|

Back

x 0 x 0

x 0 x 0

|

10.7

Vol:4581k

-0.15

-0.15

down 15c!..that's half of the dividends supposedly to be given out..

correction correction correction!

wait for oversold then buy again.. :)

ozone2002 ( Date: 19-Jan-2012 09:27) Posted:

technically overbought..

will look to take profit on this.. |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Last:0.68 Vol:22877k  +0.085 +0.085

up 8.5c! 15% in 1 day..power to da max!

ozone2002 ( Date: 25-Jan-2012 15:30) Posted:

hit 60.5

gd stuff :)

ozone2002 ( Date: 18-Jan-2012 10:36) Posted:

fundamentally a gd stock..

PE @ 6.5x 2012earnings

likely to reach > 60c..

gd luck

DYODD.. |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

HSI PUT WARRANT HOLDERS HAPPY HAPPY like ME :)Hang Seng 20,160.41 -341.26-1.66%

GD LUCK!! DYODD

ozone2002 ( Date: 27-Jan-2012 09:14) Posted:

Still advocating shorts...

markets are overbought..

would recommend HSI Puts..

gd luck ! DYODD.. |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

WE have CORRECTION!! 1% down..

finally broke down the bull...

have u put put already? :)

ozone2002 ( Date: 30-Jan-2012 10:20) Posted:

never fall much..seems like the bulls are strong..

HANG SENG INDEX(HKSE: ^HSI )

| Index Value: |

20,422.34 |

| Trade Time: |

10:03 |

| Change: |

79.33 (0.39%) 79.33 (0.39%) |

| Prev Close: |

20,501.67 |

| Open: |

20,518.00 |

| Day's Range: |

20,363.47 - 20,518.00 |

| 52wk Range: |

16,170.30 - 24,468.60 |

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

gd move..at least switch to a " rubbish" counter with better prospects :)

perfectstorm ( Date: 30-Jan-2012 11:03) Posted:

| Hi, I just did a share swap using my other rubbish counters to unifiber, no harm as switching from rubbish to another rubbish and dreaming to find gems inside the rubbish.. hahaha |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

never fall much..seems like the bulls are strong..

HANG SENG INDEX(HKSE: ^HSI )

| Index Value: |

20,422.34 |

| Trade Time: |

10:03 |

| Change: |

79.33 (0.39%) 79.33 (0.39%) |

| Prev Close: |

20,501.67 |

| Open: |

20,518.00 |

| Day's Range: |

20,363.47 - 20,518.00 |

| 52wk Range: |

16,170.30 - 24,468.60 |

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

getting too crowded in trade...

will wait for the exuberence to subside b4 entering..

anyway haven't confirmed yet.. talk is cheap :) so wait la..

DYODD gd luck!

ozone2002 ( Date: 28-Jan-2012 11:42) Posted:

don't take my word for it..

here's some history i dug up on Wilmar (fka Ezyhealth)

Wilmar's RTO of Ezyhealth valued Ezyhealth shares at $0.06/share

(pre-consolidation), or S$16M for original 262M Ezyhealth outstanding

shares.

consolidated 10 to 1 later on..

the rest is history..check wilmar share price now approx $6 that's almost 10 bagger if u consider the post consolidation.. :)

hope this helps..DYODD!!

ozone2002 ( Date: 27-Jan-2012 17:20) Posted:

Reference with Wilmar :)

same story.. |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

|

1/28/2012 @ 4:41PM

|3,201 views

Gold Is The Hottest Currency In The World

The price of gold is r oaring back from its latest

temporary correction, sending the bears into full withdrawal. If you

sold your gold in December as it fell to $1525 an ounce, you’re probably

feeling foolish at the incredible $210 rise to $1735– a 15% move in no

time at all.

Gold, you see, is not a commodity like oil and copper and wheat. It

is rather an alternative currency– one that finds buyers when paper

currencies like the Euro are being hugely increased in supply by the ECB

to forestall a sovereign cum bank crisis in Europe. There’s $650

billion in European bank and sovereign debt coming die before March 31,

2012 which can be sopped up by the $650 billion gift from ECB to the

banks at the bargain rate of 1%. And more available from the European

central bank– Europe’s very own Quantitative Easing program.

As the supply of gold cannot keep up with paper money(supply

increases very little despite exploration), and it can be bought

without loss of any real interest income, it seems clear t hat the gold

bull market is alive and well. Central banks obviously are of the mind

that gold’s rise will make up for t he decline in paper money and the

lack of income on central bank liquid investments.

Then, too, the speculators already dumped 42% of their long positions between August and December, 2011 according to the High-Tech

Strategist, a January 5, 2012 market letter by Fred Hickey that I

strongly recommend. Hedge funds sold to meet redemptions. Hot money ran

at warnings by technicians.

The truth is that the drop to $1525 in December triggered the renewed

buying by the Chinese, who are the new incremental buyers in the

world. The Chinese prefer to buy on weakness and not compete with the

central banks of Russia, Korea, Thailand,Singapore and are buying to

hold.

Zhang Jianhua, the research bureau director of the People’s Bank of China,

was quoted in the POBC internal newspaper as insisting that “The

Chinese government needs to further optimize China’s foreign exchange

asset portfolioi and seek relatively low entry points to buy gold

assets.”

Gold, apparently, is the Chinese priority for a “safe haven” when

slow economic growth leads to widespread monetary easing and fears of

ultimate inflation. Gold more than stocks or bonds or real estate, is

obviously seen as the preferred way to store wealth. In that sense the

Chinese are way ahead of the US and Europe.

After all its moves in 2011 gold was still up about 11%– more than

stocks any place, and only beaten by 10 year US treasuries. Treasuries

at 2% aren’t viewed as a reserve currency. Gold is the hottest currency

in the world. Just ask the Chinese.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

analysis from Kevin Scully..

What to do with your Jaya shares ?

If there is a takeover - we should wait for the advice of the

indepenent financial adviser on the merits of the takeover offer.

Meanwhile, we should evaluate Jaya on its own fundamentals.

I still like Jaya because it's undervalued. Its NAV per share in

Q1-2012 was US$0.593 or about S$0.74 if we use S$1.26=US$1 exchange

rate.

Jaya's current fleet in my opinion has a hidden value of US$100mn against their market value.

This

would add another S$0.16 to its reported NAV, bringing its NAV to

S$0.90. Earnings are likely to be disappointing but charter income

should come in around S$25-30mn, then you can add another S$10-20mn

from vessel sales.

You then have a range of net profit of

about S$30-50mn giving you an EPS of between S$3.9 cents to S$6.5 cents

or a PER of 9-16 times which is probably fairly valued on earnings

basis.

Given Jaya's strong balance sheet and NAV support, the

shares are still undervalued at these levels even if the takeover

offer doesn't materialise but investors need a recovery in the OSV

charter rates for the share price to rerate fundamentally close to the

S$0.90 level.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Here is what

hyper-inflation in Germany looked like after WWI. It’s stunning how

quickly the currency lost value. Those who owned gold were saved while

all others fell into poverty. Are you prepared for the same thing to

happen in the U.S.?

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Major Buy Signal For Gold And Why Stock Markets Are Ignoring Predictions Of Economic Collapse

January 26, 2012

Predictions

that the global economic system will collapse have been coming at an

accelerated pace lately. Usually, many of the most extreme scenarios

are from sources more interested in gaining publicity rather than

offering a balanced analysis.

What's unusual is that lately, many of these apocalyptic predictions

are coming from some of the most normally sedate institutions in the

world such as the IMF and the World Bank.

Central bankers and the heads of world financial organizations

usually speak in oblique and obfuscated terms designed to convey

confidence. Either the financial powers are writing a new book of rules

or we are all headed for some unimaginably horrific scenario of

financial and social chaos.

Here's a small sample of the latest warnings from the sedate and not so sedate.

IMF Chief Warns Europe Must Fuel Growth

BERLIN—The head of the International Monetary Fund warned

that in addition to cutting yawning budget deficits Europe needs to do

more to promote growth and stop the crisis from spreading to the world

economy.

" It is about avoiding a 1930s moment, in which inaction, insularity,

and rigid ideology combine to cause a collapse in global demand," IMF

Managing Director Christine Lagarde said before the German Council on

Foreign Relations. " A moment, ultimately, leading to a downward spiral

that could engulf the entire world," she said.

World Bank Projects Global Slowdown

“Developing countries need to evaluate their vulnerabilities and prepare for further shocks, while there is still time,” said Justin Yifu Lin, the World Bank’s Chief Economist and Senior Vice President for Development Economics.

Developing countries have less fiscal and monetary space for

remedial measures than they did in 2008/09. As a result, their ability

to respond may be constrained if international finance dries up and

global conditions deteriorate sharply.

“An escalation of the crisis would spare no-one. Developed- and

developing-country growth rates could fall by as much or more than in

2008/09” said Andrew Burns, Manager of Global

Macroeconomics and lead author of the report. “The importance of

contingency planning cannot be stressed enough.”

Feliz Zulauf Sees More Trouble Ahead

Felix Zulauf: Yes, I believe the peripheral nations have entered recession territory, and I believe it will get worse.

So, the situation in Europe will get worse before it gets better.

Moreover, the ECB, which has its roots in the German Bundesbank, will

see to it that the ECB does not become the lender of last resort until

they are absolutely forced into it by the market. For investors, this is

very important to understand. The new leader Mr. Draghi may leave

Trichet’s conservative path, however, as since he is in power he has

talked one way and acted in another way. This is delicate as the

credibility of the ECB could be lost quickly.

Euro Breakup Would Cause Global Meltdown

In his speech at Davos, Soros will say it is “now more

likely than now” that Greece will formally default in 2012, Newsweek

said. Soros nevertheless thinks the euro will survive, according to

Newsweek.

The world is facing a period of “evil,” Soros said, adding that he

foresees Europe descending into chaos and conflict, while rioting in the

streets of the U.S. will lead to a curtailment of civil liberties and

the global economic system possibly collapsing altogether, Newsweek reported.

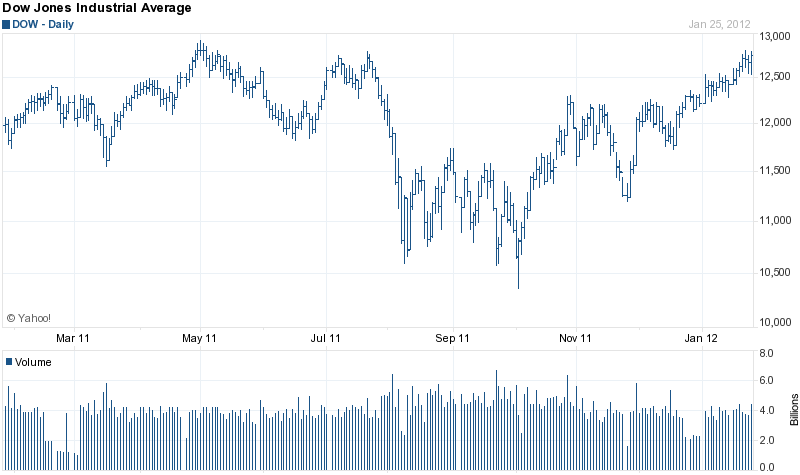

All of the risks to global prosperity mentioned above have been well

known by investors for months now. The day the IMF Chief warned of a

global depression worse than the 1930's, the Dow Jones yawned and drop

by 10 points.

Is there a major disconnect from reality by U.S. investors or has the

worst already been discounted after the steep stock market sell off

last August? Ever since an inside out day on October 3 of last year,

the Dow Jones has powered higher, ignoring all the bad news and warnings

of Armageddon. Exactly what is going on?

Dow Jones - courtesy yahoo.com

The answer is positive for both stocks and gold. The " collective

wisdom" of the markets saw a resolution to the imminent threat of the

European debt crisis last fall, and that resolution is known as

quantitative easing. As previously noted in this blog last December, Every Solution To the Euro Crisis Involve Printing Money,

which is exactly what happened. Both the European Central Bank (ECB)

and the Federal Reserve stand ready to print whatever quantity of money

is required to paper over the European and U.S. debt crisis.

The massive first phase of the ECB's Long Term Refinancing Operation

advanced about $780 billion to Europe's insolvent banking system, buying

time and postponing the day of reckoning. The ECB will hold a similar

operation in February.

Long term this does little to solve Europe's fundamental problems,

but is short term bullish for stocks and extremely long term bullish for

gold and silver.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

don't take my word for it..

here's some history i dug up on Wilmar (fka Ezyhealth)

Wilmar's RTO of Ezyhealth valued Ezyhealth shares at $0.06/share

(pre-consolidation), or S$16M for original 262M Ezyhealth outstanding

shares.

consolidated 10 to 1 later on..

the rest is history..check wilmar share price now approx $6 that's almost 10 bagger if u consider the post consolidation.. :)

hope this helps..DYODD!!

ozone2002 ( Date: 27-Jan-2012 17:20) Posted:

Reference with Wilmar :)

same story...

medivh ( Date: 27-Jan-2012 16:46) Posted:

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

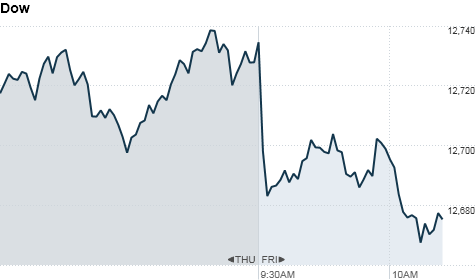

Stocks slump after unimpressive U.S. growthBy Hibah Yousuf @CNNMoneyMarkets

January 27, 2012: 10:38 AM ET  Click the chart for more stock market data.

NEW

YORK (CNNMoney) -- U.S. stocks retreated early Friday as jittery

investors digested a weaker-than-expected economic growth report and as

Europe's debt crisis still looms in the background.

The Dow Jones industrial average (INDU) dropped 55 points, or 0.4%, the S& P 500 (SPX) slipped 2 points. or 0.2%. The Nasdaq (COMP) flipped between small gains and losses.

The decline came as investors reacted to the government's first reading on fourth-quarter gross domestic product. The United States economy picked up speed

at the end of 2011, growing at an annual rate of 2.8%, as consumers

increased their spending. But the data fell short of the 3.2% forecast,

based on a consensus of economists surveyed by Briefing.com.

While

the worse-than-expected figure is disheartening, " the real

disappointment is in the details" of the report, said Mark Chandler,

global head of currency at Brown Brother Harriman. While inventories

rose during the quarter, accounting for a large part of the growth,

consumption growth, a measure of demand, was weak.

Investors had been hoping for news that would back up growing optimism about the nation's economic recovery. Instead, the news seems to jive with the Federal Reserve's lower outlook for the economy.

medivh ( Date: 27-Jan-2012 17:35) Posted:

LOL , you are right man..

The thing is last time i used to luv Put warrants..

I will look into that when the volume increases tremendously. (," )

For now many still cautious and dowan to buy so you should know what I mean.. lol (" ,)

ozone2002 ( Date: 27-Jan-2012 17:19) Posted:

very stubborn..

the higher they are ..the BIGGA da FALL! : |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Reference with Wilmar :)

same story...

medivh ( Date: 27-Jan-2012 16:46) Posted:

Wats ur price range ?

ozone2002 ( Date: 27-Jan-2012 16:42) Posted:

this is a no brainer... Large conglomerate using unifibre as a back door listing..

look at the value of the takeover..it's billion $..

don't think unifibre will be 3-4c in the near future.. |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

very stubborn..

the higher they are ..the BIGGA da FALL! :)

New123 ( Date: 27-Jan-2012 17:06) Posted:

| mkt hasn't bn corrected. Mon may see that happen..I don't think is healthy for the index to keep on going up ... |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

this is a no brainer... Large conglomerate using unifibre as a back door listing..

look at the value of the takeover..it's billion $..

don't think unifibre will be 3-4c in the near future..

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

down town to Chinatown!!

HANG SENG INDEX(HKSE: ^HSI )

| Index Value: |

20,510.67 |

| Trade Time: |

11:21 SGT |

| Change: |

71.53 (0.35%) 71.53 (0.35%) |

| Prev Close: |

20,439.14 |

| Open: |

20,443.46 |

| Day's Range: |

20,432.62 - 20,590.80 |

| 52wk Range: |

16,170.30 - 24,468.60 |

ozone2002 ( Date: 27-Jan-2012 09:14) Posted:

Still advocating shorts...

markets are overbought..

would recommend HSI Puts..

gd luck ! DYODD.. |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

only one way to solve this..

PAY UP!!! :)

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Still advocating shorts...

markets are overbought..

would recommend HSI Puts..

gd luck ! DYODD..

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

wah.. got treat ? :)

|

|

Good Post

Bad Post

|

|

|

|