investors remain assured that the Federal Reserve remains willing to step in if conditions deteriorate.

" Inflation has been the story du jour lately, and there's definitely a concern about the rising cost of commodities and how that's going to affect the margins of companies," said Tyler Vernon, CIO of Biltmore Capital.

" But at the same time, the Fed continues to be focused on the stock market and supporting the market. So at this point any news is good news, because investors are just thinking the Fed will step back in if things start slowing down," he added.

While stocks may take a breather in coming weeks, the trend is likely to remain positive until the Fed pulls the plug on its quantitative easing policy, said Dean Barber, president of Barber Financial Group.

" We're up significantly from where we were in September of last year, so I doubt it's sustainable, but we'll continue to be in a gradual, slightly upward trend at least through the summer," he said.

Economy: The consumer price index for January rose 0.4% month-to-month seasonally adjusted, compared to expectations of a 0.3% increase. The core CPI -- which excludes food and energy prices -- rose 0.2% month-to-month, compared to an expected increase of 0.1%.

The report follows on the heels of the government's Producer Price Index, a measure of wholesale inflation, which came out Wednesday. That index rose 0.8% in January, which was also larger than expected.

" Inflation is definitely out there, with both reports coming in hotter than expected," said Vernon.

Because the Producer Price Index is rising at a faster pace than the consumer price index, this indicates that companies aren't passing on the cost of raw materials to consumers, which Vernon said is a concern as companies' margins start to shrink.

In fact, 25% of companies in the S& P 500 that have reported earnings this season had lower margins because of rising commodity costs, he added.

Not only do rising prices hurt companies' margins, it means that the Federal Reserve may eventually be unable to continue propping up the economy with its policy of quantitative easing, he said.

" In the short term that's good news for stocks as investors get out of fixed income and look for a home in stocks, but in the longer term it represents issues, because investors are looking at the fact that if we're getting inflation, the Fed can't continue its process of of supporting the market."

Meanwhile, the government's weekly report on the number of people filing for jobless benefits jumped to 410,000 for the week ended Feb. 12, which was close to expectations. The report was expected to show an uptick to 408,000, from 383,000 in the previous week.

The preliminary Philadelphia Fed index, a regional reading on manufacturing, surged to 35.9 in February from 19.3 in January. The index was forecast to rise modestly to 21.

Keith Springer, president of Springer Financial Advisors, said the balance of good news like the Philadelphia Fed Index and weaker news like the report on jobless claims provides " a Goldilocks environment where the economy is not growing too fast to make the Fed stop the easing but not slow enough to give us a double dip." And this is what will help the momentum continue, he said.

Currencies and commodities: The dollar rose modestly against the Japanese yen, the British pound, and the euro.

Barber said the devaluing of the dollar through the Fed's quantitative easing is not only boosting the stock market, but causing commodity prices to climb.

" Prices aren't increasing because of increased demand -- the Fed is pumping so much money into the system and purposely devaluing the dollar, and that's where inflation is coming from," said Barber. " People are buying gold, gold, gold, and things like wheat, corn and cotton have all been driven higher too."

Gold futures for April delivery rose $10 to settle at $1,385.10 an ounce. Oil for March delivery gained $1.37 to settle at $86.36 a barrel.

The World Bank said in its latest report on the global food crisis that its price index jumped 15% between last October and last month, hovering just below its 2008 peak. Wheat, corn, sugar, fats and oils have led the price increases.

Companies: Redbox is planning a subscription movie streaming service to compete with Netflix (NFLX), according to news reports. Shares of Coinstar (CSTR), Redbox's parent company, gained nearly 8%.

Shares of Timberland (TBL) surged 30% after the outdoor goods maker logged a jump in fourth-quarter profit that widely beat economists' expectations.

Weight Watchers International (WTW) also reported a solid quarter, posting earnings per share that blew past expectations. Shares of the weight loss company soared more than 45%. The better-than-expected earnings also benefited NutriSystem (NTRI), with shares of the company rising more than 6%.

Shares of Dr. Pepper Snapple Group (DPS, Fortune 500) rose 6% after the soft drink company reported an 11% jump in earnings per share. The company's net sales rose to more than $1.4 billion.

Shares of Williams Partners (WMB, Fortune 500) -- a company focused on natural gas transportation, processing and storage -- jumped 8% after the company said it would hike its dividend and split into two entities. The company also raised its guidance for 2011-2012.

The stock price for Cliffs Natural Resources (CLF) climbed more than 7% after the company reported that it doubled its full-year revenue to $4.7 billion.

World markets: European stocks finished little changed. Britain's FTSE 100 was flat, the DAX in Germany edged lower by 0.1% and France's CAC 40 was barely above breakeven.

Asian markets ended higher. The Shanghai Composite edged higher 0.1%, the Hang Seng in Hong Kong rose 0.6% and Japan's Nikkei ticked up 0.3%.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.58% from 3.62% late Friday.

Stocks take worst hit in 2 weeks

By Hibah Yousuf, staff reporterFebruary 15, 2011: 4:38 PM ET

By Hibah Yousuf, staff reporterFebruary 15, 2011: 4:38 PM ET

NEW YORK (CNNMoney) -- U.S. stocks finished lower Tuesday, posting the biggest losses in more than 2 weeks, as investors digested a weaker-than-expected report on January retail sales.

The Dow Jones industrial average (INDU) lost 42 points, or 0.3%, with Exxon Mobil (XOM, Fortune 500), Boeing (BA, Fortune 500) and Alcoa (AA, Fortune 500) leading the blue-chip index's decline.

The S& P 500 (SPX) fell 4 points, or 0.3%. NYSE Euronext (NYX, Fortune 500) -- the parent company of the New York Stock Exchange -- was one of the biggest losers on the index. Shares dropped 3.4% after the company announced it agreed to merge with Germany's Deutsche Boerse -- creating the world's largest exchange group.

The Nasdaq (COMP) slipped 13 points, or 0.5%, with a 2.7% drop in shares of Netflix (NFLX) weighing on the tech-heavy index. The losses came a day after the online movie rental company's stock rose to an all-time high. Chipmaker Qualcomm (QCOM, Fortune 500) said Monday it is developing a new platform, to bring Netflix and other video streaming services onto Google (GOOG, Fortune 500) Android-enabled smartphones.

It was the worst performance for all three indexes since Jan. 28.

The broad selling pressure came after the government reported that retail sales slowed in January, as consumers primarily focused on paying for groceries and gasoline.

" Investors are disappointed with the retail sales data from last month that came in below expectations," said Timothy Ghriskey, chief investment officer at Solaris Asset Management. " January is a squirrely month anyway, and we also had a lot of bad weather."

Stocks ended Monday's session mixed, as investors mulled over President Obama's 2012 budget proposal in a quiet trading session. The $3.7 trillion budget request would cut the nation's long-term deficit by about $1.1 trillion, over the next 10 years.

The market has been moving gradually higher this year, amid expectations of an improving economy. The S& P 500 is up nearly 6% so far in 2011.

" This market has proven to be extremely resilient, and I think it still has more upside to it," Ghriskey said.

Economy: The Commerce Department said retail sales rose 0.3% in January, down from an increase of 0.5% in December. Sales were expected to have gained 0.5% in January, according to consensus estimates from economists surveyed by Briefing.com.

Sales excluding autos and auto parts also rose to a weaker-than-expected 0.3% -- compared to a 0.5% increase in ex-auto sales in December. Economists had forecast a rise of 0.6% in the measure for January.

The price index for U.S. imports increased 1.5% in January, the U.S. Bureau of Labor Statistics stated. The report cited higher prices for fuel and nonfuel imports as contributors to the advance. U.S. export prices rose 1.2% in January, following increases of 1.5% in November and 0.6% in December.

A separate report from the government showed that business inventories rose 0.8% in December, after edging up 0.2% the previous month. Economists were expecting inventories to increase 0.6%.

The National Association of Homebuilders' preliminary housing market index for February held steady at 16, missing expectations to rise to 17.

Companies: Sirius XM Radio (SIRI) reported a loss of 2 cents per share in the fourth quarter, and issued a 2011 sales outlook that was slightly below analysts' expectations. Shares fell 8.2%.

Hotel chain Marriott (MAR, Fortune 500) announced late Monday its plans to split into two separate, publicly traded companies. Under the plan, Marriott will spin off its timeshare operations and development business as a new independent company. Shares were up 1.1%.

Shares of Dell (DELL, Fortune 500) rallied more than 6% after the closing bell. The company posting fourth-quarter results that showed earning per share of 53 cents, beating expectations, and $15.69 billion in sales, which came in slightly below expectations. For the current year, Dell issued an upbeat guidance, saying it expects sales to rise between 5% and 9%.

World markets: European stocks closed mixed. Britain's FTSE 100 fell 0.4%, while the DAX finished slightly higher and France's CAC 40 added 0.3%.

China's consumer price index rose 4.9% in January, up slightly from 4.6% growth in December, according to data released by the Chinese government Tuesday morning.

Asian markets ended mixed. The Shanghai Composite was flat and the Hang Seng in Hong Kong slid nearly 1%, while Japan's Nikkei added 0.2%.

Currencies and commodities: The dollar fell against the euro and and the British pound, but was higher versus the Japanese yen.

Oil for March delivery fell 49 cents to $84.32 barrel.

Gold futures for April delivery rose $9 to $1,374.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury was unchanged, with the yield at 3.62%.

No do not buy any US Bank stocks ! (Hidden risk is still involved and yet not even 65% tranparent to their clients). CAVEAT EMPTOR!

niuyear ( Date: 15-Feb-2011 13:31) Posted:

Great! I am longing to buy beaten down stock, like citibank. US$1 possible?

Hulumas ( Date: 15-Feb-2011 13:24) Posted:

| Be ready for US stock market correction! |

|

|

|

Great! I am longing to buy beaten down stock, like citibank. US$1 possible?

Hulumas ( Date: 15-Feb-2011 13:24) Posted:

| Be ready for US stock market correction! |

|

Be ready for US stock market correction!

Stocks end quietly after Obama's budget plan

By Ken Sweet, contributing writerFebruary 14, 2011: 4:41 PM ET

By Ken Sweet, contributing writerFebruary 14, 2011: 4:41 PM ET

NEW YORK (CNNMoney) -- U.S. stocks ended Monday's session mixed, as investors digested President Obama's 2012 budget proposal in a quiet trading session.

The Dow Jones industrial average (INDU) fell 5 points, or less than 0.1%, to 12,268 the S& P 500 index (SPX) gained 3.2 points, or 0.2%, to 1,332 and the Nasdaq Composite (COMP) rose 7.7 points, or 0.3%, to 2,817.

Exxon Mobil (XOM, Fortune 500), Chevron (CVX, Fortune 500) and Alcoa (AA, Fortune 500) were among the top performers on the Dow, helped by a Chinese trade balance report that showed a 51% jump in imports last month for the world's now second-largest economy. Copper futures also climbed 2.1% during the session.

" Commodities, along with the long-term inflation story, continue be the primary support for this market," said Liz Ann Sonders, Charles Schwab's chief investment strategist.

Wal-Mart (WMT, Fortune 500) and Verizon (VZ, Fortune 500) were the biggest losers on the blue-chip index.

President Obama unveiled his administration's $3.7 trillion budget proposal, which will cut the nation's long-term deficit by about $1.1 trillion over the next 10 years.

Traders however said there was little for Wall Street to react to in the White House's proposal.

" The budget is not going to have a meaningful impact on equities," said Michael James, senior equity trader at Wedbush Morgan Securities in Los Angeles. " A lot of this was known well in advance."

Stocks hit multi-year highs and ended the week strong on Friday, as investors cheered the resignation of Egyptian President Hosni Mubarak.

For the week, the three major indexes closed 1.5% higher. The Dow and the S& P ended Friday's session at their highest levels since mid-June 2008.

Economy: With no reports on the domestic economy, stocks will probably have a " sideways performance," said Peter Cardillo, chief market economist with Avalon Partners.

Congress will hold budget hearings throughout the week, and investors are likely to focus their attention on deficit levels.

Companies: Shares of Emergency Medical Services (EMS). plunged 11%, after private equity firm Clayton, Dubilier & Rice announced plans to buy the company for $3.2 billion.

FedEx (FDX, Fortune 500) and UPS (UPS, Fortune 500) shares fell 1% in aftermarket trading after FedEx lowered its third-quarter outlook, citing the bad weather that plagued most of the nation this year and higher fuel costs.

Shares of General Electric (GE, Fortune 500) rose 0.8%, after the industrial conglomerate said it would purchase an oil-and-gas engineering company for $2.8 billion.

Shares of Green Mountain Coffee Roasters (GMCR) rose 7% on heavy volume after Starbucks (SBUX, Fortune 500) confirmed it was working on creating branded single-brew coffee products, but declined to say if it was working on a separate product or a partner. Green Mountain, with its Keurig cup system, is the largest producer of single-serve coffee products.

Netflix (NFLX) shares rose 7%, after the company's stock was upgraded by two investment firms. Shares also got a boost after chipmaker Qualcomm (QCOM, Fortune 500) said at an industry conference that it planned to bring streaming video onto Google Android-enabled smart phones.

Internet radio site Pandora filed late Friday to raise up to $100 million in an initial public offering.

World markets: European stocks ended mixed. Britain's FTSE 100 was little changed, France's CAC 40 eased 0.1% and Germany's DAX rose 0.3%.

As expected, China overtook Japan as the world's second-largest economy. According to government statistics, Japan's economy was valued at $5.47 trillion dollars in 2010, while China was at $5.88 trillion.

China's trade surplus shrunk to $6.5 billion in January, with exports rising 37.7% and imports rising 51%, according to news reports.

Asian markets ended higher. The Shanghai Composite jumped 2.4%, the Hang Seng in Hong Kong added 1.3% and Japan's Nikkei gained 1.1%.

Currencies and commodities: The dollar rose against the euro and the British pound, but eased versus the Japanese yen.

Oil for March delivery settled down 63 cents to $84.95 a barrel.

Gold futures for April delivery rose $4.70 to $1,365.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury edged higher, pushing the yield down to 3.61% from 3.64% late Friday.