| Latest Forum Topics / Straits Times Index |

|

|

News Update!

|

|

|

rabbitfoot

Veteran |

14-Nov-2011 00:12

|

|

x 0

x 0 Alert Admin |

Just a Suggestion for longing. Can use your cpf to Buy Fidelity America. Now only 0.82 cents. Launch price is $1. Main holdings Apple, Google...This penny unit trust moves up preety fast, can reap good profit in % terms |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 23:42

|

|

x 0

x 0 Alert Admin |

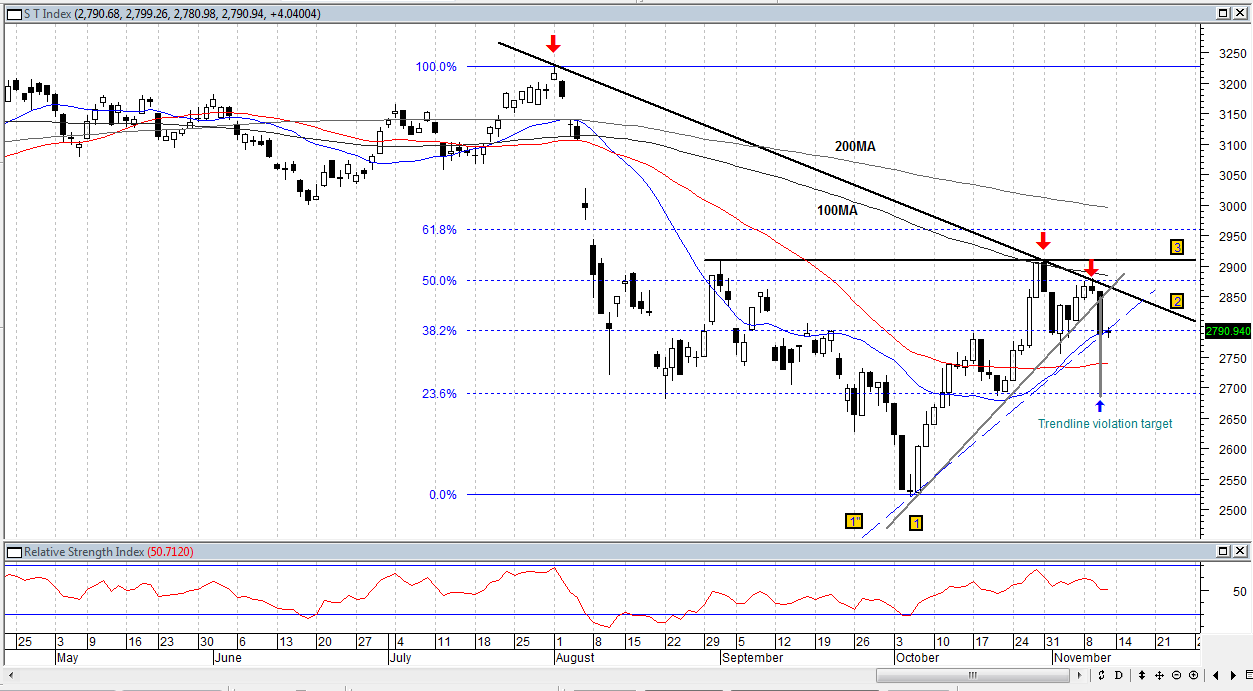

1. Trendline 1 is a short-term uptrend line. It was violated decisively on Thursday. The trendline violation target is 2,690.

The above hypothesis is, however, not infallible because trendline 1 can always be redrawn to accommodate the sharp plunge of Thursday ( see trendline 1" ). 2. Trendline 2 is a valid downtrend line. It is valid because it has been touched 3 times ( a trendline that has been touched twice is only tentative trendline ). Successful breakout from this level strengthen the confident we are already riding a new uptrend since Oct 6.

3. Trendline 3 is a major resistance, some people consider this the neckline of an inverted head and shoulders pattern. I am not certain if such a pattern is valid. However, a break above this level does have significant meaning. It marks a new higher high in the new uptrend which is an important evidence confirming the uptrend we are riding is here to stay.

|

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

13-Nov-2011 22:46

|

|

x 0

x 0 Alert Admin |

Blackstone's Byron Wien Made 10 Predictions For The Year 2011 -- Here's How They're Doing With the year coming to a close, it's time to revisit economic predictions made twelve months ago. First on our list is Vice Chairman of Blackstone Advisory Partners, Byron Wien. Wien predicted a slew of events including S& P target prices, Chinese GDP and troop levels in Iraq and Afghanistan. He says that there is in reality only a 50% chance that any of these events comes true. Oddly prophetic, considering half of his ten have. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 22:44

|

|

x 0

x 0 Alert Admin |

This 2006 Blog Post By Roubini Really Was Incredibly Prophetic In light of the crisis in Italy, Nouriel Roubini's comments on the Eurozone back in 2006 have been getting a fair amount of buzz. And in fact this buzz is well deserved. He recently reposted the blog post he wrote in 2006, after speaking at Davos, and apparently offending the Italian Finance Minister Tremonti (who is still the finance minister for the time being), by calling for Eurozone doom. The key thing here is how spot-on his assessment of the pain points were. This paragraph nailed it: And unfortunately, the lack of serious economic reforms in Italy implies that there is a growing risk that Italy may end up like Argentina. This is not a foregone conclusion but, if Italy does not reform, an exit from EMU within 5 years is not totally unlikely. Indeed, like Argentina, Italy faces a growing competitiveness loss given an increasingly overvalued currency and the risk of falling exports and growing current account deficit. The growth slowdown will make the public deficit and debt worse and potentially unsustainable over time. And if a devaluation cannot be used to reduce real wages, the real exchange rate overvaluation will be undone via a slow and painful process of wage and price deflation. But such deflation will keep real rates high and exacerbate the growth and fiscal crisis. Without necessary reforms, eventually this vicious circle of stagdeflation would force Italy to exit EMU, return to the Lira and default on its Euro debts. Some argue that Italy or other EMU laggards would not exit EMU because a sharp devaluation of the new Lira – needed to regain the lost competitiveness – would make the real value Euro debt much higher and unsustainable for the government, the private sector and households. But look at what happened to Argentina: it devalued and given the balance sheet effects of the depreciation on their US debts it was forced to pesify its dollar debts. Similarly, Italy would be forced to liralize its Euro debts. If Italy were to exit EMU this effective default on domestic and external – public and private – Euro debt obligation would become unavoidable. And a sovereign nation is able to follow such policies – EMU exit, return to national currency and effective default on Euro debt – regardless of any legal or formal constraints that the EMU treaty imposes in terms of no exit clauses. This is not science fiction as Argentina was forced to do the same.

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 22:41

|

|

x 0

x 0 Alert Admin |

A Complete Checklist For Next Week's Big Earnings Announcements Earnings season is coming to a close, with most S& P 500 and Dow Industrial components already reporting. But a number of retailers announce this week, including the Gap, Sears and U.S. bell weather, Walmart. Take a look below to see who you have stock in: Monday, November 14, 2011: Lowe's (LOW): $0.33 Dynegy (DYN): -$0.27 JC Penney (JCP): $0.11 Urban Outfitters (URBN): $0.31 PMI Group (PMI): -$0.84 Tuesday, November 15, 2011: Beazer Homes (BZH): -$0.34 Staples (SPLS): $0.47 Wal-Mart Stores (WMT): $0.98 Saks (SKS): $0.09 TJX Cos (TJX): $1.05 Agilent Technologies (A): $0.81 Dell (DELL): $0.47 Home Depot (HD): $0.58 Autodesk (ADSK): $0.41 Wednesday, November 16, 2011: Target Corp (TGT): $0.74 Abercrombie & Fitch (ANF): $0.72 Sally Beauty Holdings (SBH): $0.28 Applied Materials (AMAT): 0.19 NetApp (NTAP): $0.60 Ltd Brands (LTD): $0.24 Thursday, November 17, 2011: Williams-Sonoma (WSM): $0.38 Sears Holdings (SHLD): -$2.14 Ross Stores (ROST): $1.25 Gap Inc (GPS): $0.36 Dolby Laboratories (DLB): $0.68 Salesforce.com (CRM): $0.31 Foot Locker (FL): $0.39 GameStop (GME): $0.39 Wet Seal (WTSLA): $0.05 Dollar Tree (DLTR): $0.83 Friday, November 18, 2011: Destination Maternity (DEST): $0.19 |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

13-Nov-2011 22:39

|

|

x 0

x 0 Alert Admin |

ROBERT SHILLER: These 5 Books Explain Why The Economy Is The Way It Is Yale professor and economist Robert Shiller famously predicted the dot-com bubble in his book Irrational Exuberance, which was first published in March 2000. A few years later, he predicted the end of the housing bubble in the second edition of Irrational Exuberance, which was published in 2005 when home prices were near all-time highs. We can only dream about what could be included in a third edition, should he decide to write one. For now, it may be worthwhile to read what Shiller is reading. The Browser recently interviewed Shiller and asked what books he would recommend. The underlying theme of these books: traits essential to human capitalism. From The Browser: The Yale economist argues that rising inequality in the US was a major cause of the recent crisis, and little is being done to address it. He suggests reading that give insights into how this happened. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 22:37

|

|

x 0

x 0 Alert Admin |

DAVID ROSENBERG: We Are In Year 4 Of A 7-10 Year Depression David Rosenberg of Gluskin Sheff joined Consuelo Mack on Wealth Track this weekend to discuss his outlook for the economy. Rosenberg isn’t just bearish. He say the US economy is in a modern day depression similar to what Japan has suffered from for the last 20 years. He bases this view on the idea that de-leveraging tends to coincide during a prolonged period of economic weakness that is not merely consistent with recession. Rosenberg says we’re just 4 years into a depression that will likely last 7-10 years. He says the economy is likely to begin contracting again in 2012 and that the employment situation is going to deteriorate further. He calls the MF Global bankruptcy the Bear Stearns of 2011. Contrary to common misconception, Rosenberg is not bearish on everything. After being a long-time US Treasury bull, Rosenberg is sounding a bit less bullish on government bears. He says the love affair is over. He now prefers corporates and income at a reasonable price. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 22:35

|

|

x 0

x 0 Alert Admin |

Ironically Texas May Be Forced To Export Unrefined Crude By 2012 The US oil industry is in a bit of a quandary. The Houston & Louisiana refining area is the largest in the world. It has just had tens of billions of dollars thrown at it, to prepare it to run heavy sour sources. These heavy sour grades are typically cheaper, and contain lots of secondary products during the refining process. In simple terms, we have spent the last twenty years preparing to make more out of lower quality oil. It was a great idea, when the handwriting on the wall said these would be the only real sources of future growth in hydrocarbon volumes. This is now a problem for some companies, as their own refinery’s need the heavy sour crude’s to fuel these their product runs. What are they to do with a flood of light to super light sweet crude’s? If they ran this stuff, they would have to turn off a significant number of units at their refinery’s that are designed to capture and crack the heavy sludge. This leave the US refining patch in a bit of a jam. The new Eagle Ford shale oil is coming online in large volumes. Rumors are that Eagle Ford production will crack 500,000 barrels by the end of 2012, if they can get around localized shipping constraints. Right now it is the gathering of the stuff in quantities that are easy to ship/export that is the issue.The crude is so light in some places, they need specialized trucks to collect it and bring it to a gathering location. There isn’t the capacity to pick up the crude and bring it to market available right now. We are talking about 100,000 barrels of oil production behind pipe right now, and growing daily as people rush to install new smaller capacity pipelines around Texas to help haul it away. The number of companies that believe they can growth their domestic production by 100,000 barrels of oil in the next couple of years is growing. The irony is that the new supply is super light & sweet. A mix never expected in the US again. Platts had an article on this exact topic in June of 2011. The US could resume exporting some of its domestic crude oil production in 2012 when the output from Eagle Ford Shale in Texas ramps up. Eagle Ford shale crude’s gravity ranges from 42 API to 60 API with very low sulfur content, which in the US Gulf Coast refining terminology is considered a super light crude. But that’s the problem for US refiners: they aren’t built to process that type of crude. So the highest value for it may be outside the country. The US exports may be to the US East Coast first. The refinery’s based on the east coast tend to have a higher sweeter demand over their Southern units. In fact, the blow out in Brent prices has severely affected their profits due to sourcing costs increasing significantly this spring with the Libya revolution. There have been at least 3 refinery’s put up for sale or being put into mothballs until a cheaper source of crude is available. “U.S. east coast refining has been under severe market pressure for several years. Product imports, weakness in motor fuel demand and costly regulatory requirements are key factors in creating this very difficult environment,” ConocoPhillips said when it put Trainer on the auction block. If the three refineries on the block shut down, what does this mean for oil markets? In the case of the US, if Texas starts to export light sweet crude by large barges to the east coast. You could see a Renaissance in US exports of refined products as these units produce above domestic demand needs. The irony is that in the US we have removed the demand for the lighter sweet crude’s, so much so we will soon be exporting it from our primary refining center due to excess capacity in supplies. NOT DEMAND. The energy crisis of 2005 is not the supply crisis everyone was looking for. I wonder how long it will take society to catch up to the new reality. The US is going to become an energy exporter, even if its Texas shipping crude to those Yankees up north. Before you fall out of your chair laughing, look at this chart, conceptualize it, and then leave me a comment in the section below. I look forward to your thoughts on this chart.

It's a chart of barrels of oil produced per year from a specific zone in Texas. It will double every year for the next few. Then think about other new zones like it coming online in the next few years. Its a small amount today, but a not so small amount by tomorrow.

Read more posts on Ramblings of a Retired Portfolio Manager » |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

13-Nov-2011 22:34

|

|

x 0

x 0 Alert Admin |

Down with the EurozoneNouriel RoubiniNEW YORK – The eurozone crisis seems to be reaching its climax, with Greece on the verge of default and an inglorious exit from the monetary union, and now Italy on the verge of losing market access. But the eurozone's problems are much deeper. They are structural, and they severely affect at least four other economies: Ireland, Portugal, Cyprus, and Spain. For the last decade, the PIIGS (Portugal, Ireland, Italy, Greece, and Spain) were the eurozone's consumers of first and last resort, spending more than their income and running ever-larger current-account deficits. Meanwhile, the eurozone core (Germany, the Netherlands, Austria, and France) comprised the producers of first and last resort, spending below their incomes and running ever-larger current-account surpluses. These external imbalances were also driven by the euro’s strength since 2002, and by the divergence in real exchange rates and competitiveness within the eurozone. Unit labor costs fell in Germany and other parts of the core (as wage growth lagged that of productivity), leading to a real depreciation and rising current-account surpluses, while the reverse occurred in the PIIGS (and Cyprus), leading to real appreciation and widening current-account deficits. In Ireland and Spain, private savings collapsed, and a housing bubble fueled excessive consumption, while in Greece, Portugal, Cyprus, and Italy, it was excessive fiscal deficits that exacerbated external imbalances. The resulting build-up of private and public debt in over-spending countries became unmanageable when housing bubbles burst (Ireland and Spain) and current-account deficits, fiscal gaps, or both became unsustainable throughout the eurozone's periphery. Moreover, the peripheral countries’ large current-account deficits, fueled as they were by excessive consumption, were accompanied by economic stagnation and loss of competitiveness. So, now what? Symmetrical reflation is the best option for restoring growth and competitiveness on the eurozone's periphery while undertaking necessary austerity measures and structural reforms. This implies significant easing of monetary policy by the European Central Bank provision of unlimited lender-of-last-resort support to illiquid but potentially solvent economies a sharp depreciation of the euro, which would turn current-account deficits into surpluses and fiscal stimulus in the core if the periphery is forced into austerity. Unfortunately, Germany and the ECB oppose this option, owing to the prospect of a temporary dose of modestly higher inflation in the core relative to the periphery. The bitter medicine that Germany and the ECB want to impose on the periphery – the second option – is recessionary deflation: fiscal austerity, structural reforms to boost productivity growth and reduce unit labor costs, and real depreciation via price adjustment, as opposed to nominal exchange-rate adjustment. The problems with this option are many. Fiscal austerity, while necessary, means a deeper recession in the short term. Even structural reform reduces output in the short run, because it requires firing workers, shutting down money-losing firms, and gradually reallocating labor and capital to emerging new industries. So, to prevent a spiral of ever-deepening recession, the periphery needs real depreciation to improve its external deficit. But even if prices and wages were to fall by 30% over the next few years (which would most likely be socially and politically unsustainable), the real value of debt would increase sharply, worsening the insolvency of governments and private debtors. In short, the eurozone's periphery is now subject to the paradox of thrift: increasing savings too much, too fast leads to renewed recession and makes debts even more unsustainable. And that paradox is now affecting even the core. If the peripheral countries remain mired in a deflationary trap of high debt, falling output, weak competitiveness, and structural external deficits, eventually they will be tempted by a third option: default and exit from the eurozone. This would enable them to revive economic growth and competitiveness through a depreciation of new national currencies. Of course, such a disorderly eurozone break-up would be as severe a shock as the collapse of Lehman Brothers in 2008, if not worse. Avoiding it would compel the eurozone's core economies to embrace the fourth and final option: bribing the periphery to remain in a low-growth uncompetitive state. This would require accepting massive losses on public and private debt, as well as enormous transfer payments that boost the periphery’s income while its output stagnates. Italy has done something similar for decades, with its northern regions subsidizing the poorer Mezzogiorno. But such permanent fiscal transfers are politically impossible in the eurozone, where Germans are Germans and Greeks are Greeks. That also means that Germany and the ECB have less power than they seem to believe. Unless they abandon asymmetric adjustment (recessionary deflation), which concentrates all of the pain in the periphery, in favor of a more symmetrical approach (austerity and structural reforms on the periphery, combined with eurozone-wide reflation), the monetary union's slow-developing train wreck will accelerate as peripheral countries default and exit. The recent chaos in Greece and Italy may be the first step in this process. Clearly, the eurozone’s muddle-through approach no longer works. Unless the eurozone moves toward greater economic, fiscal, and political integration (on a path consistent with short-term restoration of growth, competitiveness, and debt sustainability, which are needed to resolve unsustainable debt and reduce chronic fiscal and external deficits), recessionary deflation will certainly lead to a disorderly break-up. With Italy too big to fail, too big to save, and now at the point of no return, the endgame for the eurozone has begun. Sequential, coercive restructurings of debt will come first, and then exits from the monetary union that will eventually lead to the eurozone’s disintegration. Nouriel Roubini is Chairman of Roubini Global Economics, Professor of Economics at the Stern School of Business, New York University, and co-author of the book Crisis Economics. Copyright: Project Syndicate, 2011. You might also like to read more from Nouriel Roubini or return to our home page. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 22:32

|

|

x 0

x 0 Alert Admin |

The Puzzling $115 Billion Drop In Chinese Household Deposits China’s latest monetary statistics could suggest that there is some easing as loans growth surprises on the upside. But it contained one piece of real shocker: household deposits fell by RMB727 billion [$115 billion]. This happens before, as deposits shift out of banks deposits to wealth management products. Those products are off balance sheet, and most probably outside of the money supply measures, so last month I wrote that perhaps the monetary statistics aren’t reliable, as the People’s Bank of China admitted itself before: China’s financial innovation has been growing, thus there has been more diversified products available for households. At the start of this year, there has been a huge growth in banks’ off-balance sheet wealth management products, which is outside of the regular deposits. The M2 money supply does not include these off-balance sheet products as part of the measurement, thus the M2 being reported has underestimated the money supply growth. In order to understand the actually financial condition, we are looking at including these off-balance sheet products and developing a new M2+ measures. Tao Wang of UBS agrees that this huge drop is down to wealth management products again (emphasis mine): Contrary to the upside surprise in bank lending, M2 growth slowed further in October, dropping to 12.9% y/y. As bank lending accelerated, deposits dropped by 200 billion in October due to a 730 billion drop in household deposits. Similar to what happened in Apr and Jul after the quarter-end supervision check, household deposits went off the balance sheet again to wealth management product, after returning to balance sheet in late September (household deposits rose by 990 billion in September). This suggests that: (1) against the backdrop of negative real interest, bank deposits remain very unattractive to household (2) banks continued to play the game of moving deposits on- and off- balance sheet, regardless of the increased regulation. Thanks to the noticeable growth of corporate lending, corporate deposits grew marginally by 86bn in October while fiscal deposits jumped 419bn. Going forward, we expect that M2 growth may rebound somewhat as the result of further relax of bank credit and faster disbursement of fiscal funding at year end. But the most puzzling part isn’t that it dropped, but the rate of drop, as Wei Yao of Société Générale said that this fall in household deposits is “the biggest monthly decline in the history”. Zhiwei Zhang of Nomura, though, is less alarmed, as he believes that besides the flight to wealth management products, household deposits tend to drop in October, so this is partly seasonal: The decline of household deposits is partly seasonal – in the past ten years, there were eight instances in October when household deposits declined. The flow to wealth management products may also have contributed.

Image Source: Nomura This article originally appeared here: The Puzzling 727 Billion Drop In Household Deposits

Read more posts on Also Sprach Analyst » |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 22:30

|

|

x 0

x 0 Alert Admin |

Hong Kong And China Look Worryingly Like These Mega-Bear Markets I occasionally come back to this chart, which compares some of the biggest stock market bubbles. Here’s the latest look, which compares the Hang Seng Chinese Enterprises Index and Shanghai Composite Index (2007 peaks) with a few other classic stock market bubbles: Dow Jones Industrial Average at 1929 peak, Nikkei 225 at 1989 peak, and the Nasdaq at 2000 peak:

This article originally appeared here: Hong Kong/China Mega-Bear Market Update

Read more posts on Also Sprach Analyst » |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 22:29

|

|

x 0

x 0 Alert Admin |

Europe Is Screwed... And There's Only One Way Out Europe remains the focus of markets, and rightly so. But the picture is not as clear as one would like. Different analysts point to different problems – if only this one problem could be solved, then all this would go away, they tend to say. Sadly, it is not one problem but three that must be solved, and none of them is easy. In today’s letter I try and offer a basic primer on the problems facing Europe. My challenge to myself is to do it in a short piece rather than the book-length tome it could easily become. Thus, in the pursuit of brevity, we will not be as in-depth as usual, but I think it helps us to step back a few feet and look at the larger picture before we focus on minutiae. Where Can I Find €3 Trillion?First, for the record, the European issue is not a crisis of confidence, as Merkel and Sarkozy, et al., keep telling us. It is structural. And until the structural issues are dealt with, the problems will not be solved. The first problem facing Europe is the glaring sore thumb: there is simply too much sovereign debt in Greece, Ireland, Spain, Italy, Portugal, and Belgium. That is not news. What has yet to be absorbed by the markets is that the cost of bailouts, present and potential, is likely to be in the €3 trillion range, talking an average of the estimates I have seen (with the Boston Consulting Group suggesting €6 trillion). €3 trillion is not pocket change. Indeed, it is a number that is inconceivable in scope. Greece has been told that they can write off 50% of their debt held by private entities, but not that owed to the IMF, ECB, or other public entities. This means something more like a 20-30% haircut on total debt. Sean Egan suggests that eventually Greece will write off closer to 90%. That is a number that cannot be contemplated in polite European circles, as it is plenty enough to cause a serious banking crisis. And that is before we get to the rest of the problem children. Portugal will need at least a 40% write-off (probably more!). The Irish are going to walk away from the bank debt they assumed in the banking crisis. While on paper Spain looks like it may survive, in reality it has significant problems in its banking sector. If they move to insure the solvency of their banks, their debts become unmanageable, not to mention that their debt grows each and every month from the rather large deficits they run and seem totally unwilling to try to reduce. The Spanish government deficit is likely to be at least 7% next year, well above their target of 6%. The “semi-autonomous regions” are in deep trouble, and their citizens are leveraged due to excessive real estate exuberance. Unemployment across Spain is 21%, and for the young it is over 40%. The Spanish government has adopted the rather novel idea that if it doesn’t pay its bills then its deficit will not be as large and therefore they can get closer to meeting their targets. Yields on Spanish debt are about 1% lower than on Italian debt, but give them time. And then there is Italy. Italy is simply too big to save. Yes, it looks like Berlusconi is leaving, but he is not the real problem. The problem is a 10-year bond yield at 7%, when your debt is 120% of GDP and growing. Italy is likely to be in recession soon, which will only make the problem worse. A drop in GDP while deficits rise means that debt-to-GDP rises faster. That means interest-rate costs are rising faster than (the lack of) growth in the economy. The deficit is a reported 4.6%. By contrast, Germany’s is 4.3%. But the difference is the debt. The market realizes that if you grow debt by 5% a year, it will not be but a few years until Italy is at 150%. There is no retreat without default from such a number, and the markets are saying, “We’ve seen this movie before and the ending is not a happy one. We think we’ll leave at intermission.” The ONLY reason that Italian yields have dropped below 7% is that the European Central Bank has been buying Italian debt “in size.” Any retreat by the ECB from buying Italian debt and Italian yields shoot to the moon. Italy will need to raise close to €350 this year, including new debt and rollover debt. The higher rates will put even more pressure on the deficit. Debt, whether it is with an individual, a family, a city, or a country, always has a limit. Debt cannot grow beyond the ability to service the debt. That is the clear lesson of Rogoff and Reinhardt’s epic work, This Time Is Different. When that limit is reached, the debt must be restructured in some way, either with better terms or through some sort of default. Mediterranean Europe simply borrowed more than it could pay, given the cash flows of the various countries. And now we are at the Endgame. How can one deal with the debt? The best solution is to figure out how to grow your economy faster than the growth of debt. Over time, debt service becomes a smaller part of the economy. But Southern Europe does not seemingly have that option. Certainly not Greece, Portugal, or Spain and this week we learned that Italian production was off 4.8%. Europe, even Germany, is slipping into recession. Germany is in the position of wanting the problem countries to cut their deficits through something called austerity. And living within your means is hardly a novel idea. It makes a great deal of sense. But when you are a country in recession and have to cut back, it only makes the recession worse for a period of time. Asking Greece to cuts its deficit by 4% a year for 4 years to get to something closer to balance means that the Greek economy will shrink by at least 10%, if not more. Tax revenues, never on solid footing, will shrink, making the deficit worse. How do you ask people to willingly enter into a depression for a rather long time in order to pay back the banks, even if the debts were freely taken on by the government and the money spent on the populace, and even if the haircuts are 50%? Yes, if Greece leaves the euro that means they will also have a depression. No one will lend them money for at least three years. Their banks will be insolvent, their pension funds destroyed. Their ability to buy needed materials (like oil, medicines, etc.) will be limited to the amount of goods they can produce and sell. Government employees will be forced to leave jobs, as there will be no money to pay them. Those on government pensions will get a fraction of what they were promised. Going back to the drachma will be painful in the extreme. Just as staying in the euro will be painful. Greece has no good choices. There are those who suggest that Europe is demonstrating the failure of the socialist welfare state. And there is some reason to say that. But I don’t think the socialist welfare state is the cause of the debt crisis. One can have a welfare state without debt, if you are willing to run a sensible budget. Think of the Scandinavian countries. And you can have countries without much social welfare get into debt problems. There are plenty of examples in history. Amassing large amounts of debt is a national problem that has as much to do with character as anything else. That is true for families or for countries. It is wanting to spend for goods and services today and pay for them in the future. Debt has its uses. Properly used, it can be of great benefit to societies and families. People can buy homes and tools that can be used for the production of goods, build roads and other infrastructure, etc. But debt cannot be allowed to become the master of the budget or the source for current spending, again whether for families or countries. And Greece and its fellow countries have used debt to fund current spending and now have run up against the inability to borrow more at sustainable levels. The easy answer is to cut spending. But when you cut back spending, even borrowed spending, it is going to affect GDP. It is something that may have to be done, but it is not without consequence. Ireland, a small country of 4.2 million people, just paid close to €1 billion to service debt that it owes for taking on the debts of its banks that went bankrupt. That is hugely unpopular in Ireland, and it will not be long before the Irish government simply says no. If the current one does not, then there will be a new one that does. Unless the Irish renegotiate their debt, they will be paying on it for decades. Debt that was private debt and paid to European banks (who lent to Irish banks) is now public debt. And it is a punitive and crushing debt. We can go to each problem country and home in on its own particular situation, and the answer almost always seems to be that the debt must be dealt with in some manner that either directly or indirectly amounts to default. (Even if the Eurozone leaders say that a 50% haircut by a bank is “voluntary.” Yeah, right. European leaders have a different understanding of voluntary than I learned in school.) But that is the problem. The European Commission is trying to figure out how to find €1 trillion to use to bail out southern Europe and Ireland. They so far cannot, and the market recognizes that fact and that the needs are actually much higher. European leaders cannot (at least publicly) fathom how to find €3 trillion. But whether or not they can “find” another few trillion, that debt will have to be restructured or defaulted. Once you go down that path, as they have with Greece, it is just a matter of time before you have to do the same for Portugal and Ireland and are Spain and Italy close on their heels? When Leverage Comes Back to Haunt YouEuropean regulators allowed their banks to leverage up to 450 to 1 on their capital, on the theory that sovereign nations in an enlightened Europe could not default, and therefore no reserves need to be kept for “investing” in government debt. And with those rules, banks borrowed massively and invested it in government debt, making the spread. It was an awesome free profit machine. Until Greece became a road bump. Now it is a nightmare. Even if you only invested 4% of your bank’s assets in Greek debt, if that is more than your capital then you are bankrupt. Irish banks were foolish and invested in Irish real estate that was in a bubble. They went bankrupt. Spanish banks were even more heavily leveraged to real estate, but have yet to write down their debt. They assume that houses will only lose about 15%, rather than the 50% that the real world is suggesting. And you can get away with that for a time if you own the agencies that rate the real estate debt, as the Spanish banks do. But most of the rest of European banks are going to go bankrupt the old-fashioned, tried-and-true, proven-over-the-centuries way: by buying government debt. Somehow they want to be seen as rational in leveraging up government debt. As I told the Irish crowd last week, don’t worry about your bank debt all you have to do is wait a little while. When French and Italian banks (and most of the other banks in Europe) are publicly insolvent and have to go to their respective countries and the ECB for capital, the relatively small amount (by comparison) of Irish bank debt will not even be noticed when you default. I was trying for a little humor, but there is a core of truth in that glib remark. France cannot afford to bail out its banks. As we have seen this week, they are already in danger of losing their AAA rating, as a false (premature?) press release from S& P suggested. (Someone is in trouble for that one! Seriously, you think S& P is not ready for this? There is reason to believe, I hear, that this was a draft for use later. We’ll see.) France will want the Eurozone to bail out their banks, and that means the ECB. If France gets such a deal, Ireland will certainly demand – and get – one, too. The German DilemmaAnd that brings us to the third problem, which has two parts: (1) the massive trade imbalances in Europe, where Germany and a few others export and the rest of Europe buys, And (2) the fact that German labor is far cheaper on a relative basis than Greek or Portugal labor (or that of most of the rest of the Eurozone). German workers have seen very little rise in their incomes, while Southern Europe labor costs have risen to over 30% higher. I won’t go into the details (I have written about this before), but there is a basic rule in economics. You can reduce private debt and you can reduce public debt and you can run a trade deficit. But you can only do two of the three at the same time. The total of the three must balance. Greece runs a massive trade deficit. They are also attempting to reduce their government debt, and private debt (that borrowed by business and consumers) is being forcibly reduced, as the banks are in full retreat. Greece must therefore endure a large reduction in its labor costs if it wants to reduce its government deficit. Sell that one to the unions. (By the way, Irish public unions took a large reduction, as did pensioners. Different political climate and country.) Germany seemingly wants the rest of Europe to behave like Germans, except that they also want them to continue to buy German products and run trade deficits, while Germany exports its way to prosperity. In the “old days” of a decade ago, a European country could simply devalue its currency and adjust the relative value of labor that way. But with a fixed currency there is no adjustment mechanism other than reduced pay or large unemployment numbers, which eventually translates into lower wages. Essentially, the southern part of Europe is on an odd sort of “gold standard,” with the euro being the fixed standard. And the adjustments are painful. There are no easy answers if you stay with the euro. And leaving is its own nightmare. So How Do We Solve the Eurozone Problem?Let’s quickly look at options for solving this. 1. The Germans (and the Dutch and Finns, et al.) can simply take their export surplus and taxes and savings and pay for the deficits in the southern zone until such time as they can be brought under control. Or they can bail out all the banks. Not just their own but throughout Europe, as a customer without a banking system cannot buy your products. That seems to be a political non-starter. 2. The problem countries can make the extremely painful adjustments, cut their deficits, and enter into a lengthy pepression. That also seems to be a political non-starter. 3. The Eurozone can forgive enough debt to get the various countries back to a place where they can function, nationalizing the banks that hold the debt, which would lead to a Europe-wide deep recession. Possible if the Eurozone leaders can sell it, but it is a tough sell. 4. A few countries (2? 3? 4?) can leave the Eurozone. If this is not done in an orderly fashion, the chaos will reverberate around the world.

Where Is the ECB Printing Press?It is hard for us in the US to understand, but the commitment of European leaders to a united Europe is amazingly strong. They will do whatever they think they must do (and/or can sell to the voters) to maintain the European Union. As a way to think about it, the US fought its most bloody war over the question of whether or not to remain a union. I think you have to call that commitment. While I am not suggesting that Europe is getting ready to start a civil war, I think it is helpful to remember that commitments to an ideal can drive people into situations that others have a hard time understanding. Let’s summarize. There is too much debt in many southern countries and while I have not yet mentioned it, France is not far from having its own crisis if they do not get back into balance. And if they lose their AAA rating, then any EFSF solution is just so much bad paper. The banks and banking system are effectively insolvent. There are large trade imbalances that make it almost impossible for the weaker Eurozone countries to grow their way out of the problem. The path of least resistance, and I use that term guardedly, is for the ECB to find its printing press. Perhaps they can borrow one from Bernanke. Yes, I know they are buying sovereign debt now, but they are “sterilizing” it, meaning they sell euro paper to offset the monetary base effects (large oversimplification, I know). But the money to solve the crisis does not exist. The only way to find it is for the ECB to print money and print in size, enough to lower the value of the euro and make exports cheaper (which gives southern Europe a chance to grow out of its problems). Which is of course something the Germans vehemently oppose, as it goes against their core DNA coding. But the choice is print or let the euro perish. I see no other realistic solution, aside from massive austerity, willingly accepted by Europeans everywhere, along with the nationalization of their banks, etc., as described above. I think there is even less willingness to endure all that. It is a hard choice, I know. If you held a gun to my head and asked, “What do you think they will do?” I would have to say, “I think the ECB prints.” But not without a lot of rancor and solemn pledges and maybe a rewriting of the treaty in order to get Germany to go along. The choice is between a much lower euro or one that is far different from today’s, with a number of countries having left it. There are no good or easy choices. As a closing aside, a lower euro means lower US and emerging-market exports (Europe is China’s biggest customer!) to Europe and more competition from Europeans in what the rest of the world sells to each other. It will be the beginning of serious trade issues and when coupled with the collapse of the Japanese yen, circa 2013, will usher in currency wars and protectionism. This will be a decade we will be glad to leave in 2020. DC, Cleveland, and New YorkI leave on Sunday for a few days to go to DC to speak at the UBS national wealth management conference. I hope to see my friend Art Cashin there, as well as finally meet Ken Rogoff, for whom I am an admitted groupie. Next weekend I will take a day trip to Cleveland and the Cleveland Clinic for some medical work. Mike Roizen is going to see what he can do to keep this 62-year-old body going for a few more decades. It is getting stiff! Then Thanksgiving, my favorite holiday, followed by a very quick trip to NYC with Tiffani for some business, media, and friends. I had great fun in Atlanta this week. Hedge Funds Care raised over $100,000 to help abused children, a very worthy cause. Last Monday I was with my daughter Melissa for her 31st birthday dinner. I was sitting across from her, and some of her friends asked where I was going next. “Atlanta,” I said. “What are you doing there?” “I am going to speak at a fundraiser for Hedge Funds Care,” was my short answer. They were aghast. “There’s a charity for hedge funds? That’s just wrong!” I couldn’t resist. I went with it. “Absolutely. Not a lot of people know or care, but a lot of hedge funds went bankrupt in the crisis in 2008. The managers lost their jobs and everything. Think of their kids! They had to leave their private schools, give up their cars and vacations, and lost their credit cards. It has been hard on them. Someone has to help, and we need to take care of our own.” I totally sucked them in. It was fun until Melissa burst out laughing And teased them for being gullible. Trips in the US somehow don’t seem all that bad any more. Just a few hours on a plane, reading and writing. It is the long international trips that wear and tear the body, I am thinking. Tomorrow I sleep in, trying to catch up. By the way, be on the lookout for a very special note from me later next week. I am working on a special offer of some of the best business marketing advice I have ever seen (which has sold for tens of thousands of dollars as seminars, papers, books, etc.), and I have arranged for my readers to get it totally free. My little way of trying to help. And now I will hit the send button and relax for the rest of the night. Have a great week! Your still having fun analyst, John Mauldin John@FrontlineThoughts.com Copyright 2011 John Mauldin. All Rights Reserved. |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

13-Nov-2011 22:26

|

|

x 0

x 0 Alert Admin |

Italy at risk of exiting euro zone - Roubini

By Kiryl Sukhotski and Megan Davies

MOSCOW, Nov 12 (Reuters) - Italy's emergency package of fiscal reforms will probably fail to keep its cost of borrowing on financial markets at affordable rates and the country faces the risk of a debt default and departure from the euro zone if more aggressive action is not taken, economist Nouriel Roubini predicted on Saturday. Roubini, made famous by predictions of the 2008-09 global banking crisis and worldwide recession that saw him nicknamed " Dr Doom" , also said Greece, Portugal and Spain were at risk of being ejected from the currency union. " I would think that in the next 12 months there is a high likelihood that 'Plan A' for Italy is not going to work," Roubini told Reuters Television in an interview in Moscow. " Italy might be forced into a debt restructuring and down the line may be forced into an exit from the euro zone." Italy, with debts of 1.9 trillion euros ($2.5 trillion), has replaced Greece at the centre of the region's financial crisis as bond markets pushed it to the brink of needing a bailout that the euro zone cannot afford. The country's parliament was on Saturday set to approve austerity measures, triggering the formation of an emergency government. [ID: nL5E7MC016] " It is highly likely that Italy is going to lose market access, that is not be able to regain it," said Roubini, who spoke on the sidelines of a financial conference organised by Sberbank, Russia's largest bank. BAILOUT FUND A " JOKE" The European Central Bank has intervened to buy Italian bonds in large amounts but, with the support of Germany, has balked at acting as a lender of last resort. Roubini said that the 440-billion-euro European Financial Stability Facility, the bailout fund set up by the euro zone to backstop its sovereign borrowers was a " joke" . The same applied to a proposed special purpose vehicle that would leverage up the EFSF's lending capacity to 1 trillion euros, he said, while the International Monetary Fund may not be able to provide sufficient financial support. " If the ECB is not going to be the lender of last resort ... at that point, after you've patched together a limit of IMF money and European money, and that isn't enough ... Italy might be forced into a debt restructuring and down the line may be forced into an exit from the euro zone," Roubini said. He said it was " highly likely" that Greece would exit the euro zone in the next 12 to 18 months, while Portugal " is a basket case like Greece is" . " They are small enough that if Italy and Spain are ring-fenced, and you let them out, you can do it in an semi-orderly way," he said. " If Italy and or Spain were to exit, then that is effectively a breakup of the euro zone." (Reporting by Kiryl Sukhotski, Writing by Megan Davies, Editing by Douglas Busvine) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 22:22

|

|

x 0

x 0 Alert Admin |

Iraqi Kurdistan confirms Exxon oil deal-minister

* Iraq says deal could jeopardise Exxon's Qurna contract

* Kurdish exports to rise next year * Salih says new oil law to go to parliament by year-end (Adds details, background) By Serena Chaudhry ARBIL, Iraq, Nov 13 (Reuters) - Iraq's Kurdish region has signed an exploration deal with Exxon Mobil, a Kurdish official said on Sunday, confirming a deal that Iraq has said could jeopardise the U.S. oil giant's southern oilfield contract. Natural Resources Minister Ashti Hawrami said the Kurdistan Regional Government (KRG) signed a contract with Exxon in mid-October for six exploration blocks in the semi-autonomous region. Iraq's central government, which has long-running disputes with the Kurdish region over oil and land, has said Baghdad would consider a deal between Exxon and the KRG illegal and a violation of the company's contract to develop Iraq's 8.7-billion-barrel West Qurna Phase One oilfield in the south. " It is a binding contract," Hawrami said at an oil and gas conference in the Kurdish capital, Arbil. " It was signed completely on the 18th of October 2011." It was the first official confirmation from the KRG. Exxon has yet to comment on the deal. Iraqi Kurdistan has enjoyed more stability and security in recent years than the rest of Iraq, which is struggling with stubborn violence from insurgents and militias more than eight years after the U.S. invasion that toppled Saddam Hussein. The KRG has signed contracts with a number of smaller foreign firms to develop oilfields in the region, but the contract with Exxon would be its first with a global oil major. Baghdad disputes the validity of the contracts, saying it has the right to control development of the world's fourth largest oil reserves. Abdul-Mahdy al-Ameedi, the director of the Iraqi oil ministry's contracts and licensing directorate, said on Friday the government had sent three letters to Exxon Mobil warning that any deal with the KRG would be considered illegal. Ameedi said such a deal could result in the termination of Exxon's contract to develop West Qurna Phase One field, a deal Exxon and partner Royal Dutch Shell clinched in 2009. In June, Deputy Prime Minister Hussain al-Shahristani said West Qurna Phase One production had hit 350,000 barrels per day and was expected to reach 400,000 bpd by year-end. A statement on Exxon from Shahristani's office on Saturday said Iraq would deal with any company that violates its laws " in the same way that we dealt with similar companies previously" . Iraq announced in September that it would bar U.S. oil firm Hess Corp from competing in its fourth energy auction, scheduled for next year, because the company signed deals with the Kurdish region. But analysts said Exxon's participation in the southern deal may be too important for the central government to carry out any threats over the Kurdistan deal. " Baghdad threat to Exxon Mobil is just that, a threat. Baghdad will not cancel the company's contract in southern Iraq because Exxon Mobil is not a small company and it knows the consequences of every step," said Ali Hussain Balou, former head of the oil and gas committee in parliament and now an analyst. AMBITIOUS PLANS The Exxon deal could further Iraqi Kurdistan's ambitious plans to boost production from the region. The chief executive of Norway's DNO told Reuters on Sunday that his company would increase crude output capacity at its Kurdish Tawke field to 100,000 bpd next year, although production would stay at 50,000 bpd. Genel Energy said output at the Tak Tak field is now 90,000 bpd and would hit 120,000 in January. Prime Minister Barham Salih told the oil conference on Sunday that Arbil and Baghdad had agreed to boost Kurdish exports to 175,000 barrels per day next year. Iraq's official goal is to raise its production capacity to 12 million bpd by 2017, although the OPEC producer acknowledges a goal of around 8 million bpd might be more realistic. Current production is 2.9 million bpd, with exports of around 2.1 million. Infrastructure limitations hamper Iraq's ability to increase exports dramatically. Salih also said he had agreed with Iraqi Prime Minister Nuri al-Maliki to present a new hydrocarbons law to the Iraqi parliament by the end of the year. Investors anxious for a more stable legal platform for their investments have been waiting for the new law for years. The law would be based on a 2007 draft agreed by political blocs, apparently shunting aside a more controversial version approved by the Iraqi cabinet that would have given more power to the central government. " We have agreed with ... Maliki that we will stick to the original draft of 2007. There may be amendments needed, but these amendments need to be agreed to mutually," Salih said. " In case of no agreement on those amendments, the provisions with the original text will be presented to parliament (by year-end) for parliament to decide." (Additional reporting by Shamal Aqrawi Writing by Jim Loney) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 22:21

|

|

x 0

x 0 Alert Admin |

Obama, Hu pitching different trade agendas

China's President Hu Jintao speaks during the APEC CEO Summit in Honolulu

HONOLULU (Reuters) - U.S. President Barack Obama and China's Hu Jintao will pitch differing trade agendas on Saturday as an antidote to weak global growth, as they try to sidestep the European debt crisis looming over an Asia-Pacific summit. The heads of the world's two biggest economies will address business leaders in back-to-back morning speeches at the Asia-Pacific Economic Cooperation CEO summit in Honolulu, and later meet face to face. But Obama and Hu do not see eye to eye on how best to promote trans-Pacific trade. Obama arrived in Hawaii late on Friday at the start of a nine-day Asian trip during which he will attempt to reassert U.S. influence over the region's course in economic and security affairs. An unstated goal is to ensure China does not muscle the United States aside from its traditional Pacific role. Obama hopes to leave his native state with at least the outline of a final deal on the Trans-Pacific Partnership, a regional trade pact being negotiated between the United States and eight other countries. Japan enhanced the stature of the U.S.-led regional trade initiative by announcing on Friday that it was interested in joining the talks, and other countries including Mexico and Canada also have indicated they might like to participate. China is not part of these trade talks, and views them warily. The differing views were captured on Friday in a politely pointed public exchange between top American and Chinese trade officials. Asked whether China would join the TPP, as the talks are known, a Chinese official, Assistant Commerce Minister Yu Jianhua, noted that no invitation had been sent to Beijing. " If one day we receive such an invitation, we will seriously study" it, Yu said. U.S. Trade Representative Ron Kirk responded that the trade deal " is not designed to be a closed clubhouse. All are welcome. But it is also not one where you should wait for an invitation." China has been reluctant to sign trade deals that would subject it to U.S-led efforts to further open its economy to foreign players because that would put competitive pressure on its state-owned enterprises. A commentary in China's state-owned news agency Xinhua said Washington was using the trade deal as a way to enhance its influence in Asia on its own terms. " The United States' primary reason for actively promoting the development and expansion of the TPP is to raise its leadership in the Asia-Pacific region," Xinhua wrote. " The United States does not want to miss a golden opportunity with the economic development in the Asia-Pacific, and at the same time it hopes to install a fixed set of rules to guide changes in the region's future political and economic structure." Hu has touted trade with China as a way to boost U.S. growth and help Obama achieve his goal of doubling exports. With Europe edging towards a recession, fast-growing Asia -- led by China -- is vital to sustaining global economic growth. Developing Asia is expected to grow 8 percent in 2012, roughly four times faster than the United States, according to International Monetary Fund forecasts. " Currently, instability and uncertainty of world economic recovery are growing," Hu told business leaders here on Thursday. " Under this type of situation, we especially need the world to cross the river in the same boat, and respond hand-in-hand with a spirit of cooperation and mutual benefit." Hu's speech on Saturday is expected to focus on steps China is taking to bolster domestic demand, and its desire for greater representation of developing economies in global forums, Chinese officials told reporters. In another sign of tough talks ahead, trade ministers here said they were unable to agree on the terms of an initiative pushed by the United States to boost trade in clean energy and other environmentally friendly technologies. They referred the issue to APEC leaders, who will meet on Sunday. [ID:nN1E7AB00P] APEC, made up of 21 economies representing more than half of global output, laid out an agenda that included promoting trade and green growth, but discussions this week invariably returned to Europe's debt troubles. China, with its $3.2 trillion in reserves, has come under pressure to come to Europe's aid by buying more government debt. Two independent sources told Reuters that Europe had spurned one of China's key demands -- that it receive more IMF influence in return for increasing its support for Europe. [ID:nL3E7MB1FP] " Europeans have to ... provide a clear picture and provide a solution and put their hands around their own issues, and the international community is willing to help," said Zhu Min, the IMF's deputy managing director. (Reporting by Reuters APEC team Writing by Emily Kaiser. Editing by Warren Strobel and Eric Walsh) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 22:20

|

|

x 0

x 0 Alert Admin |

Spain's conservatives set for runaway election win

MADRID (Reuters) - Spain's opposition centre-right People's Party (PP) has maintained the strong margin with which it is expected to win this month's general election, with a runaway lead of between 14 and 18 percentage points over the ruling Socialists, two opinion polls showed on Sunday.

With the vote now just one week away, Spaniards are angry at the Socialists for their failure to implement measures to stimulate growth and tackle a crippling 21.5 percent unemployment rate, the highest in the European Union. The PP is seen implementing austerity measures aimed at hauling the economy back into shape after a burst property bubble left the nation saddled with debt. But to do so Spain will suffer more hardship, probably entering recession again before showing any signs of improvement. A Sigma Dos poll in right-leaning newspaper El Mundo showed Mariano Rajoy's PP defeating the socialists with a 17.7 percentage point margin, 47.5 percent to 29.8 percent. A Demoscopia poll published in left-leaning newspaper El Pais put the margin at 14.5 percentage points. Both results were in line with previous surveys by the same firms in recent days, and would give the PP an outright majority of seats in parliament. Both polls also found that the Socialists would lose in their stronghold region Andalusia by a wide margin, but would hold on to a bastion in northeastern Catalonia. Sigma Dos carried out 3,000 telephone interviews from October 28 to November 10 with a margin of error of plus or minus 1.82 percent. Demoscopia interviewed almost 10,000 people by telephone from October 18 to November 8 with a margin of error of plus or minus 1.5 percent. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 22:19

|

|

x 0

x 0 Alert Admin |

Syrian forces kill 4 at pro-Assad rally - activists

AMMAN (Reuters) - Security forces shot dead four people who shouted slogans against President Bashar al-Assad at a rally organised by the authorities in the city of Hama on Sunday to show popular anger at an Arab League decision to suspend Syria, local activists said.

" Security forces were leading public workers and students into Orontes Square when groups broke away and started shouting 'the people want the fall of the regime'," one of the activists in Hama, 240 km (150 miles) north of Damascus, said. " They escaped into the alleyways but were followed, and four were killed," the activist added. State television said millions of Syrians assembled in public arenas across the country to denounce the Arab League decision, which came in response to a crackdown by Assad's forces on pro-democracy protesters, which the United Nations says has killed 3,500 people. Syrian officials blame the unrest on " terrorists" and foreign backed Islamist militants and say that 1,100 soldiers and police have been killed. The television showed crowds carrying Syrian flags and posters of Assad at public squares in Damascus, the eastern city of Raqqa and the coastal cities of Latakia and Tartous. Syrian authorities have banned most independent media since the uprising demanding political freedoms and an end to 41 years of Assad family rule began in March. (Reporting by Khaled Yacoub Oweis, Amman newsroom Editing by Michael Roddy) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 22:18

|

|

x 0

x 0 Alert Admin |

Troops occupy Rio slum in " historic" operation

Brazilian Navy soldiers patrol the Vidigal slum during the " Shock of Peace" operation to install Peacekeeping Unit (UPP) in Rio de Janeiro

RIO DE JANEIRO (Reuters) - Three thousand troops backed by helicopters and armoured cars occupied Rio de Janeiro's largest slum without firing a shot on Sunday, the biggest step in the Brazilian city's bid to improve security and end the reign of drug gangs. The occupation of Rocinha, a notorious hillside " favela" that overlooks some of Rio's swankiest areas, is a crucial part of the city's preparations to host soccer's World Cup in 2014 and the Olympics two years later. Security forces have occupied nearly 20 slums in the past three years but none as symbolically or strategically important as Rocinha, a sprawl of shacks, stores and evangelical churches located at a traffic choke point between the main city and western areas where most Olympic events will be held. With large army helicopters thudding overhead, troops began climbing the slum's winding roads just after 4 a.m. and declared the operation a success within two hours after encountering no resistance. The invasion of Rocinha and the nearby Vidigal slum was as much a media event as a military operation, as hundreds of reporters followed soldiers and police up through deserted, garbage-strewn streets. The authorities had announced their plans days in advance, giving gang members plenty of notice to flee. According to TV news channel GloboNews, only one person was detained during the operation. There were no reports of casualties. After years of living in fear of both gang members and the often-violent tactics of police, residents were wary of embracing the new reality. " Let's hope for the best, but there's a lot more that needs to be done," said Sergio Pimentel, a funeral director sitting outside his business watching the operation unfold. He pointed to an alley that he said poured raw sewage on to the street whenever it rained. " We need basic sanitation, health, education. They have to come in with everything, not just the police." " PACIFICATION" MOVES AHEAD Rio state Governor Sergio Cabral said he had called President Dilma Rousseff to inform her of the operation's success, saying it was a " historic day" for the city. " These are people who needed peace, to raise their children in peace," he told reporters. " ... They want access to a dignified life." The sprawling hillside community, home to about 100,000 people, has one of Brazil's worst rates of tuberculosis, officials say. It is often described as the largest slum in Latin America and is believed to be the main drug distribution point in Brazil's second-largest city. Police captured the slum's alleged top drug lord, a 35-year-old with a taste for expensive whiskey and Armani suits, in the trunk of a car on Thursday as they tightened their grip around Rocinha. On Sunday, a group of cops relaxed for a moment in the house of another captured drug boss and admired a huge fish tank, a rooftop swimming pool and a Jacuzzi in the bedroom. Among the articles hastily left behind by the gang member, known as " Peixe" or " Fish" , were chunks of meat ready for the barbecue and the book " The Art of War," by Sun Tzu. Under a so-called " pacification" program, Rio authorities are following up invasions by handing slums over to specially trained community police and providing services such as health centres and formal electricity and TV supply. The aim is to foster social inclusion and give the city's one million or more slum residents a bigger stake in Brazil's robust economy. Progress has sometimes been slow, however. A year after a similar operation to occupy a large slum called Alemao, the favela has yet to receive a community police force as the security forces struggle to train enough officers. Most of the occupations have taken place in slums close to Rio's wealthier areas, leading to criticism that the program is aimed mostly at supporting the city's real-estate boom and preparing for the sports events. Huge slums in more distant areas are still controlled by gangs or militia groups made up of rogue off-duty police and firefighters. |

| Useful To Me Not Useful To Me | |

|

Salute

Master |

13-Nov-2011 10:25

|

|

x 1

x 0 Alert Admin |

how come Turkey's Capadukia is not in the wonders, it's very mysterious to me..............just wonder |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

13-Nov-2011 00:42

|

|

x 0

x 0 Alert Admin |

Amazon, Halong Bay, Iguazu Falls among new 7 natural wondersThe Amazon rainforest, Vietnam's Halong Bay and Argentina's Iguazu Falls were named among the world's new seven wonders of nature, according to organisers of a global poll. The other four crowned the world's natural wonders are South Korea's Jeju Island, Indonesia's Komodo, the Philippines' Puerto Princesa Underground River and South Africa's Table Mountain, said the New7Wonders foundation, citing provisional results. Final results will be announced early 2012, said the Swiss foundation, warning there may yet be changes between the provisional winners and the final list. Sites that have failed to make the cut include Tanzania's Mount Kilimanjaro, the Dead Sea and the US Grand Canyon. Residents of Jeju welcomed the announcement, with a 2,000-strong crowd bursting into cheers of " We made it" , the Yonhap news agency reported. Jeju Govenor Woo Geun-Min said the listing would open " a new chapter" for the island's tourism industry. " This will greatly help attract tourists to Jeju, enhance investment and bolster awareness about Jeju's agricultural products," he told journalists. The island is renowned for its tangerines. The poll organised by Swiss foundation New7Wonders has attracted great interest, mobilising celebrities including Argentinian football star Lionel Messi calling on fans to pick his home country's Iguazu Falls. The results come after a long consultation process lasting from December 2007 to July 2009, when world citizens were asked to put forward sites which they deemed were natural wonders. More than a million votes were cast to trim the list of more than 440 contenders in over 220 countries down to a shortlist of 77. The group was then further cut to 28 finalists by a panel of experts. Anyone in the world was then able to vote for the final seven via telephone, text messages or Internet social networks. Founded in 2001 by filmmaker Bernard Weber in Zurich, the foundation New7Wonders is based on the same principle on which the seven ancient wonders of the world were established. That list of seven wonders was attributed to Philon of Byzantium in ancient Greece. New7Wonders said its aim is to create a global memory by garnering participation worldwide. But even as the natural wonders poll came to a close, the New7Wonders foundation has set its eyes on a new survey -- the top seven cities of the world. Participating cities will be announced on January 1, 2012. |

| Useful To Me Not Useful To Me | |