|

Latest Posts By ozone2002

- Supreme

|

|

| 04-Jul-2011 14:38 |

Mencast

/

Cornerstone investor GAY CHEE YONG in mencast

|

||

|

|

CHIONG AH!!! SHIOK AH!!! :) SHARES OF CATALIST-traded Mencast Holdings have seen heavy trading volume after it announced on May 18 it had acquired engineering systems installer Top Great Engineering & Marine. Mencast -- which makes, supplies and repairs propellers and stern gear for seafaring vessels -- is purchasing Top Great for $24 million. Mencast will pay $9.6 million in cash and satisfy the remaining $14.4 million through an allotment of new Mencast shares via three separate tranches -- “a small price to pay for an accretive deal”, according to Gary Ng of CIMB. That’s because the acquisition comes with a guarantee that Top Great will achieve net profits of not less than $8 million between May 1, 2011 and April 31, 2013. It Top Great fails to meet the target, it'll have to make good the shortfall in cash to Mencast within six months after the agreed period. For the year ended Dec 31, 2010, income earned by Top Great before deducting taxes was $4.7 million. In comparison, Mencast achieved a net profit of $8.5 million over the same period, a 20.8% y-o-y rise, on the back of $32 million in revenues, up 21.9% y-o-y. Analysts say the addition of Top Great will give Mencast the opportunity to tap a larger pool of clients in the region and add margin value with a fuller range of maintenance, repair and overhaul (MRO) services to the booming offshore and marine industry. “This [acquisition] would allow Mencast to create positive synergies, economies of scale and strengthen its value proposition to attract and retain new clientele,” Ng of CIMB points out. “We think that with Top Great being integrated into Mencast, the group would eventually make its foray into overseas markets, which would mean higher margins due to the higher premium the group charges for projects outside Singapore.” Mencast started out three decades ago as provider of repairs and maintenance services of marine propellers for fishing and bumboats in Singapore. It eventually expanded its client base to include owners and operators of tugboats and ferries in 1993 and extended its capabilities to provide a full range of sterngear equipment and services for local and regional shipyards and ship owners in 2001. In 2008, Mencast, which operates a yard in Tuas, sought a listing on the Catalist. Last year, in a bid to increase growth, Mencast announced that it would lease 16,200 sq m of land at the waterfront on Penjuru Road to build a manufacturing plant for stern gear equipment and centralise its manufacturing activities for better efficiencies. Mencast expects to complete construction of the plant -- which will be 3.5 times larger than all its existing plants combined -- by year-end. Despite slowing demand for commercial ships given an existing oversupply in the market, Mencast is confident of booking revenues from repeat MRO (Maintenance, repair and operations) contracts from ship owners and expects to see growth coming from the booming offshore sector. The company currently has an order book of about $8 million. Since the start of the year, shares of Mencast are up by about 10%, closing on May 20 at an all-time high of 45 cents each. But there’s more good news. Ng of CIMB has upgraded his 12-month target price on the stock by 6% to 70 cents apiece despite dilution from the new shares, as the stock is still trading at a 15% discount to its larger peers. At current levels, it has a market capitalisation of just $76.6 million and trades at 8 times earnings. “This stock is only at the growth stage and has not scaled the high wall of valuation,” Ng writes in a recent report. “[The shares] will climb, and a further re-rating will propel the stock with an upgrade to the Mainboard from its current board.” |

||

| Good Post Bad Post | |||

| 04-Jul-2011 09:18 |

CapitaLand

/

Capitaland

|

||

|

|

breakout 2.95!

|

||

| Good Post Bad Post | |||

| 03-Jul-2011 18:36 |

HsuFuChi

/

Hsu Fu Chi

|

||

|

|

July 2, 2011, 8.16 am (Singapore time) Nestle holds talks to buy Hsu Fu Chi: report

NEW YORK - Nestle SA has been holding talks to buy Chinese snack and candy maker Hsu Fu Chi International Ltd, Bloomberg reported on Friday, citing people familiar with the matter. Nestle is the world's largest food company. The talks have been on and off for about two years, and it is not clear that Nestle will reach a deal as other suitors have been looking at the Singapore-listed company, according to the report. A spokeswoman for Nestle, based in Vevey, Switzerland, said the company does not comment on market speculation. Officials at Hsu Fu Chi's offices in Dongguan, China could not be reached for comment after normal business hours, Bloomberg reported. -- REUTERS |

||

| Good Post Bad Post | |||

| 03-Jul-2011 10:18 |

SUTL Enterprise

/

4Cents divident declared 50% yield!!!

|

||

|

|

what is arthur tay doing????? now 6c..alrready lost half his pants........ |

||

| Good Post Bad Post | |||

| 03-Jul-2011 10:08 |

Samko Timber

/

well val stock

|

||

|

|

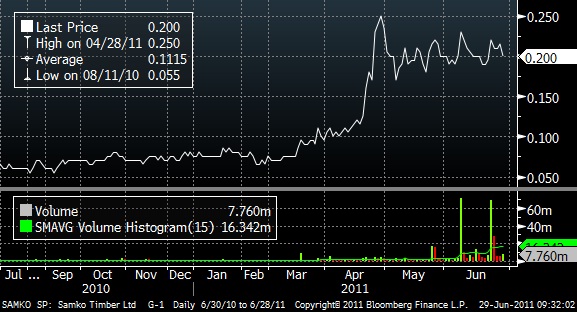

wah chiong 3x...look at the 2 heavy vol peaks..calls for danger.. time to SHORT ah! Huat ah.. gd luck! DYODD

THE

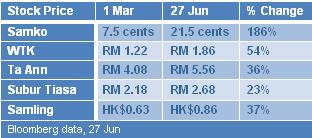

STOCK PRICE of timber processor, Samko has tripled to more than 20

cents since the tsunami and earthquake hit Japan in March. THE

STOCK PRICE of timber processor, Samko has tripled to more than 20

cents since the tsunami and earthquake hit Japan in March. Stock prices for other timber players such as Malaysia’s WTK, Ta Ann and Subur Tiasa, as well as Hong Kong’s Samling have likewise spiked up as investors bet that they would report strong earnings due to higher wood prices. ”Export prices for plywood have spiked by about 20% since the Japan tragedy due to the timber supply crunch,” said Samko CEO, Mr Aris Sunarko, in an exclusive interview with NextInsight at Samko’s Singapore office recently. Samko is Indonesia’s leading timber processor and one of the world’s top five producers of tropical hardwood plywood. It is the only such Indonesian business listed in Singapore. ”The difference between Samko and other timber processors is our focus on the domestic market,” said Mr Sunarko. About 80% of Samko’s sales are to the Indonesia market, while other players tend to be exporters. Having a production line within Java, where the market is, gives it a competitive edge in logistics.

Aris Sunarko, CEO of Samko Timber, has about 30 years of experience in the Indonesian timber industry. Photo by Leong Chan Teik

Spike in timber prices Inventory levels were already low before the Japan earthquake. When the disaster struck, demand for logs spiked as mills rushed to increase production for the construction of emergency housing for victims. The earthquake destroyed not only houses but also seriously damaged six plywood mills in Japan, where wood is a preferred building material. Some plywood mills may resume partial production in July. ”Because of the spike in demand caused by the situation in Japan, we expect to expand our export sales,” said Mr Sunarko. Samko's export markets include Japan, Korea, the Middle East, Singapore, Europe and the US. In 1Q, better average selling prices and domestic sales helped lift net profit by 6% to Rp 11.4 billion (US$1.3 million). This was despite revenues decreasing by 12% year-on-year to Rp 596.3 billion (about US$69.2 million) after Samko reduced its interest in a loss-making subsidiary (IDX-listed Sumalindo) from 51.6% to 31% as of March 2010.

Samko

produces plywood, laminated veneer lumber and medium density fiberboard

for housing, construction, furniture and renovation applications.

Managing the supply crunch Governments nowadays against deforestation and competition with other crops for plantation land has led to a decline in world timber production. As soft and hardwood trees take 15 to 30 years to mature, investors tend to shy away from timber investments, favoring instead crops like oil palm, which can be harvested for their kernels from year 4 onwards, all the way through year 20. In Indonesia, timber is popular as the cheapest housing material and has stable long-term demand due to a growing GDP. The Indonesian government policy now is to suspend issuance of new forestry permits for a two-year period. By moving to upstream activities such as tree planting to secure its logging supply from plantations, Samko expects to continue increasing its market share in Indonesia. " By further expanding our use of plantation logs, our supply of raw materials will be less affected by the weather," said Mr Sunarko. Samko has been increasing its share of Indonesia's market for plywood over the past few years. “Our long term plans include plantation expansion, R& D for the enhancement of wood species and developing products with eco-friendly applications,” said Mr Sunarko. In May, Samko announced that it has executed a term sheet in relation to the acquisition of 100% in BioForest Pte Ltd from Temasek Life Sciences Ventures for S$7.4 million. BioForest produces tree seedlings for the plantation industry, and is able to genetically duplicate elite tree candidates, thereby producing seedlings that will have the same desirable characteristics as the mother trees.  Ho Chee Mun, assistant to the CEO, is also a timber industry veteran. Photo by Leong Chan Teik

Currently, about 85% of Samko’s finished timber products are made from plantation logs supplied by farmers on community forests. The remaining 15% is made of natural forest hardwood. A key risk for Samko is bad weather, which has turned unpredictable in recent times. Overly wet or dry weather conditions mean timber harvesters have to stop work due to dangerous tree felling conditions, muddy roads or insufficient river water for timber rafting. Samko is majority-owned by two Indonesian families. The Putera Sampoerna family owns about 40.7% while the Sunarko family owns about 36.5%. Hence, the name ‘Samko’. And now, watch a short interview with Aris Sunarko... where he explains Samko's key business features and the benefits to Samko from Japan's reconstruction programme...... |

||

| Good Post Bad Post | |||

| 03-Jul-2011 09:55 |

CapitaLand

/

Capitaland

|

||

|

|

Break above 2.93.. will average up from there.. trend has already reversed.. gd luck! |

||

| Good Post Bad Post | |||

| 01-Jul-2011 11:21 |

Viking Offshore

/

VIKING OFFSHORE AND MARINE LTD

|

||

|

|

16c!!! amazing ... | ||

| Good Post Bad Post | |||

| 01-Jul-2011 10:51 |

Viking Offshore

/

VIKING OFFSHORE AND MARINE LTD

|

||

|

|

Restructuring underway Under ReviewSale of United Envirotech Limited shares. & Marine (VOM) announced the disposal of 32m shares in United Envirotech Limited (UEL), through a series of married deals and also on the SGX open market, reducing its stake to 4.48% from 11.19% previously. This move is not surprising as the management has always reiterated its intention to dispose of its non-core assets. Viking OffshoreEstimate realized gain of $5.8m. were booked as available-for-sale assets, were purchased in June 2008, at an average price of $0.21 per share. The investment was impaired when the market price of the shares fell to $0.12 per share as at 31 Dec 2008. Subsequent appreciation in the market prices of UEL shares were credited to a revaluation reserve in the balance sheet. With average selling prices for the married deals and open market trades at $0.30 and $0.33 respectively, disposal of UEL shares would realize gains of about $0.18 per share. This translates to approximately $5.8m of realized gains. Sales proceeds totaled about $9.66m in cash, and will be utilized towards the repayment of loans and payables. We believe this would improve VOM's cash flows in the near term. The UEL shares, whichRestructuring process underway Viking Airtech Pte Ltd in late 2009, VOM has sought to transform itself from a consumer products company into an O& M player. To date, the company has disposed off a number of non-core investments such Tung Lok Restaurants Limited and UEL shares. VOM has also made several acquisitions of companies in the O& M space as it seeks to become an integrated solutions provider to shipyards and vessel operators. Recall that the VOM's strategy comprises of three key stages: (1) invest in complementary businesses, (2) integrate the different businesses to extract add-on values, and (3) internationalize its operations. We believe the company is currently executing second stage of its strategy. . Since its purchase ofExperienced management. company's strategy is aided by the fact that it is helmed by a very experienced management team. VOM Chairman Mr Andy Lim is a seasoned dealmaker, and is also the founder and Chairman of private equity firm, Tembusu Partners. CEO Mr Ong Choo Guan has over 30 years of management experience in the O& M industry. In our view, execution of theRating under Review. coverage, we are still in the process of revising our estimates hence, we are putting our Buy rating and S$0.31 fair value

|

||

| Good Post Bad Post | |||

| 01-Jul-2011 10:32 |

Viking Offshore

/

VIKING OFFSHORE AND MARINE LTD

|

||

|

|

14.5........arghh | ||

| Good Post Bad Post | |||

| 01-Jul-2011 09:43 |

PSL

/

PSL HOLDINGS LTD

|

||

|

|

48.5 to 43 it 's shorting time open high down bar..high vol.. shorting time for me.. dyodd...

|

||

| Good Post Bad Post | |||

| 01-Jul-2011 09:24 |

Viking Offshore

/

VIKING OFFSHORE AND MARINE LTD

|

||

|

|

14c........y u go up so fast...:( down boi down.. |

||

| Good Post Bad Post | |||

| 01-Jul-2011 09:22 |

SPH

/

SPH

|

||

|

|

3.9...gd!shiok! ~7% dividend..

|

||

| Good Post Bad Post | |||

| 30-Jun-2011 11:12 |

Citic Envirotech

/

United Envirotech

|

||

|

|

Viking sold off their shares in Utd..hence the explanation of the married deals that day.. |

||

| Good Post Bad Post | |||

| 30-Jun-2011 11:08 |

PSL

/

PSL HOLDINGS LTD

|

||

|

|

wait for signal to short.. don't be so kan cheong.. |

||

| Good Post Bad Post | |||

| 30-Jun-2011 11:02 |

Viking Offshore

/

VIKING OFFSHORE AND MARINE LTD

|

||

|

|

13.5 - 14.. don't go up so fast lei.. i haven't accumulate enough @ 12c :(........... |

||

| Good Post Bad Post | |||

| 30-Jun-2011 10:55 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||

|

|

STI flying like a G6 |

||

| Good Post Bad Post | |||

| 29-Jun-2011 23:50 |

Viking Offshore

/

VIKING OFFSHORE AND MARINE LTD

|

||

|

|

June 29, 2011, 6.40 pm (Singapore time) Viking nets S$5.82m from sale of UEL shares

By

CARINE LEE

|

||

| Good Post Bad Post | |||

| 27-Jun-2011 20:00 |

PSL

/

PSL HOLDINGS LTD

|

||

|

|

rally too fast too soon.. u watch the movie fast n furious?.. looking to short once a down bar shows up on high vol.. good luck! |

||

| Good Post Bad Post | |||

| 27-Jun-2011 19:57 |

SunVic Chemical

/

Sunvic - Cheap valuations, record year but...

|

||

|

|

Sunvic higher than average vol today.. surged from 69.5 to 72.5 will look for an entry ard 71.5 if interest is still strong.. |

||

| Good Post Bad Post | |||

| 27-Jun-2011 19:54 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||

|

|

Ausgrp had a nice surge today on decent vol... 35-37.5..closed high 37.5 will look for an entry @ 36.5 tmr to ride the uptrend.. risk low 32c...reward high 44c |

||

| Good Post Bad Post | |||

| First < Newer 2281-2300 of 7452 Older> Last |