Latest Forum Topics /

GLD USD

Last:464.4

+0.6

+0.6

|

|

|

Gold & metals

|

|||

|

bsiong

Supreme |

06-Jul-2013 13:52

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

Mid-Day Gold & Silver Market Report – 7/5/2013

STOCKS HOLD ON TO GAINS GOLD SUFFERS Stocks have wavered some but are staying positive today on a strong jobs report. Investors can expect continued volatility today with fewer participants in the trading session, which would help even things out. It seems that investors may have decided that the most recent jobs report is not a “Goldilocks” report, a term financial analysts have begun using for reports that are just good enough to point to continued economic recovery, but not so good that the Fed will wind down the QE program too soon. Quincy Krosby, market strategist for Prudential Financial, said, “It’s obvious that Treasury traders believe this is enough for the Fed to begin to taper.” The consensus is that tapering will happen sometime between September and December. The news for the Gold price is sounding like a broken record this afternoon. Positive data had the anticipated inverse reaction on the Gold price, pushing the Precious Metal down about three percent today. Natixis analyst Nic Brown summarized the current sentiment well when he said, “After the strong U.S. numbers we are approaching the point in which the Fed will start to taper and as a consequence we fully expect that, if the U.S. economy continues to improve, you will see a further strengthening of the dollar, which is negative for the dollar-denominated Gold price." At 1 p.m. (ET), the APMEX Precious Metals spot prices were:

|

||

| Useful To Me Not Useful To Me | |||

|

bsiong

Supreme |

06-Jul-2013 13:51

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

Morning Gold & Silver Market Report – 7/5/2013

STRONG JOBS REPORT BRINGS DOWN METALS PRICES Precious Metals prices fell this morning, reacting to a stronger-than-expected jobs report for June. Danske Bank analyst Christin Tuxen said that a stronger jobs report “would suggest that although rates are set to stay at record lows in Europe, that may not be the case in the United States.” The U.S. dollar rose more than one percent against competitors due to weakness in the euro, which also contributed to the losses in metals. The jobs report showed a gain of 195,000 jobs in June, though theunemployment rate was unchanged at 7.6 percent due to an increase in the labor force of 177,000. The jobs readings from April and May were revised upwards as well. The good economic news has many investors believing that the Federal Reserve’s tapering of its quantitative easing program could indeed be coming soon, putting pressure on the price of Gold. At 9 a.m. (ET), the APMEX Precious Metals spot prices were:

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

bsiong

Supreme |

06-Jul-2013 13:49

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

Gold Deeper Setback Would Present OpportunityHourly Chart Prepared by Jamie Saettele, CMT

Commodity Analysis: To review - “I’m looking for a ‘tradeable low’ in goldbetween 1220 and 1265. 1265 is the June 2010 high. 1250 is the extension from 1523 of the 1523-1796 range. 1220 is the 161.8% extension from 1322 of the 1322-1488 range. 1227 is the November 2009 high. There are clusters of levels at 1155 and 1045/80 as well. It’s been gold’s tendency since September 2012 to ‘crash’ for 2-4 weeks and consolidate for at least a month. This week would be week 2 of this ‘crash’.” The low was 1180 and the rally from that level is impulsive, which makes the low ‘tradeable’. The 2 ‘best’ areas for support are probably the former 4th wave low at 1225 and the large volume area at 1210.

Commodity Trading Strategy: Order to go long 1215, stop 1180.

LEVELS: 1210 1225 1242 1263 1297 1308 |

||

| Useful To Me Not Useful To Me | |||

|

johnloke49

Member |

05-Jul-2013 13:43

|

||

|

x 0

x 0 Alert Admin |

have you guy think about silver, but it is more volatile, but profitable, i am looking to buy silver, waiting for signal. next high for gold 5000, silver 125.from weiss research Larry ( not me) |

||

| Useful To Me Not Useful To Me | |||

|

bsiong

Supreme |

04-Jul-2013 12:04

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

Closing Gold & Silver Market Report – 7/3/2013

GLOBAL CRISES BOOST APPEAL OF GOLD Gold and Silver are realizing slight gains today as the safe haven appeal of Precious Metals temporarily resumed following political turmoil in Portugal and Egypt. “Rising tensions in Egypt and re-emergence of the European crisis, along with the mixed data today” combined to underpin gold prices Wednesday, according to a Precious Metals dealer chief market analyst. As hastening violence erupts in Egypt, austerity difficulties in Portugal have re-focused the spotlight on the eurozone as Portuguese debt and frantic stock selloffs highlight troubles in the region. Domestic investors will await Friday’s nonfarm payroll data to see if the reports can incite movement in Precious Metals markets that are currently in a tug-of-war with bargain hunting physical buyers and ETF sellers. Though U.S. stocks were able to overlook international issues and end the trading session higher ahead of the holiday, some analysts remain leery of a market that has surged to record levels despite pessimistic technical indicators and daunting concerns regarding the future of quantitative easing (QE). “We're still in this rough period. We have a 10 percent to 20 percent correction ahead of us later this quarter, early next quarter. For two months now I've been a seller of anything above Dow 15,000 and I'll stay that way,” Paul Schatz of Heritage Capital told CNBC. As the bull trend continues for U.S. equities, the tapering of QE could negatively impact stocks that have benefited so greatly from the monthly injections of liquidity. At 5 p.m. (ET), the APMEX Precious Metals spot prices were:

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

johnloke49

Member |

03-Jul-2013 23:00

|

||

|

x 0

x 0 Alert Admin |

'Gold have crash twice and go on to break new high, i think this time, will it be different. When those report that 1200 is the production cost, and it will never go below that will be in for a surprise. mkt don't care a damn of the those mine production cost, But it is true that in the end, the supply and demand will bring the price back to it mean. I hope it go to 1040. a good site for gold is .....http://www.kitco.com/ |

||

| Useful To Me Not Useful To Me | |||

|

bsiong

Supreme |

03-Jul-2013 21:27

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

Morning Gold & Silver Market Report – 7/3/2013DATA BRING STOCKS, METALS DOWN A smattering of economic data released this morning caused U.S. stock futures and Precious Metals prices to fall, though stocks only added to losses while Precious Metals had been hanging on to gains. This downward trend started after the ADP’s private sector jobs report showed a better than expected increase, and continued after data showed the U.S. trade deficit widened by 12.1 percent and jobless claims fell by just 5,000. Gold and Silver prices were kept from climbing higher by a stronger U.S. dollar, which is reacting to news out of the eurozone that brings Greece and Portugal’s debt situation back in focus. Political issues in Portugal and concern over Greece receiving its next round of bailout money kept European stocks down overnight. Commerzbank analyst Daniel Briesemann said, “Prices are treading water at the moment and a firmer dollar is capping further increases. Debt crisis in Greece and Portugal, which seem to be back in focus, is weighing on equities and possibly leading to some higher demand for Gold, but on the other end we are still seeing outflows from ETFs and that's negative.” At 9 a.m. (ET), the APMEX Precious Metals spot prices were:

|

||

| Useful To Me Not Useful To Me | |||

|

bsiong

Supreme |

03-Jul-2013 16:20

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

Closing Gold & Silver Market Report – 07/02/2013

U.S. STOCKS CLOSE DOWN GOLD STRUGGLES AGAINST DOLLAR Solid numbers from automobile sales and factory orders weren’t enough to keep stocks in the black today as investors began to look ahead to the jobs report, due Friday. The decline started after New York Federal Reserve President William Dudley confirmed the U.S. Federal Reserve’s stance on rate hikes and their intentions for scaling back the quantitative easing program. His speech didn’t seem to help the market, though. One upside is that trading volume in general should be light this week due to the U.S. stock market closing at 1 p.m. (ET) on July 3 and being closed all day Thursday for the Fourth of July holiday. The Gold price is still struggling against a strong U.S. dollar. Early Tuesday, Gold had gained much of the ground lost last week but those gains were short lived as money managers used the opportunity to sell out of long positions. Phillip Streible, senior commodities broker at R.J. O'Brien in Chicago, said, " The dollar index is strengthening quite a bit, equities are strengthening and you're seeing interest rates go up. That seems to be the perfect storm against the metal at the moment.” Investors seem hesitant to move much before both the holiday and Friday’s jobs numbers. A strong reading could be positive for the dollar but could push the Gold price lower. At 5:00 p.m. (ET), the APMEX Precious Metals spot prices were:

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Octavia

Elite |

02-Jul-2013 23:51

|

||

|

x 0

x 0 Alert Admin |

Has Gold's 'Bubble' Burst Or Is This A Golden Buying Opportunity? Introduction With the end of the second quarter it is important to take stock and review how various assets have performed in the first half of 2013 and assess the outlook for the rest of 2013 and, more importantly, the coming years.

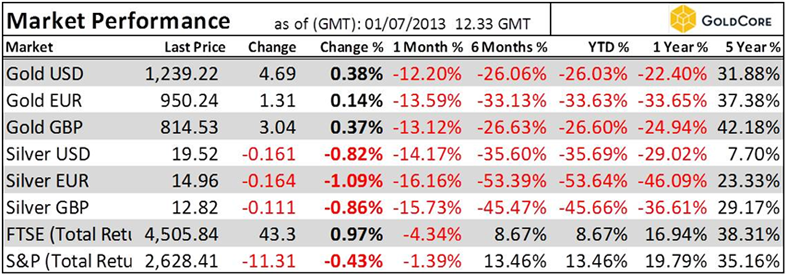

Global stock, bond, commodity and precious metal markets have been highly volatile since Federal Reserve Chairman Ben Bernanke again suggested that the Fed would soon cut the pace of its highly unorthodox money printing and bond buying. Gold and particularly silver had a torrid quarter and have significantly underperformed the vast majority of equity and bond markets in the quarter and in the last six months.  Gold in USD, GBP, EUR and JPY in 1H, 2013 Markets were volatile prior to Bernanke’s “jawboning”, particularly after the Bank of Japan said it would boost the monetary base by ¥60 trillion to ¥70 trillion ($600 billion or $700 billion) annually. This led to record gold prices in Japanese yen in April prior to a series of mini Nikkei crashes and gold falling sharply in all currencies. Review of Asset Performance H1, 2013 Precious Metals Gold prices fell 23% for the quarter, their largest quarterly fall since gold began trading in 1971. The 27% fall this year is the worst first-half performance since 1981. Silver slumped 31% in the second quarter and was down 36% in the first half.  Gold in USD, GBP, EUR, MSCI Word Stock Index, CRB Commodities Index & US 10 Year Yield Platinum tumbled 16% in the second quarter and is down 12% year to date. Palladium fell 15% in the second quarter and is down 3.6% year to date. Equities The global benchmark MSCI World Equity Index was down 1.2% in the second quarter but remains up 7% year to date after strong gains in the first quarter due to cheap money and hopes of a continuing global economic recovery.  MSCI WORLD – 1 Year Wall Street's three major indices finished the quarter with slight gains, with the Dow up 2.3%, the S& P 500 up 2.36% and the Nasdaq up 4.1%. The DJIA is just 3.2% below its record high set May 28 and up 13.8% in 2013. That is the best first-half performance for any year since the technology-stock-driven bull market of 1999 which was followed by the stock market crash of the early 2000s. The Standard & Poor's 500-stock index rose 2.4% in the quarter and posted a first-half gain of 12.6%, the best since 1998. The Russell 2000 Index, which tracks small-company stocks often seen as closely tied to the U.S. economy, rose 2.7%. Concerns about China and other emerging markets and geopolitical unrest saw that MSCI's broadest index of Asia-Pacific shares outside Japan down 7% for the year. The MSCI Emerging Market stock index dropped 9.1%. Bonds Bloodletting was not confined to the precious metals markets and there was considerable bloodletting in the bond market, as the yield on the U.S. Treasury 10-year note rose to 2.49% on Friday, from 1.84% on April 1 and from 1.63% on May 2, a low for the quarter. Treasuries through the iShares Barclays 20-year-plus ETF fell 8.9% in the last three months, its worst performance over the last 10 quarters. The Barclays investment grade corporate-bond index fell 3.3%.  US Generic Govt 10 Year Yield – 1 Year Also hit hard were emerging-market bonds, where investors were caught flat footed, not just by worries about the Fed but also by concerns about China's economy and political unrest in Brazil, Turkey and in the Middle East. Commodities Commodities saw weakness in general with copper, corn and coffee all having deep declines in the quarter due to concerns about global economic growth. The Standard & Poor’s GSCI Spot Index of 24 commodities fell 6.7% last quarter, the most in a year.  Thomson Reuters/ Jefferies CRB Commodities Index – 1 Year NYMEX oil had a monthly gain of 4.7% in June but still had a second-quarter fall of around 1%. Yet, it remains up 5.75% year to date. Brent crude oil sank 7.1% since March for a third quarterly decline, the longest streak in 15 years and is down 7.4% year to date. Natural gas prices declined 11% this quarter but remain up 7% this year. Copper, near its lowest price in three years, lost 10.3% in the quarter and 15% in the second half. Copper was depressed by concerns over slower growth in top consumer China and saw its third quarterly decline in a row. Year to date corn, wheat, coffee and sugar are down 22%, 15%, 16% and 13% respectively. Soybeans have eked out a 2% gain and cotton is 14% higher year to date. Currencies Part of the reason for weakness in commodities was the strength of the dollar which is the strongest currency in the world year to date.  Currency Performance in GBP (Year to Date) The euro, Danish krone, Swiss franc and Swedish krona have also displayed strength so far in 2013.  Currency Performance in Euros (Year to Date) The weakest currencies have been the precious metals, the Japanese yen, the Australian dollar and the Norwegian krone. Outlook For 2013 and Rest of Decade The volatility of recent weeks is but a mere small taste of the volatility in store for all markets in the coming months and years. The global debt crisis is likely to continue for the rest of the decade as politicians and central bankers have merely delayed the day of reckoning. They have ensured that when the day of reckoning comes it will be even more painful and costly then it would have been previously. Macroeconomic, Systemic, Geopolitical and Monetary Risks Despite a degree of irrational exuberance and complacency in markets in recent months, some of which have contributed to the fall in gold and silver prices, there remain significant risks. > > Macroeconomic The global economic recovery remains very tentative. China, Japan, the U.S., the UK, most European countries and all major economies face major challenges and there is a real risk of double dip recessions and a global recession. > > Systemic Many western banks and sovereign nations are bordering on insolvency and remain very vulnerable. Contagion remains the real concern and there is a real risk that periphery economies are canaries in the coalmines and herald coming problems for larger industrial nations such as Japan, China, the UK and the U.S. Should this happen long term interest rates would likely rise from the unsustainable record low levels seen today. > > Geopolitical Geopolitical risk from terrorism and war remains high and there are many geopolitical hot spots in the world especially in the Middle East - in Syria and between Iran and Israel. Tensions between Iran and Israel and the U.S. could lead to a military incident that degenerates into a regional conflict in the Middle East. Other potential flashpoints are in Afghanistan, Pakistan, the Koreas and increasing tensions between the U.S. and China and the U.S. and Russia. While there is little risk of a direct military confrontation between the U.S. and emerging superpower China, there is a risk of war being waged through proxies and of economic war involving economic protectionism and currency wars. > > Monetary The initial skirmishes of the ‘global currency wars' have been seen in recent years. These currency wars involve competitive currency devaluation and currency debasement as governments and central banks internationally devalue their currencies in order to maintain job sustaining, export growth and maintain fragile economic recoveries. We are experiencing a mere lull in currency wars but expect them to return with a vengeance when economic growth falters. Bail-Ins, Sovereign Debt and Currency Devaluations There will be banking and sovereign casualties in the coming years with obvious ramifications for those seeking to protect and grow wealth. Thus, it has never been more important for investors and savers internationally to have diversified portfolios. Lack of diversification and being overweight equities and property and the use of leverage and speculation led to much wealth destruction in recent years. Today, many investors and savers are overweight cash deposits and long term government bonds and are thus being recklessly conservative. This is despite the real risk of further sharp losses in government bond markets and the real and underappreciated risk of “bail-ins”. With bail-ins set to become policy in the western world, retail and corporate depositors need to be extra selective and vigilant. Owning physical gold outside the banking system becomes even more important so as to protect from deposit or asset confiscation. It is important to acknowledge the risks posed to the European Monetary Union due to a potential sovereign default still remain. Greece, Italy, Spain, Ireland and even France all remain vulnerable and the Eurozone debt crisis could rear its ugly head at any stage in the coming months. Despite Fed talk that they may ‘taper’ and reduce QE, loose monetary policies internationally are set to continue which will support the precious metals in the long term. New Bank of England governor, Mark Carney is likely to be a dovish inflationist who may debase sterling, making gold important for people in the UK looking to preserve their wealth. Sterling is already down 5% and 7% against the dollar and euro so far in 2013 and we expect further weakness in sterling in the coming months. Conclusion The short term outlook for the precious metals is, as ever, uncertain. Further weakness is possible although there is strong support for gold at the $1,200/oz level from a technical and fundamental perspective. There is robust international demand for gold at these levels and gold is becoming increasingly uneconomical to mine at these depressed price levels. Pound, euro and dollar cost averaging into a physical gold position protects from volatility and from short term price risk and remains prudent. Longer term we continue to believe that gold is in a secular bull market which will continue from 2015 to 2020. We continue to believe that gold should reach and surpass its inflation adjusted high of $2,400/oz in the coming years.  Support & Resistance Chart – (GoldCore) Given the variety of macroeconomic, systemic, geopolitical and monetary risks in the world today, owning an internationally diversified portfolio with healthy allocations to gold and silver bullion has never been more prudent. |

||

| Useful To Me Not Useful To Me | |||

|

hello123

Senior |

02-Jul-2013 22:28

Yells: " google ' sgx swinger ' - for how stock operators work " |

||

|

x 0

x 0 Alert Admin |

Gold futures GC rose from 1185 3 days ago to hit a high of 1267 today before falling off .. now 1245 while GLD rose from 115 to hit a high of 122.4 today before falling ..

|

||

| Useful To Me Not Useful To Me | |||

|

bsiong

Supreme |

02-Jul-2013 22:03

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

Morning Gold & Silver Market Report – 7/2/2013

INVESTORS AWAIT DATA Precious Metals prices are mostly flat this morning, as Gold eyes a third straight day of gains. Societe Generale metals analyst Robin Bhar explained, “It is a short-covering bounce after the losses seen last week, and people are now data-watching and want to see how this impacts on the [Federal Open Market Committee] policy.” Mixed results from economic data are forcing investors to question how soon the U.S. Federal Reserve’s tapering of the quantitative easing program will begin. After a pullback in European and Asian stocks, U.S. stock futures areattempting to hold onto gains this morning. UBS strategist Stephanie Deo said, “We believe that the markets have overreacted since the recent Fed announcement on June 19. The selloff in Treasuries is believed to be over and the equity correction was not warranted.” Investors are now waiting for the next big data event: Friday’s release of the June jobs report. At 9 a.m. (ET), the APMEX Precious Metals spot prices were:

|

||

| Useful To Me Not Useful To Me | |||

|

bsiong

Supreme |

02-Jul-2013 08:34

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

Closing Gold & Silver Market Report – 07/01/2013

GOLD PRODUCTION COULD SLOW After a second quarter slide that saw Gold fall more than 23 percent, the yellow metal has started July with strong gains. Following the recent decline that sent Gold through many key technical levels, today’s price jump is due to a drove of backfill orders by bargain hunting investors. Along with discussion that the U.S. Federal Reserve will begin tapering quantitative easing, the “strengthening of the [U.S. dollar], unwinding of the global carry trade and tame global inflation” have all amalgamated to drive Precious Metals prices down the last couple months. However, with prices being so low, Gold producers are second guessing the profitability of their endeavors. The world’s second largest Gold miner, Barrick Gold Corp, recently postponed the launch of a South American mine by two years. Experts predict many other producers will suspend production unless the Gold price can rebound enough to once again make manufacturing lucrative. Economic factors helped stocks rise Monday, as reports showed domestic manufacturing and construction spending edge higher for June. The data comes just ahead of quarterly corporate earnings reports, which will most likely begin funneling in following the July 4 holiday. Continued positive data on the economic front could exacerbate sentiment among Fed officials pushing for the early reduction of monetary easing measures that have been so critical in driving stock and Precious Metals markets. At 5:10 p.m. (ET), the APMEX Precious Metals spot prices were:

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

bsiong

Supreme |

02-Jul-2013 00:06

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

July 01, 2013 - 07:38:07 PDT

SHANGHAI STARTS NIGHT TRADING FOR GOLD AND SILVER FUTURES JULY 5China is the world’s largest gold producer and the second-largest consumer after India, but industry executives and prof... Read More |

||

| Useful To Me Not Useful To Me | |||

|

bsiong

Supreme |

01-Jul-2013 22:10

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

Morning Gold & Silver Market Report – 07/01/2013

U.S. STOCKS, GOLD START JULY STRONG Wall Street rose during the second quarter while the Gold price had one of its worst quarters in history. Stocks finished the month up amid concerns about the U.S. Federal Reserve’s tapering of their quantitative easing program. As July gears up, an upbeat managers survey in Europe helped overcome some of the lackluster readings on Chinese factory activity and investors are now looking forward to this morning’s manufacturing data and construction spending. But it isn’t all smooth sailing this week. Mike McCudden, head of derivatives at Interactive Investor, said, “Volumes will likely be depressed by the Independence Day holiday later in the week, plus the fact there’s the nonfarm payrolls on Friday, and there’s absolutely the prospect for some rampant volatility, even if overall markets remain relatively unchanged.” The Gold price is on the rise to start the month, ahead of this week’s economic data, as the U.S. dollar retreated from Friday’s four-week high.Saxo Bank senior manager Ole Hansen said, “Today's rebound is showing us that a lot of the panic activity has run its course for now... positions that needed to be reduced were reduced last week. Obviously, investors will watch the [European Central Bank] meeting and U.S. data this week and any impact on currencies will affect Gold too.” At 9:02 a.m. (ET), the APMEX Precious Metals spot prices were:

|

||

| Useful To Me Not Useful To Me | |||

|

bsiong

Supreme |

01-Jul-2013 22:00

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

|

||

| Useful To Me Not Useful To Me | |||

|

bsiong

Supreme |

01-Jul-2013 17:10

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

June 28, 2013 - 16:29:52 PDT

Year-Over-Year Percent Change Oscillator - Gold BullionYou can see the upside potential in the chart, as gold appears due for a reversal toward the mean. Read More |

||

| Useful To Me Not Useful To Me | |||

|

bsiong

Supreme |

01-Jul-2013 17:01

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

June 28, 2013 - 05:33:23 PDT

Citi - Are Gold And Silver Finding A Bottom?Citi's FX Technicals group, as the following charts suggest, expect both precious metals to move much higher in the long... Read More |

||

| Useful To Me Not Useful To Me | |||

|

hello123

Senior |

01-Jul-2013 04:27

Yells: " google ' sgx swinger ' - for how stock operators work " |

||

|

x 0

x 0 Alert Admin |

Gold has found a good swing bottom last nite at 1185( GC) and 115( GLD) .. so i expect a bounce from here to at least 1275( GC) and 123( GLD ) . for more details , pse see my gold chart .tq |

||

| Useful To Me Not Useful To Me | |||

|

bsiong

Supreme |

29-Jun-2013 08:54

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

Gold Plunges, but Lands at Key Fibonacci Support - is a Bounce Coming?

Chart prepared by Christopher Vecchio

Analysis: Gold has dropped by -25% this quarter. Call it what you will, but these are liquidation type conditions, not the hallmark of rational investing. With that said, Gold has fallen into the 10/20 RSI support region, where price has held on numerous probes lower ultimately producing a short-term rally. More recently, daily RSI has only dipped into this region in mid-February and mid-April. Accordingly, because the trend is still down, we look for any rallies in precious metals to be sold until sufficient technical evidence mounts to warrant a suggestion otherwise.

Trading Strategy: It is possible, however, that a near-term bottom in Gold may be around the corner. Basing just below $1200/oz shouldn’t be dismissed, as at 1189.91 lies the 100% extension of March high/April low/April high move, as well as the 61.8% extension of the October high (post-QE3 announcement)/April low/April high move at 1192. Time is a factor of course, and the longer Gold lingers near these key levels, the higher the probability of a break towards 1000.00/25. |

||

| Useful To Me Not Useful To Me | |||

|

bsiong

Supreme |

29-Jun-2013 08:52

Yells: "The Greatest Wealth is Health" |

||

|

x 0

x 0 Alert Admin |

Weekly Gold & Silver Market Recap – 6/28/2013PRECIOUS METALS WEIGHED DOWN BY POSITIVE U.S. OUTLOOK This week the Precious Metal prices continued to fall based on a positive outlook with the United States economy. Even before the U.S. market opened Monday, the Gold price pushed near a three year low in overnight trading as it lost nearly one percent on a stronger dollar. So far, this has been a difficult year for the Precious Metal, having lost 24 percent overall. Danske Bank analyst Christin Tuxen said, “This is a fairly quiet week, with not much in the calendar, but with the dollar and U.S. Treasuries yields stronger, we see Gold remaining under pressure." Unfortunately, it did not take any new reports to come out to send the Gold price even lower. By the close of business Wednesday, Gold futures had fallen once again to new multiyear lows. The 23 percent decline in Gold price this quarter has many investors spooked, causing a sustained onslaught of panic selling in electronic markets. “A combination of dollar strength, economic progress and a re-rating to the market’s expectations of central-bank asset purchases are crushing prices,” SpreadEx financial trader David White said. Though Wall Street powerhouses Goldman Sachs and Credit Suisse have downgraded their short term projections for Gold, some experts still tout exposure to Precious Metals in any investment portfolio as an excellent hedge against inflation and geopolitical turmoil. Though the possible slowing of asset purchases has forced Gold and Silver lower, the volume of “new money” flowing into markets is expected to have long-term economic significance in propelling metals prices toward former highs. As the week started winding down, The Gold price is hovering around a very important level with regards to production cost. Reports have surfaced that many Gold mines have closed because it is simply too expensive to mine the metal compared to the current prices. Andrew Su of Compass Global Markets said, “This fall in the price of Gold is not truly based on supply and demand - It's based on expectations of what the Federal Reserve is doing. I think that somewhere along the line the Gold prices will simply start rising, because production will reduce supply significantly.” As Gold experiences gains headed into the weekend, Silver is up more than 4 percent today. Gold is set to realize its largest quarterly dip since 1968, which continues to cause panic among electronically traded Gold investors, but has provided ongoing demand for bargain hunting physical Precious Metals buyers. NOT ALL ECONOMIC NEWS POSITIVE THIS WEEK On Monday, global markets were hit hard by a more than 5 percent drop in the Chinese stock market. This increased fears of a liquidity crunch, so much so that Goldman Sachs became the latest to cut its Chinese growth forecasts. European markets fell prey to negative results after the Shanghai stocks melted down. Stephen Pope, managing partner at Spotlight Ideas, said, “I would suggest that almost all of the downward movement in U.S. futures ... is due to the concern over the state of the Chinese economy and the implications for the rest of the world.” He continued on to say he believes we have overplayed the downside of the U.S. Federal Reserve story, but with China, “we have another excuse to trade with timidity.” In the United States, it seems as if the markets did not show much concern over the disappointing Gross Domestic Product report. The first quarter economic growth in the United States was estimated at 2.4 percent however, the final revised number came in much lower at 1.8 percent. This report could put a damper on talks of ending the Fed’s monetary easing program. While the growth is positive, many economists believe it will take more robust growth to get the Fed to change its easing course. This idea of continuing the Fed’s monetary easing program gained steam when one of the Fed members spoke Thursday. William Dudley, president and chief executive officer of the Federal Reserve Bank of New York, advised that if future economic data does not meet the expectations that were discussed at last week’s policy meeting, the Fed may not keep their word on tapering monetary policy. “If labor market conditions and the economy's growth momentum were to be less favorable than in the FOMC's outlook — and this is what has happened in recent years — I would expect that the asset purchases would continue at a higher pace for longer,” Dudley said. Dudley has a perpetual vote with fiscal policy and agreed last week with Ben Bernanke’s timeframe to cut back on asset buying. At 4:46 p.m. (ET), the APMEX Precious Metals spot prices were:

|

||

| Useful To Me Not Useful To Me | |||