|

Back

x 0 x 0

x 0 x 0

|

10 Countries With The Largest Gold Reserves

Michael Sanibel, On Wednesday 7 September 2011, 1:07 SGT

The chemical element Au with atomic number 79 " has never been

worth zero." King Tutankhamen and the Incas had at least one thing in

common - they understood the value and scarcity of gold and used it as a

symbol of wealth and power. Nothing has changed since.

Even though gold is no longer used to back currencies like the

dollar, it is still stockpiled by countries around the world. Since the

price of gold has fluctuated dramatically, the holdings are expressed in

metric tons (or tonne = 1000 kg) as documented by the World Gold

Council in August 2011. One U.S. ton is approximately 0.9 tonnes. Here's

a look at the countries holding the largest gold reserves and the

amount of holdings.

United States - 8,133.5

While

the U.S. permanently abandoned the gold standard in 1971, it has the

largest holdings of any country by a wide margin. While most of the gold

is held at Fort Knox in Kentucky, gold is also held by the U.S. Mints

in Philadelphia and Denver and several other locations.

Germany - 3,401.0

Germany's central bank, the

Deutsche Bundesbank in Frankfurt, is the manager of the country's

reserves. However, reports have surfaced that the bulk of Germany's gold

is in the physical custody of the New York Federal Reserve. Two years

ago, international journalist, Max Keiser received an acknowledgment of

these holdings in the U.S. directly from the Bundesbank.

International Monetary Fund (IMF) - 2,846.7

The

IMF overseas the economic activity of its 187 member countries around

the globe. While its gold policies have changed over time, the reserves

are intended to aid national economies and stabilize international

markets. Depending on market conditions, it will buy or sell portions of

its reserves in support of specific economic initiatives.

Italy - 2,451.8

Italy's reserves are held and

managed by the Banca D'Italia. Italy is one of the PIIGS nations (along

with Portugal, Ireland, Greece and Spain), all of which are suffering

financial woes that threaten the entire eurozone. Parliament approved

austerity measures in exchange for financial assistance, but the country

is also embroiled in a political crisis that centers on Prime Minister

Silvio Berlusconi. In addition to being charged with paying for sex with

a minor, his government is under investigation for influence peddling

and corruption.

France - 2,435.4

The Banque de France is the central depository for France's gold reserves.

After World War II, the Bretton Woods Agreement established a

standard that pegged the dollar at the gold exchange rate of $35 (USD)

per ounce. Subsequently, President Charles de Gaulle reduced French

dollar reserves by exchanging them for gold from Fort Knox. As a result

of this action and other economic considerations, President Richard

Nixon ended the convertibility of dollars to gold in 1971.

China - 1,054.1

While the world's most populous

country is sixth on the list of total holdings, gold accounts for only

1.6% of China's foreign reserves. It is the largest foreign holder of

U.S. Treasuries with a total investment of $1.166 trillion as of June

30, 2011.

China is the world's largest producer of gold and can buy gold from

its own mines without reporting those transactions publicly. It has

reasons to buy gold off the open market since open market transactions

would push the price even higher and devalue its U.S. Treasury holdings.

The Wall Street Journal has reported that China dramatically

increased its gold purchases in response to inflation fears. Because of

possible stealth transactions, China's total gold holdings and the

prices it pays are uncertain.

Switzerland - 1,040.1

Switzerland's seventh place

rank on this list is notable considering its economy is the 38th

largest and its population is the 95th largest in the world.

The Swiss National Bank is charged with managing the gold reserves and the country's monetary policy.

Russia - 775.2

Russia's gold reserves are in the

custody of the Central Bank of the Russian Federation. The country has

been on a buying spree, increasing its holdings by 21% in 2009 as it

opened several new mines, and another 24% in 2010. The Wall Street Journal has reported that Russia plans to buy an additional 90 tonnes per year to replenish its reserves.

Japan - 765.2

Gold accounts for only 3.3% of Japan's total foreign reserves which are managed by the Bank of Japan.

Netherlands - 615.5

The gold reserves and national finances are managed by the Netherland Bank.

The Bottom line

The biggest holders of gold are

governments, central banks and international entities that currently

account for 30,500 of the world's estimated 160,000 tonnes. The current

rate of new production from mining is about 2,497 tonnes per year. As

the price has risen, more mines have become economically feasible to

open or reopen.

Gold has gotten much attention lately as the price has risen to new

highs, although it is still well below the January 1980

inflation-adjusted high of about $2,400 per ounce. Unlike money, you

can't print more gold, so it's likely to continue to be a safe haven

investment during uncertain economic times.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Just me and Andy Lim having faith in this counter..good luck to us :)

Tuesday, 23 August 2011 07:30

Andy Lim

RIGHT AFTER Viking Offshore & Marine announced its 2Q results,

its chairman, Andy Lim, started a share buying spree on Aug 10.

From nothing in his own name, he now owns 9,335,000 shares. His latest

announced purchase happened on Aug 19 involving 460,000 shares.

In total, he is estimated to have spent over $900,000.

He has a deemed interest in 144.1 m shares, or a 23.93% stake.

For 1H, Viking Offshore posted revenue of $48.6m, or a 37% year-on-year growth. Its after tax profit rose 7% to $5.1 m.

Earnings per share came up to 0.9 cents.

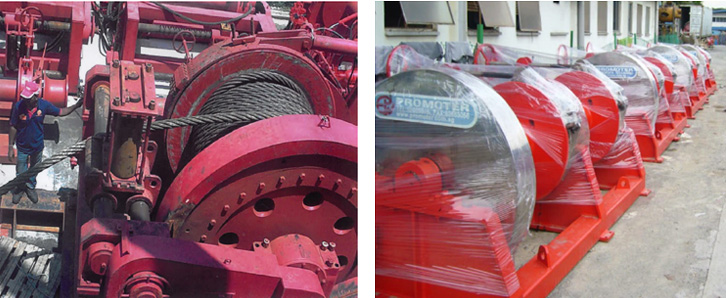

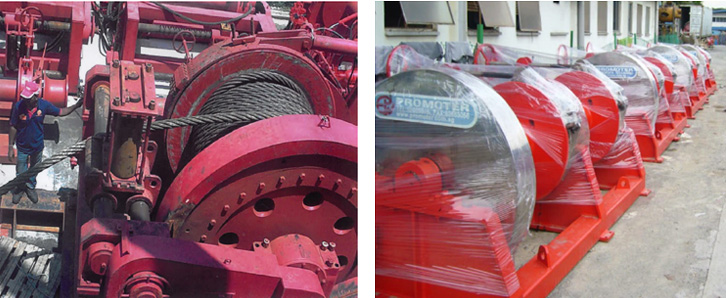

Promoter

Hydraulics, a subsidiary of Viking, is the largest supplier of

hydraulic winches and power packs in South East Asia. Photo: Viking

website

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Today gold has hit

another all-time record high. After topping out overnight at

$1,880/ounce, gold closed at $1,860. Gold has gone parabolic as

investors world-wide seek a safe haven for their money. There is a real

risk that gold will correct hard over the next few weeks so I would not

be a buyer now. This week I fielded numerous calls from clients and

radio listeners asking me if they should buy gold (where were they three

years ago when I was pounding the table to buy?) a sign of a

speculative, short-term top. If bad news comes out of Europe next week

and the stock market continues to crash (the stock market is very

oversold and due for a relief rally) gold will continue to run higher.

If the markets calm down a nasty 10-15% correction is probable. Silver

is also having some fun, trading over $42/ounce but still almost $8 from

it’s high in late April. Silver I would consider buying here, $50 bucks

is likely in the weeks ahead. I have called precious metals “financial

life insurance” and they sure are acting like it.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

MEGA VEGA BEGA oversold..

agree with u..

i love it when fear rules the market..i capitalize on fear

alexchia01 ( Date: 22-Aug-2011 16:18) Posted:

Hope you guys see what I see.

Technical rebound is in the making.

There is a high chance that STI would go Up tomorrow.

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

In boom time, the experts will say the boom will never end..this time it's different..n then what happens markets crash...

In doom time, the experts say it's a recession,depression,will take a long time to recover.. n then what happens the markets rally to the moon..

So ask urself what are these experts saying now?.. probably the opposite of what they say will happen..

gd luck!!

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Vote of confidence from Andy Lim..Chairman of Viking..

has been buyin on the open market recently..

approx 6.77 mil shares accumulated..

focus on the big picture n u know that this business is a profitable biz..

a drop in price is an opportunity to accumulate more in a good biz..

e.g if BMW price drops..does it mean BMW is a lousy car? everything is the same, but only thing the price changes..

gd luck!

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Time to take some profit off gold when it is reaching new highs..PRECIOUS METALS: Gold Prices Ease After Wild Week

--Comex Dec gold down $9.40, or 0.5%, at $1,742.10/troy oz

--Gold slips in quiet trade ahead of the weekend

--Investors cash in recent gains after CME margin hike

By Tatyana Shumsky

Of DOW JONES NEWSWIRES

NEW YORK (Dow Jones)--Gold oscillated near unchanged Friday as traders balanced their positions after a volatile week.

The most actively traded contract, for December delivery, was recently

down $9.40, or 0.5%, at $1,742.10 a troy ounce on the Comex division of

the New York Mercantile Exchange. The contract had set a string of

records throughout this week, rising above $1,800 for the first time and

gaining 6% since last week.

Thinly traded August-delivery gold was down $8.80, or 0.5%, at $1,740.00 a troy ounce.

Gold prices wobbled around the unchanged line in quiet trade ahead of

the weekend. After a volatile week marked by frequent 400 point

gyrations in the Dow Jones Industrial Average and 3% upswings in gold

many traders were relieved to see a calmer day emerge.

" The market is quietening down a little bit and dramatic price action

will be more likely on the down- then on the up-side," said Sterling

Smith, analyst with Country Hedging, adding that a decline to $1,650 was

likely in coming days.

Gold prices have struggled to make fresh gains in the wake of higher

trading collateral requirements, known as margins, announced Wednesday.

CME Group Inc., which owns Nymex, increased the amount of deposit

required to trade its benchmark 100-troy-ounce contract by 22%, in rules

that came into effect after the market closed Thursday.

The rule change gave pause to gold's record-breaking rally and some

investors took the chance to cash in recent gains in both futures and

physical gold-backed exchange-traded funds. The world's largest gold

ETF, SPDR Gold Trust (GLD), saw gold holdings decline 3% to 1,272.89

metric tons from this week's high of 1,309.92 metric tons, and well

below the record 1,320.44 metric tons set June last year.

" Some ETF investors clearly view the recent gold's sharp price rally

as exaggerated and have taken profits, as financial markets calm. Even

so, the persisting uncertainty among market players should prevent a

stronger fall in gold prices in our view," said analysts at Commerzbank.

A weaker dollar kept also supported gold prices. The greenback slipped

against a trade weighted basket of currencies, with the ICE Dollar

Index falling to 74.433 recently, from 74.63 late Thursday in New York.

Dollar-denominated gold futures appear cheaper to buyers using foreign currencies when the dollar weakens.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Be greedy when others are fearful...

enough said...

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

The best stocks to own with the greatest earning potential are those that are out of coverage, fallen out of investors interests, but have businesses which are profitable.

Read Peter Lynch, Warren Buffet, these are their guiding principles..

Fear and Greed rules the markets, you just have to capitalize on it when u see the opportunity.

Been there done that, just waiting for the big bull to come for stocks, it will come, history always repeats itself.

Gd luck!

P/s i'm accumulating more viking as the price deteriorates...i'm not related to anyone or have connection with anyone from Viking.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

clearly ur emotions have gotten the better of you and clouded your rational thinking..

to each his own...

investing was never a bed of roses...

gd luck~~

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

More good news!!

August 5, 2011, 5.27 pm (Singapore time)

Mencast's unit secures contract from Shell

By

TEO SI JIA

Mencast

Holdings Ltd announced on Friday that its wholly owned subsidiary

Unidive Marine Services Pte Ltd has secured a contract from Shell

Eastern Petroleum for the provision of underwater inspection, repair and

maintenance services.

The one-year contract took effect from Aug 1 and will last until

July 31 next year, with a renewal option for a further four years.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Remember the Golden Rule: He who has the gold makes the rules! - The smart money has been accumulating physical gold for some time

now. The sheeple are still pretty much asleep. By the time they wake up,

the stampede will have started and the sheeple will once again be

caught buying at exorbitant prices near the top! Gold is going to at

least US$10,000/oz ! Silver US$300/oz ! The flight from fiat currencies

to hard asset gold has started. Worldwide currency debasement is the

order of the day!

-

Emerging world buys $10 bln in gold as West wobbles

By Amanda Cooper, Reuters

* Thailand adds nearly 19 T to reserves in June -IMF

* Russia buys, Kazakhstan makes third buy of 2011

LONDON, Aug 3 (Reuters) – Central banks of

emerging market countries such as Korea and Thailand have added more

than $10 billion of gold to their reserves this year in a sign of waning

faith in the West’s benchmark bonds and currencies like the dollar and

the euro.

-

International Monetary Fund data for June

on Wednesday showed Thailand bought gold for the second time this year,

raising its reserves by nearly 19 tonnes to over 127 tonnes, while

Russia bought another 5.85 tonnes, bringing its reserves to 836.7

tonnes, the world’s eighth largest official stash of the metal.

-

So far in 2011, emerging market central

banks have bought nearly 180 tonnes of gold, more than double the

roughly 73 tonnes purchased by central banks globally in the whole of

2010.

-

The spot price of gold has risen by more

than 17 percent this year to a record $1,672.65 an ounce, driven chiefly

by investor concerns over the impact on the developed world’s economy

of its debt burdens and sluggish growth.

-

Mexico has been the largest buyer of gold

in the year to date, with $5.3 billion worth of purchases, or 98 tonnes

of gold, followed by Russia, which has bought 48 tonnes, worth $2.6

billion at current prices. Earlier this week, Korea confirmed it had

bought 25 tonnes of gold in June and July.

-

“Central banks evidently do not regard the

price level as too high and are diversifying their currency reserves.

This was the first purchase of gold for the Korean central bank in over

ten years,” said Commerzbank metals analyst Daniel Briesemann.

-

Central Banks Join Rush to Gold

by Liam Pleven, Se Young Lee and In-Soo Nam, http://wsj.com/

Central banks are ramping up their gold buying as they seek to

diversify their reserves away from the dollar and other beleaguered

currencies. South Korea became the latest government to disclose a big

bullion purchase, saying Tuesday that it recently bought 25 metric tons –

more than doubling its holdings to 39 metric tons. Mexico, Russia and

Thailand have also been major buyers in 2011.

-

This year, governments have almost tripled

their net gold purchases, increasing their holdings by 203.5 metric tons

this year, up from a 76-metric ton rise last year, according to the

World Gold Council, an industry group backed by miners.

-

The demand marks a major shift in central

banks’ thinking about gold. Increasingly, they see bullion as protection

against risks posed by declining paper currencies and global economic

upheaval, and their vast resources and conservative bent make them a

powerful force in the gold market.

-

While gold is an asset that does not

generate income, that shortcoming is less glaring among historically low

interest rates. Before 2010, governments had on balance been shedding

their bullion for two decades, during which gold was seen by some as a

relic. According to data from GFMS Ltd., a metals consultancy, 1988 was

the last year that official holdings increased.

-

“We definitely have seen a sea change” in

central bank attitudes toward gold, said David Greely, chief commodities

strategist at Goldman Sachs Group. Central bank buying provides

“longer-term support for gold prices,” he said.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

i'm buying companies with good stable earnings that have been whacked down due to market sentiment..

business fundamentals hasn't changed..only the fear levels of market players..

gd luck!

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

great news!!

Mencast Holdings Ltd announced that its wholly-owned subsidiary, Unidive Marine Services Pte Ltd, has secured a term contract from Keppel FELS Limited in relation to, inter alia, the fabrication, installation and completion works and services for jack-up derricks. The Contract is for a two-year period from June 2011 and is estimated to be worth S$5.18 million. Works for the first jack-up derrick is expected to commence on 16 August 2011. (close: S$0.62, -1.6%)

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

the scenario is like this today..

speculator : " Hullo...who is this calling?"

Person on other line : " margin CALL!!"

time to pick up quality shares with gd earnings and cash rich and low valuations..gd luck!!

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

On Tuesday the price of gold soared to a new all-time record of $1,657 an ounce as investors worldwide sought protection from volatile stock, bond and currency markets. Contrary to many market watchers who thought there would be a relief rally in equities after a debt-cieling agreement, stocks tumbled 266 points on Tuesday. The economy is clearly contracting at an alarming rate and another financial crisis may be right around the corner. Technically, the U.S. stock market has broken key support levels and looks very dangerous at this time.

The U.S. government has become an embarrassment and is totally dysfunctional. The much celebrated debt ceiling agreement is a farce and does nothing to reign in meaningful spending. Although the government now can borrow $600 billion immediately, spending cuts won’t happen until 2013 at the earliest. The typical Washington game of “kicking the can”. There is no doubt in my mind that we have entered an uncertain and dangerous time. The Federal Reserve will have no choice but to continue Quantitative Easing (money printing), who else is going to buy the next $2.4 trillion in U.S. debt? It’s not going to be the Chinese based on recent anti-American statements by Chinese economic officials. Gold and silver are a must in any financial portfolio given the precarious times in which we are now living.-Lou

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Gd luck on ur investment path..

patience has run out unfortunately..

i still remain vested ..

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Gold hits record on global growth worries, Europe debt

By Rujun Shen

SINGAPORE |

Wed Aug 3, 2011 12:40am EDT

(Reuters) - Gold hit a record high on Wednesday as investors made a

beeline for bullion to shelter from the impact on financial markets of the deteriorating outlook for the global economy and Europe's worsening debt crisis.

Spot gold rose to an all-time

high of $1,661.14 in early Asian hours, hitting its ninth record in 16

trading sessions and up nearly 17 percent so far this year. It was

trading at $1,657.88 by 0424 GMT, little changed from the previous

close.

U.S. gold gained nearly 1 percent to $1,660.6. It rose to a high of $1,664.2, just 30 cents off the record set on Tuesday.

Gold priced in sterling and euro also reached historical highs.

U.S. politicians completed a last-gasp deal

to avoid a default on Tuesday, but there was little relief for markets

as investors focused instead on how tighter fiscal policy could

constrict growth of the world's largest economy.

The

size of the U.S. debt remained a concern for ratings agency Moody's.

Moody's retained its triple-A rating for the United States' but assigned

a negative outlook to it, underscoring the threat of a future downgrade

that would drive up the cost of borrowing and could slow future growth.

" People

are gravely concerned over government credit and the fact that the U.S.

doesn't seem to be offering satisfying measures to assure fiscal

positions and there is the sense that it will ultimately have some kind

of real consequences in the markets," said a Singapore-based trader.

" We are seeing a fairly large scale of capital flight not just out of the dollar, but out of other currencies as well. The precious metals market has emerged as an instrument of default, no pun intended."

Gold

jumped 2.6 percent in the previous session, its biggest gain since

early November just after the U.S. Federal Reserve launched a second

round of government debt purchases, or quantitative easing.

Technical analysis suggested that gold's bull run might extend to $1,679, said Reuters market analyst Wang Tao.

South

Korea's central bank said on Tuesday it spent more than $1 billion in

its first gold purchase in more than a decade, joining the trend among

central banks to diversify their foreign reserves amid global growth

uncertainties.

Holdings in the

SPDR Gold Trust, the world's largest gold-backed exchange-traded fund,

jumped 1.4 percent to 1,281.76 tonnes, highest since end of last year.

" The

momentum in gold in the short term will continue to run strong,

supported by worries about global economic growth, gold purchase by

South Korea's central bank announced yesterday and rising in SPDR Gold

Trust holdings," said Li Ning, an analyst at Shanghai CIFCO Futures.

Li expected gold to test $1,680 in the short term.

The

latest weak data from the United States, following a batch of dour

manufacturing surveys on Monday, added to fears over a deteriorating

global economy. U.S. consumer spending dropped in June for the first time in nearly two years and incomes barely rose.

Concerns about spreading sovereign debt crisis in the euro zone underpinned gold's strength.

" It

seems to me that it hasn't reached the peak, and what the authorities

have tried to do is postponing rather than preventing what the markets

want to do with government credit in euro zone and maybe in the U.S.,"

said the Singapore-based trader.

Italy

found itself dragged deeper into the euro zone debt crisis on Tuesday,

prompting emergency consultations in Rome and among European capitals.

Yields on Italian and Spanish bonds

hit their highest levels in 14 years, with five-year Italian yields

reaching the same level as Spain's in a sign Rome is overtaking Madrid

as a key focus of investors' concern about debt sustainability.

(Additional reporting by Manolo Serapio Jr. in SINGAPORE Editing by Himani Sarkar)

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Ditto!

ozone2002 ( Date: 28-Jul-2011 11:21) Posted:

| BUY!..2G capital gay chee yong is in this...see the annual report SSH list.. |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

a wise men once said..

buy when markets are fearful.....

so i buy ...........when cosco shareholders are fearful

|

|

Good Post

Bad Post

|

|

|

|