Post Reply

141-160 of 493

Post Reply

141-160 of 493

Sapphire rebound should be swift and strong....

Dilution of shares and consolidation as well as accumulation are now completed. SO YES, YES, YES its price starts rebounding!

Isolator ( Date: 11-Dec-2012 16:29) Posted:

| Found support finally.... is time for the rebound.... |

|

Found support finally.... is time for the rebound....

Don't worry, today onward, it start happening price moving upward. Is that okay with you?

waves88 ( Date: 21-Nov-2012 17:30) Posted:

Is this counter dead or is it a on going concern? All the big talk but nothing happen.

Price goes only one way so far.... down !

cashiertan ( Date: 22-Aug-2012 12:32) Posted:

| no volume. even i wanna buy also cannot. wanna sell also cannot. |

|

|

|

Is this counter dead or is it a on going concern? All the big talk but nothing happen.

Price goes only one way so far.... down !

cashiertan ( Date: 22-Aug-2012 12:32) Posted:

| no volume. even i wanna buy also cannot. wanna sell also cannot. |

|

no volume. even i wanna buy also cannot. wanna sell also cannot.

So far the company delivers whatever it promise... and in 2013 it will be among the biggest in Sichuan..... China is now consolidating the steel industries in a bid to control the volume and thus the price of iron and steel. This will be benefical to Sapphire.

Looks promising......it is a matter of time when the stock price catches up....

ozone2002 ( Date: 22-Aug-2012 10:58) Posted:

Looks promising....dyodd

| SAPPHIRE: Higher profits to come from 2 proposed acquisitions? |

|

Written by Leong Chan Teik

Wednesday, 22 August 2012 07:28

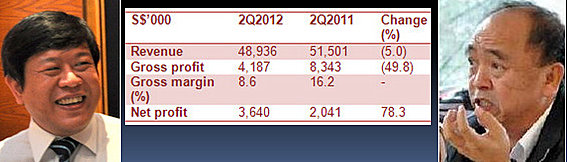

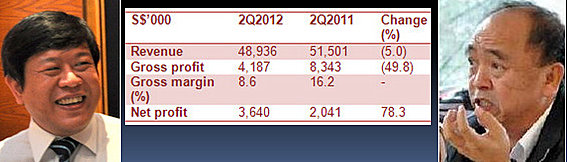

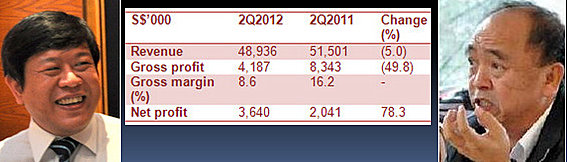

Sapphire had a S$3.6 m net profit in 2Q mainly because of a net gain from fair value hedge of $5.7 million.

In the photos: CFO Ng Hoi-Gee (left) and executive director Roger Foo.

TO UNDERSTAND Singapore-listed Sapphire Corporation's business, start with the steel industry in China.

If infrastructure development in China slows down, as it already has, demand for steel goes down and so will steel prices.

In fact, steel prices in China are at a two-year low currently, no thanks also to an oversupply of steel.

Against this backdrop, Sapphire has had a challenging time this year. Its profit excluding non-operating significant items was negative S$737,000 in 2Q and negative S$7.5 million in the first half of the year.

This backdrop also helps explains why its stock price was recently at 12.5 cents, nearly unchanged from 13 cents at the start of this year. The stock trades at a big discount to NAV of 31.12 cents a share.

At last Friday's lunch briefing for analysts and investors: Emma Cheung, who joined Sapphire as Chief Operating Officer in Jan 2012. She has over 23 years of management experience focusing on commodity trading, logistics, and M& A, especially in the PRC. Photo by Leong Chan Teik

Sapphire operates in niches in the steel industry, a few of which are doing relatively fine:

> Vanadium pentoxide flakes: Sapphire produces these flakes for use in the production of light-weight, high-tensile steel for constructing infrastructure.

This segment enjoyed a 21% gross margin in 2Q, although the margin was more juicy a few years ago when the selling price was around RMB200,0000 per tonne compared to RMB60,000 recently.

> Rebar processing was the star business segment with a 44% gross margin.

> Hot rolled coils and other steel products: However, these products were loss-making, incurring -11% margin.

> Mineral trading was also loss-making with a -5% margin.

The question of whether Sapphire would pay a dividend for FY12 came up during a lunch briefing for analysts and investors last Friday.

Mr Roger Foo, an executive director, replied: " It will be subject to our cashflow needs. We have a loan to repay to Credit Suisse early next year and we will need to inject capex to facilitate the production of silicon steel."

The latter business (ie, silicon steel) is a proposed new venture which Sapphire envisages going into via its proposed acquisition of 100% interest of Longwei Medal Product Co.

Two acquisitions -- to boost profit and revenue

Sapphire announced two proposed acquisitions which will be funded by internal resources (and/or external borrowings). In other words, there won't be a rights issue or share placement.

Sapphire had S$26.3 milllion in the bank as at end-June 2012.

" The proposed acquistions will address our immediate and mid-term objectives of improving our revenue stream," said Angeline Lim, Sapphire's corporate communications manager.

Cold rolled coil: As the name suggests, steel is processed while cold. It is manufactured from hot rolled coil that has been chemically cleaned before being rolled. Photo: Internet

a. Acquisition of Longwei Metal Product Co. for RMB152 million at its revalued net asset value.

Sapphire said with vendor support, the interest cost is only 3% (about half of the China banks' rates).

The acquisition will enable Sapphire to immediately offer up to 200,000 tonnes a year of cold rolled coil steel production.

The business is located in Chengdu, a distribution hub and gateway for major industries in the southwest region.

The business was loss-making last year but Sapphire aims to restructure it and, ultimately, to upgrade Longwei's auxillary assets to produce silicon steel.

The latter is a premium product which can reap RMB2,000-3,000 in proft per tonne, compared to a few hundred RMB for other steel products, said CFO Ng Hoi-Gee.

The capex for that has not been disclosed.

Rebars (reinforcement bars) are staple products used in reinforced concrete. Photo: Internet

b. Acquisition of a rebar production line from an associate company (11.69% stake), Chengyu Vanadium & Titanium (CVTT) for RMB155.2 million.

The rebar processing business is a high-margin business.

Sapphire expects a steady income stream and a gross margin of about 40% from this business segment over the next five years.

The return on investment for Sapphire is only 2.5 years based on a CVTT guarantee that it would buy a minimum of 500,000 tonnes per annum at RMB300 per tonne.

That works out to 500K tonnes x RMB 300 = RMB 150 million in revenue, or RMB60 million in gross profit a year.

Compare that with the Group's RMB24.2 million in gross profit in FY2011 or RMB8.1 million in 1H2012.

On that basis, it appears that shareholders can look forward to, assuming shareholders approve of the acquisitions, enhanced profitability from Sapphire from the fourth quarter of this year.

|

|

|

Looks promising....dyodd

| SAPPHIRE: Higher profits to come from 2 proposed acquisitions? |

|

Written by Leong Chan Teik

Wednesday, 22 August 2012 07:28

Sapphire had a S$3.6 m net profit in 2Q mainly because of a net gain from fair value hedge of $5.7 million.

In the photos: CFO Ng Hoi-Gee (left) and executive director Roger Foo.

TO UNDERSTAND Singapore-listed Sapphire Corporation's business, start with the steel industry in China.

If infrastructure development in China slows down, as it already has, demand for steel goes down and so will steel prices.

In fact, steel prices in China are at a two-year low currently, no thanks also to an oversupply of steel.

Against this backdrop, Sapphire has had a challenging time this year. Its profit excluding non-operating significant items was negative S$737,000 in 2Q and negative S$7.5 million in the first half of the year.

This backdrop also helps explains why its stock price was recently at 12.5 cents, nearly unchanged from 13 cents at the start of this year. The stock trades at a big discount to NAV of 31.12 cents a share.

At last Friday's lunch briefing for analysts and investors: Emma Cheung, who joined Sapphire as Chief Operating Officer in Jan 2012. She has over 23 years of management experience focusing on commodity trading, logistics, and M& A, especially in the PRC. Photo by Leong Chan Teik

Sapphire operates in niches in the steel industry, a few of which are doing relatively fine:

> Vanadium pentoxide flakes: Sapphire produces these flakes for use in the production of light-weight, high-tensile steel for constructing infrastructure.

This segment enjoyed a 21% gross margin in 2Q, although the margin was more juicy a few years ago when the selling price was around RMB200,0000 per tonne compared to RMB60,000 recently.

> Rebar processing was the star business segment with a 44% gross margin.

> Hot rolled coils and other steel products: However, these products were loss-making, incurring -11% margin.

> Mineral trading was also loss-making with a -5% margin.

The question of whether Sapphire would pay a dividend for FY12 came up during a lunch briefing for analysts and investors last Friday.

Mr Roger Foo, an executive director, replied: " It will be subject to our cashflow needs. We have a loan to repay to Credit Suisse early next year and we will need to inject capex to facilitate the production of silicon steel."

The latter business (ie, silicon steel) is a proposed new venture which Sapphire envisages going into via its proposed acquisition of 100% interest of Longwei Medal Product Co.

Two acquisitions -- to boost profit and revenue

Sapphire announced two proposed acquisitions which will be funded by internal resources (and/or external borrowings). In other words, there won't be a rights issue or share placement.

Sapphire had S$26.3 milllion in the bank as at end-June 2012.

" The proposed acquistions will address our immediate and mid-term objectives of improving our revenue stream," said Angeline Lim, Sapphire's corporate communications manager.

Cold rolled coil: As the name suggests, steel is processed while cold. It is manufactured from hot rolled coil that has been chemically cleaned before being rolled. Photo: Internet

a. Acquisition of Longwei Metal Product Co. for RMB152 million at its revalued net asset value.

Sapphire said with vendor support, the interest cost is only 3% (about half of the China banks' rates).

The acquisition will enable Sapphire to immediately offer up to 200,000 tonnes a year of cold rolled coil steel production.

The business is located in Chengdu, a distribution hub and gateway for major industries in the southwest region.

The business was loss-making last year but Sapphire aims to restructure it and, ultimately, to upgrade Longwei's auxillary assets to produce silicon steel.

The latter is a premium product which can reap RMB2,000-3,000 in proft per tonne, compared to a few hundred RMB for other steel products, said CFO Ng Hoi-Gee.

The capex for that has not been disclosed.

Rebars (reinforcement bars) are staple products used in reinforced concrete. Photo: Internet

b. Acquisition of a rebar production line from an associate company (11.69% stake), Chengyu Vanadium & Titanium (CVTT) for RMB155.2 million.

The rebar processing business is a high-margin business.

Sapphire expects a steady income stream and a gross margin of about 40% from this business segment over the next five years.

The return on investment for Sapphire is only 2.5 years based on a CVTT guarantee that it would buy a minimum of 500,000 tonnes per annum at RMB300 per tonne.

That works out to 500K tonnes x RMB 300 = RMB 150 million in revenue, or RMB60 million in gross profit a year.

Compare that with the Group's RMB24.2 million in gross profit in FY2011 or RMB8.1 million in 1H2012.

On that basis, it appears that shareholders can look forward to, assuming shareholders approve of the acquisitions, enhanced profitability from Sapphire from the fourth quarter of this year.

|

Sapphire Corporation Limited on Monday said its wholly-owned subsidiary, Neijiang Chuanwei Special Steel Co Ltd, is acquiring Longwei Metal Product Co Ltd from Sichuan Chuanwei Group Co Ltd for 152.03 million yuan (US$23.99 million).

The purchase consideration is based on the net asset value of Longwei and the adjustment to the value of its land use rights, and will be further adjusted on the closing date based on certain agreed upon-procedures to be performed by external auditors to finalise the net asset value of Longwei in accordance with the terms of the Equity Transfer Agreement. Longwei is primarily engaged in the manufacturing, selling and trading of welded pipes, welded wires, scraps and cold-rolled steel. It currently owns two cold rolling production lines with an annual production capacity of approximately 200,000 tonnes of cold rolled steel products, depending on the thickness of the CRC to be produced. (closing S$0.115, -0.86%)

All penny cheong oredi. This counter hopeless. So much good news still cannot move. Think it is dead.

SSH transaction..increased stake in sapphire corp

SAPPHIRE CORPORATION LIMITED Wang Jin 24.32 27.18

Just hold tight.... This counter is dollars counter in long term....

Wang Jin change in percentage from 24.32 % To 27.18 %..........another 2.82% to takeover ?

paul1688 ( Date: 18-Apr-2012 22:53) Posted:

Wednesday, 18 April 2012 14:00

TOP FUND MANAGERS from China have just visited Sapphire Corp to learn about its business exposure in China.

They were on a hunt for undervalued Singapore-listed stocks with exposure to China’s economic growth. Sapphire trades at around 17 cents compared to its intrinsic value of 42.5 cents (as estimated by SIAS Research in a report in March 2012). The fund managers learnt about Sapphire’s involvement in areas such as: a. Iron ore production for making steel. b. Vanadium pentoxide production for strengthening steel.

They also sought to appreciate the demand for its products in rapidly-expanding cities of Chengdu and Chongqing. You can have an opportunity to hear speak with the management of Sapphire too, and improve your understanding of its business prospects, by attending its AGM on Tuesday, April 24.

In addition to shareholders, Sapphire welcomes observers to its AGM and thereafter to lunch at its office.

If you wish to attend, email your full name & contact number to Angeline Lim, Corporate Communications Manager: angelinelim@sapphirecorp.com.sg

|

|

|

Thanks Vivivie.

It is time to load at this gem since even pennies has moved pass this counter.

What I don't like is their " impairment loss for assets availale for sale" . Can KPMG do something about it ?...it is giving a false picture.

Vivivie ( Date: 25-Apr-2012 10:11) Posted:

|

China Fund coming to buy?

Talk only but no action.....maybe should consider expanding into Myanmar.....

Vivivie ( Date: 19-Apr-2012 21:53) Posted:

| Hold a few years? You crazy or what?

|

|

Hold a few years? You crazy or what?

So not much different to hold another few year.... It could be $1 by then....

my longest holding to date! =.= in deep deep red. lol

Isolator ( Date: 19-Apr-2012 09:59) Posted:

| No worry for sapphire as long as you can hold for a few years.... It should be above 50ct by that time..... |

|

No worry for sapphire as long as you can hold for a few years.... It should be above 50ct by that time.....