Hope it will close higher, tomorrow all will be green green.

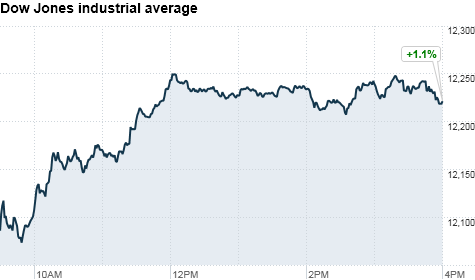

| Dow | 11745.90 | 132.60 | 1.14% |

bishan22 ( Date: 17-Mar-2011 16:11) Posted:

|

Europe showing recovery.

| FTSE100 | 5633.77 | 35.54 | 0.63% | 5645.99 | 5602.13 | 08:09:09 |

| DAX | 6571.94 | 58.10 | 0.89% | 6574.45 | 6555.16 | 09:09:11 |

| CAC | 3730.36 | 33.80 | 0.91% | 3730.59 | 3722.84 | 09:09:01 |

Mar 17, 2011

STI 1.07% lower at midday

SINGAPORE shares were lower at midday on Thursday, with the benchmark Straits Times Index at 2,939.27, down 1.07 per cent, or 31.73 points.

About 650 million shares exchanged hands.

Losers beat gainers 369 to 56.

Rough day for stocks: S& P 500, Nasdaq erase year's gains

The S& P 500 lost nearly 25 points, or 2%, Wednesday. That steep drop put the benchmark index down 0.1% for the year.

The S& P 500 lost nearly 25 points, or 2%, Wednesday. That steep drop put the benchmark index down 0.1% for the year.NEW YORK (CNNMoney) -- A sell-off in U.S. stocks accelerated Wednesday, with all three major indexes ending at their lowest levels of 2011.

The S& P 500 and Nasdaq composite erased their gains for the year, while the Dow is barely hanging on, up only 0.3% in 2011.

Trading was extremely choppy as investors tried to sort out disappointing U.S. housing data against the backdrop of developments in Japan.

It didn't help that European Union energy commissioner GŁnther Oettinger sounded a warning bell about increased risks related to Japan's crippled nuclear reactors at a meeting in Brussels.

Moreover, the U.S. Embassy in Tokyo cautioned American citizens who live within 50 miles of the damaged Fukushima Daiichi nuclear plant to evacuate or take shelter indoors.

" Today's not a good news day, and the market is reacting emotionally," said Fred Dickson, chief market strategist at D.A. Davidson & Co.

The Dow Jones industrial average (INDU) tumbled 242 points, or 2%, with all 30 components of the blue chip index in the red. IBM (IBM, Fortune 500), General Electric (GE, Fortune 500) and American Express (AXP, Fortune 500) led the decline. The index was down almost 300 points at its low for the day.

The S& P 500 (SPX) slipped 25 points, or 2%, to end at 1,256.88. The broad index closed 2010 at 1,257.64.

The Nasdaq (COMP) lost 51 points, or 1.9%, to finish at 2,616.82. The tech-heavy index closed at 2,652.87 last year.

Global concerns also pushed the dollar below •80 briefly, hitting •79.75, matching the record low hit in April 1995 (More on currencies).

Wall Street's most widely cited measure of volatility, the VIX (VIX), surged more than 20% to 29.40. Earlier, it climbed above 30 for the first time since July.

Dickson is advising his clients to get to the sidelines until the picture of the nuclear threat in Japan becomes clearer.

Wednesday's declines came on the heels of a sharp sell-off in the previous session, which was dominated by worries about Japan.

Japan in crisis: In a televised speech Wednesday, Japan's emperor told citizens not to give up hope as the country grapples with an epic earthquake.

" It's quite rare of the emperor to appear on television, and that has made investors a little nervous," said David Jones, chief market strategist with IG Markets in London.

Prior to the speech, Tokyo's Nikkei index rose 5.7%, rebounding from two days of losses that had drained more than 16% from the index.

The increasingly desperate situation at Japan's nuclear plants is keeping investors on edge.

Stunned by the devastation in Japan, they have been reducing their exposure to risky assets and flocking to investments that are considered safe, including U.S. Treasuries. Investors continued to buy up U.S. government debt Wednesday, sending the 10-year yield down to 3.23% from 3.32% late Tuesday.

Aside from Japan, Moody's Investors Service cut Egypt's rating by one notch, further into non-investment grade quality.

And late Tuesday, Moody's downgraded Portugal's credit rating from A1 to A3 -- a lower investment grade status. And Fitch downgraded Bahrain's debt to below investment grade, following a government clash with protesters.

Asian markets ended higher, with the Shanghai Composite index rising 1.2% and Hong Kong's Hang Seng index edging up 0.1%.

European markets closed sharply lower. The FTSE 100 dropped 0.8%, and France's CAC 40 and DAX in Germany tumbled more than 1%. (World markets)

Economy: The government said new home construction fell 22.5% in February, more than economists were expecting, while the number of permits for future housing construction fell 8.2% to all all-time low.

Separately, the government's Producer Price Index showed that prices at the wholesale level jumped 1.6% in February, which was much more than expected.

Commodities: Oil prices -- which fell nearly 4% on Tuesday -- were higher Wednesday, as concerns about the ongoing turmoil in North Africa and the Middle East were revived. Oil for April delivery gained 80 cents, or 0.8%, to settle at $97.98 a barrel.

Gold futures for April delivery climbed $3.30 to settle at $1,396.10 an ounce.

Stocks headed higher at the open

NEW YORK (CNNMoney) -- U.S. stocks were set to open slightly higher Wednesday, after Japanese stocks rebounded from a two-day skid in the aftermath of last week's earthquake.

Dow Jones industrial average (INDU), S& P 500 (SPX) and Nasdaq (COMP) futures were higher ahead of the opening bell. Futures measure current index values against perceived future performance.

Tokyo's Nikkei index rose 5.7% Wednesday, a bounceback from two days of losses that had drained more than 16% from the index. The partial recovery came despite more gloomy news from the crippled Fukushima Daiichi nuclear power plant, where workers trying to end the crisis were evacuated for a time because of elevated radiation levels. (CNN.com's coverage)

After three explosions and a fire in four days, a handful of workers have been struggling to contain a dangerous radiation threat at the stricken nuclear facility located about 138 miles north of Tokyo.

The increasingly desperate situation followed the 9.0-earthquake that rocked Japan on March 11 and caused a massive tsunami that has ravaged the world's third-largest economy. The death toll now stands at 3,771 people.

Other Asian markets ended higher, with the Shanghai Composite index rising 1.2% and Hong Kong's Hang Seng index edging up 0.1%. Stocks in London, Frankfurt and Paris were higher in early trading.(World markets)

U.S. stocks fell sharply Tuesday as investors looked past a somewhat positive statement from the Federal Reserve to focus on the deteriorating situation at Japan's Fukushima Daiichi nuclear power plant.

Investors, stunned by the devastation in Japan, had been reducing their exposure to risky assets and flocking to investments that are considered safe, including U.S. Treasuries. But the Wednesday rebound in Japanese stocks sent Treasuries lower.

Economy: In the United States, investors will take in reports on the nation's housing market and inflation at the wholesale level.

Before the market opens, the government will release a report on new home construction and applications for building permits in February.

Economists expect the number of housing starts rose to an annual rate of 575,000 units in the month, down from 596,000 in January. But building permits, considered a leading indicator of activity in the housing sector, are expected to have increased slightly to 563,000, according to consensus estimates from economists surveyed by Briefing.com.

Separately, the government's Producer Price Index is forecast to show prices at the wholesale level increased 0.6% in February, following a 0.8% rise in January.

Core PPI, which excludes food and energy costs, is expected to show an increase of 0.2% in the month, down from 0.5% the month before.

A report on the U.S. current account balance in the fourth quarter and the government's weekly energy inventory report are also on tap.

Currencies and commodities: The dollar gained against the euro and the Japanese yen, but eased against the British pound.

Oil prices, which fell nearly 4% on Tuesday, were higher early Wednesday as concerns the ongoing turmoil in North Africa and the Middle East were revived. Oil for April delivery gained $1.31 to $98.49 a barrel.

Gold futures for April delivery climbed $5.40 to $1,398 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.33% from 3.3% late Tuesday.

Mar 16, 2011

STI higher at midday

SINGAPORE shares were higher at midday on Wed, with the benchmark Straits Times Index at 2,952.25, up 0.21 per cent, or 6.17points.

About 712.2 million shares exchanged hands.

Gainers beat losers 224 to 161.

Mar 16, 2011

STI opens higher

SINGAPORE shares opened higher on Wednesday, with the benchmark Straits Times Index at 2,973.77 in early trade, up 0.96 per cent, or 27.91 points.

Around 111.3 million shares exchanged hands.

Gainers beat losers 178 to 45.

Sorry, I stand corrected. IT is up more than 500 pts. Hope it holds.

Hope that situation for the Japanese people improves too.

GuavaXF30 ( Date: 16-Mar-2011 08:29) Posted:

|

Where dod you get 500 pts from ? I only see them up 159 pts. At the high, it was up about 171 pts.

Anyway, should have some recovery but not much. Fear is still there. What is more important for the world market is DOW. Last night was down almost 300 pts but ended down just 137. At one point about half an hour before close, it was almost even, down just a few points but close lower towards the close probably due to day traders profit-taking.

YES, evem in this kind of market, there are people profiteering. I just hope that they will be conscientious enough to donate their profit from yesterday to the victims in Japan....

zhixuen ( Date: 16-Mar-2011 08:22) Posted:

|

ivanignatius ( Date: 16-Mar-2011 08:18) Posted:

|

Surely the point here is that no-one has any idea what happens next. If the reactor blows, it'll take Japan into a serious downturn, and Japan is still 7% of world GDP so that is a disaster. In that case, load up on anything with a yield as we're heading for a deflationary world. Suggest buying perpetual bonds, Cambridge REIT.

On the other hand, if Japan gets on top of this quickly, the focus will go back to all the problems in Bahrain and Libya and the spiralling oil price, and China property overheating, and inflation will be the main threat. In that case, gold is probably the best bet, as well as Japan equities.

What to do?

Stocks claw back from steep sell-off

By Annalyn Censky, staff reporterMarch 15, 2011: 5:27 PM ET

By Annalyn Censky, staff reporterMarch 15, 2011: 5:27 PM ET

NEW YORK (CNNMoney) -- Stocks regained some lost ground in the last hour of trading Tuesday, but Japan's devastating earthquake and nuclear crisis still have investors on edge.

All three of the major U.S. stock indexes closed down about 1.2%, after plunging much deeper earlier in the day.

The Dow Jones industrial average (INDU) posted a 138-point loss, after falling 297 points earlier. All but one of the 30 Dow components were in the red. The S& P 500 (SPX) fell 15 points and the Nasdaq (COMP) dropped 34 points.

A somewhat positive statement from the Federal Reserve, which would typically garner attention, failed to sway investors significantly in the afternoon.

" Everybody's looking at Japan over the Fed," said Phil Streible, a senior market strategist with Lind-Waldock. " People are scrambling and trying to figure out the specific impact of Japan's problems."

The Fed made no mention of the events in Japan. Markets are reeling from the staggering human and economic toll from Japan's 9.0-measure earthquake and subsequent tsunami last Friday, which killed at least 3,373 people.

The earthquake also damaged Japan's Fukushima Daiichi nuclear power plant, and subsequent explosions and fires there have only escalated fears about a nuclear crisis in Japan.

Japan's Nikkei index (NKY) dropped 10.6% on Tuesday alone, and over the last two days, it shed 16.1% -- its worst two-day loss since 1987.

Other Asian markets also finished lower Tuesday, with the Shanghai composite losing 1.4%, and Hong Kong's Hang Seng index falling 2.9%.

European markets also closed sharply lower. Germany's DAX dropped 3.4%, while France's CAC-40 lost 2.3% and Britain's FT-100 retreated 1.3%.

The Japanese nuclear plant that exploded Saturday is equipped with reactors designed by Dow component General Electric (GE, Fortune 500). GE shares fell 1.6% Tuesday.

Insurance companies in the S& P 500 also sank, led by Aflac (AFL, Fortune 500) which tumbled 5.6%. Aflac generated about 75% of its revenue in Japan last year.

Hartford Financial Services Group (HIG, Fortune 500) fell 4.6%, Prudential (PRU, Fortune 500) dropped 2% and MetLife (MET, Fortune 500) fell 3%.

Netflix (NFLX) was one of the few stocks to buck the downward trend, rising 7.9% after Goldman Sachs (GS, Fortune 500) upgraded the stock earlier in the day.

Meanwhile, oil prices fell nearly 4% as investors pulled back after its recent run, and gold prices fell 2.3%.

The dollar rose versus the euro and the British pound, but fell slightly against the yen. Like the U.S. dollar, the yen is considered a safe-haven asset in times of economic uncertainty.

The price on the benchmark 10-year U.S. Treasury rose as investors sought the safety of government debt, pushing the yield down to 3.32% from 3.35% late Monday.

The Japanese government has taken steps to shore up the nation's financial system. But investors remain nervous about the short-term outlook for the world's third-largest economy.

Ahead of the opening bell, steep losses in world markets triggered the New York Stock Exchange to invoke Rule 48 -- which gives the exchange the right to pause trading in the event of exteme volatility.

NYSE typically invokes the rule several times each year.

Wall Street's most widely cited measure of volatility, the VIX (VIX) surged 14.8%.

Dow Jones pulled back but rebounded from it's psychological support at 12000 points. this short term rebound could possibly bring about a small rally to STI.

http://sgsharemarket.com/home/2011/03/dow-jones-profit-taking/

Stocks surge as banks lead gains, oil drops

By Ken Sweet, contributing writerMarch 8, 2011: 4:20 PM ET

By Ken Sweet, contributing writerMarch 8, 2011: 4:20 PM ET

NEW YORK (CNNMoney) -- U.S. stocks closed broadly higher Tuesday, led by a strong performance in the financial sector.

Easing oil prices lent further support. Crude prices retreated following reports that Libyan leader Moammar Gadhafi is working to step down and exit the country safely.

The Dow Jones industrial average (INDU) advanced 124 points, or 1%, to close at 12,214 the S& P 500 (SPX) added 11.7 points, or 0.9%, to 1,321.80 and the Nasdaq Composite (COMP) gained 20 points, or 0.7%, to 2,766.

Bank of America (BAC, Fortune 500) sparked a rally in financial shares after CEO Brian Moynihan issued a rosy multi-year outlook at the bank's first shareholder meeting in four years. Moynihan also said the banking giant plans to increase its buyback program and may raise its dividend.

Shares of Bank of America jumped 5% American Express (AXP, Fortune 500) rose 3.5% and JPMorgan Chase & Co. (JPM, Fortune 500) rose 2.7%. The jump in BofA shares is a change of pace for the Charlotte N.C.-based bank, which has seen its stock price fall 12% from a year ago despite the S& P 500 being up 16%.

Shares of other retail banks were also higher, with SunTrust (STI, Fortune 500), USBancorp (USB, Fortune 500) and Hutchington Bancshares (HBAN) each rising 3% or more.

" The whole financial sector was way oversold, so this move could be just a technical bounce," said David Rovelli, managing director of U.S. equity trading at Canaccord Adams. " There's still a ton of risk in the financials and BofA still has the mortgage processing problems."

Oil prices: Investors continue to monitor developments in Libya and the civil war's effect on energy prices. Oil futures lost 53 cents or 0.5%, to $104.91 a barrel Tuesday. The retreat came a day after prices spiked to almost $107.

Shares of major oil drilling and refining names also fell with Chesapeake Energy (CHK, Fortune 500) falling 2%, ConocoPhilips (COP, Fortune 500) dropping 1% andTesoro (TSO, Fortune 500) shares falling 4%.

Gold also eased from the prior session's highs, with prices closing down $7.30 to $1,427.20 an ounce. Gold settled at a record high of $1,434.50 an ounce Monday, as investors sought perceived safety in the precious metal.

Investors have been focusing on geopolitical developments and oil prices across North Africa and the Middle East. Traders are worried that spreading unrest will keep commodities at these elevated levels and will undermine the economic recovery.

" When you throw together high oil with increases in cotton, soy and food, you have a nasty combination that will impact earnings," Rovelli said. " The whole key is how long commodities stay up there. If they don't start to decline, it's going to be a burden on stocks."

Over the long term, however, analysts surveyed by CNNMoney agree that the oil and gold volatility will fade as the crisis in Libya abates.

In the meantime, Jim McDonald, chief investment strategist with Northern Trust, said investors should remain overweight the materials and energy sectors.

" The situation in North Africa and the Mid East is a wild card but it remains a situation that you don't want to disrupt your portfolio for," McDonald said. " Stick with companies with solid balance sheets who are positioned for strong economic growth."

Companies: Urban Outfitters (URBN) shares plunged 17% after the retailer reported a profit late Monday that widely missed forecasts, saying its margins were hit by increased markdowns.

Shares of Sprint Nextel (S, Fortune 500) jumped 5%, on reports that the company was in early negotiations with Germany's Deutsche Telekom to sell Deutsche's T-Mobile business to Sprint.

Starbucks (SBUX, Fortune 500) began rolling out its new logo Tuesday, as the coffee company celebrates its 40th anniversary this week. Shares rose 1.2%.

Morgan Stanley (MS, Fortune 500) is considering dropping the Smith Barney name from its brokerage business, according to sources cited in the Wall Street Journal. Shares gained 1.7%.

Economy: There were no major reports on Tuesday's calendar.

World markets: European stocks closed mostly flat. Britain's FTSE 100 rose less than 0.1%, and the DAX in Germany ticked up 0.1%, while France's CAC 40 added 0.6%.

Asian markets ended higher. The Shanghai Composite ticked up 0.1%, the Hang Seng in Hong Kong jumped 1.7%, and Japan's Nikkei advanced 0.2%.

Currencies: The dollar gained against the euro, the Japanese yen and the British pound.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, with the yield rising to 3.55%.