|

Latest Posts By ozone2002

- Supreme

|

|

| 03-Jun-2013 11:49 |

SoundGlobal

/

Sound Global Ltd (formerly: Epure)

|

|||||

|

|

China spending US$850b!! Sound global is a laggard water play compared to Utdenviro

gd luck dyodd

Published June 03, 2013 (Biz Times)

Singapore's water companies aim to quench China's US$850b thirst

[SINGAPORE] Water companies in Singapore are attracting big-name investors as they profit from exporting their expertise to China, which plans to spend US$850 billion over the next decade to improve its scarce and polluted water supplies. Singapore is a hub for water technology because of its own concerns about water security. With few domestic freshwater resources of its own, the city-state has been trying to reduce its reliance on imports from neighbouring Malaysia, where politicians have in the past threatened to turn off the taps. Since 2006, the number of companies in Singapore's water sector has doubled to about 100 and S$470 million (US$371.2 million) has been committed to fund water research, government data shows. Over the same period, Singapore-based water companies secured more than 100 international projects worth close to S$9 billion. |

|||||

| Good Post Bad Post | ||||||

| 03-Jun-2013 10:48 |

Vard

/

Vard Holdings

|

|||||

|

|

orgasmic! :) | |||||

| Good Post Bad Post | ||||||

| 03-Jun-2013 10:26 |

JB Foods

/

JB Foods

|

|||||

|

|

buy value don't chase prices.. gd luck dyodd DBS JB Foods expects to report a net loss for the Group for 2Q2013 and 1H2013. The expected loss is mainly attributable to the continued unusual cocoa market consolidation that was previously highlighted in the Group’s 1Q2013 results announcement. The unusual market consolidation has further lowered the average selling price of the Group’s cocoa powder. The cocoa powder industry is dominated by a few major players and any consolidation in the industry would have an impact

|

|||||

| Good Post Bad Post | ||||||

| 03-Jun-2013 10:23 |

Swiber

/

Swiber

|

|||||

|

|

NAISE! Time: 9:25AM Exchange: SGX Stock: Swiber(AK3) Signal: Resistance - Breakout with High Volume Last Done: $0.78 |

|||||

| Good Post Bad Post | ||||||

| 03-Jun-2013 10:19 |

Vard

/

Vard Holdings

|

|||||

|

|

CHIONG AHHHHHHHHHHHHHHHHHHHH!!! :) gd luck dyodd Time: 9:39AM Exchange: SGX Stock: Vard Holdings(MS7) Signal: Bullish MACD Centerline Crossover Last Done: $1.17 |

|||||

| Good Post Bad Post | ||||||

| 03-Jun-2013 10:18 |

Swiber

/

Swiber

|

|||||

|

|

Swiber Holdings announced that the Group is exploring options to establish Islamic Trust Certificates Programme

|

|||||

| Good Post Bad Post | ||||||

| 03-Jun-2013 10:13 |

Swiber

/

Swiber

|

|||||

|

|

Once you find a company with gd fundamentals.. the price will take care of itself gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| 03-Jun-2013 09:16 |

Vard

/

Vard Holdings

|

|||||

|

|

|

|||||

| Good Post Bad Post | ||||||

| 31-May-2013 16:35 |

Swiber

/

Swiber

|

|||||

|

|

i posted @1:30pm in SJ forum ... 3pm SWIBER breakout as alerted by chart genie.. super fast reaction time :) gd luck dyodd Time: 3:01PM Exchange: SGX Stock: Swiber(AK3) Signal: Resistance - Breakout with High Volume Last Done: $0.75

|

|||||

| Good Post Bad Post | ||||||

| 31-May-2013 13:27 |

Swiber

/

Swiber

|

|||||

|

|

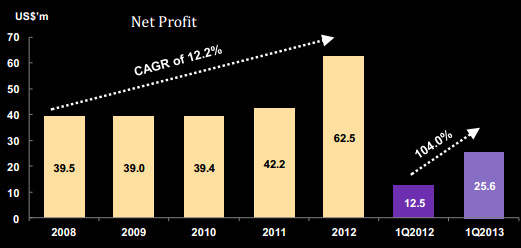

swiber's profit very steady from 2008-2011, then 2012 surged higher..

1Q13 earnings already dble that of 1Q12 earnings..wow..

gd luck dyodd

CIMB says Swiber is 'cheap' at 72 cents target is 91 cents

Net profit doubled to US$25.6 million in 1Q on a 59.3% increase in revenue to US$309.7 million Net profit doubled to US$25.6 million in 1Q on a 59.3% increase in revenue to US$309.7 millionAnalyst: Lim Siew Khee What Happened Upstream reported that Swiber is preparing to invest as much as US$500m to build a deep-water offshore construction vessel. The company has floated a newbuild tender for a 4,000-tonne crane vessel with S-lay, reel lay and flex-lay systems. According to Upstream, at least eight yards have been shortlisted for the tender with a contract value of US$400m-500m.

What We Think

Management is non-committal on the news but stated that deep-water is an eventuality. The company is only at the preliminary stage of evaluating the newbuild project. If it goes ahead, we believe that Swiber is likely to choose Chinese yards that provide favourable financing with low upfront payment. Assuming tail-heavy payment terms, a cash call is likely in 2015/2016, nearer to delivery, in our view.

Swiber has a fleet of about 62 vessels currently (12 units under sale and leaseback, 27 units via JVs and 23 units 100% owned). The new deepwater addition will be similar to Ezra’s iced-class subsea construction vessel, Lewek Constellation (about US$420m). We make no changes to our EPS forecasts as the news is not confirmed and the project, if it goes ahead, can only start contributing in FY16/17. What You Should Do

The stock is cheap at 7.4x CY14 P/E and 0.7x P/BV vs. Singapore OSV’s average of about 1.1x P/BV and 9x CY14 P/E.

|

|||||

| Good Post Bad Post | ||||||

| 31-May-2013 10:52 |

Ezion

/

Ezion

|

|||||

|

|

Big boys exit.. should follow smart money too..

gd luck dyodd

Ezra to realise gain of US$65.7m after cutting Ezion stake

By

Ezra Holdings on Friday said that it would sell all the remaining 4.17 per cent stake in Ezion Holdings Limited, representing 40 million shares, for S$90 million. Ezra would place the shares at S$2.25 each, which is a 4.9 per cent discount to Ezion’s volume weighted average price of S$2.37 on Thursday. It will realise a net gain of about US$65.7 million from the divestment. “The divestment is part of Ezra’s ongoing capital management efforts to enhance shareholder value through the realization of our investments,” Ezra said. |

|||||

| Good Post Bad Post | ||||||

| 31-May-2013 10:42 |

Halcyon Agri

/

Best Rubber company on SGX

|

|||||

|

|

This one keeps chionging up 7c today IPO price 36c.. now 92.5c almost 2-3 times.. great stuff although i have taken profit already.. good luck dyodd |

|||||

| Good Post Bad Post | ||||||

| 31-May-2013 10:19 |

Yongnam

/

Yong nam

|

|||||

|

|

One of the cheaper alternatives to Myanmar play .. Believe with their strong record in MRT csontruction, they have a high chance in winning the Myanmar contract DBS A strong contender for Myanmar airport projects contender for Myanmar’s airport projects We believe Yongnam’s consortium is a strong upside to the stock price Yangon’s airport project win could add S$0.12 is a strong contender for the projects Current valuations are not reflecting that Yongnam Upgrade to BUY with higher TP of S$0.41Strong contender for Myanmar airport projects. Yongnam is partnering JGC Corporation and Changi Airport Planners and Engineers to bid for two airport projects in Myanmar. We think Yongnam’s consortium stands a good chance of securing the projects given its Singapore and Japan representation. JGC corporation is Japan-based while Yongnam and Changi Airport Group are Singapore-based, all of which are viewed favourably by the Myanmar Government. Yangon airport project win likely to boost valuations by 12 S cts. boost share price by 12 S cts. We estimated that the construction of the Yangon Airport project could add S$10.4m or 6 S cts per share to FY14F earnings. Thereafter, the rights to operate the airport for the next 30 years would add another 6 S cts to the stock based on discounted cashflow projection. We believe a win on Yangon airport project couldUpgrade to Yongnam’s current valuations are only in line with peers, and not reflecting Yongnam as a strong contender for project wins in Myanmar. We are convinced Yongnam stands a good winning chance and thus believe +1SD valuation is achievable. At +1SD of 10x blended PE, we revised

|

|||||

| Good Post Bad Post | ||||||

| 31-May-2013 09:32 |

Kreuz

/

Kreuz cruising back up?

|

|||||

|

|

my calls to buy Kreuz was when Kreuz was ard 50c this was based on the fundamental analysis that i researched on.. you can check the history of this post.. my call to sell was in line with DBS TP 78c.. that's already 50% gain.. this performance is better than STI for 2013... i'm just here to share my knowledge and trade well.. not here to " curse so and so if the price goes up after i've sold" as someone had proclaimed.. gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| 30-May-2013 15:53 |

Geo Energy Res

/

Geo Energy

|

|||||

|

|

consolidating very long.. but looks like there's support from insiders as reported below follow the big money.. gd luck dyodd

Written by Leong Chan Teik

Thursday, 30 May 2013 11:48

|

|||||

| Good Post Bad Post | ||||||

| 30-May-2013 11:31 |

Kreuz

/

Kreuz cruising back up?

|

|||||

|

|

glad i'm out :).. gd luck to those still vested.. dropped to 70.5

|

|||||

| Good Post Bad Post | ||||||

| 30-May-2013 11:28 |

Citic Envirotech

/

United Envirotech

|

|||||

|

|

i gave an early warning sign to take profit.. DBS issued theirs today.. Utd dropping from $1 to 91.5c.. almost 10% DBS 4Q13 headline net profit of S$6.8m for United Envirotech met our S$6.2m forecasts but fell short if we exclude the S$1.8m of forex gain. Higher contribution from EPC drags margins but growing Treatment supports transformation to a recurring earnings model. Earnings estimates are intact as higher costs offset the increase in turnover. However, higher tariffs and capacity have lifted Treatment’s DCF valuation and therefore, our fair value is lifted to S$0.97 (Prev S$ 0.74). UENV’s share price has done exceedingly well, rising 90% YTD. We believe near term upside will be capped, but acquisitions or new

|

|||||

| Good Post Bad Post | ||||||

| 29-May-2013 09:08 |

SoundGlobal

/

Sound Global Ltd (formerly: Epure)

|

|||||

|

|

now 62.. breakout from consolidation.. look @ its peer utdenviro's mega rally to $1 hope to play catch up.. gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| 28-May-2013 17:14 |

Nam Cheong

/

Nam Cheong

|

|||||

|

|

now @ 29c.. super good run! :) gd luck dyodd

|

|||||

| Good Post Bad Post | ||||||

| 28-May-2013 14:41 |

China Minzhong

/

China Minzhong Food forum

|

|||||

|

|

up 4.5c today.. hope can play catch up with Sinogrand.. gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| First < Newer 701-720 of 7452 Older> Last |