|

Latest Posts By ozone2002

- Supreme

|

|

| 13-May-2013 08:54 |

IPC Corp

/

Solid NTA 27c

|

||

|

|

IPC Corporation Limitedannounced it has entered into an agreement to purchase a business hotel in Naha, Okinawa, in Japan. Completion of the purchase and delivery of the hotel to the company is by July 2013. The hotel is currently being operated under the name of Okinawa Port Hotel Ė a 10-storey building, has 193 guest rooms. The acquisition cost cannot be disclosed as there is a non-disclosure agreement signed with the seller, the group signed. The purchase is partially funded by bank borrowings, it added. The Okinawa Hotel shall be leased to Nest HOTEL Japan Corporation (NHJ) with a fixed term till 30 June 2018. (Closing price: S$0.152, +1.333%) | ||

| Good Post Bad Post | |||

| 11-May-2013 13:50 |

Far East Orchard

/

Orchard Parade

|

||

|

|

resistance @ $2.4 | ||

| Good Post Bad Post | |||

| 11-May-2013 13:47 |

Singapore Land

/

Sp Land

|

||

|

|

Divy paid out 20c.. still going up 9+ hope there's privatization or someway of unlocking value of SP Land.. gd luck dyodd |

||

| Good Post Bad Post | |||

| 11-May-2013 13:44 |

Raffles Edu

/

Times to goes up

|

||

|

|

Tycoon Oei Hong Leong raises stake in Raffles Education Corp Multi-millionaire investor Oei Hong Leong has become a substantial shareholder of private-education provider Raffles Education Corp. On Sept 12, he purchased 11.55 million shares at 32.6 cents each on the open market, increasing his direct stake to 4.9%. A day later, Oei scooped up another 8.8 million shares directly and through Oei Hong Leong Art Museum, bringing his direct and deemed interest to 5.9% and 1.3%, respectively. | ||

| Good Post Bad Post | |||

| 10-May-2013 17:05 |

Croesus RTrust

/

CROESUS Forum

|

||

|

|

Yield is really good..! based on 93c IPO is 8% yield.. Current price 1.14.. yield is about 6.5%, better than putting it in the bank n earn the meagre interest gd luck dyodd |

||

| Good Post Bad Post | |||

| 10-May-2013 16:04 |

China Minzhong

/

China Minzhong Food forum

|

||

|

|

Time: 2:35PM Exchange: SGX Stock: ChinaMinzhong(K2N) Signal: Resistance - Breakout with High Volume Last Done: $1.11 |

||

| Good Post Bad Post | |||

| 10-May-2013 15:12 |

China Minzhong

/

China Minzhong Food forum

|

||

|

|

coming $1.12..price in which Indofood had some stake in.. another stake was ard 91.5c gd luck dyodd |

||

| Good Post Bad Post | |||

| 10-May-2013 15:10 |

IPC Corp

/

Solid NTA 27c

|

||

|

|

up 3% to 15.5c.. lets see if it is the onset of a bigger move up.. has to play catch with Nikkei.. gd luck dyodd |

||

| Good Post Bad Post | |||

| 10-May-2013 14:44 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||

|

|

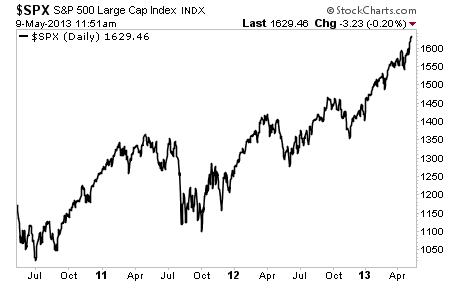

May 9, 2013 This Bubble Will be Even Worse Than 2008 Stocks are officially in a blow-off top. This is the culmination of Bernankeís lifeís work. In his mind he has succeeded in saving capitalism by spending trillions of Dollars pushing stocks higher.

Tonight, this Deal Closes Forever The price for The Perfect Trade is about to rise to $1499 per year. We're up 52% this year so far... CRUSHING the market, our competitors, even the legend's hedge funds. And we've done it with one trade, made once per week. Want in on this strategy? You've got just four days to move... --------------------------------------------- It doesnít matter that the US hasnít experienced 3% GDP growth a SINGLE year since he took the Fed. It doesnít matter that the employment ratio is at levels last seen back in the early Ď80s. It doesnít matter that there are now a record number of Americans on food stamps. All that matters is that stocks are up. That equals a recovery for the Fed. This whole mess is sad really. Having seen two bubbles burst in the last 13 years, we all know how this ends: in disaster. And each time the disaster has been bigger. Indeed, the 2008 collapse was a far worse thing than the Tech Crash. And whatís coming will be even worse than 2008. This time around, entire countries will go bust, not just banks.

Iíve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. Iíve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation. As I write this, all of them are SOARING. Are you ready for another Collapse in the markets? Could your portfolio stomach another Crash? |

||

| Good Post Bad Post | |||

| 10-May-2013 14:41 |

GLD USD

/

Gold & metals

|

||

|

|

Weíve been getting some questions about the recent move in the markets and gold, so Iíd like to take a few moments to detail whatís going on and the importance of looking at assets from the standpoint of gold. We have heard a ton of different viewpoints from our passionate readers on the yellow metal. And although we can appreciate the many ways to use or invest in gold, we wanted to share our core ideas about the value of gold itself. A whopping 72% of our readers responding to our recent gold survey believe the noble metal will continue to rise in value as the result of a weakening dollar.

The dollar, like any paper currency, is an unreliable way to assign a value to anything. For example, the price of a new car in 1950 was $1,510. The average price of a new car in April 2012 was $30,748.

And letís talk about a loaf of bread ...

Now certainly youíre not going to tell me about the huge advances in bread-making technology that can explain this jump in price. In fact, the opposite should be true.

Itís because the value of our dollar has diminished. The purchasing power eroded over time. More dollars in circulation means we need more of them to make the same purchases weíve always made. *** Hereís whatís happening Ö Pumping more currency into the economy is called inflation, because the people doing it are inflating the money supply. A result of inflation is rising prices we all know that to be true. All we need to do is look at the prices at the pump. What did you pay when you started driving compared to this morning? In 1950 there were a little over 27 billion dollars in circulation ($27,156,290,042 to be exact). As of May 1, according to the Fed, $1.18 trillion is in circulation. In other words, the money supply has expanded by 43 times. Again, more dollars in circulation mean higher prices. You might expect to see a 43 times increase in prices rather than just an 18 times increase. Well, there are several factors we have to keep in mind:

In addition to the money supply growing 43 times in the last 62 years, the Fed can just ďprintĒ more money anytime it wants. These two facts combined make the dollar, and all fiat currencies, notoriously unreliable as a measure of real wealth.

Think about that, 27 years is the average lifespan. That means some fiat currencies live a shorter life, a few longer, but none are solid and reliable in the long term! *** So what can we use as a more-stable measure?

In order to buy and hoard gold in any real quantities, you must have the funds to purchase it. And if the central banks/governments just print money, the price of gold in relation to that currency will eventually go up Ö which makes it harder to buy.

*** You probably remember hearing about neutron stars in school. Theyíre about 15 kilometers (about 9.3 miles) wide and have a mass of nearly 1.5 times our sun. A teaspoon of material from the neutron star would weigh over 10 million tons!

Einstein said Energy = Mass times the Speed of Light squared (E=MC2). Imagine all the mass of a neutron star, times two. The resulting explosion would release more energy than the entire human race could use in a trillion years. In this unimaginable inferno, and only in that instant ... gold is created. Metallurgists and alchemists have been trying to create gold out of other things, unsuccessfully, throughout our entire history. Once we mine all the gold out of the ground, there is no more. Thereís a finite supply buried and that amount available grows smaller each year. Good thing itís reusable and indestructible! *** Gold is has a wonderful balance of abundance and rarity, which makes it a realistic financial tool. Thereís not too much, like seashells on the shore, and thereís not too little, like the radioactive element Astatine ó with only an estimated 75 milligrams in the Earthís crust. The noble metal is attractive to look at, so itís used in jewelry, and has functional industrial uses. And finally, for all these reasons plus its shiny nature and indestructible hardiness, gold has been used as money since King Croesus struck the first gold coins around 545 B.C. Gold is a much better way to evaluate your investments and the buying power of currencies. Itís more stable and it gives a realistic view of your gains or losses. Its use as a benchmark makes it much harder for those in power to hide reductions in the buying power of your assets. Thatís why they hate it, and why you should be using it to evaluate your investments. |

||

| Good Post Bad Post | |||

| 10-May-2013 14:11 |

GLD USD

/

Gold & metals

|

||

|

|

that's a clear ascending triangle formation... (read: bullish) vested in both gold (paper n physical) gd luck dyodd..

|

||

| Good Post Bad Post | |||

| 10-May-2013 13:21 |

IPC Corp

/

Solid NTA 27c

|

||

|

|

This stock has not been moving much in spite of the gains that Nikkei has been making so far. In fact today they are up 2+%.. IPC has hardly moved throughout.. definitely opportunity to load up when it's not in the spotlight.. gd luck dyodd From UOB Chart Genie Time: 12:56PM Exchange: SGX Stock: IPC Corp(I12) Signal: Bullish MACD Crossover Last Done: $0.152 |

||

| Good Post Bad Post | |||

| 10-May-2013 11:53 |

China Minzhong

/

China Minzhong Food forum

|

||

|

|

1.09.. can have a gd lunch :) congrats to those vested~~ |

||

| Good Post Bad Post | |||

| 10-May-2013 11:43 |

UOB Kay Hian

/

UOBKH

|

||

|

|

UOB-Kay Hian Q1 profit jumps 38%

By

UOB-Kay Hian Holdings' first-quarter net profit leaped 37.8 per cent as improved market sentiment and " penny fever" fuelled exceptional stock market activity during the period. Profit attributable to shareholders climbed to S$31.9 million, or 4.4 Singapore cents, for the three months ended March. That largely mirrored a 31.9 per cent year-on-year increase, to $86.9 million, in commission income. Net asset value rose to S$1.5544 as at end-March from $1.4979 as at end-December. UOB-Kay Hian attributed higher market turnover and improved investor sentiment to the improved earnings. |

||

| Good Post Bad Post | |||

| 10-May-2013 11:38 |

Sin Heng Mach

/

SIN HENG...the next MYMMMAR rush

|

||

|

|

DBS from Mar'13 Sin Heng (Trading buy, Fair Value: S$0.29) has more than 40 years of experience in rental and trading of cranes and aerial lifts from Singapore. The outlook for cranes is expected to be buoyant on the back of the tight supply in the industry. Domestic crane demand is expected to be strong, supported by a strong pipeline of construction and civil engineering projects, as the population of Singapore increases. Its newly formed JV in Myanmar could present abundant business

|

||

| Good Post Bad Post | |||

| 10-May-2013 11:33 |

Sin Heng Mach

/

SIN HENG...the next MYMMMAR rush

|

||

|

|

consistent performer.. announcing their latest results Company Results S/NCompany NameQ/HY/FYCurrency, UnitsRevenueNet Profit CurrentPreviousChange (%)CurrentPreviousChange (%) 13Sin Heng Heavy Machinery Limited3Q13S$ M44.3 26.6 51.2 3.1 1.5 109.6

|

||

| Good Post Bad Post | |||

| 10-May-2013 11:14 |

Kreuz

/

Kreuz cruising back up?

|

||

|

|

Kreuz back up again after the dip due to DBS revising their TP upwards to $0.78 still a undervalued stock in any case.. gd luck dyodd Continues to impress (DBS) 1Q13 earnings in line on track for another growth year adding assets should reap benefits over the cycle Prudent balance between chasing growth and pace of Still cheap at just 6x FY13F PE despite strong run Maintain BUY with a higher TP of S$0.78Highlights Another quarter of solid earnings execution US$10.8m (up 5% y-o-y) was in line with expectations, on the back of 1.4% revenue growth to US$49m. 1Q net profit amounts to 24% of our full year estimates. Gross margin improved to 32.1%. . 1Q13 net profit ofOur View Subsea sector fundamentals continue to be robust market is expected to be one of the brightest spots in offshore O& G services, backed by an increase in the development of oil and gas fields in deeper waters /harsher environments and development of marginal fields which need tie-backs to existing infrastructure. Current orderbook stands at US$200m, largely unchanged from last quarter, and underpins revenues for the next 12 months. We estimate YTD contract wins of around US$60m, including variation orders and unannounced contract wins, on track to meeting our fullyear new order win estimate of US$150m. . The subseaMay exercise option for another MSV contract with a Chinese shipyard for the construction of a state-ofthe art multi-purpose support vessel and has the option of indicating interest to order one more within 6 months. It may make sense for Kreuz to exercise this option, since the newbuilding price is relatively cheap, and Kreuz may be able to bid competitively for global SURF projects against bigger players like Subsea 7 and Technip, when these vessels are delivered 2-3 years down the line. Funding is not an issue, with balance sheet now in healthy position. . Kreuz recently inked aRecommendation Maintain BUY. while being prudent not to be too aggressive currently with asset acquisitions. This ensures Kreuz does not have to take on low margin contracts just to ensure high fleet utilisation, and reduces the cyclical effects of the O& G industry to an extent. Thus, Kreuz remains one of our top picks in the sector. TP raised to S$0.78, pegged to a higher multiple of 8x FY13 earnings, given its solid track record and long

|

||

| Good Post Bad Post | |||

| 10-May-2013 10:54 |

China Minzhong

/

China Minzhong Food forum

|

||

|

|

huat together.. Sharing is caring.. hope my posts have been useful |

||

| Good Post Bad Post | |||

| 10-May-2013 09:54 |

China Minzhong

/

China Minzhong Food forum

|

||

|

|

wondering if i can send a complain to admin for the person who keeps giving me bad posts? | ||

| Good Post Bad Post | |||

| 10-May-2013 09:45 |

China Minzhong

/

China Minzhong Food forum

|

||

|

|

as predicted sometime ago.. gd luck dyodd

|

||

| Good Post Bad Post | |||

| First < Newer 821-840 of 7452 Older> Last |