|

Latest Posts By pharoah88

- Supreme

|

|

| 05-Apr-2010 11:37 |

Ying Li Intl

/

Ying Li

|

||||

|

|

cOngratulatiOns ! yOu are nOw in the mOney. gOOd fOrtune is hErE

|

||||

| Good Post Bad Post | |||||

| 05-Apr-2010 11:35 |

Ying Li Intl

/

Ying Li

|

||||

|

|

she cannOt TOAST fOr YiNG Gi anymOre ?

|

||||

| Good Post Bad Post | |||||

| 05-Apr-2010 11:32 |

Ying Li Intl

/

Ying Li

|

||||

|

|

Monday: 5th APRIL 2010 11:31AM 14th POSITION TOP VOLUME CHART TOUGHCED HiGH S$0.535 nO wOrry nO swEat |

||||

| Good Post Bad Post | |||||

| 05-Apr-2010 11:24 |

Ying Li Intl

/

Ying Li

|

||||

|

|

ALL the photos are gOne ?

|

||||

| Good Post Bad Post | |||||

| 05-Apr-2010 11:21 |

Oceanus

/

Oceanus

|

||||

|

|

Monday: 5th APRIL 2010 11:21am 7th POSITION TOP VOLUME CHART TOUCHED HIGH of S$0.375 nO wOrry nO swEat |

||||

| Good Post Bad Post | |||||

| 05-Apr-2010 10:23 |

UniFiber System

/

UniFiber

|

||||

|

|

DAWN of RiSING SUN Monday: 5th APRIL 2010 08:59.03 S$0.040 23,393,000 BOUGHT frOm SELLER 09:07.53 S$0.040 4,000,000 BOUGHT frOm SELLER 09:22.46 S$0.040 9,083,000 BOUGHT frOm SELLER |

||||

| Good Post Bad Post | |||||

| 05-Apr-2010 09:42 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||||

|

|

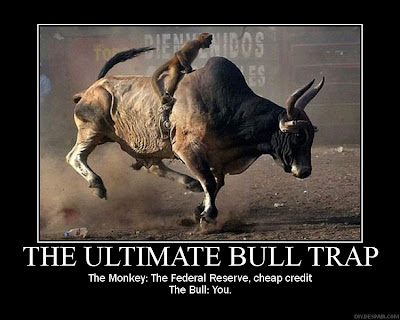

The Monkey needs the BULL. The Monkey will have to grOw the BULL. Otherwise, Monkey has nO BULL tO RIDE. Both Monkey and BULL nEEd tO gO On fOrever and EvEr fOr their Own gOOd. HOW ? they themselves WiLL knOw

|

||||

| Good Post Bad Post | |||||

| 05-Apr-2010 09:34 |

Chemoil Ene USD

/

CHEMOIL

|

||||

|

|

mypaper Thursday: 1st APRIL 2010 BETWEEN THE LINES HOUSTON

And there the price has stayed, more or less, since August, reaching a rough stability in the US$70 to US$83 range. Economists and government officials say that if prices remain in that band, it could benefit the world economy, the future security of energy supplies and even the environment. The price is high enough to drive “It’s a sweet spot,” said Mr Kenneth Rogoff, a Harvard professor of international finance. “It’s not too low that it’s crushing demand for and fiscal crises in oil-exporting countries. And it’s not so high that it’s driving African countries deeper into poverty and threatening the recovery in the US and Europe.” Petrol prices have stabilised along with oil prices, with the average US price for a gallon of regular petrol ranging from US$2.50 to US$2.80 since June. Oil prices have jumped somewhat this week, but they are still within the band they have occupied for months. Light, sweet Texas crude closed on Tuesday at US$82.37 a barrel. Energy experts say that several far-flung global developments have converged to put supply and demand in relative equilibrium, at least for the time being. Members of the Organisation of Petroleum Exporting Countries have remained fairly disciplined in complying with their announced production cuts. Meanwhile, among non- Opec producers, growing oil output in Brazil, Russia and the Gulf of Mexico has counterbalanced production declines in the North Sea, Alaska, Venezuela and Mexico. On the demand side, growing appetites for oil in China, India and other developing nations have been offset by declining demand in the United States and Europe, because of their slowing economies, conservation efforts and growing use of biofuels. “The current price range provides a geopolitical benefit,” said Mr David Goldwyn, the US State Department coordinator for international energy affairs. “With ample capacity in oil, and commercial inventories at five-year highs, markets are well positioned to absorb any potential supply disruption, even without resorting to strategic stocks.” While the last four decades have been punctuated by various oil-price booms and busts stemming from oil embargoes, wars and recessions, periods of relative stability lasting months or years have been OIL prices have done something remarkable over the last half-year or so: They have barely budged. Memories are still fresh of the chaotic climb to US$147 (S$206) a barrel only two summers ago, accompanied by petrol costing U$4.11 a gallon. The spike led to accusations from drivers and politicians that oil companies were price-gouging. Then crude prices plummeted, along with the world economy, to around US$34 a barrel just over a year ago, only to double again in a matter of months as confidence began to recover.investment in future oil production and in supplies of alternative energy, they note, but low enough that consumers can bear it.renewable energy sources or causing debtcommonplace. Not surprisingly, oil producers prefer stability to plan their investments. “The worst thing that happens in our industry is volatility,” said Mr G. Steven Farris, chairman and chief executive of Apache Corp. With prices stabilising, his company has increased its exploration and development budget by 50 per cent this year, to US$6 billion. Meanwhile, many of the independent oil companies are pumping up their oil-exploration investment budgets as well. “If we still had US$35 oil prices, you would not have seen us be nearly as active in the Gulf of Mexico,” Mr James Hackett, chairman and chief executive of Anadarko Petroleum, said in an interview. The biggest long-term threat to the new balance is growing consumption in China and other developing countries. But some analysts express hope that such countries can curb their oil-demand growth as they build power-transmission lines that will enable them to replace inefficient diesel generators with alternative power sources like gas and nuclear. “Demand will change; supply will change,” said Mr Christof Ruehl, chief economist of BP, the oil company. “The world changes all the time.” NYT BETWEEN THE LINES Oil prices will jump almost 20 per cent this year, driven by demand from China and emerging markets, according to UniCredit

|

||||

| Good Post Bad Post | |||||

| 05-Apr-2010 08:52 |

AusGroup

/

AUSGROUP: 1H09 revenue up 28.8% to reach A$260.5 m

|

||||

|

|

mypaper Thu:1st APRIL 2010 my01-022-0-mya.pdf

BETWEEN THE LINES

HOUSTON

And there the price has stayed, more or less, since August, reaching a rough stability in the US$70 to US$83 range. Economists and government officials say that if prices remain in that band, it could benefit the world economy, the future security of energy supplies and even the environment. The price is high enough to drive “It’s a sweet spot,” said Mr Kenneth Rogoff, a Harvard professor of international finance. “It’s not too low that it’s crushing demand for and fiscal crises in oil-exporting countries. And it’s not so high that it’s driving African countries deeper into poverty and threatening the recovery in the US and Europe.” Petrol prices have stabilised along with oil prices, with the average US price for a gallon of regular petrol ranging from US$2.50 to US$2.80 since June. Oil prices have jumped somewhat this week, but they are still within the band they have occupied for months. Light, sweet Texas crude closed on Tuesday at US$82.37 a barrel. Energy experts say that several far-flung global developments have converged to put supply and demand in relative equilibrium, at least for the time being. Members of the Organisation of Petroleum Exporting Countries have remained fairly disciplined in complying with their announced production cuts. Meanwhile, among non- Opec producers, growing oil output in Brazil, Russia and the Gulf of Mexico has counterbalanced production declines in the North Sea, Alaska, Venezuela and Mexico. On the demand side, growing appetites for oil in China, India and other developing nations have been offset by declining demand in the United States and Europe, because of their slowing economies, conservation efforts and growing use of biofuels. “The current price range provides a geopolitical benefit,” said Mr David Goldwyn, the US State Department coordinator for international energy affairs. “With ample capacity in oil, and commercial inventories at five-year highs, markets are well positioned to absorb any potential supply disruption, even without resorting to strategic stocks.” While the last four decades have been punctuated by various oil-price booms and busts stemming from oil embargoes, wars and recessions, periods of relative stability lasting months or years have been OIL prices have done something remarkable over the last half-year or so: They have barely budged. Memories are still fresh of the chaotic climb to US$147 (S$206) a barrel only two summers ago, accompanied by petrol costing U$4.11 a gallon. The spike led to accusations from drivers and politicians that oil companies were price-gouging. Then crude prices plummeted, along with the world economy, to around US$34 a barrel just over a year ago, only to double again in a matter of months as confidence began to recover.investment in future oil production and in supplies of alternative energy, they note, but low enough that consumers can bear it.renewable energy sources or causing debtcommonplace. Not surprisingly, oil producers prefer stability to plan their investments. “The worst thing that happens in our industry is volatility,” said Mr G. Steven Farris, chairman and chief executive of Apache Corp. With prices stabilising, his company has increased its exploration and development budget by 50 per cent this year, to US$6 billion. Meanwhile, many of the independent oil companies are pumping up their oil-exploration investment budgets as well. “If we still had US$35 oil prices, you would not have seen us be nearly as active in the Gulf of Mexico,” Mr James Hackett, chairman and chief executive of Anadarko Petroleum, said in an interview. The biggest long-term threat to the new balance is growing consumption in China and other developing countries. But some analysts express hope that such countries can curb their oil-demand growth as they build power-transmission lines that will enable them to replace inefficient diesel generators with alternative power sources like gas and nuclear. “Demand will change; supply will change,” said Mr Christof Ruehl, chief economist of BP, the oil company. “The world changes all the time.” NYTBETWEEN THE LINES Oil prices find a sweet spot Oil prices will jump almost 20 per cent this year, driven by demand

|

||||

| Good Post Bad Post | |||||

| 04-Apr-2010 15:44 |

User Research/Opinions

/

POEM

|

||||

|

|

Andrew SPILLS TRUTH | ||||

| Good Post Bad Post | |||||

| 04-Apr-2010 15:34 |

Genting HK USD

/

Star Cruise

|

||||

|

|

Key points for 2009 in comparison with year 2008:

2. Capacity decreased by 33.6% from approximately 2.5 million to approximately 1.7 million capacity days 3. Occupancy percentage increased by 6% from 85% to 91% in 2009 4. Net revenue decreased by 16.7% but net yield increased by 25.4% 5. Ship operating expenses decreased by 44.6% in 2009, achieved through savings from lower fuel costs, various cost control and ship deployment initiatives 6. Selling, general and administrative expenses excluding depreciation and amortisation decreased by 10.8% in 2009 7. Operating profit before impairment was US$5.3 million for 2009, versus an operating loss before impairment of US$16.2 million in 2008

|

||||

| Good Post Bad Post | |||||

| 04-Apr-2010 15:22 |

Genting HK USD

/

Star Cruise

|

||||

|

|

Press Release: Genting Hong Kong Group Announces Full Year Results for 2009 Page 1 of 5

|

||||

| Good Post Bad Post | |||||

| 04-Apr-2010 15:08 |

Ying Li Intl

/

Ying Li

|

||||

|

|

Pretty Lady has been kidnapped | ||||

| Good Post Bad Post | |||||

| 04-Apr-2010 15:00 |

Best World

/

will it go up ?

|

||||

|

|

sEEms all MLMs are nOt dOing wEll aftEr the wOrld Credit sub-PRiME Financial tsUnami ???? |

||||

| Good Post Bad Post | |||||

| 04-Apr-2010 14:53 |

RafflesEdu

/

Raffles Edu

|

||||

|

|

singapOre education system also mutated towards Double Alternative Education [DAE] Teach Less in School so that students Learn More at Home ALL our children must marry a spouse who is a Teacher. Otherwise, who is going to Teach at Home ? many primary school examinations have been cancelled. text book syllabi also halved for some subjects [Learn Half only in school. Parent needs to Teach Half at Home ?] 'O' Level also cancelled. Very soon "A" Level also cancelled ? Ultimately, university exams may also be cancelled ? bY then, it will be like REC ???? who knows ITE may become FAMOUS. LIKE ACCA which started as ITE vocational course but is now recognised as higher than university Degree ???? Like OBAMA said, things CHANGED so CHANGE and keep CHANGING nothing is the same anymore. everything CHANGES ALL THE TIMES me tOO. jUst ! |

||||

| Good Post Bad Post | |||||

| 04-Apr-2010 14:43 |

RafflesEdu

/

Raffles Edu

|

||||

|

|

tOlent is nOt talent In reality, many people mistaken tOlent who has nO talent at all as talent and OverPAID them HIGHLY as talent. this GRAVE MISTAKE was the rOOt CAUSE of the WOrld Financial Tsunami. P I A is the short form for Philippines, India, China. this is also what ALTERNATIVE EDUCATION is about.

|

||||

| Good Post Bad Post | |||||

| 04-Apr-2010 14:31 |

SMRT

/

SMRT

|

||||

|

|

WHY do PEOPLE DRIVE or TAKE A TAXI ? ? KEY OBJECTIVE is TRAVEL CONTINUITY from START TO END WITHOUT DISTRUPTION. DO NOT DISCRIMINATE the PUBLIC TRANSPORT RIDERS from this BASIC DECENT CONVENIENT HAPPINESS ???? |

||||

| Good Post Bad Post | |||||

| 04-Apr-2010 14:23 |

SMRT

/

SMRT

|

||||

|

|

the Sunday Times 4 APRIL 2010 page 6 home PLEASE DON'T TAKE AWAY MY LONG BUS RIDES "Many REGULARS on Long-Haul services find them CONVENIENT and DON'T WANT A CHANG" Shuli Sudderuddin PS: Please CREATE EMPLOYMENT AND HAPPINESS DON'T INVENT UNNECESSARY MISERIES FOR the HARD WORKING SINGAPOREANS "BUS JOURNEY IS LONGER BUT LESS CROWDED" Sufyan Saad WILL SHORT ROUTE BUSES PACK PASSENGERS TO "DEATH" ???? |

||||

| Good Post Bad Post | |||||

| 04-Apr-2010 14:13 |

Chemoil Ene USD

/

CHEMOIL

|

||||

|

|

http://www.forbes.com/global/2007/0903/044.htmlSingapore's 40 Richest Riding the Waves Wayne Arnold 09.03.07

Robert Chandran has changed citizenship twice en route to a fortune from a company that fuels the world's shipping industry.Mumbai-born Robert Chandran traded in the American dream for a Singaporean vision. After immigrating to California in 1976, he earned a fortune in San Francisco Bay Area real estate and built the largest supplier of marine fuel in the U.S. Two years ago he gave up his U.S. passport for Singaporean citizenship and moved to the island-state and listed his company, Chemoil Energy, on the Singapore stock exchange last year in an initial public offering. "I'm at a stage in life where I can live anywhere, I suppose," says the 57-year-old executive. "I want to live in Asia." Singapore offered a variety of advantages: an ultraefficient entrepôt with low taxation and no tax on global income, no Sarbanes-Oxley headaches and front-row seats in the fastest-growing markets for Chemoil's fuel. "Singapore made sense," he says. The move already appears to be paying off. Last year Chemoil's revenues rose 18% to a record $4.35 billion, with net profits rising 17% to a record $57.8 million. Earnings in the first quarter of this year jumped 25%. As for Chandran, his 46% stake in the company now makes him worth more than $490 million, No. 14 on our list of Singapore's 40 Richest. Chemoil's business is deceptively simple. The company bills itself as a gas station for ships, a business known as bunkering. It has a slew of small competitors strewn across the highly fragmented bunkering market. Chemoil's advantage is its global scale. "What makes Chemoil different from other independent players is that it has a presence in most of the key bunkering ports worldwide," says Cheryl Lee, an analyst at ubs in Singapore. The company's operations span almost every major port, from Los Angeles and New York to Rotterdam, Panama and, of course, Singapore, the world's largest ship-fueling port. Not only does that allow Chemoil to offer global service to customers, it also allows the company to buy fuel where it's cheapest and sell it where it's dearest. "No other independent player has this presence," says Lee. Chemoil raised $85 million for its war chest from its ipo. Its ambition is simple, says Chief Financial Officer Jerome Lorenzo: more and more gas stations. In Singapore the company is building a $125 million terminal that will make it the only bunkering company capable of handling very large crude carriers (448,000 cubic meters capacity). It is expanding operations to the port of Fujairah in the United Arab Emirates and has its eyes on the Suez Canal and Gibraltar. Expansion seems to come easily to the genial Chandran, whom colleagues describe as passionate and even impetuous. "He's a consummate entrepreneur, his mind always full of ideas," said Adrian Tolson, Chemoil's vice president for sales and marketing. A vegetarian Hindu with a Californian's love of wine, Chandran is accustomed to stalking the office shoeless. Fittingly, he indulges a penchant for philosophy by signing every e-mail with a phrase adapted from Longfellow: "Strive to leave footprints on the sands of time." |

||||

| Good Post Bad Post | |||||

| 04-Apr-2010 13:59 |

Others

/

COE CASINO

|

||||

|

|

should the S$18,000 be CONFISCATED ???? should the Car Dealer be FINED for COE PROFITEERING ????

|

||||

| Good Post Bad Post | |||||

| First < Newer 11801-11820 of 13894 Older> Last |