|

Latest Posts By ozone2002

- Supreme

|

|

| 30-Aug-2012 09:37 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

great set of results.. hence the top volume today and giving both the usual dividend as well as special dividend.. these should gain some investor confidence.. still trading @ low 6-7x PE.. gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 29-Aug-2012 14:31 |

Intraco

/

TatHong see value IN INTRACO 62cents

|

||||

|

|

Mr Oei Hong Leong has called off talks to buy a substantial stake in Intraco after he failed to secure promises of support from the major shareholders of seller Hanwell Holdings, according to BT. This will deprive Intraco shareholders of a potential 70 cent-per-share general offer from Mr Oei, who has said that he would offer to take the company private if

|

||||

| Good Post Bad Post | |||||

| 29-Aug-2012 14:10 |

Seatrium

/

Sembmarine

|

||||

|

|

fundamentally strong!!!!!!!!

|

||||

| Good Post Bad Post | |||||

| 28-Aug-2012 15:06 |

Viking Offshore

/

VIKING OFFSHORE AND MARINE LTD

|

||||

|

|

Just read their corporate update.. looks like there's progress into securing contracts in Brazil & Myanmar Extend business reach to overseas customers One of our Group companies, Marshal System Pte Ltd ( of approximately S$1.1 million from a leading Singapore yard to supply Fire and Gas Detection, Telecommunications, and Controls and Instrumentation systems to a Brazilian rig owner. This the “Marshal”) have been awarded contractsrepresented the Group’s first successful foray into the Bra further opportunities in the tendering and evaluation stages. Another subsidiary, Viking Airtech Pte Ltd also secured its first major order from a leading Indonesian infrastructure fabricator for an offshore platform to be commissioned in Myanmar. The initial award is for an estimated S$2.3 million to provide turnkey system for Heating, Ventilation, and Air Conditioning systems including offshore supervision and commissioning in Myanmar. This project award is one of the numerous opportunities the Group has participated in, and the remainder are still under tendering. Promoter Hydraulics Pte Ltd also won a contract of approximately S$1.9 million with a large Australian infrastructure contractor for the deployment of mooring winches and power packs for the Gorgon liquefied natural gas project in Western Australia. The Group has been executing on its planned Internationalisation strategy since the beginning of the year. The results have thus far been encouraging and will continue to be the focus going forward to

Expand business portfolio through adding capabilities Concurrent to expanding our customer base overseas, the Group have also been broadening our

offerings portfolio by developing additional capabilities. Recognising the sizable required investment

and competing resources needs and potentially low yielding research and development activities, the

Group embarked on this business initiatives in a more controllable and cost-effective manner

|

||||

| Good Post Bad Post | |||||

| 28-Aug-2012 10:03 |

Nam Cheong

/

Nam Cheong

|

||||

|

|

enjoy the ride :) gd luck dyodd

|

||||

| Good Post Bad Post | |||||

| 28-Aug-2012 10:01 |

Nam Cheong

/

Nam Cheong

|

||||

|

|

been advocating this stock since Jun.. finally it's above 20c.. & top volume.. DBS also aggressively promoting this stock.. gd fundamentals.. gd margins.. gd luck dyodd..

|

||||

| Good Post Bad Post | |||||

| 27-Aug-2012 11:20 |

Viking Offshore

/

VIKING OFFSHORE AND MARINE LTD

|

||||

|

|

more n more buy backs.. gd sign .. dyodd gd luck Viking Offshore and Marine Ltd 23-Aug-12 Share Buy-Back 36,000 0.1080

|

||||

| Good Post Bad Post | |||||

| 27-Aug-2012 11:19 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||||

|

|

We maintain our view that in the near-term, STI runs the risk of a pullback, which may already have started off the 3100 level, to 3000 or even 2930 before finding support. Post pullback, look for a re-test of 3100 while an upside break

|

||||

| Good Post Bad Post | |||||

| 27-Aug-2012 09:08 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

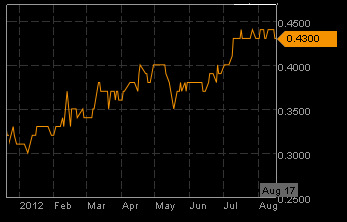

still sticking to my targets.. of 50c.. the resources boom has not peaked yet ..as quoted by RBA chief n analyst Australian mining boom is not over yet, RBA chief and analysts say

|

||||

| Good Post Bad Post | |||||

| 24-Aug-2012 15:27 |

SingPost

/

Singpost

|

||||

|

|

PROPERTY SPIN-OFF A BONUS BUY FOR DEFENSIVENESS - Recent prop listings highlight buoyant mood - May be an opportune time - But group is cash rich The buoyant mood in Singapore’s property sector means that this could be an opportune time for SingPost to spin off some of its assets it may even receive an offer that is hard to resist. The group has about 61 post offices and we estimate that about 16 or so are potentially saleable. However, the jewel in its book is the Singapore Post Centre (SPC). We estimate that the SPC is worth S$765m based on its current mix of industrial, office and retail use, but the value may increase to about S$1.56b if the building is converted to full commercial use. However, putting market sentiment aside, the group may not be in a rush to unlock value as it is currently cash-rich. Hence we regard a spin-off as a bonus and investors should focus on more fundamental factors such as the company’s defensive nature and consistent dividends. Maintain BUY with S$1.14 fair value estimate. |

||||

| Good Post Bad Post | |||||

| 24-Aug-2012 10:02 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

Don't worry Australia is big on LNG.. Ric Deverell, of Credit Suisse, a bank, reckons it is too early to pronounce the end of the Australian boom. Although China’s market for iron ore has cooled, energy companies are also investing A$180 billion ($189 billion) in liquefied natural gas (LNG) projects, mainly for export to Asia. “LNG is the main game,” he says. Glenn Stevens, the central-bank governor, reckons Australia’s luck has a way to go. Australia, he says, is better off exposed to China with a high variable growth rate than to Europe with a low one. DYODD gd luck :) |

||||

| Good Post Bad Post | |||||

| 24-Aug-2012 09:47 |

IPC Corp

/

Solid NTA 27c

|

||||

|

|

IPC is past few days trading is strange.. volume is substantial but price range bound.. didn't break up or down.. monitoring... dyodd |

||||

| Good Post Bad Post | |||||

| 24-Aug-2012 09:13 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

Today RBA says the boom peak in 1-2 years time.. so safe.. any case ausgrp hit high of 40.5 gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 23-Aug-2012 16:22 |

Viking Offshore

/

VIKING OFFSHORE AND MARINE LTD

|

||||

|

|

more buy backs Viking Offshore and Marine Ltd 22-Aug-12 Share Buy-Back 150,000 0.1070

|

||||

| Good Post Bad Post | |||||

| 23-Aug-2012 15:13 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

doesn t look rosy CANBERRA/MELBOURNE - Australia declared the top of the resources boom, which had cushioned the country against the global financial crisis, a day after the world's biggest miner BHP Billiton shelved two major expansion plans worth at least US$40 billion. One minister went as far as calling the end of the resources boom, but later rowed back to say commodity prices had peaked while investments in multi-billion dollar projects would continue, especially in the energy sector. " This construction boom will continue, but the days of record commodity prices are gone," Resources and Energy minister Martin Ferguson told reporters on Thursday. " We've done well - A$270 billion (US$282 billion) in investment, the envy of the world. It has got tougher in the last six to twelve months," he said earlier on Australian radio. His comments came after BHP scrapped plans for a US$20 billion-plus expansion of its Olympic Dam copper mine in South Australia and a new harbour, estimated at more than US$20 billion, to nearly double its iron ore exports in Western Australia. Fuelled by Chinese-led demand for its coal, iron ore and other resources, Australia's economy was one of the very few in the developed world to sail through the global financial crisis without sliding into recession. But with China heading for the slowest pace of annual growth in more than a decade, investors are nervous about the near-term outlook for miners. The resources boom has fuelled what has been dubbed a two-speed economy, which has pumped up the local dollar and exacerbated the pain felt in manufacturing and retail in Australia's most populous states. While manufacturers, like Ford and Bluescope Steel, have cut production and axed jobs, unemployment has stayed at around 5 per cent, thanks to jobs growth in resources projects, where truck drivers command six-figure pay packets. Olympic Dam alone would have created 25,000 jobs, South Australia's government said. Politicians may be worried the whole economy is moving into the slow lane, but analysts say the fear is premature, as energy projects will continue full steam ahead. National Australia Bank does not see the boom peaking until 2013 and 2014, when resource capital spending will be around 1 per cent of gross domestic product higher than now. Finance Minister Penny Wong also played down fears of a collapse in the mining boom, saying the government has factored in a peaking in Australia's terms of trade, which measures the difference between export earnings and import costs. " We've still got a long way to run when it comes to this investment boom," Ms Wong told Australian radio. " We've got over half a trillion dollars of investment, and over half of that...is at the advanced stage. So I think the 'doom and gloom' that some are putting about isn't appropriate." Mr Ferguson's warnings on the mining boom may also be a response to opposition attacks blaming a new carbon tax for BHP's woes. Well behind in the polls, the government is trying to claw back voter support ahead of an election due next year. Seven out of eight of the 10 biggest resources projects under construction will produce LNG, ranging in scale from US$5 billion to US$43 billion, according to Deloitte Access Economics. BHP put the Olympic Dam expansion on hold as it reported a 35 per cent slide in second-half profit, the biggest sign of the pain inflicted by China's slowdown. Weaker demand from China has knocked prices of all key commodities, including iron ore, languishing at its lowest levels since December 2009, copper, coal and aluminium. BHP and companies that work with the miners, such as rail transporter QR National, say while they are cautious on the near-term outlook, they expect demand growth in China and India to underpin growth in the medium to long term. -- REUTERS |

||||

| Good Post Bad Post | |||||

| 23-Aug-2012 14:00 |

IPC Corp

/

Solid NTA 27c

|

||||

|

|

top vol today.. 22m done so far price should break 154 to move further upwards.. from its symmetrical triangle formation gd luck dyodd.. |

||||

| Good Post Bad Post | |||||

| 23-Aug-2012 11:14 |

Food Empire

/

Results Commentary

|

||||

|

|

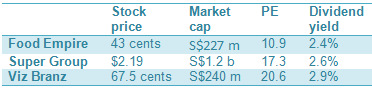

Written by Sim Kih

Thursday, 23 August 2012 07:10

|

||||

| Good Post Bad Post | |||||

| 23-Aug-2012 09:56 |

GLD USD

/

Gold going up this year?

|

||||

|

|

Pimco Fund Expands Gold Holding on Outlook for Inflation Pimco Commodity Real Return Strategy Fund has expanded its holding of gold as a hedge against inflation, anticipating further moves by central banks to spur economic growth, said Nic Johnson, the fund's manager. The $20 billion fund increased its gold holdings to 11.5 percent of total assets from 10.5 percent two months ago, Johnson said today in a telephone interview from Newport Beach, California. The commodity fund is part of Pacific Investment Management Co., which also owns the world's largest bond fund. " We think gold is going to perform in a positive correlation to changes in inflation," Johnson said. " We see higher inflation because of rising commodity prices, unconventional monetary policies and increasing sovereign debt." Gold rallied in New York today to the highest price since May 2 after Federal Reserve policy makers issued the minutes from their July 31-Aug. 1, which indicated the Federal Open Market Committee may expand monetary stimulus to bolster the economy. Gold futures for December delivery rose as high as $1,658.20 an ounce on the Comex. The precious metal surged 70 percent from the end of December 2008 to June 2011 as the Fed kept borrowing costs at a record low and bought $2.3 trillion of debt in two rounds of so- called quantitative easing. Gold advanced in the past two months amid speculation that China, the U.S. and Europe may take more steps to boost economic growth. " We are tactical and will look for attractive dips" in prices to add to the fund's holdings, Johnson said, adding that a drop near $1,500 would prompt some buying. |

||||

| Good Post Bad Post | |||||

| 23-Aug-2012 09:34 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

good stuff! continue to reap the rewards.. gd luck dyodd :)

|

||||

| Good Post Bad Post | |||||

| 22-Aug-2012 11:00 |

Lian Beng

/

Lian Beng

|

||||

|

|

Tuesday, 21 August 2012 20:18

|

||||

| Good Post Bad Post | |||||

| First < Newer 1481-1500 of 7452 Older> Last |