|

Back

x 0 x 0

x 0 x 0

|

that's true...

cos w/o food..money n gold will be useless..

niuyear ( Date: 26-Jan-2012 13:59) Posted:

U have to be self-sufficient from now onwards.

How?

Not keeping cash or gold, but,

plse keep :

1) seeds.

2) soil

3) raw materials

When that 'time' come whereby " food War' breaks out, you will have somethg to eat

hahaha!!

victortan ( Date: 24-Jan-2012 00:08) Posted:

Today debt is terrible, all bank are leverage up to the nose, it got to take a long deflationary to do a unwind.

in these environment , some say gold will do well, some say gold will collapse.

But i think it will collapse.If there is a major selldown in stock.

in a deflation , you will need cash to pay debt,

cash will be king. |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 1 x 1

|

EZION SECURES A CONTRACT WITH AN APPROXIMATE VALUE OF USD 93.5 MILLION

OVER A 4.5 YEAR PERIOD TO PROVIDE A SERVICE RIG TO SUPPORT A NATIONAL OIL

MAJOR IN NORTH AMERICA

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Last:4.81 Vol:4619k  -0.11 .. hmm?the other way -0.11 .. hmm?the other way

niuyear ( Date: 26-Jan-2012 13:01) Posted:

Sembmarine cheong arhhhhhhhh...............................

HUAT ARHHHHHHHHHHHHHHHHHHH |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

THat's 20-30 points down from opening.. free fall.. profit taking.. shorters delight.. gd luck.. market is overbought..!

STI(SES: ^STI )

| Index Value: |

2,890.13 |

| Trade Time: |

09:53 SGT |

| Change: |

1.51 (0.05%) 1.51 (0.05%) |

| Prev Close: |

2,891.64 |

| Open: |

2,906.77 |

| Day's Range: |

2,890.13 - 2,917.59 |

| 52wk Range: |

2,521.95 - 3,236.93 |

Quotes delayed, except where indicated otherwise. Currency in SGD.

Headlines

- No Headlines available for ^STI at this time.

victortan ( Date: 26-Jan-2012 10:04) Posted:

Freefall??? 3pts down freefall???

shortist better be nimble. dont be too confident.

I would still like s-chip, buy when nobody is looking.

just for sharing, becos i am vested, so i am bias, be careful |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

shortie shortie shortie shortie..

see STI free fall from opening today..

warrenbegger ( Date: 25-Jan-2012 14:34) Posted:

I agreed with U, many of the counter is heavily overbought and if any rotten shit happen, siao liao.

I won't short now because don't know this siao rally last how long, and it won't be late to short if bear give surpise again.

Now, just be very careful if MANY of U r chasing px and lost back. Stock is not a straight line :)

Anyway, lets wish each other huat big big beginning of this years. Lets enjoy the movies before it end :)

ozone2002 ( Date: 25-Jan-2012 11:13) Posted:

every tom dick n harry share is OVERBOUGHT..!!!

i shall get ready my CFD short n put warrants...

what goes up must come down..

gd luck!! DYODD.. |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

so 65c offer is a steal...

Given Jaya is controlled by a financial investor, there is a possibility that it could be sold " lock stock and barrel" at the right price. Its NAV grew by 16.8% to S$0.72 cents for the financial year ending Jun 2011.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Gold surges 2.5 percent, above $1,700 after Fed

A man melts down gold jewellery in Los Angeles, California August 23, 2011.

Credit: Reuters/Lucy Nicholson

By Frank Tang and Amanda Cooper

NEW YORK/LONDON | Wed Jan 25, 2012 5:31pm EST

NEW YORK/LONDON (Reuters) - Gold surged 2.5 percent on Wednesday to above $1,700 an ounce, its biggest one-day gain in four months, as the U.S. Federal Reserve said interest rates would likely remain near zero into late 2014.

Bullion's rally dwarfed the slight gains in equities and other commodities as the U.S. central bank affirmed views that the pace of U.S. economic recovery remained sluggish.

Investors piled into gold on fears that their portfolio values will shrink due to currency depreciation as global central banks use easy monetary policies to flood markets with cash to boost ailing economies, a fund manager said.

" Ben Bernanke is saying if you keep your money under your mattress you lose out as the purchasing power of the U.S. currency is being eroded," said Axel Merk, portfolio manager of Merk Funds with $750 million in assets under management.

" If you hold gold, the purchasing power is better when all other major currencies are being debased," Merk said.

Benchmark interest rates set by Group of Seven economies currently average 0.5 percent.

The metal also received a boost from the central bank's more sanguine outlook on inflation. It suggested that prices were now rising at a pace consistent with policymakers' goals.

Low interest rates particularly benefit zero-yielding gold, unlike stocks and bonds. Minimal borrowing costs also tend to fuel a gradual increase in commodity prices, supporting the metal's traditional role as a hedge against inflation.

Spot gold was up 2.7 percent at $1,710.44 an ounce by 4:33 p.m. EST (2133 GMT), after rising to a session peak of $1,712.80, its highest since December 12.

U.S. February gold futures settled up $35.60 at $1,700.10 an ounce.

Trading was hectic as volume rose above 300,000 lots, one of the largest turnovers since September and double its 30-day average.

Technical buying also lifted prices after the metal broke above chart resistance at its 100-day moving average for the first time in 1-1/2 months.

Silver rose more than 4 percent on gold's coattails, while U.S. equities measured by the S& P 500 index finance/markets/index?symbol=us%21spx" > .SPX and the euro -- with which gold had traded in lockstep in late 2011 -- climbed less than 1 percent.

" From an equity standpoint, it's not a good story as the Fed was anticipating a much slower rate of growth than the market was," said Frank McGhee, head precious metals trader at Integrated Brokerage Services LLC.

" Gold was reacting to the Fed's guidance of historically low rates all the way until 2014, which suggests that there will be plenty of investment money around for an extended period of time," he said.

Gold is up 9 percent for the year after the metal briefly entered a bear market and fell 10 percent in December as the metal appeared to lose its safe-haven status.

COMEX OPTIONS EXPIRE THURSDAY

With the gold market already more choppy than usual at the end of a two-day meeting of the Fed Open Market Committee, Thursday's expiry of February gold options could further increase volatility in the precious metal.

Prior to the FOMC, the gold options market showed that investors would like to protect against downside risk in underlying futures, as most open interest is clustered around puts with lower strike prices.

Put options give the holder the right, but not the obligation, to sell gold at a set price by a set date.

George Gero, vice president of RBC Capital Markets, said Wednesday's gains could be partly attributed to huge short covering ahead of Thursday's option expiration.

Silver rose 4.1 percent on the day to $33.31 an ounce.

Platinum group metals also rose, with platinum up 2 percent at $1,575.85 an ounce, while palladium rose 2 percent to $690.47 an ounce.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

anyone can explain why Starhub shareholder equity has been falling drastically?

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

hit 60.5

gd stuff :)

ozone2002 ( Date: 18-Jan-2012 10:36) Posted:

fundamentally a gd stock..

PE @ 6.5x 2012earnings

likely to reach > 60c..

gd luck

DYODD.. |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

TP $0.5 as per Kim Eng's report..

looks like 2012 will be a gd year for yingli with a recovery in revenue and profits..

not vested

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

every tom dick n harry share is OVERBOUGHT..!!!

i shall get ready my CFD short n put warrants...

what goes up must come down..

gd luck!! DYODD..

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

likely takeover @ 65c by a Dutch firm...

NAV is ard 58c

still at least 10% upside to NAV..

good for a punt..

gd luck~~! DYODD

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

the value of fiat currency is ultimately zero..as it is not backed by anything..

just a statement saying it's legal tender..

worthless piece of paper..

gd luck~~

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Bearish Gold Forecasts Suggest Soaring Gold Prices In 2012

January 15, 2012

Will

gold soar this year as central banks go wild with money printing? Or

will gold collapse as debt defaults overwhelm the system and propel the

world economy into a deflationary black hole?

Members of this week's Barron's Roundtable

were asked what they thought about gold. Panel members offered their

usual variety of informed opinions on what could happen to the price of

gold during 2012 - here's what they had to say.

Marc Faber, editor of the Gloom, Boom & Doom Report, expects

massive money printing by central banks during 2012 and a continuing

correction in gold prices.

The worse the news gets, the more the U.S. and the European Central Bank and China will print money.

In the past 10 years gold and silver have performed superbly. The gold

price overshot on the upside when it reached $1,921 an ounce on Sept. 6.

Now it is in a correction phase and could fall another $200.

It is not that the gold price will go up. It is that the value of paper

money will go down. Diversification is important, and people should put

15% to 25% of their assets in gold.

Brian Rogers, Chief Investment Officer of T. Rowe Price, sees oil as a

good investment but does not foresee a big rally in gold prices.

It is easier to get your arms around oil than gold in

terms of the numbers and demand. Oil is a good investment in the next

few years, with optionality to the upside if something extreme happens

in the Middle East. Gold is a good diversifier, but not a great way to

make money.

Fred Hickey, editor of The High-Tech Strategist, predicts higher gold

prices this year and views gold stocks as a relative better value than

gold bullion.

Gold will rally, then have a seasonal selloff. By the end

of the year it could be up 15%, as has been typical in this 11-year

secular bull market for gold.

Gold stocks have been terrible. They dropped 20% last year, so that

makes them a better buy relative to the price of gold. Last year I owned

a lot of gold. Now I have more money in gold stocks than in physical

gold or the GLD [ SPDR Gold Trust].

I own a smaller amount of exploration companies through the GDXJ [

Market Vectors Junior Gold Miners exchange-traded fund] and a larger

percentage of producers.

Felix Zulauf, President of Zulauf Asset Management, sees gold prices

soaring as the world economy approaches depression like conditions,

forcing central banks to print money on a vast scale.

The world economy will experience a brutal slowdown.

Deflationary forces are going to strengthen and commodities in general

will decline. You can buy oil to hedge a decline in base metals. Gold

started a cyclical correction within a secular bull market last summer.

The first wave of selling is ending now. Gold has to be bought some time

this year, probably in the second half, below $1,600. Then the monetary

authorities will load their guns again and print more money, which will

make investors buy more gold. The gold market is so tiny that when

people want to shift just a small piece of their wealth into gold, the

price flies to new highs.

Scott Black, President of Delphi Management, favors a modest position

in gold stocks but thinks that people holding gold as a hedge against

inflation are misguided.

A lot of people own gold as a hedge against inflation. I

don't see inflation in the cards in the U.S. Capacity utilization in the

manufacturing sector it is only 77%. We own a couple of gold stocks but

buy them as we do other stocks. We look for high returns on equity and

low P/Es. We own Barrick Gold [ABX], which trades for 7.8 times this

year's expected earnings. Even absent a big upswing in gold prices, it

will do well because production is growing.

Putting things into perspective, the rather lukewarm endorsement for

gold by the Barron's Roundtable should be viewed as a bullish indicator

for gold prices. The healthy and normal correction in the price of gold

from the high of $1,900 in August has resulted in rampant bearishness

and numerous predictions that the bull market in gold is over.

Ironically, many of the most bearish gold forecasts are coming from the

same " analysts" who were predicting the end of the gold bull market

multiple times over the past decade.

Bearish sentiment on gold has reached extreme levels

according to the Hulbert Gold Newsletter Sentiment Indicator. The

average gold timer has thrown in the towel. Over leveraged speculative

investors panicked at the first sign of weakness in gold and sold out.

According to Hulbert, " this is building a strong foundation for a fresh

assault on gold's recent all-time high above $1,900 an ounce."

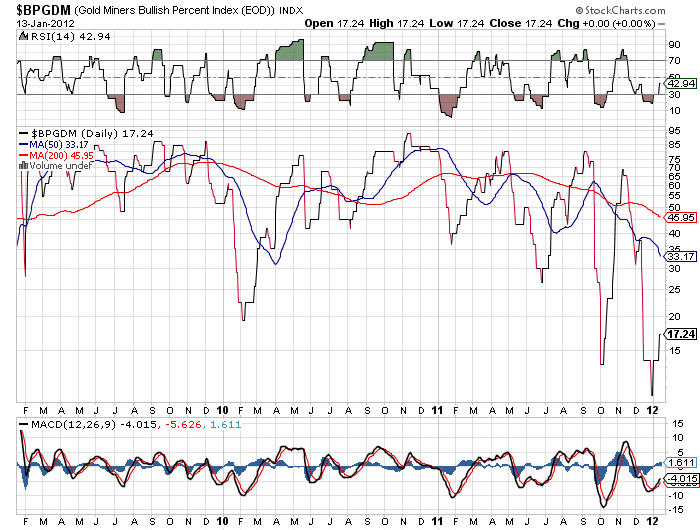

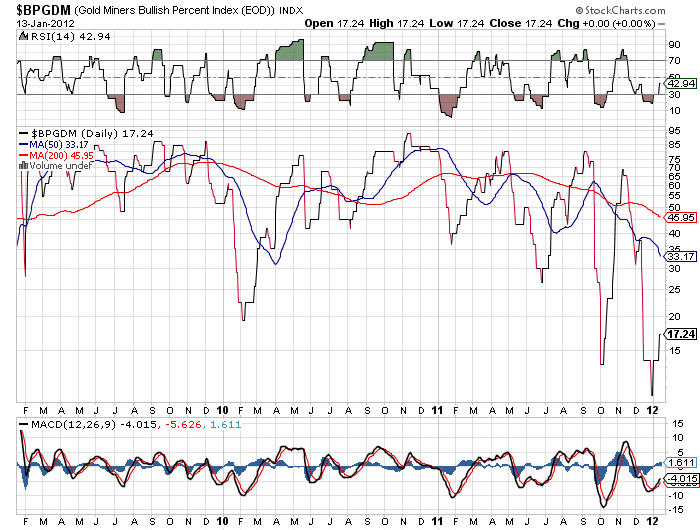

Bearish sentiment on gold stocks has also reached extreme levels as seen by the Gold Miners Bullish Percent Index.

Courtesy: Stockcharts.com

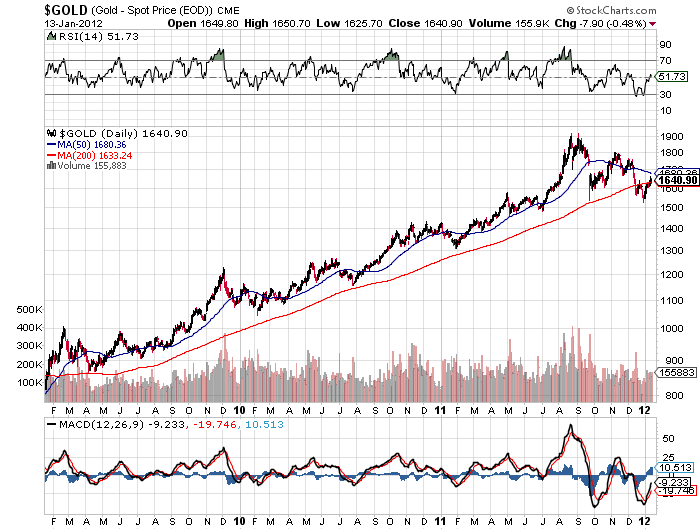

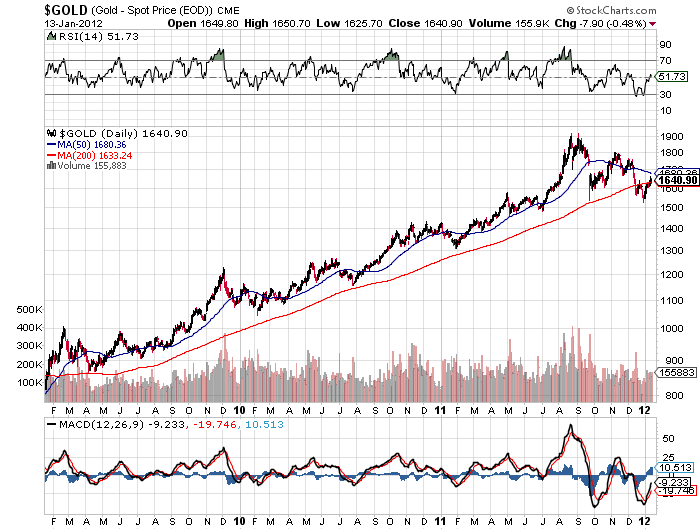

After briefly falling below the 200 day moving average, gold

rebounded strongly, rising from $1,598 at the start of the year to a

Friday closing price of $1,635.50. Over the past decade, the few times

that gold previously fell through the 200 day moving average set the

groundwork for a major price advance.

Courtesy: stockcharts.com

The fundamental and technical indicators for gold remain rock solid.

Gold may very well wind up shocking the bears by outperforming every

other asset class in 2012.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Did u notice the technical indicator at the bottom of the chart?

if it's not SERIOUSLY overbought then by all means follow the analyst call..

remember the HERD will always get trampled..

gd luck!!

krisluke ( Date: 21-Jan-2012 21:59) Posted:

| Written by The Edge |

| Monday, 16 January 2012 14:04 |

Sempcorp Marine ($4.30) — Poised for breakout

This counter has recovered handsomely, but can only be said to have broken above its reverse-head-and-shoulders formation when it moves above $4.40. A successful break above this level indicates a measuring objective of $5.80. Volume is expanding and should be able to support a breakout.

The failsafe level is at $4. If prices move below this level, the upside target is no longer valid, but the chances of that happening appear slim at the moment.

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

hope Next Wed when market open can collect BIG BIG ANG PAO from the markets! :) China's economy starts new year weakAFP – 11 minutes ago

China's

manufacturing activity shrank for the third straight month in January,

data showed Friday, leading analysts to warn of a further slowdown for

the world's number two economy.

HSBC's preliminary purchasing

managers' index (PMI) stood at 48.8 in January, up only marginally from

48.7 in December, the British banking giant said.

A reading above 50 indicates expansion while a reading below 50 suggests a contraction.

The

news come days after the government released data showing the economy

grew 9.2 percent last year, well down from the 10.4 percent growth in

2010, while most forecasts put this year's expansion at between just 8.0

percent and 8.5 percent.

However, some analysts believe it could

slow even more in the first quarter, with growth even dipping below the

8.0 percent level considered necessary to maintain jobs and contain

social unrest.

" The third consecutive below-50 reading of the

manufacturing PMI suggested that growth is likely to moderate further,"

Qu Hongbin, HSBC chief economist for China, said in a statement.

The

country's manufacturing activity contracted in November for the first

time in 33 months, according to separate figures previously released by

the China Federation of Logistics and Purchasing.

" The ongoing slowdown of investment and exports implies more headwinds to growth," Qu said.

China's

economy grew 8.9 percent year-on-year in the fourth quarter, the

government said this week, slowing from 9.1 percent in the third

quarter, due to weaker exports amid turbulence in Europe and the United

States.

The country's exports rose 20.3 percent for all of last

year, slowing dramatically from growth of 31.3 percent in 2010, to

$1.899 trillion.

Urban fixed asset investment -- a measure of

government spending on infrastructure -- rose at a slightly slower pace

of 23.8 percent last year, figures released this week showed.

Swiss

investment bank UBS forecast China's gross domestic product (GDP)

growth could slow to less than 8.0 percent in the first quarter.

" We

expect exports to weaken substantially and property construction to

decelerate further in the next few months, dragging down GDP growth,"

Hong Kong-based UBS economist Wang Tao said in a report Thursday.

China's

property market is slowing after the government took aim at speculation

over the last year by banning purchases of second homes, hiking minimum

down-payments and introducing property taxes in select cities.

Home

prices in nearly three-quarters of China's major cities -- 52 out of 70

tracked by the government -- fell in December from November, the

government said this week.

The key to maintaining growth will be

credit easing combined with efforts to spur domestic consumption as

exports slow, analysts said.

In a bid to boost growth and counter

turmoil in the key export markets of Europe and the United States, China

in December cut the amount of money banks must hold in reserve for the

first time in three years.

" We expect more policy easing to stabilise growth," said Qu of HSBC.

The

government is also keen to have domestic consumption play a greater

role in powering the economy, allowing consumers to buy up the goods

produced by the nation's millions of factories.

" However, demand

-- especially domestic demand -- is not strong enough to reduce

inventories and it is still affected by the overall economic

environment," said Zhang Xinfa, an analyst at Galaxy Securities in

Beijing.

Retail sales, a key indicator of consumer spending, rose

17.1 percent in 2011, slightly slower than in 2010, figures releases

this week showed.

Chinese stocks were higher after the PMI

announcement, as investors still believe that China will not suffer a

" hard landing" of its economy, dealers said. The benchmark Shanghai

index closed up 1.0 percent.

ozone2002 ( Date: 20-Jan-2012 16:46) Posted:

thinking of HSI put warrant..

top volume..

markets are overbought!

gd luck DYODD

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

thinking of HSI put warrant..

top volume..

markets are overbought!

gd luck DYODD

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

loving it!

ozone2002 ( Date: 18-Jan-2012 10:36) Posted:

fundamentally a gd stock..

PE @ 6.5x 2012earnings

likely to reach > 60c..

gd luck

DYODD.. |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Q By Joshua Fellman and Anjali Cordero - Jan 20, 2012 2:08 AM GMT+0800

Jan. 20 (Bloomberg) -- Li Ning Co. (2331) said it will sell 750 million yuan ($119 million) of convertible bonds to TPG Capital and Singapore’s government, and that 2011 sales may have fallen as much as 7 percent and profit margins narrowed.

The Chinese retailer and maker of shoes and sportswear, founded by the former Olympic gymnast of the same name, will use proceeds from the five-year, 4 percent bonds to boost its brand, open stores and fund product development, according to a Hong Kong stock exchange statement yesterday.

The company in August said first-half net income plummeted 49 percent from a year earlier to 294 million yuan as costs and competition increased. The full-year profit margin for 2011 may have shrunk as much as 8 percentage points from 2010’s 11.7 percent, Li Ning said in a separate filing yesterday.

Li Ning cited “flat” order growth and inventory repurchases from distributors, and said margins declined on its new wholesale discounting policy while its cost index may have gained as much as 8 percentage points.

For this year, Li Ning said it will cut costs “across the board,” except for marketing and research-and-development, and will seek to control procurement expense to protect profit margins. The company will clear inventory at the retail level and seek to use the London Olympics to boost its brand image.

TPG will buy 561 million yuan of the convertible bonds and Government of Singapore Investment Corp. will take 189 million yuan through is private-equity arm, Li Ning said. The bonds are convertible to shares at HK$7.74 each, a 15 percent premium to the last traded price of HK$6.72.

Li Ning’s stock was suspended Jan. 18, before the filing, and will resume trading in Hong Kong today. The shares dropped 63 percent in 2011, and have gained 8.9 percent this year, compared with an 8.2 percent increase in the benchmark Hang Seng index.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

stubbornly high...very overbought...

poised for correction

|

|

Good Post

Bad Post

|

|

|

|