| Latest Forum Topics / Straits Times Index |

|

|

News Update!

|

|||

|

krisluke

Supreme |

26-Oct-2011 20:32

|

||

|

x 0

x 0 Alert Admin |

Incoming ECB head gives euro zone pre-summit boost

(Updates China, talks on Greek writedown)

* Draghi signals ECB to continue " non-standard measures" * Large gaps remain in EU's " comprehensive solution" * Few numbers expected on rescue fund or bank capital * EU leaders meet at 1600 GMT, euro zone from 1730 GMT * EFSF head to visit China on Friday By Luke Baker and James Mackenzie BRUSSELS/ROME, Oct 26 (Reuters) - The incoming head of the European Central Bank threw the euro zone a lifeline hours before a crucial summit on Wednesday by signaling the bank would go on buying troubled states' bonds to combat market turmoil. Mario Draghi delivered the message that financial markets have been waiting for about the ECB's intentions as leaders of the 17-nation single currency area struggled to produce a comprehensive plan to resolve the bloc's sovereign debt woes. " The Eurosystem (of central banks) is determined, with its non-conventional measures, to prevent malfunctioning in the money and financial markets creating an obstacle to monetary transmission," he said in typically coded ECB language in a speech text released in Rome. Draghi, who will succeed Jean-Claude Trichet on Nov. 1, made clear that measures could only be a temporary expedient and said it was up to governments to tackle the roots of the debt crisis that began in Greece two years ago. However, his statement appeared to rebuff pressure from Germany's powerful Bundesbank for the ECB to end the bond-buying programme which prompted the resignation of the two most senior German ECB policymakers this year. Prospects for a detailed masterplan to resolve the debt crisis at Wednesday evening's euro zone summit looked dim, with disagreements remaining on some critical aspects, including how to give region's bailout fund extra firepower. EU officials and European diplomats lowered expectations of a breakthrough when leaders meet from 1730 GMT, despite Franco-German assurances that a " comprehensive solution" to two years of debt turmoil would be found. The leaders may agree only on broad outlines and leave crucial details, including the numbers on a Greek debt write-down and on funds available for financial fire-fighting, for later negotiation among finance ministers. A European Commission spokesman said there would not be detailed numbers on all aspects of the political agreement. While there is consensus on the need for around 110 billion euros ($150 billion) to be injected into the European banking system to withstand a potential Greek debt default and wider financial contagion, there is little clarity on either of the other two critical parts of the plan. Governments and banks were still arguing hours before the summit over the scale of the writedown private bondholders will have to take on their Greek debt holdings, sources familiar with the negotiations said. And many uncertainties remain around complex plans to scale up the region's 440 billion euro ($600 billion) bailout fund, known as the European Financial Stability Facility, without allowing it to draw on the European Central Bank. Investors stayed cautious ahead of the summit outcome, with the euro holding steady against the dollar and European shares little changed. 50 PERCENT " HAIRCUT" ? One proposal set to be adopted involves creating a special purpose investment vehicle (SPIV) to tap foreign sovereign and private investors, such as Chinese and Middle Eastern wealth funds, to buy bonds of troubled euro zone countries. The EFSF said its chief, Klaus Regling, would visit China to meet with investors on Friday. Chinese and European officials said there was no word yet on whether Beijing, which holds AAA-rated EFSF bonds and an estimated 600 billion euros in euro-denominated debt, would also invest in the SPIV. The other proposed method for scaling up the EFSF involves using it to offer partial guarantees to purchasers of new euro zone debt. The two options may be used in combination. German Chancellor Angela Merkel told parliament that private bondholders would have to take a substantial write-down so that Greece's debt could be reduced to 120 percent of gross domestic product by 2020 from 160 percent this year. Greek Finance Minister Evangelos Venizelos was reported to have told Greek banks the most likely outcome of negotiations was a 50 percent " haircut" for private investors, who would receive cash and new bonds in return for the debt. Citing sources in Brussels, where he has been meeting bankers, the daily Kathimerini said banks would receive 15 euros in cash and 35 euros in 30-year bonds with a 6 percent coupon for every 100 euros of debt they own. Banking sources and EU officials told Reuters the banks were now willing to accept a 50 percent reduction in the net present value of their holdings, while governments had sought a 60 percent " voluntary" write-down on the notional value. Jean-Claude Juncker, the chairman of euro zone finance ministers, forecast an eventual deal on a 50 percent write-off, but officials said it might not come in time for Wednesday's summit. European leaders' pattern of responding too little, too late to the debt and banking woes has turned it into a wider economic and political crisis that threatens to undermine the euro single currency and the European Union project. Financial markets have been hoping for weeks that the summit, scheduled to start at 1600 GMT with a gathering of all 27 EU leaders, will yield a detailed overall solution on how to combat the debt crisis. But EU sources said figures may not materialise until Nov. 7-8, when EU and eurozone finance ministers hold their next regular meeting. Further complicating Wednesday's talks, which will be preceded by a meeting of senior finance officials and central bankers to try to hammer out a meaningful agreement, was intense market pressure on Italy. LETTER OF INTENT Italy's inability to deliver a substantive plan for reforming its pensions system has raised doubts about Prime Minister Silvio Berlusconi's seriousness in tackling a crisis that threatens the euro zone's third largest economy. Berlusconi will bring to Brussels a " letter of intent" to his European partners on long awaited reforms, aides said, after his government nearly collapsed on Tuesday over their demands that Rome fulfil a pledge to raise the retirement age. Italy has the euro zone's largest sovereign bond market, with a public debt of 1.8 trillion euros, 120 percent of GDP. EU leaders fear that failure to make its debts more sustainable will mean it goes the same way as Greece, Ireland and Portugal, which have had to accept EU/IMF financial aid programmes. The rescue fund doesn't have enough money to bail Rome out. Draghi's statement appeared to supersede a dispute between Germany and France over how the ECB, the ultimate defender of the euro, should be involved in trying to resolve the crisis. Paris had wanted the summit to endorse a continuation of the ECB's " non-standard measures" as long as Europe faces exceptional circumstances. Merkel, fighting to secure parliamentary backing for the scaling up of the EFSF, said Germany opposed a line in the draft summit conclusions urging the ECB to continue these measures -- a key backstop against deeper turmoil. A senior euro zone source said the phrase would be dropped. (Additional reporting by Michael Martina in Beijing, Annika Breidthardt and Sarah Marsh in Berlin, Daniel Flynn and Harry Papachristou in Athens, Phil Pullella in Rome Writing by Luke Baker and Paul Taylor editing by Janet McBride) |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

26-Oct-2011 20:30

|

||

|

x 0

x 0 Alert Admin |

FTSE steady as European debt plan concerns linger

The London Stock Exchange building is seen in central London

* Defensives rise, gold higher on investor caution * Retailers fall on downgrades By David Brett LONDON, Oct 26 (Reuters) - Britain's top share index was steady on Wednesday, with investors keeping largely to the sidelines as the prospects for a comprehensive deal to tackle the euro zone debt crisis at a summit looked slim. An announcement is expected after the European Union summit, although deep disagreements remain on critical aspects of the potential plan. " Impasse is my expectation. I just can't see how European leaders can agree on a plan this quickly, with so many big issues and personalities involved even if we do get some announcement," said a London-based trader. The UK's benchmark index edged up 1.74 points to 5,527.28 by 1107 GMT, with the FTSE 100 trading just 20 percent of its average 90-day volume. " No-one's wanting to do anything, volumes are dire," said another trader, as fund managers kept their powder dry ahead of any announcement out of Europe, with possible press conferences due from around 2000 GMT. Investors sought shelter in defensive stocks and safe-haven assets such as gold , in case an agreement in Europe could not be reached, and with the FTSE 100 having gained 12 percent in the last two weeks. British American Tobacco rose 1.1 percent as the world's second-biggest cigarette maker reported sales increased by 7 percent in the first nine months of the year, and investors sought its defensive qualities. " BAT's Q3 update reads as reassuring to us and testifies to the company's continued resilience and status as a defensive port in a storm," Investec said in a note. Peer Imperial Tobacco IMT.L gained too, up 1.8 percent. Drugmaker Shire added 1.8 percent as Societe Generale upgraded it to " buy" from " hold" on the basis of upcoming launches and its defensive growth qualities. Peer GlaxoSmithKline was flat as it reported marginally lower-than-expected earnings but raised its interim dividend and said it was increasing buyback expectations. AstraZeneca reports on Thursday and Shire's results are expected on Friday. Mid-cap Hikma climbed 6.3 percent with traders citing an upgrade by Morgan Stanley to " overweight" from " equalweight" helping the shares higher. Fresnillo and Randgold rose as much as 2.6 percent as investors bought the equities as a proxy for gold, which has gained over the last four trading days as demand for assets offering protection against disappointment from Europe has risen. MACRO CONCERNS While most investors concentrated on the euro zone, data showed Britain was continuing to struggle its way out of recession, hurt by the debt crisis. British factory orders fell at their fastest pace in a year in October and firms expected to cut output as worries about the crisis weighed on sentiment. Broker recommendations had a significant impact on stock moves as investors sought legitimate reasons to trade ahead of any announcement from Europe. Next slipped 2.1 percent as Deutsche Bank downgraded the retailer to " hold" from " buy" on valuation grounds, while retaining its 2,780 pence target. Marks and Spencer fell 1.1 percent as Nomura cut earnings forecasts, saying " a disappointing first half is principally a function of a greater-than-expected squeeze on consumer spending power and near-term operational inflexibility" . British consumer goods group Reckitt Benckiser shed 2.2 percent as ING cut it to " hold" from " buy" after warning of slower growth on Tuesday. Smiths Group and Whitbread were among the heaviest fallers after losing their dividend attractions, combining to take 0.5 point off the index The FTSE gained some support as Wall Street futures pointed to a firmer open ahead of September U.S. durable goods orders due at 1230 GMT, and September new home sales due at 1400 GMT. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

krisluke

Supreme |

26-Oct-2011 20:28

|

||

|

x 0

x 0 Alert Admin |

FIVE FATAL FLAWS OF TRADING Close to ninety percent of all traders lose money. The remaining ten percent somehow manage to either break even or even turn a profit - and more importantly, do it consistently. How do they do that? That's an age-old question. While there is no magic formula, one of Elliott Wave International's senior instructors Jeffrey Kennedy has identified five fundamental flaws that, in his opinion, stop most traders from being consistently successful. We don't claim to have found The Holy Grail of trading here, but sometimes a single idea can change a person's life. Maybe you'll find one in Jeffrey's take on trading? We sincerely hope so. The following is an excerpt from Jeffrey Kennedy's Trader's Classroom Collection. For a limited time, Elliott Wave International is offering Jeffrey Kennedy's report, How to Use Bar Patterns to Spot Trade Setups, free. Why Do Traders Lose? If you've been trading for a long time, you no doubt have felt that a monstrous, invisible hand sometimes reaches into your trading account and takes out money. It doesn't seem to matter how many books you buy, how many seminars you attend or how many hours you spend analyzing price charts, you just can't seem to prevent that invisible hand from depleting your trading account funds. Which brings us to the question: Why do traders lose? Or maybe we should ask, 'How do you stop the Hand?' Whether you are a seasoned professional or just thinking about opening your first trading account, the ability to stop the Hand is proportional to how well you understand and overcome the Five Fatal Flaws of trading. For each fatal flaw represents a finger on the invisible hand that wreaks havoc with your trading account. Fatal Flaw No. 1 - Lack of Methodology If you aim to be a consistently successful trader, then you must have a defined trading methodology, which is simply a clear and concise way of looking at markets. Guessing or going by gut instinct won't work over the long run. If you don't have a defined trading methodology, then you don't have a way to know what constitutes a buy or sell signal. Moreover, you can't even consistently correctly identify the trend. How to overcome this fatal flaw? Answer: Write down your methodology. Define in writing what your analytical tools are and, more importantly, how you use them. It doesn't matter whether you use the Wave Principle, Point and Figure charts, Stochastics, RSI or a combination of all of the above. What does matter is that you actually take the effort to define it (i.e., what constitutes a buy, a sell, your trailing stop and instructions on exiting a position). And the best hint I can give you regarding developing a defined trading methodology is this: If you can't fit it on the back of a business card, it's probably too complicated. Fatal Flaw No. 2 - Lack of Discipline When you have clearly outlined and identified your trading methodology, then you must have the discipline to follow your system. A Lack of Discipline in this regard is the second fatal flaw. If the way you view a price chart or evaluate a potential trade setup is different from how you did it a month ago, then you have either not identified your methodology or you lack the discipline to follow the methodology you have identified. The formula for success is to consistently apply a proven methodology. So the best advice I can give you to overcome a lack of discipline is to define a trading methodology that works best for you and follow it religiously. Fatal Flaw No. 3 - Unrealistic Expectations Between you and me, nothing makes me angrier than those commercials that say something like, " ...$5,000 properly positioned in Natural Gas can give you returns of over $40,000..." Advertisements like this are a disservice to the financial industry as a whole and end up costing uneducated investors a lot more than $5,000. In addition, they help to create the third fatal flaw: Unrealistic Expectations. Yes, it is possible to experience above-average returns trading your own account. However, it's difficult to do it without taking on above-average risk. So what is a realistic return to shoot for in your first year as a trader - 50%, 100%, 200%? Whoa, let's rein in those unrealistic expectations. In my opinion, the goal for every trader their first year out should be not to lose money. In other words, shoot for a 0% return your first year. If you can manage that, then in year two, try to beat the Dow or the S& P. These goals may not be flashy but they are realistic, and if you can learn to live with them - and achieve them - you will fend off the Hand. For a limited time, Elliott Wave International is offering Jeffrey Kennedy's report, How to Use Bar Patterns to Spot Trade Setups, free. Fatal Flaw No. 4 - Lack of Patience The fourth finger of the invisible hand that robs your trading account is Lack of Patience. I forget where, but I once read that markets trend only 20% of the time, and, from my experience, I would say that this is an accurate statement. So think about it, the other 80% of the time the markets are not trending in one clear direction. That may explain why I believe that for any given time frame, there are only two or three really good trading opportunities. For example, if you're a long-term trader, there are typically only two or three compelling tradable moves in a market during any given year. Similarly, if you are a short-term trader, there are only two or three high-quality trade setups in a given week. All too often, because trading is inherently exciting (and anything involving money usually is exciting), it's easy to feel like you're missing the party if you don't trade a lot. As a result, you start taking trade setups of lesser and lesser quality and begin to over-trade. How do you overcome this lack of patience? The advice I have found to be most valuable is to remind yourself that every week, there is another trade-of-the-year. In other words, don't worry about missing an opportunity today, because there will be another one tomorrow, next week and next month ... I promise. I remember a line from a movie (either Sergeant York with Gary Cooper or The Patriot with Mel Gibson) in which one character gives advice to another on how to shoot a rifle: 'Aim small, miss small.' I offer the same advice in this new context. To aim small requires patience. So be patient, and you'll miss small." Fatal Flaw No. 5 - Lack of Money Management The final fatal flaw to overcome as a trader is a Lack of Money Management, and this topic deserves more than just a few paragraphs, because money management encompasses risk/reward analysis, probability of success and failure, protective stops and so much more. Even so, I would like to address the subject of money management with a focus on risk as a function of portfolio size. Now the big boys (i.e., the professional traders) tend to limit their risk on any given position to 1% - 3% of their portfolio. If we apply this rule to ourselves, then for every $5,000 we have in our trading account, we can risk only $50-$150 on any given trade. Stocks might be a little different, but a $50 stop in Corn, which is one point, is simply too tight a stop, especially when the 10-day average trading range in Corn recently has been more than 10 points. A more plausible stop might be five points or 10, in which case, depending on what percentage of your total portfolio you want to risk, you would need an account size between $15,000 and $50,000. Simply put, I believe that many traders begin to trade either under-funded or without sufficient capital in their trading account to trade the markets they choose to trade. And that doesn't even address the size that they trade (i.e., multiple contracts). To overcome this fatal flaw, let me expand on the logic from the 'aim small, miss small' movie line. If you have a small trading account, then trade small. You can accomplish this by trading fewer contracts, or trading e-mini contracts or even stocks. Bottom line, on your way to becoming a consistently successful trader, you must realize that one key is longevity. If your risk on any given position is relatively small, then you can weather the rough spots. Conversely, if you risk 25% of your portfolio on each trade, after four consecutive losers, you're out all together. Break the Hand's Grip Trading successfully is not easy. It's hard work ... damn hard. And if anyone leads you to believe otherwise, run the other way, and fast. But this hard work can be rewarding, above-average gains are possible and the sense of satisfaction one feels after a few nice trades is absolutely priceless. To get to that point, though, you must first break the fingers of the Hand that is holding you back and stealing money from your trading account. I can guarantee that if you attend to the five fatal flaws I've outlined, you won't be caught red-handed stealing from your own account. For more information on trading successfully, visit Elliott Wave International to download Jeffrey Kennedy's free report, How to Use Bar Patterns to Spot Trade Setups. |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

26-Oct-2011 20:25

|

||

|

x 0

x 0 Alert Admin |

China shares end up 0.7 pct on policy optimism

3d map of China overlaid with the Chinese flag

The Shanghai Composite Index finished at 2,427.5 points, after a 1.7 percent rise on Tuesday. After a period of tight policy which has choked lending, investors are hopeful easier monetary conditions will support the stock market which has fallen around 14 percent this year. (Reporting by Chen Yixin and Jacqueline Wong) |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

26-Oct-2011 20:23

|

||

|

x 0

x 0 Alert Admin |

HK shares close up 0.5 pct, H-shares strong

view of Hong Kong CBD from the sea with One International Finance Centre clearly visible

The Hang Seng Index closed up 0.52 percent at 19,066.54. The China Enterprises Index of top Hong Kong-listed mainland companies finished up 1.92 percent at 10,050.59. The Shanghai Composite Index closed up 0.74 percent at 2,427.48, its third straight gain, after Chinese Premier Wen Jiabao's pledge to fine-tune the country's economic policy spurred talk that policy could ease in the near term. HIGHLIGHTS: * Gains on Wednesday edged the Hang Seng Index nearer to the gap that opened up between 19,247 and 19,454, the low on Sept. 18 and high on Sept. 19, seen as offering near-term resistance. But turnover stayed below average on Wednesday, as it has all week, suggesting longer term investors were sitting out ahead of the euro zone meeting and third-quarter earnings from Chinese companies later in the day. * Resources-related stocks led gains, with Aluminum Corp of China Ltd (Chalco) defying its unfavourable earnings by gaining 3.9 percent in Hong Kong and 2.6 percent in Shanghai in volumes more than twice its respective 30-day averages. Analysts said the move was more associated with higher global commodities prices than company-specific factors and further boosted by hopes for easier economic policy after Premier Wen's comments late on Tuesday. * Weakness in Hong Kong property held back the Hang Seng Index for much of the day. In a report dated Oct. 26, Barclays analysts said office rents in Hong Kong would likely fall by at least 10 to 15 percent in the next two years and could drop by as much as 40 percent in a " hard landing" scenario. Sun Hung Kai Properties Ltd , Cheung Kong Holdings Ltd and Henderson Land Development Co Ltd were the top three drags on the Hang Seng Index. (Reporting by Clement Tan Editing by Chris Lewis) |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

krisluke

Supreme |

26-Oct-2011 20:22

|

||

|

x 0

x 0 Alert Admin |

|

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

26-Oct-2011 20:18

|

||

|

x 0

x 0 Alert Admin |

If Greece defaults and the European situation begins to spin out of control where will money flow? It would not make sense for market participants to buy Euro's during a default regardless of whether the default it structured or not. In fact, it is more likely that European central banks and businesses would be looking to either hedge their Euro exposure or convert their cash positions to another currency all together. Some market pundits would argue that gold and silver would likely benefit and I would not necessarily argue with that logic. However, the physical gold and silver markets are not that large and depending on the breadth of the situation, vast sums of money would be looking for a home. The two most logical places for hot money to target in search of safety would be the U.S. Dollar and U.S. Treasury's. The U.S. Dollar and U.S. Treasury obligations are both large, liquid markets that could facilitate the kid of demand that would be fostered by an economic event taking place in the Eurozone. My contention is that the U.S. Dollar would rally sharply along with U.S. Treasury's and risk assets would likely selloff as the flight to safety would be in full swing. To illustrate the point that the U.S. Dollar will likely rally on a European crisis, the chart below illustrates the price performance of the Euro compared to the U.S. Dollar Index. The chart speaks for itself:  Clearly the chart above supports my thesis that if the Euro begins to falter, the U.S. Dollar Index will rally sharply. In the long run I am not bullish on the U.S. Dollar, however in the case of a major event coming out of the Eurozone the Dollar will be one of the prettiest assets, among the ugly fiat currencies. Clearly the chart above supports my thesis that if the Euro begins to falter, the U.S. Dollar Index will rally sharply. In the long run I am not bullish on the U.S. Dollar, however in the case of a major event coming out of the Eurozone the Dollar will be one of the prettiest assets, among the ugly fiat currencies.

The first leg of the rally in the U.S. Dollar occurred back in late August. I alerted members and we took a call ratio spread on UUP that produced an 81% return based on risk. I am starting to see a similar type of situation setting up that could be an early indication that the U.S. Dollar is setting up to rally sharply higher in the weeks ahead. The daily chart of the U.S. Dollar Index is shown below:

As can be seen from the chart above, the U.S. Dollar Index has tested the key support level where the rally that began in late August transpired. When an underlying asset has a huge breakout it is quite common to see price come back and test the key breakout level in following weeks or months. We are seeing that situation play out during intraday trade on Friday. We are coming into one of the most important weeks of the year. Several cycle analysts are mentioning the importance of the October 26th – 28th time frame as a possible turning point. I am not a cycle expert, but what I do know is that we should know more about Europe's situation during that time frame. It would not shock me to see the U.S. Dollar come under pressure and risk assets rally into the October 26th – 28th time frame. However, as long as the U.S. Dollar Index can hold above the key breakout area the bulls will not be in complete control. If I am right about the U.S. Dollar rallying higher, the impact the rally would have on gold and silver could be extreme. While I think gold would show relative strength during that type of economic scenario, I think both metals would be under pressure if the U.S. Dollar started to surge. In fact, if the Dollar really took off to the upside I think both gold and silver could potentially selloff sharply. As I am keenly aware, anytime I write something negative about gold and silver my inbox fills up with hate mail. However, if my expectations play out there will be some short term pain in the metals, but the selloff may offer the last buying opportunity before gold goes into its final parabolic stage of this bull market. The weekly chart of gold below illustrates the key support levels that may get tested should the Dollar rally.  For quite some time silver has been showing relative weakness to gold. It is important to consider that should the U.S. Dollar rally, silver will likely underperform gold considerably. The weekly chart of silver is illustrated below with key support areas that may get tested should the Dollar rally: For quite some time silver has been showing relative weakness to gold. It is important to consider that should the U.S. Dollar rally, silver will likely underperform gold considerably. The weekly chart of silver is illustrated below with key support areas that may get tested should the Dollar rally:

Clearly there is a significant amount of uncertainty surrounding the future of the Eurozone and the Euro currency. While I do not know for sure when the situation in Europe will come to a head, I think the U.S. Dollar will be a great proxy for traders and investors to monitor regarding the ongoing European debacle. Clearly there is a significant amount of uncertainty surrounding the future of the Eurozone and the Euro currency. While I do not know for sure when the situation in Europe will come to a head, I think the U.S. Dollar will be a great proxy for traders and investors to monitor regarding the ongoing European debacle.

If the Dollar breaks down below the key support level discussed above, gold and silver will likely start the next leg of the precious metals bull market. However, as long as the U.S. Dollar can hold that key level it is quite possible for gold and silver to probe below recent lows. Both gold and silver have been rallying for quite some time, but the recent pullback is the most severe drawdown so far. It should not be that difficult to surmise that gold and silver may have more downside ahead of them as a function of working off the long term overbought conditions which occurred during the recent precious metals bull market. Make no mistake, if the Dollar does rally in coming months risk assets will be under significant selling pressure. While the price action will be painful, those prepared and flush with cash will have an amazing buying opportunity in gold, silver, and the mining complex. Right now, risk remains excruciatingly high as the European bureaucrats wag the market's dog. Subscribers of OTS have pocketed more than 150% return in the past two months. If you'd like to stay ahead of the market using My Low Risk Option Strategies and Trades check out OTS at http://www.optionstradingsignals.com/specials/index.php and take advantage of our free occasional trade ideas or a 66% coupon to sign up for daily market analysis, videos and Option Trades each week. |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

26-Oct-2011 20:16

|

||

|

x 0

x 0 Alert Admin |

Gold continues the weekly bullish wave as we expected earlier, where the metal is supported by the high level of uncertainty ahead of the European summit’s results today, where all eyes are looking forward to the European leaders, with speculations that they will be able to provide a comprehensive plan to tackle the debt crisis and stop the contagion. Gold opened in the Asian session at $1705.02 per ounce and recorded the highest at $1719.96 and the lowest at $1694.82 and is currently hovering around $1717.50 an ounce. Markets are anxious, while jitters and rising debt woes are dominating investors, especially after news reports yesterday showed that the finance chiefs’ meeting ahead of the European summit today was canceled, which supported metals to rebound yesterday despite the strong dollar, where we clarified earlier that the U.S. dollar pressured metals to the downside as gold became less attractive after exchange institutions raised margins on gold futures twice. The cancelation of the finance ministers’ meeting provided us with two points of view, where the first one is positive and suggests that finance ministers found common grounds and saw no need for the meeting today. But, on the other hand, the second view is negative and indicates that European leaders found no applicable solutions and will provide nothing to the markets today. Gold is currently trading around the highest level in more than a month, after the sharp incline seen yesterday, where the importance of the summit and the effects it could have on the market supported investors to hold more gold as a hedge against uncertainty especially with lack of major fundamentals and the sharp volatility and fluctuations seen in the market. The European summit highlights the day with all eyes worldwide focused on the European leaders, where a final plan is expected to overcome the debt crisis, awaiting details on the mechanism of aiding Greece, leveraging the European Financial Stability Facility and empowering the banking sector. Concerning Greece, markets are waiting for more information regarding the second bailout and the percentage hair-cut on the Greek bonds, which could be around 50%. Leaders will also provide a final decision on how the European Financial Stability Facility will work. In general, we expect metals to extend the gains today ahead of the summit results, where a strong plan could relieve markets and ease the jitters and debt woes, while a disappointment could trigger more volatility and fluctuation and could spread losses across the board, which could force investors to close their position on gold to cover the losses. Silver also extended the gains recorded in the past two sessions after opening the session today at $33.23 per ounce, recording a high of $33.70 and a low of $32.87, and is trading now around $33.31 per ounce. Among other precious metals, platinum opened the session today at $1565.00 per ounce and is currently trading around $1566.25 per ounce, after reaching the highest at $1577.25 and the lowest at $1561.75 per ounce. :)------------------------------------------------------------------------------------------------------------------------------------------(: Crude oil enjoyed the upside rally as it extended its gains for the fifth consecutive day reaching high levels that not expected due to optimism from Europe that EU leaders would finally come up with a comprehensive plan for the Euro Area to contain its crisis in today’s summit. Investors are so optimistic ahead of the summit today which will likely present a decisive plan that would care about prevent crisis from spreading to other huge European nations such as Italy and Spain by lowering the borrowing costs for these countries along with pulling up Greece from default. Also, it is expected that leaders would find a way to recapitalize European banks in order to prevent a credit crunch among markets by provide more liquidity into markets using some of tools that they would announce in today’s summit, where they indicated in the first summit that EU banks need m more than 100 billion Euros to be recapitalized. Crude oil for December delivery continued yesterday’s rally after it opened the session at $92.47 and reached so far a high of $93.89 and recorded a low of $92.30, where it is currently trading positively around $93.50. Vagueness is still dominant on how would they agree to extend the firepower of the EFSF after they ruled out the ECB’s role as a main refinancer for the fund following German calls, where investors are wondering now whether the EFSF will buy debt-laden nations bonds in order to lower borrowing costs or they will insure these bonds. As the main focus for investors is on Europe and the latest developments ahead of the summit, Germany called yesterday the ECB to stop its temporary non-standard measures which allow for the bank to buy governments’ bonds in the secondary market, which limit the ECB’s role in helping debt-laden nations. On the other hand, investors are worried about how EU leaders will decide about the Greek debt haircuts, as expectations that they will writedown almost 50%-60% of Greek bonds value which considered a big cut for private sector’s money, where a hard talk is expected to take a place in the summit over this issue. Nonetheless, crude is benefiting from all these hopes that clear the outlook for Europe and make it better, as the expected plan would support the European economy and ease fears over the deepening debt crisis, and as a result improve the global pace of growth, which will increase the demand on crude significantly. All these questions are dominate investors’ thinking ahead of the summit which will keep markets volatile but with a good positive momentum amid hopes that leaders will absolutely present a decisive and comprehensive plan for the crisis, and if not, we will see a huge selloff among global markets that would drive markets sharply down and specially oil which is considered a very growth sensitive commodity. But today, EIA report will be released today which will take some of the investors’ attention ahead of the summit, and it is expected to weigh down crude oil and reform a negative pressure on it, as it is expected to show a rise in U.S. crude inventories by 1.4 million barrel in the last week, after it recorded an unexpected drop by 4.7 million barrel a week before. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

krisluke

Supreme |

26-Oct-2011 20:14

|

||

|

x 0

x 0 Alert Admin |

Nymex Crude Oil (CL)Crude oil rises further to as high as 94.65 so far today and intraday bias remains on the upside for 50% retracement of 114.83 to 74.95 at 94.89 first. Break will target key level around 100, which is close to 100.62 resistance and 61.8% retracement at 99.6. On the downside, below 91.10 minor support will turn bias neutral and probably bring retreat to 4 hours 55 EMA (now at 88.49). But near term outlook will stay cautiously bullish as long as 84.10 support holds and we'd expect further rally ahead. In the bigger picture, the break of 90.52 resistance completes a double bottom reversal pattern (75.71, 74.95) and indicate that fall from 114.83 has possibly finished. The corrective structure in turn argue that price actions from 114.83 are merely forming a sideway consolidation pattern. In otherwise, whole rebound from 33.2 might not be finished yet. There is now prospect for another high above 114.83 before reversal. But after all we didn't change our view that price actions from 147.24 are forming an long term consolidation pattern. Hence, even if further rally might be seen, we'll look for reversal signal again above 114.83. Nymex Crude Oil Continuous Contract 4 Hours Chart

|

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

26-Oct-2011 20:12

|

||

|

x 0

x 0 Alert Admin |

Comex Gold (GC)Gold's strong rally and break of 1705.4 resistance indicate that whole decline from 1923.7 has likely finished at 1535 already. Intraday bias remains is now on the upside for 61.8% retracement of 1923.7 to 1535 at 1775.2 first. Break will pave the way to retest 1923.7 high. On the downside, though, break of 1604.7 support will argue that choppy rebound from 1535 is finished and will turn focus back to this low. In the bigger picture, current development indicates that gold has made a medium term top at 1923.7, ahead of long term projection level of 161.8% projection of 253 to 1033.9 from 681 at 1945.6 and 2000 psychological level. While the fall from 1923.7 was steep and deep, gold is still holding inside long term rising channel from 681 and above 55 weeks EMA at 1530.7. Hence, we're not too bearish in gold yet. Strong support is anticipated at 1478.3/1577.4 support zone to contained downside, at least initially, and bring rebound. However, note that sustained break of 1478.3 will strongly suggest that the long term up trend has already reversed. Comex Gold Continuous Contract 4 Hours Chart

|

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

26-Oct-2011 01:07

|

||

|

x 0

x 0 Alert Admin |

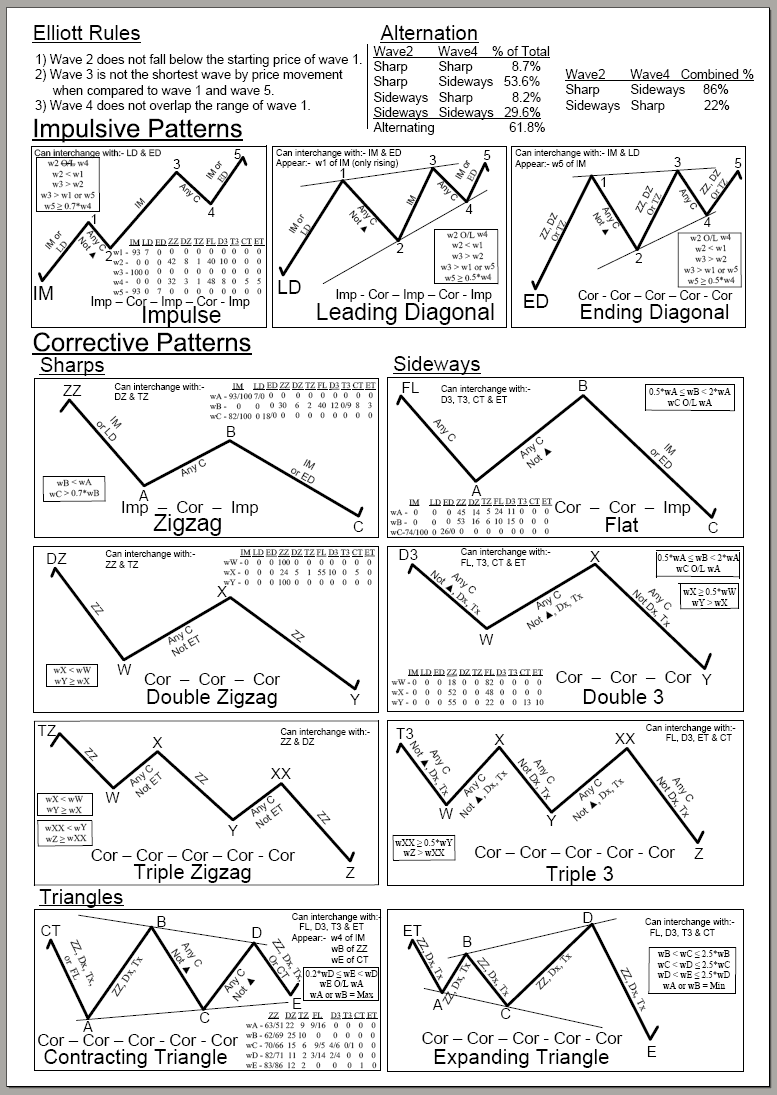

Cheat sheet summary of elliott wave

|

||

| Useful To Me Not Useful To Me | |||

|

Sgshares

Elite |

25-Oct-2011 22:41

|

||

|

x 0

x 0 Alert Admin |

LONDON (MarketWatch) -- European Commission President José Manuel Barroso said Tuesday he was confident of a successful outcome at Wednesday's summit of euro-zone leaders, where a package of measures to tackle the debt crisis is expected to be announced. " Just a little more than 24 hours before the European Council and the follow-up euro-area summit, let me repeat that we are working on solid and convincing solutions to deliver tomorrow a comprehensive package for stability and growth," Barroso said at a press briefing. " It is time to end the uncertainty." | ||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Sgshares

Elite |

25-Oct-2011 22:39

|

||

|

x 0

x 0 Alert Admin |

This is good news to longies and bad news to shorties

|

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

25-Oct-2011 22:33

|

||

|

x 0

x 0 Alert Admin |

No news liao, mainly abt earning report from DJ 30..... Time to ZzzzzZzzzzz Enjoy the singapore ONly October holiday |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

25-Oct-2011 22:26

|

||

|

x 0

x 0 Alert Admin |

CNBC: Finance Minister Meeting Was Never Needed, Europe's Close To A Solution |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

25-Oct-2011 22:22

|

||

|

x 0

x 0 Alert Admin |

|||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

25-Oct-2011 22:19

|

||

|

x 0

x 0 Alert Admin |

|||

| Useful To Me Not Useful To Me | |||

|

Noob79

Master |

25-Oct-2011 22:19

|

||

|

x 0

x 0 Alert Admin |

Tml Europe and US will continue to fall... EU finance minister cancel tml meeting... STI going to see super red.... | ||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

25-Oct-2011 22:14

|

||

|

x 0

x 0 Alert Admin |

Wall St extends losses after consumer data

Times Square, New York

The Dow Jones industrial average was down 122.16 points, or 1.03 percent, at 11,791.46. The Standard & Poor's 500 Index was down 15.45 points, or 1.23 percent, at 1,238.74. The Nasdaq Composite Index was down 29.79 points, or 1.10 percent, at 2,669.65. (Reporting by Angela Moon Editing by Theodore d'Afflisio) |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

25-Oct-2011 22:12

|

||

|

x 0

x 0 Alert Admin |

Merkel seeks wide support for euro rescue plans(AP:BERLIN) Chancellor Angela Merkel said Tuesday she hopes for wide domestic support of her eurozone rescue efforts ahead of an expected parliamentary vote on plans to increase the firepower of the currency bloc's rescue fund. Germany's main parties were working on a joint text to put to a vote Wednesday, just ahead of a European Union summit, and the biggest opposition party signaled that it plans to back the plans. The EU summit will consider plans to boost the euro440 billion ($600 billion) bailout fund by offering government bond buyers insurance against possible losses and attracting capital from private investors and sovereign wealth funds. Before leaving for Brussels, Merkel is seeking the German parliament's approval. She said Tuesday she aims for " support that is as wide as possible" for her efforts. She looked likely to get her wish, with a key opposition leader saying that " we have a great interest in the second part of the European summit not failing." Still, Frank-Walter Steinmeier, the parliamentary leader of the center-left Social Democrats, complained that there's still too little detail on the plans. He said parties are working together to draw up a text to put to a vote, and he called for the German parliament to vote again after the summit once its results are finalized. Wednesday's vote comes about a month after the German parliament approved moves to expand the size and powers of the fund, the so-called European Financial Stability Facility. Several skeptics in Merkel's governing coalition opposed that move, though not enough to cause her trouble, and said they will again vote " no" on Wednesday. " We've been told again and again, if you vote 'yes' now then we have solved the problems ... and things have always tended to get more difficult," said Wolfgang Bosbach, a rebel lawmaker from Merkel's Christian Democrats. " With rescue funds that get bigger and bigger, we are delaying into the future the solution of the problems and piling burdens onto the young generation," Bosbach said on n-tv television. |

||

| Useful To Me Not Useful To Me | |||