By Chikako Mogi

TOKYO (Reuters) - Assets from Asian shares to oil to gold rose on Friday and the euro steadied as stimulus measures from major central banks continued to buoy investor confidence, offsetting weak economic data.

The MSCI's broadest index of Asia-Pacific shares outside Japan rose 0.7 percent after slipping to its lowest in nearly a week on Thursday.

Australian shares were up 0.4 percent, with energy stocks picking up on higher oil prices and defensive stocks extending their recent gains. Hong Kong shares were up 0.7 percent.

Tokyo's Nikkei stock average added 0.6 percent.

" The general consensus at the moment is that any major dips in the market will be supported by the fact that central banks are happy to act," said Stan Shamu, market analyst at IG Markets.

Safe-haven currencies such as the dollar and the yen were slighly pressured, with the yen struggling against the dollar at 78.25 yen while the euro edged up 0.1 percent against the dollar at $1.2978.

Commodities-linked currencies such as the Australian dollar, which is often used to gauge investor risk sentiment, rose 0.4 percent to $1.0470.

" Key global stock indices, while pausing from their rally, generally remain at high levels, suggesting that markets have not entirely turned against risk," Junya Tanase, chief FX strategist at JPMorgan in Tokyo.

" Major central banks pursuing aggressive monetary easing have reduced tail risks for the global economic growth and the euro zone debt crisis, raising the probability for dollar and the yen to weaken and support the cross yen," he said.

Manufacturing reports from the euro zone, China and the United States on Thursday showed factory activity remained lacklustre, evidence of sluggish growth globally.

U.S. manufacturing ended its weakest quarter of growth in three years this month and jobless benefits claims held near two-month highs last week, but the Philadelphia Federal Reserve Bank's business index for the U.S. mid-Atlantic region shrank at a lessened pace in September.

Euro zone's manufacturing purchasing managers index showed a slight recovery this month but the downturn in the services sector steepened at the fastest pace since July 2009. China's manufacturing PMI contracted for the 11th month in a row, but some sub indexes showed signs of stabilising.

CENTRAL BANK LIQUIDITY HELPS

In the past week the U.S. Federal Reserve and the Bank of Japan have launched further monetary easing packages, and the European Central Bank recently outlined a scheme to help cap the borrowing costs of highly indebted euro zone members which request assistance.

" The market retains an attitude of buying risk on the dip. Central bank easing forces investors to take more risk," said Olivier Korber, derivatives strategist at Societe Generale in Paris, in a research note.

" The period between euphoria and economic rebound is typically one with range bound periods, where the market hunts for weak hands."

With central banks around the world keeping markets awash with funds, gold looked set to benefit from investors seeking a hedge against future inflationary risks.

Spot gold was up 0.3 percent at $1,772.21 an ounce, nearing its highest since February 29 of $1,779.10 hit on Wednesday.

Over the past 30 days, gold futures open interest has gained about 25 percent to a one-year high as of wednesday while prices have risen nearly $200, or 10 percent, in the past four weeks.

U.S crude climbed 0.8 percent to $93.11 a barrel on concerns over instability in the Middle East and a refinery shutdown in Venezuela, while Brent rose 0.4 percent to $110.50.

Asian credit markets firmed slightly, narrowing the spread on the iTraxx Asia ex-Japan investment-grade index by 2 basis points.

Spain, which had been the main source of market jitters with its borrowing costs surging on worries about its refinancing ability and led to the ECB's bond-buying plan, raised funds above its target at Thursday's auctions.

But Madrid faces a refinancing of 27.5 billion euros in October and need additional 10 billion euros to offset the fallout from austerity measures.

Greece continues its struggle to secure approval of restructuring plans from its global creditors in exchange for a bailout to keep the country solvent.

|

Latest Posts By ozone2002

- Supreme

|

|

| 03-Oct-2012 09:27 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

support is @ 51.5 .. if it breaks below.. probably be end for the rally for the short term.. gd luck dyodd

|

||||

| Good Post Bad Post | |||||

| 03-Oct-2012 09:12 |

IPC Corp

/

Solid NTA 27c

|

||||

|

|

technicals are showing the IPC is going to move up soon.. divergence between prices and technical indicators are indicating this. gd luck dyodd.. vested more @ 14.5 |

||||

| Good Post Bad Post | |||||

| 02-Oct-2012 17:04 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

58 to 53 that's 5c or ~10% fall.. that's pretty steep.. gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 02-Oct-2012 16:01 |

GMG Global

/

GMG CHIONG tomoro -Flash floods hit southern Thail

|

||||

|

|

rubber prices rallied close to 5%.. beneficiaries for higher rubber prices are Sri trang and GMG.. gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 02-Oct-2012 15:50 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

Aus central bank cut rates today, usually stocks in that market will rise.. book in some profits with Ausgrp, Oct is here anyway, stay in cash so that you have ammunition to take advantage of the correction if there is. gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 02-Oct-2012 10:06 |

Viking Offshore

/

VIKING OFFSHORE AND MARINE LTD

|

||||

|

|

very good efforts by the company. Company D.O.T. Buy/Sell No.of shares S$/shr Viking Offshore and Marine 01-Oct-12 Share Buy-Back 100,000 0.1130

|

||||

| Good Post Bad Post | |||||

| 02-Oct-2012 09:45 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||||

|

|

before a crash happens, things must rise.. gd luck dyodd.. |

||||

| Good Post Bad Post | |||||

| 28-Sep-2012 15:08 |

Viking Offshore

/

VIKING OFFSHORE AND MARINE LTD

|

||||

|

|

smart move buy Viking to enhance shareholder value .. accumulate when the shares are cheap.. let go when O& G services stocks come into play or become overvalued gd luck dyodd.. Viking Offshore and Marine 27-Sep-12 Share Buy-Back 76,000 0.1130 Viking Offshore and Marine Ltd 26-Sep-12 Share Buy-Back 50,000 0.1130 Viking Offshore and Marine Ltd 25-Sep-12 Share Buy-Back 80,000 0.1120

|

||||

| Good Post Bad Post | |||||

| 28-Sep-2012 14:58 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

hope u guys held on to this gem.. gd luck dyodd.. may want to take some profit in lieu of Oct pullback

|

||||

| Good Post Bad Post | |||||

| 21-Sep-2012 14:01 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

broad market STI is up close to 20 points.. now for ausgrp to follow suit.. gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 21-Sep-2012 11:30 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||||

|

|

|

||||

| Good Post Bad Post | |||||

| 21-Sep-2012 11:17 |

Citic Envirotech

/

United Envirotech

|

||||

|

|

United Envirotech has signed a contract for the acquisition, upgrading and expansion of an industrial wastewater treatment plant in Weifang City, Shandong Province, China. The design capacity of the industrial wastewater treatment plant is 10,000 m3/day for Phase I. The plant capacity will be expanded to 20,000 m3/day for Phase II and 50,000 m3/day for Phase III of the project. The total investment for Phase I is approximately RMB120m, with a 30-year concession to

|

||||

| Good Post Bad Post | |||||

| 21-Sep-2012 10:22 |

Federal Int

/

Federal

|

||||

|

|

what happened to this counter.. remember it was @ 60-70c when i last traded it.. now only 4.6 c any case seems like a gem with its low share price vs NAV of 13.3c profitable company in the O& G services sector.. gd luck dyodd |

||||

| Good Post Bad Post | |||||

| 21-Sep-2012 09:11 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

started off well now 42-425.. as usual my constant reminder... Don't SELL OUT TOO CHEAP!! gd luck dyodd.. |

||||

| Good Post Bad Post | |||||

| 20-Sep-2012 14:02 |

Mencast

/

Cornerstone investor GAY CHEE YONG in mencast

|

||||

|

|

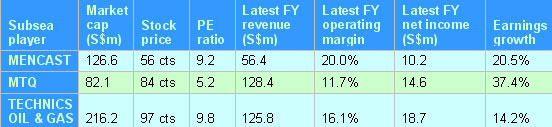

Mencast has the highest operating margin of 20%.. think it has more room to grow with it recent acquisition.. gd luck dyodd Here we feature three players with strong earnings growth in the past year.

Bloomberg, 19 Sep 2012

Mencast CEO Glenndle Sim. NextInsight file photo Mencast – MRO player for offshore Take Mencast for example. From being a vessel sterngear manufacturer and solutions provider, its top line has leaped with its transformation into maintenance, repair and overhaul solutions provider that also caters to the offshore sector. Just a year after acquiring three businesses for its offshore & engineering segment, the segment's 1H2012 revenue doubled year-on-year to S$22.4 million and contributed 64.6% to top line. Group net profit attributable to shareholders rose 27.7% to S$6.9 million. The acquired businesses includes services such as: * Top Great Engineering & Marine - Inspection, maintenance and fabrication of offshore structures as well as engineering and other services related to onshore structures, provided by the newly acquired. * Unidive - Diving services for subsea inspection, repair and maintenance * Team International Development and Team Precision Engineering - Manufacturing of metal precision components Its offshore & engineering order book as at 30 June 2012 was S$17.8 million, compared to S$10.2 million a year prior to this. |

||||

| Good Post Bad Post | |||||

| 20-Sep-2012 11:57 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

just to re-iterate my point again.. do not let the drop in prices rattle u to sell your stake cheaply ...

|

||||

| Good Post Bad Post | |||||

| 19-Sep-2012 14:55 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

DON'T sell OUT TOO CHEAP!!! dyodd gd luck |

||||

| Good Post Bad Post | |||||

| 19-Sep-2012 13:31 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

watch for a break of the immediate resistance of 42.5 once break out from there.. it will propel further.. gd luck.. dyodd.. don't sell out too early for ausgrp!!!!

|

||||

| Good Post Bad Post | |||||

| 18-Sep-2012 14:12 |

Singapore Land

/

Sp Land

|

||||

|

|

UIC one of the top 20 gainers for today.. STI in the red.. something is going on.. |

||||

| Good Post Bad Post | |||||

| 18-Sep-2012 09:53 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

DBS just showing the path that ausgrp will take to reach 65c :) don't sell out too early.. gd luck dyodd.. |

||||

| Good Post Bad Post | |||||

| First < Newer 1401-1420 of 7452 Older> Last |