|

Latest Posts By ozone2002

- Supreme

|

|

| 04-Jun-2013 14:51 |

Triyards

/

Mid to long term - should be good.

|

||||

|

|

best time to vest in gd stocks is when the interests in low.. when you have 1st mover advantage, must exercise patience to bear the fruits of your labour.. remember true value of a good stock will catch up with its price eventually gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 13:26 |

SinoGrandnes

/

Sino Grandness - a growth stock with low PE

|

||||

|

|

Three Shares That Have Made Investors a FortuneBy Ser Jing Chong - June 3, 2013 | See also: G3BJS5M05S10^STI Here’s a quick question for you: How much has the Straits Times Index (SGX: ^STI) gained in the last 12 months? Here’s a quick question for you: How much has the Straits Times Index (SGX: ^STI) gained in the last 12 months?

With all the news of big dives in Japan’s Nikkei 225 Index dominating financial media and possible fears of contagion for our local market – given how the STI fell by almost 2% the week before when the Nikkei made a 7% plunge – it can be easy to miss the forest for the trees. So, here’s your answer for some perspective: The index is up more than 20% since 31 May 2012. Hurray! Investors who had purchased the index through index trackers like the Nikko AM Singapore STI ETF (SGX: G3B) would have been very happy indeed as a 20% annual gain is sizeable any way you slice it. But, at the same time, there are also a handful of shares that have made annual gains far in excess of what the index achieved. Some have even made gains that are more than 10 times the index’s 20% return. Let’s take a closer look at three such stocks in particular – Sino Grandness (SGX: JS5), Super Group (SGX: S10) and MTQ Corporation (SGX: M05). They’ve grown by 280%, 140% and 110% respectively and their share price performance along with the STI’s is shown in the graph below.

Source: Yahoo Finance Sino Grandness, a vegetable and fruit canning company, got listed on the Mainboard exchange in 2009 and since then, had seen its earnings-per-share (EPS) jump by almost three times from S$0.08 in 2009 to S$0.214 in 2012. Last year was a particularly good one for Sino Grandness as its per-share profits almost doubled from S$0.118 in 2011. The company’s recent first quarter results for 2013 continued the trend of double digit year-on-year earnings growth as quarterly EPS increased by 23% to S$0.052. Such earnings performances would have gone a long way in propping up Sino Grandness’s share price. If we dig deeper into the other two companies, Super Group and MTQ, we’ll see similar trends as well. 2012 saw Super Group’s EPS increase by almost a third from S$0.111 in 2011 to S$0.142. Meanwhile, the instant beverage manufacturer’s first quarter results for this year saw a 25% bump up in per-share profits from S$0.317 a year ago to S$0.397. At the risk of sounding like a broken record, here’s how MTQ Corporation, provider of engineering services to the oil & gas industry, performed for its financial year ended 31 March 2013 – EPS grew by 41% from S$0.163 in the previous year to S$0.231. These three companies saw considerable share price increases, but underneath that, were three businesses that became more valuable as per-share profits grew. |

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 13:16 |

Nam Cheong

/

Nam Cheong

|

||||

|

|

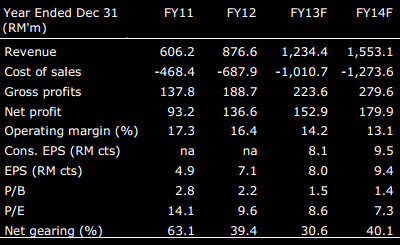

Excerpts from analysts' reports OCBC Investment Research raises fair value of Nam Cheong to 35 cents. Analysts: Chia Jiunyang, CFA, and Low Pei Han, CFA  Petronas had pledged to spend RM300b in capital expenditure over 2011-15, 80% more than the previous 5-year period. Petronas had pledged to spend RM300b in capital expenditure over 2011-15, 80% more than the previous 5-year period. We believe this will likely result in increased investments across the Malaysian offshore oil & gas industry. Already, Nam Cheong is seeing a healthy pick-up in order wins (FY11: 13 vessels FY12: 21 vessels) and it has recently expanded its shipbuilding programme to 28 vessels for FY14F (FY13: 19 vessels). Its large order-book of RM1.3b, for 26 vessels delivered over FY13-15F, helps to mitigate its risk by providing a base level of earnings. Given the strong growth profile, we find current valuation (FY13F PER of 8.6x) attractive. We now raise our FV to S$0.35 (previously S$0.30) on a higher PER of 11x. Maintain BUY. |

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 13:12 |

Geo Energy Res

/

Geo Energy

|

||||

|

|

Magnifique! Time: 11:48AM Exchange: SGX Stock: Geo Energy(RE4) Signal: Resistance - Breakout with High Volume Last Done: $0.475 |

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 11:05 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

ausgrp looks to have a reversal from its current downtrend.. gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 10:37 |

Yongnam

/

Yong nam

|

||||

|

|

36c moving up on the back of Myanmar airport bid.. hope to secure the contract gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 10:26 |

Vard

/

Vard Holdings

|

||||

|

|

1.195! .. indeed the cheapest O& M play on SGX.. gd luck dyodd

|

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 10:07 |

Halcyon Agri

/

Best Rubber company on SGX

|

||||

|

|

The best rubber company on SGX getting better! :) gd luck dyodd Natural rubber producer Halcyon Agri Corp, has agreed to acquire assets of Malaysian natural rubber producer Chip Lam Seng group for MYR63m. This will lift Halcyon Agri potential annual production capacity by 180,000 tonnes

|

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 10:04 |

Yamada Green Res

/

Yamada-Since it IPO at 0.22c-good response

|

||||

|

|

made a cool 3c ~ 10+%.. great strategy :) Time: 9:20AM Exchange: SGX Stock: Yamada(MC7) Signal: Bullish MACD Crossover Last Done: $0.275

|

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 10:02 |

Triyards

/

Mid to long term - should be good.

|

||||

|

|

Ezra triggered! hope this will rub off on Triyards.. Time: 9:36AM Exchange: SGX Stock: Ezra(5DN) Signal: Resistance - Breakout with High Volume Last Done: $1.01 gd luck dyodd

|

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 09:58 |

Swiber

/

Swiber

|

||||

|

|

drop 1.5c today.. may want to take some profit 1st.. gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 09:08 |

Geo Energy Res

/

Geo Energy

|

||||

|

|

If there's INSIDERS buying, it's a general indication that they are bullish on the stock and its business.. who would know the business better other than insiders? do analysts or retailers know much more than insiders? congrats to those who heeded my advice and ignored the unnecessary noise in the forum Gd luck dyodd..

|

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 09:01 |

Vard

/

Vard Holdings

|

||||

|

|

Vardey! 1.18! show ur true value! gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 04-Jun-2013 08:56 |

Yongnam

/

Yong nam

|

||||

|

|

Yongnam Holdings (Maybank) Waiting on the “East Wind” Alert: Indicative results for Myanmar airports to arrive earlier. Yongnam’s consortium announced the formal submission of its bid for the new Hanthawaddy International Airport in Myanmar last week. This follows upon the bid to extend the existing Yangon International Airport, which was submitted a month earlier. Based on our latest info, the indicative results for both will come sooner than earlier expected. Award for Yangon extension may arrive any moment. urgent need to ease congestion at Yangon Airport, we understand the authorities are anxious to start construction. The award for this bid is expected any moment from now. Separately, we now expect indicative results for Hanthawaddy by July this year, when the government will enter into direct negotiation with 1 or 2 preferred bidders. Due to the50% chance of winning Yangon, add $0.045 to our TP. estimate Yongnam’s consortium has a 50% chance of winning the Yangon project, and we add SGD0.045 to our TP based on this probability. We assign this high probability due to the consortium’s standout combination of technical expertise, track record and friendly government ties. Yongnam has an outsized voice in this consortium due to the structure, and should pick up significant construction work. We nowNew 130m term loan – Reading between the lines. company announced a new 5-year SGD130m syndicated loan. We understand only around SGD25m is used to replace expiring loans, with the rest being additional debt if drawn down (net gearing estimated to go up from 34% to 65%). We are positive because 1) Given that loan collateral is minimal, this speaks volumes for the banks’ confidence in the company’s prospects. 2) We think this also implies management is thinking big in terms of new project wins. Last week, theYou can factor in the Golden eggs. announcements of the Myanmar airport projects will serve as concrete near-term share price catalysts. We currently estimate Yongnam has a 25% chance of winning the bigger Hanthawaddy project, though we do not factor this in. We add SGD0.045 (50% chance of winning Yangon) to our TP, deriving SGD0.485. Reiterate BUY. We believe the impendingYongnam Holdings – Summary Earnings Table Source: Maybank KEFY DEC (SGD m) 2011 2012 2013F 2014F 2015F Revenue 332.7 301.6 381.1 359.4 368.8EBITDA 99.1 76.9 93.7 98.2 112.8Recurring Net Profit 63.4 43.5 55.7 61.3 74.1Recurring EPS (SG cents) 5.1 3.5 4.3 4.7 5.7DPS (SG cents) 1.0 1.0 1.2 1.3 1.4PER (x) 6.9 10.1 7.9 7.2 5.9EV/EBITDA (x) 3.6 4.3 3.7 4.0 4.0Div Yield (%) 2.9 2.9 3.4 3.8 4.2 P/BV (x) 1.5 1.3 1.2 1.1 0.9 ROE (%) 21.7 13.5 15.3 15.0 16.0 ROA (%) 11.8 7.6 8.8 10.0 11.2

|

||||

| Good Post Bad Post | |||||

| 03-Jun-2013 16:49 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

i would think that the Johor to raise taxes on foreign property owners will impact this stock's impending RTO.. | ||||

| Good Post Bad Post | |||||

| 03-Jun-2013 16:39 |

SoundGlobal

/

Sound Global Ltd (formerly: Epure)

|

||||

|

|

didn't know Jim Rogers bought HyfluxSingapore's water companies aim to quench China's $850 billion thirst* China to spend $850 bln in next decade on water supplies * Huge fortunes to be made in Chinese water sector-Rogers * International investors buying stakes in Singapore firms * " Hydrohub" city-state focuses on recycling, desalination By Eveline Danubrata SINGAPORE, June 3 (Reuters) - Water companies in Singapore are attracting big-name investors as they profit from exporting their expertise to China, which plans to spend $850 billion over the next decade to improve its scarce and polluted water supplies. Singapore is a hub for water technology because of its own concerns about water security. With few domestic freshwater resources of its own, the city-state has been trying to reduce its reliance on imports from neighbouring Malaysia, where politicians have in the past threatened to turn off the taps. Since 2006, the number of companies in Singapore's water sector has doubled to about 100 and S$470 million ($371.2 million) has been committed to fund water research, government data shows. Over the same period, Singapore-based water companies secured more than 100 international projects worth close to S$9 billion. Singapore has been experimenting with reservoirs, recycled water known as NEWater, and desalination as it aims to become self-sufficient in water by 2061, when a water supply agreement with Malaysia expires. " Singapore should be one of the world's dominant players in water. It should be the Silicon Valley of water," said Jim Rogers, who co-founded the Quantum Fund with George Soros and owns shares of Singapore's biggest listed water treatment company, Hyflux Ltd. Hyflux, which has a market capitalisation of S$1.2 billion, signed two agreements in April for projects in China. The company is known for its membrane technology used for ultrafiltration, a process to separate certain dirty or harmful particles in water. Hyflux's chief executive, Olivia Lum, is the biggest shareholder with 32.4 percent as of March, while Matthews International Capital Management LLC and Mondrian Investment Partners Ltd have a combined 14.2 percent of deemed interest, according to its latest annual report. U.S. private equity firm KKR & Co LP invested $40 million in United Envirotech Ltd earlier this year after subscribing to $113.8 million of its convertible bonds in 2011. The company is listed and based in Singapore, but most of its operations are in China, where it derives more than 90 percent of its revenue. It designs and builds water treatment plants, on top of providing services to China's chemical, petrochemical and industrial park sectors, all of which are heavy water users. United Envirotech, whose " membrane bioreactor technology" combines membrane separation with biological wastewater treatment, said on May 28 its net profit for the full year ended March 2013 had nearly tripled from a year earlier. The company is in talks with some investors who have expressed interest in buying a stake, a spokeswoman said, adding that Singapore is attractive to the firm because of its status as a financial centre and its ongoing growth as a " global hydrohub" . " The root of the whole commitment to grow the water industry lies with the Singapore water story," said Goh Chee Kiong, executive director of cleantech at Singapore's Economic Development Board. " Singapore has been very vulnerable when it comes to water for many decades, therefore we view water as a strategic resource and asset." ON THE RADAR With the world's population hovering at around 7 billion, investors are betting on soaring demand for clean water not just for people, but also to help fuel industries ranging from semiconductors and pharmaceuticals to petrochemicals and agriculture. " Water treatment companies have not been on the radar for a while, but now investors are increasingly looking at companies that are undervalued or have yet to realize their potential," said Carey Wong, an analyst at OCBC Investment Research. In the last 12 months, the Thomson Reuters Global Water and Other Utilities Index has jumped around 20 percent. In Singapore, shares of United Envirotech have surged more than 170 percent over the same period, outperforming the 19 percent gain in the benchmark Straits Times Index. SIIC Environment Holdings Ltd, Memstar Technology Ltd and HanKore Environment Tech Group Ltd have risen in the range of 33-67 percent. However, Hyflux shares have underperformed the index in the past year. CIMB Research said in a report that the company's project win rate has to accelerate so its share price can pick up. Its valuation also appears " fairly priced" compared to its major Asian peers, CIMB said. Moya Asia Ltd and Sound Global Ltd, both of which reported weak quarterly earnings recently, have lagged the index too. Conglomerates Sembcorp Industries Ltd and Keppel Corp Ltd also have some water-related businesses. CHINA BOUND Many companies have their sights set on China where, despite spending 700 billion yuan ($114 billion) on water infrastructure over the five years to 2010, much of the water remains undrinkable, a situation that has led to mounting discontent across the country. China's environment ministry said 43 percent of the locations it was monitoring in 2011 contained water not fit even for human contact. United Envirotech said stricter discharge limits imposed by the Chinese government and water shortages in various parts of the country are pushing up demand for water treatment services. Chinese players like China Everbright International Ltd and Beijing Enterprises Water Group Ltd may put up a tough fight, especially for the lower-end water treatment projects, due to their ability to keep costs down and their local network, said DBS Vickers analyst Tan Ai Teng. Scinor Water Ltd recently received financing from CLSA Capital Partners' Clean Resources Asia Growth Fund and venture capital firm Kleiner Perkins Caufield & Byers to expand the Chinese company's membrane manufacturing capacity and products. " There are going to be huge fortunes made in China on water because China has a staggering water problem and they know it. They are spending a lot of money to solve it," said Rogers. |

||||

| Good Post Bad Post | |||||

| 03-Jun-2013 15:23 |

Triyards

/

Mid to long term - should be good.

|

||||

|

|

i was looking through the financials of Triyards.. didn't know it's such an undervalued stock.. single digit PE and decent earnings.. wonder if Triyards+Ezra Parent has the same effect as Swiber-Kreuz gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 03-Jun-2013 15:07 |

Geo Energy Res

/

Geo Energy

|

||||

|

|

the feeling is darn gd! :) up 8%!

|

||||

| Good Post Bad Post | |||||

| 03-Jun-2013 14:28 |

Geo Energy Res

/

Geo Energy

|

||||

|

|

Time: 2:03PM Exchange: SGX Stock: Geo Energy(RE4) Signal: Resistance - Breakout with High Volume Last Done: $0.45

|

||||

| Good Post Bad Post | |||||

| 03-Jun-2013 14:11 |

Geo Energy Res

/

Geo Energy

|

||||

|

|

up ~5% today.. great stuff.. breakout from consolidation + insider buying gd luck dyodd |

||||

| Good Post Bad Post | |||||

| First < Newer 681-700 of 7452 Older> Last |