|

Latest Posts By ozone2002

- Supreme

|

|

| 21-Nov-2012 10:27 |

Viking Offshore

/

VIKING OFFSHORE AND MARINE LTD

|

|||||

|

|

Viking Offshore and Marine Ltd 14-Nov-12 Share Buy-Back 146,000 0.1060 |

|||||

| Good Post Bad Post | ||||||

| 21-Nov-2012 10:16 |

Seatrium

/

Sembmarine

|

|||||

|

|

let's got semb mar 4.26! buy on bad news (low) sell on good news (high) go go go gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| 15-Nov-2012 15:48 |

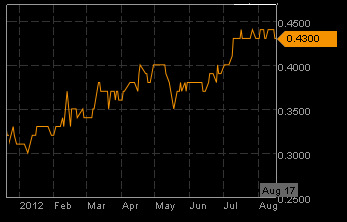

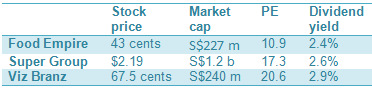

Food Empire

/

Results Commentary

|

|||||

|

|

great set of results profit surge 90% continue to accumulate on dip gd luck dyodd

|

|||||

| Good Post Bad Post | ||||||

| 15-Nov-2012 14:35 |

Seatrium

/

Sembmarine

|

|||||

|

|

got @ 4.2 wait for contract wins for the rest of 2012 gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| 14-Nov-2012 10:29 |

SinoGrandnes

/

Sino Grandness - a growth stock with low PE

|

|||||

|

|

making progress .. UOBKH just issued their buy recommendation report.. 78c gd luck dyodd Sino Grandness Food (SFGI SP) Strong earnings growth + catalyst = BUY BUY Price/Target Mkt. Cap/ F. Float +64.2% S$0.475/S$0.78 S$126.0m/56% Fundamental View Technical View Source: Nextview The stock appears to be supported at above $0.455 and it could move towards its potential resistance at S$0.525. Financials Year to 31 Dec (Rmb m) 2010 2011 2012F 2013F 2014F Net turnover 645.1 1,019.7 1,666.3 2,315.7 2,466.8 EBITDA 166.2 227.0 396.7 510.0 543.7 Operating profit 155.9 210.5 370.5 477.6 510.0 Net profit 117.2 151.7 272.6 347.2 372.8 EPS (RMB cent) 44.1 56.9 102.5 130.6 140.3 Net margin (%) 18.2 14.9 16.4 15.0 15.1 Dividend yield (%) 1.8 0.0 0.0 0.0 2.9 P/E (X) 5.4 4.2 2.3 1.8 1.7 P/B (X) 1.5 1.1 0.8 0.5 0.4 ROE (%) 27.8 27.2 32.8 29.5 24.0 Source: Company, UOB Kay Hian Valuation • 2012F PE (ended Dec 12) and 0.135x PEG (2012-14F). Currently, the fast-moving consumer goods (FMCG) peers in Hong Kong are trading at an average of 33.2x FY11 PE. At the current share price of S$0.475, it is trading at 2.3x• 2013F PE, pegged to Singapore-listed peers’ average. We note the potential upside of S$1.12/share if GF obtains approval from an exchange to list assuming a holding company discount of 20% to SGF’s Garden Fresh stake and a 3.0x 2014F PE valuation to its remaining business. We have a target price of S$0.78 which translates into 3.0xFinancial Highlights • on higher revenue, and stronger gross profit margins despite greater operating costs. Revenue increased 68.1% yoy to Rmb1.23b, boosted by yoy growth of 130.2% and 30.6% in sales for the beverages and canned food segments respectively. SGF reported a 72.4% leap in 9M12 net profit to Rmb224m• stronger than expected as SGF managed to leverage on the current beverage distribution network to sell their ownbrand bottled fruits. This segment’s Rmb85.3m sales also enjoyed a higher gross margin of more than 40% that lifted the group’s gross margin to 39.2% in the same period from 34.4% in 9M11. However, selling and distribution expenses and administrative costs rose 116.2% yoy and 39.5% yoy respectively as higher sales volume resulted in higher labour costs and transportation expenses. Domestic sales of the canned food segment performed• Fresh bottled juices output capacity to 280,000 tonnes p.a. from 70,000 tonnes p.a. a year ago by securing new capacities based in Zhejiang, Beijing and Sichuan provinces. The strategically-located supply points will also assist SGF in extending their distribution network to north and west China without incurring higher transport costs. Assuming that SGF fully utilised the capacity and sold juices at an ASP of Rmb5000/tonne, the group can record potential sales of Rmb1.4b and Rmb245.0m using historical net profit margins. The group had announced that it had quadrupled its Garden• increasing its A& P activities through advertisements, trade shows, sponsorship programmes as well as new TV commercials for Garden Fresh juices. The group will also boost its sales and marketing efforts byRisks • accounted for more than 80% of total in-house production cost for canned F& B segment manufacturing. Any sharp movements in raw material prices would erode SGF's GPM if the group is unable to adjust the ASP accordingly. Volatility in raw material prices. Raw agricultural products• both CB1 and CB2 were issued on the premise for GF’s eventual listing, SGF would have to redeem the bonds at an effective interest rate of more than 24% if the beverage business is unable to complete the IPO process. Sino Grandness is an integrated manufacturer and distributor of bottled juices as well as canned fruits and vegetables. Since its establishment in 1997, the group has rapidly grown to become one of the leading exporters of canned asparagus, long beans and mushrooms from China. The group serves globally renowned customers across Europe, North America and Asia, such as Lidl, Rewe, Carrefour, Walmart, Huepeden, Coles and Metro. In 2010, the group successfully launched its own-branded bottled juices, juice and vegetable-fruit juice to target the huge domestic consumer base in China. As a percentage to group revenue, sales from the Chinese market have surged from 4.8% in 2008 to 41.9% in 2011 due to strong sales growth

|

|||||

| Good Post Bad Post | ||||||

| 12-Nov-2012 09:29 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

|||||

|

|

broke resistance..more upside to come vested again gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| 10-Nov-2012 13:07 |

CapitaCom Trust

/

CapitaComm

|

|||||

|

|

it's a good ride up.. super uptrend.. time to take profits gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| 10-Nov-2012 12:32 |

SinoGrandnes

/

Sino Grandness - a growth stock with low PE

|

|||||

|

|

patience is the key .. once you have found a good stock/biz.. it will be just a matter of time before the herd notices and rushes in.. by then those who vested earlier will reap the bigger share of the pie.. gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| 10-Nov-2012 12:20 |

Seatrium

/

Sembmarine

|

|||||

|

|

tried to get @ 4.3 didn't managed to get any.. will continue trying sembmar earnings visibiliy is for investors to see.. $12.1 bn order book.. i saw the Edge article on Sembmar... unprecedented order book! it's definitely a buy on dip for me.. accumulate on weakness.. gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| 10-Nov-2012 12:17 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

|||||

|

|

saw DMG's report on Ausgrp.. states that ausgrp current valuations are underserved.. MEANS that it's FREAKING undervalued. i will continue to buy on dip .. PE still less than 10x... business is improving gd luck dyodd ..

|

|||||

| Good Post Bad Post | ||||||

| 08-Nov-2012 16:53 |

Ezion

/

Ezion

|

|||||

|

|

very very promising counter.. up when all are red.. now 1.43.. gd luck dyodd

|

|||||

| Good Post Bad Post | ||||||

| 08-Nov-2012 13:52 |

Midas

/

Midas

|

|||||

|

|

{DBS} MIDAS announced it expects to book at loss for 3Q12 due to 1) lower revenue 2) higher operating and finance costs as well as 3) share losses from associate Nanjing Puzhen Railway Transport. For the 9 months till Sept12, Midas still expects to stay profitable. While the 3Q12 loss is unexpected by our analyst, he maintains his view that the company should be able to achieve a strong turnaround next year for its core

|

|||||

| Good Post Bad Post | ||||||

| 08-Nov-2012 13:49 |

ST Engineering

/

ST Engg

|

|||||

|

|

{DBS} ST Engineering reported 3Q12 net profit of S$146m (+9% y-oy), which is ahead of our estimates. There is a margin improvement across all segments. YTD order wins of S$3.5bil has already surpassed FY11 levels, which will underpin FY13/14 earnings visibility. Our analyst revises up FY12/13F earnings by 3-4%. Maintain BUY with higher TP of S$3.80

|

|||||

| Good Post Bad Post | ||||||

| 08-Nov-2012 13:46 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||

|

|

STI continues choppy trend, gradual downward bias to 2985 (by DBS) � � (from $1.57) Eurozone woes shifted back to the limelight. The European Commission slashed its 2013 Eurozone economic growth forecast to just 0.1% from 1% forecasted 6 months ago. The EU’s autumn economic forecasts said the Eurozone GDP will contract 0.4% this year and that it would take until 2014 to recover to 1.4%. Meanwhile, Germany’s industrial production fell a worse than expected 1.8% in September versus consensus for a 0.5% decline. Spain’s industrial output tumbled 7% in September, also far worse than the 3.6% forecasted. There was also nervousness ahead of the Greece lawmaker’s vote to push through an unpopular austerity bill needed to unlock bailout funds. The positive close to Asian equity bourses yesterday indicates that the tumble on Wall Street last night was unexpected. Thus, a downward knee jerk reaction is expected today. Regional bourses are currently down 0.8-1%. The choppy trend continues on the STI – Tuesday was down, yesterday was up, today is down. STI has also fallen below 3030, which heightens the risk for a downward bias to 2985, in a choppy

|

|||||

| Good Post Bad Post | ||||||

| 08-Nov-2012 11:56 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||

|

|

buy china stocks..recommend sino grandness..recent net profit up ~90% gd luck dyodd In our view, Barack Obama's reelection as US president is positive for the Chinese economy and Sino-US relations, relative to the scenario of a Romney win. Our reasons are: 1) The US economy is already on a path towards recovery, and the continuation of the Obama administration will provide policy certainty and thus less economic volatility for the rest of the world economy. Given that about 20% of Chinese exports go to the US market, China's economic performance is sensitive to the US economy. China should worry less about a sudden change in policies and export demand from the US under Obama. 2) Obama is less likely to launch a trade war against China. In the election campaign, Romney has been significantly harsher than Obama on China, claiming that he would name China as a currency manipulator immediately after he takes office. With Obama in office for four more years, we should expect relatively fewer " accidents" in Sino-US economic relations. 3) The Obama win is positive for maintaining a conducive international environment for reforms in China. The Obama administration has been working closely with the Chinese policy makers on a range of issues via the US-China Strategic Dialogues. In these dialogues, the two sides have agreed on principles for many reforms in China and the US. On reforms in China, the key agreements include further efforts to liberalize the financial sector, to open the capital account, to permit greater RMB flexibility, and to increase the dividend payout ratios from SOEs to the budget. In our view, these market-oriented reforms can be more easily carried out in a friendly international environment (with Obama as US President), but could face greater domestic opposition in China if the US-China relations deteriorate (under Romney). |

|||||

| Good Post Bad Post | ||||||

| 07-Nov-2012 11:42 |

Ezion

/

Ezion

|

|||||

|

|

very promising counter.. gd luck dyodd Building a solid base (DBS) • strengthening ties FY13/14F lifted 6-7% Repeat business from Pemex underscores• Mr. Tan Boy Tee unveiled as strategic partner and coinvestor• 3Q12 in line 4Q should be sequentially stronger• BUY maintained TP raised to S$1.82Repeat business from Pemex indicates strengthening relationship FY13/14F lifted 6-7%. another pair of service rig contracts from Pemex worth US$298m over a 7-year period. This will be executed via a 50/50 JV with Kim Seng Holdings, implying limited impact to Ezion’s balance sheet. These rigs will add US$10.3m/year to Ezion’s earnings and lift our FY13/14F by 7%/6%. Ezion has announcedNew strategic partner. veteran, Mr. Tan Boy Tee, as its strategic partner. Mr. Tan, an existing Ezion shareholder, will subscribe for 10m new shares and concurrently acquire another 10m Ezion shares from Ezion’s CEO. Dilution from this exercise is only a mere 1.2%, while Ezion shareholders will stand to gain from his vast industry experience and his ability to co-fund future projects with Ezion. Separately, Ezion unveiled industry3Q12 results in line. core net profit +24% y-o-y /+8% q-o-q to US$16.1m. This was on the back of the deployment of two additional liftboat and service rig as compared to 3Q11, and the commencement of the QCLNG project during the period. Ezion’s 3Q12 results were in line, withMaintain BUY, TP raised to S$1.82. S$1.82 on higher FY13F earnings and adjusting for marginal dilution from the proposed new share issuance to Mr. Tan. Maintain BUY as Ezion continues to execute well and deliver on earnings. With Mr. Tan now roped in as a strategic partner and co-investor, we see a greater possibility for Ezion to undertake more projects without significantly stretching its

|

|||||

| Good Post Bad Post | ||||||

| 07-Nov-2012 11:12 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

|||||

|

|

expected some selling pressure as indicated in my post due to the bullishness of the buy ups yesterday uptrend looks to be intact with technicals oversold fundamentals still a low 7.5x PE gd luck dyodd

|

|||||

| Good Post Bad Post | ||||||

| 07-Nov-2012 10:59 |

SinoGrandnes

/

Sino Grandness - a growth stock with low PE

|

|||||

|

|

Sino grandness reported a stellar performance for its recent financial announcement problem with this stock is that the awareness for this stock has not been raised if they could get more awareness through fund managers, brokerage firm analyst to cover the stock this will create more attention for the stock and hence increase the market activity for the stock gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| 07-Nov-2012 09:19 |

SinoGrandnes

/

Sino Grandness - a growth stock with low PE

|

|||||

|

|

i rather the company use the retain earnings if they can command a high return on those earnings in the business than give the shareholders dividend.. by doing this, the shareholders gain more through capital appreciation through stock prices.. gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| 06-Nov-2012 22:07 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

|||||

|

|

price rise today was due to very insignificant sellers in the market.. majority of the volume done was buy ups, hence the rise in prices... tmr may face some selling, lookin to buy on dip.. uptrend intact, technicals moving up from oversold position gd luck dyodd |

|||||

| Good Post Bad Post | ||||||

| First < Newer 1281-1300 of 7452 Older> Last |